Investment is a broad and profound field, with commodity trading playing a pivotal role. Foods, metals, and energy products, these ubiquitous commodities relate closely to our daily lives, offering unique investment and profit opportunities. In this article, we will introduce some of the best commodity brokers. They excel in markets with their quality trading platforms, diversified commodity options, rich educational resources, and excellent customer services. Whether you are a beginner or experienced commodity trader, hopefully, this ranking will support you in choose a proper broker.

Best Commodity Brokers Overall

- Tight spreads from 0.6 points on major commodity CFDs like gold and oil.

- Innovative web and mobile apps provide robust trading capabilities on-the-go.

- Multiple regulated entities give global traders peace of mind.

- Auto-trading platforms integrate well with commodities for automated strategies.

- Ultra low spreads from 0.0 pips make scalping strategies cost-effective.

- Negative balance protection provides security against market volatility risks.

more

Comparison of the Best Commodity Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Commodity Brokers Overall

| Broker | Logos | Why are they listed as the Best Commodity Brokers? |

| Interactive Broker |  |

✅ Interactive Brokers offer an impressive range of tradable commodities, enhancing investment opportunities. ✅Its up-to-date technology caters to both retail and professional investors, ensuring smooth and efficient trading. ✅Comparatively low-cost futures trading, making it financially appealing to traders. |

| IG |  |

✅ Overseen by several top-tier regulators, ensuring a secure trading environment. ✅ A total of 35 commodities provided, broadening trading possibilities. ✅ IG's platforms, including the highly-rated proprietary platform, provide a seamless trading experience. |

| AvaTrade |  |

✅ Boasting a strong regulatory background, AvaTrade offers a reliable trading platform for commodities. ✅ Costs are incorporated within the spread, providing clarity and simplicity in its pricing. ✅ AvaTrade‘s platform options, both proprietary and third-party, bring versatility to users’ trading experiences. |

| Exness |  |

✅ Exness allows for significant leverage, which can amplify potential profits. ✅ Known for its transparent pricing and relatively low fees, which reduces trading costs. ✅ With transparent pricing and relatively low fees, trading costs are manageable. |

| Plus500 |  |

✅ “zero commission” pricing model integrates costs within the spread, simplifying fee structure. ✅ Its proprietary trading platform is intuitive and equipped with powerful tools. ✅ The cost of trading commodities is integrated within the spread, simplifying the pricing structure. |

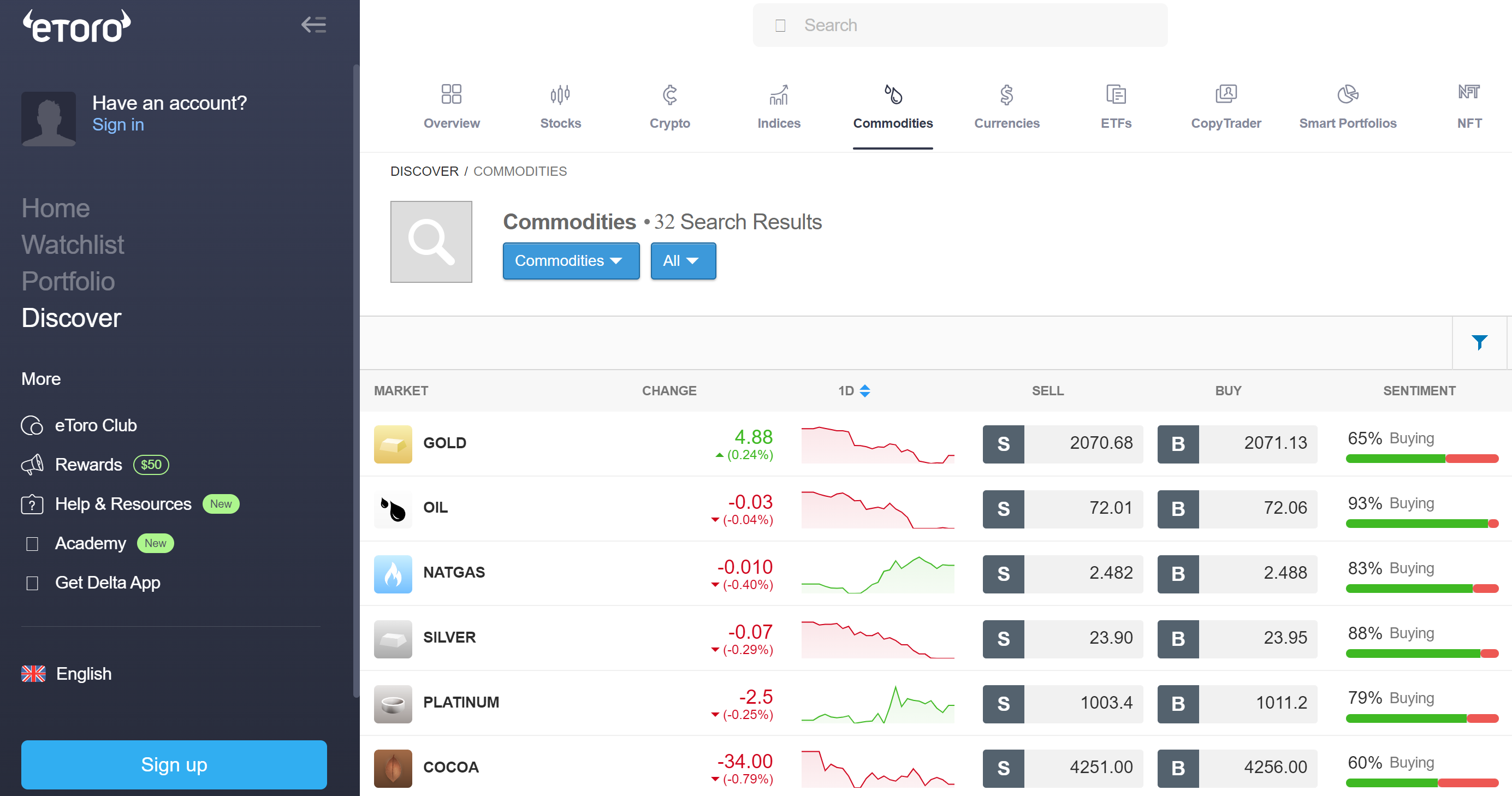

| eToro |  |

✅ eToro offers a unique social trading experience, allowing users to follow and replicate successful commodity traders. ✅ Working on a spread-only pricing model for commodities, delivering a simplified and transparent pricing structure. ✅ eToros platform is easy to use and caters to the needs of both novices and professionals. |

| TD AmeriTrade |  |

✅ Being regulated by top-tier financial authorities, it guarantees a highly secure trading environment. |

Overview of the Best Commodity Brokers

InteractiveBroker

|

|

Broker |

InteractiveBroker |

Regulated by |

IIROC |

Minimum Deposit |

$2,000 |

Tradable Instruments |

Stocks, Bonds, Metals, ETFs, Cryptocurrency, Indices, Currencies, Futures |

Commodities Available |

20 |

Trading Platforms |

IBKR Trader Workstation ( TWS) |

Trading Costs |

Futures: USD 0.275 to 0.935 per contract tiered, USD 0.935 per contract, Fixed: US-Future and Future Options |

Demo Accounts |

✅ |

Copy Trading |

❌ |

Customer Support |

7/24 multilingual customer support |

Interactive Brokers Group, Inc., founded in 1978, is a leading global brokerage firm headquartered in Greenwich, Connecticut, USA. The firm distinguishes itself with its broad range of tradable instruments, offering its clients access to stocks, options, futures, forex, bonds, and funds worldwide from a single integrated account. InteractiveBrokers' technologically advanced trading platforms, such as their flagship Trader Workstation (TWS), are highly acclaimed for their speed, reliability, and wide range of features. The firm is well-known for its comprehensive educational resources and responsive customer service, which includes 24-hour phone and chat support.

As for commodities, InteractiveBrokers offers clients a wide door to the commodities markets. Traders gain access to trade futures contracts on a variety of commodities including, but not limited to, precious metals, energy products, grains, and soft commodities like coffee and sugar in numerous global markets. Their commodity trading fees, known for being relatively low in the industry.

✅Where InteractiveBrokers Shines:

• Highly acclaimed trading platforms, such as the Trader Workstation (TWS), are known for their speed, reliability, and extensive features.

• Offering some of the industry's lowest commissions and fees, commodities fees also much lower.

• A broad selection of tradable instruments, including stocks, options, futures, forex, bonds, ETFs, and more.

• IG's fees for stock CFD trades can be considered high relative to some competitors.

• While IG does provide 7/24 customer service, some users report the response times can be slow, particularly at peak times.

❌Where InteractiveBrokers short:

• The functionality and interface of their trading platforms, such as TWS, might seem overwhelming for beginners.

• A monthly fee will be charged if no trading activities occur for a period of time.

IG

|

|

Broker |

IG |

Regulated by |

ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA |

Minimum Deposit |

$0 |

Tradable Instruments |

Forex, Shares, Indices, Commodities, options, Futures, Spot trading, cryptocurrency, and many more. |

Commodities Available |

35 commodities |

Trading Platforms |

Mobile trading app, MT4, Web-based platform |

Trading Costs |

Spreads from 0.6 points on major FX pairs, 0.8 points on major indices, and 0.1 points on commodities. |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Customer Support |

5/24 |

Founded in 1974, IG Group is a UK-based company offering access to a wide variety of markets via online trading and betting. Their range of tradable instruments spans across forex, indices, stocks, commodities, and cryptocurrencies of over 17,000 markets. IG's proprietary trading platform along with MetaTrader 4 (MT4). Their customer support is commendable, available 24/7, with options for live chat, phone, and email.

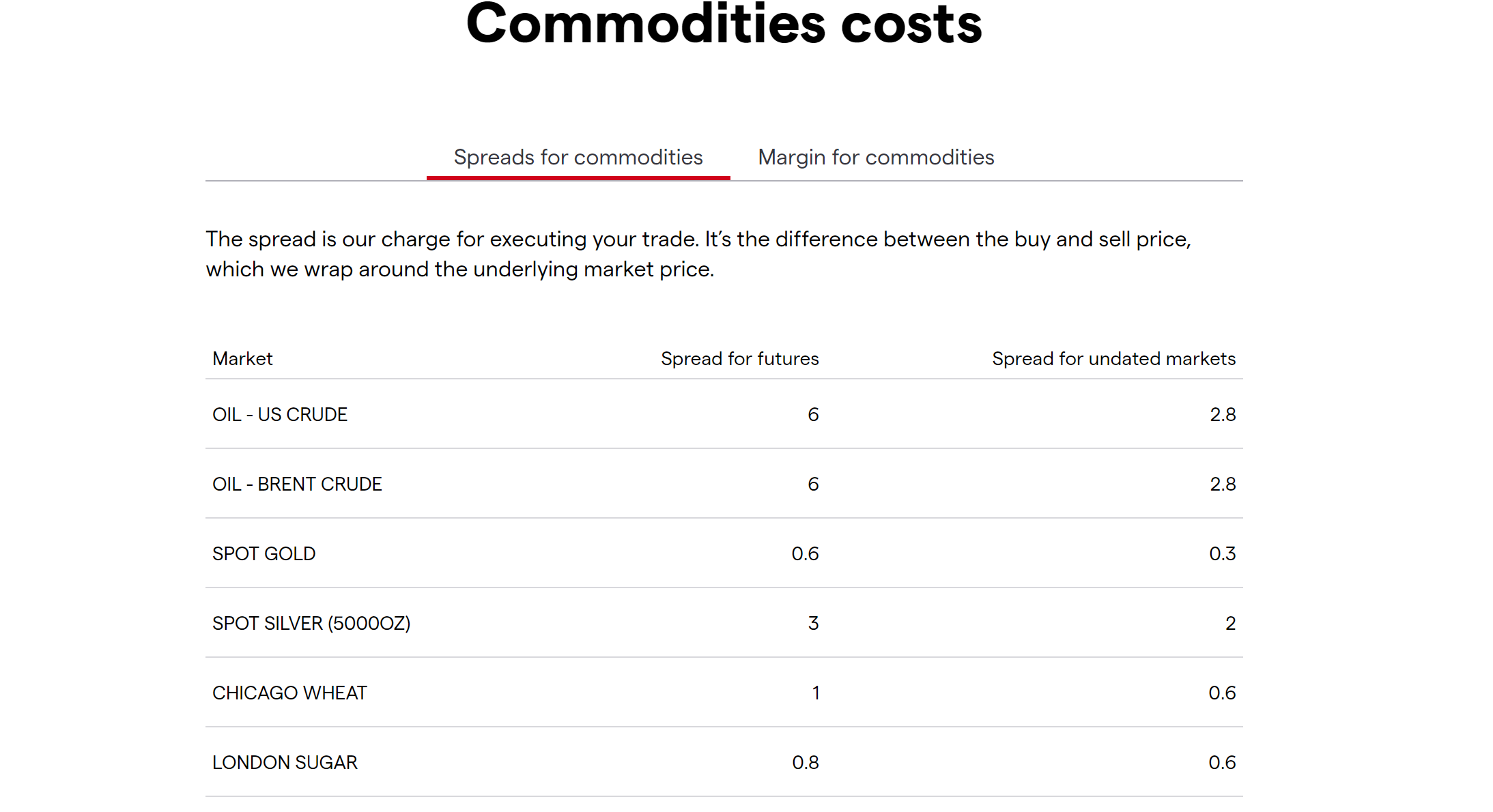

When it comes to commodities, IG offers one of the most robust selections in the industry. Traders have the ability to trade both physical commodities in the form of futures contracts, and commodity CFDs (contracts for differences), which include energies, precious metals and soft commodities, among others, a total 35 commodities. The screenshot below display some of the commodity trading fees, mainly calcuated in spreads. For oil - both US Crude and Brent Crude - the spread for futures is 6, while that for undated markets is 2.8. For spot gold, there's a spread of 0.6 for futures and 0.3 for undated markets. Spot Silver (5000oz) has a spread of 3 for futures and 2 for undated markets. Chicago Wheat sees a spread of 1 for futures and 0.6 for undated markets, while London Sugar rounds up with a spread of 0.8 for futures and 0.6 for undated markets.

✅Where IG Shines:

• Aregulated by multiple bodies globally, providing client fund safety assurance.

• A wide range of more than 17,000 markets including forex, indices, stocks, commodities, and cryptocurrencies.

• Providing vast commodities options, totally 35, competitive spreads charged on commodities products.

• 7/24 customer support, easily addressing trading problems of traders in different time zones.

• Quality eductional contents, giving traders great help in equipped themselves with forex trading knowledge.

❌Where IG short:

• High threshold of entry which may discourage some traders.

• Its web-based trading platform can be slower sometimes.

Avatrade

|

|

Broker |

Avatrade |

Regulated by |

ASIC, FSA, FSCA |

Minimum Deposit |

$100 |

Tradable Instruments |

Forex, Stocks, Cryptocurrencies, Commodities, ETFs, Indices |

Commodities Available |

16 |

Trading Platforms |

AvaTradeGO, MetaTrader 4, Mac Trading, Web Trading, Mobile Trading |

Trading Costs |

Average spreads from 0.9 pips, minimum trade size depends on asset |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Customer Support |

5/24 |

Avatrade, a globally recognized online brokerage firm, was founded in 2006 and is headquartered in Dublin, Ireland. The company is registered and regulated across multiple jurisdictions worldwide, including Japan, Australia, and the European Union. Avatrade offers a wide array of tradable instruments, ranging from forex, commodities, indices, stocks, ETFs to cryptocurrencies. They offer both proprietary trading platforms - AvaTradeGo and AvaOptions - along with the popular MetaTrader 4 and MetaTrader 5. Customer service is available in multiple languages and includes live chat, email, and phone support.

One of Avatrade's distinguishing features is its varied commodities offerings. The brokerage offers over 24 commodities CFDs, including critical ones like gold, oil, silver, natural gas, and grains. Traders can engage in commodities trading with competitive fixed and floating spreads starting from 0.03 points. Importantly, Avatrade enables the trading of commodities with leverage up to 200:1, facilitating greater market exposure.

✅Where Avatrade Shines:

• Operates under the regulation of multiple entities, thus ensuring a secure trading environment.

• Impressive range of educational materials, including video tutorials, eBooks, and webinars, ideal for beginner traders who want to learn the basics.

• Providing automated trading options which can be useful for traders looking to save time and leverage tested strategies.

• For high volume traders who conduct a high number of transactions monthly, the trading fees and spreads at AvaTrade are competitive and relatively low cost.

• A choice of user-friendly trading platforms including the beginner-friendly AvaTradeGO, the popular MetaTrader 4 (MT4) platform, and options for web trading and mobile trading.

❌Where Avatrade short:

• Some users have found the withdrawal process to be slower.

• Charging an inactivity fee after 3 months of account dormancy, which is a downside for sporadic traders.

• Advanced traders may be disappointed with the lack of API access for trading automation at AvaTrade.

• The website and trading platforms feel a bit outdated in terms of user interface and design compared to newer competitors.

Exness

|

|

Broker |

Exness |

Regulated by |

CYSEC, FCA, FSCA, FSA |

Minimum Deposit |

$10 |

Tradable Instruments |

Forex currency pairs, Cryptocurrencies, Commodities (Energies and Metals), Indices, and Stocks |

Commodities Available |

15 |

Trading Platforms |

MetaTrader 4, MetaTrader 5, Exness CopyTrade, Mobile Apps |

Trading Costs |

Spreads from 0.1 pips, no commissions |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Customer Support |

7/24 |

Exness, established in 2008, is a reputable online broker with its headquarters in Cyprus. Exness, founded in 2008 in Cyprus, offers a diversified portfolio, including forex, metals, energies, indices, and cryptocurrencies, backed by strong regulatory bodies like CySEC and FCA. Supported trading platforms include the industry-standard MetaTrader 4 and MetaTrader 5, along with proprietary Exness Trader for mobile. Their customer service is commendable, featuring multilingual support through a variety of channels — live chat, email, and calls.

Moving towards commodities, Exness's commodity market centers around metals and energies, featuring gold, silver, palladium, natural gas, and multiple crude oil types. Variable spreads and leverage up to 1:500 are significant attractions of Exness's commodities trading.This provides traders with opportunities to capitalize on commodity price movements while keeping trading costs relatively low.

✅Where Exness Shines:

• For traders looking to save on trading costs, Exness offers some of the most competitive spreads and commissions in the industry, raw spreads start from just 0.1 pips on USD/EUR.

• Regulated by top-tier authorities including the Cyprus Securities and Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA).

• For certain types of accounts, low minimum deposit from $10, making it accessible to newcomers or those with smaller investment capitals.

• Unlimited leverage, significantly magnifying potential profits.

• For novice traders, Exness has a well-stocked education section on their website featuring trading basics, video tutorials, analytics, webinars and more. This is ideal for beginners.

❌Where Exness short:

• Customer service is underwhelming with support only via email and live chat channels.

• Expert traders may find the lack of advanced order types like trailing stops and option builder tools limiting for complex strategies.

• Both the website and mobile trading apps could benefit from a refreshed design and improved navigation flows.

Plus500

|

|

Broker |

Plus500 |

Regulated by |

CySEC, FCA, ASIC |

Minimum Deposit |

$100 |

Tradable Instruments |

Forex, Commodities, Stocks, Indices, Cryptocurrencies |

Commodities Available |

15 |

Trading Platforms |

Plus500 trading platform |

Trading Costs |

Spreads from 0.6 pips, no commissions |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Customer Support |

24/5 |

Founded in 2008, Plus500 is an Israel-based online brokerage platform with numerous global subsidiaries, regulated by entities such as the FCA in the UK, CySEC in Cyprus, ASIC in Australia, and MAS in Singapore. Known for an extensive range of over 2,000 tradable financial instruments, Plus500 covers forex, indices, commodities, equities, ETFs, and even cryptocurrencies. Unique to this broker is their proprietary trading platform, Plus500, providing a user-friendly environment with powerful charting features for traders. They also offer multilingual customer support services via email and live chat across different time zones.

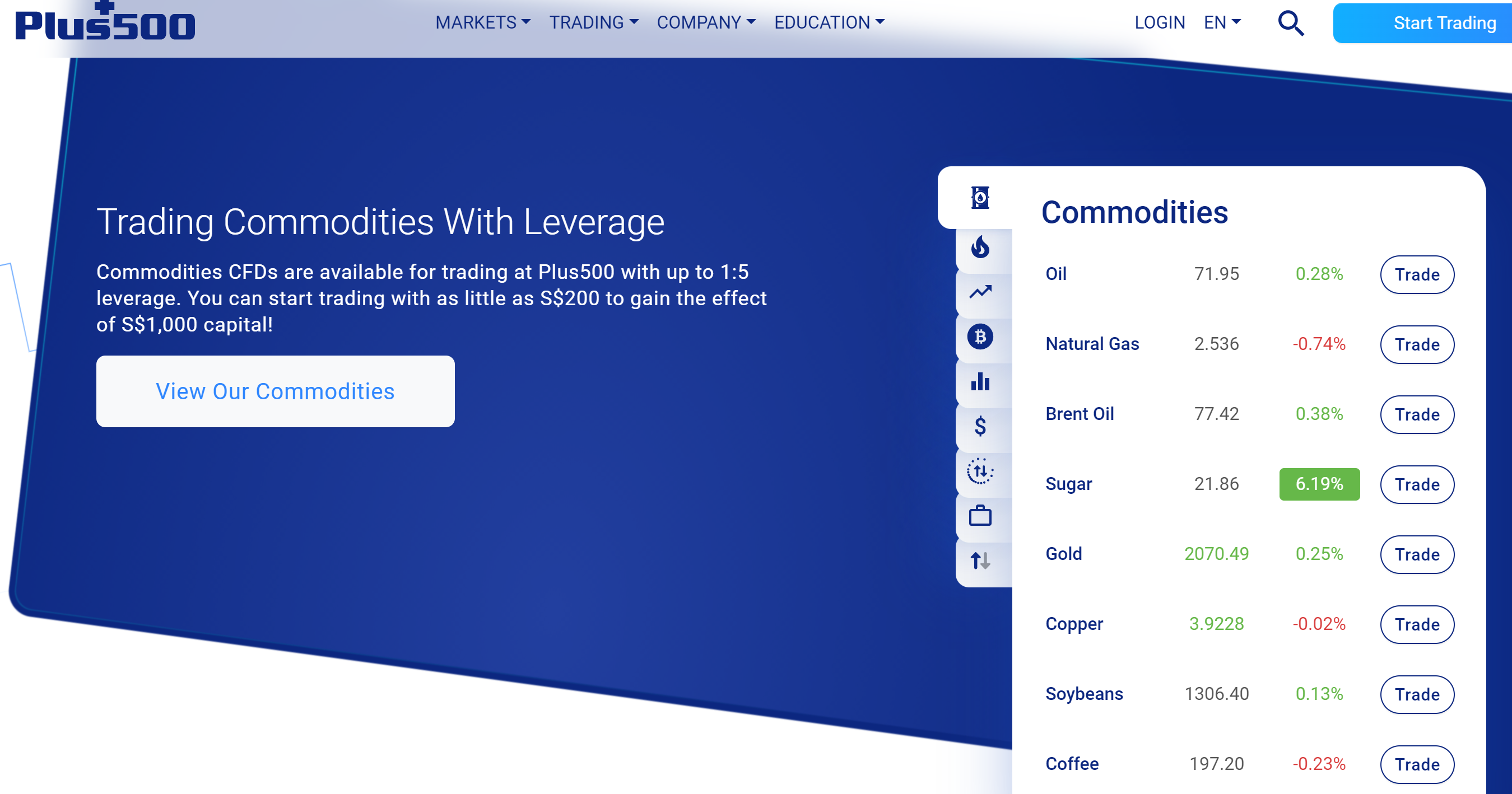

Regarding commodities, Plus500 offers an impressive array of options ranging from metals - including gold, silver, platinum, palladium - to energy - such as oil, gas - and agricultural commodities like wheat, corn, cotton, and more. Leverage on commodity CFDs is set at 1:5, which can give you more trading flexibility. It operates on a “zero-commission” structure, where trading costs are integrated into the spread. The spread for commodities varies depending on the volatility and liquidity of the specific commodity.

✅Where Plus500 Shines:

• Strong regulation framework, providing an assurance of secure trading.

• Its proprietary platform with a user-friendly interface suitable for both beginner and experienced traders.

• Opening a live or demo account is quick, convenient and fully digital, allowing traders to get started with real money or virtual funds almost instantly.

• For frequent traders, the spreads and commissions charged by Plus500 are competitive relative to other online brokers. This helps keep trading costs low.

❌Where Plus500 short:

• It lacks the option of telephone customer support and doesn't offer the MetaTrader or cTrader platforms, which might be a con for traders familiar with these platforms.

• Their educational resources could be better to cater to beginner traders.

• Tradable products is limited mainly to CFDs across forex, stocks, indices, commodities and cryptocurrencies.

• The research tools, technical indicators and risk management features on Plus500's platforms are quite basic and insufficient for thorough analysis.

eToro

|

|

Broker |

eToro |

Regulated by |

FCA, CySEC, ASIC |

Minimum Deposit |

$10 |

Tradable Instruments |

Forex, Commodities, Cryptocurrencies, Stocks, ETFs |

Commodities Available |

17 |

Trading Platforms |

Proprietary Web and Mobile Platforms |

Trading Costs |

No commissions, only spreads |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Customer Support |

24/7 |

Established in 2007, eToro is a globally recognized social trading platform, with its headquarters in Cyprus and additional offices in Israel and the UK. eToro operates under the regulation of CySEC, FCA, and ASIC, offering a diverse choice of tradable instruments such as stocks, cryptocurrencies, forex, indices, ETFs, and commodities. It is particularly known for pioneering social and copy trading, allowing users to follow and replicate the strategies of top traders. Its proprietary trading platform is intuitive with advanced features serving both new and experienced traders. Furthermore, eToro's multi-lingual customer support can be accessed through live chat and ticketing system.

In terms of commodities, eToro delivers a wide range of trading opportunities. Traders can explore commodities like gold, oil, natural gas, silver, and various agricultural products. It should be noted that eToro operates on a spread-only pricing model for commodities, which means that instead of charging a specific fee, the cost of trading is integrated within the spread itself, contributing to a simplified pricing structure. Notaly, eToro offers copytrader, allowing commodity traders to copy trades of successful traders, thus enhancing thier profitability to varying degree.

✅Where eToro Shines:

• Its position as a leader in social trading, offering an innovative platform that integrates community and technology.

• Offering a substantial range of financial instruments from commodities, stocks, and cryptocurrencies to indices, ETFs, and forex.

• Providing an array of tradable assets and a user-friendly interface with a focus on transparency.

• Advocating for trading transparency, posting each trader's risk scores and previous trading performances for reference.

❌Where eToro short:

• Some users find the platform's withdrawal process slow and complain about the high minimum withdrawal limit.

• The absence of phone support can also be a downside for some customers.

• While basic educational resources are available, more in-depth material for experienced traders is limited.

TD Ameritrade

|

|

Broker |

TD Ameritrade |

Regulated by |

SFC |

Minimum Deposit |

$2,000 |

Tradable Instruments |

Stocks, ETFs, Options, Futures, Forex |

Commodities Available |

50 futures contracts |

Trading Platforms |

Thinkorswim, TD Ameritrade Mobile, Web Platform |

Trading Costs |

$0 commissions for stocks, options; futures fees vary |

Demo Accounts |

❌ |

| Copy Trading | ❌ |

Customer Support |

24/5 |

Founded in 1975, TD Ameritrade is a US-based brokerage firm headquartered in Omaha, Nebraska. It is regulated by top-tier financial authorities, namely the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). TD Ameritrade offers an extensive selection of tradable instruments including stocks, options, ETFs, futures, forex, and much more. It offers three main trading platforms - a web platform, Trade Architect, and the advanced Thinkorswim, all known for their powerful features and user-friendly interfaces. The firm provides robust customer support through 24/7 phone lines, messaging, and email.

In terms of commodities, TD Ameritrade provides trading in a wide range of futures contracts, from agricultural commodities like corn, wheat, and cattle, to energy commodities such as crude oil and natural gas, and metals including gold, silver, and copper. Specific trading fees for commodities hinge on the contract being traded, with fees typically built into the spread or as standard brokerage fees.

✅Where TD Ameritrade Shines:

• No platform or data fees, trade surcharges, or order cancellation fees, making price structure transparent and predictable.

• Provides paper trading for practice which is beneficial especially for beginners.

• Powerful trading platforms, particularly Thinkorswim for advanced traders.

• Flaunting comprehensive research and educational resources and offers exceptional customer support.

❌Where TD Ameritrade short:

• It primarily serves the US market only, limiting its global reach.

• Requiring a substantial minimum deposit for certain types of accounts, which could deter traders with limited capital.

• Although the firm offers a broad commodities selection, the cost can be high as it typically includes a standard brokerage fee.

Forex Trading Knowledge Questions and Answers

What is a commdity broker?

A commodity broker is a brokerage who specializes in executing buy and sell orders for commodity contracts, such as agricultural products, oil, and metals, on behalf of traders. They serve as intermediaries between buyers and sellers in the commodity futures and options markets.

What fees does a commodity broker charge?

A commodity broker typically charges a commission for each trade executed, a flat fee per trade, a percentage of the trade value, or a tiered commission schedule based on trade volume. They may also charge additional fees for account maintenance, market data access, and for other services provided. The exact charges can, in fact, vary widely between brokers.

Is commodity trading profitable?

Yes, commodity trading can be profitable. Specfically, the amount of profit that a trader can earn from commodity trading greatly varies as it's influenced by several factors like trading experience, trade size, market volatility, type of commodity traded, and strategy employed. Two major trading strategies commonly used by successful traders are speculation and future contracts.

For example, let's say a trader obtains a futures contract to buy wheat at 5 per bushel for a total of 5,000 bushels, the total contract value is 25,000. If the price of wheat rises to 6 per bushel by the contract′s delivery date, the contract is now worth 30,000. Selling this contract before the delivery date would net the trader a profit of 5,000. However, if the price drops to 4 per bushel, the contract value would decrease to $20,000, resulting in a loss.

What are soft commodities?

“Soft commodities” refer to goods that are grown, such as grains, coffee, sugar, cocoa, and livestock. These commodities are often affected by weather conditions, disease, and water supply, making their prices quite volatile.

What are hard commodities?

“Hard commodities,” are mined or extracted, such as gold, oil, and natural gas. The production and availability of hard commodities can be influenced by geopolitical issues, technology, and major natural events. Their prices can also be volatile but are often subject to different influences than soft commodities.

Commodity and Futures: What are differencess?

Commodities are raw materials or primary agricultural products, that can be bought and sold, such as gold, oil, wheat, or sugar. Futures, on the other hand, are financial contracts obligating the buyer to buy an asset, such as a physical commodity or a financial instrument, at a predetermined future date and price. Hence, a futures contract is a way to invest in commodities, but it can also be used for investing in financial instruments like indices or bonds.

Can I trade commodity without a broker?

Theoretically, it's possible to trade commodities without a broker by directly accessing the futures exchanges. However, in reality, most individual traders will find it easier and more convenient to trade through a broker.

Brokers provide easier access to the markets, and they handle the trading logics, like order execution, account management, and sometimes even offer guidance and trading tools. Trading without a broker would require substantial knowledge about the trading process, relevant laws and regulations, as well as substantial resources to meet the financial requirements set by the exchanges.

That said, it's important to research potential brokers before deciding to work with one, making sure their services align with your trading goals and risk tolerance.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!