Score

Traling

South Africa|2-5 years|

South Africa|2-5 years| https://traling.com/en/home

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:SUMMIT LIFE

License No.:53006

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by South Africa FSCA(license number: 53006)National Futures Association-UNFX Non-Forex License. Please be aware of the risk!

Basic information

South Africa

South AfricaAccount Information

Users who viewed Traling also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

traling.com

Server Location

United States

Website Domain Name

traling.com

Server IP

172.67.165.227

Company Summary

| Traling | Basic Information |

| Company Name | Traling |

| Headquarters | South Africa |

| Regulations | FSCA (Exceeded) |

| Tradable Assets | Indices, commodities, forex, cryptocurrency,stocks |

| Account Types | Demo, classic trading, silver trading, gold trading account, platinum trading, VIP trading, PAMM Account |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:400 |

| Spreads | As low as 0.9 pips |

| Payment Methods | Credit/Debit Cards, Wire Transfer and APMs |

| Trading Platforms | MetaTrader4 and MetaTrader5 |

| Trading Tools | Trading central, economic calendar |

| Customer Support | Email (hello@traling.com or info@traling.com)Phone (+44-1919340500) |

| Bonus Offerings | Welcome bonus, account type bonus, rescue bonus, risk free bonus |

Overview of Traling

Traling, based in South Africa, is a forex and commodities broker that prides itself on offering a robust online trading platform. With a focus on granting traders access to a diverse range of financial instruments, Traling provides an extensive selection of tradable assets, spanning indices, commodities, forex, cryptocurrency, and stocks. Despite its commitment to flexibility and accessibility, Traling operates beyond the purview of regulation by the Financial Sector Conduct Authority (FSCA) of South Africa, as indicated by its license number: 53006. It's crucial to acknowledge the potential risks associated with trading on an unregulated platform like Traling.

Is Traling Legit?

Traling exceeds the regulation. It's worth mentioning that the company operates beyond the business scope regulated by South Africa's Financial Sector Conduct Authority (FSCA). Traders should exercise caution and be aware of the associated risks when considering trading with such a broker. There may be limited avenues for dispute resolution, potential concerns regarding fund safety and security, and a lack of transparency in the broker's business practices. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

Traling presents a diverse range of trading instruments and offers multiple account types to cater to different trader needs. Utilizing the widely acclaimed MetaTrader 4/5 platform, it provides flexibility and accessibility to traders. The broker also supports multiple deposit and withdrawal methods, enhancing convenience for users. However, Traling operates without regulatory oversight, potentially exposing traders to risks. Additionally, the lack of transparency regarding company policies and procedures, along with unclear information on spread and minimum deposit, may pose challenges for traders. Therefore, while Traling offers opportunities for trading, traders should approach with caution due to the lack of regulatory supervision and limited support resources.

| Pros | Cons |

|

|

|

|

|

|

|

Trading Instruments

Traling offers a diverse array of trading instruments, including indices, commodities, forex, cryptocurrency, and stocks.

With indices, traders can enjoy up to 1:50 leverage for CFDs, accompanied by 0% commissions or hidden fees.

Commodities trading involves CFDs on over 20 popular commodities, with no commissions or unexpected charges.

For forex trading, Traling provides CFDs on more than 45 FX pairs, covering major, minor, and exotic currencies, without any hidden commissions.

Cryptocurrency trading on the platform boasts tight spreads and is free from commissions or fees.

Lastly, traders can access CFDs on over 150 of the most popular stocks, with no commissions or unexpected charges.

Account Types

Traling provides a diverse range of account types to meet the varying needs and preferences of traders.

Beginning with the demo account, users can practice trading strategies in a risk-free environment.

Moving up, the Classic Trading Account, Silver Trading Account, Gold Trading Account, Platinum Trading Account, and VIP Trading Account offer access to an extensive selection of assets.

Moreover, Traling introduces the innovative PAMM Account, where a Master account aggregates balances from all slave accounts. This unique feature streamlines fund management, as all deposits and withdrawals made by investors impact both the balance of the master account and its free margin.

Leverage

Traling offers maximum leverage of 1:400 for each trading account.

Spreads and Commissions

Traling provides trading accounts with flexible spreads. Additionally, the platform offers zero commissions on deposits.

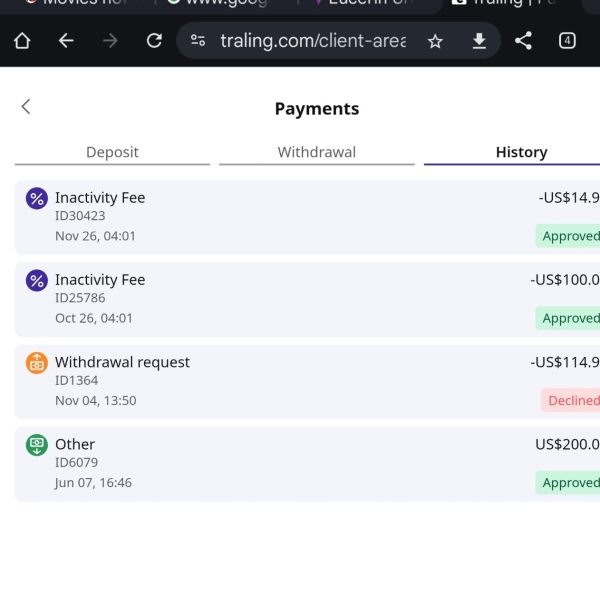

Deposit & Withdraw Methods

Traling offers an array of deposit methods, including Credit/Debit Cards, Wire Transfer, and various Alternative Payment Methods (APMs) such as Crypto, Gpay, ApplePay, EFT, PIX, WebPay, Gcash, PayMaya, Mobile Money, Sticpay, and Jeton.

When it comes to withdrawals, the minimum withdrawal amount from a Traling account is 10 EUR/USD (or equivalent, based on account currency) for Wire Transfer. However, if traders use e-wallets, they can withdraw any amount as long as it covers the associated fee.

The withdrawal process typically takes about 8 to 10 business days to complete. However, it's essential to note that the duration may vary depending on factors such as the trader's local bank and the chosen withdrawal method.

Trading Platforms

Traling offers a suite of trading platforms designed to cater to the diverse needs of traders across various devices.

Traling Web provides traders with a user-friendly online trading interface accessible directly through a web browser.

Traling Mobile App brings the power of trading to the fingertips of traders, allowing them to access markets and execute trades instantly from their smartphones or tablets. With MetaTrader 5 for Android, traders can trade forex, stocks, and other assets while on the go. The app provides Android-native options for all device types, ensuring a seamless and intuitive trading experience.

For traders who prefer a desktop-based trading solution, Traling Desktop offers MetaTrader 4 for PC. This institutional-grade multi-asset platform provides exceptional trading capabilities and comprehensive technical analysis tools.

Trading Tools

Traling offers a suite of trading tools designed to empower traders with valuable insights and analysis to enhance their trading experience.

Trading Central: Traling integrates Trading Central's award-winning solutions, providing traders with access to independent research and leading analysis data. With its registered investment expertise and intuitive user interface, traders can make informed decisions backed by AI-driven analytics.

Economic Calendar: Traling's Economic Calendar provides traders with limitless market perspective and opportunities. With full personalization options, traders can customize their trading accounts according to their preferences. They have control over open and closed positions, access to a wide range of analytical tools, and the ability to customize market notifications.

Customer Support

Traling provides multilingual professional support to assist traders with any queries or issues they may encounter during their trading journey. Traders can reach out to the support team via email at hello@traling.com or info@traling.com. Additionally, they can contact customer support by phone at +44-1919340500.

Conclusion

In conclusion, Traling offers diverse trading instruments and account types, supported by the MetaTrader 4/5 platform and multiple deposit methods. However, its lack of regulatory oversight and transparency regarding policies pose risks and challenges for traders. Caution and thorough research are advised before engaging with Traling to ensure a safer trading experience.

FAQs

Q: Is Traling regulated?

A: No, Traling operates without regulation, which means it lacks oversight from recognized financial regulatory authorities.

Q: What trading instruments are available on Traling?

A: Traling offers a range of trading instruments, including indices, commodities, forex, cryptocurrency, and stocks.

Q: What account types does Traling offer?

A: Traling provides various account types, including demo, classic trading, silver trading, gold trading account, platinum trading, VIP trading, and PAMM Account, catering to different trading preferences and experience levels.

Q: How can I contact Traling's customer support?

A: You can reach Traling's customer support primarily through email at hello@traling.com or info@traling.com. Additionally, you can contact customer support by phone at +44-1919340500.

Q: How long does it take for deposits and withdrawals to be processed by Traling?

A: The processing time for deposits varies and is not specified, while withdrawals are stated to be processed within 8 to 10 business days. However, the duration may vary depending on factors such as the trader's local bank and the chosen withdrawal method.

Risk Warning

Online trading carries substantial risk, and there's a possibility of losing all invested capital. It may not be suitable for everyone. Understanding the risks involved is crucial, and the information provided in this review could be subject to change due to the company's ongoing updates to its services and policies. Additionally, the review's generation date could impact its relevance, as information might have changed since then. Therefore, it's advisable for readers to verify updated information directly with the company before making any decisions or taking action. Ultimately, the reader bears sole responsibility for using the information provided in this review.

Keywords

- 2-5 years

- Regulated in South Africa

- Financial Service Corporate

- Suspicious Scope of Business

- Suspicious Overrun

- Medium potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now