The FTSE 100, serving as a barometer for the UK's business sector, aggregates the performance of the country's top 100 public companies. This index is a popular instrument among traders worldwide seeking exposure to the UK's economic health. With many brokers offering access to FTSE 100 trading, this article dissects leading player, uncovering their strengths in fees, platforms, and resources, to help you identify the perfect partner for your FTSE journey, whether you're a seasoned veteran or a curious newcomer.

Comparison of the Best FTSE100 Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best FTSE 100 Forex Brokers Overall

| Brokers | Logos | Why are they listed as the Best FTSE 100 Brokers? |

| IG |  |

✅ A reputable platform with years of innovative advancements, giving traders a sophisticated and user-friendly trading experience. ✅ Provides vast trading opportunities across a range of assets including indices like the FTSE 100. ✅ Offers robust educational resources and customer support, aiding both novice and experienced traders. |

| Pepperstone |  |

✅ Known for offering some of the most competitive spreads and commissions in the industry. ✅ Leverages high-tech software for fast trade execution, reduces slippage. ✅ Excellent customer service with 24/5 support, ensuring trader concerns are addressed promptly. |

| CMC Markets |  |

✅ Equipped with a comprehesive trading platforms suite, including CFD trading platforms, MT4 and Share Trading platform. ✅ Traders can get to trade CFDs across forex, indices, commodities using one single platform. ✅ CMC Markets gives traders the option to customise their leverage within the limits set by the regulators. |

| Plus500 |  |

✅Heavily and globally regulated, Plus500 thus ensures a high level of compliance and security. ✅Plus500 platform is intuitive and user-friendly, making it accessible to a broad range of traders. ✅ Provides multiple features like stop-loss at no extra cost, helping traders effectively manage risk. |

| eToro |  |

✅ Offers the unique feature of social trading, where users can copy the trades of successful investors. ✅ Provides commission-free trades, reducing overall trading costs. ✅ Aside from indices like FTSE 100, also allows trading cryptocurrencies, commodities, and stocks. |

| ThinkMarkets |  |

✅ Strictly regulated by renowned bodies such as FCA, ASIC, CYSEC, enhancing the trust factor. ✅ Known for good customer service with quick response times and helpful assistance, average 29 seconds response time. ✅ Offering a range of free trading tools like advanced charting, news feed, and market analyses. |

| Trading212 |  |

✅ Regulated by top-tier regulators, giving its traders more trading confidence. ✅ Trading 212 doesn't enforce a minimum deposit, making it accessible to all types of investors. ✅Offering a demo account, allowing new traders to gain trading experience without risking real capital. |

| City Index |  |

✅With over 30 years in the industry, it has gainned high recognization for its service and platform. ✅Apart from indices like FTSE 100, City Index offers a wide array of tradable products including shares, commodities, and forex. ✅ Recognized for its speed of trade execution, which can make a significant difference in volatile markets. |

Overview of the Best FTSE 100 Brokers

|

|

Broker |

IG |

Regulated by |

ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA |

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

FTSE 100 Trading Costs |

NO commissions, only spreads charged |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

Debit Card, Wire Transfer, Bank Transfer (Automated Clearing House (ACH)) |

Customer Support |

7/24 |

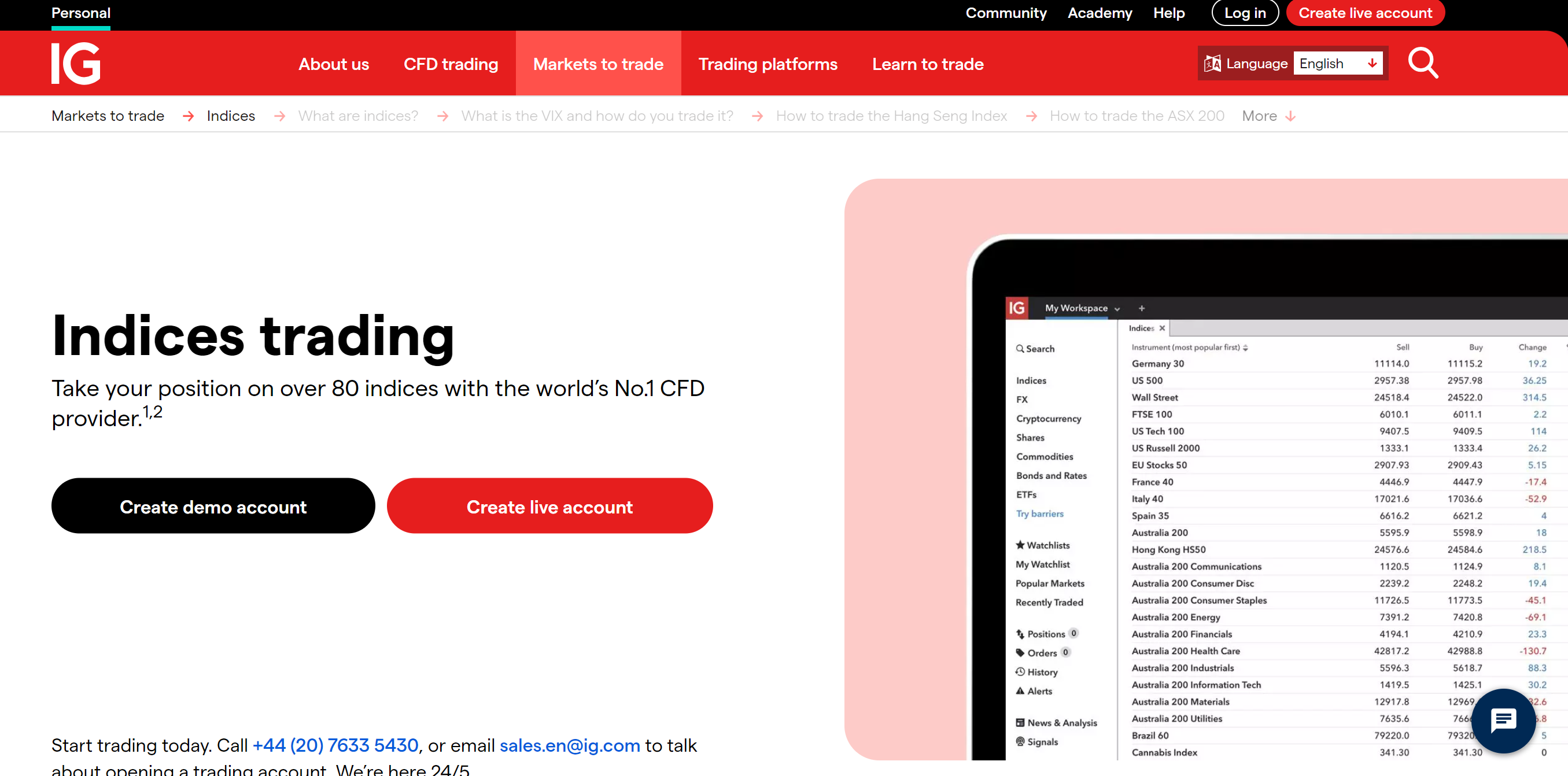

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

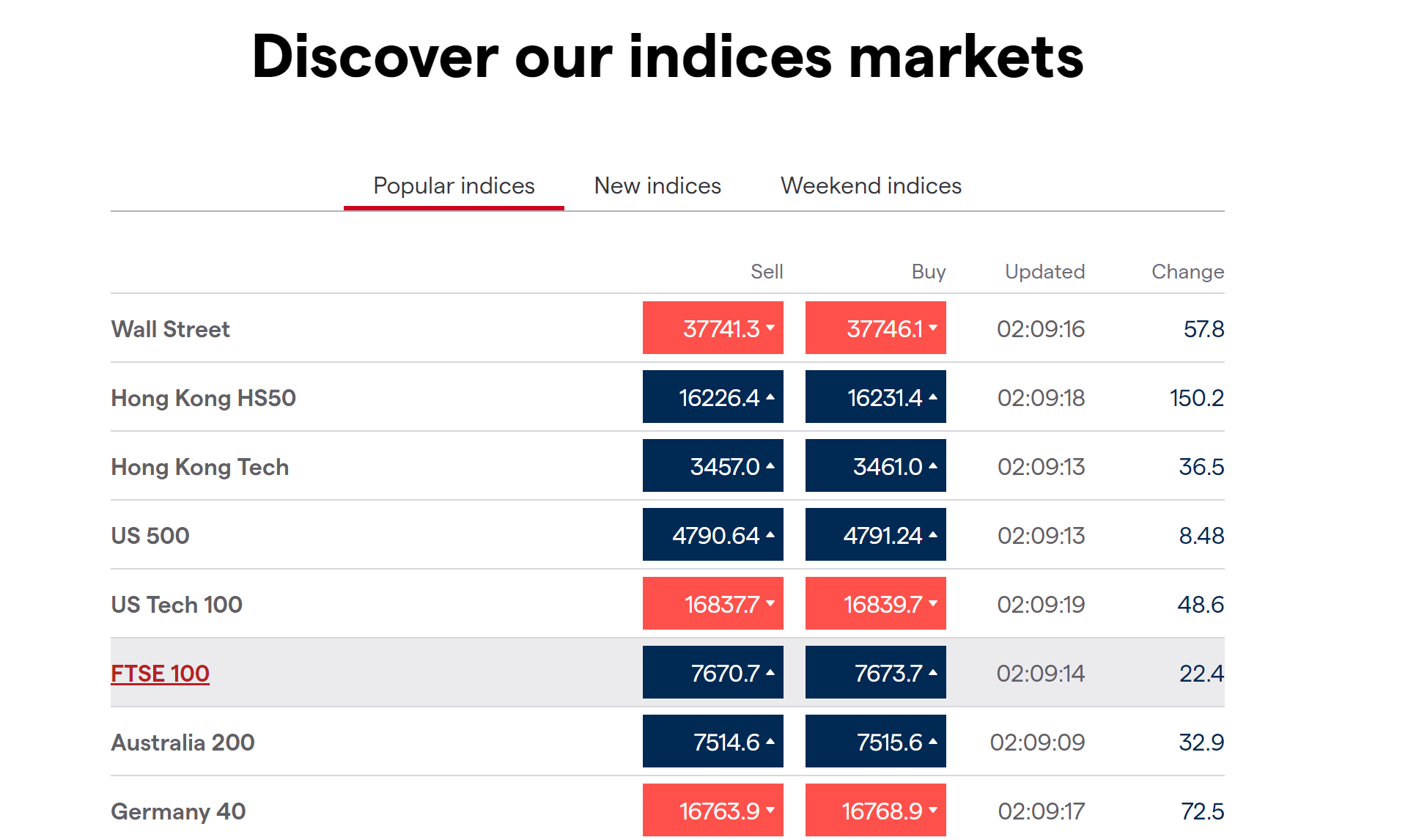

Renowned in index trading, IG provides access to over 80 global indices, including the acclaimed FTSE 100. With a leading 158 weekly trading hours for FTSE 100, IG offers increased flexibility to adapt to global market fluctuations. Traders at IG should account for spread costs and potential additional charges like overnight funding.

✅ Where IG shines:

• Globally regulated, IG's services are accessible globally, making them a go-to source for international trading.

• Their proprietary platform stands out with its high reliability, speedy execution, and advanced charting tools.

• FTSE 250 trading is one of IG's standout offerings, with tight spreads, direct market access, and up-to-date FTSE-related news.

• Providing guaranteed stop-loss orders (GSLOs), which lock in a maximum loss limit in advance, which few other brokers can do this.

• 7/24 customer support, IGs attentive and widely accessible customer support sets them apart in addressing trader queries and issues.

❌Where IG Shorts :

• IG charges an inactivity fee of $12 per month after two years of inactivity, unfavourable for long-term investors who trade less frequently.

• Presently, its product range is limited in the U.S with focus largely on forex, causing them to miss out on traders interested in other instruments.

• Some users might find the desktop trading platform complex and difficult to navigate, especially beginners.

• Some superior research tools and features are available at an extra cost which could be discouraging for some traders.

Pepperstone

|

|

| Broker | Pepperstone |

Regulated by |

ASIC, FCA, CYSEC, DFSA, SCB |

Min. Deposit |

$200 |

Tradable Instruments |

CFDs across Forex, Crypto, Indices, Commodities and Shares, and more |

Trading Platforms |

MetaTrader 4, MetaTrader 5, cTrader. |

FTSE 100 Trading Costs |

Minimum spreads from 1.0 pip |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay |

Customer Support |

7/24 |

Pepperstone, established in 2010, is an Australia-based online brokerage firm regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. It offers a diversified portfolio of tradable instruments, encompassing forex, commodities, indices, shares, and cryptocurrencies. Pepperstone provides renowned trading platforms - MetaTrader 4, MetaTrader 5, TradingView, and cTrader - featuring 99.99% fill rate and fast execution. Notably, Pepperstone is recognized for its competitive fee structure, which includes low spreads and no commission charges on specific account types. Also, Pepperstone is praised for its exceptional customer service, providing 24/5 support through various channels like live chat, email, and phone. Its credibility and customer-centric approach have earned it high satisfaction ratings among users worldwide.

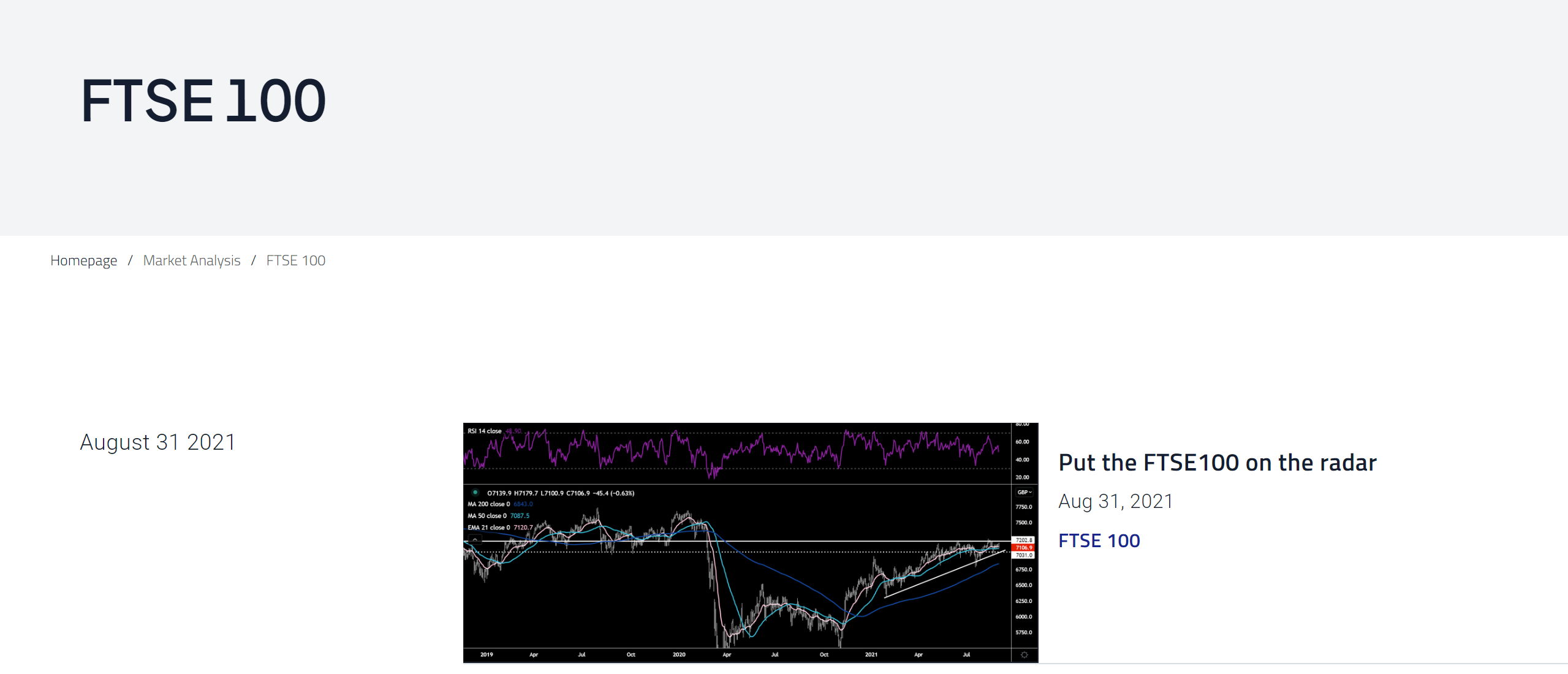

In particular, Pepperstone's FTSE 100 trading service warrants special attention. This offering allows traders to tap into the movement of the UK's top 100 publicly traded companies. The broker's low-cost structure makes FTSE 100 trading appealing, with minimum spreads on UK 100 (FTSE 100) from 1.0 pips, greatly reducing trading costs. Whether you are an experienced trader looking to diversify your portfolio or a beginner interested in exploring market opportunities, Pepperstone welcomes you.

✅ Where Pepperstone Shines:

• Strictly regulated by top-tier regulators, operating securely and transparently, giving clients more trading confidence.

• Pepperstone provides users with MetaTrader 4, MetaTrader 5, Tradingview, and cTrader - all renowned for their advanced features, stability, and user-friendly interfaces.

• Fast order execution, average execution speed around 30 milliseconds, featuring a high recognition in the industry.

• Pepperstone is known for its low-cost trading environment, with spreads on FTSE 100 starting from 1.0 pip, competitive in the industry.

• Equipped with a Pepperstone academy, offering rich and solid educational content for its traders to learn for free.

❌Where Pepperstone Shorts :

• With the absence of micro account, $200 to start trading, some traders, especially beginners, may feel disappointed.

• While the MetaTrader and cTrader platforms are excellent, Pepperstone lacks a proprietary platform. Some traders prefer a unique, broker-developed platform that's fine-tuned to their specific trading environment.

• Unlike some competitors, Pepperstone doesn't have an in-built social or copy trading feature.

CMC Markets

|

|

Broker |

CMC Markets |

Regulated by |

FCA, FMA, IIROC, MAS |

Min. Deposit |

$0 |

Tradable Instruments |

forex, index, share, commodity and treasury market |

Trading Platforms |

|

FTSE 100 Trading Costs |

No commissions, competitive spreads |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

Credit/debit card, Online banking, Bank transfer |

Customer Support |

5/24 |

Founded in 1989, CMC Markets is a Australia-based brokerage firm that has a long and solid operational history of over 20 years. Globally regulated by multiple regulatory authorities like FCA in the UK, IIROC in Canada, MAS in Singapore and more, it provides a large selection of tradable instruments, including but not limited to forex, CFDs, commodities, indices, and treasuries. On its proprietary 'Next Generation' trading platform, clients can access advanced features, analytical tools, and charting capabilities. As for trading costs, CMC Markets offers competitive spreads and comparatively low fees. CMC Markets's customer support services are recognized for their responsiveness and helpfulness, available 24/5 via phone, email, and live chat. Over the years, CMC Markets has earned solid recognition, exhibiting a strong commitment to maintaining high standards of customer satisfaction and platform innovation.

In terms of FTSE 100 trading, CMC Markets stands out with its unique offering of the UK 100 index. This product tracks the price movement of the FTSE 100's constituents, providing access to the performance of the top 100 UK-listed companies. Competitive pricing ensures that while trading the UK 100 index, transaction costs are kept to a minimum, which can enhance overall profitability. Whether a novice trader or a seasoned investor, trading the UK's principal index with CMC Markets represents an opportunity to interact with a significant portion of the global financial market, backed by the firm's industry-leading trading platform and customer support.

✅ Where CMC Markets Shines:

• Offering access to extensive range of over 10,000 tradable products including forex, indices, commodities, shares, ETFs, and treasuries.

• Equipped with a comprehensive suite of trading platforms, including CFD Trading platforms ( Next Generation platform), MT4 trading platform, as well as Share trading platforms.

• Competitive spreads for indices trading, which can be as low as 0.3 points for major indices like the UK 100.

•In certain regions, CMC Markets also supports social trading services, allowing users to imitate the trades of experienced investors.

• CMC Markets has an impressive speed of order execution, reducing chances of slippage.

❌Where CMC Markets Shorts :

• While the Next Generation platform is powerful and feature-rich, it could be overwhelming for new traders due to its advanced nature.

• An inactivity fee of $15 per month for users that are inactive for one year, increasing overall trading costs.

• Like many other brokers, CMC Markets does not accept U.S traders, either.

• While there are charting tools and news updates, the lack of additional proprietary market research tools could be a downside.

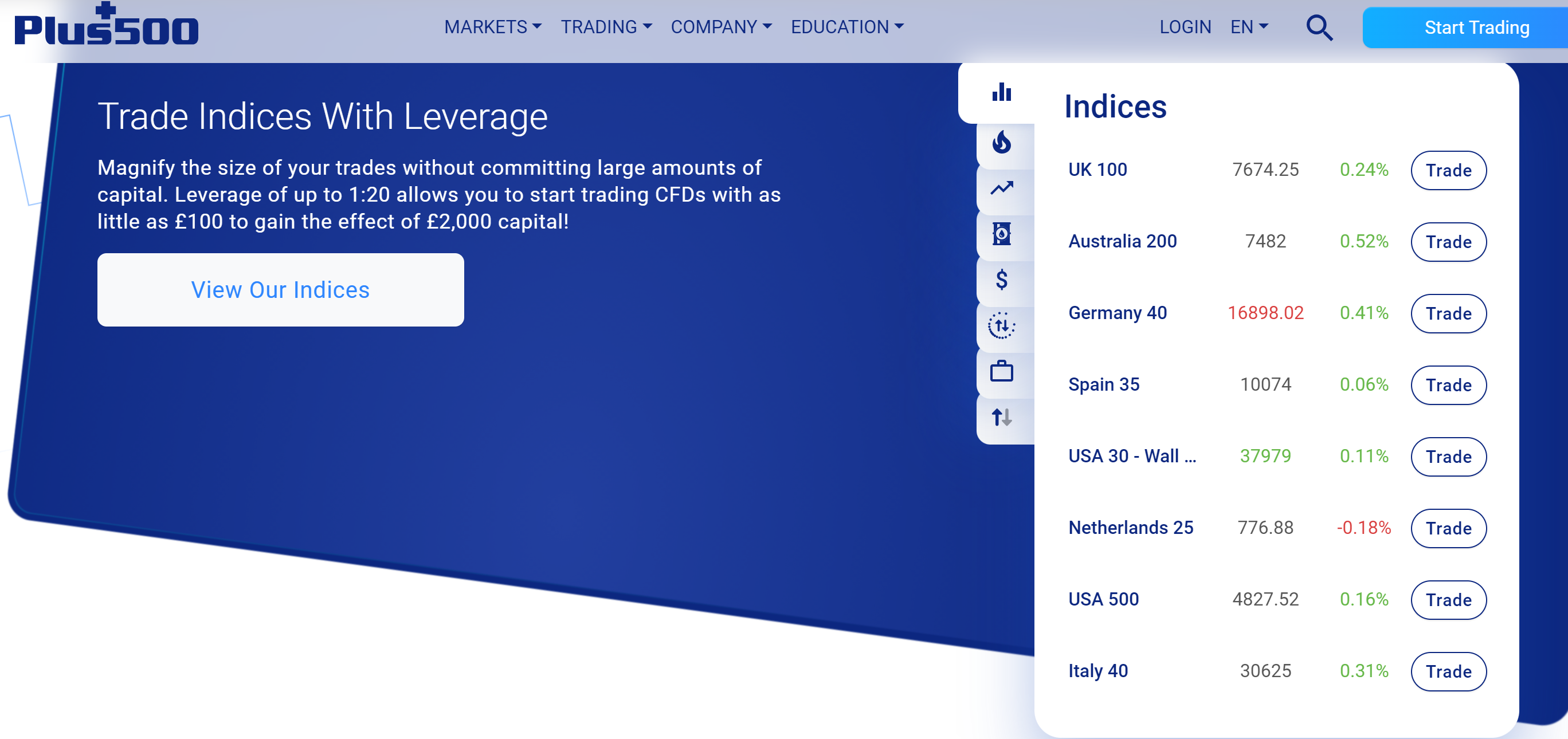

Plus500

|

|

Broker |

Plus500 |

Regulated by |

ASIC, FCA, CYSEC, FSA |

Min. Deposit |

$100 |

Tradable Instruments |

currency pairs, cryptocurrencies, soft and hard commodities (such as wheat, gold and oil), shares, indices, ETFs, Options |

Trading Platforms |

Plus500 Trading Platform |

FTSE 100 Trading Costs |

0.02% to 0.20%+ markup on raw spreads |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Visa or MasterCard, PayPal or Skrill, Bank transfer |

| Customer Support | 24/7 |

Plus500 is a widely recognized online brokerage founded in 2008, with roots in Israel and registered operations in the UK, Cyprus and Australia. It is regulated by highly reputable authorities, including the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC), ensuring a secure trading environment. Plus500's trading instruments cover a broad array of CFDs including shares, forex, commodities, indices, ETFs and options. The broker operates a proprietary trading platform that is known for its robustness, intuitive interface, and real-time financial market updates. It is available on multiple devices, including smartphones and tablets. Traders can rely on Plus500's support team available 24/7 via email and live chat, providing timely assistance and professional service.

Plus500 has pressing appeal for those looking to trade the FTSE 100 index. The platform provides exposure to the performance of the top 100 listed companies on the London Stock Exchange, with a marked investment into simplicity and streamlined trading experiences. Plus500 offers a competitive structure for trading fees; on major indices like the FTSE 100, traders may experience a 0.02% to 0.20%+ markup on raw spreads. This minimal markup ensures transparency in pricing, while also maintaining below average costs for clients.

✅ Where Plus500 Shines:

• Regulated by top-tier financial authorities like FCA, CySEC, and ASIC, adding an extra layer of trust and security for traders.

• Offering an extensive range of CFD trading instruments, including forex, commodities, indices, shares, ETFs, and options.

• Their proprietary platform is known for its simplicity and intuitive design, making it an ideal choice for beginners.

• Plus500 operates on a no-commissions policy, earning primarily through the spread, which can make trading cost-effective.

• Plus500 offers a free demo account with virtual money, which is useful for beginners to practice trading strategies without financial risk.

❌Where Plus500 Shorts :

• Only offering its own proprietary platform and does not support third-party platforms like MetaTrader or cTrader.

• Plus500 charges an inactivity fee of $10 per month if you don't log in to your trading account for three months.

• Plus500s platform provides basic live feeds of news and economic events, but it lacks more detailed data like company balance sheets and income statements.

• Plus500 doesn't offer a phone line for customer support. This could cause inconvenience for some traders looking for immediate assistance.

eToro

|

|

Broker |

eToro |

Regulated by |

ASIC, FCA, CYSEC |

Min. Deposit |

$100 |

Tradable Instruments |

Stocks, Indices, ETFs, Currencies, Commodities, Cryptoassets |

Trading Platforms |

eToro trading platform |

FTSE 100 Trading Costs |

A trading fee of 0.15% for the FTSE 100 trading |

Max. Leverage |

400:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Credit/Debit Card, Bank Transfer,Klarna/Sofort, eToro Money |

Customer Support |

7/24 |

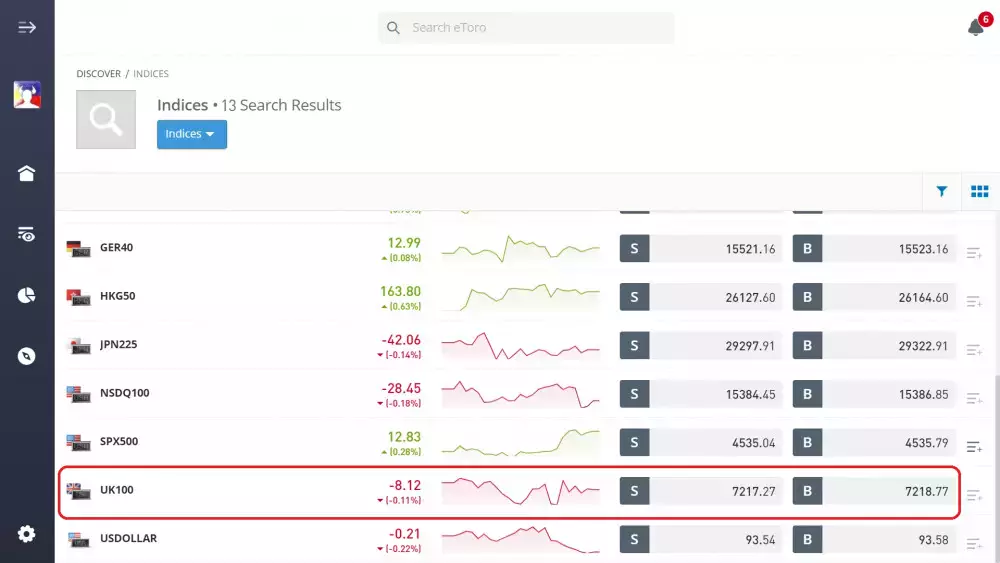

Founded in 2007, eToro is a pioneering trading and investment platform, popular for its social trading capabilities, operating under muiltiple regulations from the Cyprus Securities and Exchange Commission (CySEC) and the UK's Financial Conduct Authority (FCA), Australia Securities & Investment Commission (AISC). eToro offers vast tradable assets spanning forex, commodities, cryptocurrencies, stocks, indices, and ETFs. The platform stands out for its easy-to-use and intuitive platform that also features a unique 'CopyTrader' functionality, allowing less experienced investors to mirror the strategies of successful traders. In terms of trading fees, eToro implements a spread-based structure rather than commission-based, meaning the cost is integrated into the selling and buying price of the asset. When it comes to customer support, eToro provides a comprehensive help center and offers service in several languages. eToro's user-friendly interface, innovative features, and extensive range of assets have led to worldwide recognition and a strong user base.

Recognized particularly for its user-friendly style and low-cost structure, eToro provides exceptional access to UK100 (FTSE 100) trading. Clients can engage with this significant global index, representing the performance of top-tier companies listed on the London Stock Exchange. eToro charges a trading fee of 0.15% for buying or selling the FTSE 100 as a CFD (Contract for Difference). This fee is applied to both opening and closing positions.

✅ Where eToro Shines:

• Heavily and globally regulated, with good operation, eToro has won so many traders' recognition all over the world.

• A leader in the area of social trading, allowing users to copy trades from successful traders, which is an excellent advantage for beginners.

• eToro is one of the few brokers that offer extensive cryptocurrency trading options.

• eToro's focus on Environmental, Social, and Governance (ESG) integration in investments distinguishes it from many brokers, contributing towards sustainable and responsible trading.

• eToro has introduced some unique features like their “Popular Investor Program” which rewards successful traders who are followed by others, “CopyPortfolio” allowing users to invest in multiple markets based on a particular theme.

❌Where eToro Shorts:

• While eToro's fee structure is generally competitive, fees for certain tradable instruments, especially non-leveraged stock trading, can be comparatively high.

• eToro charges a flat fee of $5 for each withdrawal, a potential disadvantage compared to brokers who offer free withdrawals.

• eToro uses a proprietary platform and does not support the widely used MetaTrader 4 or 5 platforms.

• Although eToro's platform is user-friendly, it lacks advanced technical analysis tools that seasoned traders might require.

ThinkMarkets

|

|

Broker |

ThinkMarkets |

Regulated by |

ASIC, FCA, FSA (Japan), CYSEC, FSA ( Seychelles) |

Min. Deposit |

$0 |

Tradable Instruments |

forex, CFDs on metals, indices, equities, cryptocurrencies, commodities and more |

Trading Platforms |

MetaTrader 4, MetaTrader 5, ThinkTrade, ThinCopy |

FTSE 100 Trading Costs |

Varies depending on spot indices trading or CFD trading |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Bank Wire, Credit/Debit Cards (Visa and Mastercard), Cryptocurrencies, Skrill, Neteller |

Customer Support |

7/24 |

Founded in 2010, ThinkMarkets is a leading online brokerage firm with headquarters in Australia and the UK, operating under the regulations of the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission( CYSEC). ThinkMarkets provides over 4,000 tradable assets from forex pairs, indices, commodities, to cryptocurrencies and shares across their two main platforms, the popular MetaTrader 4, MetaTrader 5, their proprietary ThinkTrader and a cpoy solution called ThinCopy. Trading costs are competitive, with spreads on major currency pairs starting from 0.0 pips and no charges on deposits and withdrawals. ThinkMarket's customer support is globally acknowledged, providing multilingual 24/7 assistance through various channels such as live chat, email, and phone. User recognition has been high for ThinkMarkets due to its intuitive platforms, transparent pricing models, and array of educational materials catering to traders of all levels.

ThinkMarkets allows traders to trade FTSE 100 in two ways. The first way is through Spot Indices, where commissions begin from a minimum of 0.25 basis points per contract with a baseline of £5 per trade. The spreads are variable, commencing from 1 point, which is contingent on market fluctuations. For instance, if you execute a trade for 1 contract of the UK100 (FTSE 100) with a spread of 1 point at a contract size of £10, the overall commission would equate to £2.50. This is calculated by multiplying the contract size (£10) by 0.25 basis points. The second way is through Contract For Differences (CFDs), which precisely has zero commission charges. However, the variable spreads are usually more substantial than those of Spot Indices, initiating from 5 points for the UK100. For example, if you trade 1 CFD contract of the UK100 with a spread of 5 points and a contract size of £10, your total expenditure would be £50, derived from multiplying the contract size (£10) by 5 points.

✅ Where ThinkMarkets Shines:

• Hevaily regulated, a well-respected broker that has won high recognition globally.

• Traders have access to the popular MetaTrader 4 and ThinkMarkets proprietary ThinkTrader platform, which has advanced analysis and charting tools.

• The popular copy trading solution, ThinkCopy, gives traders more trading chances.

• Customer support at ThinkMarkets is highly accessible and responsive, offering multilingual service 24/7 via various channels.

• Mini account designed for beginners, only requiring $10 to start trading.

❌Where ThinkMarkets Shorts:

• Certain restrictions on scalping exist, which might hinder traders who utilize such kinds of high-frequency trading strategies.

• ThinkMarkets does not offer portfolio customization options. This means traders can't tailor their portfolios to meet specific investment goals or restrictions.

Trading212

|

|

Broker |

Trading212 |

Regulated by |

FCA, CYSEC |

Min. Deposit |

€10 |

Tradable Instruments |

FOREX, Stocks, ETFs, Index futures, Commodity futures, FOREX futures, Treasury futures, Cryptocurrencies |

Trading Platforms |

A proprietary platform |

FTSE 100 Trading Costs |

Spreads starting at 1.6 pips |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

Bonus |

❌ |

Payment Methods |

Bank Transfers, Card Payments, OnlineBankingPL, Giropay, Carte Bleue, Blik, Direct eBanking |

Customer Support |

7/24 |

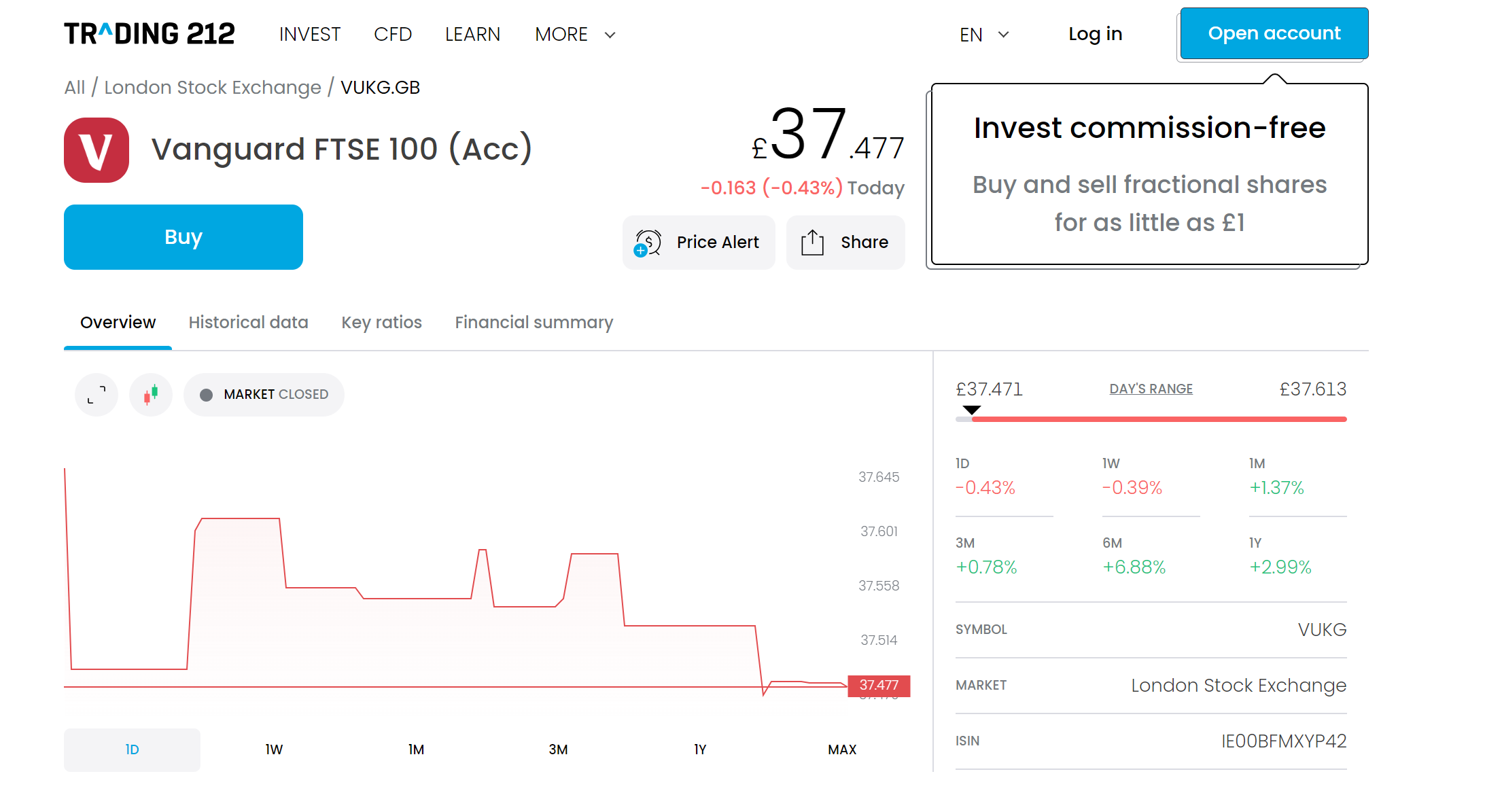

Established in 2006, Trading212 is a progressive online broker with registration in the United Kingdom, regulated by the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CYSEC), delivering over 13,000 stocks and ETFs. Its trading platform is proprietary and known for its user-friendly nature, suitable for novice and experienced traders alike. Trading212 impresses with its highly competitive, zero-commission structure across numerous instruments, contributing to its popularity. Furthermore, 7/24 customer support is maintained to a high standard with reliable service available in various languages, with average response time around 29 seconds. Trading212's approach of combining zero commission trading with a user-friendly platform has led to high user recognition in the trading community.

With regards to FTSE 100 trading, Trading212 provides a robust platform for investors to capitalize on the movement of the top 100 companies listed on the London Stock Exchange. Thanks to their zero-commission model, trading fees related to the FTSE 100 are minimal, which includes tight variable spreads that adapt to market conditions, with average spreads on the UK 100 (FTSE 100) starting at 1.6 pips.

✅ Where Trading212 Shines:

Regulated by reputable authorities, including FCA and CYSEC, giving its standards more trading confidence.

Trading212 allows trading in fractional shares, which enables investors with smaller accounts to invest in high-value stocks.

Trading212 stands out for its zero-commission trading across a broad range of asset classes including stocks, Forex, commodities, indices, and cryptocurrencies.

7/24 localized customer support service, providing assistance for traders from all over the world at any hour of any day.

❌Where Trading212 Shorts:

Lack of support for algorithmic trading via API can be a disadvantage, especially for advanced traders.

Unlike some brokers, Trading212 does not currently offer social trading or copy trading features.

No MetaTrader Support, a disadvantage especially for those accustomed to these popular platforms.

City Index

|

|

Broker |

City Index |

Regulated by |

FCA |

Min. Deposit |

$0 |

Tradable Instruments |

Currencies, Indices, Commodities, Shares, Cryptocurrencies, Spread Betting |

Trading Platforms |

City Index platform, Mobile App, MetaTrader 4, and Tradingview |

FTSE 100 Trading Costs |

spread as low as 1 point |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Bonus |

❌ |

Payment Methods |

Credit/debit card,Online banking |

Customer Support |

5/24 |

City Index, launched in 1983, is a reputable online broker based in London, England, authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Through City Index, traders can access a wide-ranging selection of over 13,500 global markets including stocks, commodities, forex, indices, and cryptocurrencies. Three versatile trading platforms are available to users: the proprietary City Index platform, Mobile App, MetaTrader 4, and Tradingview. The broker stands out with competitive spreads and relatively low trading fees. City Index provides efficient customer support via phone and live chat from Sunday to Friday. The diverse and inclusive offerings, coupled with strong customer support, have earned City Index significant recognition in the global trading community.

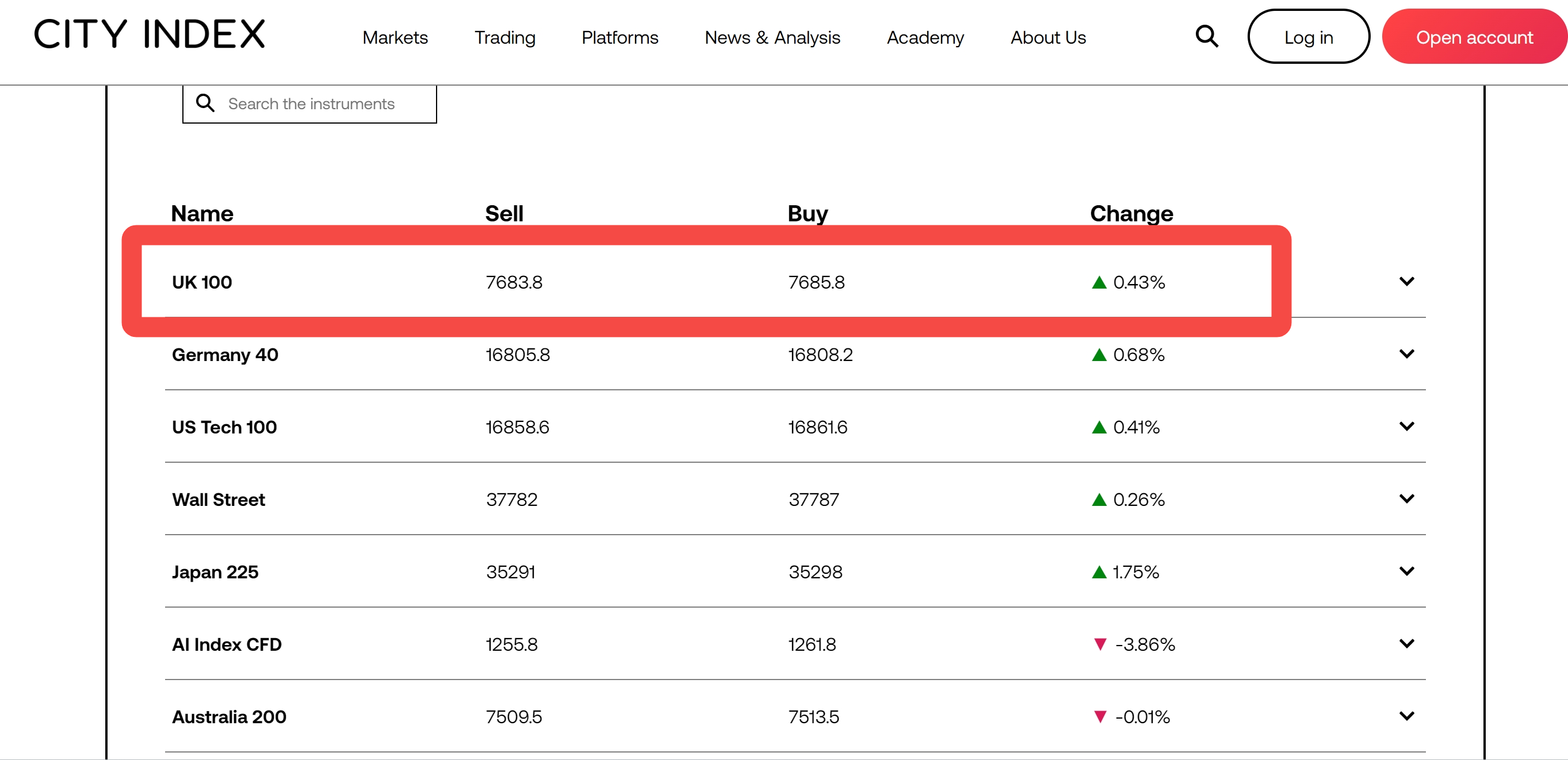

Turning to FTSE 100 trading, or the “UK 100” as it is called in the City Index platform, the broker provides a reliable and efficient trading environment. Tight spreads as low as 1 point provide a cost-effective way to speculate on the UK's blue-chip index, leverage up to 20:1 allowing for amplified exposure.

✅ Where City Index Shines:

City Index is regulated by the FCA, enhancing its credibility. It offers secure payment gateways and holds its clients' funds in segregated accounts, adding an extra layer of security.

Over 13,500 instruments, with an extensive range that includes commodities, forex, cryptocurrencies, and indices such as the FTSE 100, or the “UK 100” as it is known within the platform.

City Index provides comprehensive research and analysis tools which enable traders to make informed decisions.

❌Where City Index Shorts:

City Index charges an inactivity fee of $15 per month if there is no trading activity for a year, resulting in extra costs for traders who do not trade regularly.

While City Index does provide excellent customer support, it is not available round the clock.

City Index imposes a withdrawal fee for transactions below a certain amount, increasing overall trading costs, especially for those who frequently withdraw smaller amounts.

City Index does not offer a social trading feature which might lose the interest of traders looking to learn from or replicate experienced traders' strategies.

Forex Trading Knowledge Questions and Answers

What is the FTSE 100 index?

The FTSE 100 is a share index that represents the 100 largest companies listed on the London Stock Exchange, based on their market capitalization. Often referred to as “the Footsie,” it serves as a significant indicator of the UK's corporate sector's health and overall economic conditions. The index includes a diverse range of sectors, making it a broad measure of the UK's business performance. The FTSE Group, a part of the London Stock Exchange Group, is responsible for maintaining the FTSE 100 Index.

Is the FTSE 100 a good investment?

Investing in the FTSE 100 can be a strategic move, given its broad representation of the UK's economic performance, exposing investors to diverse sectors, spreading risk across different industries. However, like any investment, it's not without risks. Market volatility, economic conditions, currency exchange rates, and political events can all impact its value. Ultimately, whether the FTSE 100 is a suitable investment depends on individual financial goals, risk appetite, and investment timeline.

What are trading hours for the FTSE 100 index?

The regular trading hours for the FTSE 100 Index on the London Stock Exchange are from 8:00 a.m. to 4:30 p.m. UK local time, from Monday to Friday. However, these hours can vary depending on the broker you use. Some brokers, such as IG, offer extended trading hours for the FTSE 100 Index, allowing trades outside the standard market hours, including weekends. Always check with your specific broker to get accurate trading hours for the FTSE 100 Index.

What are the trading fees for FTSE 100?

The trading fees for the FTSE 100 depend on two main factors: how you're trading it and which broker you choose. If you trade in the CFD way, commission varies by broker, but generally none, and spread starts from 1 point at some brokers, but can be wider depending on market conditions and liquidity. If you trade in ETFs way, often no commissions at several brokers, especially for popular FTSE 100 ETFs. Annual fees charged by the ETF to cover management costs, typically ranging from 0.07% to 0.43%. The third way is spread betting, typically no commissions, but traders need to pay a spread on every open and closed position. As for spreads, similar to CFDs, starting from 1 point but can widen depending on the provider and market volatility. Lastly, the fourth way to trade FTSE 100 is through Futures Contracts, with commissions vary by broker and exchange, but generally higher than other methods. Yet contract values are typically large, often multiples of the index value.

| Ways to Trade | Spreads | Commissions | Other Fees |

| CFD | Spreads from 1 points typically | None | None |

| ETFs | Not Applied | None | Annual management fee from 0.07% to 0.43% |

| Spread Betting | Spreads from 1 point | None | No |

| Futures Contracts | Not Applied | Varies depending on Brokers, typically higher | Not Applied |

Are there any commission-free ways to trade FTSE 100 Index?

What is the leverage to trade FTSE 100?

The leverage available for trading the FTSE 100 can fluctuate and is set by various brokers. Often, leverage ratios for index trading such as the FTSE 100 could range up to 1:20 for retail clients and higher for professional clients.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!