Score

Prime Coin

China|2-5 years|

China|2-5 years| https://prime-coin.info/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

China

ChinaAccount Information

Users who viewed Prime Coin also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

prime-coin.info

Server Location

United States

Website Domain Name

prime-coin.info

Server IP

172.67.150.125

Company Summary

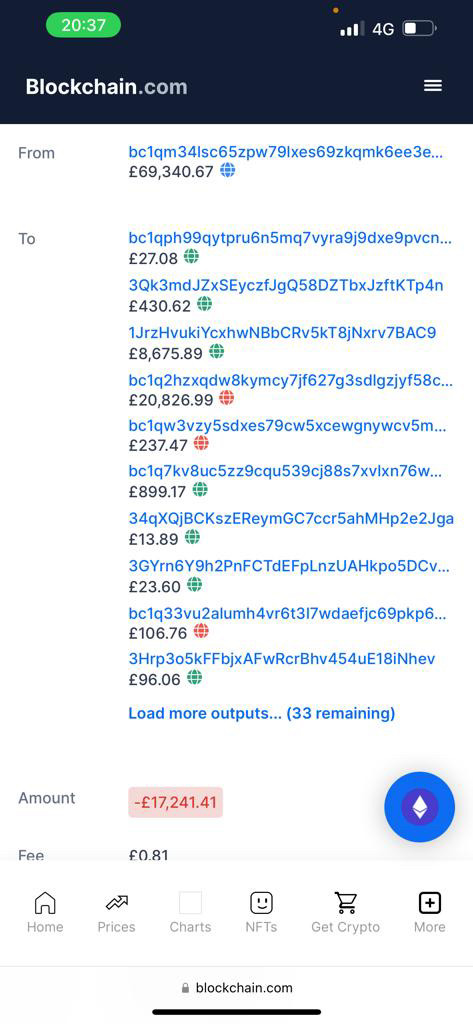

| Prime Coin | Basic Information |

| Company Name | Prime Coin |

| Founded | 2022 |

| Headquarters | China |

| Regulations | Not regulated |

| Tradable Assets | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Account Types | Basic, Bronze, Silver, Gold, Platinum, Diamond, Black |

| Minimum Deposit | Varies by account type (from $250) |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Commission | Not specified |

| Deposit Methods | Credit/Debit Card, Bank Transfer |

| Trading Platforms | Web Trading Interface, Mobile Application |

| Customer Support | Email: support@prime-coin.info |

| Education Resources | Not specified |

| Bonus Offerings | None |

Overview of Prime Coin

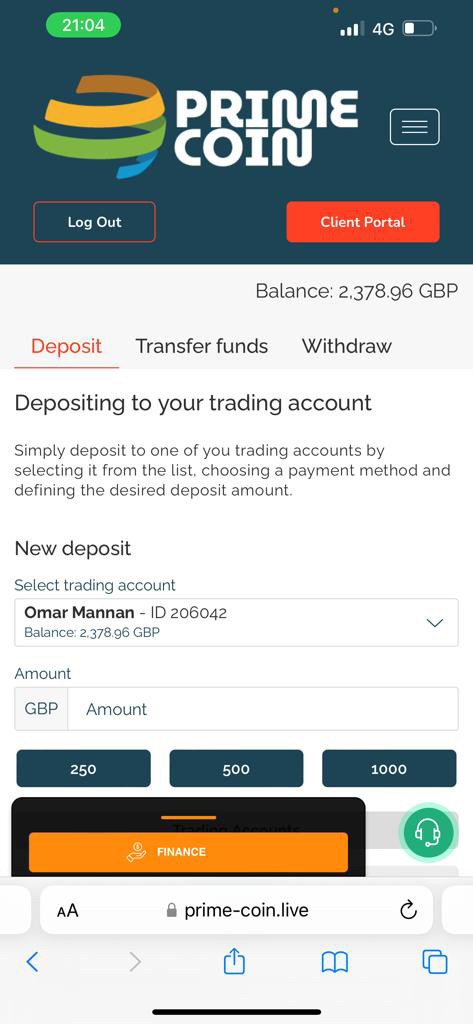

Prime Coin, founded in 2022 and based in China, is an online broker that offers a diverse range of trading instruments, including Forex, commodities, indices, shares, and cryptocurrencies. While the broker provides multiple account types tailored for traders with varying capital and experience levels, it operates without any recognized financial regulatory oversight, which is a cause for concern. The absence of regulatory compliance can raise questions about the safety of traders' funds and the overall transparency of the broker's operations. Prime Coin's offering of web-based and mobile trading platforms provides flexibility for different trading styles, but the mobile application lacks support for options trading.

Additionally, the broker's lack of specific information on spreads, commissions, and leverage can create uncertainty for potential clients, as these factors significantly impact trading costs and risk management. With limited deposit and withdrawal methods primarily in major currencies, Prime Coin may not accommodate all traders' preferences. The broker's customer support options appear to be confined to email communication, potentially limiting timely assistance. While Prime Coin presents a variety of trading opportunities and account types, traders should approach this broker with caution due to the lack of regulatory oversight and the ambiguities surrounding its trading conditions and fees.

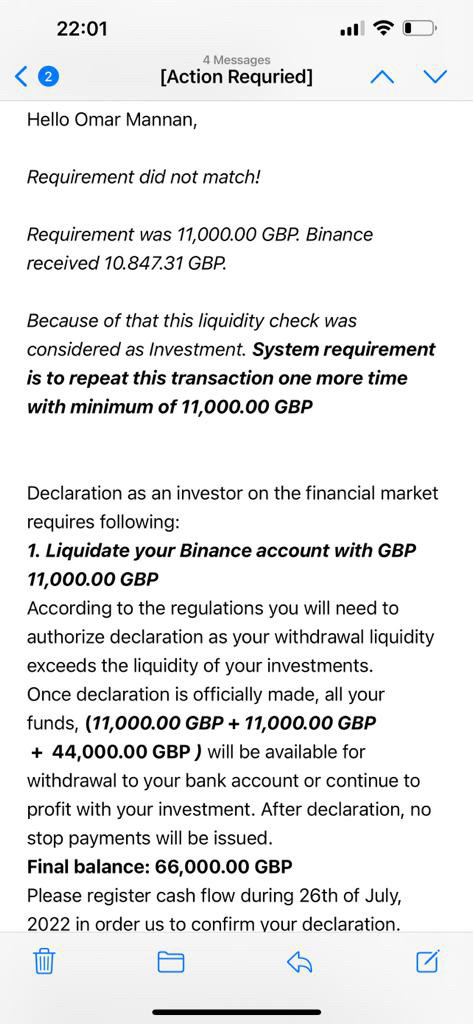

Is Prime Coin Legit?

Prime Coin is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Prime Coin carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

Prime Coin offers a diverse range of trading instruments, making it suitable for traders interested in various financial markets, including forex, commodities, indices, shares, and cryptocurrencies. Additionally, the availability of multiple account types caters to traders with different experience levels and capital requirements. The flexibility in choosing between web and mobile trading platforms enhances accessibility. Furthermore, Prime Coin accepts multiple major currencies, providing convenience to traders from various regions. However, it's essential to note that the broker operates without any recognized regulatory oversight, raising concerns about the safety of funds. Moreover, the lack of specific information regarding spreads, commissions, and leverage can leave traders uncertain about the cost of trading. Limited deposit and withdrawal methods and the absence of phone or live chat support could potentially inconvenience traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Trading Instruments

Prime Coin offers a diverse array of trading instruments, allowing traders to access various financial markets. These instruments encompass:

1. Forex (FX): Prime Coin provides access to the foreign exchange market, offering a wide range of major and minor currency pairs. Traders can engage in currency trading with pairs like EUR/USD, USD/JPY, GBP/USD, and more, capitalizing on currency price movements and exchange rate fluctuations.

2. Commodities: Prime Coin extends its offerings to include commodities, allowing traders to participate in the raw materials market. This category typically includes precious metals like gold and silver, as well as energy resources such as oil and gas. Commodity trading provides diversification opportunities and the chance to profit from the price fluctuations of essential raw materials.

3. Indices: Prime Coin caters to traders interested in indices, representing baskets of stocks that reflect the performance of specific market segments. This category includes popular indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq 100. Trading indices provides insights into global market trends and sentiment.

4. Shares: Prime Coin allows traders to invest in individual company shares. This means traders can participate in the equity markets and potentially benefit from the performance of specific publicly traded companies.

5. Cryptocurrencies (Cryptos): Acknowledging the growing popularity of digital assets, Prime Coin offers trading in various cryptocurrencies. Traders can choose from a selection of prominent cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. This enables participation in the dynamic and volatile cryptocurrency market.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indices | Stock | ETF | Options |

| Prime Coin | Yes | Yes | Yes | No | Yes | No | No | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IC Markets | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Exness | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

Account Types

Prime Coin offers a range of trading account types designed to cater to traders with varying experience levels and capital requirements:

1. Basic Trading Account: The Basic Trading Account is an entry-level option with a minimum deposit requirement of $250. It's suitable for novice traders who are just starting in the world of online trading. This account type offers an accessible way to get involved in the financial markets with a limited investment.

2. Bronze Account: To step up from the basic level, traders can opt for the Bronze Account with a minimum deposit of $5,001. This account type is ideal for traders who have gained some experience and are ready to commit more capital to their trading activities. It offers additional features and potentially more trading opportunities.

3. Silver Account: The Silver Account requires a minimum deposit of $15,001. It's designed for traders who are seeking a more substantial trading account and are likely to have more experience in the markets. With this account, traders may gain access to enhanced features and services.

4. Gold Account: With a minimum deposit of $50,001, the Gold Account is tailored for traders with more significant capital to invest. This account type may come with even more benefits, such as premium customer support and advanced trading tools.

5. Platinum Account: For traders with substantial resources, the Platinum Account, requiring a minimum deposit of $150,001, offers a high-level trading experience. It often includes an array of advantages, such as personalized services and unique trading conditions.

6. Diamond Account: The Diamond Account is designed for high-net-worth individuals and institutional traders, with a minimum deposit of $500,001. It provides a top-tier trading environment with a range of exclusive benefits and specialized support.

7. Black Account: The Black Account is the highest-tier account type, typically tailored for traders and institutions with significant capital exceeding $1 million. This account offers the most premium features, personalized assistance, and elite trading conditions.

Prime Coin's various account types ensure that traders can choose the one that best aligns with their trading goals, experience level, and available capital, thereby tailoring their trading experience to their individual needs.

Leverage

Prime coin leverage is a financial tool that allows traders to amplify their profits (or losses) by using a deposit, known as margin, to provide them with increased exposure. In other words, leverage allows traders to control a larger position than they would be able to with their own capital.

Prime coin leverage is available on a number of cryptocurrency exchanges. The leverage ratio offered by different exchanges varies, but it is typically between 10:1 and 100:1. This means that traders can control a position that is 10x to 100x larger than their account balance.

It is important to note that leverage is a double-edged sword. It can amplify both profits and losses. Traders should use leverage with caution and should only use leverage if they understand the risks involved.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Prime coin | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:100 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions (Trading Fees)

Information about the spreads and commissions at Prime Coin is notably absent. This lack of transparency concerning spreads and commissions can be a concern for traders as these factors directly impact the cost of trading and can significantly affect overall profitability. The absence of this critical information may deter potential clients from fully understanding the financial implications of trading with Prime Coin and could lead to uncertainty and hesitancy in choosing this broker. Traders often seek clarity and openness regarding pricing, and Prime Coin's limited information on spreads and commissions may deter some from considering its services.

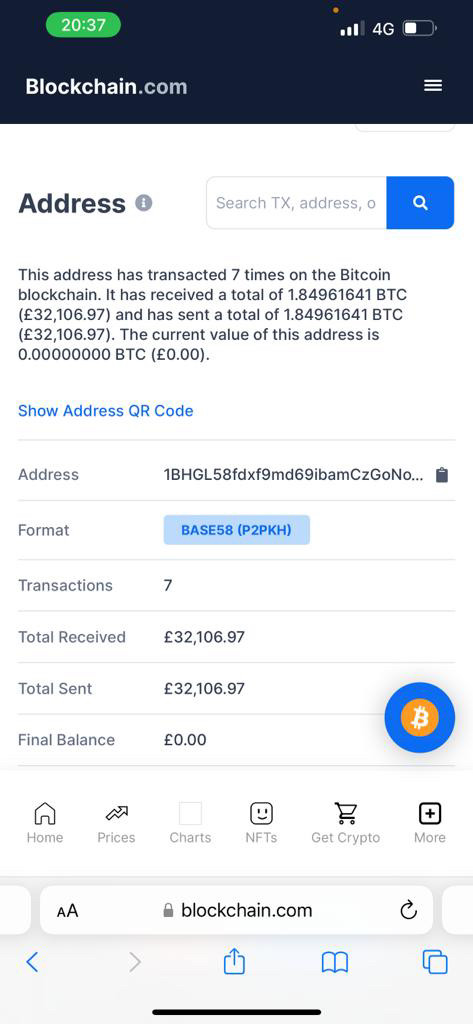

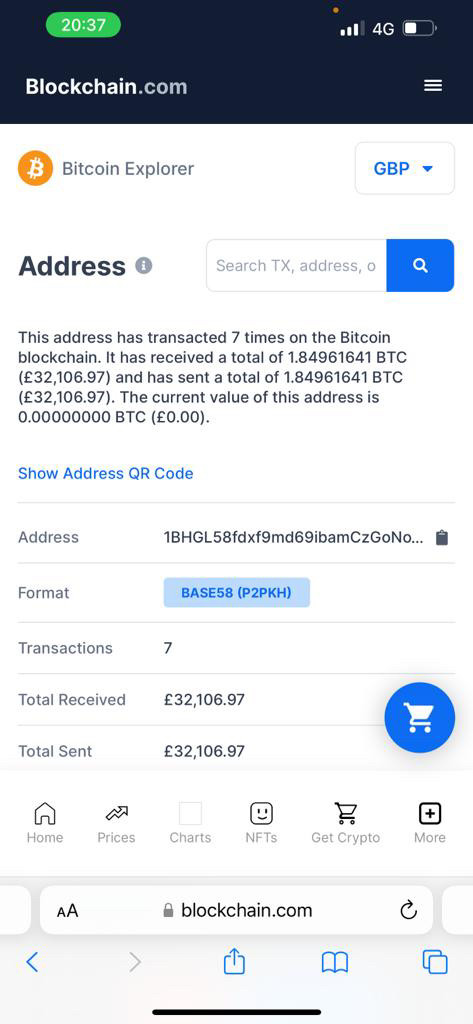

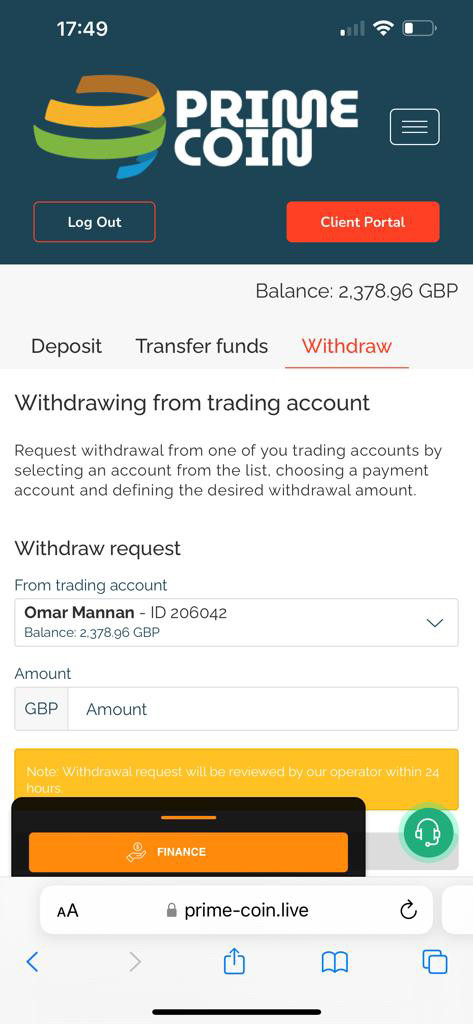

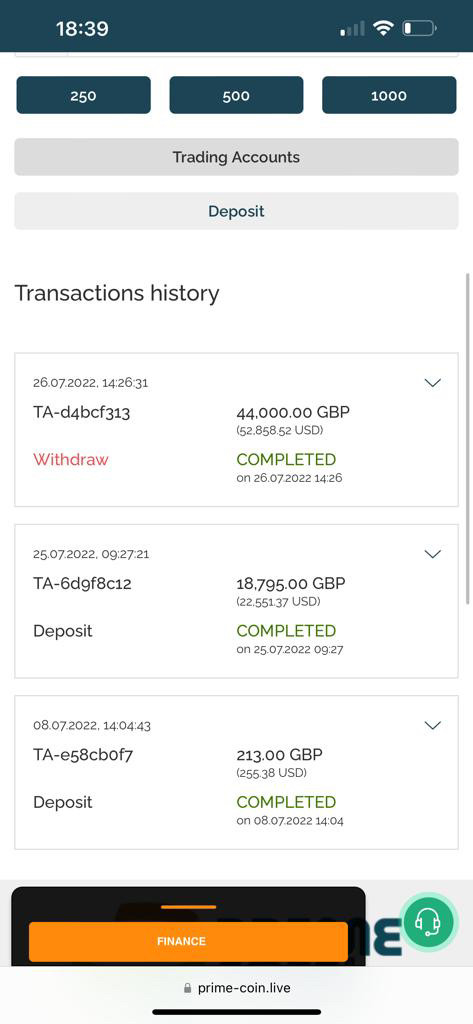

Deposit & Withdraw Methods

Prime Coin offers limited deposit and withdrawal options, which may not align with the preferences of all traders. The available methods include debit or credit card payments and bank transfers. While these methods can be used for both funding and withdrawing, the selection is relatively limited compared to brokers offering a broader array of options. Additionally, the broker transacts in a few major currencies, including the US Dollar, EURO, and Great British Pound, which may not accommodate traders who prefer alternative currency options. Withdrawals are subject to a stringent two-factor authentication process. Firstly, the funds to be withdrawn must be readily available in the trading account, and secondly, they can only be withdrawn to the registered and verified bank account specified during the account opening process. This withdrawal process may be limiting for traders who seek more flexibility in managing their funds.

Trading Platforms

Prime Coin offers two primary trading platforms to meet the diverse needs of its traders:

1. Web Trading Interface: Prime Coin's web-based trading platform provides a user-friendly and accessible way for traders to engage with the financial markets. It offers detailed charting analysis for every tradable asset, ensuring that traders have the tools needed for in-depth market analysis. The platform also delivers real-time updates, keeping traders informed of market developments as they happen. It's accessible through a web browser, requiring a simple login through the website portal. Additionally, Prime Coin offers a variety of account types to accommodate different types of investors and traders.

2. Mobile Trading Application: For traders who prefer to monitor their portfolio on the go, Prime Coin offers a mobile trading application. This mobile app is suitable for passive traders who want to check the value of their investments at any time. While it offers basic charts and real-time updates on the portfolio's value and specific asset classes, it's important to note that options trading is not supported within the mobile application. The app is designed for quick and convenient use, making it a valuable tool for traders who need flexibility in managing their investments.

Customer Support

Prime Coin offers customer support through email, and you can reach out to them at support@prime-coin.info. While email support can be a convenient way to contact the customer service team, it's essential to note that Prime Coin's support options appear to be limited to email communication. This means that if you have inquiries, issues, or concerns related to your trading activities, you would typically contact them via email. It's advisable to provide detailed information and be patient when using email support, as response times may vary. For traders who prefer more immediate or direct forms of communication, such as phone or live chat support, the absence of these options could be a limitation when seeking timely assistance.

Conclusion

In conclusion, Prime Coin offers a wide range of trading instruments and account types, making it suitable for diverse traders. However, the lack of regulatory oversight raises concerns about fund safety, and the absence of specific pricing details can lead to uncertainty. The limited deposit and withdrawal methods may not suit all traders, and the lack of phone or live chat support might affect the accessibility of customer assistance.

FAQs

Q: Is Prime Coin regulated by any financial authority?

A: No, Prime Coin is not regulated by any recognized financial regulatory authority, which may raise safety and transparency concerns for traders.

Q: What trading instruments are available at Prime Coin?

A: Prime Coin provides access to various trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

Q: Can I choose from different account types at Prime Coin?

A: Yes, Prime Coin offers a range of account types, each designed to accommodate traders with varying experience levels and capital requirements.

Q: What deposit and withdrawal methods are accepted by Prime Coin?

A: Prime Coin accepts payments through debit or credit cards and bank transfers, with transactions conducted in US Dollars, Euros, and Great British Pounds.

Q: Does Prime Coin provide phone or live chat support?

A: No, Prime Coin offers customer support primarily through email, which may not provide immediate assistance to traders with inquiries or issues.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 1

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now