Score

FlowBroker

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://www.flow-broker.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed FlowBroker also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

flow-broker.com

Server Location

United States

Website Domain Name

flow-broker.com

Server IP

199.60.103.181

Company Summary

| FlowBroker Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Bahamas |

| Regulation | Unregulated |

| Customer Support | customerservices.bhs@lcg.com |

FlowBroker Information

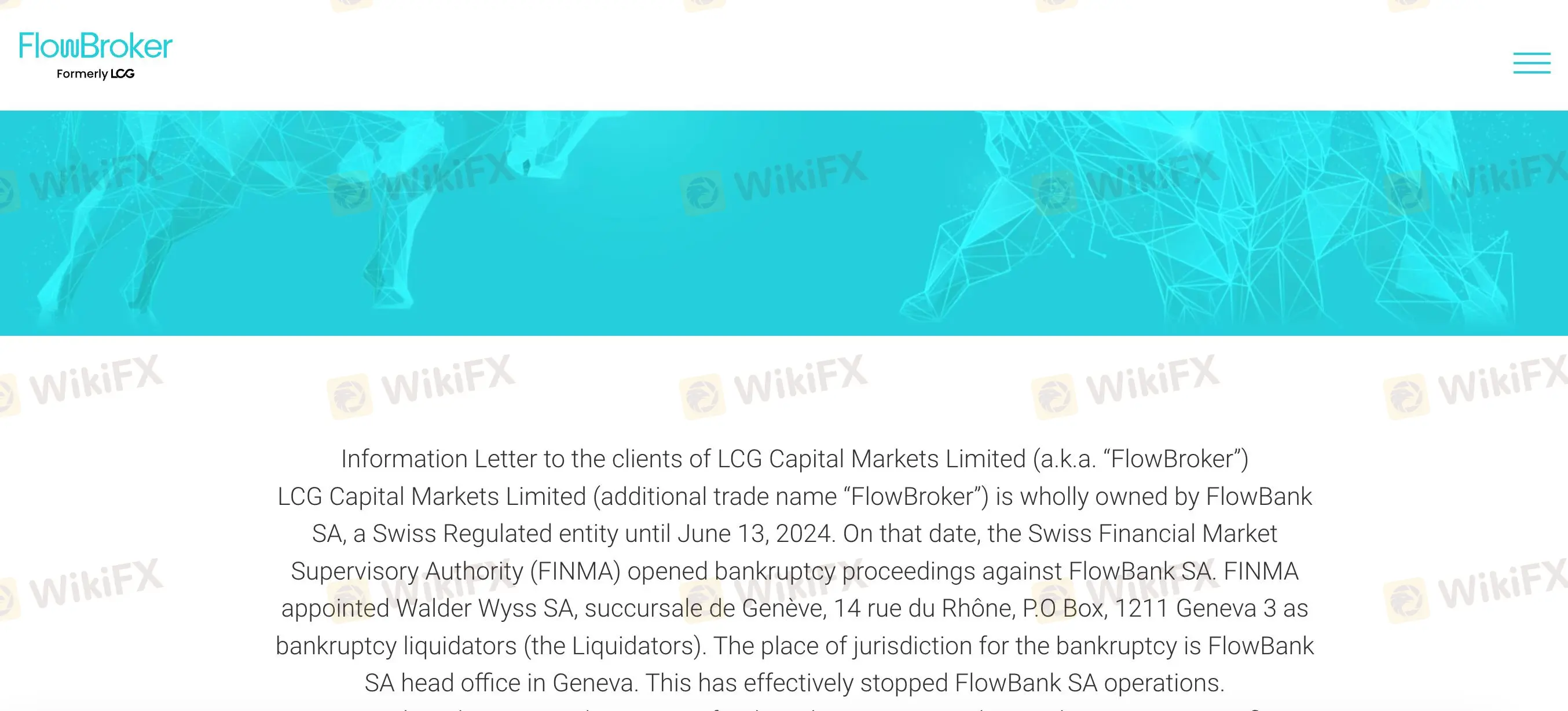

Established in 2023, FlowBroker offers unregulated financial services. Due to FlowBank SA's insolvency, its lack of regulation and operating halt have made potential traders cautious.

Pros and Cons

| Pros | Cons |

| None identified due to operational suspension | Unregulated |

| Parent company FlowBank SA is under bankruptcy proceedings. | |

| Trading services currently suspended, and product offerings are unclear. |

Is FlowBroker Legit?

FlowBroker is an unregulated financial services firm. In the Bahamas, it is neither regulated nor licensed. Furthermore, the broker is not licensed by major regulatory authorities like the Australian Securities and Investments Commission or the UK Financial Conduct Authority (FCA).

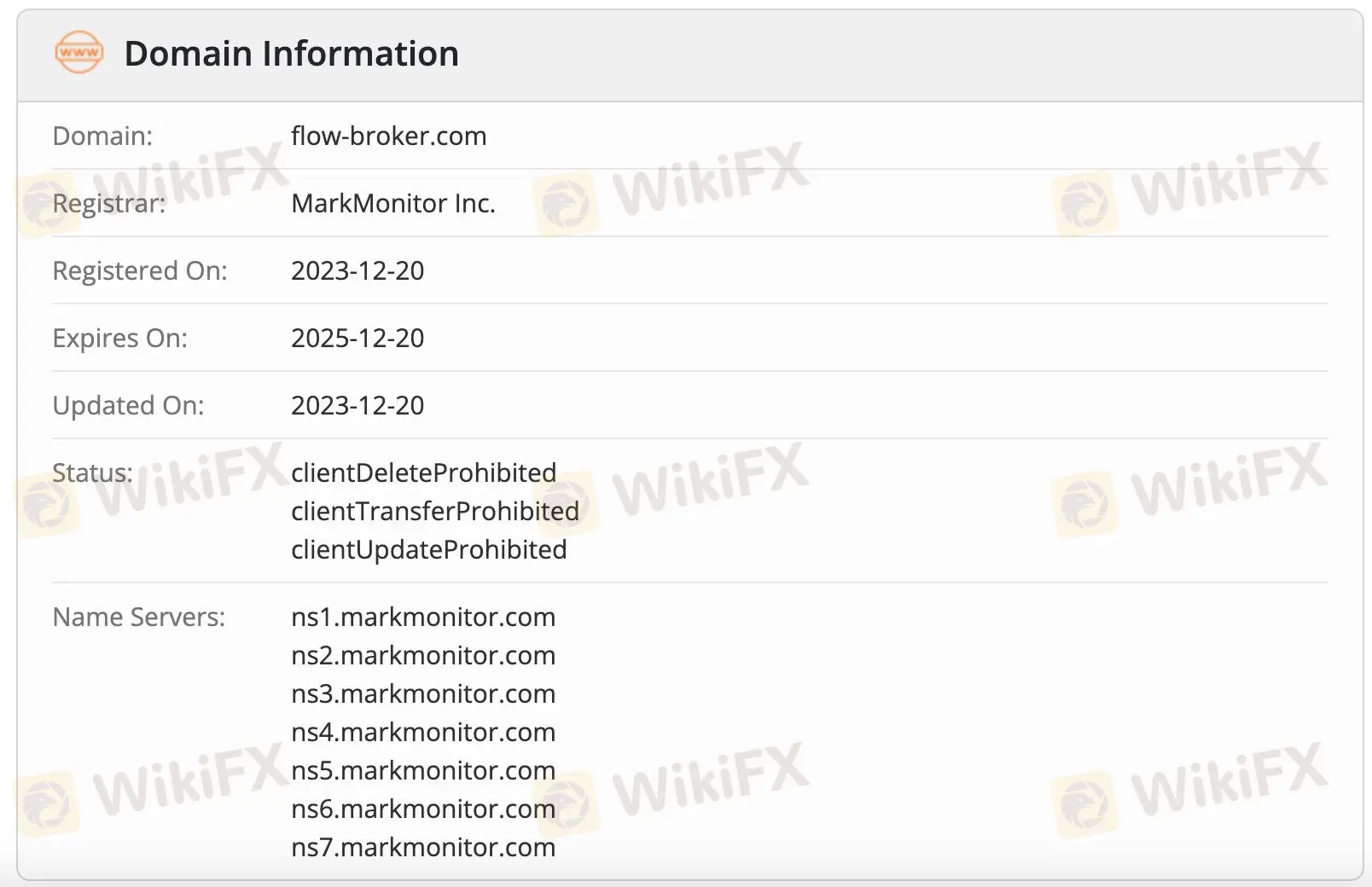

The domain flow-broker.com was registered on December 20, 2023 and will expire on December 20, 2025. Administrative limitations such as clientDeleteProhibited, clientTransferProhibited, and clientUpdateProhibited have been implemented to prevent the domain from being readily updated or migrated.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now