PAMM (Percentage Allocation Management Module) accounts are unique investment vehicles that allow investors to earn potential returns from forex trading without actively participating in the markets themselves. We have developed a comprehensive ranking based on overall performance, customer service, economic viability, and other key aspects concerning both investors and traders. These rankings take into account multiple considerations and have been created after extensive research and careful analysis.

We on WikiFX have devoted a significant amount of time, resources, and expertise to ensure that this research provides valuable insights on the top-performing PAMM Account Forex Brokers of 2024. We believe this comprehensive guide will be an invaluable resource for those interested in exploring investment opportunities in forex through PAMM accounts.

Best PAMM Account Forex Brokers

Best for investors seeking managed trading on a platform supporting multiple accounts and currencies

more

Comparion of Best PAMM Account Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best PAMM Account Forex Brokers Reviewed

① FP Markets

Best overall PAMM account forex broker 2024 for superior trading experience

FP Markets is a well-regarded Australian broker respected for its comprehensive trading services including forex and CFD trading. With regulation from both the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), it offers a high level of security for traders. FP Markets provides access to popular platforms MetaTrader 4 and MetaTrader 5, both of which are known for their user-friendly interfaces and extensive features.

The broker also provides PAMM and MAM services, giving professional traders and fund managers the ability to manage multiple accounts simultaneously. With a reputation for transparency, and a high level of flexibility and control for fund managers, FP Markets is a suitable choice for both individual traders and professional fund managers.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $100 AUD or equivalent |

| Regulation | ASIC, CYSEC |

| Trading Instruments | Forex, stocks, index, commodities, bonds, precious metals, cryptocurrencies |

| Max. Leverage | 1:500 |

| Trading Fees | From 1.0 pips + no commission (Std account) |

| Trading Platforms | MT4, MT5, WebTrader, Mobile App |

| PAMM Account Trading Platform | MT4 |

| Deposits & Withdrawals | Free deposits & fees for withdrawals- China UnionPay, crypto payments, cryptocurrency solutions, credit/debit cards, bank wire transfers, Neteller, Skrill, Broker-to-broker |

| Customer Support | 24/7 live chat, phone, email |

| Regional Restrictions | FP Markets does not accept applications from residents of countries or jurisdictions that violate local laws or regulations. |

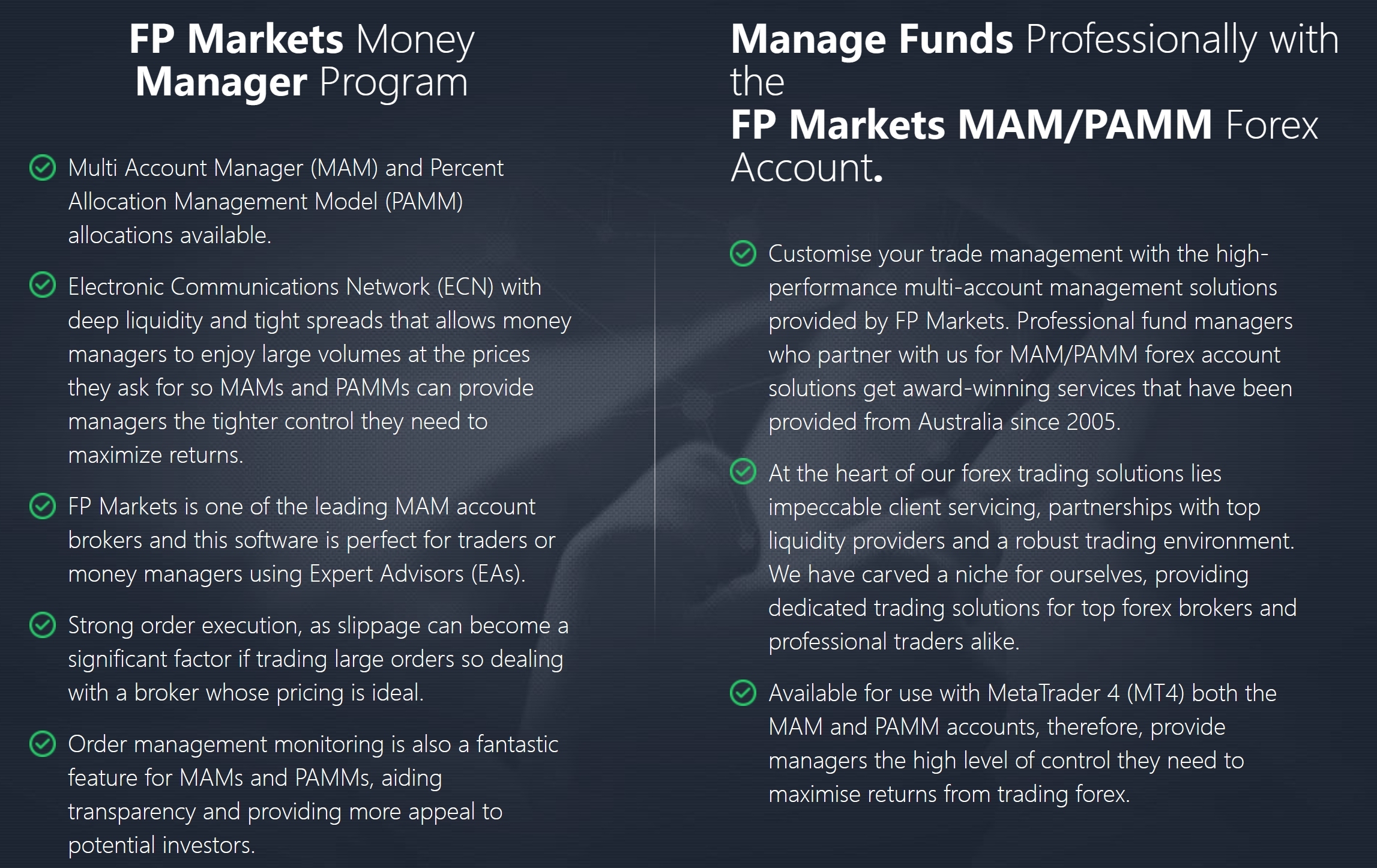

FP Markets PAMM Account Key Features

Transparency and Control: Managers have tight control of trading conditions, including commissions, spread mark-ups, account currency, performance fees and margin/call. Performance and commissions are calculated in real time.

Customisation: Managers can customise their trading conditions, including, among other things, commissions, spread mark-ups, account currency, performance fees, and margin/call.

Technological Infrastructure: The MAM/PAMM software enables investors to be a part of a set of accounts which are traded together by a trader who has permission from clients to trade their accounts.

Trading Platform: The service is available for use with MetaTrader 4 (MT4), a popular platform for its trading features and user-friendly interface.

Quick Deposit and Withdrawal: It's possible to easily withdraw or deposit funds in and out of the MAM/PAMM accounts without disrupting trading activity.

Overall, FP Markets allows professional fund managers to manage multiple forex trading accounts simultaneously in a flexible, efficient and, importantly, controlled manner.

FP Markets PAMM Account Pros & Cons

| Pros | Cons |

| √ Well regulated by ASIC and CySEC | × Limited Information on specific terms of PAMM services |

| √ Available on MetaTrader 4, a widely respected trading platform | × May be difficult for inexperienced forex investors |

| √ High control and flexibility for fund managers | |

| √ Real-time performance and commission reports for transparency | |

| √ Suitable for use with Automated Trading via Expert Advisors (EAs) |

② HFM (HF Markets)

Best for hands-off investing with control over investment sizes and risk

HF Markets, also known as HotForex, is an award-winning forex and commodities broker, providing trading services and facilities to both retail and institutional clients. With the option of PAMM (Percentage Allocation Money Management) accounts, investors can have their funds handled by experienced traders or fund managers.

HF Markets is characterized by offering a minimum deposit of $250 for its PAMM accounts, automated trade management, and maximum control over investment sizes and the flexibility of deposits and withdrawals. They are committed to transparency, providing real-time management reporting and investor accountability. Their services also come with a risk control feature known as the 'rescue level'.

However, services are not available in certain jurisdictions such as the USA, Canada, Iran, North Korea, Syria, and Sudan.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Min. Deposit | $250 (PAMM account) |

| Regulation | CySEC, FCA, DFSA, FSA, CNMV |

| Trading Instruments | Forex, Metals, Oil, and Indices (PAMM account) |

| Max. Leverage | 1:300 (PAMM account) |

| Trading Fees | From 1.6 pips + no commission (PAMM Premium account) |

| From 0.4 pips + $8 round turn (PAMM Premium Plus account) | |

| Trading Platforms | MT4, MT5, HFM App |

| PAMM Account Trading Platform | MT4 |

| Deposits & Withdrawals | Free for most deposits & withdrawals, Bank transfer, credit/debit cards, crypto, Fasapay, Neteller, PayRedeem, Skrill, bitpay |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | Residents of the USA, Canada, Sudan, Syria, North Korea, Iran, Iraq, Mauritius, Myanmar, Yemen, Afghanistan, Vanuatu and EEA countries are excluded. |

HFM PAMM Account Key Features

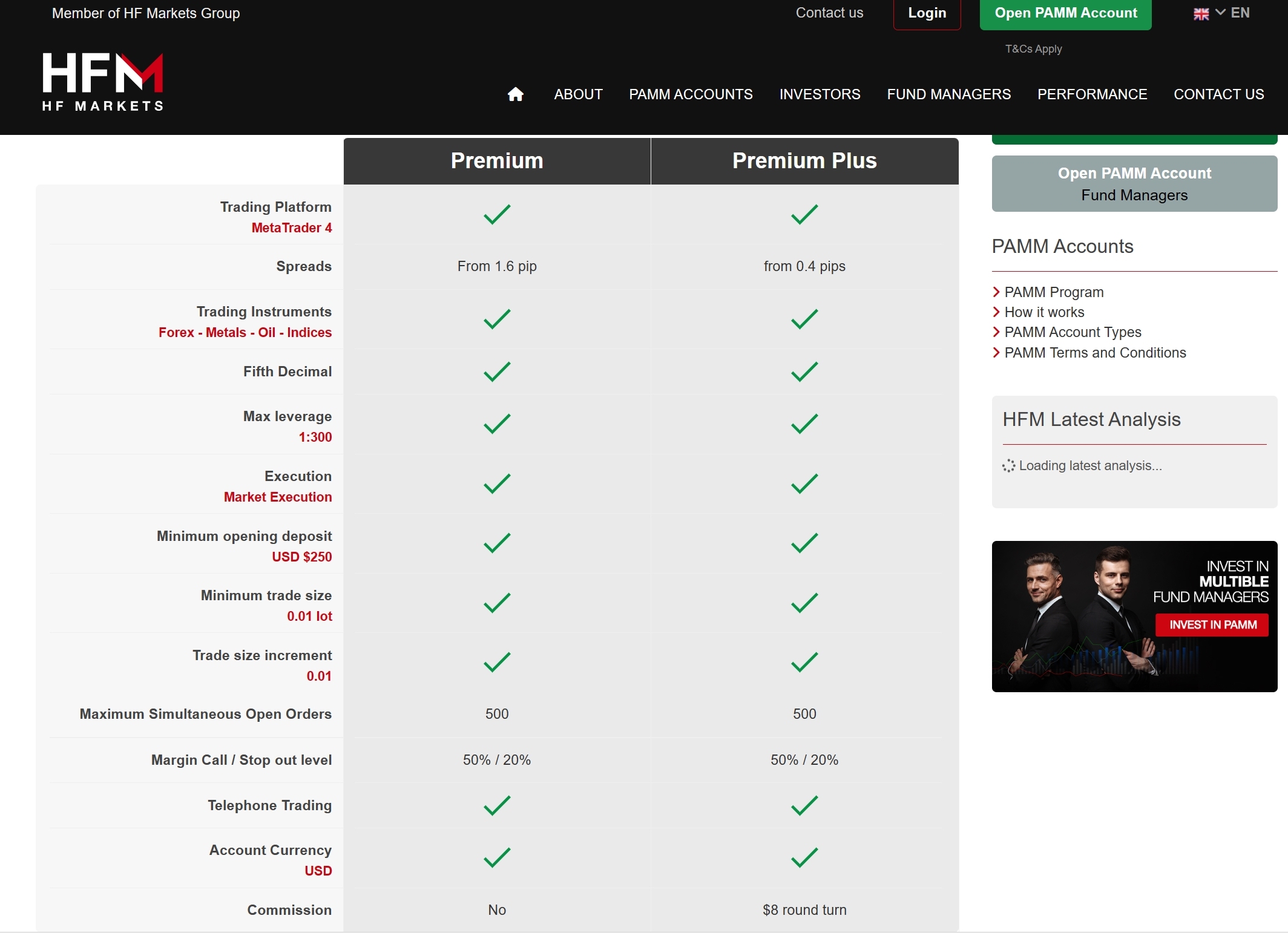

HF Markets offers PAMM accounts with the choice of opening a Premium or Premium Plus Account, each with differing conditions to suit different trading objectives. The PAMM accounts on HF Markets run on the MetaTrader 4 trading platform.

The Premium account offers spreads from 1.6 pip whilst the Premium Plus account offers spreads from 0.4 pips. Both account types offer a maximum leverage of 1:300 and allow for a minimum trade size of 0.01 lots. However, a commission of $8 round turn is applied only to the Premium Plus account.

The minimum opening deposit for both types of accounts is 250 USD. They provide the potential for trading in Forex, Metals, Oil, and Indices.

HFM PAMM Account Pros & Cons

| Pros | Cons |

| √ Full control for investors over investment sizes and making deposit-withdrawal | × Not all services are available to residents of USA, Canada, Sudan, Syria, Iran, North Korea, etc |

| √ Availability of a rescue level for risk control | |

| √ Complete automation and real-time manager reporting for efficient trade management | |

| √ Complete accountability and account transparency |

③ Dukascopy

Best for investors seeking managed trading on a platform supporting multiple accounts and currencies

Dukascopy is a top-rated brokerage regulated by FSA and FINMA, offering over 1200 trading instruments including forex, commodities, cryptocurrencies, metals, indices, bonds, stocks, and ETFs. The agency ensures a competitive cost for traders, with average trading fees around 0.3 pips and a default commission rate of 0.7 pips. Dukascopy provides a maximum leverage of 1:200, and its trading platforms include JForex4, MetaTrader 4 (MT4), and Web Binary Trader.

One notable service is their PAMM Account where traders can manage multiple accounts on MT4. Various deposit and withdrawal methods are supported, which includes wire transfers, payment cards (MasterCard, Maestro, Visa), Skrill, Neteller, and cryptocurrencies (Bitcoin, Ethereum, Tether). Dukascopy offers 24/7 customer support via live chat, phone, and email.

However, their services are not available for residents of Belgium, Israel, Russia, Turkey, Canada (including Québec), and the UK.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Min. Deposit | N/A |

| Regulation | FSA, FINMA |

| Trading Instruments | 1200+, forex, commodities, cryptocurrencies, metals, indexes, bonds, stocks, ETF |

| Max. Leverage | 1:200 |

| Trading Fees | Average around 0.3 pips + a default commission rate of 0.7 pips |

| Trading Platforms | JForex4, MT4, Web Binary Trader |

| PAMM Account Trading Platform | MT4 |

| Deposits & Withdrawals | Wire transfers, payment cards (Maestro, MasterCard, Visa), skrill, Neteller, and cryptocurrencies (Bitcoin, Ethereum, Tether) |

| Customer Support | 24/7 live chat, phone, email |

| Regional Restrictions | Residents of Belgium, Israel, Russian Federation, Turkey, Canada (including Québec) and the UK are excluded. |

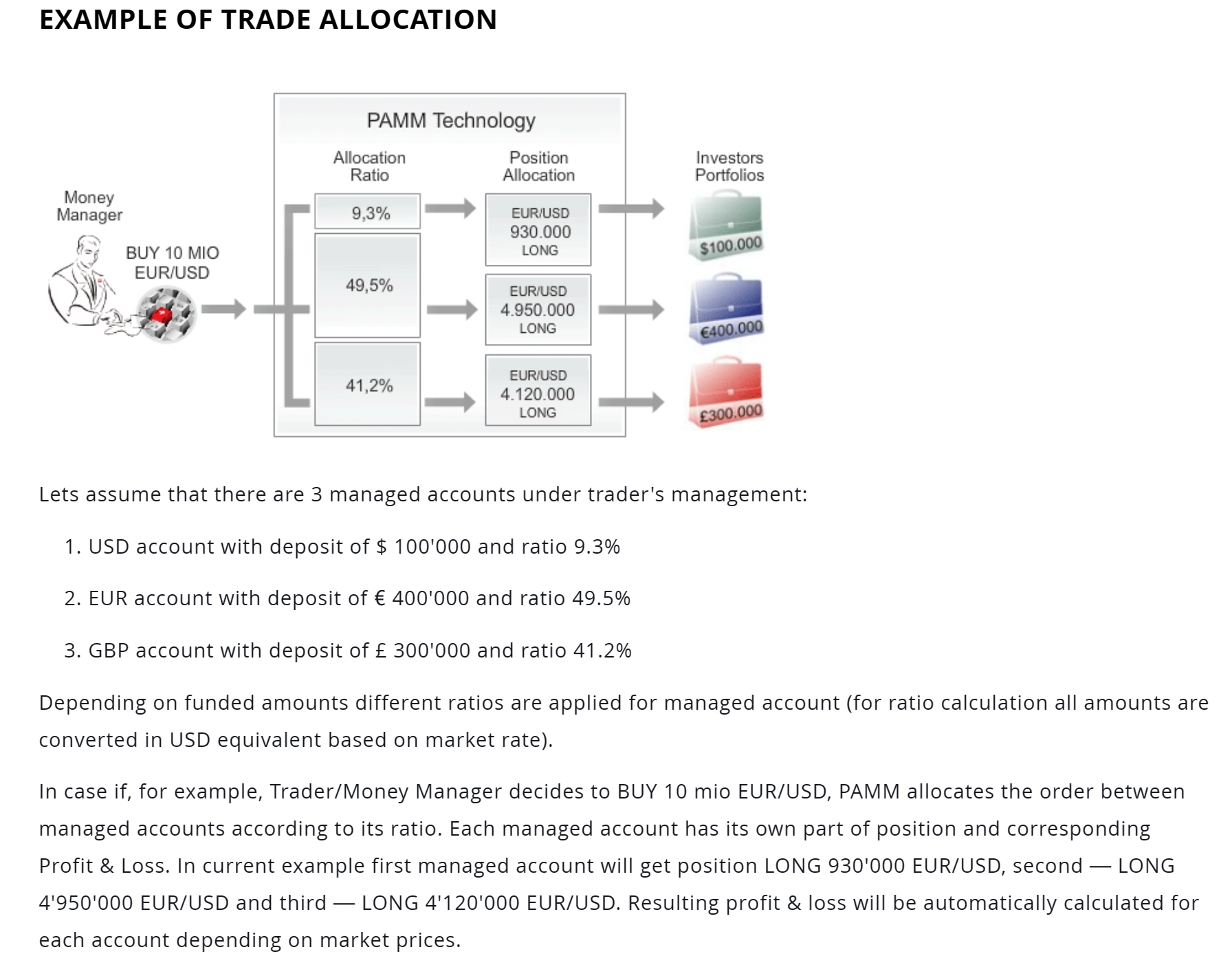

Dukascopy PAMM Account Key Features

Ability for clients to have their accounts managed by a trader appointed by them.

Allows the trader to manage an unlimited number of accounts on a single platform.

Accounts can be funded in different currencies and deposited with different institutions.

Managed accounts have individual ratios based on deposit size.

Trading results are allocated among managed accounts according to ratios.

Traders can add or remove funds and accounts without stopping trading activities.

Instant trade allocation between managed accounts.

Functionality for performing fee calculation is available.

Note that Dukascopy does not participate in trading decisions made by external account managers.

Dukascopy PAMM Account Pros & Cons

| Pros | Cons |

| √ Allows unlimited number of accounts to be managed on a single platform | × Trading results allocation depends on deposit size, which might not favor smaller accounts |

| √ Accounts can be funded in different currencies and with different institutions | × Services are not available to residents of Belgium, Israel, Russian Federation, Turkey, Canada (including Québec) and the UK |

| √ Allows traders to add or remove funds and accounts without interrupting trading activities | |

| √ Provides instant trade allocation between managed accounts | |

| √ Performance fee calculation functionality available |

④ FIBO Group

Best for offering an opportunity to earn income through an efficient asset management system

FIBO Group is a reasonably rated financial brokerage, regulated by CySEC, BaFin, and FSC. They offer a diverse array of trading instruments, including forex, spot metals, cryptocurrencies, and CFDs. With a generous maximum leverage of 1:1000 and trading fees starting from 0 pips, plus varied commissions based on account type, FIBO Group provides a compelling trading environment.

Its trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader - which are also used for their PAMM Accounts. FIBO supports multiple deposit and withdrawal methods, although fees may vary based on the method used. Customer support is available 24/5 via live chat, phone, and email.

However, their services are not available for residents of the United Kingdom, North Korea, and the USA.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $0 |

| Regulation | CySEC, BaFin, FSC |

| Trading Instruments | Forex, spot metals, cryptocurrencies, CFDs |

| Max. Leverage | 1:1000 |

| Trading Fees | From 0 pips + commission vary on the acccount type |

| Trading Platforms | MT4, MT5, cTrader |

| PAMM Account Trading Platform | MT4, MT5 |

| Deposits & Withdrawals | fees vary on the method - Swift, Visa, MasterCard, Neteller, Skrill, WebMoney, Fasapay, Perfect Money, cryptocurrencies |

| Customer Support | 24/5 live chat, phone, email |

| Regional Restrictions | Residents of United Kingdom, North Korea and USA are excluded. |

FIBO Group PAMM Account Key Features

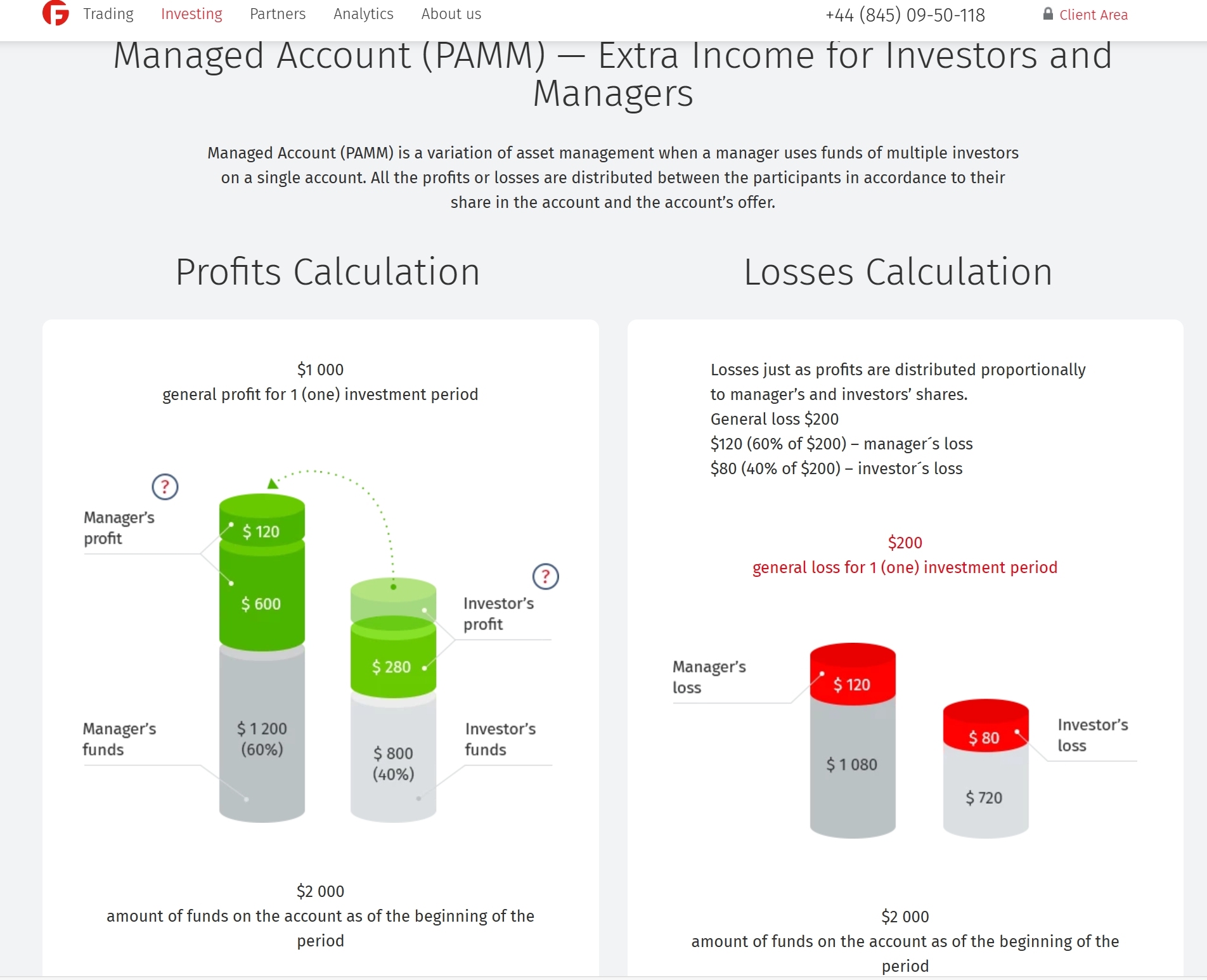

Fibo Group's Managed Account (PAMM) service offers a unique investment opportunity for both managers and investors. It allows a manager to handle funds from multiple investors in one account. Profits and losses are proportionally distributed among participants based on their shares. Options to withdraw profits or leave them for the next investment period, are available at the end of each period. Calculation for profits and losses is explicitly covered while ensuring fair distribution.

In addition, Fibo Group offers a PAMM-agent programme that helps attract more investors. This approach provides an extra income to both investors and managers, offering the potential for greater returns. Regional support and customer service appear to be well-established, and the offer also provides comprehensive information regarding performance metrics and criteria.

FIBO Group PAMM Account Pros & Cons

| Pros | Cons |

| √ Allows usage of funds from multiple investors on one account | × Not available for residents of the United Kingdom, North Korea and USA |

| √ Proportional distribution of profits and losses based on shares held by each participant | × Risk level is generally high for most PAMM accounts |

| √ Opportunity to generate income for both managers and investors through the PAMM-agent programme | |

| √ Ability to withdraw profits or reinvest for the investor at the end of each investment period | |

| √ Transparency regarding the calculation mechanisms and proportional distribution for profits and losses | |

| √ Comprehensive information regarding performance metrics and criteria |

⑤ ThinkMarkets

Best for experienced traders aiming to manage others' investments and grow their portfolio

ThinkMarkets is a well-rated brokerage offering a diverse range of trading instruments including forex, cryptocurrencies, indices, commodities, Share CFDs, and metals. It is regulated by ASIC, JFSA, FCA, CySEC, and FSA, and provides a maximum leverage of 1:2000. O

n average, forex trading fees are 1.2 pips with no commission on a Standard account. The trading platforms provided by ThinkMarkets are MetaTrader 4, MetaTrader 5, ThinkTrader, and ThinkCopy. Also, these platforms are utilized for their PAMM accounts.

They offer a variety of deposit and withdrawal methods including Visa, MasterCard, Swift, SEPA, Skrill, Neteller, cryptocurrencies, Apple Pay, Google Pay, Perfect Money, etc. Customers can reach out to their support team 24/7 via live chat, phone, or email.

However, their services are not available for residents of the United States, Canada, the European Union, Australia, United Kingdom, and Japan.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $10 |

| Regulation | ASIC, JFSA, FCA, CySEC, FSA |

| Trading Instruments | 4000+, forex, cryptocurrencies, indices, commodities, share CFDs, metals |

| Max. Leverage | 1:2000 |

| Trading Fees | Average FX 1.2 pips + no commission (Std account) |

| Trading Platforms | MT4, MT5, ThinkTrader, ThinkCopy |

| PAMM Account Trading Platform | MT4, MT5 |

| Deposits & Withdrawals | Visa, MasterCard, Swift, SEPA, Skrill, Neteller, cryptocurrencies, Apple Pay, Google Pay, Perfect Money, etc. |

| Customer Support | 24/7 live chat, phone, email |

| Regional Restrictions | Residents of the United States, Canada, the European Union, Australia, United Kingdom and Japan are excluded |

ThinkMarkets PAMM Account Key Features

ThinkMarkets offers a PAMM service known as “Percentage Allocation Management Module”. This service encourages experienced traders to become Money Managers to manage the investments of others. The flexibility in fee structure allows you to earn commissions based on performance and/or charge a management fee.

It provides access to a wide range of instruments across global markets and advanced tools to mitigate risk. The intuitive platform supports management of multiple investor accounts and tracking of performance through transparent reporting and analytics. The PAMM service of ThinkMarkets connects money managers and investors for mutual financial gain.

ThinkMarkets PAMM Account Pros & Cons

| Pros | Cons |

| √ Offers an opportunity to earn additional income as a PAMM Manager | × Not available for residents of the United States, Canada, the European Union, Australia and Japan |

| √ PAMM service aggregates multiple investors' trades, allowing individual investors to leverage the intelligence of expert traders | |

| √ Provides a flexible payment structure, with the possibility to earn commissions based on performance and/or charge a management fee | |

| √ Allows access to a wide range of instruments across various global markets | |

| √ Supports management of multiple investor accounts through a comprehensive dashboard | |

| √ Enhanced transparency with performance tracking through transparent reporting and analytics |

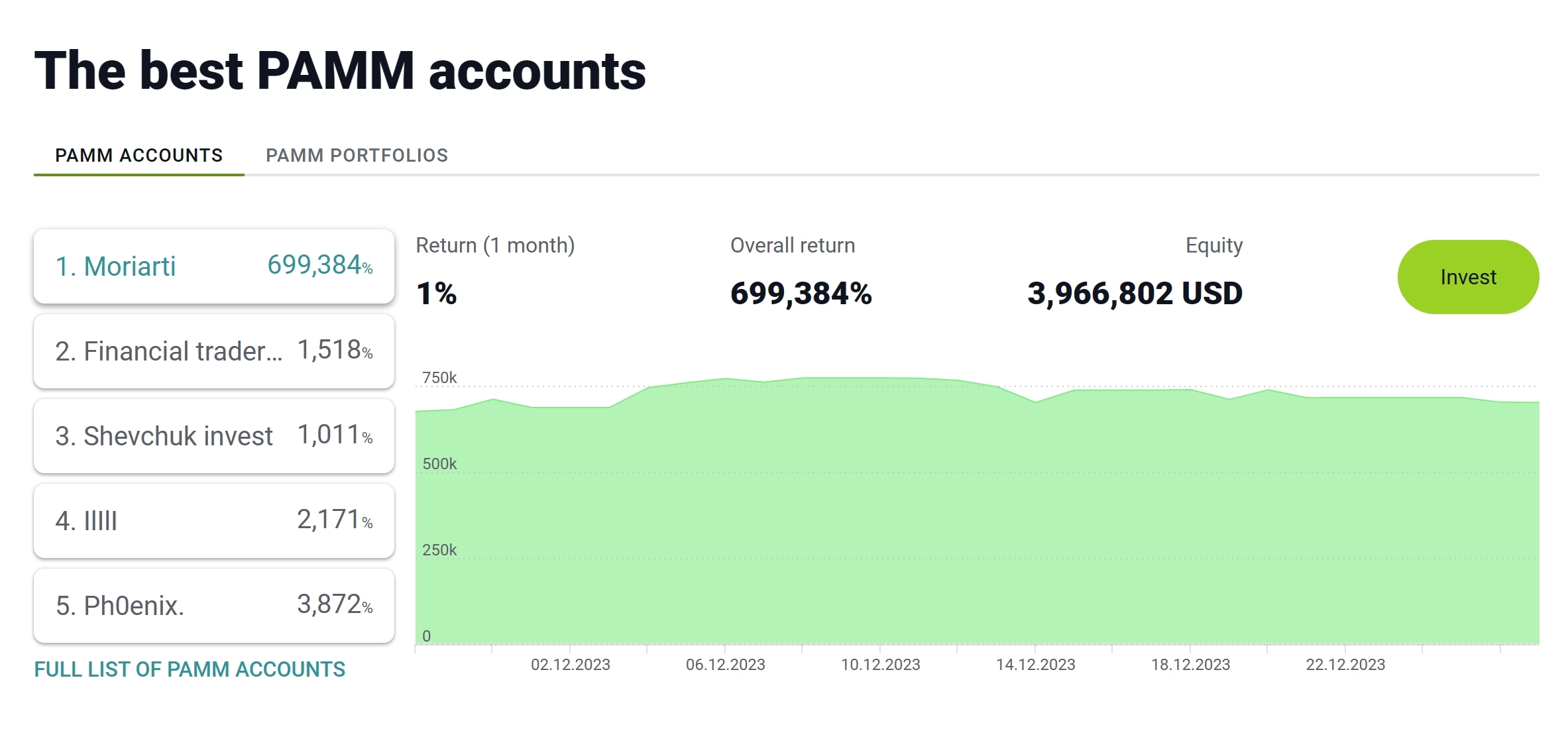

⑥ Alpari

Best for passive investors seeking high returns through experienced traders

Alpari is a well-rated forex broker regulated by NBRB. It offers over 250 trading instruments with a maximum leverage of 1:1000. The trading fees start from 1.2 pips with no commission on a Standard account, via the MT4 platform. Although the PAMM account's trading platform is not specified, Alpari is known to provide MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Alpari International direct platforms.

Various methods including Visa, Mastercard, Maestro, Skrill, Neteller, WebMoney, bank transfers, and more are available for depositing and withdrawing funds. Their customer support can be reached through live chat, phone, or email.

However, Alpari doesn't provide services to residents of the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, North Korea, Puerto Rico, the Occupied Area of Cyprus, Russia, Ukraine, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar, the European Union, and the United Kingdom.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Min. Deposit | $/€/£ 5, ₦1 000 |

| Regulation | NBRB |

| Trading Instruments | 250+, forex, metals, CFDs |

| Max. Leverage | 1:1000 |

| Trading Fees | From 1.2 pips + no commission (Std account, MT4) |

| Trading Platforms | MT4, MT5, Alpari International direct platform |

| PAMM Account Trading Platform | N/A |

| Deposits & Withdrawals | Free for deposits, withdrawal fee vary on the method, Visa, MasterCard, Maestro, Skrill, Neteller, WebMoney, Bank Transfers, Local Transfer, LOAD, etc. |

| Customer Support | Live chat, phone, email |

| Regional Restrictions | Alpari does not provide services to residents of the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Russia, Ukraine, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar, European Union and United Kingdom. |

Alpari PAMM Account Key Features

Alpari is a popular global brokerage that offers a unique PAMM (Percentage Allocation Management Module) service. This service, which was created by Alpari, allows traders and investors to come together under mutually beneficial terms.

Alpari's PAMM account lets investors earn without having to trade. Investors can put their funds in the accounts of traders who receive a percentage of the profits they make from trading with the funds as a reward.

Alpari also offers PAMM Portfolios, which are several PAMM accounts combined into one, providing a way to hedge bets by choosing accounts with varied risk profiles. It offers potential high returns, transparency, and control over your funds. Alpari is also home to a referral program, where partners can earn a share of the profit generated by managers on each client they refer.

Alpari PAMM Account Pros & Cons

| Pros | Cons |

| √ Offers PAMM Portfolios which allow the balancing of risk by combining multiple PAMM accounts | × Not available for residents of the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Russia, Ukraine, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar, European Union and United Kingdom |

| √ High transparency, with a compliance check conducted by an international auditing firm | |

| √ Provides control to investors to withdraw profits or funds at any moment |

PAMM Account Forex Brokers FAQs

What is a PAMM account?

A PAMM (Percentage Allocation Management Module) account is a type of investment where investors entrust their capital to a professional trader to manage the forex trades on their behalf. The professional trader, also known as the money manager, uses their expertise to trade on the forex market with their own money as well as the pooled money from the investors. The potential profits or losses are distributed among the accounts based on the proportion of their participation in the total fund. This type of setup allows investors to take part in forex trading without the need for deep knowledge or time to trade personally.

MAM vs PAMM account - what's the difference?

MAM (Multi Account Manager) and PAMM (Percentage Allocation Management Module) are both types of managed forex accounts where a money manager trades on behalf of investors. However, there are important differences in the functionality and fund allocation methods between the two.

PAMM Account

With a PAMM account, the money manager performs trades on a master account, and these trades are then proportionately mirrored on investor sub-accounts. The distribution of profits or losses happens based on each investor's share in the total pooled investment. The method is transparent, but it offers lesser control to the manager in terms of risk management or trade allocation.

MAM Account

On the other hand, a MAM account provides more flexibility to the money manager. While MAM maintains the concept of a master account and sub-accounts, it allows the manager to manually adjust the allocation of profits, losses, and even trades to each investor differently. This provides an effective way for a money manager to control risk and address individual investor's risk profiles.

You can learn more about the differences between MAM accounts and PAMM accounts based on the comparion table below :

| Aspect | MAM Account | PAMM Account |

| Trade allocation | Can be changed per investor | Fixed based on investor's share of total pool |

| Profit/Loss distribution | Adjustable | Based on individual stake in total fund |

| Risk management | Can be customized per investor | Same for all investors (proportional) |

| Flexibility for money manager | High | Moderate / Low |

How do PAMM accounts work?

PAMM accounts work by allowing investors to allocate a portion of their funds to a selected trader or money manager, who then trades with pooled money on the forex markets.

Step 1: Setup

An experienced trader or money manager sets up a PAMM account with a broker. This person will manage the account and make trades.

Step 2: Investment

Interested investors choose this PAMM account and allocate a certain amount of their money to it. The amount can be selected based on the investor's risk tolerance and investment goals.

Step 3: Trading

The money manager trades on the Forex market using their own money and the pooled money from all the investors in the PAMM account. They use their trading skills and strategies to try to generate profit.

Step 4: Profit and Loss Distribution

The profits or losses from the trades are distributed among the investors based on their proportionate share in the total pool. If the trader makes a profit, it is allocated to investors according to the percentage of their investment. If the trader incurs a loss, it is also distributed proportionately.

Typically, the money manager earns a performance fee, which is a percentage of the profits made from trading.

What does a PAMM account forex broker do?

A PAMM account forex broker provides a platform where investors and professional traders can collaborate. The role of the broker in this system has multiple aspects:

Platform Provision

The broker provides the PAMM account platform that allows the setup of the master account (used by the money manager or trader) and the respective investor sub-accounts.

Maintain and Track Accounts

The broker keeps track of all the transactions, profits and losses, and distributes them based on the percentage of the total pool each investor holds. They also track and calculate the fees or compensations for the account manager.

Safety and Regulation

A reliable forex broker also ensures that operations abide by regulatory norms, protecting the interests of both the traders and investors. They provide safety mechanisms for funds and ensure transparent operations.

Customer Support

They offer customer service and support to resolve queries or issues that investors or money managers may face with PAMM accounts.

Education Resources

Many brokers also provide educational resources on how to use PAMM accounts, potential risks and advantages, along with generic forex trading education.

Thus, the forex broker acts as a mediator facilitating the trading process in a safe and controlled environment.

Pros & cons of PAMM account

PAMM accounts come with their own set of advantages and disadvantages.

| Pros √ | Cons × |

| · Less time-consuming for investors | · Significant risk of loss due to forex volatility |

| · Access to experienced traders | · Dependence on the money manager's performance |

| · Investment diversification | · Limited control over individual investment |

| · Transparent performance of the money manager | · Performance and management fees may reduce profit |

| · Profits and losses scaled per invested funds |

Pros

√ Less Time-Consuming: For investors, a PAMM account is beneficial as they don't have to manage their accounts individually. This is a huge time saver, especially for individuals who have limited time to engage in trading activities.

√ Access to Experienced Traders: PAMM accounts provide an opportunity for novice investors to invest under the guidance of skilled and experienced traders.

√ Investment Diversification: Investors can diversify their investment by allocating funds to multiple PAMM accounts managed by different traders, potentially reducing the risk.

√ Transparency: There are usually clear rules for PAMM accounts, and the performance of the money manager is transparently displayed, which helps investors make informed choices.

√ Scaling: Profits and losses are scaled based on the proportion of the invested funds, which could mean higher earnings for successful trades compared to standard accounts.

Cons

× Risk of Loss: The forex market is volatile, and there's a significant risk of losing funds despite your investments being handled by experienced traders.

× Dependence on Money Manager's Performance: Your investments rely heavily on the trading skills of the money manager. If the trader's performance suffers, so will your investments.

× Limited Control: Since the trading activities are handled entirely by the account manager, investors have very limited control over their investments.

× Performance and Management Fees: Most PAMM account managers charge a fee for their services, usually a percentage of the profits, which could reduce the net profit for the investor.

How to choose a PAMM account forex broker?

Choosing a PAMM account forex broker involves careful consideration of several critical factors:

Regulation

Check whether the forex broker is regulated by a reputable authority. This ensures they are under regulatory oversight, which generally offers more security and trustworthiness.

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Record of the PAMM Manager

Investigate the history and track record of the PAMM account manager. Look at their past performance, their trading style, risk levels and the duration theyve been active.

PAMM Specific Features

Brokers can offer different types of PAMM accounts with various features. Some might allow you to distribute your investment among multiple managers for diversification, others may offer different risk levels, etc. Make sure the features align with your investment goals and risk tolerance.

Brokerage Fees

Understand all the costs associated with the investment, including management and performance fees, any hidden charges, and how they might impact your returns.

Trading platform

Look at the broker's platform itself. Is it user-friendly? Does it offer advanced trading tools? You want a platform thats easy to use and has all the tools and features you need.

Withdrawal and Deposit Options

The broker should have flexible and convenient options for deposit and withdrawals, ensuring you can manage your funds easily.

Customer Service

Assess the broker's customer service. Are they available when you need them? Do they respond promptly, and are they helpful? Good customer service is invaluable in the finance industry.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Best DMA Forex Brokers (Direct Market Access) for 2024

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.