Withdrawals remains an important process during the trading process, and even the most important part at the end of trading. Simply put, being able to withdraw your funds or not can directly decide whether your trading is sucessful or not. Traders, therefore, deserve instant access to their hard-earned gains. This is where many forex brokers with instant withdrawal step in, boosting that they offer 10 minutes withdrawal.

Through a rigorous and data-driven selection process, we have selected the top 7 forex brokers who excel in instant withdrawals based some core dimensions including regulation, reputation, tradable instruments, trading platforms, trading costs to provide clear guidance for traders.

Best Forex Brokers with Instant Withdrawals

Customer support team operates 24/7 to speed up the withdrawal process and reduce any possible waiting time.

Supports instant withdrawals to Skrill and Neteller within 60 minutes, no fees charged on instant payment withdrawals.

Been in the industry for years, ActivTrades has been known for its efficient withdrawal process.

Instant withdrawal available through debit/credit cards and e-wallets, processing withdrawals even on weekends for added convenience.

Regulated by two top-tier regulators, FCA and ASIC, giving traders more reassurance.

Instant withdrawals via credit/debit cards (Visa/MasterCard), minimal KYC verification time enables meeting withdrawal conditions quickly.

more

Best Forex Brokers with Instant Withdrawals Compared

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers with Instant Withdrawals Reviewed

① IC Markets Global

|

|

| Broker | IC Markets |

| Regulated by | CYSEC, ASIC |

| Min. Deposit | $200 |

| Tradable Instruments | CFDs on forex, commodities, indices, bonds, stocks, and futures, digital currencies |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Trading Costs | Standard Acount: spreads from 0.8 pips, with no commissions charged |

| Raw Spread: spreads from 0.0 pips, with commissions at $3.5 | |

| Raw Spread (cTrader): spreads from 0 pips, with commissions at $3.0 | |

| Max. Leverage | 1:1000 |

| Instant Withdrawal | ✅ |

| Demo Account | ✅ |

| Copy Trading | ✅ |

| Payment Methods | Credit/debit cards (MasterCard/Visa), PayPal, Neteller, Neteller VIP, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLI, Thai/Vietnamese Internet Banking, Rapidpay, Klarna |

| Customer Support | 7/24 |

IC Markets, an established name in the forex industry, was founded in 2007 and operates out of Sydney, Australia, strictly regulated by the ASIC in Australia and CYSEC in Cyprus, which lends it considerable credibility. Traders choosing IC Markets have access to vast tradable instruments, spanning across CFDs on forex, commodities, indices, bonds, stocks, and futures, and digital currencies. To boost trading, IC Markets supports multiple trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView. One of its key strengths lies in its dedicated customer support, available 24/7 and offering assistance in multiple languages. IC Markets has earned recognition among users for its competitive spreads, quick trade execution, and deep liquidity. Besides, IC Marketse further also provides advanced features like social trading solutions via Myfxbook and ZuluTrade, which enable traders to follow and copy trades executed by seasoned professionals.

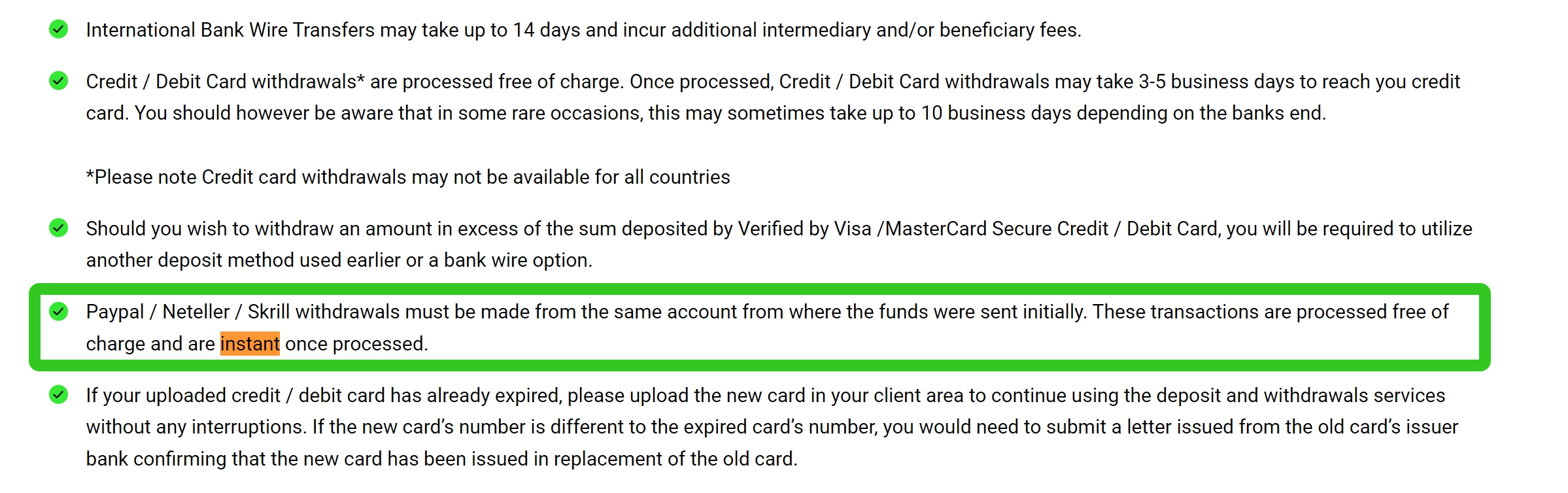

What truly sets IC Markets apart is its reputation for providing instant withdrawals, a feature highly prized in the Forex trading industry. The broker has integrated several payment options for instant withdrawals, including electronic wallets like Skrill, Neteller, and PayPal. Other available payment options range from bank transfers and credit cards to various country-specific methods. For IC Markets, there is no minimum withdrawal amount set, allowing traders to withdraw any part of their funds. Currencies available for trading and transactions include USD, EUR, GBP, AUD, CAD, SGD, NZD, and more.

② ActivTrades

|

|

Broker |

|

Regulated by |

FCA, SCB (Offshore) |

Min. Deposit |

$0 |

Tradable Instruments |

Currencies, Commodities, Indices, Shares, Bonds and ETFs |

Trading Platforms |

ActivTrader, MT4, MT5 |

Trading Costs |

CFDs on shares, spreads from 0.75 pips, Major forex pairs spreads from 0.23 pips |

Max. Leverage |

1:500 |

Instant Withdrawal |

✅ |

Demo Account |

✅($10,000 virtual fund) |

Copy Trading |

✅ |

Payment Methods |

MasterCard, PayPal, Bank Transfer, Visa, Neteller, Skrill, Sofort |

Customer Support |

7/24 |

ActivTrades is a reputable online Forex broker that was founded in 2001 and set its base in London, United Kingdom, operating under the guidance of the Financial Conduct Authority (FCA), ensuring stringent adherence to regulations and secure trading practices. ActivTrades offers extensive tradable assets, extending to Currencies, Commodities, Indices, Shares, Bonds and ETFs. It supports MetaTrader 4 and MetaTrader 5, as well as its properitary trading platforrm called ActivTrader. It prides itself on its robust, round-the-clock customer support, proficient in multiple languages. ActivTrades has won noticeable recognition among users for its competitive spreads, secure trading framework, and the introduction of innovative tools such as the Autochartist for advanced market scanning and the PIP calculator for potential profit analysis.

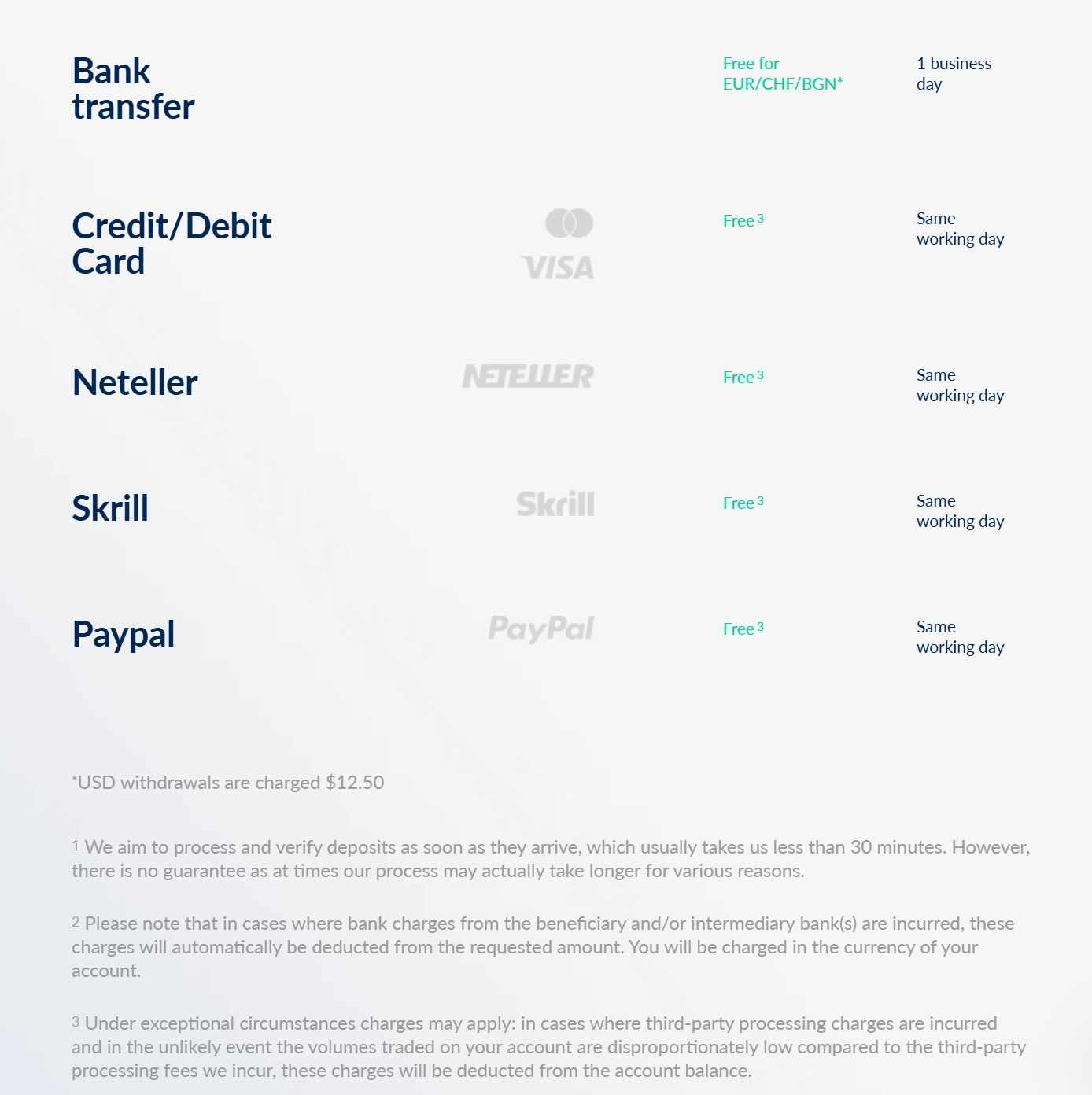

ActivTrades shines with its reputation for quick withdrawal processes. It generally processes withdrawal requests within the same working day, including credit/debit card, Neteller, Skrill, and PayPal, while USD withdrawals are charged $12.50. What's more, ActivTrades does not impose a minimum withdrawal limit. These standout features, reflecting the broker's client-focused approach, make ActivTrades a top pick when it comes to brokers excelling in their deposit and withdrawal functionality.

③ Axi

|

|

Broker |

Axi |

Regulated by |

|

Min. Deposit |

$5 |

Tradable Instruments |

Forex, shares, indices, commodities, IPOs |

Trading Platforms |

Copy Trading App, MT4, MT4 WebTrader |

Trading Costs |

Standard Account: No commissions, spreads from 0.9 pips |

| Pro Account: spreads from 0.0 pips, a $7 commission per round trip per lot | |

Max. Leverage |

30:1 |

Instant Withdrawal |

✅ |

Demo Account |

✅(30-day trial with $50,000 virtual fund) |

Copy Trading |

✅ |

✅ |

|

Payment Methods |

credit/debit card (Visa/MasterCard), PayPal, Bank Transfer |

Customer Support |

24 hours a day, Sunday 11 PM UK Time to Friday 11 PM UK Time |

Established in 2007, AXI, formerly known as AxiTrader, is a well-respected Forex broker, headquartered and registered in Sydney, Australia. Regulated by both ASIC and FCA, the company offers its clients a high standard of trading security. Axi provides traders with over 140 tradable assets ranging from forex, shares, indices, commodities, and IPOs. AXI supports both MetaTrader 4 and Copy Trading App, celebrated for their user-friendly interfaces and the comprehensive set of tools they provide. Besides, the broker maintains stellar customer support that is accessible 24 hours a day, Sunday 11 PM UK Time to Friday 11 PM UK Time. AXI regularly earns high user recognition, on account of its competitive spreads, seamless execution, and unique features like the Axi-One integration platform for seamless trading experiences.

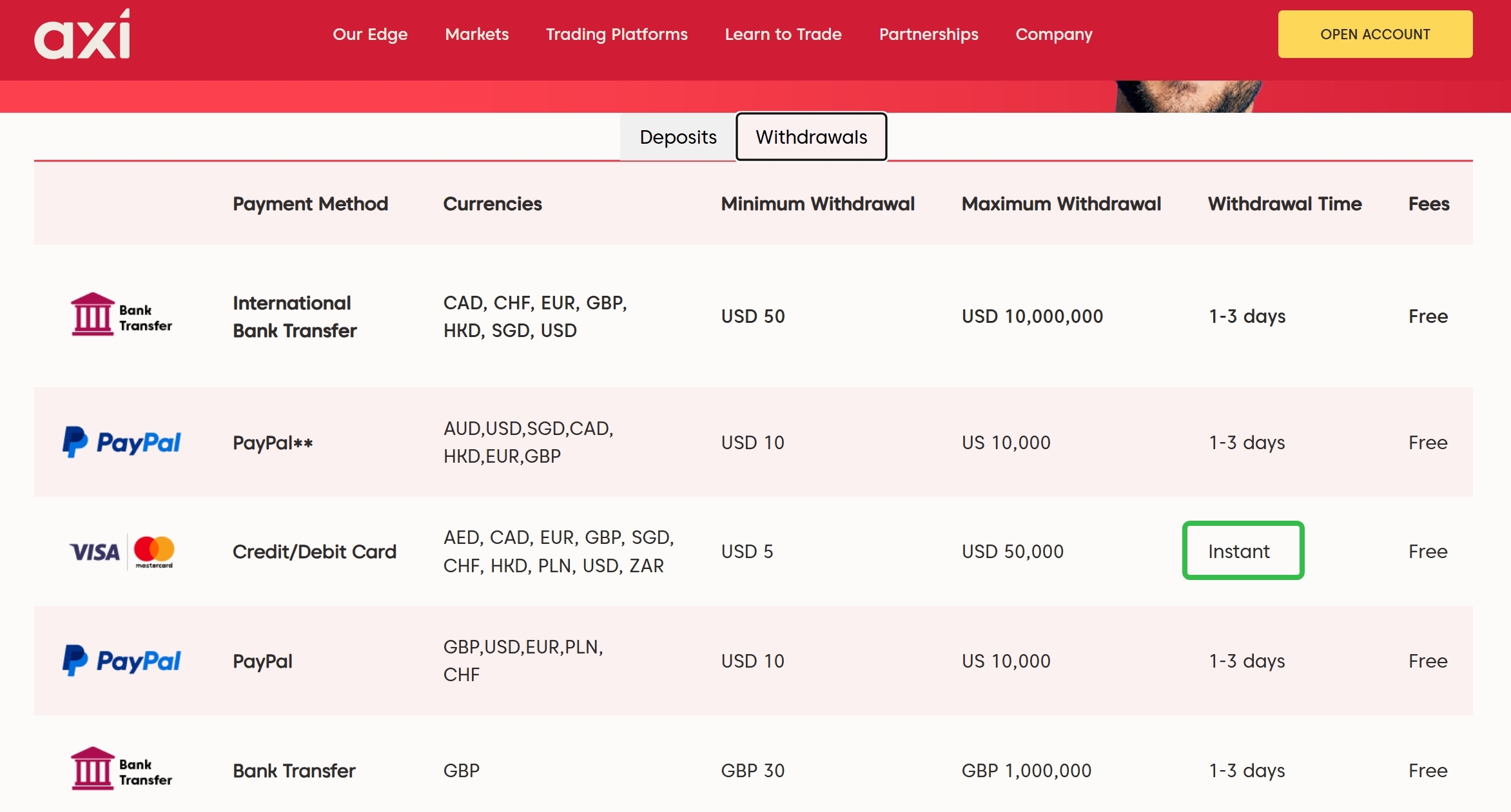

AXI accepts withdrawal via credit/debit cards (Visa/MasterCard), PayPal, and Bank Transfer. Withdrawal via credit/debit cards are instant, while others require 1-3 days to be processed. The good thing is that the broker does not incur any withdiawal fees. The minimum withdrawal amount varies between USD 5 and USD 50.

④ HFM

|

|

Broker |

HFM |

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex, commodities, metals, bonds, energies, ETFs, indices, cryptos, stocks |

Trading Platforms |

MT4, MT5, HFM App |

Trading Costs |

Cent Account: No commissions, spread from 1.2 pips |

| Zero Account: spread from 0 pips, but commission charged | |

| Pro Account: No commissions, spread from 0.6 pips | |

| Premium Account: No commissions, spread from 1.2 pips | |

Max. Leverage |

2000:1 |

Instant Withdrawal |

✅ |

Demo Account |

✅ |

Copy Trading |

✅ |

Payment Methods |

Bank wire transfer, credit/debit cards (MasterCard, Visa), crypto, fasapay, Neteller, PayRedeem, Skrill |

Customer Support |

7/24 |

Founded in 2010, HFM ( formerly Hot Forex) is an influential player in the online Forex brokerage space, registered in the United Kingdom, is globally regulated by CYSEC, FCA, DFSA and FAQ. HFM provides traders with extensive tradable instruments, including forex, commodities, metals, bonds, energies, ETFs, indices, cryptos, and stocks. The brokerage supports MetaTrader 4, MetaTrader 5, two widely acclaimed platforms known for its comprehensive technical analysis tools and easy navigation, as well as its proprietary HFM App. HFM provides round-the-clock, multi-lingual customer service and has won significant user recognition for its competitive spreads, transparent trading environment, and an array of unique features like social trading, which allows novice traders to replicate the strategies of successful traders.

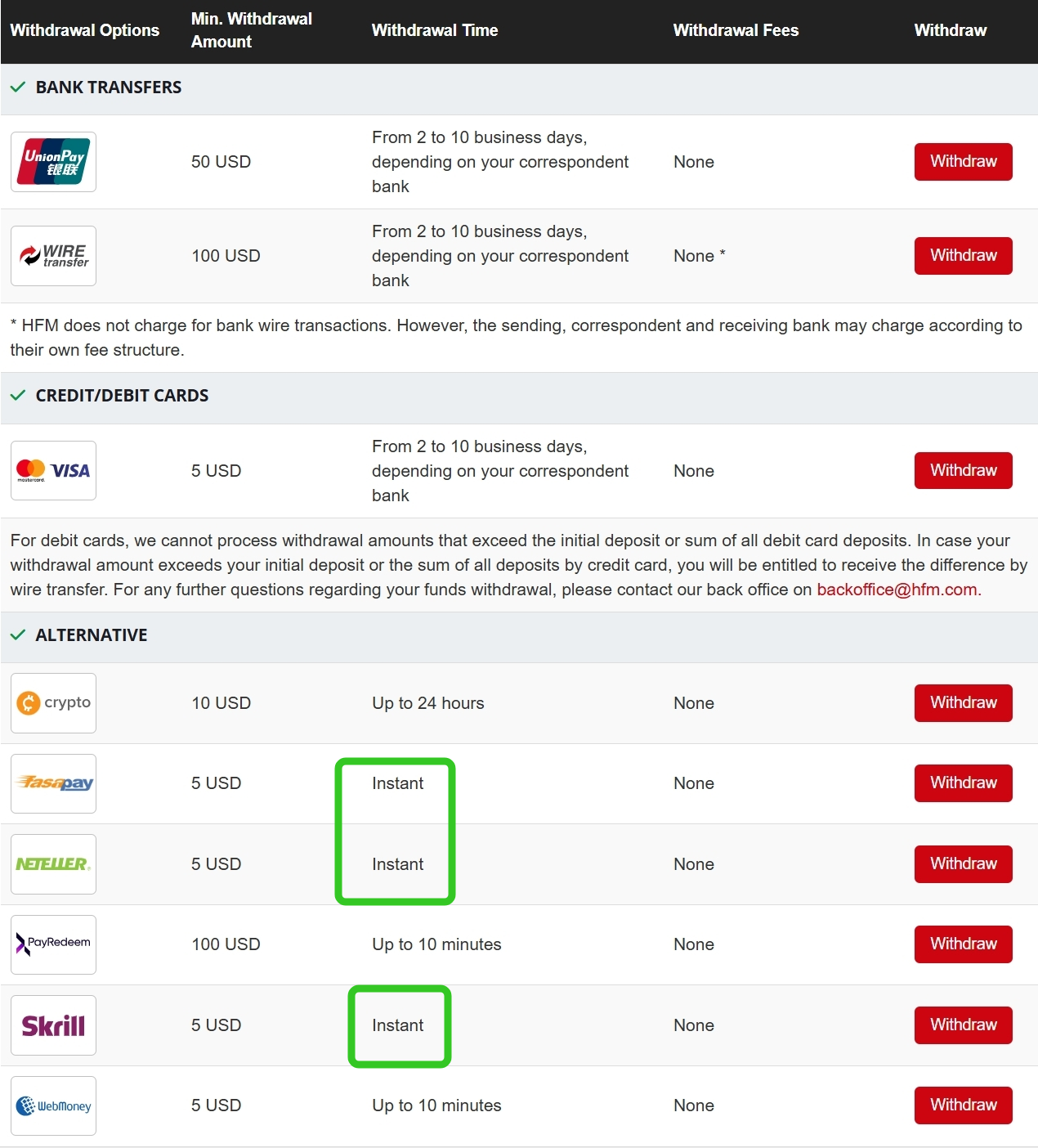

Regarding withdrawal, HFM stands out as a favored choice among traders. As outlined on their website, HFM offers instant withdrawal through some e-payment options including fasapay, Neteller, and Skrill. This is in addition to other payment options which include bank wire transfers and major credit/debit cards. They maintain a minimum withdrawal requirement of $100 for wire transfers while for e−wallets and debit/credit cards,the minimum limit is set at $5. The flexibility and speed in withdrawal options reflect HFM's efforts to ensure a smooth trading experience.

⑤ FBS

|

|

Broker |

|

Regulated by |

ASIC, CySEC, FSC (Offshore) |

Min. Deposit |

$5 |

Tradable Instruments |

Forex, forex exotic, metals, indices, energies, stocks |

Trading Platforms |

FBS app, MT5, MT4 |

Trading Costs |

Floating spread from 0.7 pips, commissions from 0% |

Max. Leverage |

1:3000 |

Instant Withdrawal |

✅ |

Demo Account |

✅ |

Copy Trading |

✅ |

Payment Methods |

Visa, MasterCard, etc. (vary on the region) |

Customer Support |

7/24 |

Established in 2009, FBS is an internationally recognized online Forex broker headquartered in Belize. Holding a license from the ASIC in Australia, the FSC in Belize and the CYSEC in Cyprus, the firm is renowned for its substantial compliance with international standards and regulations. At FBS, traders gain access to a broad range of tradable assets including forex, forex exotic, metals, indices, energies, and stocks. The broker proudly supports both MetaTrader 4 and MetaTrader 5, highly-regarded platforms known for their extensive trading tools and user-friendly design. FBS also stands out for its multi-lingual, 24/7 customer support, providing proficient assistance whenever needed. Among traders, FBS is highly recognized for its tight spreads, flexible leverage options, and array of unique features like copy trading and an interactive Forex training academy.

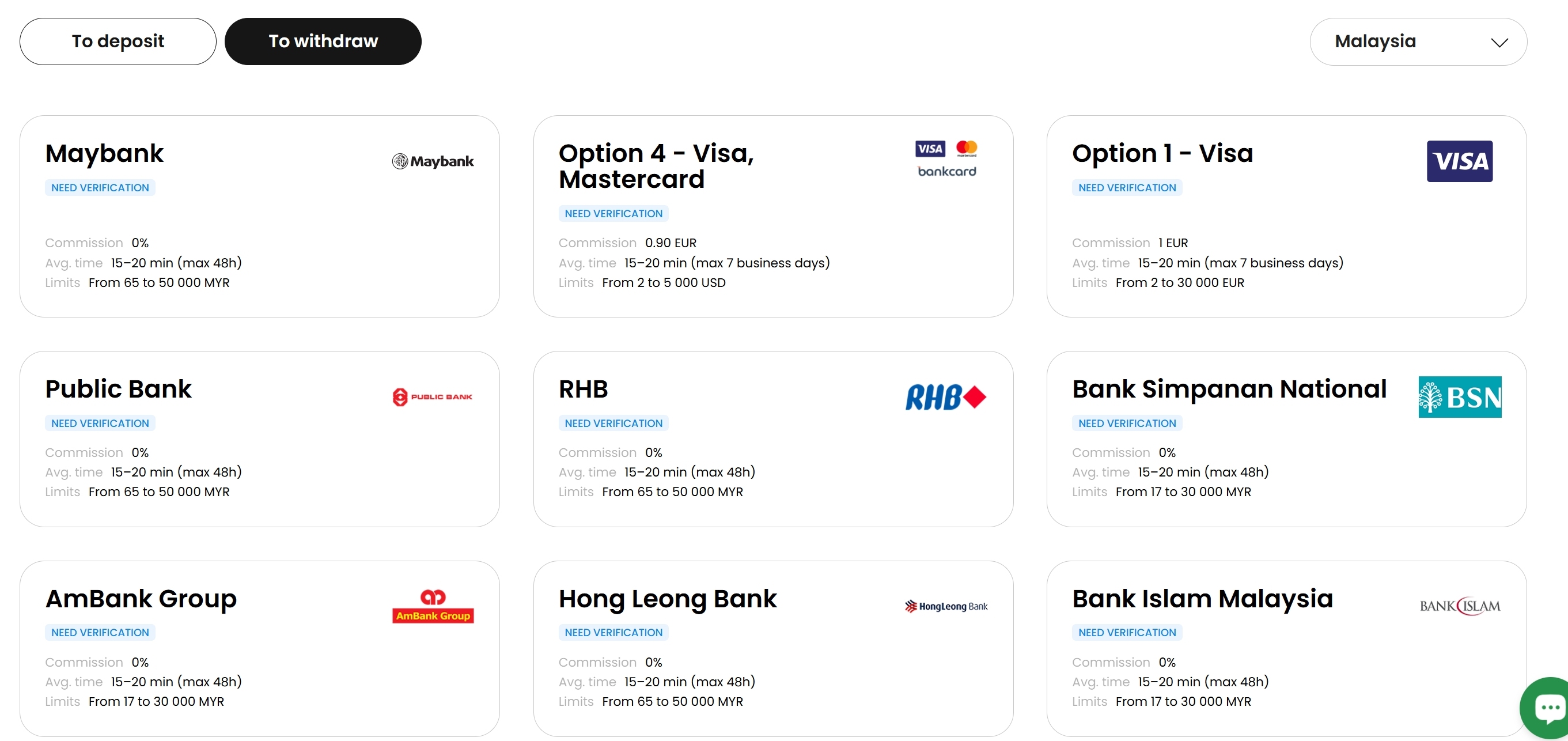

FBS remains a top choice among brokers for instant withdrawals, and offers multiple payment options. For example, in Malaysia, the broker accepts withdrawals via wire transfers and credit/debit cards including Maybank, Visa, MasterCard, Public Bank, RHB, Bank Simpanan National, AmBank Group, Hong Leong Bank, and Bank Islam Malaysia – all of which featuring instant withdrawals within 15-20 minutes. Notably, FBS tailors payment methods depending on regions and countries, which means that traders can choose the withdrawal method that best suits their location or preference.

⑥ XM

|

|

| Broker | XM |

| Regulated by | ASIC, CySEC, FSC, DFSA, FSCA |

| Min. Deposit | $5 |

| Tradable Instruments | Forex, precious metals, stock derivatives, commodities, equity indices, energies |

| Trading Platforms | MT4, MT5 |

| Trading Costs | Micro account: Spread on all majors is as low as 1.6 pips, no commissions charged |

| Standard account: Spread on all majors is as low as 1.6 pips, no commissions charged | |

XM Ultra Low account: Spread on all majors is as low as 0.8 pips, no commissions charged |

|

| Shares account: Spread is as per the underlying exchange, commission charged | |

| Max. Leverage | 1000:1 |

| Instant Withdrawal | ✅ |

| Demo Account | ✅ |

| Copy Trading | ✅ |

| Bonus | ✅ |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets |

| Customer Support | 5/24 |

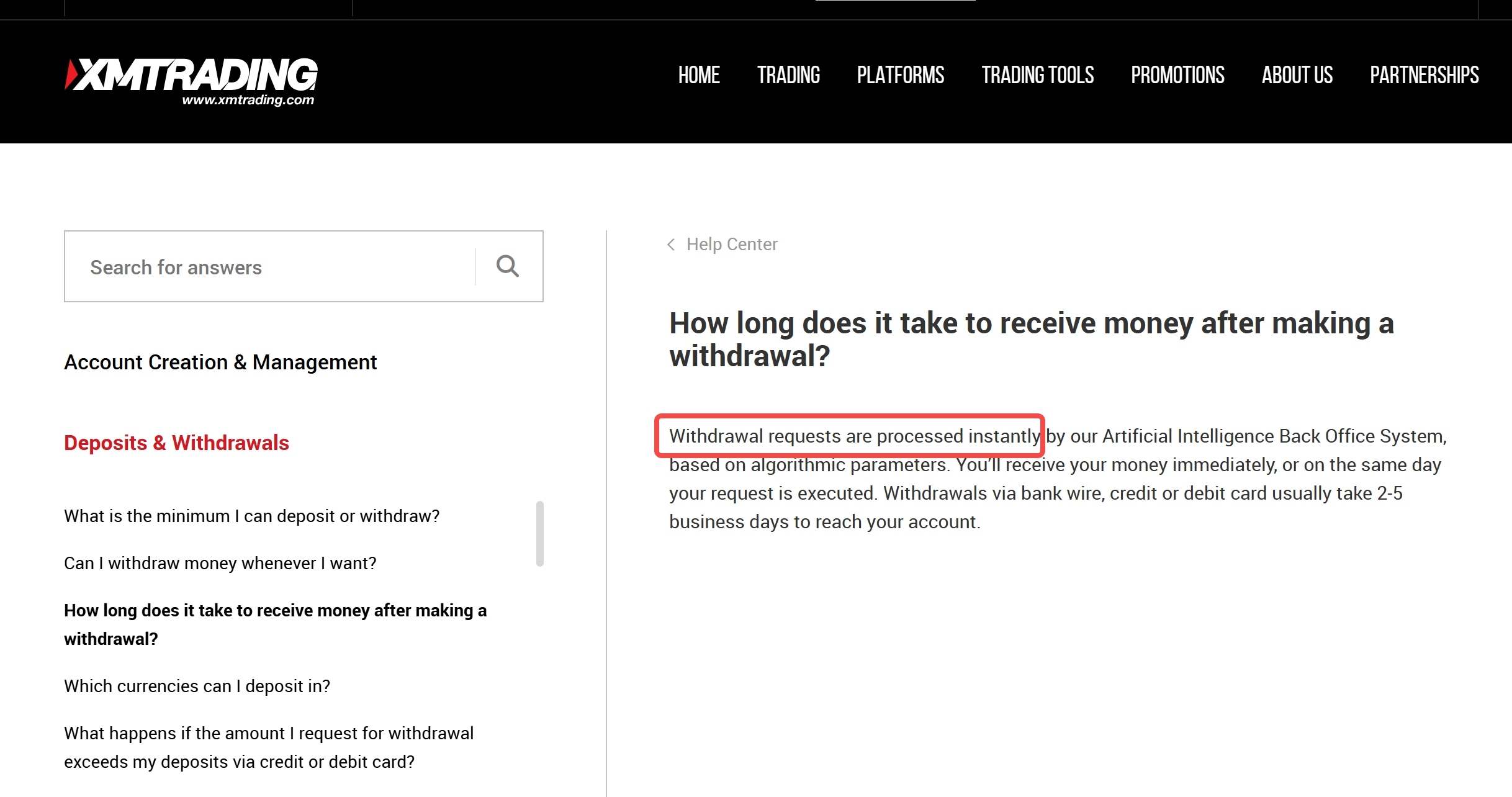

XM is a highly reputable online broker founded in 2009, offering a wide range of trading instruments across global markets. With over 5 million clients in more than 190 countries, XM is known for its robust regulatory framework, being regulated by top-tier authorities such as ASIC, CySEC, and FSC. The broker is particularly favored for its user-friendly trading platforms, low deposit requirements, and a strong focus on client education. XMs customer support and transparent trading conditions have made it a popular choice for traders of all levels.

XM offers a highly efficient withdrawal process. Withdrawal requests are processed instantly by XM's Artificial Intelligence Back Office System. For withdrawals via bank wire, credit, or debit card, funds typically reach your account within 2-5 business days. XM supports a wide range of payment methods, including credit/debit cards, bank transfers, and e-wallets. Additionally, XM does not charge any fees for deposits or withdrawals, further enhancing its appeal for traders.

⑦ Axiory

|

|

Broker |

|

Regulated by |

FSC (Offshore) |

Min. Deposit |

$10 |

Tradable Instruments |

Forex, gold and metals, oil and energies, CFD indices, CFD stocks, exhcange stocks, exchange ETFs |

Trading Platforms |

MT4, MT5, cTrader, MyAxiory App |

Trading Costs |

Nano account: Average spreads at 3 pips (eur/usd), commissions at 6 USD/lot, commissions of stock CFD: 0.04 USD per CFD (min 6 USD) |

Max. Leverage |

1:2000 |

Instant Withdrawal |

✅ |

| Demo Account | ✅($10,000 virtual fund) |

Copy Trading |

✅ |

Payment Methods |

Visa, JCB, UnionPay, Bank Transfer, Neteller, Skrill, ThunderX Pay |

Customer Support |

5/24 |

Axiory, founded in 2012, is a regulated Forex and CFD broker headquartered in Belize, operating under the offshore regulatory oversight of the International Financial Services Commission (FSC). Axiory provides access to various trading instruments including forex, gold and metals, oil and energies, CFD indices, CFD stocks, exhcange stocks, and exchange ETFs. The broker supports the highly acclaimed MetaTrader 4 and MetaTrader 5 platforms, the user-friendly, feature-rich cTrader platform, as well as MyAxiory App. Furthermore, Axiory is renowned for its dedicated customer service, which is available 24/5 and offers multi-lingual support. The broker enjoys significant user recognition attributed to its competitive pricing, transparent practices, and supplementary features like personalized trading tools and comprehensive educational resources.

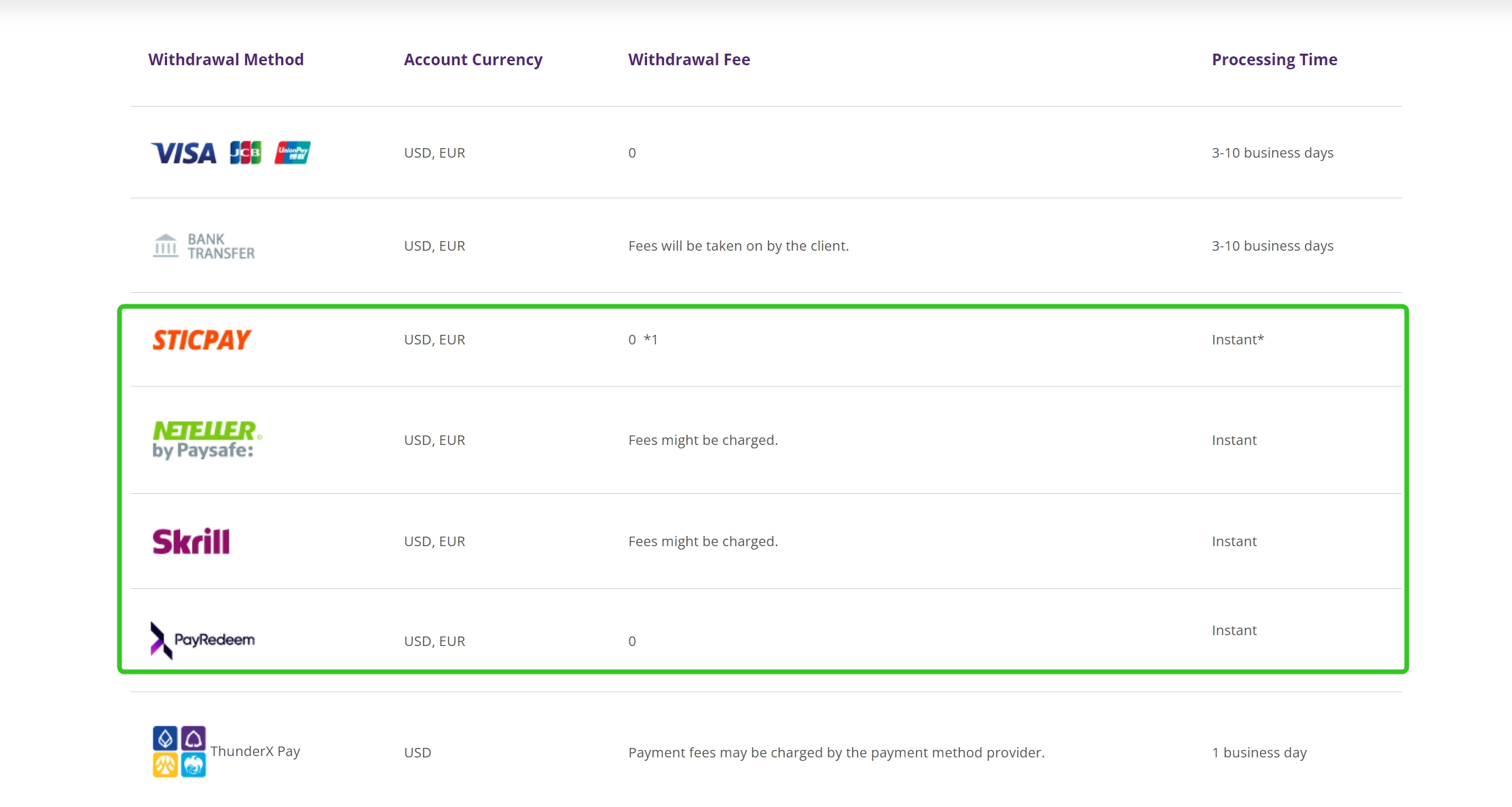

In terms of withdrawal processes, Axiory ensures instant withdrawals through various e-payment systems such as Neteller, Sticpay, Skrill and PayRedeem with currencies available in USD and EUR. Additional payment options supported by the broker include bank wire transfers and debit/credit card withdrawals. Notably, Axiory does not impose any minimum withdrawal amount, thus maintaining financial accessibility for traders. This robust offering of varied withdrawal methods, paired with a favorable withdrawal policy, rightfully places Axiory among the top choices for traders who prioritize swift and hassle-free withdrawals.

Forex Trading Knowledge Questions and Answers

What defines an "Instant Withdrawal" in a forex broker?

An “Instant Withdrawal” in a Forex broker refers to the quick process by which traders can withdraw their funds from their trading account, typically within 30 minutes. This means that the processing of the withdrawal request happens almost immediately, allowing traders to have prompt access to their funds. The actual receipt of the funds can vary depending on the withdrawal method used. E-wallet withdrawals tend to be instantaneous, while bank transfers or credit/debit card withdrawals may take a few business days due to banking processes.

What are the typical payment options for instant withdrawals?

The typical payment options for instant withdrawals in Forex trading predominantly include e-wallet systems, such as Skrill, Neteller, PayPal, and in some instances, Perfect Money, AstroPay. These payment providers are known for their swift processing times, often allowing traders to access their funds almost immediately after the broker has processed the withdrawal request. Some brokers might also offer instant withdrawals with credit or debit cards, though this can potentially involve longer processing times due to banking procedures.

Are Instant Withdrawals safe and secure?

It is hard to say. Instant withdrawals can be safe and secure, provided they are handled by a reliable and strictly regulated forex broker. These brokers operate under stringent regulatory standards set by financial authorities, ensuring the security of client funds and transactions. Encryption technologies are widely used to safeguard sensitive information during the withdrawal process. However, traders must do their part by keeping their login details confidential, using secure internet connections for transactions, and regularly monitoring their account activities.

Are there any fees associated with instant withdrawals?

Yes, there can be fees associated with instant withdrawals, but it largely depends on the various forex broker policies as well as the withdrawal method being employed. Some brokers might offer free withdrawals, some may charge a flat fee regardless of the withdrawal amount, and others may charge a percentage of the withdrawal amount. In the case of e-wallets, while most brokers may not charge a fee, the e-wallet providers themselves might. Before requesting a withdrawal, traders are better verify the fee structure directly from the broker's website or customer support to avoid unexpected charges.

Are instant withdrawals always truly instant?

While instant withdrawals by forex brokers can process extremely quickly, they may not be truly instant in all cases. For example, a trader requesting a withdrawal via PayPal or Skrill during trading hours might receive the funds within 30-60 minutes. However, a request made overnight or during weekends may only be processed the next business day when staff are available to review and approve the withdrawal.

There are also instances where extra verification steps or troubleshooting are needed which can delay instant withdrawals by a few hours to ensure a smooth transfer. For larger sums above beyond routine limits, the processing time may exceed standard instant timeframes as additional examinations and risk checks are needed.

What should I consider when choosing a broker for instant withdrawals?

Regulation: Ensure the broker is regulated by a trusted financial authority. This gives assurance that the broker follows secure and transparent financial practices.

Reputation: It can also be beneficial to check reviews and user experiences about the broker's withdrawal process to get a sense of reliability and customer satisfaction.

Speed of Processing: Confirm that the broker indeed offers instant or speedy withdrawals. “Instant” ideally means the processing time should be within 24 hours, but this can vary among brokers.

Withdrawal Methods: Check which withdrawal methods are available and which of them offer instant withdrawals. Often, e-wallets tend to be faster compared to traditional methods like bank transfers or credit/debit cards.

Fees: Review the brokers policy for withdrawal fees. Some brokers may charge a fee for instant withdrawals or for certain withdrawal methods.

Minimum Withdrawal Amount: Some brokers may have a minimum withdrawal requirement, which is important to know if you plan on withdrawing small amounts frequently.

Customer Support: An effective customer support team can be valuable in cases where you encounter issues or delays in the withdrawal process. Make sure the broker offers quality customer service.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers. We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!