An AED account, short for Emirati Dirham account, is a special type of account denominated in the UAE's currency. These are appealing especially to those driving business in the Middle East. Numerous brokers globally offer such unique prospect. However, the quality varies immensely. For clarity, we selected the top five brokers who genuinely offer AED accounts, based on detailed evaluations around regulation, reputation, user satisfaction, and more. This article will explore more details of these elite brokers, supporting investors in their decision-making process.

Comparison of the Best Forex Brokers With AED Accounts

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers With AED Accounts Overall

| Brokers | Logos | Why are they listed as the Best AED Account Brokers? |

| Exness |  |

✅Extensive Market Access: Exness offers a wide range of trading instruments providing traders with an opportunity to diversify their portfolios. ✅Competitive Spreads: Exness offers competitively low spreads in the industry, making it a cost-effective solution for many traders. ✅Ease of Use: Their user-friendly interface and comprehensive customer service can be attractive to both newcomers and experienced traders alike. |

| HYCM |  |

✅Experience and Reputation: With over 40 years of experience in the financial industry, HYCM has a solid reputation and a proven track record. ✅Range of Trading Platforms: HYCM offers multiple trading platforms, including MetaTrader 4 and MetaTrader 5, which are renowned for their advanced tools and features. ✅Regulatory Oversight: HYCM is regulated by multiple top-tier authorities, ensuring safety and transparency in their operations. |

| Dukascopy Bank |  |

✅Advanced Technology: Dukascopy is known for its innovative technological solutions, including its proprietary JForex platform, designed for active traders. ✅Transparency: Dukascopy Bank is Swiss-regulated and operates with a high standard of transparency and security in financial operations. ✅Comprehensive Research Tools: The broker provides a wealth of research tools and educational resources, a boon for making informed trading decisions. |

| ADSS |  |

✅UAE-Born Broker: As a UAE-based broker, ADSS is deeply rooted in this market, known customer preference within this area better. ✅Unique Trading Tools: ADSS offers unique tools like the “Orex” platform, providing one-click trading, technical analysis, and other advantages. ✅ Broad Market Access: Their offering is diverse, including forex trading, commodities, shares, indices, and more, appealing to various trading interests. |

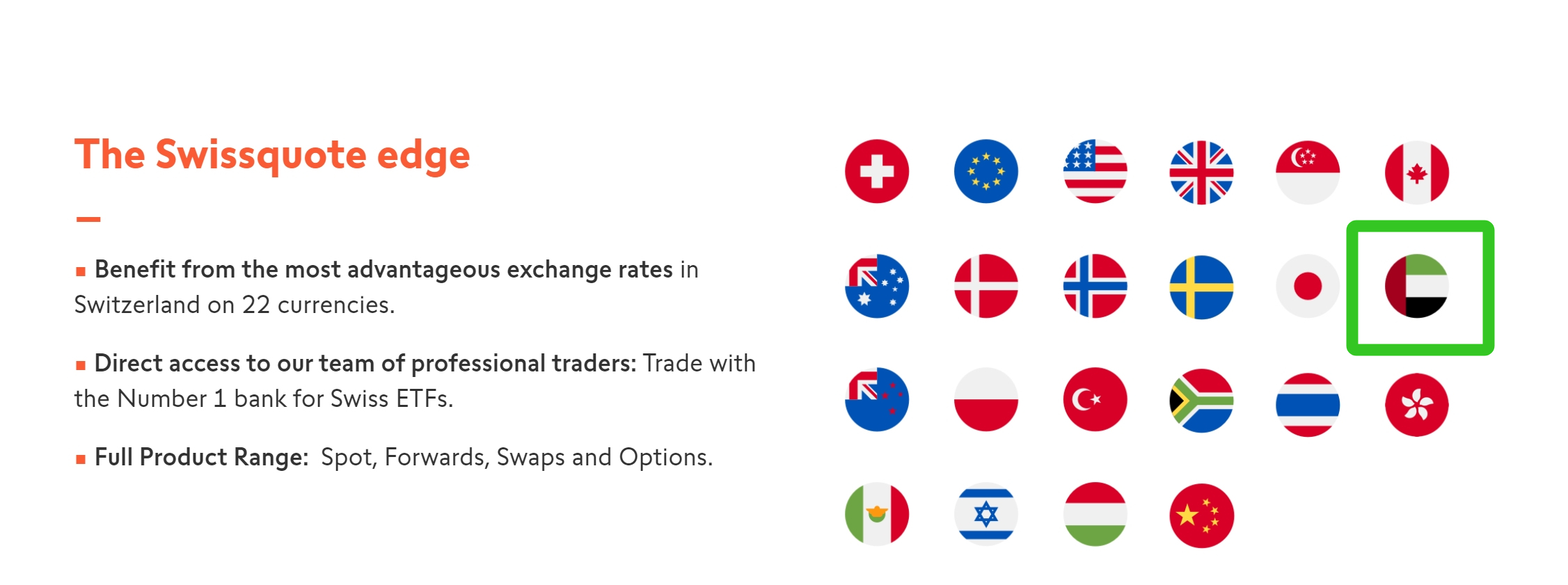

| Swissquote |  |

✅Robust Regulation: Swissquote is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which is among the strictest globally, ensuring traders' security. ✅Excellent Research Capabilities: It offers premium research resources that can help traders make informed decisions. ✅Educational Resources: Swissquote also provides a wealth of educational content and tools, ideal for beginners and experienced traders looking to expand their knowledge base. |

Overview of the Best Forex Brokers With AED Accounts

Exness

|

|

| Broker | Exness |

Regulated by |

FCA, CYSEC, FSCA, DFSA |

Min. Deposit |

$10 |

Tradable Instruments |

Cryptocurrencies,Forex, Commodities, Stocks, Indices and more |

Trading Platforms |

Exness Trade app, Exness Terminal, MetaTrader 5, MetaTrader 4,MetaTrader WebTerminal, MetaTrader mobile |

Trading Costs |

Raw Spread: Spreads from 0.0 pips, with commissions at $3.5 per lotPro: Spreads from 0.1 pips, no commissions charged |

Max. Leverage |

Unlimited |

AED Accounts |

✅ |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

E-payment systems, bank cards, Bitcoin wallets, mobile banking methods, and even payments using bank cashiers |

Customer Support |

7/24 |

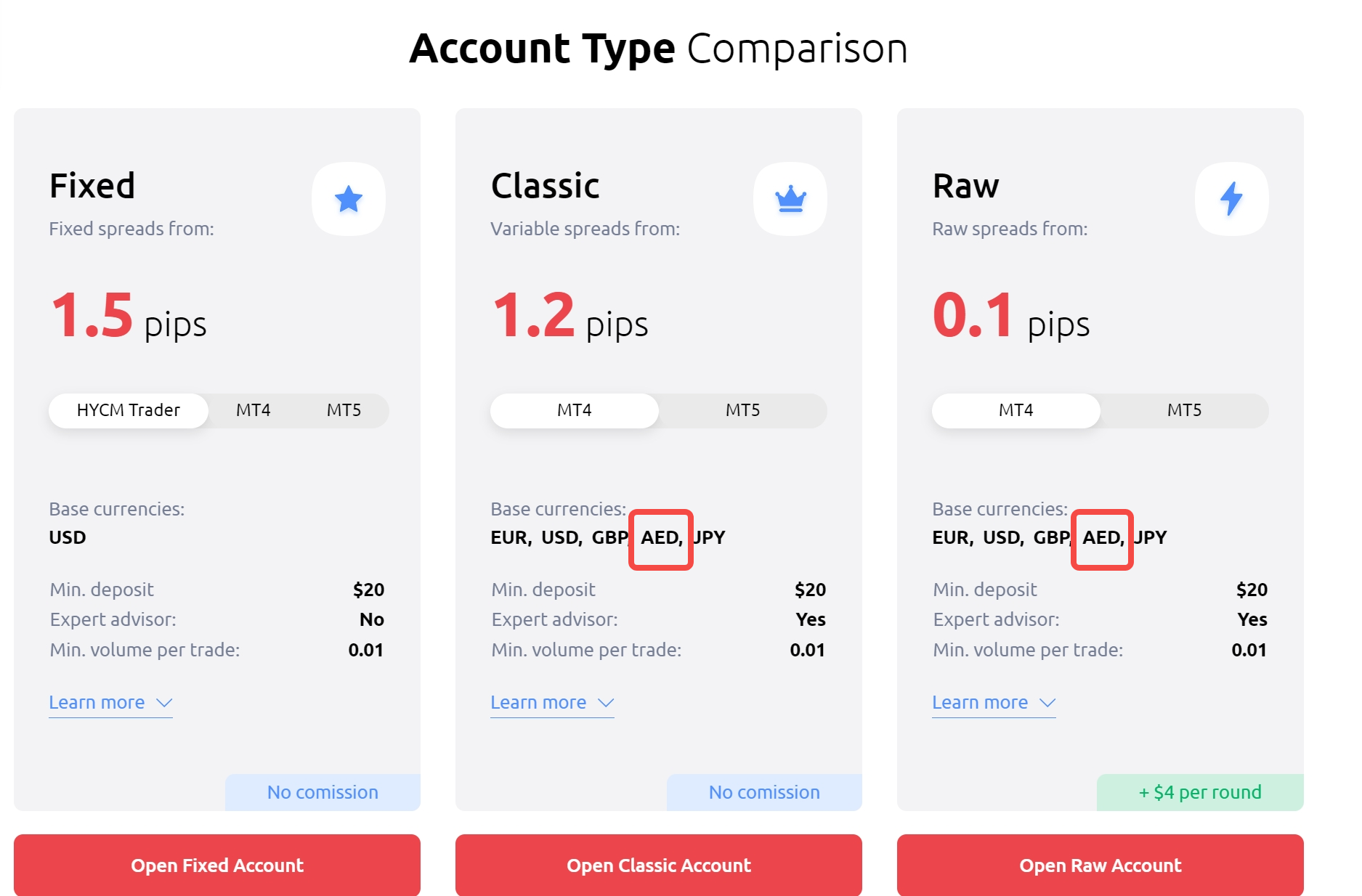

Exness is a well-established forex broker that was founded in 2008, with its main operational base in Limassol, Cyprus, providing a broad spectrum of tradable instruments, including forex pairs, metals, indices, cryptocurrencies, energies, and stocks. To suit varying trader requirements, Exness offers numerous trading platforms such as MetaTrader 4 and MetaTrader 5, Exness Trade App, readily accessible across desktop, web, and mobile devices. Standout features of Exness include superior customer support available 24/7 through multiple channels including live chat, email, and multilingual call services. The broker stands out for its transparency, providing key financial data directly via its official website, and has also gained recognition for its fast withdrawal processes, flexible leverage, and competitive spreads.

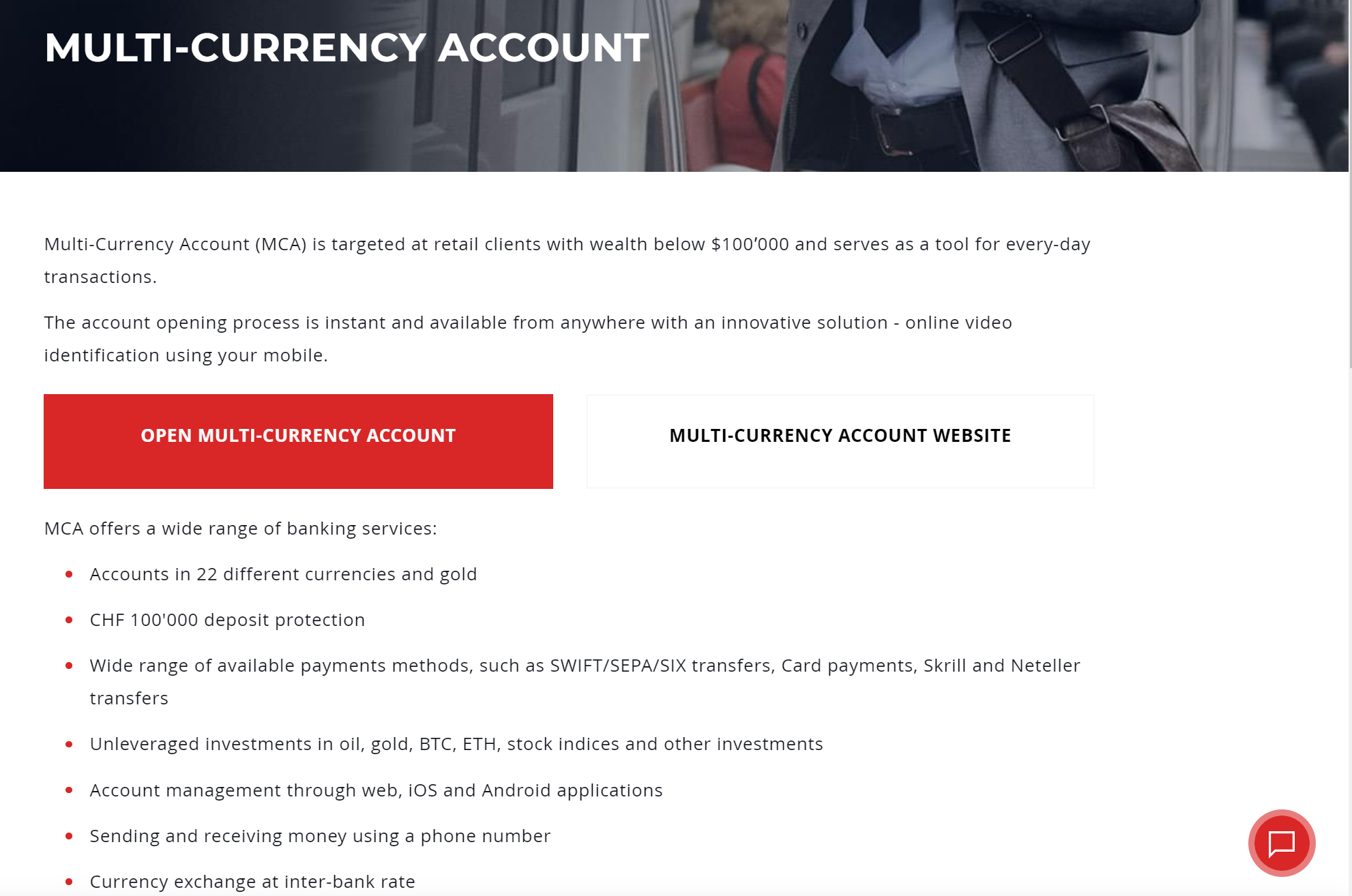

As for the AED account offering, Exness tailors this to traders who commonly conduct transactions in UAE Dirhams, protecting them from foreign exchange risks. There are two options for the Exness AED account: MT4 Standard Account and Multi-Currency Account (MCA). MT4 Standard Account allows you to deposit and withdraw funds in AED, along with 13 other currencies. However, it's important to note that this option is only available for the Standard account type on the MT4 platform. Multi-Currency Account allows you to hold and trade with multiple currencies, including AED. You can then convert between currencies within the account at competitive rates. This option is available for all account types and platforms.

✅Where Exness Shines

• Globally and heavily regulated, a well-respected broker offers its clients great assurances.

• Offering access to popular platforms such as MetaTrader 4 and MetaTrader 5, across different devices.

• User reviews often praise Exness for its fast withdrawal processes, making it easier for traders to access their profits.

• Their round-the-clock customer service is highly responsive and available in over 20 localized languages.

• Experienced traders appreciate the low spreads offered by Exness.

• Unlimited leverage ratio giving scalping traders and high-frequency traders, giving them great encouragement in trading.

❌Where Exness Shorts

• Due to regulatory constraints, Exness's services are unavailable in certain countries, such as the U.S. and Japan.

• Though Exness does offer stock trading, the selection is quite limited as compared to some other industry players focused more on equity trading.

HYCM

|

|

Broker |

HYCM |

Regulated by |

FCA, CYSEC |

Min. Deposit |

$20 |

Tradable Instruments |

Forex currency pairs, metals, energy resources such as oil and gas, commodities, indices, stocks, ETFs and cryptocurrencies |

Trading Platforms |

MetaTrader 4, MetaTrader 5, HYCM Trader |

Trading Costs |

Fixed spreads from 1.5 pips, Variable spreads from 1.2 pips, Raw spreads from 0.1 pips |

Max. Leverage |

500:1 |

AED Accounts |

✅ |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

Welcome bonus up to $100 |

Payment Methods |

Debit/Credit Card (Visa or Mastercard), Skrill, Neteller, China Union Pay, Interac or Wire Transfer |

Customer Support |

24/5 |

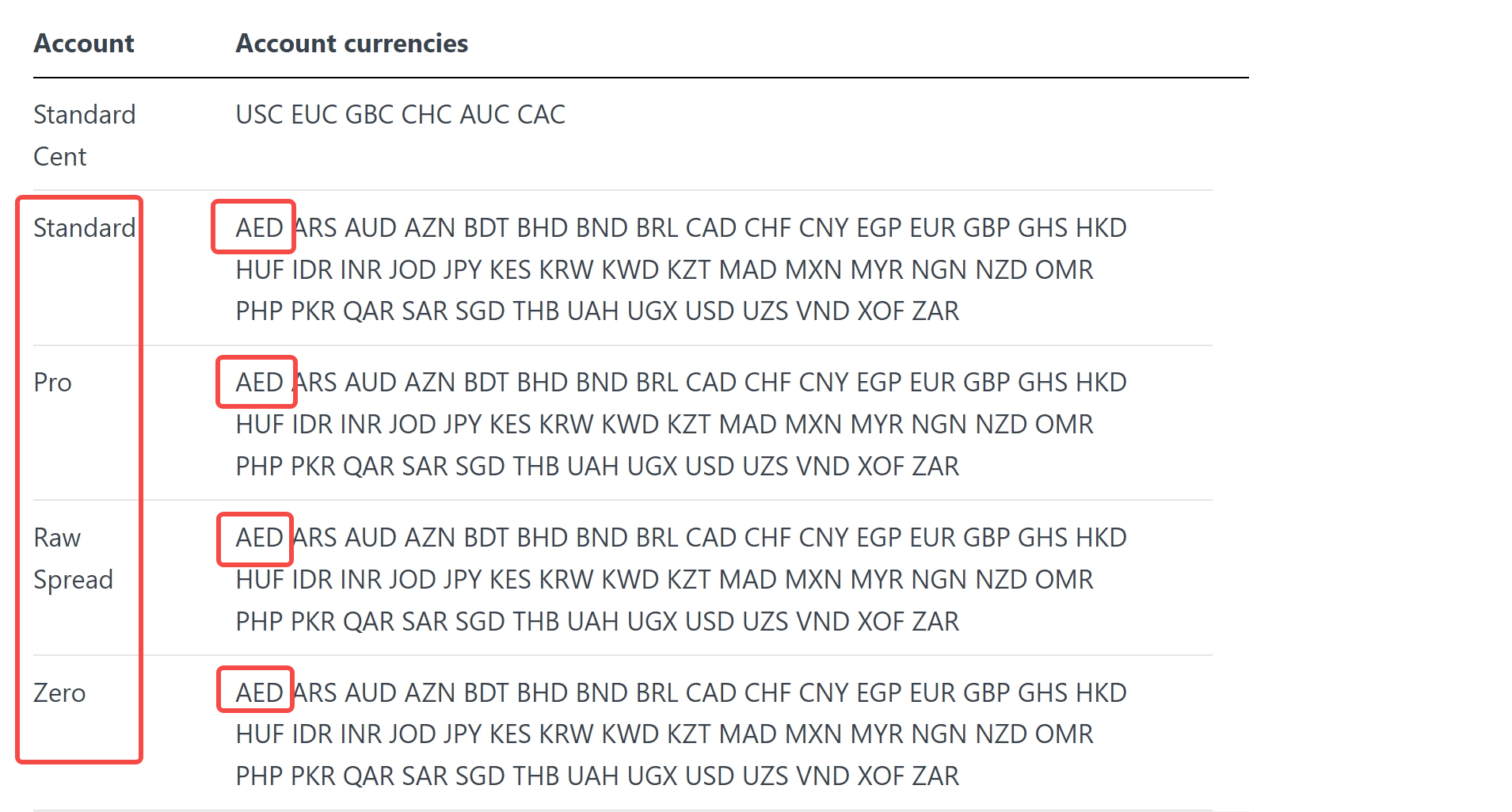

HYCM is a forex and CFD broker with a long-standing reputation in the financial markets. Founded in 1977, the broker is headquartered in the United Kingdom and regulated by top-tier financial authorities, including the FCA and CySEC. HYCM offers over 300 tradable instruments that span forex, cryptocurrencies, stocks, indices, commodities, and ETFs. It supports the MetaTrader 4 and MetaTrader 5 platforms, available on desktop, mobile, and web versions, as well as HYCM Trader and WebTrader. HYCM provides customer support via live chat, phone, and email, and prides itself on the quality of its client services, with prompt responses and multilingual support staff. A unique feature of HYCM is the broad options of account types designed to cater to the distinct needs of traders, whether they are beginners, experienced, or professional. In the industry, HYCM is recognized for its transparency, rigorous regulation, and strong emphasis on customer service.

HYCM's AED accounts functionality extends across their Classic and Raw accounts, which implies you can easily deposit, withdraw, and trade directly in AED without incurring currency conversion fees. The Classic and Raw accounts both require a minimum deposit of only $20, with base currencies available in EUR, USD, GBP, AED, and JPY.

✅Where HYCM Shines

• Established in 1977, HYCM has a long history and a strong reputation in the financial markets.

• HYCM is regulated by top-tier financial authorities, including FCA and CYSEC, ensuring reliable and secure trading.

• HYCM supports popular platforms including MetaTrader 4 and MetaTrader 5, as well as its proprietary tarding platforms, HYCMTrader.

• HYCM offers a relatively low minimum deposit requirement for its Classic and Raw accounts, only $20 to start real trading.

❌Where HYCM Shorts

• Due to regulatory restrictions, HYCM does not provide services in certain countries, including the US.

• HYCM charges an inactivity fee after 90 days of non-trading, which can be a drawback for infrequent traders.

• Particularly on Fixed and Classic accounts, the spreads may be higher than industry average, from 1.5 pips and 1.2 pips, respectively.

Dukascopy Bank

|

|

Broker |

|

Regulated by |

FSA, FINMA |

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Crypto, Indexes, Stocks.Bonds, Energy, Au. Commodities,ETF |

Trading Platforms |

JForex 4 Desktop,JForex 3 Desktop,JForex iOS,JForex Android,JForex Web 3, MT4 |

Trading Costs |

Tiered commission structure, ranging from $0 to $25 per $1 million traded.An extra fee of $0.5 per MT4 lot(or $5 per $1 million) applies for MT4 trading. |

Max. Leverage |

200:1 |

AED Accounts |

✅ |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

Wire Transfer, Payment Cards,Skrill, Neteller, Crypto |

Customer Support |

5/24 |

Founded in 2004, Dukascopy Bank is a Swiss online bank that provides trading services, particularly in Forex and CFDs. Based in Geneva, Switzerland, it is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and offers a secure and dependable trading environment. Dukascopy provides a wide range of tradable instruments, including Forex, metals, binary options, CFDs on commodities, indices, stocks, and cryptocurrencies. It offers the sophisticated JForex 3 platform, ideal for trading and technical analysis, available on both desktop and mobile for ease of use. Dukascopy Bank provides customer support 24/7 via chat, phone, and email. Unique features of Dukascopy Bank include its Swiss Forex marketplace (SWFX), advanced security of client funds, transparent pricing, and a host of tools and features fit for both novice and experienced traders. Dukascopy Bank is recognized in the industry for its technological innovation, robust security, and reliable customer service.

Dukascopy Bank does not directly offer AED accounts. Their primary account options consist of Swiss francs (CHF), Euros (EUR), US Dollars (USD), and British Pounds (GBP). However, they provide alternative solutions for trading with and managing AED. One way is Multi-Currency Account (MCA), which allows you to hold and trade in over 30 currencies, including AED. You can deposit and withdraw funds in various currencies, convert between them at competitive rates, and manage your portfolio with greater flexibility. Another is trading AED currency pairs. Even with non-AED base currencies, you can trade several forex pairs involving AED, like AED/USD and AED/EUR. This allows you to profit from fluctuations in AED's value without needing a direct AED account.

✅Where Dukascopy Bank Shines

• As a Swiss bank, Dukascopy is regulated by the strict Swiss Financial Market Supervisory Authority (FINMA), adding an extra layer of security for clients.

• Offering an ample selection of tradable instruments, spanning from Forex, stocks, cryptos, indices, CFDs, to cryptocurrencies.

• Its proprietary JForex 3 platform offers advanced trading features and is appreciated for its user-friendly interface, and extensive capabilities for technical analysis.

• Dukascopy Bank prides itself on offering round-the-clock customer service, providing assistance via chat, phone, and email.

❌Where Dukascopy Bank Shorts

• Compared to some other brokers, Dukascopy has a relatively higher minimum deposit requirement, potentially forming a barrier to entry for novice traders.

• Although the JForex 3 platform offers comprehensive features, its complexity could be overwhelming for newcomers in the trading scene.

• Some users have reported occasional spreads widening during highly volatile or low-liquidity periods.

• Dukascopy does not offer micro accounts, which can be unfavorable for traders who wish to trade at smaller volumes.

ADSS

|

|

Broker |

ADSS |

Regulated by |

FCA |

Min. Deposit |

$0 |

Tradable Instruments |

forex, commodities, indices, shares, bonds, and crypto, CFDs on futures and spot futures |

Trading Platforms |

MetaTrader 4, ADSS Platform |

Trading Costs |

commission-free for retail traders, spreads from 1.2 pips. Traders with deposits exceeding $250,000, spreads from 0.7 pips, Equity CFD commissions at 0.20%. |

Max. Leverage |

500:1 |

AED Accounts |

✅ |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

Deposit bonus |

Payment Methods |

Bank Wire, Credit Card, Online Bank Transfer, Skrill, Neteller and Cash U |

Customer Support |

5/24 |

ADSS, formerly known as ADS Securities, is a prominent global financial services provider established in 2011 and based in Abu Dhabi, United Arab Emirates. Being regulated by the Central Bank of UAE, it offers a broad array of tradable instruments, including forex, precious metals, commodities, shares, indices, and cryptocurrencies. ADSS provides access to a couple of advanced trading platforms, namely the popular MetaTrader 4 and its proprietary OREX platform, accessible on web and mobile devices. In terms of customer support, ADSS provides top-notch, multilingual support that is reachable via live chat, email, and phone. Noteworthy features of ADSS include competitive spreads and high liquidity, made possible due to its relationships with top-tier liquidity providers. It's recognized in the industry for its strong regulatory oversight, high-quality customer service, technological innovation, and comprehensive educational resources.

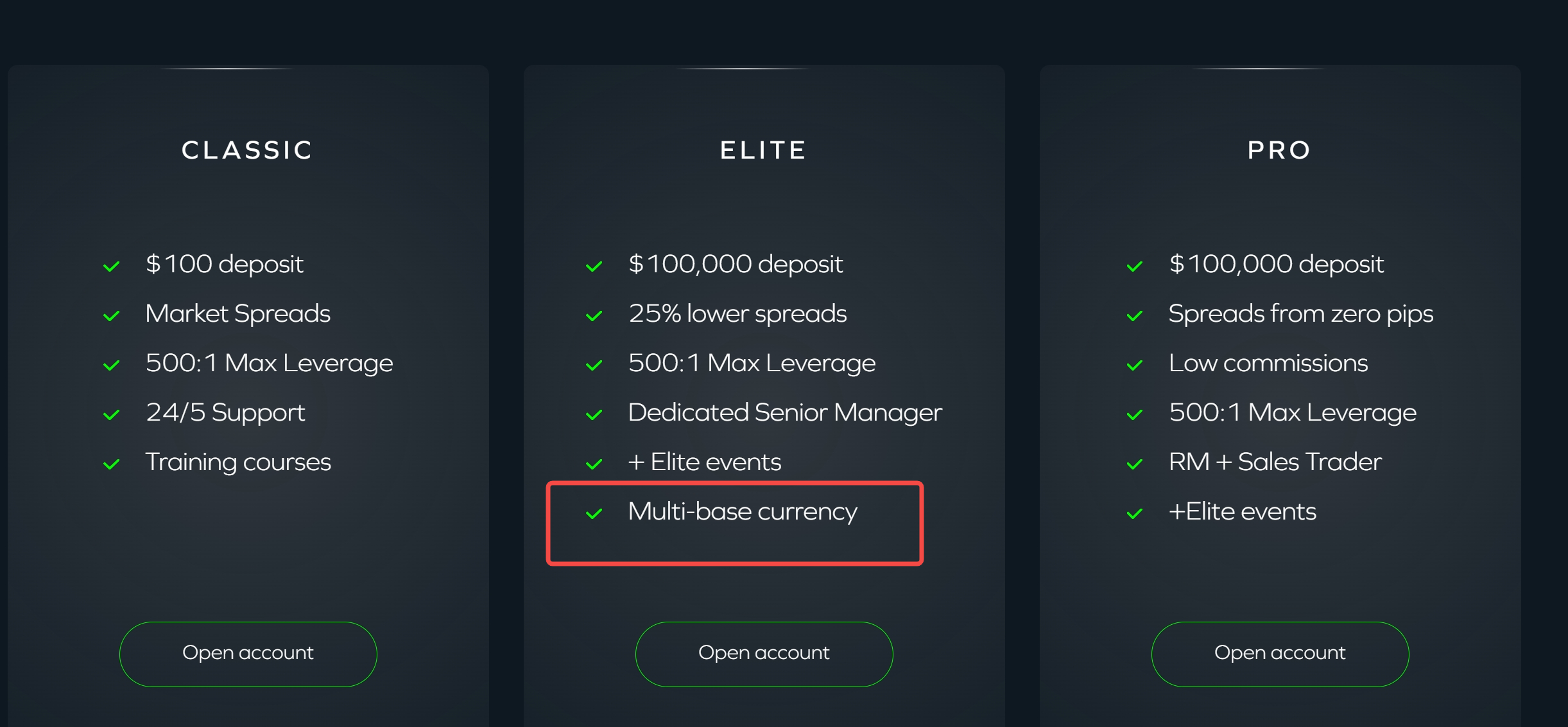

ADSS, being based in the UAE, understandably offers AED-denominated accounts as a standard feature for all their Classic, Elite, and Pro trading accounts. This allows traders to deposit and withdraw funds in AED, no need to convert your currency or incur conversion fees. Also, traders can freely access forex pairs directly priced in AED, like AED/USD and AED/EUR.

✅Where ADSS Shines

• Offering a large variety of tradable instruments, including forex, precious metals, stocks, commodities, indices, and cryptocurrencies.

• For Islamic investors, ADSS shines with its comprehensive suite of Sharia-compliant products and services, including swap-free forex accounts.

• Being based in UAE, ADSS can offer AED accounts, which is an advantage for local traders.

❌Where ADSS Shorts

• ADSS doesn't serve clients in some jurisdictions because of regulatory restrictions.

• If compared to other brokers specialising in that space, the variety of offered cryptocurrencies might be quite limited.

Swissquote

|

|

Broker |

Swissquote |

Regulated by |

FCA, MFSA, FIMA, DFSA |

Min. Deposit |

$0 |

Tradable Instruments |

Shares, ETFs, Options and Futures, and more |

Trading Platforms |

Advanced Trader, Metatrader 4, Metatrader 5 |

Trading Costs |

Standard: Minimum fee of CHF 5 per order, plus 0.85 CHF for real-time market data. |

Max. Leverage |

500:1 |

AED Accounts |

✅ |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Wire Transfer, Visa/MasterCard |

Customer Support |

24/5 |

Swissquote, established in 1996, is a leading financial services provider and online forex and CFD Broker headquartered in Gland, Switzerland, regulated by well-respected agencies such as the Swiss Financial Market Supervisory Authority (FINMA) and the Financial Conduct Authority (FCA) in the UK. The broker offers a wide array of tradable instruments, including forex pairs, CFDs on commodities, indices, precious metals, bonds, options, and a selection of cryptos. Swissquote supports diverse trading platforms such as MetaTrader 4, MetaTrader 5, and its proprietary Advanced Trader, all available on desktop and mobile for seamless trading experience. The broker boasts a robust customer support system, available through email, phone, and live chat. Swissquote stands out for its financial strength, competitive pricing, robust trading platforms, and it's ability to cater to the needs of different types of traders, from novices to experienced ones. Moreover, its reputation is bolstered by the fact that it's part of Swissquote Group Holding Ltd - a firm listed on the SIX Swiss Exchange.

Like Dukascopy, Swissquote does not directly offer dedicated AED accounts in the traditional sense at this moment, instead, they do offer alternatives for interacting with AED within their platform: Multi-Currency Account (MCA). Swissquote's MCA allows traders to hold and trade in multiple currencies, including AED, alongside supported base currencies like USD, EUR, CHF, etc. While not an AED-specific account, it provides flexibility for managing AED and trading AED pairs.

✅Where Swissquote Shines

• A well-regulated broker, listed on the SIX Swiss Exchange and licensed by FINMA, a stringent Swiss regulatory body.

• Swissquote offers negative balance protection to protect clients from losing more than their invested capital.

• Offering both MT4 and MT5 trading platforms, giving traders a superb trading experience.

❌Where Swissquote Shorts

• Swissquote's fees can be relatively high compared to some other brokers, especially for smaller accounts.

• Limited product portfolios offered compared to many other forex brokers, mainly focusing on forex and commodities.

• Swissquote's primary focus is on serving clients in European and Asian markets. This might mean less emphasis on Middle Eastern regulations and specific needs.

Forex Trading Knowledge Questions and Answers

What is AED account?

An AED account is a banking account that uses the United Arab Emirates Dirham (AED) as its primary currency. It's typically leveraged by individual customers or enterprises that frequently conduct transactions in the UAE or with UAE-based entities, thereby minimizing currency exchange risks and related costs. Such accounts are offered by multiple global and regional banks.

Is AED traded on forex?

Yes, the AED, or the Emirati Dirham, is indeed traded on the foreign exchange (forex) market. It usually comes as a currency pair with other major currencies such as the US Dollar (USD/AED), British Pound (GBP/AED), or the Euro (EUR/AED). Its value, like any other currency, is influenced by various factors including economic indicators, geopolitical developments, and market forces of demand and supply. Trading of AED on forex provides investors an opportunity to capitalize on fluctuations in its value.

What is the cheapest way to transfer money from USA to UAE?

The cheapest way to transfer money from USA to UAE largely depends on the amount, and the frequency of the transfer. Typically, online money transfer services like TransferWise (now Wise), Remitly and XE offer competitive exchange rates and lower fees than traditional banks. They provide different options like bank transfers, debit card, or credit card transfers. However, for larger amounts, wire transfers through banks might be preferred despite the higher fees for their perceived security. It's advisable to compare the fees, exchange rates and speed of delivery of each method before making a decision. Always remember that while fees are important, the most critical aspect is the exchange rate applied, as this can significantly affect the total cost of the transfer.

Why do forex brokers offer AED accounts?

Forex brokers actively providing accounts denominated in AED, is a significant decision that is driven by a host of strategic purposes. This intenational move is not an random choice but is driven by a larger goal to fulfill varying client needs while also positioning the brokerage in a competitive stance in the global financial market space. Offering AED accounts comes with both benefits and responsibilities, which they are readily willing to undertake.

Localization Effort: To cater to traders from the UAE, brokers offer AED accounts. This allows locals to trade in their own currency, eliminating the need for complex conversions, thereby simplifying transactions and enhancing user experience.

Portfolio Diversification: In the international financial markets, the diversification of currency offerings is a common strategy. By including AED in their portfolio, brokers can attract a wider demographic of traders from around the globe.

Competitive Advantage: By offering AED accounts, brokers can differentiate themselves from competitors, embodying a genuine commitment to serving a global customer base. This can lead to increased customer acquisition, loyalty, and a better market position.

Exchange Rate Opportunities: International currency markets are characterized by constant fluctuations. By offering AED accounts, brokers provide traders an opportunity to monetize on the movements of AED against other currencies.

Why does AED peg to USD?

The United Arab Emirates (UAE) pegs its currency, the AED, to the USD largely due to its heavy reliance on the oil sector. Considering that oil prices worldwide are largely quoted in USD, pegging the AED to the USD is seen as a strategic move that helps mitigate the impact of price volatility on its key exports. Additionally, by aligning its currency to the USD, the UAE government can more effectively manage its economic measures and balance of payments. Currently, for instance, the UAE is strategically maintaining a surplus in its current account relative to its GDP to uphold this currency peg.

What are the fees associated with AED accounts?

The fees associated with AED accounts can vary greatly depending on the bank or financial institution. Commonly, you may encounter these types of fees:

• Account Maintenance Fee: This is a recurring fee for keeping the account open. Some banks waive it if you maintain a certain minimum balance.

• Transaction Fees: These are charges for specific transactions like money transfers, check issuance, or use of other banking services.

• ATM Fees: Fees may apply for using ATMs, especially those that are not in the bank's network.

• Overdraft Fees: If your account goes below zero, the bank may charge a fee.

• Foreign Transaction Fees: If you use your AED account to make purchases in other currencies, the bank may charge a conversion fee.

• Early Closure Fee: Some banks may charge a fee if you close the account within a certain time frame after opening.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best DMA Forex Brokers (Direct Market Access) for 2024

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.