The minimum deposit is the initial amount a broker requires its new clients to fund their accounts with. While most forex brokers have minimums of $100 or more, some set the barrier as low as $5. Geniunely, such low minimum deposit makes forex trading more easily accessible for new traders and those with limited capital to start. More precisely, $5 dollars give investors an affordable way to experience real forex trading first-hand, build skills, and determine if they have the motivation to commit more funds long-term before barriers get higher. While for forex brokers, they expand their potential client base dramatically by reducing perceived risk - even if their lowest tier accounts are not tremendously profitable on a stand-alone basis. Today, we select four best forex broker with $5 minimum deposit based on core asprects like regulation, trading costs, trading platform, customer services, and more for your reference.

Top 4 Forex Brokers with $5 Minimum Deposit

A trusted broker requires a tiny $5 allowing traders to enter markets easily.

Solid trading platform performance, reducing risk of slippage.

$5 trading account here comes with low trading fees.

Superb trading environment, including copy trading feature and competitive fees.

A well-established forex broker with excellent operation.

$5 to allow more traders to enter international markets easily.

more

Comparison of Top 4 Forex Brokers with $5 Minimum Deposit

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Top 4 Forex Brokers with $5 Minimum Deposit Overall

| Brokers | Why are they listed as the Best Forex Brokers with $5 Minimum Deposit? |

No. 1 XM  |

✅Operating under a strong regulatory framework, giving traders more trading confidence. ✅$5 to open a micro account, enjoying the same trading conditions as other high minimum deposit accounts. ✅Solid trading platform perfomance, fast order execution. |

No.2 HFM  |

✅Globally regulated, a well-operated broker with a solid reputation. ✅ $5 to open a cent account, enjoying spread-only fee strcuture. ✅ Various quality educational contents, copy trading feature also provided. |

No.3 FBS  |

✅A well-established Crypiot broker under strong regulation. ✅ $5 to open a real account, equipped with 3000 times leverage and competitive spreads. ✅A series of quality educational resources, including demo accounts. |

No.4 Alpari |

✅ Favorable trading conditions on offer, including tiered-acocunts, generous leverge, low fees on ECN accounts. ✅ $5 to open a micro accocunt, providing access to forex and precious metal trading. ✅Offering AlpariCopyTrade for copy trading, friendly to beginners. |

Overview of the Best Forex Brokers with $5 Minimum Deposit

XM- Best $5 Minimum Depsosit Broker with All-Around Offerings

Broker |

|

Regulated by |

ASIC (Australia), CYSEC (Cyrus), FSC ( Belize), DSFA (UAE) |

Min.Deposit |

$5 |

Tradable Instruments |

Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, CommoditiesEquity Indices, Precious Metals, Energies |

Trading Platform(s) |

MT4 & MT5, available on PC, iPhone, iPad |

Leverage |

1:1000 |

Trading Fees |

0.6 pips on all major currency pairs, no commissions on FX accounts |

Payment Methods |

credit and debit cards, bank transfers, e-wallets, and many more |

Copy Trading |

✅ |

Bonus |

$50 trading bonusDepsoit bonus up to $5,000 |

Customer Support |

7/24 live help |

Pros |

✅ Heavily regulated, negative balance protection applied. ✅Diversified product portfolios, including Turbo Stocks. ✅Competitive trading fees, no commissions on FX. ✅Generous bonuses, giving traders more confidence. ✅Quality and rich educational content. |

Cons |

❌Average stock CFD fees |

XM, a Cyprus-based brokerage with an impressive 14-year operational history in the industry. XM provides access to an extensive array of over 1,000 markets, spanning Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, and Energies. Beyond its diverse market offerings, XM distinguishes itself by offering favorable trading conditions. These include competitive spreads, a copy trading feature allowing replication of successful strategies, and an attractive deposit bonus of up to $5,000. Moreover, XM provides 7/24 customer support, placing clients' concerns above all else.

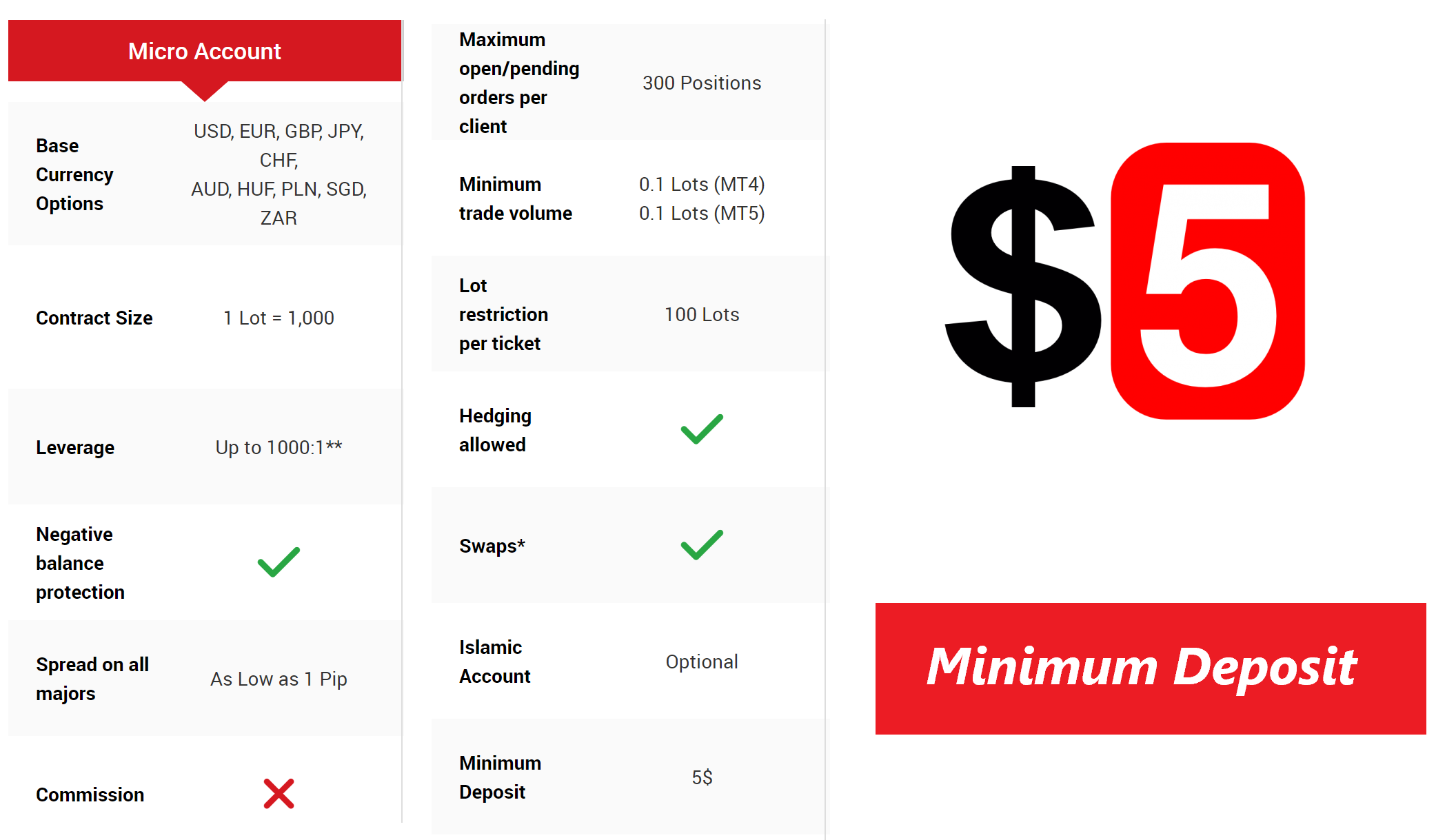

XM allows its traders to open a Micro account for a mere $5. This Micro account offers an array of enticing options, such as 10 base currency choices, a generous leverage of 1000:1, a fee structure focused solely on spreads, and Islamic account options. A $5 micro account offers conditions almost as good as higher minimum deposit accounts, truly an ideal choice for both regular traders and beginners alike.

HFM-Best $5 Minimum Deposit Forex Broker for Copy Trading

Broker |

|

Regulated by |

CYSEC (Cyprus), FCA (UK), DFSA (UAE), FSA (Seychelles), CNMV (Spain) |

Min.Deposit |

$5 |

Tradable Instruments |

Forex, Metals, Energies, Indices, Stocks, Commodities, Bonds, ETFs, Cryptos |

Trading Platform(s) |

HFM Platform, MT4, MT5 |

Leverage |

1:2000 |

Trading Fees |

Spread from 0.6 pips on Pro accounts |

Payment Methods |

Bank transfers, credit/debit cards,cryptos, fasapay, neteller, skrill, and more |

Copy Trading |

✅ |

Bonus |

20% Top-up bonus, up to $5,000 |

Customer Support |

7/24 customer support |

Pros |

✅Globally regulated, with good operation for years. ✅HF Copy for copy trading, PAMM investing available. ✅Generous bonus up to $5,000 offered. ✅Solid educational resources, advantageous for beginners. |

Cons |

❌Limite tradable assets and base currencies on Cent account |

HF Markets, or HFM for short, is a reputable forex broker boasting a solid 15-year track record. They offer traders access to over 1000 markets, spanning Forex, Metals, Stocks, Bonds, Indices, Energies, Commodities, Cryptos, and ETFs. Impressively regulated and efficiently operated, HFM remains trusted broker, serving a vast clientele of 2.5 million accounts with $2 billion in client deposits and a network of 41,000 partners.

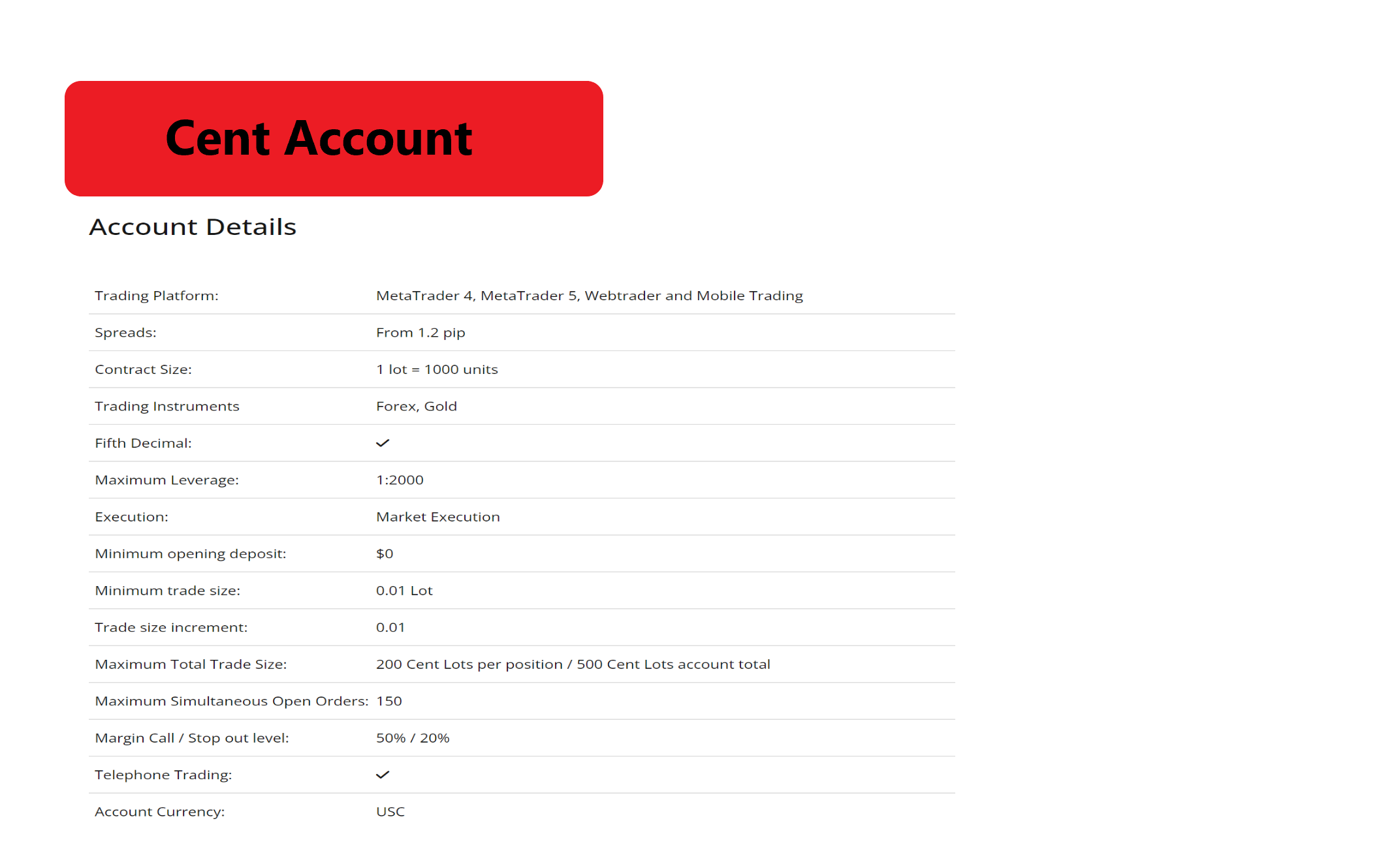

HFM permits traders to initiate a Cent account with just $5, enabling them to trade Forex and Gold across platforms like MT4, MT5, Webtrader, and mobile trading. Notably, this account comes with an astonishingly high leverage of up to 1:2000. As for trading costs here, traders can benefit from spreads starting from 1.2 pips on major currency pairs, all without incurring any commission charges.

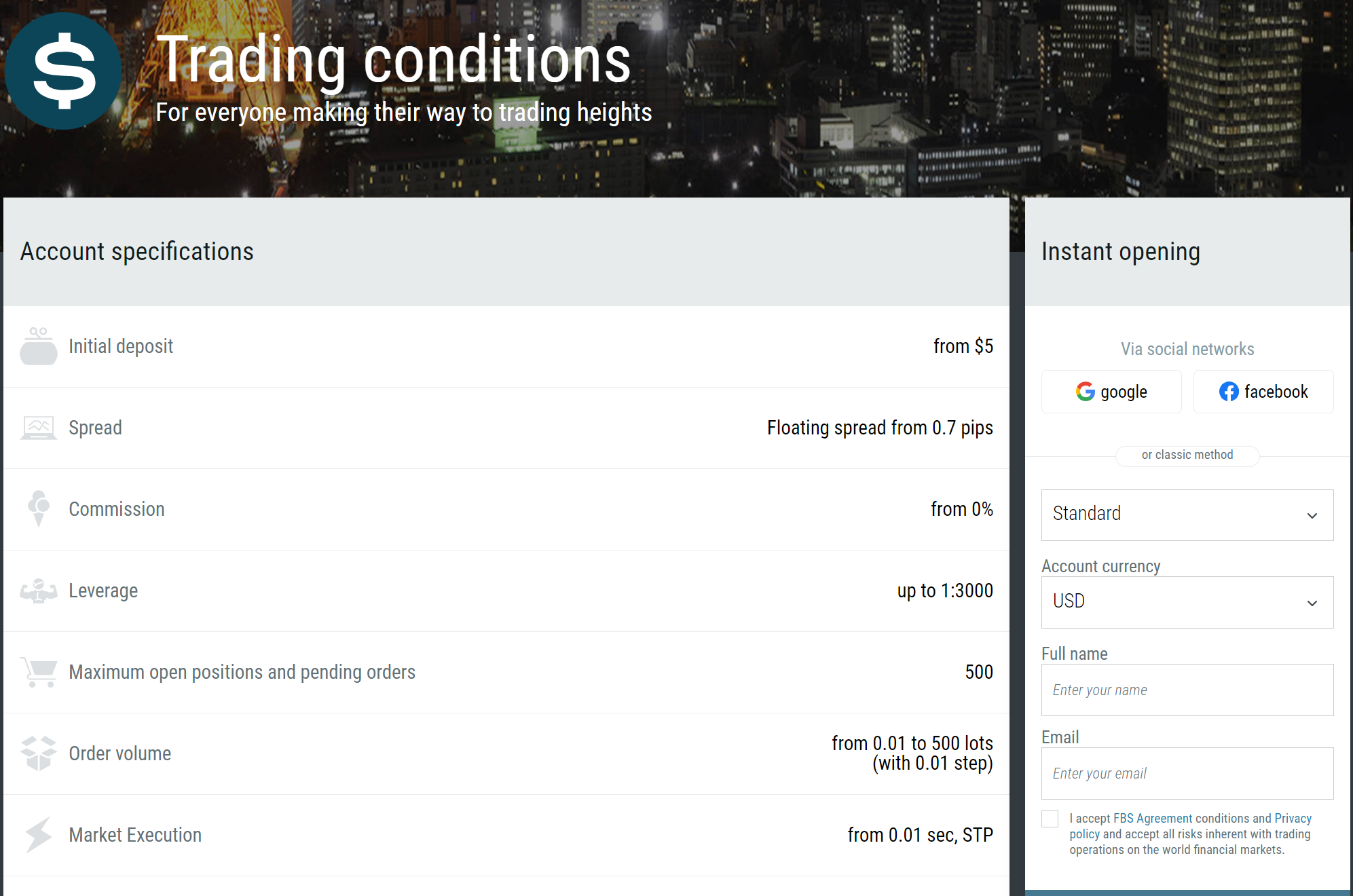

FBS - Best $5 Minimum Deposit Forex Broker with Generous Leverage

Broker |

|

Regulated by |

CYSEC (Cyprus), FSC (Belize) |

Min.Deposit |

$5 |

Tradable Instruments |

Forex, Metals, Indices, Energies, Stocks, Forex Exotics, Cryptos |

Trading Platform(s) |

MT4, MT5 |

Leverage |

1:3000 |

Trading Fees |

Spreads from 0.7 pips, commission from 0% |

Payment Methods |

Local banks and global methods |

Copy Trading |

✅ |

Bonus |

No |

Customer Support |

7/24 |

Pros |

✅ Providing access to 550 markets through MT4, MT5 ✅ Low thresholds to enter markets, only $5 ✅ Various educational resources |

Cons |

❌Single account |

FBS, an online forex broker established back in 2009, operates under the regulation of CYSEC and FSC. They offer clients access to a diverse range of over 550 trading instruments, spanning Forex, Metals, Indices, Energies, Stocks, Forex Exotics, and Cryptos. FBS provides a single trading account for all its clients, with the option for demo and swap-free accounts. Order execution occurs in as little as 0.01 seconds, alongside floating spreads starting from 0.7 pips. Impressively, FBS has catered to a staggering 27 million clients from more than 150 countries thus far.

FBS simplifies things with just one account type, and it only requires a minimum deposit of $5.Within this account, traders can access the forex market with competitive spreads starting at 0.7 pips and a notable absence of commissions. Notably, this acount comes with a remarkably high leverage of up to 1:3000.

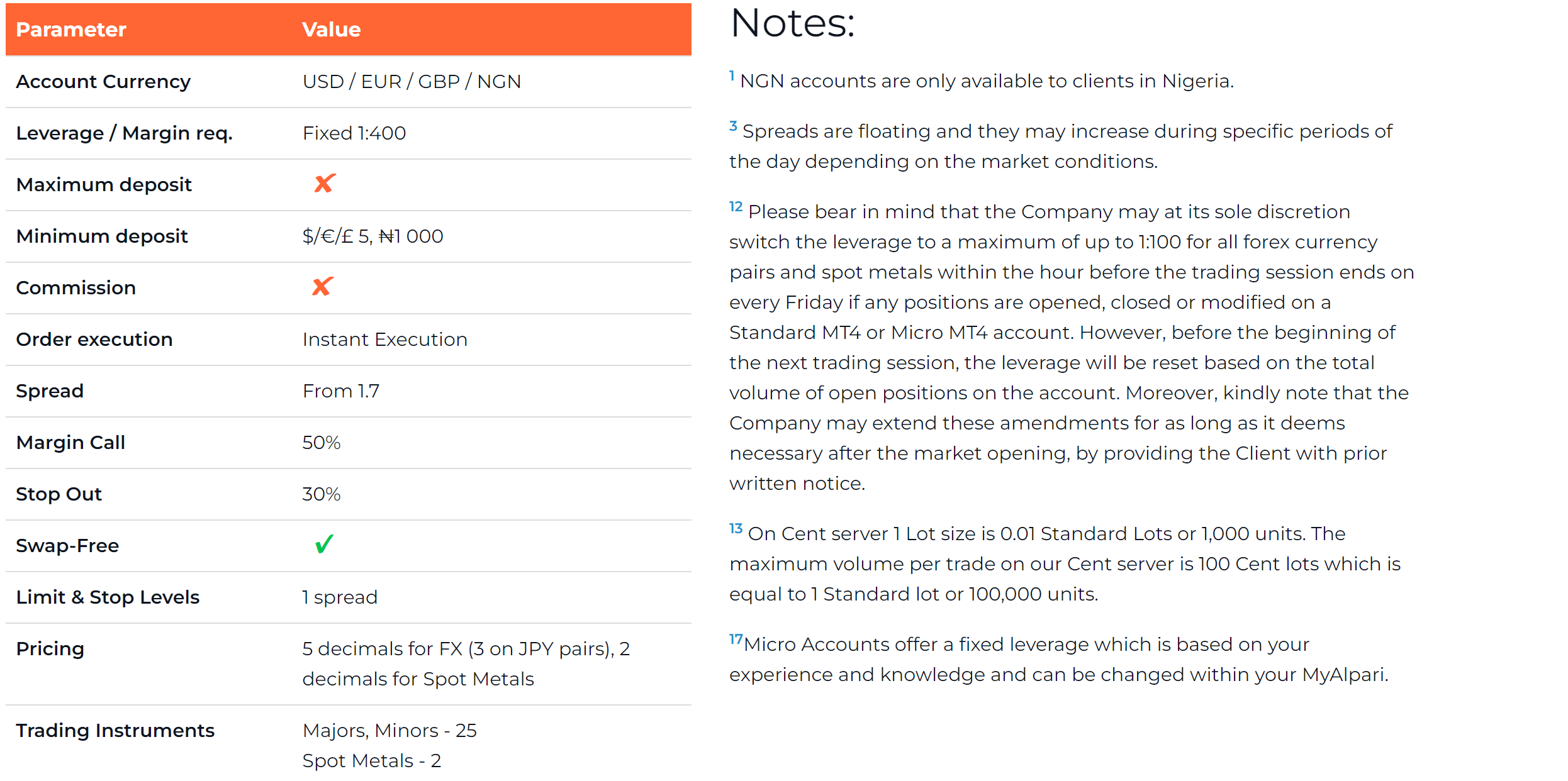

Appari International - Best $5 Minimum Deposit Forex Broker for ECN Trading

Broker |

|

Regulated by |

NBRB (Belarus) |

Min.Deposit |

$5 |

Tradable Instruments |

Forex, CFDs |

Trading Platform(s) |

MT4, MT5 |

Leverage |

1:1000 |

Trading Fees |

Spreads from 0.4 pips on ECN account, commissions applied |

Payment Methods |

Visa, MasterCard, Skrill, Neteller, WebMoney, Bank Transfers, Local Tranfer, VLoad |

Copy Trading |

✅ |

Bonus |

No yet |

Customer Support |

5/24 |

Pros |

✅ Singlar regulation ✅Generous leverage up to 1000:1 ✅Copy trading allowed |

Cons |

❌Singlar regulation ❌ Limited product portfolios |

Alpari International is an established broker that has 20 years of experience in the forex industry. Offering access to a diverse array of over 250 trading instruments, its primary focus lies in forex and CFDs though industry-leading MT4 and MT5. Besides, Alpari extends copy trading services through Alpari CopyTrade, enhancing its range of offerings for clients.

At Alpari International, clients can open a Micro account with just $5. This account type features a fixed leverage of up to 1:400, offering spreads starting from 1.7 pips, all without incurring any commissions. The account supports four base currencies—USD, EUR, GBP—yet restricts trading options to 25 major and minor currencies, alongside gold and silver.

Key Factors of choosing $5 Minimum Deposit Forex Brokers

Regulatory Compliance

Customer Fund Segregation: Brokers must keep client funds separate from company funds in different bank accounts to minimize accounting errors.

Negative Balance Protection: This ensures traders cannot lose more than their account balance, which is essential when trading high-risk instruments like CFDs.

Market Risk Limits: Most top-tier regulators limit leverage to 1:30 to protect traders from adverse price movements, while less strict regulators may allow up to 1:3000.

Compensation Plans: Jurisdiction-based compensation schemes protect clients from the broker's credit risk. For instance, CySEC-regulated brokers are part of the Investor Compensation Fund (ICF), offering up to €20,000 in compensation, while the UK's FCA provides up to £85,000 through the Financial Services Compensation Scheme (FSCS).

Trading Costs

Brokers with low or no minimum deposits might compensate with higher trading fees (spreads, commissions). Understanding the cost structure is crucial.

Cent Accounts

Check if the broker offers different account types (standard, mini, micro). For new traders wanting to learn without significant risk, cent accounts are ideal. They often have no deposit limits and allow trading volumes far lower than standard accounts.

Trading Product Selection

For starting with less than $200, be aware that many assets may be inaccessible due to high margin requirements. Choose brokers offering a range of affordable instruments.

Leverage

Brokers may offer high leverage to offset low deposit requirements. While high leverage lets you control large trades with minimal capital, it also magnifies losses, potentially depleting your investment quickly if the market moves unfavorably.

Trading Platform

Assess the brokers trading platform for functionality and stability. Ensure it supports necessary trading tools and technical analysis features.

Forex Trading Knowledge Questions and Answers

Can I Trade Forex with $5?

Abusoulately, you can. Brokerage firms tend to base their minimum deposit amounts on various factors such as market trends, their target audience, and crafted marketing plans. Most traders often encounter minimum deposit requirements ranging from $100 to $500, which is generally acceptable. However, to stand out in the competitive forex market, some brokers opt for significantly lower initial deposit requirements.

Take, for instance, brokers like XM, HFM, and FBS—they set the bar at a mere $5 to begin trading. This offers traders a budget-friendly chance to explore and enter the forex market.

Which is the Best $5 Minimum Deposit Forex Broker?

XM. Here we compare these brokers based on various dimensions like regulations, trading costs on some major instrumets, trading platform, negative balance protection and more, all to determine the best $5 minimum deposit option. XM emerges as the clear winner, offering more favorable trading conditions, featuring lower trading costs.

Features |

|

|

|

|

Regulation |

ASIC, CYSEC, FSC, DSFA |

CYSEC, FCA, DFSA, FSA, CNMV | CYSEC , FSC | NBRB |

Year Established |

2009 | 2010 | 2009 | 1998 |

Execution Types |

Market Maker | Market Maker | Market Maker | STP |

Minimum Deposit |

$5 | $5 | $5 | $5 |

Average Trading Cost EUR/USD |

0.6 pips | 0.8 pips | 0.9 pips | 1.1 pips |

Average Trading Cost GBP/USD |

1.2 pips | 1.3 pips | 1.3 pips | 1.2 pips |

Average Trading Cost Gold |

0.2 points | 0.28 points | 0.28 points | 0.27 points |

Trading Platforms(s) |

MT4 & MT5 | HFM Platform, MT4, MT5 | MT4, MT5 | MT4, MT5 |

Demo Accounts |

✅ | ✅ | ✅ | ✅ |

Islamic Account |

✅ | ✅ | ✅ | ✅ |

Negative Balance Protection |

✅ | ✅ | ✅ | ✅ |

What is the Best Leverage with a $5 Trading Account?

While many $5 trading accounts often offer high leverage, it's challenging to determine the ideal level of leverage these accounts should provide. Ultimately, this depends on what type of trader you are.

If you're new to forex trading, excessively high leverage, especially 1000 or 2000 times, might not be suitable due to the significantly increased risk. We suggest you to start with the lowest possible leverage for safer trading.

However, if you're a high-frequency or scalping trader, higher leverage would naturally be more advantageous. Here's why: For short-term trading strategies like scalping, higher leverage allows for larger positions with smaller capital, potentially magnifying profits in a shorter timeframe. While for high-frequency traders, they can magnify their buying power, allowing them to open larger positions with a lower minimum deposit. With this larger position size, high-frequency traders can capitalize on even the smallest price changes, thus potentially increasing their profits.

Can I Trade with $5 on Exness?

I am afraid not. Exness follows a unique minimum deposit structure, where the required minimum deposit for an Exness Standard account varies based on payment methods. However, all payment options supported by Exness require a minimum deposit of $10. $10 might be a tad higher than your original budget, but Exness is a reputable and trusted broker worth considering. Suppose you're worried about potential initial losses, their demo accounts remain an ideal option for you to test the trading environment and practice your trading skills without risking any real capital.

What Currency Pairs can I Trade with a $5 Account?

Basically, currency pairs available to trade will vary across different forex brokers offering micro orcent accounts with $5 minimum deposits. However, there are some restrictions including the following:

Major pairs only - Your basic EUR/USD, GBP/USD, USD/JPY and other majors are usually available. Some brokers may exclude more volatile pairs like GBP/JPY though.

No minor or exotic pairs - Brokers often limit these smaller liquidity markets to larger account sizes because spreads are naturally higher already.

Fewer cross currencies - CAD, AUD, and NZD crosses have high spreads so combining them (like AUD/CAD for example) may be prohibited.

Pros and Cons of Trading with Low Minimum Deposit Broker

Considering a broker with a low minimum deposit can bring forth several advantages. However, it also poses certain drawbacks that traders should ponder before stepping into the market. Now, let's explore the pros and cons of trading with such brokers:

Pros

Lower barriers to entry. You can start trading forex with just a $5 account instead of the typical $1,000. This allows you to enter the market with minimal upfront investment as a new trader.

Access trading platforms to build experience. You can practice skills like opening and closing positions, using stop-losses, analyzing currency pairs on platforms like MetaTrader 4 with lower financial risk compared to depositing thousands upfront while still learning.

Plentiful educational resources. Brokers offering $100 minimum accounts often provide daily technical analyses of currency price movements, regularly scheduled trading strategy webinars, and video tutorials on forex concepts that are enormously beneficial for gaining initial working knowledge faster as a novice.

Cons:

Typical Higher spreads. These ultra low barriers to entry $5 accounts usually fall under classifications like “Micro” or “Cent” accounts offered specifically to small retail traders. And it's common to see spreads on major currency pairs widened out to around 3-5 pips on these accounts versus 1-2 pips normally seen across mainstream broker accounts.

Hidden fees may be high. After promotional periods, additional fees like a $5 per trade commission, $50 quarterly data subscription for real-time quotes, $25 withdrawal processing fees could erode profits quickly with a small account balance despite low headline commission rates.

Slower Order Execution. During volatile news events, it could take over a minute for a market order to execute vs under 10 seconds for higher volume brokers, potentially leading to price slipping and bad fills as the underlying market continues moving away from your intended entry/exit level while waiting in queue.

Poor Customer Services. For most forex brokers, their core target customers are often traders making much larger minimum deposits, such as $1,000+ per account. In contrast, micro accounts opened with just $5 minimum deposits contribute little towards the brokerages' overall profit margins. Therefore, major retail brokers rationally allocate their best service teams and resources towards servicing higher balance customers first. This leads to the common complaints of lagging response times among low minimum deposit account holders.

To Wrap Up

In reviewing top forex brokers with $5 minimum deposits, our goal was highlighting repuatable platforms for new traders to start small. However, we caution against prioritizing deposit minimums above all else when selecting brokers long-term. The focus should be finding the optimal balance of low capital requirements and robust trading functionality over time. Use our recommendations as a baseline guide, but keep assessing brokers as your skills and deposit capability grow.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best DMA Forex Brokers (Direct Market Access) for 2024

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.