Online stock trading, a key part of modern investing, allows investors to buy and sell shares of companies over the internet. Online stock trading brokers, thus naturally, provide trading platforms where investors can execute trades directly. Beyond stock trading services, they also offer extensive services such as market research, trading tools, real-time quotes, and educational resources to assist in investment strategies. Considering a sea of stock brokers there, we aim to provide a refined list of reputable ones, with selections based on core dimensions such as regulatory compliance, stock products, cost efficiency through fee structures, and the robustness of the trading platforms, hopefully providing useful guidence.

Best Online Stock Trading Brokers Overall

- A superior range of research materials and cutting-edge charting capabilities.

- Giving traders the opportunity to trade in more than 150 markets, competitive commission rates.

- Supporting trading in a wide array of assets including stocks, forex, and cryptocurrencies.

Trading platform provided by IG, renowned for its speed, stability, and intuitive interface.

Providing both SaxoTraderGo for casual traders and SaxoTraderPro for more experienced investors.

Offering access to international equities, forex, commodities, derivatives, and even bonds.

more

Comparison of the Best Online Stock Trading Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Online Stock Trading Brokers Overall

| Brokers | Logos | Why are they listed as the best stock trading brokers? |

| InteractiveBrokers |  |

✅ Supervised by top regulatory bodies, Interactive Brokers offers a trustworthy trading environment. ✅Lowcommissions on US ETF and stocks, just 0.005per share with a 1 minimum per order. ✅Support for trading over 13000 stocks, thereby ensuring a wide variety of investment options for stock traders. |

| IG |  |

✅Well-regulated by top-tier regulatory bodies, including the FCA, ASIC, FSA, giving traders more trading confidence. ✅ Trading platform provided by IG is renowned for its speed, stability, and intuitive interface. ✅ Providing access to generous financial instruments, including over 13,000 international shares. |

| Saxo Bank |  |

✅High-quality news feeds and sophisticated market analyses provided by industry professionals. ✅ SaxoTraderGO for simple, seamless trading and SaxoTraderPRO for advanced trading tools. ✅ Global access to international equities, forex, commodities, derivatives, and bonds. |

| eToro |  |

✅Heavily and globally regulated, adding an extra layer of security for traders. ✅Known for its unique social trading feature that allows people to follow and mimic the strategies of successful traders. ✅ eToro discloses its fee structure clearly and upfront, 0% commissions on stock trading. |

| TD Ameritrade |  |

✅ A well-established stock broker that has operated for over 50 years, won numerous traders' recognition. ✅TD Ameritrade imposes no minimum to open an account, plus commission-free online stock, ETF, and options trades. ✅ Noted for high-quality research tools and educational resources with extensive market insights. |

| Fidelity |  |

✅Responsive and helpful customer service, solving trading problems in a timely manner. ✅ Fidelity is praised for its low fee structure, including zero commission trades on US stocks, also offering low costs for their mutual funds. ✅ Fidelity provides a wealth of research tools and data analysis for its users. |

| Wellbull |  |

✅ Zero commissions for stocks, options, and ETF trades. ✅ Webull offers commission-free trades on US stocks, options, and ETFs. ✅ Webull allows trading during both pre-market and after-market hours, giving traders extra flexibility. |

Overview of the Best Stock Trading Brokers

InteactiveBrokers

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

InteactiveBrokers |

Regulated by |

ASIC, FCA, FSA, FSC, IIROC |

Min.Deposit |

$250 |

Tradable Instruments |

Mutual Funds, ETFs Bonds, Options, Spot Currencies, Futures, Cryptpcurrencies, Currencies, Hedge Funds, and more. |

Trading Platforms |

Trader Workstation (TWS), IBKR Desktop, IBKR Mobile |

Stock Trading Fees |

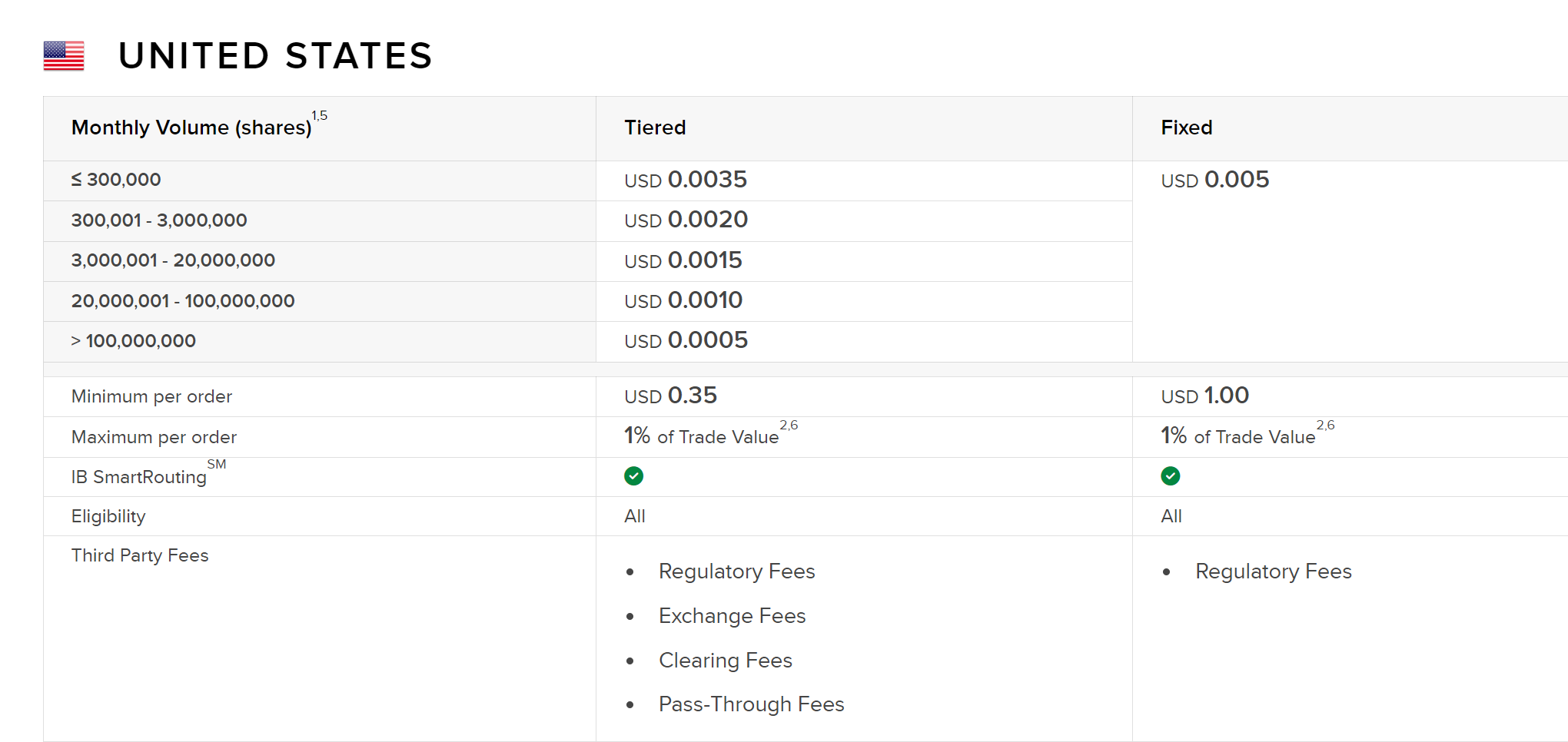

Tiered fee structure, for example, USD 0.0035 per share for a monthly volume of 300,000 shares or less |

Payment Options |

ACH Transfer, Bank Wire, Online Bill Pay, Check, Wise Balance |

Customer Support |

7/24 |

InteractiveBrokers was founded in 1977, making it one of the longest-running online brokers. The company is headquartered in the United States, registered and supervised by several top-tier financial authorities globally, including the FCA, ASIC, SFC and more. Interactive Brokers provides vast tradable instruments - including stocks, ETFs, futures, options, forex, and bonds - in over 150 markets across 33 countries, couped with its proprietary Trader Workstation (TWS) platform. As for fees, the brokerage firm operates on a tiered fee structure, with prices that tend to decrease for higher-volume traders, more reasonable for active traders and institutional clients. Customer support is available 24/7, and it has a highly regarded educational portal, making it user-friendly for beginner traders. Recognition-wise, InteractiveBrokers consistently ranks highly in user testimonials and professional reviews alike, underlining its well-established reputation in the trading industry.

InteractiveBrokers offers a wealth of choices with access to a variety of exchanges worldwide, over 13000 stocks tradable. This broker employs a tiered commission structure, particularly advantageous for stock traders who handle larger volumes, as the cost per share decreases with the number of shares traded. For example, as the table below shows, for a monthly volume of 300,000 shares or less, the trading fee is USD 0.0035 per share for the tiered pricing model, and USD 0.005 for the fixed pricing model. While for trading volumes between 300,001 and 3,000,000 shares, the fee under the tiered pricing model is significantly reduced to USD 0.0020 per share.

✅Where InteractiveBrokers shines:

• Being overseen by top regulatory bodies, Interactive Brokers offers a trustworthy trading environment, solidifying its standing in the industry.

• With access to over 13000 stocks and a tiered commission structure favoring high-volume transactions, Interactive Brokers makes an excellent choice for stock traders.

• With a tiered pricing structure, the more clients trade, the less the cost per share, making it an attractive choice for high-volume traders. Low non-trading fees and price improvement features further enhance cost efficiency for all traders.

• Interactive Brokers offers a global platform with products traded on over 150 exchanges across 33 countries. The wide range of tradable instruments, from stocks to futures and forex, provides flexibility for traders targeting multiple markets.

❌Where InteractiveBrokers shorts:

• The advanced features of InteractiveBrokers, especially the Trader Workstation platform, might be overwhelming for beginners who are new to trading.

• While they offer support 24/7, responses can be slow or lack a personal touch. Improving speed and quality of customer service could greatly enhance user experience.

• While Interactive Brokers provides extensive data and analytics for U.S. equities, there is somewhat limited provision of fundamental data for non-U.S. stocks.

• There have been user reports of slow account verification processes, which could be a disadvantage for those who want to start trading as fast as possible.

IG

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

IG |

Regulated by |

ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DSFA |

Min.Deposit |

$10 |

Tradable Instruments |

Forex, Indices, Shares,Commodities, Cryptocurrencies, Options and futures, ETFs and ETCs |

Trading Platforms |

IG Online Platform, IG Mobile App, MetaTrader 4, L2 Dealer |

Stock Trading Fees |

Commission of 2 cents per US shares, and 0.18% on Hong Kong shares |

Payment Options |

Card Payment, Bill Payment, BPAY, Bank Transfer, PayPal, Cheque,a and more |

Customer Support |

7/24 |

IG is a reputable broker, established in 1974, and headquartered in the United Kingdom. Recognized and regulated by major global authorities such as the FCA ASIC, and FSA, IG commands a high level of trust among investors. IG offers a bulk of tradable instruments, spanning forex, indices, commodities, and more impressively, over 13,000 international stocks. Traders have the flexibility to operate on IG's proprietary platform, which is lauded for its user-friendly design and advanced charting tools, or alternatively, there's an option for MetaTrader 4 platform.

IG apply a clear and competitive fee structure. Spread-betting and CFD accounts are available with low spreads, while traditional share dealing does incur standard commission costs. Notably, there are no withdrawal fees and the inactivity fee only applies after 2 years of non-use. IG's well-respected client support is accessible 24/5 via telephone, email, and live chat. Moreover, IG has successfully positioned itself as a knowledge hub, providing educational resources from webinars to detailed market analyses.

For stock trading, IG offers a wealth of options, with access to 13,000 global shares. Share dealing costs are based on the number of trades executed per month. For instance, in the UK and Ireland, 0-2 trades are charged at £10, and this commission is reduced to £3 for over three trades performed in the previous month. For US markets, the charge is $0.02 per share. These competitive commission structures do favor frequent traders, bolstering IG's appeal for active stock investors.

✅Where IG shines:

• IG provides access to generous financial instruments, including over 13,000 international shares.

• IG's proprietary platform and the option of MetaTrader 4 both offer an accessible and feature-rich trading experience, user-friendly interface married with powerful charting tools enhancing IG's trading platform versatility.

• Importantly, well-regulated by top-tier regulatory bodies, including the FCA, ASIC, FSA,adding a layer of security for traders.

• Offering weekend trading options, a great advantage for traders who prefer to trade on Saturdays and Sundays.

• IG provides DMA, which is an excellent option for stock trading, allowing traders to place trades directly into the exchange's order books, leading to greater liquidity and potentially more favorable prices.

❌Where IG shorts:

• IG's fee structure can be high for smaller account sizes or less frequent traders. Free trading is only available when certain conditions are met, which can be restrictive for some traders.

• Despite providing advanced features, IG's proprietary platform seems complicated for some clients, particularly novices.

• IG does not allow trading in fractional shares, which might limit some investment strategies, especially for those with smaller account balances who wish to diversify their portfolios.

Saxo Bank

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

Saxo Bank |

Regulated by |

ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

Min.Deposit |

$50 |

Tradable Instruments |

Forex, Stocks and ETFs, Options and Futures, BondS, Cryptocurrencies, and more |

Trading Platforms |

SaxoTraderGO, SaxoTraderPRO |

Stock Trading Fees |

USD 3 per trade as a minimum for U.S. Markets; 0.1% of the trade volume, with a minimum fee ranging from EUR 3 to EUR 12 for most European markets; For Asian and Middle Eastern markets, the fees range from 0.15% to 0.3% of the trade volume; |

Payment Options |

Debit Card, Bank/Wire Transfer, Stock Transfer |

Customer Support |

5/24 |

Saxo Bank, founded in 1992, is based in Denmark, bosasting multiple global registrations, including the UK's FCA and Australia's ASIC. Saxo Bank provides access to an extensive range of tradable instruments, including over 40,000 instruments across FX, CFDs, futures, options, ETFs, mutual funds and notably, more than 23,500 international stocks. Traders can work on Saxo Bank's proprietary SaxoTraderGO or the more advanced SaxoTraderPRO. Saxo Bank employs a transparent fee structure, volume-based, the higher the trading volume, the lower the fee per trade. There are no withdrawal fees, yet an inactivity fee is implemented after six months of inactivity. For customer support, Saxo Bank is reachable 24/5 through phone, email, and live chat. The broker is widely appreciated for its high-level research tools, innovative trading technology, and comprehensive educational resources.

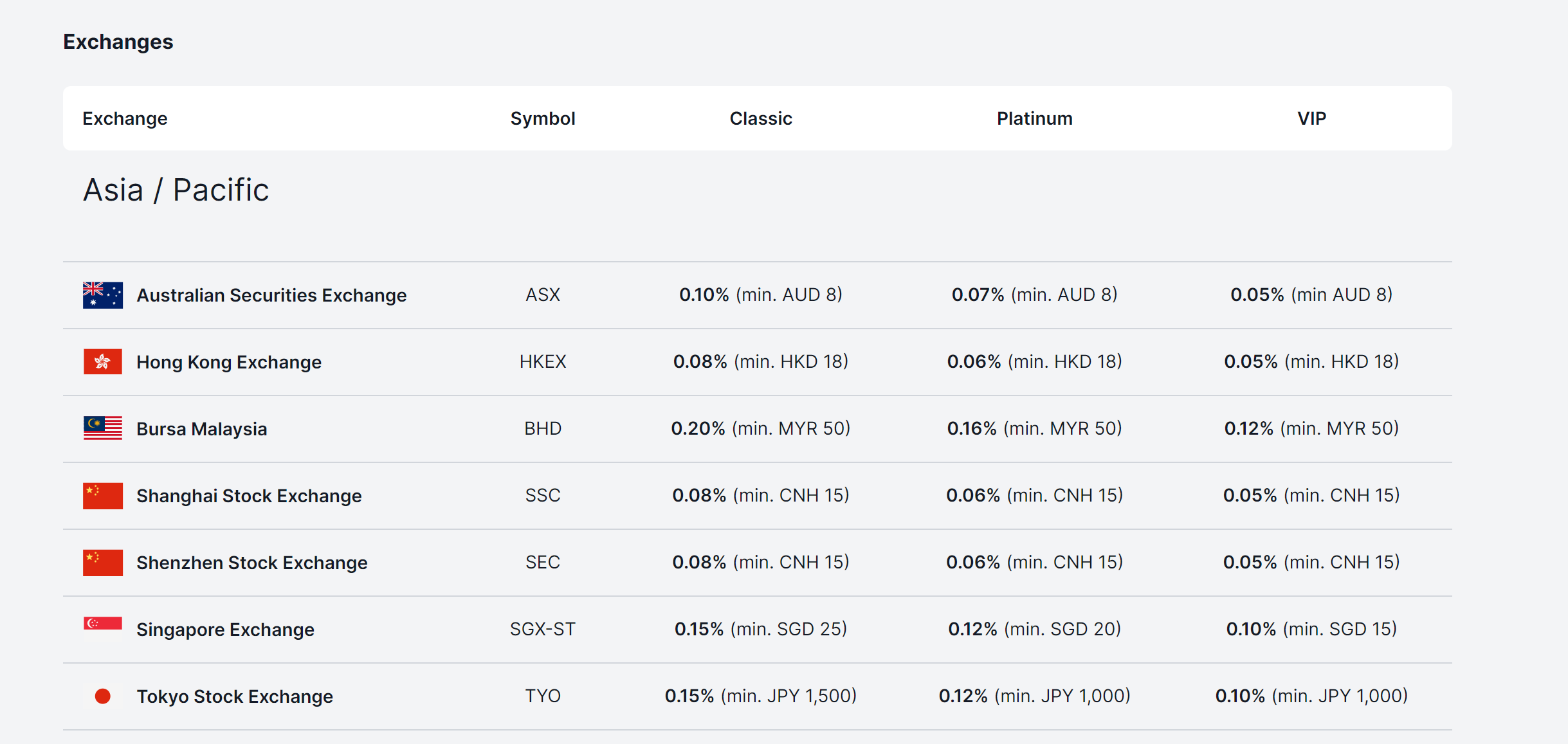

Speaking specifically to stock trading, Saxo Bank proffers over 23,500 international stocks from 37 global exchanges. Its fees hinge on the specific market but generally benefit high volume traders. Saxo Bank employs a transparent, tiered, and volume-based fee structure.

To elaborate, for most stock markets, Saxo Bank charges a percentage of the trade's value as the commission, with a minimum fee that varies depending on the specific market. For example, for the US market, the bank charges USD 3 or 0.02 USD per share (whichever is higher), and this fee can be reduced to 0.01 USD per share for high volume trades.

For European markets such as Austria, Belgium, France, Germany, Ireland, Italy, Netherlands, Portugal, Spain, etc., the fees stand at 0.10% of the trade's value, with a minimum commission of EUR 10. For the United Kingdom, 0.10% of the trade's value is charged, with a GBP 8 minimum.

✅Where Saxo Bank shines:

• Being regulated by multiple top-tier authorities, Saxo Bank offers a secure trading environment, instilling trust amongst its users.

• Saxo Bank offers a broad portfolio of over 40,000 financial instruments across various asset classes, including over 23,500 stocks, standing out amongst brokers for its breadth in stock trading offerings.

• Saxo Bank provides users with two proprietary platforms, SaxoTraderGO and SaxoTraderPRO, both offering a wide range of functionalities, advanced charting and analytical tools, and seamless user experiences.

• Saxo Bank provides comprehensive in-house market analyses and access to external research insights that can aid wise decision.

❌Where Saxo Bank shorts:

• Saxo Bank requires a high initial deposit to begin trading, typically, $10,000 for their entry-level “Classic” account, which may pose a barrier to entry for beginner traders or those with limited principals.

• While the tiered, volume-based pricing structure offers cost advantages to high volume traders, it can be complex to understand for less experienced investors and those who trade less frequently.

• Saxo Bank charges an inactivity fee, typically amounts to EUR 100, if there is no trading activity on a client's account for a certain period.

eToro

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

eToro |

Regulated by |

ASIC, CYSEC, FCA |

Min.Deposit |

$10 |

Tradable Instruments |

Stocks, Indices, ETFs, Currencies, Commodities, Cryptocurrencies |

Trading Platforms |

eToro's Web Platform, eToro's Mobile App |

Stock Trading Fees |

0% commission basis for stock trading |

Payment Options |

Debit Card, Bank Account, PayPal,Wire Transfer |

Customer Support |

5/24 |

Established in 2007, eToro is a globally recognized trading platform regulated by a host of top-tier authorities, including CySEC in Cyprus, FCA in the United Kingdom, and ASIC in Australia. On eToro, traders can access over 5,000 tradable assets, spanning stocks, ETFs, Cryptocurrencies, and more. As for fees, eToro operates a spread-based pricing model for all its products, excluding shares and ETFs where the platform offers commission-free trading in real stocks for non-leveraged positions. Customer support of eToro is available through live chat and ticket system. They also offer an extensive range of educational resources catering to both beginners and experienced traders.

When it comes to stock trading, eToro provides a wide range of international stocks, numbering over 2000, from a multitude of stock exchanges worldwide. For non-leveraged stock trades, eToro charges no commission, a benefit attractive to many stock traders. Yet, to remember, other fees, such as withdrawal and currency conversion fees, may still apply.

✅Where eToro shines:

• Heavily regulated by multiple top-tier authorities globally, reassuring traders about the platform's safety.

• eToro has gained a global audience of millions of traders from over 140 countries, contributing to robust discussion and varied strategies on their social network, further enhancing the social trading experience.

• Beyond the CopyTrader system, eToro also offers CopyPortfolios, a managed portfolio service where assets (stocks, cryptocurrencies, etc.) are bundled together under chosen market strategies, allowing investors to diversify their portfolios without having to manage each unit individually.

• eToro offers real stock trading without charging commission, proving particularly beneficial for stock investors and swing traders.

• eToro's unique platform features a social-network-style environment that encourages interaction between traders, and its CopyTrader system also allows traders to mirror the trades of successful investors.

❌Where eToro shorts:

• eToro has higher non-trading fees compared to other brokers. They charge a $5 withdrawal fee and an inactivity fee of $10 per month after one year of inactivity.

• Though they offer commission-free trading on stocks and ETFs, their spreads can be higher compared to other brokers, especially on certain forex pairs and cryptocurrencies.

• eToro doesn't provide direct phone support for customer service, leading to inconvenience for those who prefer immediate assistance over call.

TD Ameritrade

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

TD Ameritrade |

Regulated by |

SFC |

Min.Deposit |

$0 |

Tradable Instruments |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, and more |

Trading Platforms |

Thinkorswim |

Stock Trading Fees |

0 commission on online stock trading |

Payment Options |

ACH, Wire Transfer, Check, Account Transfer to another firm |

Customer Support |

7/24 |

TD Ameritrade, established in 1975, is one of the largest and most well-respected online brokers in the United States, headquartered in Omaha, Nebraska. In October 2020, Charles Schwab completed its acquisition of TD Ameritrade in a deal reportedly worth roughly 26billion.The integration of operations is expected to take a couple of years,during which both entities will continue to operate independently.The consolidation of these two brokerage giants will result in creating an extraordinarily large customer base,with more than 6 trillion in client assets.T he acquisition is viewed as a significant move in the brokerage industry.

TD Ameritrade offers a broad spectrum of tradable instruments, including stocks, ETFs, options, futures, FOREX, and mutual funds. provides multiple trading platforms tailored to traders of varying experience levels. These include the web-based Trade Architect, the thinkorswim desktop platform for more advanced traders, and the TD Ameritrade Mobile App for trading on the go. In terms of fee structure, TD Ameritrade offers 0 commission trades on online stocks,ETF,and options trades, Option trades come with a 0.65 per contract fee. Lastly, customer support is a significant aspect of TD Ameritrades offerings, with 24/7 support via phone, email, and live chat.

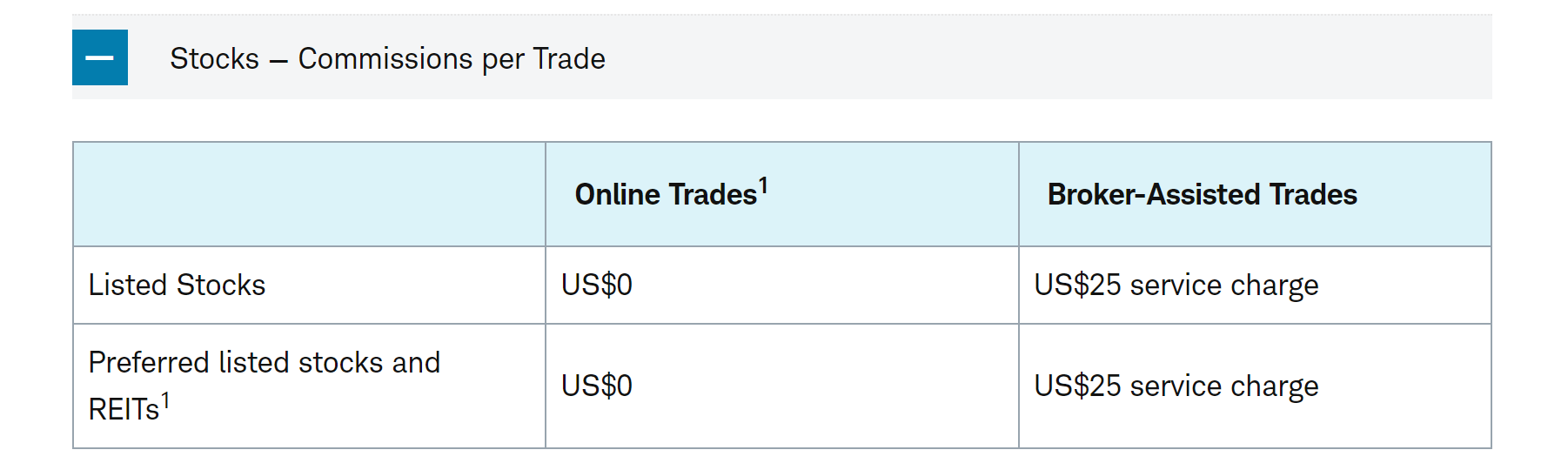

In relation to stock trading, TD Ameritrade stands out with a massive range of stocks to choose from since it includes every stock exchange in the United States. Notably, TD Ameritrade offers $0 commission trades on online stocks, broker−assisted trades for the same instruments incur a US25 service charge. This fee structure is in line with their general policy of promoting online trading while still providing broker-assisted options for traders who prefer them.

✅Where TD Ameritrade shines:

• TD Ameritrade requires no minimum investment to open an account, providing a great deal of flexibility for new and low-volume traders.

• TD Ameritrade stands out with its zero commission on online stocks, ETFs,and options trades (although a 0.65 fee per contract applies on options).

• They offer multiple platforms, including web-based Trade Architect for beginners, thinkorswim for advanced traders, and a mobile app for trade on the go.

• TD Ameritrade offers one of the largest selections of commission-free ETFs in the brokerage industry.

• TD Ameritrade is essentially a one-stop-shop for various types of investments including, options, futures, forex, and even managed portfolios, which might appeal to investors looking to diversify.

❌Where TD Ameritrade shorts:

• As compared to many online brokerage platforms, TD Ameritrade's fee for broker-assisted trades is relatively high at $25.

• TD Ameritrade primarily serves U.S. residents. Non-U.S. residents can have challenging times opening an account.

• While the broker does offer a range of forex pairs to trade, it's only available through the thinkorswim platform and not on other platforms or apps.

Fidelity

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

Fidelity |

Regulated by |

SFC |

Min.Deposit |

$0 |

Tradable Instruments |

Stocks, options, ETFs, mutual funds, CDs, IPOs, and precious metals |

Trading Platforms |

Web-based platform, Active Trader Pro |

Stock Trading Fees |

Zero-commission basis for online U.S stock trading |

Payment Options |

Electronic Funds Transfer (EFT), Wire Transfers, Check Deposits, Mobile Check, and more |

Customer Support |

5/24 |

Fidelity Investments, founded in 1946, is a multinational financial services corporation based in the United States, offering a full spectrum of investment options including stocks, bonds, mutual funds, ETFs, options, and more to both domestic and international clients. Fidelity offers multiple trading platforms, including the web-based platform Fidelity.com, Active Trader Pro, and a mobile app. As for trading fees, Fidelity maintains a competitive position with $0 commission for online U.S. stocks, ETFs, and options trades. No account minimums are required, which is a relief for beginners or small investors. Customer service at Fidelity is available 24/7, with phone, live chat, and email support, in addition to in-person assistance at various Fidelity branches around the U.S.

When it comes to stock trading, Fidelity Investments offers an extensive range of choices, allowing traders to invest in a wide array of companies across various sectors. They offer $0 commission for online U.S. stocks which applies to both exchange-listed and over-the-counter (OTC) stocks. Aside from the commission-free trades, Fidelity is also known for offering real-time trade execution, ensuring that the clients not only get the price they see when they decide to make a trade, but also have the potential for price improvement – getting a better price than expected.

✅Where Fidelity shines:

• Fidelity does not require a minimum investment to open a brokerage account, making it accessible for beginners and small-scale investors.

• Fidelity offers $0 commission for online U.S. stock, ETF, and options trades, quite attractive.

• Fidelity offers a high number of no-transaction-fee mutual funds, in addition to its extensive ETF offerings, • providing more choices for investors.

• Fidelity offers cash management tools that act like a checking account, providing clients with FDIC insurance on their holdings.

• Fidelity allows fractional share trading, so you can invest in stocks and ETFs with less money.

❌Where Fidelity shorts:

• Fidelity mainly focuses on the U.S. markets, and while it does offer some international trading, its offerings are more limited compared to some other brokerage firms.

• Although Fidelitys platforms are packed with features, some users find the design less intuitive compared to some competitors. The abundance of tools and features can sometimes create a more complicated navigation experience, particularly for beginners.

• Some of Fidelitys mutual funds come with short-term trading fees which could deter active traders.

Wellbull

|

|

| Overall Rating: ⭐⭐⭐⭐⭐ | |

Broker |

Wellbull |

Regulated by |

FSA |

Min.Deposit |

$0 |

Tradable Instruments |

US-listed stocks, ETFs, Over-the-counter (OTC) securities, and options |

Trading Platforms |

Webull Desktop Native, Webull Mobile App, Webull WebTrade |

Stock Trading Fees |

Zero commission on online stock trading |

Payment Options |

electronic Direct Debit Authorisation (eDDA), Fast and Secure Transfers (FAST), Telegraphic Transfer (TT) |

Customer Support |

5/24 |

Founded in 2008, Webull is a digital trading platform based in the United States, providing access to stocks, ETFs, options and cryptocurrencies. Two main trading platforms offered, its mobile app and a desktop platform, coming with features including real-time quotes, in-depth charts, and technical analysis tools. Webull operates under a $0-commission fee structure for U.S. stock, ETF and options trades. They also dont have a minimum deposit requirement.

Webull offers wide range of stock offerings allows traders to invest in a multitude of companies across various industries. Webull's zero commission structure means clients don't pay any commission fees when trading US stocks. Yet, if the trades require broker assistance, they may come with extra charges. Moreover, for accounts with short selling or margin trading, Webull does charge interest and it's advisable to check the latest rates on Webull's official website or by contacting their customer service.

✅Where Wellbull shines:

• Webull doesn't require users to maintain a minimum balance, making it an attractive choice for beginner traders or those with limited funds.

• Webull's mobile and desktop platforms are designed with intuitive interfaces, making the process of executing trades, researching investment opportunities and managing portfolios convenient.

• Clients can trade U.S. stocks, ETFs, and options with zero commission, a policy that stands out among many brokerage firms.

• Webull's mobile and desktop platforms are designed with intuitive interfaces, making the process of executing trades, researching investment opportunities and managing portfolios convenient.

❌Where Wellbull shorts:

• Despite offering 24/7 customer support via email and live chat, Webull does not offer phone support, which might disappoint users who prefer more personal interaction.

• Webull's margin rates can be on the higher side, which can bring additional costs for margin trading.

Forex Trading Knowledge Questions and Answers

How much money do I need for stock trading?

This cannot be generally described as a simple number. The amount of money you need to start stock trading can depend on various factors.

Your Investing Style Matters: Day trading typically requires more capital than long-term investing due to regulations surrounding the minimum equity required in your account. In the US, for example, the minimum equity requirement for a pattern day trader is $25,000.

The Stocks You Want to Buy: For example, if you want to buy shares of a company whose stock is priced at 100,and you want to buy 5 shares,you′ll need 500.

Broker minimums Required: Some brokers require minimum deposits to open an account, although many have eliminated account minimums. Some brokers do not set a limit for traders to enter the stock markets, while some brokers require a high minimum deposoit.

Your Risk Tolerance Decides: A piece of advice: never invest money you can't afford to lose. An experienced stock trader would likely advise you to only invest surplus money that you won't need for at least five years.

Is stock trading suitable for beginners?

Yes, stock trading is suitable for beginners if they are willing to learn and understand the market dynamics, have clear trading strategies, and can manage risks effectively. It's desirable to start small, gain experience and gradually involve more capital. Importantly, only invest money they can afford to lose.

What are differences between stock trading and investing?

The major difference between stock trading and investing lies in the time horizon and the intention behind each activity. Stock trading is a short-term activity that seeks to take advantage of price fluctuations in the market to make profits. On the other hand, investing is a long-term activity where one purchases shares in a company with the expectation that the company will grow and the value of the investment will increase over time.

How do I choose the best stocks to trade?

Company Performance: Analyze the financial statements of the companies you're interested in. These include balance sheets, income statements, and cash flow statements. Companies with increasing revenue, decreasing debt, and solid cash flow can be promising. Important ratios to consider are Price to Earnings (P/E), Price to Sales (P/S), and Price to Book (P/B).

Industry Health: What are the prospects for the industry in which the company operates? Fast-growing industries often pave the way for companies within them to grow at a similar pace. However, ensure that the growth is sustainable and not part of a temporary hype.

Stock Price Trends: Technical analysis is the study of statistical trends, collected from historical trading activity, such as price and volume. It helps predict future price movements based on past trends. Remember, while useful, this approach is not foolproof.

Stock Volatility: Volatile stocks can provide more trading opportunities due to the frequent price fluctuations. But, it's important to remember that volatile stocks also carry higher risk.

Liquidity: Liquidity refers to how quickly shares can be bought and sold without impacting the price. Highly liquid stocks tend to have a high daily trading volume which allows for easier entrance and exit.

Dividends: Some stocks pay dividends, which can provide an additional return on top of any potential capital appreciation. However, not all profitable trades come from dividend-paying stocks.

Can I buy stocks without a broker ?

Yes, you can buy stocks without a broker through strategies like direct stock purchase plans (DSPPs) offered by some companies, and via a dividend reinvestment plan (DRIP), which lets you reinvest dividends into buying more shares. However, using a broker provides access to advice, a wider range of stocks and platforms for easier trading.

What are successful strategies for stock trading?

Stock trading can be not that tough sometimes, and you can enhance your profitability by following some useful trading strategies. Here, let's explore some stock trading strategies that help.

Trend Following: This strategy involves buying stocks during an upward trend and selling when the trend begins to reverse. For example, if Apple's stock is in an upward trend, a trader would continue purchasing more shares until the financial indicators suggest the trend is reversing. When it comes to its success rate, it can range significantly. Depending on market conditions and selected trade filters, it's been reported to yield a success rate around 15-30%, but these can result in high reward trades.

Breakout Trading: Traders buy stocks after they break above resistance or sell when they fall below support. For instance, if Amazons shares have failed to rise above 50 several times,that′s considered a resistance level. If the stock price increases to 51, traders would buy shares expecting the upward trend to continue. According to reports, breakout strategies can have a success rate of about 20-40%.

Swing Trading: This involves capitalizing on stocks' short-term price movements. If Tesla's stock fell significantly due to a one-time event, a swing trader might purchase shares expecting the price to rebound in a few days. Success rates for swing trading vary greatly depending on experience, skill and the use of technical analysis. A reasonable range can be expected around 50-60% for those proficient in this strategy.

Position Trading: Traders hold positions for weeks or months, based on long-term price movements. If a pharmaceutical company is in the testing phase for a groundbreaking drug, a position trader might purchase shares, anticipating increased stock value if the drug is approved. Success rates are challenging to quantify, though experienced position traders could see success rates up to 40-50%.

Mean Reversion: The strategy operates on the belief that high and low prices are temporary and will revert to their average over time. If Amazon's stock has traditionally traded around 3000 and then spikes to 3500, a mean reversion trader might expect the price to fall back to $3000. Some reports suggest mean reversion strategies can achieve success rates of 60% or higher, again, dependent on many variables.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!