Score

Axi

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://www.axichina.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:AXICORP FINANCIAL SERVICES PTY LTD

License No.:000318232

Single Core

1G

40G

1M*ADSL

- The claimed AustraliaASIC regulation (license number: 000318232) is verified as a clone firm. Please pay attention to the risk!

Basic information

United Kingdom

United KingdomBogus firm Axi imitating Australian broker AxiTrader

The inspection team conducted a field survey to the bogus company Axi’s claimed address, and found the real company that it is intended to imitate (AxiTrader). That is the natural outcome of the fact that Axi misused/appropriated the real company’s licensing details. Axi claims to hold a full license (318232) from the Australian ASIC, and unsurprisingly this is also a false claim and it actually

Australia

AustraliaBogus firm Axi imitating Australian broker AxiTrader

The inspection team conducted a field survey to the bogus company Axi’s claimed address, and found the real company that it is intended to imitate (AxiTrader). That is the natural outcome of the fact that Axi misused/appropriated the real company’s licensing details. Axi claims to hold a full license (318232) from the Australian ASIC, and unsurprisingly this is also a false claim and it actually

Australia

AustraliaUsers who viewed Axi also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

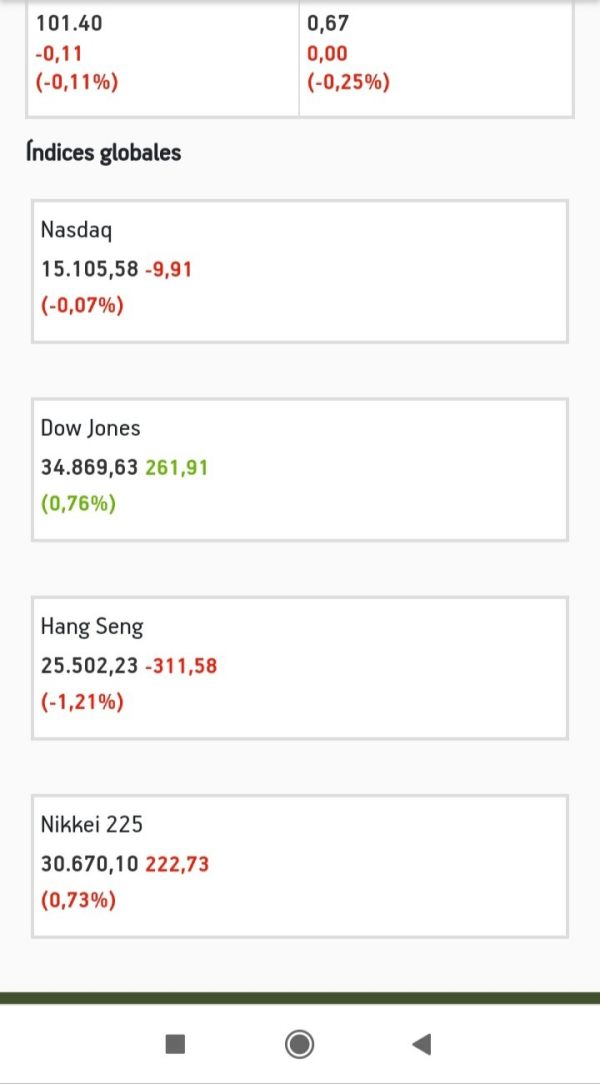

Mkt. Analysis

Creatives

Website

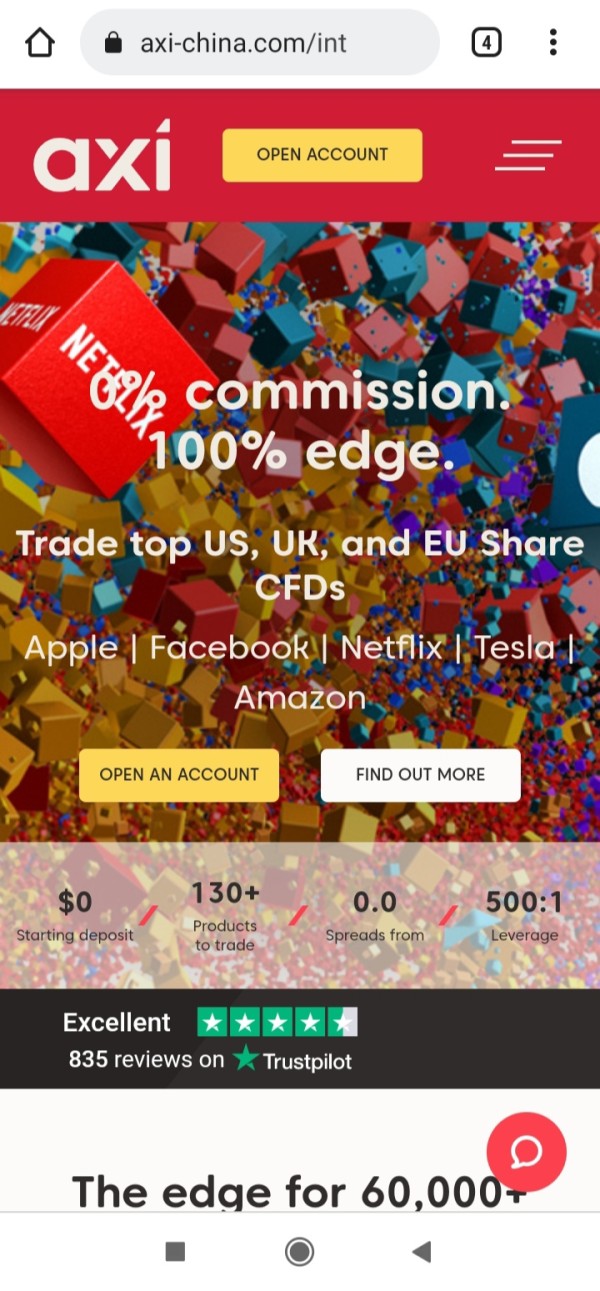

axichina.com

Server Location

Hong Kong

Website Domain Name

axichina.com

Website

WHOIS.PAYCENTER.COM.CN

Company

XINNET TECHNOLOGY CORPORATION

Domain Effective Date

0001-01-01

Server IP

58.64.211.237

Company Summary

| Axi | Basic Information |

| Company Name | Axi |

| Founded | 2007 |

| Headquarters | Australia |

| Regulations | None (Claimed ASIC regulation has been verified as a clone firm) |

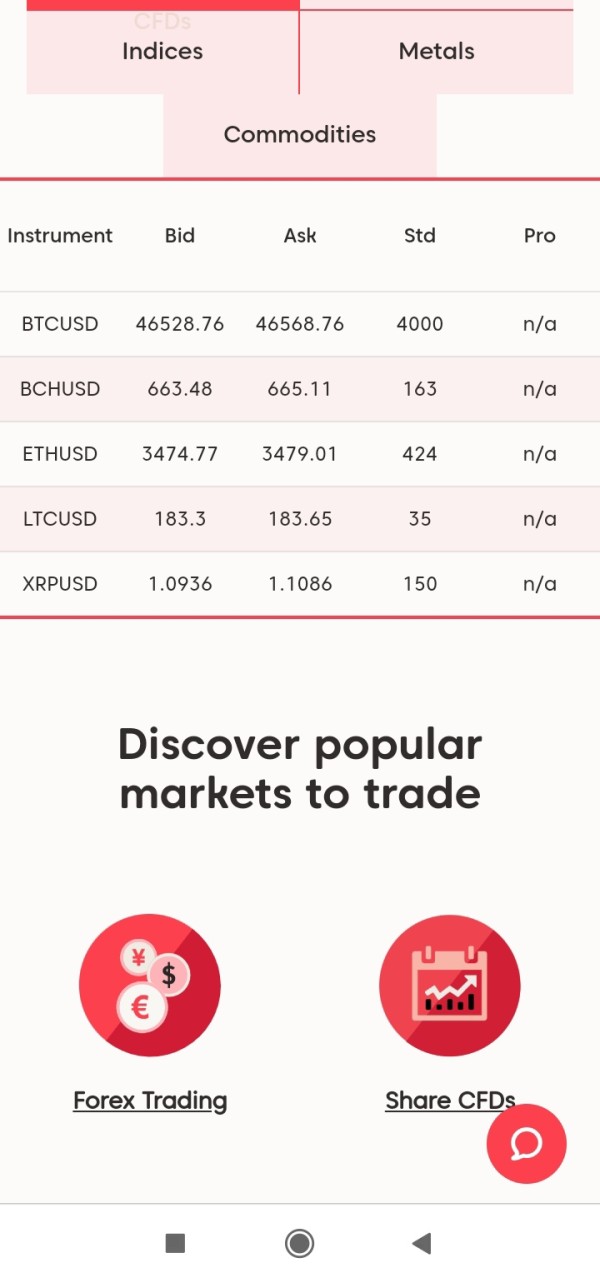

| Tradable Assets | 50 currency pairs, 6 cryptocurrency pairs, 20 commodities, 31 index CFDs |

| Account Types | Standard, Pro, Elite |

| Minimum Deposit | Varies (Standard: $0, Pro: $0, Elite: $25,000) |

| Maximum Leverage | Up to 500:1 |

| Spreads | Varies (Standard: From 0.4 pips, Pro: From 0.0 pips, Elite: From 0.0 pips) |

| Commission | Varies (Standard: None, Pro: $7 round trip, Elite: $3.50 round trip) |

| Deposit Methods | Bank wires, credit/debit cards, online payment platforms, cryptocurrencies, etc. |

| Trading Platforms | MetaTrader 4 (MT4), MT4 web terminal, Axi Copy Trading App |

| Customer Support | Phone: 303-893-0552 (Monday-Friday, 9am to 5 pm MST),Fax: 202-893-0507 |

| Education Resources | Not specified |

| Bonus Offerings | None |

Overview of Axi

Established in 2007 and based in Australia, Axi provides traders with a diverse range of trading instruments, including forex, cryptocurrencies, commodities, and index CFDs. Offering account types such as Standard, Pro, and Elite, Axi caters to traders of varying experience levels. Despite claiming ASIC regulation, which has been verified as a clone firm, Axi operates without genuine regulatory oversight.

Is Axi Legit?

Axi claims to be regulated by ASIC (Australian Securities and Investments Commission) with license number 318232. However, it's important to note that this regulation has been verified as a clone firm. Traders should exercise caution and be aware of the associated risks when considering trading with Axi, as it operates without legitimate regulatory oversight.

Pros and Cons

Despite offering a range of trading instruments and account types, Axi faces significant drawbacks. The absence of genuine regulatory oversight, coupled with concerns about fund safety and transparency, casts doubt on the reliability of the broker. Additionally, regulatory restrictions limit accessibility for traders from certain regions, undermining its potential reach. The lack of valid regulation raises uncertainty regarding the legitimacy and credibility of Axi, posing risks for prospective traders.

| Pros | Cons |

|

|

|

|

|

Trading Instruments

Axi offers traders a diverse range of trading instruments, including 50 currency pairs, 6 cryptocurrency pairs, 20 commodities, and 31 index CFDs.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Currency | Stocks | Indices | Crypto | Commodities |

| Axi | Yes | No | Yes | Yes | Yes |

| FXTM | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes |

| XM | Yes | Yes | Yes | Yes | Yes |

Account Types

Axi offers three account types: Standard, Pro, and Elite. The Standard account, which is the default option, provides spreads as low as 0.4 pips and does not charge any commissions. On the other hand, the Pro account offers zero spreads but charges a commission of $7 per trade. Lastly, the Elite account features zero spreads and a lower commission of $3.50 per trade, but requires a higher minimum deposit of $25,000. All accounts support leverage up to 500:1 and offer access to over 140 FX pairs and Metals CFDs. Additionally, Axi provides demo accounts for practice trading and Islamic accounts with no swap fees for clients with specific religious requirements.

| Account Type | Standard | Pro | Elite |

| Features | Free setup, Autochartist, Myfxbook, PsyQuation, EA compatibility, VPS | Free setup, Autochartist, Myfxbook, PsyQuation, EA compatibility, VPS | Free setup, Autochartist, Myfxbook, PsyQuation, EA compatibility, VPS |

| Account Currencies | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | USD, EUR, GBP, AUD |

| Available Leverage | Up to 500:1 | Up to 500:1 | Up to 500:1 |

| Minimum Deposit | $0 | $0 | USD 25,000 |

| Commission Per Trade | None | $7 round trip (USD) | $3.50 round trip (USD) |

| Decimal Pricing | 5 digit pricing | 5 digit pricing | 5 digit pricing |

| Trading Instruments | 140+ FX pairs, Metals CFDs | 140+ FX pairs, Metals CFDs | 140+ FX pairs, Metals CFDs |

| Min. Lot Size Per Trade | 0.01 lots | 0.01 lots | 0.01 lots |

| Spreads | From 0.4 pips | From 0.0 pips | From 0.0 pips |

| Demo Account | Yes | Yes | Yes |

| Swap/Rollover Free | Yes | Yes | Yes |

| Hedging | Yes | Yes | Yes |

| Scalping | Yes | Yes | Yes |

| Copy Trading Support | Yes | Yes | Yes |

Leverage

Axi offers leverage up to 500:1 across all its account types, allowing traders to amplify their positions in the market. However, the maximum leverage may vary depending on the asset being traded, and traders should be aware of the associated risks when using high leverage.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Axi | eToro | XM | RoboForex |

| Maximum Leverage | 1:500 | 1:400 | 1:888 | 1:2000 |

Spreads and Commissions

Axi provides variable spreads on its Standard and Pro accounts, starting from as low as 0.4 pips. The Standard account does not charge any commissions, while the Pro account incurs a commission of USD 7 per round trip. The Elite account, designed for professional traders, features zero spreads but requires a higher deposit of USD 25,000 and a commission of USD 3.50 per round trip.

Deposit & Withdraw Methods

Axi offers a variety of deposit and withdrawal methods, including bank wires, credit/debit cards, online payment platforms like Neteller and Skrill, cryptocurrencies such as Bitcoin, and regional online banking solutions. Withdrawal requests are processed within one to two hours, ensuring swift access to funds for traders. While Axi does not charge internal fees for withdrawals, third-party processor costs may apply. Traders must ensure that the name on their Axi account matches the name on the chosen payment processor or bank account. Additionally, Axi accepts traders from the UK, South Africa, Malaysia, Singapore, and Canada, but not from the US.

Trading Platforms

Axi offers the MetaTrader 4 (MT4) platform for trading, accessible on Windows, Mac, and Android devices. Additionally, traders can utilize the MT4 web terminal for browser-based trading convenience. For those interested in copy trading, Axi provides the Axi Copy Trading App, allowing users to follow and replicate trades of successful investors

.

Customer Support

The Axi customer support can be reached through telephone: 303-893-0552 (Monday-Friday, 9am to 5 pm MST), Fax: 202-893-0507. Address: HugeDomains2635 Walnut St.Denver, CO 80205.

Negative Reviews

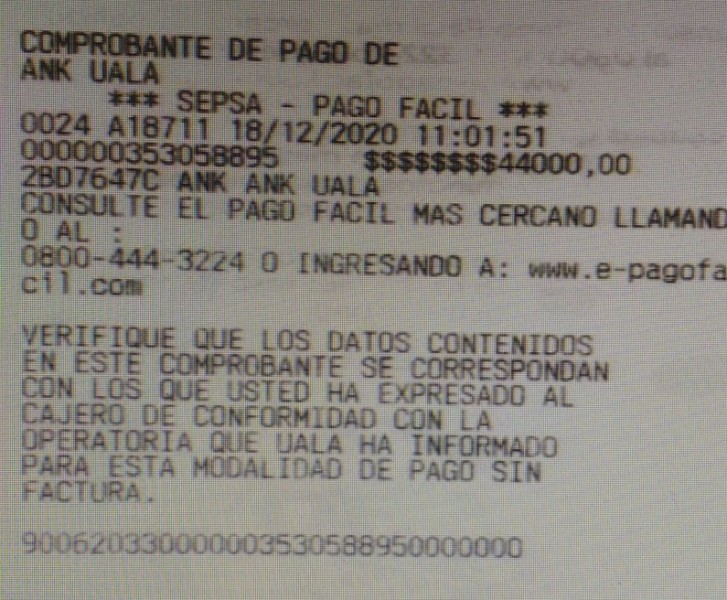

This Axi has been exposed in a series of scandals. Many scammed traders said that they were unable to withdraw funds from Axi platform, and this broker deducted rollover and bonus without their permission. A traders said that he deposited $44000 and his balance increased to $70500 and then this broker blocked him.

Conclusion

In conclusion, while Axi offers a diverse range of trading instruments and account types, its lack of genuine regulatory oversight presents significant disadvantages. The absence of valid regulation raises concerns about fund safety, transparency, and the legitimacy of the broker. Moreover, regulatory restrictions limit accessibility for traders from certain regions, potentially restricting its market reach. Prospective traders should carefully consider these drawbacks before engaging with Axi's services.

FAQs

Q: Is Axi regulated?

A: No, Axi's claimed ASIC regulation has been verified as a clone firm, raising doubts about its regulatory status.

Q: What trading instruments does Axi offer?

A: Axi provides access to 50 currency pairs, 6 cryptocurrency pairs, 20 commodities, and 31 index CFDs.

Q: What account types does Axi offer?

A: Axi offers three account types: Standard, Pro, and Elite, each with varying features and requirements.

Q: What is the minimum deposit required to open an account with Axi?

A: The minimum deposit varies depending on the account type, ranging from $0 for the Standard and Pro accounts to $25,000 for the Elite account.

Q: What is the maximum leverage offered by Axi?

A: Axi offers leverage up to 500:1 across all its account types, allowing traders to amplify their positions in the market.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Clone Firm Australia

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1148456316

Mexico

I deposited 80,000 pesos but could not withdraw it after 1 week.

Exposure

2021-10-15

FX3335052786

Venezuela

I deposited $44000 and my balance increased to $70500. But they blocked me after I withdrew.

Exposure

2021-09-10

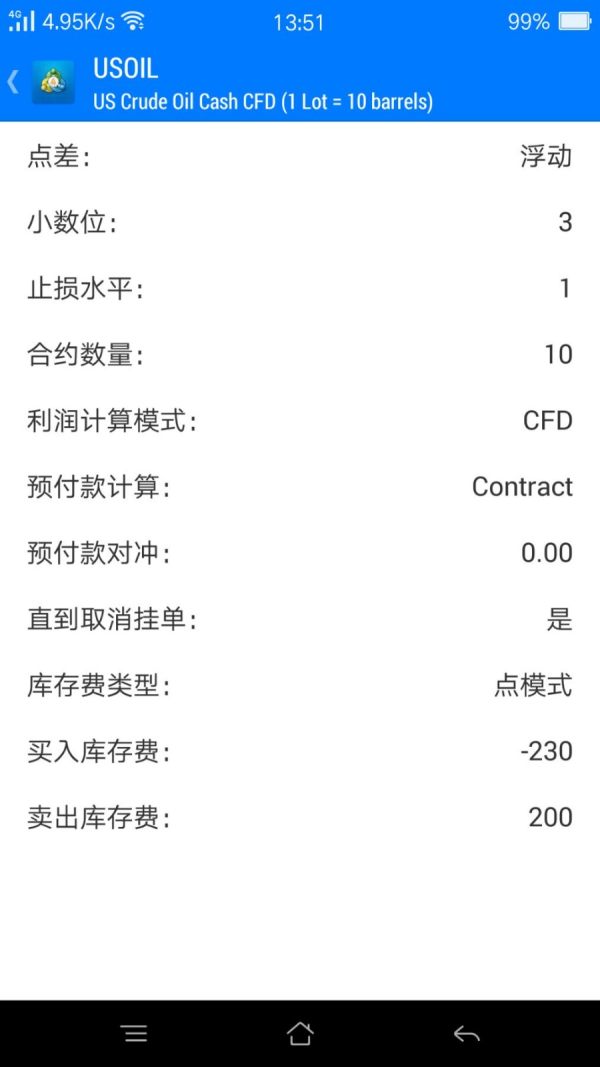

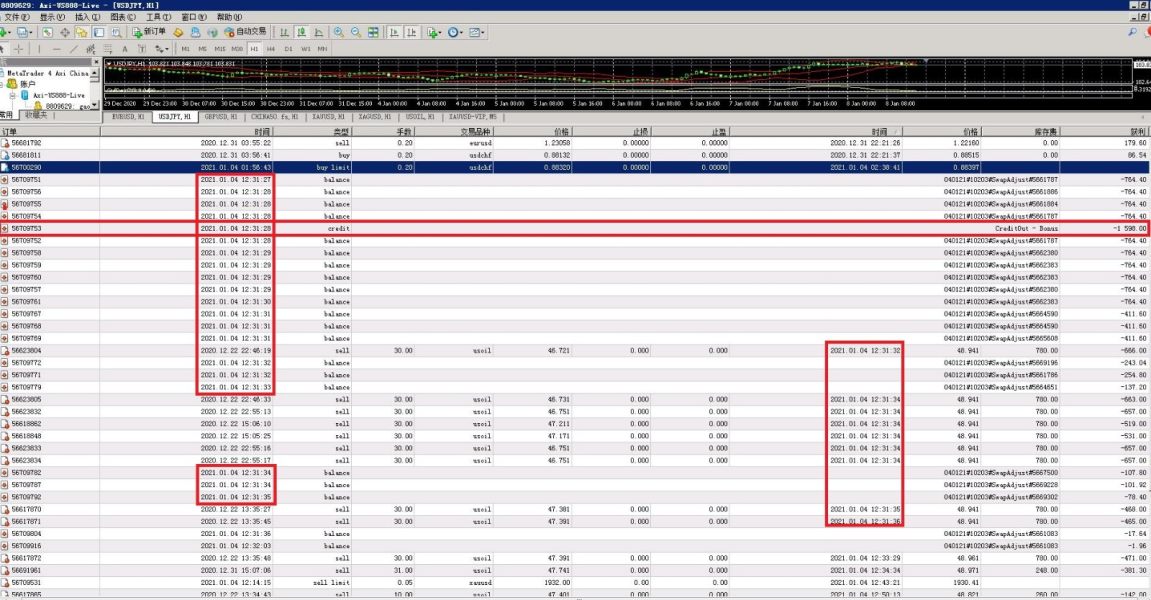

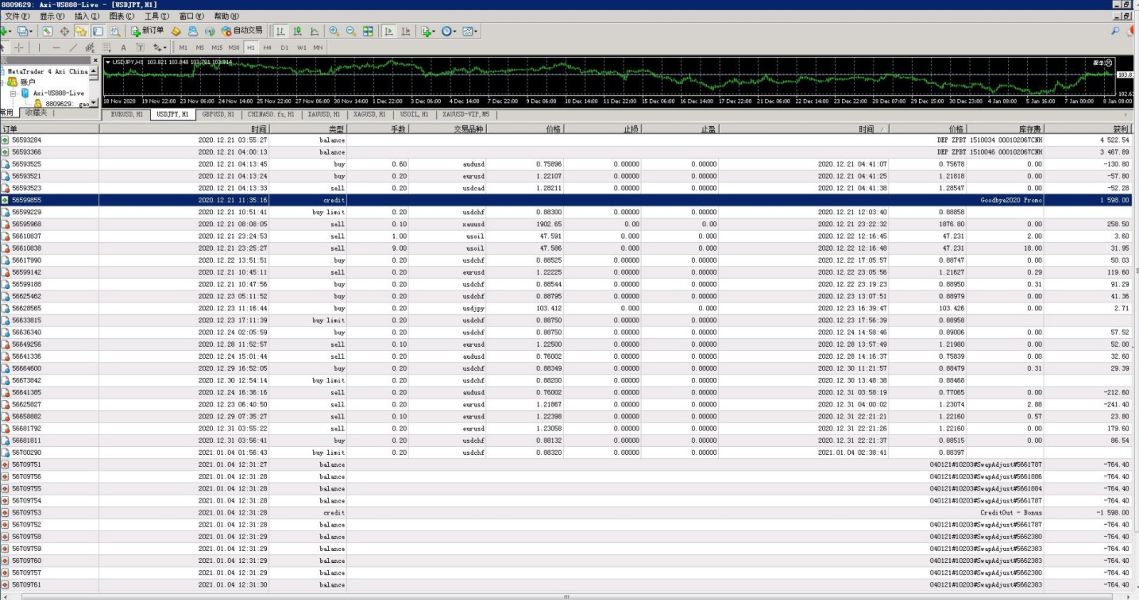

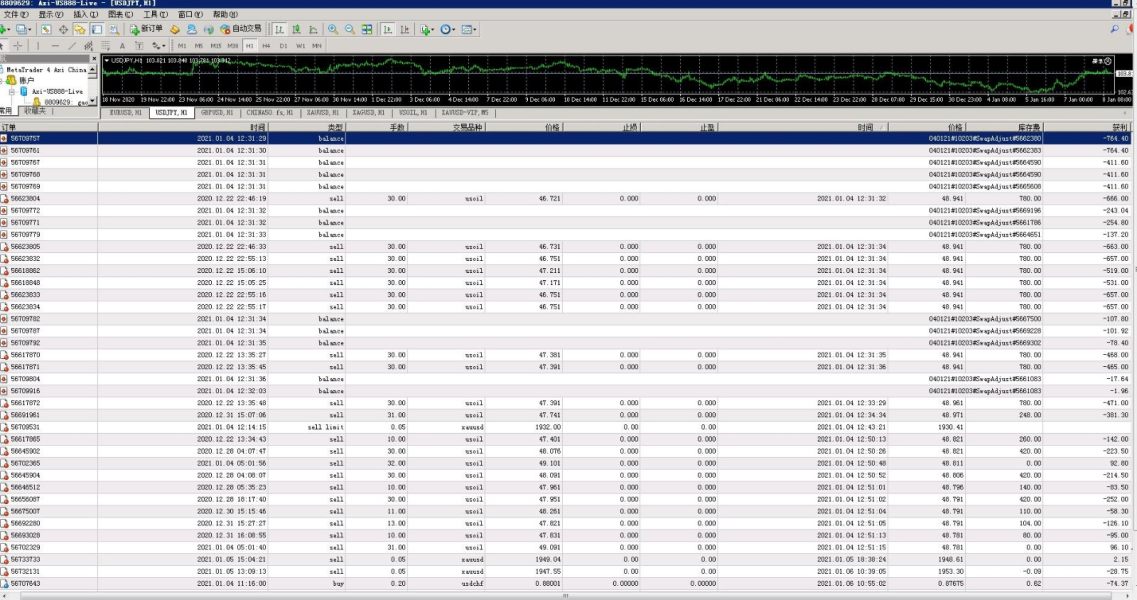

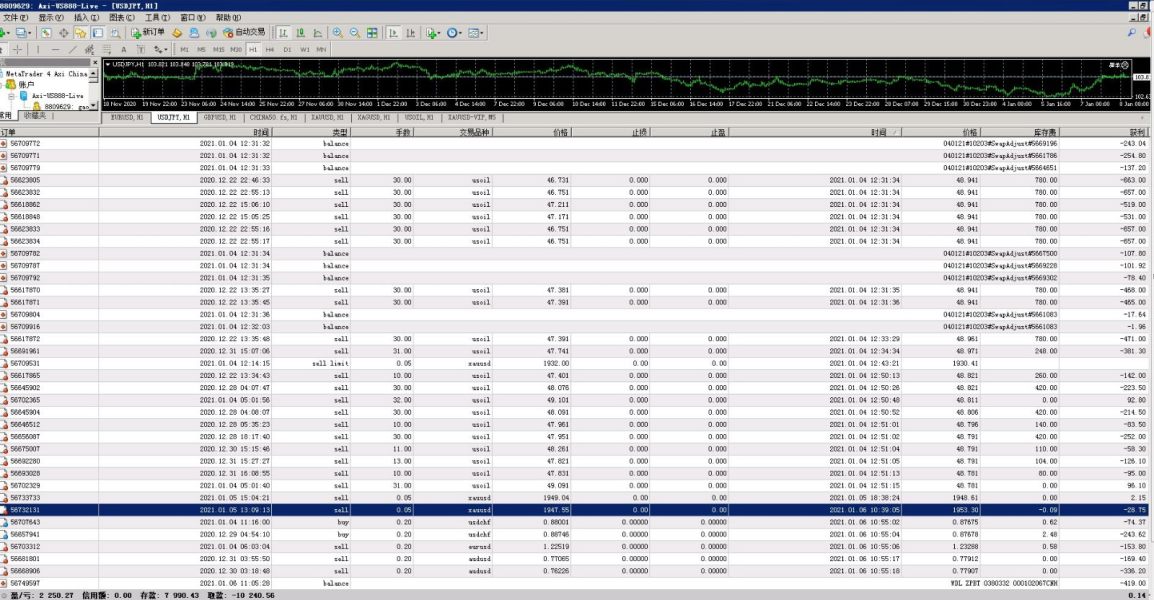

FX3149017791

Hong Kong

1: The crude oil was invested since December 21. The next day I saw that their rollover was -23 pips for long orders and 20 pips for empty orders, so I specifically consulted the customer service of the platform's official website. The customer service said that the overnight fee is Normal (there are screenshots showing the overnight fee of MT4 software and screenshots of consulting customer service) 2: After confirming that the overnight fee is correct, I re-operated the crude oil empty order on December 22 and held the position until January 4 for a total of 14 days , And a part of it slowly increased in the middle 3: On January 4, the platform privately deducted all the overnight interest and bonus I received, which caused the account to be directly liquidated at the high position of crude oil, and then the crude oil began to plummet 4: Contact the platform, the platform said they set the wrong crude oil overnight fee, so they have to deduct it (I have been operating the crude oil for half a month and they did not realize the error, just when the crude oil new high was deducted and the position could be liquidated. Deductions will not be liquidated at any time within half a month. Only on January 4th, is there such a coincidence?) 5: Let’s take a step back. Even if they set the wrong settings, it’s completely their own problems. Their mistakes have seriously affected my judgment of operation (for other varieties, I usually do short-term operations in Weicang because of customer service. It is said that the overnight fee is normal, so I placed a heavier list on crude oil to prepare for the midline) 6: Regarding the bonus issue, the platform said that the bonus cannot carry losses. When the net value is lower than the credit limit, the bonus will be deducted. However, the situation at that time was that my net worth was still about $3,000 after deducting the overnight fee. (Initially deposit 7990, bonus 1598), much higher than 1598, did not meet the conditions for deduction of bonus (all transaction records can be checked) 7: Don’t let customers pay for platform errors

Exposure

2021-01-14

達達尼亞

South Africa

This Axi is definitely a scammer, and they used delayed tactics when I told them I wanted two withdraw my funds. After two months, I finally received my funds, but I won’t like to use this broker anymore.

Neutral

2023-03-13