Score

ADSS

United Arab Emirates|5-10 years|

United Arab Emirates|5-10 years| https://www.adss.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

United Arab Emirates 8.03

United Arab Emirates 8.03Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 19 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

United Arab Emirates

United Arab EmiratesAccount Information

Users who viewed ADSS also viewed..

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Singapore Singapore | 749*** | ETHEREUM | 12-22 01:04:48 |

| 847*** | ETHEREUM | 12-22 00:05:01 | |

Shanghai Shanghai | 339*** | ETHEREUM | 12-21 22:00:05 |

Stop Out

0.88%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

United Arab Emirates

Japan

adss.com

Server Location

United States

Most visited countries/areas

United Arab Emirates

Website Domain Name

adss.com

Website

WHOIS.ASCIO.COM

Company

ASCIO TECHNOLOGIES, INC

Domain Effective Date

2003-10-12

Server IP

104.16.86.25

adss-asia.com

Server Location

United States

Website Domain Name

adss-asia.com

Website

WHOIS.CORPORATEDOMAINS.COM

Company

CSC CORPORATE DOMAINS, INC.

Domain Effective Date

2017-11-28

Server IP

157.240.2.50

adssasia.com

Server Location

United States

Website Domain Name

adssasia.com

Website

WHOIS.ASCIO.COM

Company

ASCIO TECHNOLOGIES, INC. DANMARK - FILIAL AF ASCIO TECHNOLOGIES, INC. USA

Domain Effective Date

2017-11-28

Server IP

165.160.13.20

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Registered Country/Region | United Arab Emirates |

| Regulation | FCA |

| Minimum Deposit | $100 |

| Maximum Leverage | 1: 500 |

| Minimum Spreads | 1.9 pips on the EUR/USD pair |

| Trading Platform | MT4 trading platform |

| Demo Account | Available |

| Trading Assets | Forex (major currency pairs and minor currency pairs), 16 Indices, Commodities, and CFDs |

| Payment Methods | Bank Wire Transfer, BipiPay, GSD Pay, Neteller, Skrill |

| Customer Support | 5/24, email, phone |

General Information

ADS Securities LLC (“ADSS”) is a limited liability company incorporated under United Arab Emirates law. The company is registered with the Department of Economic Development of Abu Dhabi (No. 1190047) and has its principal place of business at 8th Floor, CI Tower, Corniche Road, P.O. Box 93894, Abu Dhabi, United Arab Emirates. ADSS is authorised and regulated by the Central Bank of the United Arab Emirates. ADSS began operations from Abu Dhabi, United Arab Emirates (UAE) since 2011. Today, the broker has offices in Hong Kong, Singapore and London, UK. It boasts of over 150,000 individual clients and about 400 institutional clients from all over the world.

With tradable assets such as indices, forex, equities, cryptocurrencies, and commodities, traders can diversify their portfolios and take advantage of market opportunities. The company provides multiple account types, including Classic, Elite, and Elite+, to cater to traders with different preferences and capital sizes. Traders can choose between the ADSS Platform and the MT4 platform for their trading activities.

ADSS is regulated by the Financial Conduct Authority (FCA), providing traders with a level of trust and security. However, it's important to note that the regulatory status of the Securities and Futures Commission of Hong Kong (SFC) is listed as “Revoked,” which may raise concerns for some traders.

Pros and Cons

ADSS has its strengths and weaknesses. It offers a range of features and services that may appeal to traders, while also having certain limitations that need to be taken into account. It's important for traders to assess the overall picture and consider these factors before deciding to trade with ADSS.

| Pros | Cons |

| Wide range of tradable assets | Regulatory status of the SFC in Hong Kong listed as “Revoked” |

| Leverage of up to 500:1 | Withdrawal fee of $15 |

| Multilingual customer support | Potential payment provider fees for deposits |

| Educational resources and access to webinars/seminars | Limited trading options (no options trading or ETFs) |

| Significant Research Tools |

Is ADSS Legit?

ADSS is regulated by the Financial Conduct Authority (Regulation No. 577453) and the Securities and Futures Commission of Hong Kong (Regulation No. AXC847). However, the regulatory status of the Securities and Futures Commission of Hong Kong (license number: AXC847) is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

Market Instruments

ADSS offers a wide range of trading instruments to cater to different market preferences. Traders can access global markets and choose from various options to diversify their portfolios.

Indices: Traders can trade indices CFDs on ADSS's platform, providing exposure to major indices like Nasdaq, S&P, FTSE, and Dax. With competitive spreads and leverage of up to 333:1, traders can take advantage of market moves and trade on both long and short positions.

Forex: ADSS allows traders to trade forex pairs with their user-friendly trading platform. With no hidden fees and competitive spreads, traders can access major, minor, and exotic currency pairs, such as EUR/USD and NZD/CHF. The market-leading leverage of 500:1 on FX majors offers increased trading power.

Equities: Traders can take positions on equities listed on global stock exchanges, including major players from the GCC region. By trading CFDs on equities like Netflix, Tesla, and Apple, traders can capitalize on volatility and benefit from favorable spreads.

Cryptos: ADSS enables traders to participate in the cryptocurrency market by offering CFDs on leading cryptocurrencies like Bitcoin. Traders can take advantage of 24/5 trading, competitive spreads, and the opportunity to go long or short on the price movements of cryptocurrencies.

Commodities: Traders can benefit from market volatility by trading CFDs on spot commodities, futures, and commodity-linked ETFs. With 0% commission on trades, traders can access popular commodities such as gold, oil, and coffee. Trading commodities on ADSS provides a simplified approach compared to commodity futures.

Here is a comparison table of trading instruments offered by different brokers::

| ADSS | RoboForex | Pocket Option | Tickmill | EXNESS Group | AMarkets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metals | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Account Types

ADSS provides a range of account types to suit the diverse needs of traders, including Classic Account, Elite Account, and Elite+ Account.

Classic Account:

The Classic account is designed for traders who want to start with a minimum deposit of $100. This account offers market spreads, allowing traders to participate in the financial markets at favorable rates. With a maximum leverage of 500:1, traders can potentially amplify their trading positions. The Classic account also includes 24/5 support and access to training courses, providing traders with the necessary resources to enhance their trading skills.

Elite Account:

For traders with larger capital and seeking additional benefits, the Elite account requires a deposit of $100,000. With this account, traders enjoy spreads that are 25% lower compared to the Classic account, resulting in potentially reduced trading costs. Similar to the Classic account, the Elite account offers a maximum leverage of 500:1, enabling traders to take advantage of larger trading positions. Elite account holders receive dedicated support from a Senior Manager, ensuring personalized assistance and guidance. They also gain access to exclusive Elite events and have the flexibility of multi-base currency options.

Elite+ Account:

For elite traders with significant capital, the Elite+ account requires a deposit of $250,000. Elite+ account holders benefit from ultra-low spreads, which can further minimize their trading costs. With a maximum leverage of 500:1, traders have the potential to engage in larger trading positions. In addition to personalized support from a Manager and Sales Trader, Elite+ account holders enjoy exclusive Elite events and the convenience of multi-base currency options.

ADSS offers these different account types to accommodate traders with varying capital sizes and provide them with tailored features and benefits that suit their trading objectives and preferences.

How to Open an Account?

Visit the ADSS website. Look for the “Open Account” button on the homepage and click on it.

2. Open your account by providing the required information. For UAE residents, ADSS offers the option to register with UAE Pass, making the account setup process convenient and efficient.

3. After filling out the application and uploading documents, the system will open a personal account for the client.

4. Deposit funds into your account using options such as UAEPGS, Apple Pay, or Samsung Pay. These payment methods offer flexibility and security, allowing you to easily and securely fund your trading account.

5. Download the platform and start trading

Leverage

ADSS offers leverage for trading in different instruments:

Indices: Trade major indices such as FTSE, S&P500, Dow Jones, German Dax, Nasdaq, and CAC 40 with leverage of up to 333:1.

Forex: Access major currency pairs like EUR/USD, GBP/USD, USD/JPY, as well as minor and exotic pairs with leverage of up to 500:1.

Equities: Take positions on UK shares, US shares, German shares, Saudi shares, and other euro shares with leverage ratios varying from 4:1 to 20:1.

Cryptos: Trade popular cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin with leverage ratios ranging from 2:1 to 4:1.

Commodities: Engage in trading commodities such as US Crude, Gold, Silver, Coffee, Natural Gas, and Copper with leverage ratios ranging from 20:1 to 200:1.

Note: Leveraged trading involves risks and should be carefully considered.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | ADSS | RoboForex | Pocket Option | Tickmill | Exness | AMarkets |

| Maximum Leverage | 1:500 | 1:2000 | 1:500 | 1:500 | 1:3000 | 1:3000 |

Spread & Commissions

ADSS, like most brokers, makes a profit from spreads instead of charging commissions. Prices are competitive and traders can view current prices at any time. For CFDs and forex pairs, you can view the value, the change, the percent change, the open, the high, the low, and the previous. You can also view the required margin in percentage.

The broker does offer variable or fixed spreads. The target spreads for EUR/USD range from 1.6 to 2.4 pips depending on account type.

The Classic Account with a minimum deposit of $100 makes it more affordable for the most conservative traders, yet it carries higher spreads than the Elite account type. In the Classic account, target spreads drop to 1.6 pips on the EUR/USD. In contrast, ADSSs most competitive offering is the Elite account which requires a $200 000 deposit or a trading volume of more than $500 million per month. It comes with perks beyond discounted spreads.

Other spreads that traders can expect when trading with ADS Securities are:

GBP/USD Average: 1.1 pips

USD/JPY Average: 1.1 pips

AUD/USD Average: 0.8 pips

USD/CHF Average: 2.3 pips

Non-Trading Fees

There is a $15 processing fee per withdrawal, plus additional fees may be applied on the bank's side. The broker does not charge commissions for depositing funds, and there are no fees for inactivity on the account.

Trading Platforms

ADSS provides two trading platforms for its clients: ADSS Platform and MT4 (MetaTrader 4)

ADSS Platform: The ADSS platform offers essential functionalities such as a product page, order ticket, charting tools, blotters, account summary, and funding options. It provides traders with an overview of relevant information, including price evolution charts, daily statistics, instrument overviews, and product access details. By expanding the view, traders can access additional trading information such as order sizes, margin requirements, commissions (if applicable), and overnight holding costs. The platform also displays any active working orders for efficient position management.

2. MT4 (MetaTrader 4): ADSS offers access to the widely recognized MT4 platform, known for its advanced charting capabilities, fast trade execution, and extensive range of technical analysis tools. Traders can benefit from the features and flexibility of MT4, including its user-friendly interface and robust functionalities. ADSS has customized the MT4 platform to ensure a secure and efficient trading experience for its clients.

Both platforms provide traders with the necessary tools and features to meet their trading needs. They offer charting options, order placement capabilities, and execution efficiency to enhance the overall trading experience.

Deposit & Withdrawal

ADSS offers multiple deposit and withdrawal methods for its clients. Deposits can be made using methods such as bank wire transfer, credit card, online bank transfer, Skrill, Neteller, and Cash U. Notably, ADSS stands out as the only broker in the UAE that provides funding through UAEPGS, a local payment gateway. Clients can also withdraw funds using the same options available for deposits.

While ADSS offers a diverse selection of deposit and withdrawal methods, it's important to consider that the broker applies a withdrawal fee of $15 for all withdrawal transactions. This withdrawal fee has had a negative impact on the broker's overall rating. On the other hand, ADSS does not impose any charges on deposits, although clients should be aware that their payment providers may apply fees.

There are many ways to deposit funds into ADSS accounts, so clients will have enough options to choose from. As a MENA-focused broker, ADSS provides the opportunity to use the local UAEPGS (UAE Payment Gateway Services) solution. Traders should note that there is no deposit fee at ADSS.

| Deposit Method | Base Currencies | Fees |

| Wire Transfer | USD | No |

| Credit Card | USD | No |

| Online Bank Transfer | USD | No |

| Skrill | USD | No |

| Neteller | USD | No |

| Cash U | USD | No |

| UAEPGS | AED | No |

The same options that are available for deposits can be used for withdrawals. Traders should note that ADSS charges a $15 withdrawal fee for all withdrawal methods.

| Withdrawal Method | Base Currencies | Fees |

| Wire Transfer | USD | $15 |

| Credit Card | USD | $15 |

| Online Bank Transfer | USD | $15 |

| Skrill | USD | $15 |

| Neteller | USD | $15 |

| Cash U | USD | $15 |

| UAEPGS | AED | $15 |

Customer Support

The ADSS customer support team is multilingual and can be reached 24/5. The quickest way to get support is to use the instant web chat facility on the website. There is also an 'Enquiry form' on the 'Contact us' page of the website. A support representative will respond by email or by calling the enquirer. There are several phone lines provided by the support team. They can also be reached through email and fax. On social media, ADSS is on Facebook, Twitter, LinkedIn, and Instagram.

Client Enquiries:

Email: ts@adss.com

Phone: +971 2 657 2414

Address:

8th floor, CI Tower

Corniche Road, PO Box 93894

Abu Dhabi, United Arab Emirates

Educational Resources and Community Support

ADSS provides a range of educational resources and community support to help traders enhance their skills and knowledge:

1. Learning Materials: ADSS offers a variety of learning materials, including trading guides, video tutorials, and a comprehensive financial glossary. These resources empower traders by providing them with the necessary information and understanding of trading terms and concepts.

2. Seminars and Webinars: ADSS organizes seminars and webinars conducted by industry experts. These events serve as valuable learning opportunities for both beginner and experienced traders. Participants can gain insights, learn new strategies, and stay updated on market trends.

3. FAQ Section: ADSS has a dedicated page that addresses common questions and provides answers related to ADSS, trading account information, and trading basics. This section aims to assist prospective clients and beginner traders by addressing their queries and providing helpful information.

4. MT4 Platform Tutorials: ADSS offers tutorials specifically designed for traders who are new to the MT4 platform. These tutorials provide step-by-step guidance on using the platform effectively, helping traders navigate its features and functions.

5. Educational Webinars: ADSS conducts educational webinars that cover various topics, including the risks and rewards of trading. These webinars provide valuable insights and guidance to traders, enabling them to make informed trading decisions.

6. Training Workshops: ADSS organizes training workshops in the UAE and UK, offering traders the opportunity to enhance their trading skills through practical training sessions.

These expert educational resources, seminars, webinars, tutorials, and workshops collectively support the ADSS trading community, fostering continuous learning and improvement among traders.

User Experience and Additional Features

ADSS offers a range of user experience enhancements and additional features to support traders in their trading activities. Traders can access exclusive market analysis provided by the research team, which includes daily and weekly market emails. These emails provide insights into market trends, fundamental analysis, and market sentiment on widely traded instruments. This information can assist traders in staying informed about the market conditions.

Furthermore, ADSS offers daily analysis and trading ideas delivered directly to traders' inboxes. This feature keeps traders updated on the latest market developments and provides potential trading opportunities. Additionally, ADSS provides technical data, including forex analysis via Autochartist trade set-ups, which can help traders analyze market trends and make informed trading decisions.

These user-friendly features and additional resources aim to enhance the trading experience for ADSS clients. By providing market analysis, trading ideas, and technical insights, ADSS supports traders in their decision-making process and helps them stay informed about market conditions.

Conclusion

ADSS is a regulated brokerage company that provides traders with access to various financial markets and a range of account types to suit their needs. While it offers advantages such as competitive spreads, leverage, and multilingual support, there are also disadvantages to consider, including the abnormal regulatory status of the SFC and the withdrawal fee. Traders should carefully evaluate these factors before deciding to trade with ADSS.

| Pros | Cons |

| FCA-Regulated | MT5 trading platform is not availabl |

| MT4 trading platform | Lack of a comprehensive trading academy |

| Demo & Islamic accounts available | Clients from some countries are not allowed to register |

| Professional customer support | No 7/24 customer support available |

| Acceptable minimum deposit of $100 | |

| Competitive spreads and fees |

FAQs

Q: Is ADSS regulated?

A: ADSS is regulated by the Financial Conduct Authority (FCA) and the Securities and Futures Commission of Hong Kong (SFC). However, it's important to note that the regulatory status of the Securities and Futures Commission of Hong Kong (SFC) is listed as “Revoked.”

Q: What are the tradable assets offered by ADSS?

A: ADSS offers indices, forex, equities, cryptocurrencies, and commodities as tradable assets.

Q: What are the different account types offered by ADSS?

A: ADSS provides Classic, Elite, and Elite+ account types to cater to traders with different capital sizes.

Q: What is the minimum deposit required to open an account with ADSS?

A: The minimum deposit required to open an account with ADSS is $100.

Q: What is the maximum leverage offered by ADSS?

A: ADSS offers leverage of up to 500:1.

Keywords

- 5-10 years

- Regulated in United Arab Emirates

- Retail Forex License

- Hong Kong Dealing in futures contracts & Leveraged foreign exchange trading Revoked

- High potential risk

News

News Why Did ADSS Exit UK?!

ADS Securities London Limited (ADSSL), a subsidiary of ADSS, is winding down its operations in the UK following a strategic decision by its parent company, while reporting strong financial results and experiencing key executive departures.

2023-07-17 17:22

News ADSS Decides to Shut Down its London Operations and Withdraw from UK Market

ADSS, an Abu Dhabi-based broker, has announced plans to shut down its London operation and withdraw from the UK online trading market. This significant shift follows a drop in the company's revenues and the loss of several top executives.

2023-07-17 14:54

Exposure Regulatory status update this week, be sure to stay away from the following platforms!

A wise trader should know the brokers’ regulatory information as early as possible. WikiFX brings you the latest information about brokers whose regulatory license status has changed within a week, so we hope you can avoid these risks.

2022-11-23 17:15

Review 34

Content you want to comment

Please enter...

Review 34

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

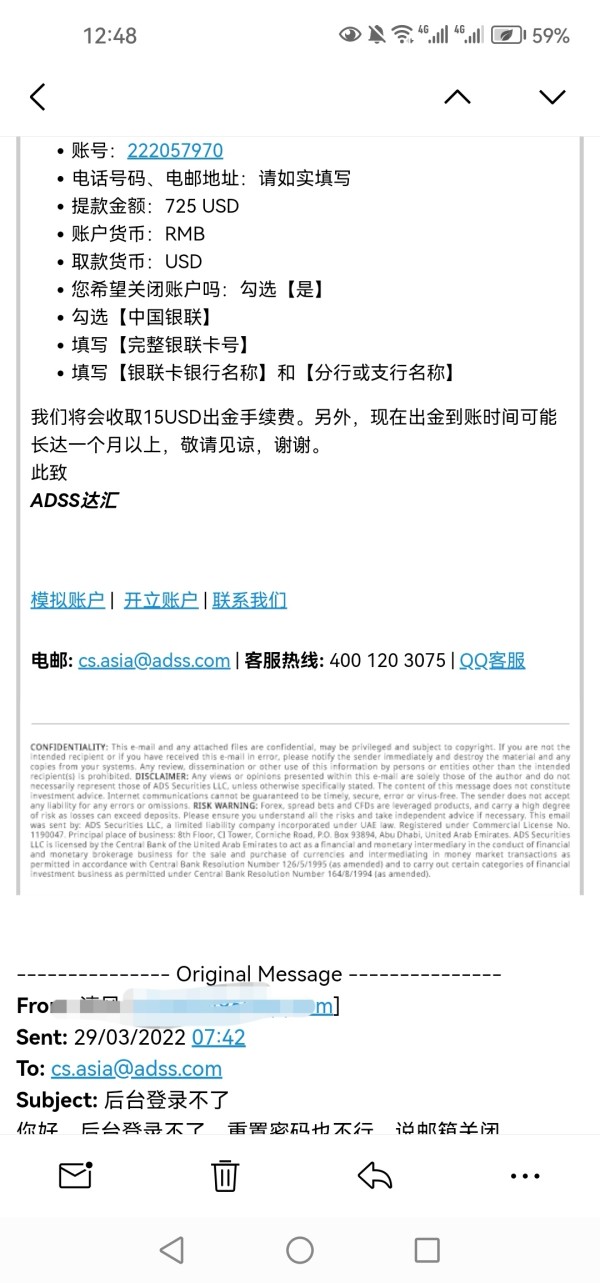

51854579

Hong Kong

Emails are sent every day, at first they said it would take more than a month to process. Then they said it would take a year, and now they didn't reply to the email.

Exposure

09-16

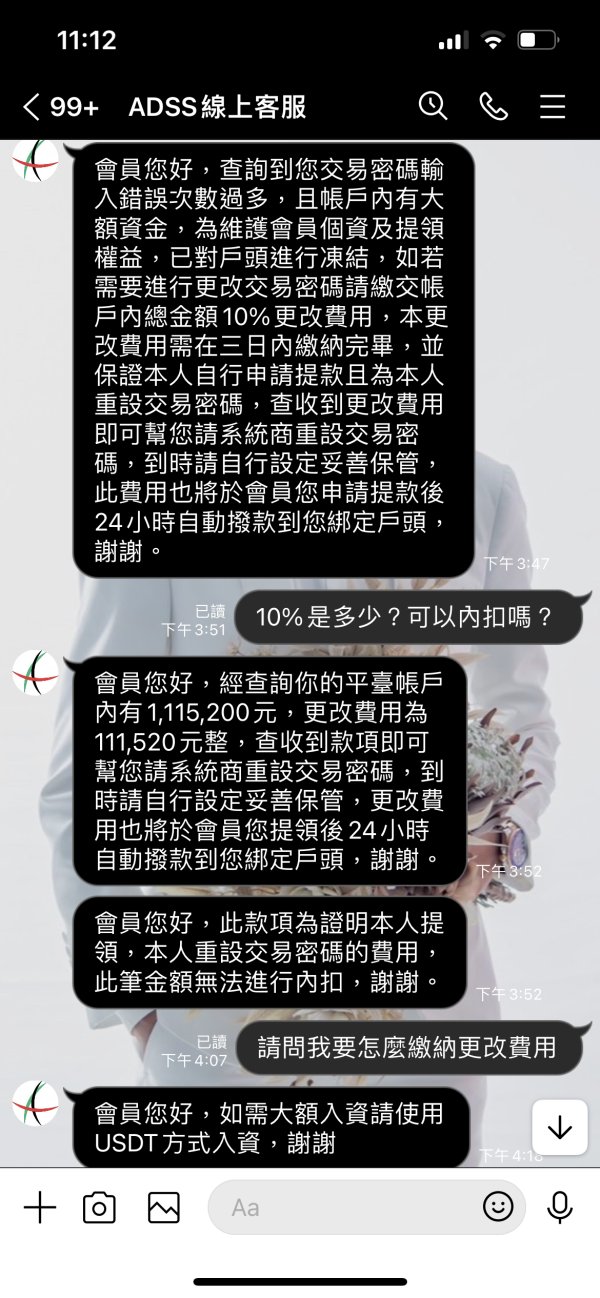

Jian Yoyo

Taiwan

I clearly remember the transaction password Also typed in notepad Now it says my transaction password is wrong Then enter multiple times Cause account freeze Is it right to need another amount of funds? If you want to cheat money Do not use various reasons and excuses

Exposure

04-03

FX1305625852

Malaysia

When I wanted to withdraw a great deal of money, it rejected me without any reason. I lost more than 200,000. Stay away from it.

Exposure

2021-09-16

Hong Kong

Was I scammed? I do not know what to do now.

Exposure

2021-08-01

大格子

Hong Kong

It said transactions were illegal. The system was under maintenance. Customer service asked me to pay a margin of more than 20,000.

Exposure

2021-07-31

FX8810320312

Malaysia

My withdrawal took two months from May 24. I was told the swift code was wrong in early June and corrected it. Then it asked me to fill in FACTA and CRS on June 16. On July 21, customer service of the platform told me in email that the withdrawal was done on June 8. 1)It was not invoice. 2)I did not fill in my bank name and bank number. I kept sending emails asking the customer service how to transfer funds to my account. I also checked my bank account, and no funds were transferred to it. After that, I tried to call the customer service, the phone only connected to the mailbox. Now their customer service doesn’t reply at all.

Exposure

2021-07-25

Jacky Chen88144

Taiwan

I encountered so many problems such as unable to place orders or close positions. But I can place orders on other brokers at the same time. They do not receive new customers and deposits. If you wanna withdraw funds, your positions should be settled before the withdrawal. Be careful of this broker.

Exposure

2021-04-13

FX2297889546

Hong Kong

Frauds in ADSS induce me to invest. Can't withdraw after profiting, it's said that the bank card number was wtong and I have to pay margin to unfreeze it. Now my account balance is cleared.

Exposure

2020-11-16

FX2297889546

Hong Kong

The card number has been checked. But it said that my bank card is wrong, and I cannot withdraw the funds. Fraud.

Exposure

2020-11-15

A29333

Hong Kong

At first, it's said that I can withdraw after depositing. But now I wa told that my card number was wrong when I withdrew. Don't believe in such fraud platform. Besides, they will add your WeChat and chat with you to build a relationship. I was cheated of 54,000

Exposure

2020-11-13

友源

Hong Kong

The withdrawal is unavailable because of varied reasons.

Exposure

2020-07-19

假如生活欺骗了你32449

Hong Kong

Told by the customer service,only by paying 150000 RMB margin and changing card number can I withdraw my money.After so that,I was told that my credit score was below 80 and asked to pay 12680 RMB.When my credit score raised to 96,the customer service asked me to deposit another 8600 RMB.Fraud platform!!!

Exposure

2019-09-12

陈老狗

Hong Kong

ADSS manipulated clients’ accounts with severe slippage and delayed order trading.Garbage platform!!!!!!!!

Exposure

2019-09-06

风吹裤衩屁屁凉^o^

Hong Kong

The platform gives no access to withdrawal,inducing me pay 100000 RMB for kinds of margin.After that,it still declines my request,continuing to ask for money.

Exposure

2019-08-15

FX7540314512

Hong Kong

With the help of agents, I invested in a platform named ADSS. Because FX110 and other websites show the high credibility of ADSS, I deposited my money to trade by batch in June. But, I was prevented from doing so soon. When applying for withdrawal, I was turned down with the reason that my account was under a trading investigation. How could that happen? Why? After several short and unsmooth talks with the customer service personnel, I didn't yet get reasonable explanations . | 6 13th, I opened an account on this platform. | 6 14th, I deposited over 500,000 through Unionpay and Bipipay by batch, and the receiver was two ADSS-assigned individual accounts in ICBC. | 6 18th-21st, I made small deals. | 6 26th, I was making deals by batch, but the account was suspended one more hours later. When it happened, there was a paper profit of 30% in my account. (Since ADSS offers leveraged deals, the profit was calculated after deleveraging, equivalent to 2.5%. Customers' accounts are restricted from making deals, and their applications for withdrawal was refused next day. | 7 8th, tradings were restricted, the capital frozen and the customer back stage couldn't be logged in. So far, there were no explanations, for example, why was my account suspended? How long did it took to investigate the whole thing? When can I withdraw my money? Why can the platform restrict customers' trading because of "abnormality".

Exposure

2019-07-17

FX7540314512

Hong Kong

Xuewen Zhu, introduced by ADSS agent Lijuan Liang, opened three trading accounts in ADSS in batches from June 13 to 24,namely,was 222058591,222058665,222058712, with a total deposit of $83453.19. Considering that ADSS is a well-known forex broker, he was rest assured to have a deposit.There has been a profit since the three accounts were traded on the 26th,June.But within an hour,the account was banned.He applied for the withdrawal next day,but haven't received payment yet.

Exposure

2019-07-11

FX5989330434

Hong Kong

I deposited 50000 RMB on September 2018 on ADSS and traded CSI300 on it. Their original website was www.adssasia.com, now it became www.adss-asia.com. I found it is regulated after searching it on WikiFX and then deposited on it. However, from November to December, ADSS’s website became inaccessible and I can’t withdraw. They changed to a Chinese domain in late December. I suspected them at that time. On December 25th, they illegally closed all their positions and made my 33 lots CSI300 unable to stop loss, causing great loss to me. I contacted ADSS’s service, who told me I can’t be compensated and the market we invested is not the real market. It is actually a dealing-desk virtual market. They could shut the market whenever they want.

Exposure

2019-01-08

FX5959111319

Hong Kong

ADSS’s service is trash. All their customer service is missing. Their candlestick chart is fake, which produced ridiculous slippage to make us lose.

Exposure

2018-09-26

FX7379782805

Hong Kong

ADSS is actually quite good, but I quit it now, because of the slippage. When the stop-loss and take-profit orders were set, the gold slippage slid out 1 dollar. I am overwhelmed. As for the ten pips of foreign exchange slippage is very normal. If you open the position manually, there is no way to get the evidence. This kind of slippage is actually like a thief. The broker clearly profits from the spread. The gold spread of ADSShas more than 100 points, which is equivalent to a 100 dollar for a standard lot This is already good. It also steals 100 dollars. . Don't you think it is low? It is better to provide a spread of 200 pips, the price is clear,

Exposure

2018-08-06

进哥哥

Hong Kong

I set stop loss level but they produced ridiculous slippage. It never happened to me when I traded on other platforms.

Exposure

2018-06-30