Over the past few years, alongside mainstream cryptocurrency trading platforms, many forex brokers have also ventured into supporting cryptocurrency trading. If you're already using a forex trading platform, it might be more convenient to directly trade cryptocurrencies on your current platform. Nevertheless, forex brokers vary in their cryptocurrency trading services and associated fees. Hence, the question arises: which brokers are well-suited for cryptocurrency trading? In this article, the content will discuss essential considerations spanning broker background, preads, trading fees, payment methods, security measures, and customer service, to help you select a reputable broker skilled in both forex and cryptocurrency trading.

Best Crypto Forex Brokers Overall

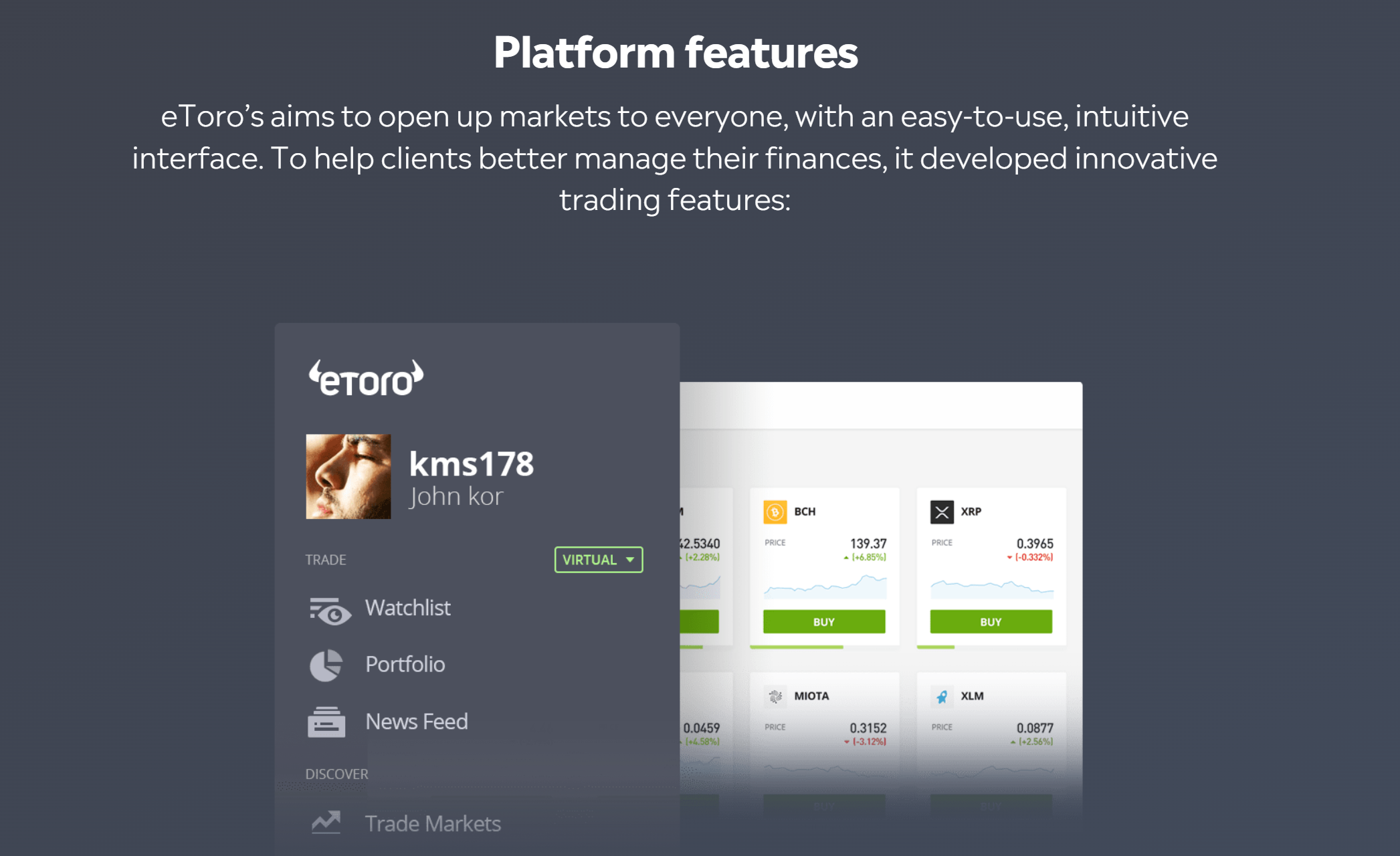

Intuitive social trading platform to copy positions of top traders.

Ability to invest in underlying assets directly or as CFDs across stocks, crypto.

Ultra-fast order execution speeds below 30 milliseconds to capitalize on volatile moves.

Access to deep liquidity from top tier liquidity providers ensuring tight spreads.

A trusted broker offering competitive trading fees, extensive markets, highly recognized by traders.

Advanced copy trading solutions to give clients great confidence.

more

Comparison of the Best Crypto Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Crypto Forex Brokers Overall

Brokers |

Logos | Why are they listed as the Best Crypto Forex Brokers? |

eToro |

|

✅Offers trading on 25+ top cryptocurrencies - most of any broker. ✅Provides social and copy trading features for crypto. ✅Regulated in major jurisdictions including the UK, Australia, and Cyprus. |

Eightcap |

|

✅Ultra-competitive spreads from just 0.5 pips with no commissions. ✅Providing access to over 100 crypto derivatives, competitive pricing. ✅Advances trading platforms including MetaTrader 4, MetaTrader 5, Tradingview. |

Avatrade |

|

✅Allows trading on 16 major cryptocurrencies with flexible leverage. ✅Provides automated and algorithmic trading options. ✅Fully regulated broker with over almost 20 years experience. |

BDSwiss |

|

✅Trades CFDs on 26 major cryptocurrencies, an excellent platform for crypto enthuatists. ✅User-friendly trading platform ideal for beginners, $10 to start real trading. ✅A trusted broker, regulated by CYSEC, and has operated for many years. |

Capital.com |

|

✅A heavily regulated broker, with a solid reputation and traders' love. ✅Offers trading on over 130 top cryptocurrencies, offering traders vast options. ✅Focusing on technology, this broker provides solid and advanced trading platforms. |

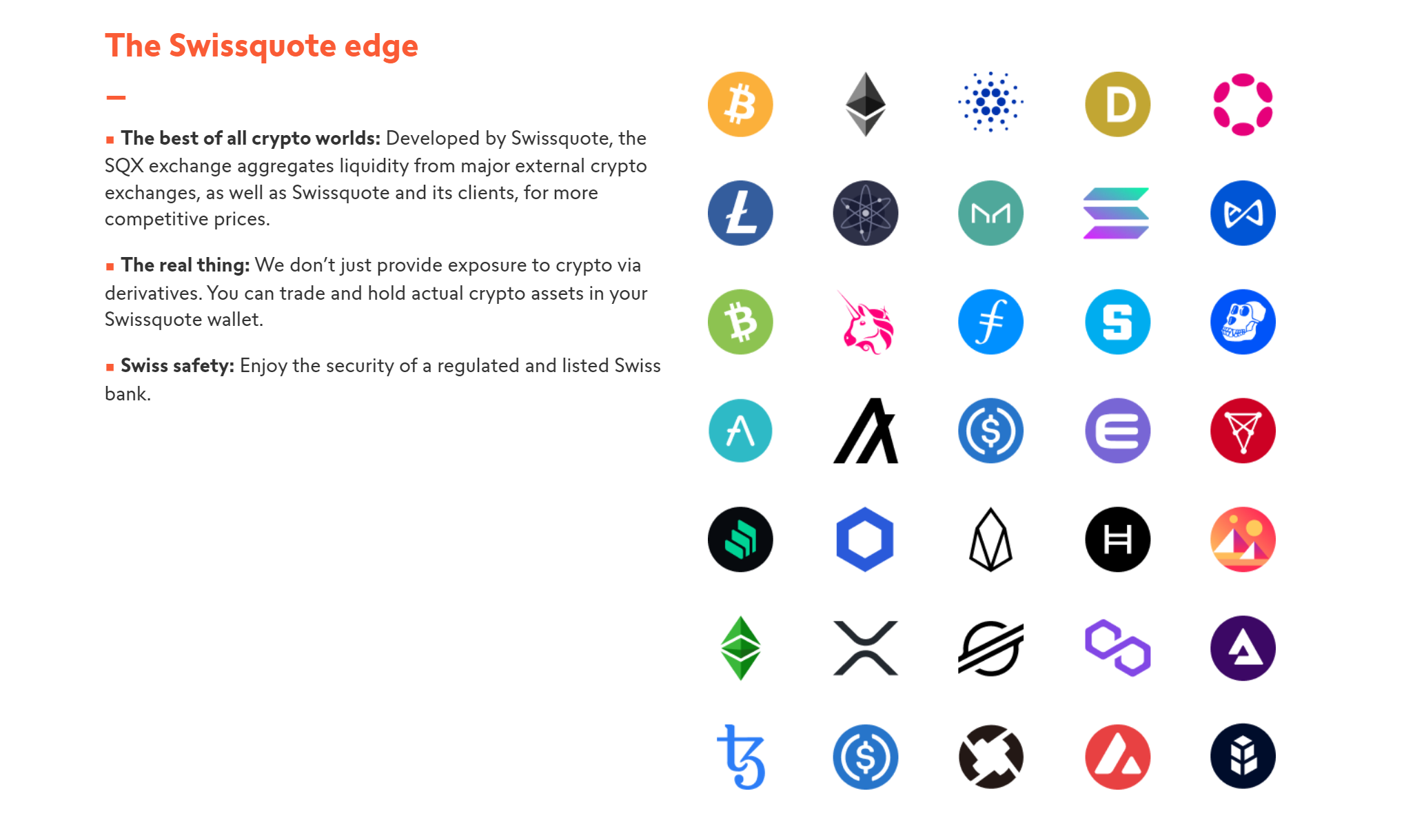

Swissquote |

|

✅Bank-owned broker with strong financial backing. ✅35 major cryptocurrencies available for trading. ✅Advanced trading tools and research available. |

Plus500 |

|

✅Allows trading 8 cryptocurrencies with low fees. ✅Intuitive mobile app ideal for trading on the go. ✅Authorized and regulated by regulators globally, giving traders great assurance. |

Overview of the Best Crypto Brokers

eToro-Best Crypto Brokers for Crypto and Social Trading

|

|

Broker |

|

Regulated by |

|

Min.Deposit |

$10 |

Tradable Instruments |

Cryptocurrencies, Stock Investing, ETF Investing, Options Trading |

Cryptocurrencies |

25 cryptos available |

Trading Platform |

eToro Online trading, Mobile App |

Trading Costs |

0% commissions on stocks, spreads apply |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Payment Methods |

Debit Card, Bank Card, PayPal, Wire Transfer, eToro Money |

Customer Support |

5/24 |

eToro is a global trading platform offering services in stocks, forex, and cryptocurrencies. Known for its user-friendly interface and innovative ‘social trading’ feature, it allows users to follow and copy the trades made by more experienced traders. Another distinctive feature of eToro is “CopyPortfolios” - these are investment funds where multiple assets or traders are bundled together into a single portfolio. CopyPortfolios aim to help investors minimise long-term risk by diversifying their investments. They can “Copy” a whole portfolio strategy instead of having to choose individual assets or traders.

eToro employs a unique blend of traditional trading with modern technolog, offering a wide choice of cryptocurrencies for trading, which is a major lure for potential investors. Besides, eToro charges a single, simple and transparent fee of 1% for buying or selling crypto, which is much lower than trading on other platfoms or exchanges.

✅Where eToro Shines:

• User-friendly interface makes it accessible for beginners.

• “Social trading” feature enables learning from and copying successful traders.

• Multiple asset classes are available for trading, including forex and cryptocurrencies.

• Regulated by several reputable entities (ASIC, CYSEC, FCA).

• Offers a demo account for practice.

❌Where eToro Shorts:

• Trading costs can be on the higher side compared with some other platforms.

• The educational resources, while helpful, might not be comprehensive enough for advanced traders.

• A fixed $5 fee for withdrawals and a $10 monthly inactivity fee after 12 months with no login activity.

EightCap-Best Crypto Brokers for Vast Crypto Derivatives Trading

|

|

Broker |

|

Regulated by |

|

Min.Deposit |

$100 |

Tradable Instruments |

Forex, Commodities, Indices, Shares, Crypto |

Cryptocurrencies |

100+ cryptos |

Trading Platform |

TradingView, MetaTrader 5, MetaTrader4, WebTrader |

Trading Costs |

Spreads varies depending on trading accounts |

Demo Accounts |

✅ |

Copy Trading |

❌ |

Payment Methods |

Credit/Debit Cards, Skrill, Neteller, Poli, as well as International/Local Bank Transfers |

Customer Support |

5/24 |

EightCap is a respected forex broker operating under four jurisdictions, including tier-1 regulations of FCA and ASIC. This broker offers over 800 traable instruments covering Forex, Commodities, Indices, Shares, Crypto and EightCap also allow access to robust trading platforms including TradingView, MetaTrader 5, MetaTrader4, WebTrader.

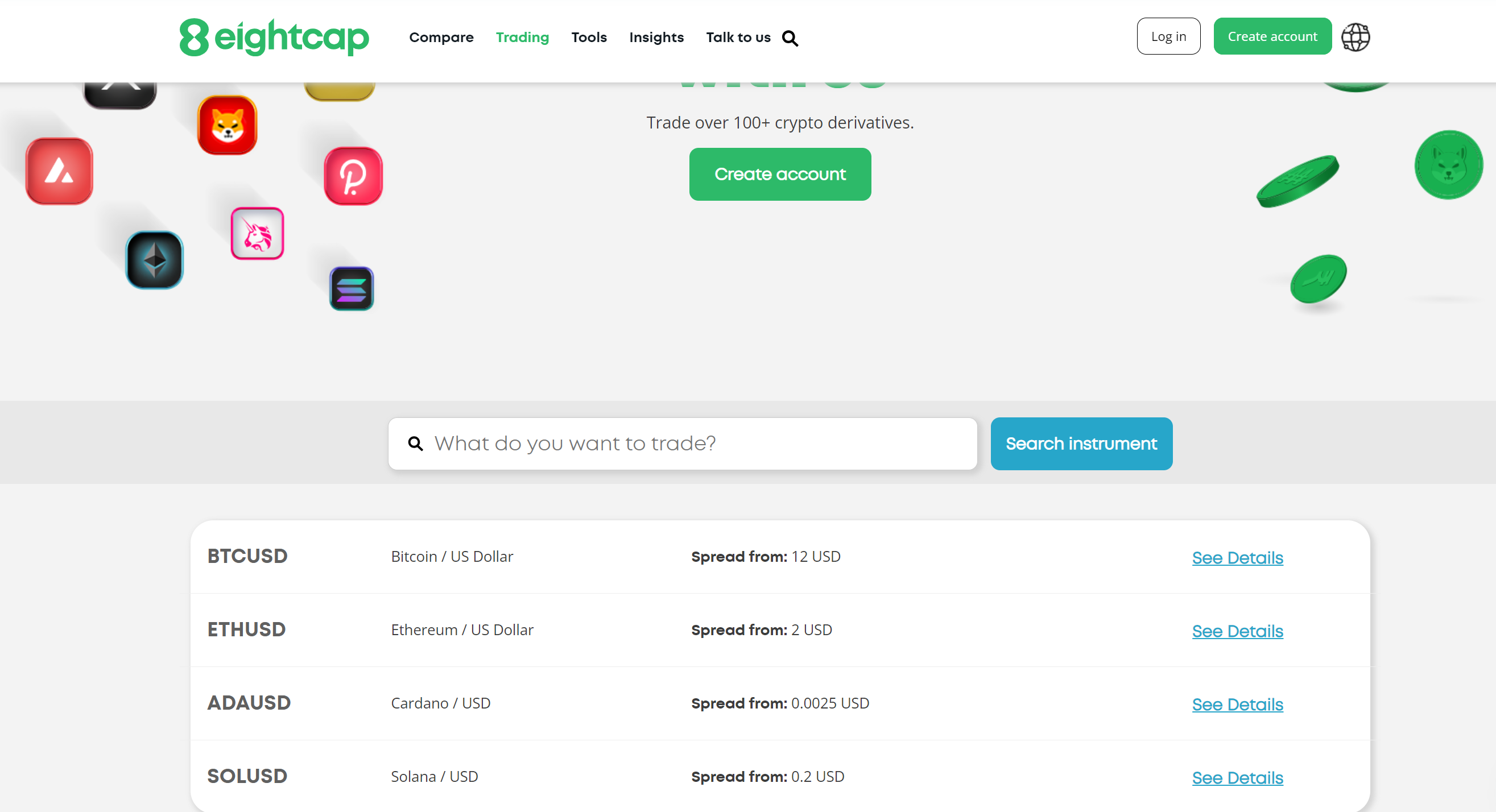

Over 100+ crypto derivatives are available through Eightcap's CFD (Contract for Difference) products. This means you can speculate on the price movements of these cryptos without actually owning the underlying asset. The list of individual cryptocurrencies offered by Eightcap includes major ones like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), as well as less popular ones like Tezos (XTZ) and Basic Attention Token (BAT).

✅Where EightCap Shines:

• Extensive markets to enter, including over 100 cryptocurrencies derivatives to trade.

• Regulated by two tier-1 regulators, FCA and CYSEC, offering clients great confidence.

• Competitive spreads on forex trading, with spreads on the eur/usd pair from 0.0 pips.

• Robust trading platforms, including MetaTrader 4, MetaTrader 5, TradingView.

• $100 to open a standard or raw account, making it easily accessible for both beginners and seasoned traders.

• Eightcap does not charge dormant accounts with inactivity fees.

❌Where EightCap Shorts:

• No 7/24 customer support to solve emergencies during weekends.

• Limited trading tools offered compared to other respected brokers.

AvaTrade - Best Crypto Brokers for Advanced Trading Platforms

|

|

Broker |

|

Regulated by |

|

Min.Deposit |

$100 |

Tradable Instruments |

Forex, Precious Metals, Energies, Agriculture, Cryptocurrencies, Stocks, Indices, Crypto CFD, FXOptions |

Cryptocurrencies |

15 cryptos available |

Trading Platform |

WebTrader, AvaOptions, MT4, MT5, AvaSocial, DupliTrade |

Trading Costs |

Spreads on the eur/usd pair starting from 0.9 pips |

Demo Accounts |

✅ |

| Copy Trading | ✅ |

Payment Methods |

Credit Cards, Debit Cards, Wire Transfers, and various e-payment solutions. |

Customer Support |

5/24 |

Avatrade is a well-established online broker registered in 2006, offering tradable instruments spanning indices, commodities, stocks, forex pairs, options though MeTaTrader trading platforms, as well as its properietary trading platforms. Notably, Avatrade is known for its offering of social trading solutions supported by AvaSocial and DupliTrade. Trading fees on the Avatrade platform rank in the middle of the competition, with spreads on the eur/usd pair commencing from 0.9 pips.

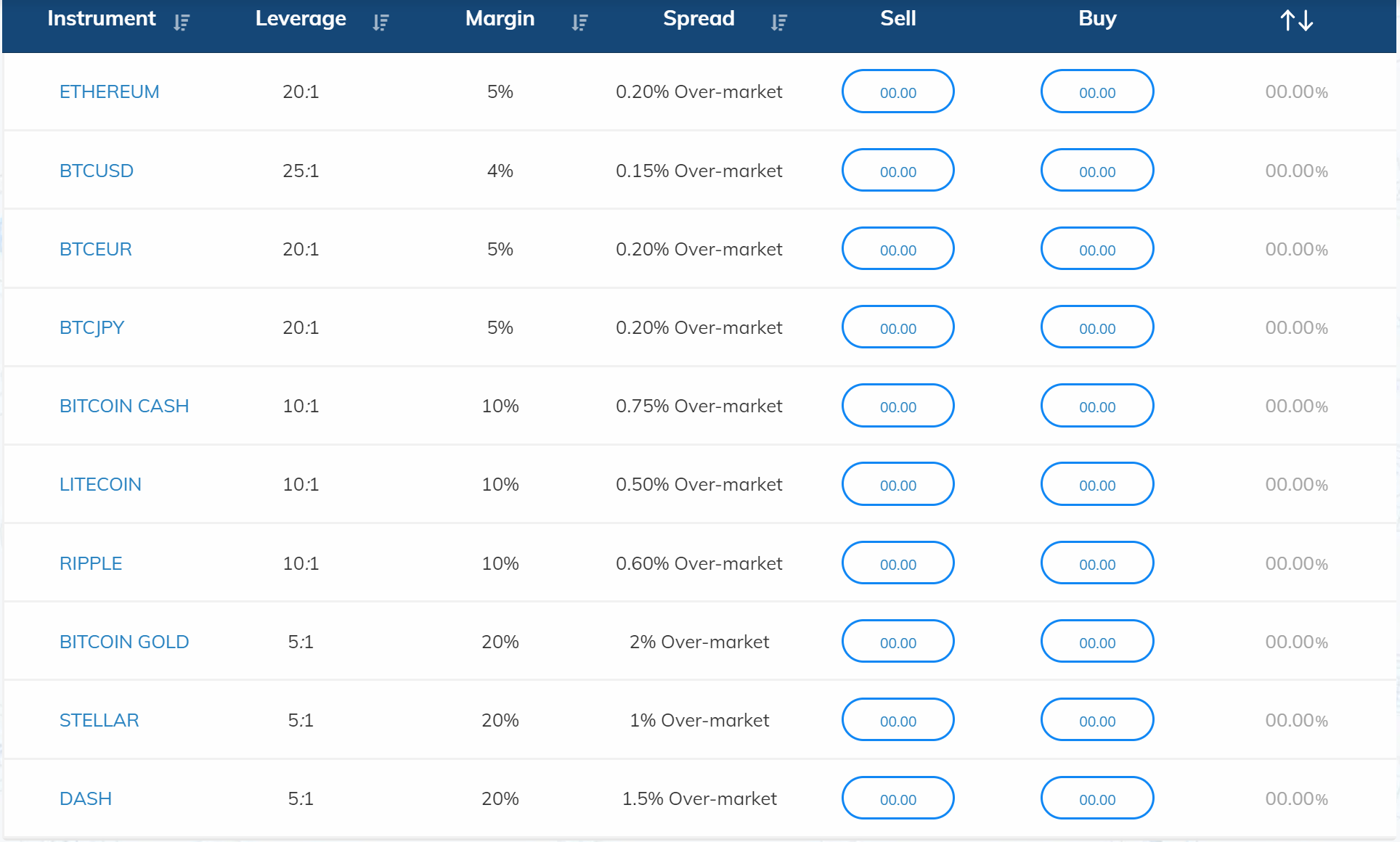

Regard crypto trading, flexible trading leverage ratios are applied on cryptos, varying from 25:1 to 5:1. Avatrade does not charge commissions on any trade, only spreads calculated. Most of its cryptos, like BTCUSD, BTCEUR, BTCJPY, BCHUSD, ETHERUM, XPR (Ripple), Litecoin, BTGUSD, DASH, Stellar (XLMUSD), and more, are 24/7 for MeTaTrader accounts.

✅Where Avatrade Shines:

• Heavily regulated, a well-established forex broker with a good reputation.

• Avatrade does not charge direct commissions, and they make money mainly through spreads.

• Robust trading platforms, MT4, MT5, including its copy trading solutions supported by AvaSocial and Duplitrade.

• An excellent platform for its crypto trading, spreads-only crypto trading fees and flexible leverage offered.

❌Where Avatrade Shorts:

• Avatrade's trading fees, mainly spreads, not that competitive, in the middle of the industry.

• An inactivity fee of $15, after 3 consecutive months of non-use of trading accounts.

BDSwiss -Best Crypto Brokers for Quick Order Execution

|

|

Broker |

|

Regulated by |

|

Min.Deposit |

$10 |

Tradable Instruments |

Forex, Commodities, Shares, Indices, Cryptocurrencies |

Cryptocurrencies |

26 cryptocurrencies available |

Trading Platform |

MetaTrader4,MetaTrader5, BDSwiss Mobile App, and BDSwiss Webtrader |

Trading Costs |

Spreads from 0.0 pips |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Payment Methods |

VISA, MasterCard, Skrill, Neteller, Bank Wire, Cryptos, Online Banking, AstroPay, GblobePay, Direct Bank Transfer, and more |

Customer Support |

5/24 |

Founded in 2012, BDSwiss is a reliable and user-friendly broker catering to both beginner and experienced traders, providing access to over 250 CFDs on forex, stocks, indices, commodities, and CFDs on cryptocurrencies. Multiple trading platforms offered include MetaTrader4,MetaTrader5, BDSwiss Mobile App, and BDSwiss Webtrader. Competitive spreads and commission-free options for certain accounts make BDSwiss cost-conscious. Their multilingual customer support team stands ready to assist you 24/5.

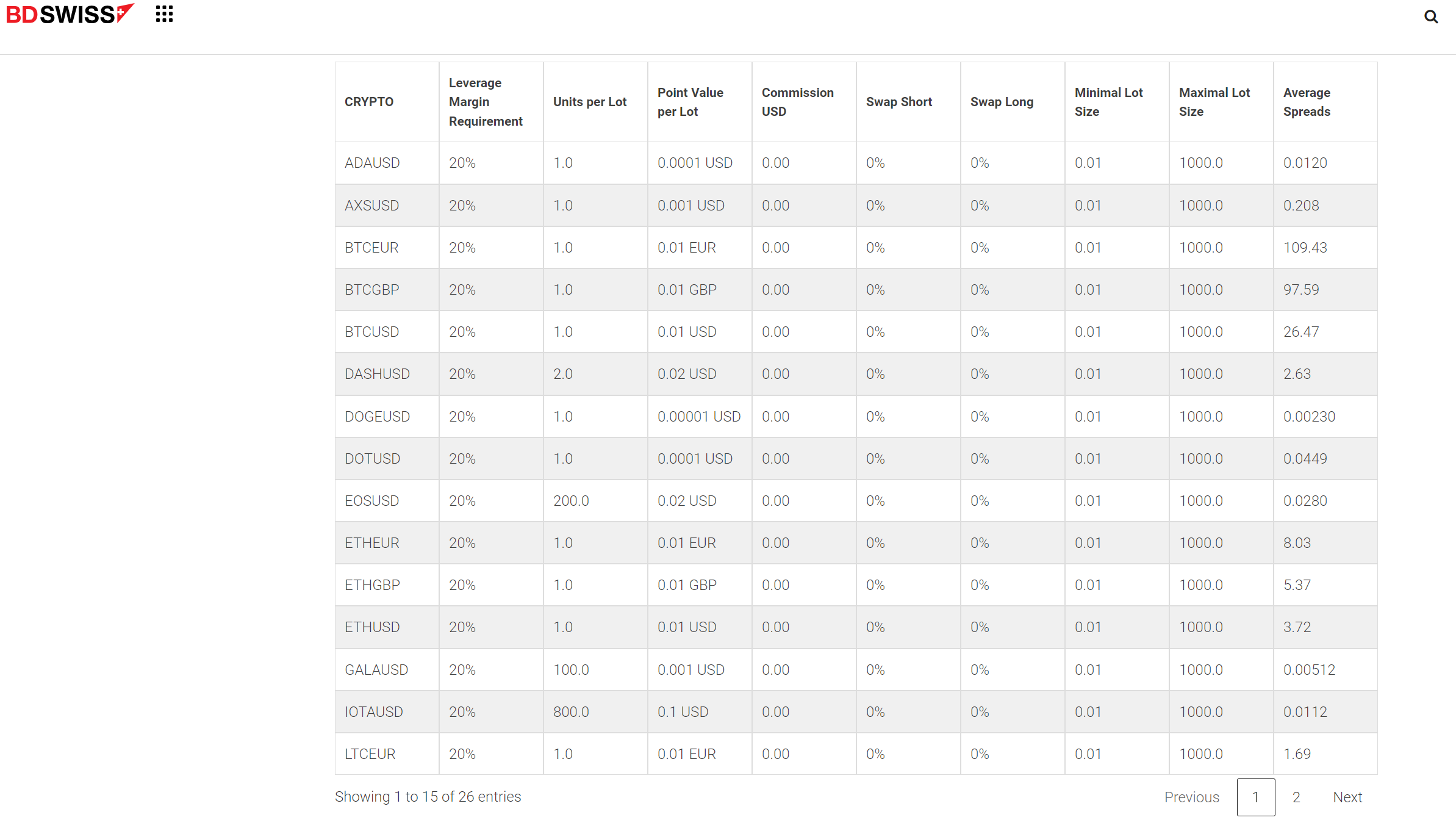

While crypto may not be their primary focus, BDSwiss provides access to CFDs on over 26 cryptocurrencies. Spreads for cryptos trading are clearly displayed below, with BTCUSD at 26.47 pips, DOGEUSD at 0.00230 pips. If you're looking at a range of 0.0023 for DOGEUSD to 109.43 for BTCEUR, with most hovering around the 3-8 mark. So, depending on the crypto and amount traded, these spreads can impact your profits or losses by a small to moderate percent.

✅Where BDSwiss Shines:

• Vast popular tradable instrument choices, including 50 currency pairs, and 26 cryptocurrencies.

• $10 to start real trading, making it easily accessible for both beginners and those who want to start small.

• Robust trading platforms including MetaTrader4,MetaTrader5, BDSwiss Mobile App, and BDSwiss Webtrader, flexible choices.

• Multiple and convenient payment options, offering great convenience.

• Quality educational content, including Learning Center, Live Education, Educational Videos, Seminars, and more.

❌Where BDSwiss Shorts:

• 7/24 customer support, trading problems during weekends cannot be addressed in a timely manner.

• No negative balance protection offered.

• Potentially higher fees for smaller accounts.

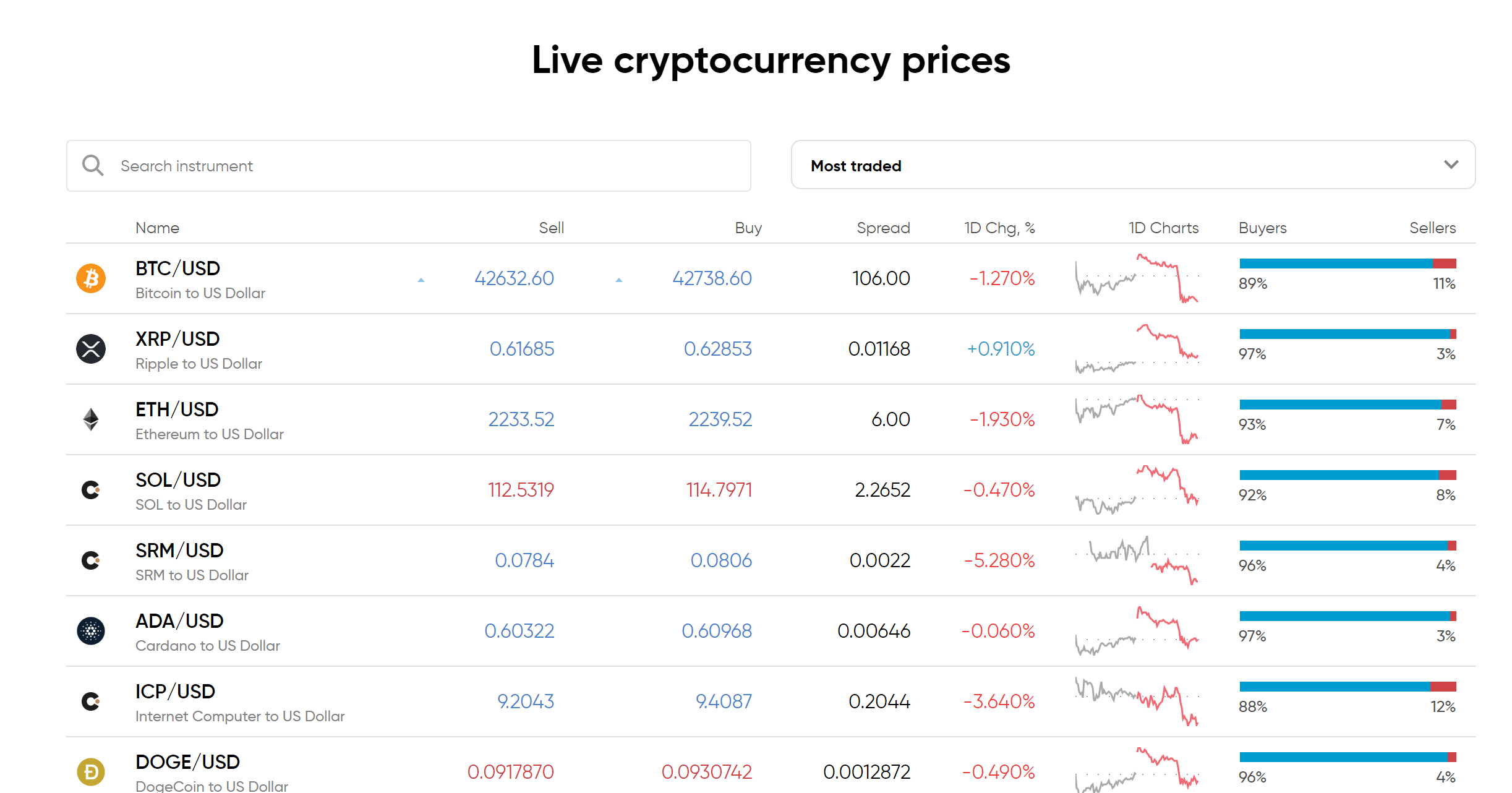

Capital.com -Best Crypto Brokers for Stromg Regulation and 130 Cryptocurrencies CFDs

|

|

Broker |

|

Regulated by |

|

Min.Deposit |

$20 |

Tradable Instruments |

Shares, Indices, Forex Commodities, Cryptocurrencies, ESG |

Cryptocurrencies |

130 cryptocurrencies via CFDs |

Trading Platform |

Mkobile Apps, Desktop Trading, Capital.com API, Tradingview, MetaTrader 4 |

Trading Costs |

Low spreads |

Demo Accounts |

✅ |

Copy Trading |

❌ |

Payment Methods |

Bank transfer, Credit/debit cards, Apple Pay, PayPal, Neteller, Skrill, Sofort, Trustly, and more |

Customer Support |

5/24 |

Registered in Cyprus, Capital.com emerged in 2016 as a user-friendly CFD trading platform, fostering a community of over 570,000 tra ders worldwide. Dive into a vibrant marketplace with 91,000+ active clients monthly, generating over $56 million in monthly investing volume and facilitating over $35 million in withdrawals each month.

Capital.com also offers access to over 130 cryptocurrencies for CFD trading, from earlier giants like Bitcoin and Ethereum to promising up-and-comers. Capital.com offers competitive fees, including commission-free trading on certain accounts, making it a cost-effective entry point for crypto enthusiasts.

✅Where Capital.com Shines:

• Requiring no minimum deposit, easily accessible for beginners or who start small.

• A respected broker, heavily and globally regulated, including ASIC, and FCA.

• Quality and solid educational contents, including market guides, learning hub and trading strategies guide.

• Robust trading platforms, including MT4, Tradingview, mobile app, giving clients more flexibility.

• A high rating of 4.3 out of 5 based on nearly 10,000 reviews.

❌Where Capital.com Shorts:

• A monthly fee of 10 USD for being an inactive client for more than 1 year.

• Minimum withdrawal limitations, starting from $50.

Swissquote - Best Crypto Brokers for Banking Backgroud

|

|

Broker |

|

Regulated by |

|

Min.Deposit |

$1000 |

Tradable Instruments |

Stocks, Currency Pairs, Precious Metals, Stock Indices, Commodities, Bonds |

Cryptocurrencies |

35 cryptocurrencies available |

Trading Platform |

MT4, MT5, Advancedtrader |

Trading Costs |

No FX commissions |

Demo Accounts |

✅ |

Copy Trading |

✅ |

Payment Methods |

Wire Transfer, VISA, MasterCard |

Customer Support |

5/24 |

Born in 1996 in the heart of Switzerland, Swissquote has become a haven for over 300,000 active traders looking for a secure and diverse trading experience. Swissquote provides access to a bulk of markets, including Stocks, Currency Pairs, Precious Metals, Stock Indices, Commodities, Bonds. Notably, Swissquote provides access to multiple trading platforms choicesm including MT4, MT5, Advancedtrader. As for customer support, they can be reached through 5/24 multilingual.

While not the largest crypto haven, Swissquote offers a solid selection of 35 cryptocurrencies for CFD trading. When it comes to fees, Swissquote keeps them competitive in the industry. Traders can benefit from commission-free trading on certain accounts.

✅Where Swissquote Shines:

• Over 400 tradable instruments available, including 35 cryptocurrencies.

• Double MetaTrader platforms offered, high preformance and user-friendly.

• Advanced trading tools, including Autocharitists and Trading Central.

• Specialized and favorable trading conditions designed for professional clients.

❌Where Swissquote Shorts:

• High minimum deposit of $1000, not friendly to beginners.

• Limited payment methods, leading to great inconvenience to withdrawals.

• No 7/24 customer support, traders may find helpless during weekends.

Plus500 - Best Crypto Broker for Heavy Regulation and Competitive Trading Fees

|

|

| Broker | Plus500 |

| Regulated by | ASIC, FSA, CYSEC, FCA, FMA, MAS |

| Min.Deposit | $100 |

| Tradable Instruments | Crypto, Indices, Forex, Commodities, Shares, Options, ETFs |

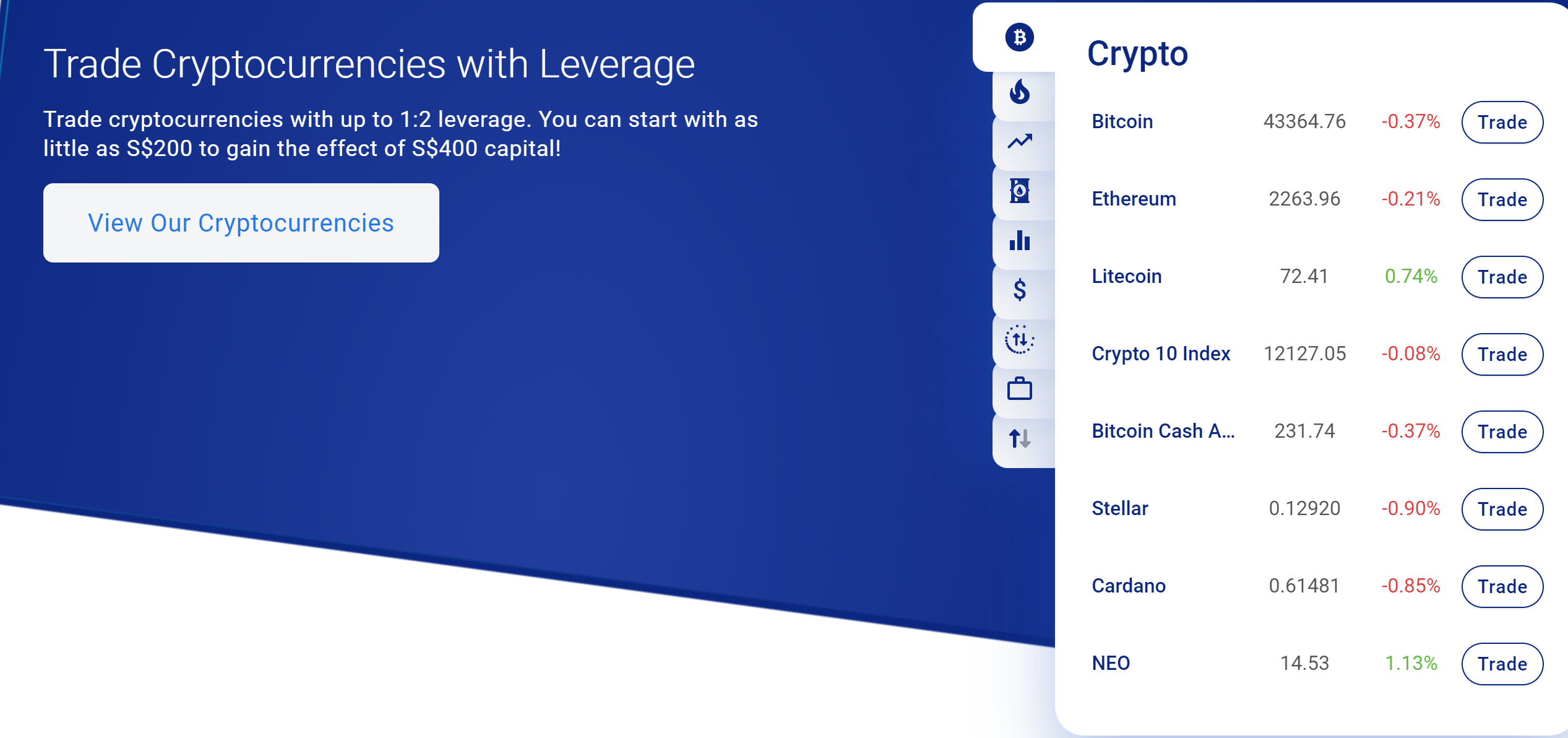

| Cryptocurrencies | 8 mainstream cryptos to trade |

| Trading Platform | Plus500 trading platform |

| Trading Costs | Currency pairs from 0.6 pips, commissions free |

| Demo Accounts | ❌ |

| Copy Trading | ✅ |

| Payment Methods | VISA, MasterCard, PayPal, PayNow, Apple Pay, and more |

| Customer Support | 7/24 |

Born in 2008, Plus500 has established itself as a prominent CFD (Contract for Difference) trading platform catering to over 25 million clients globally. Its user-friendly interface and diverse instrument selection have captured the interest of beginners and experienced traders alike. Navigate CFDs across multiple markets, including forex, stocks, indices, commodities, and options. The platform shines with its intuitive design and powerful tools. Execute trades, monitor prices, and analyze trends with ease. Mobile trading lets you stay connected to the markets on the go, ensuring you never miss an opportunity.

Another strongest suit is that Plus500 offers CFD trading on 8 major cryptocurrencies like Bitcoin and Ethereum. Fees on this platform are generally competitive, with transparent structures and no hidden charges. Leverage applied to crypto trading is up to 1:2, which means that you can start with $200 to gain the effect of $400 capital.

✅Where Plus500 Shines:

• A trusted broker, heavily and globally regulated, including two tier-1 regulations, FCA and ASIC.

• Known for its intuitive and user-friendly interface, making it a great choice for beginner and experienced traders alike.

• Access to over 2800 tradable instruments, covering Indices, Forex, Commodities, Crypto, Shares, Options, ETFs.

• Solid educational content, such as trading academy, allowing clients to learn more for free.

• 7/24 customer service, considerate and responsive, addressing clients' trading problems in a timely manner.

❌Where Plus500 Shorts:

• Trading fees are not necessarily lowest in the industry compared with other competitors.

• Primarily focusing on CFD products.

Forex Trading Knowledge Questions and Answers

Is Trading Cryptocurrency Legal?

Trading cryptocurrency is legal and widely popular in many countries, like the United States, the European Union, the United Kingdom. In Japan, cryptocurrency is a legal form of payment. Crypto exchanges must register with the Financial Services Agency and comply with strict standards. In China, cryptocurrency trading is illegal for banks and financial institutions, but over-the-counter (OTC) peer-to-peer trading remains legal for individuals. However, China is cracking down on crypto activities. In India, the regulatory stance on crypto has been uncertain, but the Supreme Court has overturned a previous ban, effectively legalizing crypto trading. Regulation is still being developed.

Which Brokers Offer the most Cryptocurrencies Tradable?

eToro provides access to the largest variety of tradable cryptos, offering trading on 25 major cryptocurrencies including Bitcoin, Ethereum, Litecoin, XRP, ADA, SOL, DOT, DOGE, SHIB plus more. They cover all the biggest coins by market cap as well as small-cap assets and tokens. For traders looking for exposure to the most diverse range of cryptocurrencies, eToro provides the most options. Notably, eToro allows clients to copy the trades of experienced cryptocurrency traders on the platform, and the minimum amount to copy a trader is just $200.

What Fees Do You Pay Attention to When Choosing a Crypto Broker?

Typically, brokers charge a spread, commission, swap fee, and inactivity fee.

We consider a spread of less than 2 pip for USD/JPY to be low. In the cryptocurrency market, we consider a spread of less than $50 for Bitcoin and less than $4 for Ethereum to be low.

A commission is a fixed cost to enter a trade. Typically, accounts that charge a commission offer tighter spreads. For currency pairs and gold, a commission of less than $2 per trade is considered low.

Swap fee is charged when you hold a leveraged position overnight. Traders who plan to use a swing trading strategy (involving holding positions for several days or even weeks) should pay particular attention to these fees.

An inactivity fee is a charge imposed by a broker when your account is dormant. In this case, a certain amount of money is charged per month. An inactivity fee of less than $10 is considered low.

Eightcap appears to have the lowest overall fees amongst the major crypto brokers compared here. They offer both zero commissions as well as ultra tight spreads starting from just 0.5 pips.

eToro and Capital.com also have competitive fees with no commissions and tight crypto spreads. Interactive Brokers has low commissions but makes up for it through tighter spreads. AvaTrade, Plus500, and Swissquote tend to have higher comparative fees.

| Broker | Commissions | Typical Crypto Spreads | Overall Fees |

| eToro | None | 0.75% BTC/ETH | Low |

| AvaTrade | None | 1% - 1.5% | Moderate |

| Eightcap | None | From 0.5 pips | Very Low |

| Plus500 | None | 1% | Reasonable |

| Interactive Brokers | 0.12% - 0.18% per side | Tight spreads | Low |

| Capital.com | None | From 0.9 pips | Low |

| Swissquote | 0.5% - 1% per trade | 1% | Higher |

What’s the Difference between a Crypto Exchange and a Crypto Broker?

Cryptocurrency exchanges and brokers serve different functions in the trading of digital assets. While both provide platforms to trade cryptocurrencies, they operate in distinct ways.

Trading Mechanism Differs

Cryptocurrency exchanges are marketplaces where users can buy and sell actual cryptocurrencies, like Bitcoin, Ethereum, etc. Exchanges match orders between buyers and sellers directly through an order book. For example, you can place a limit order on Coinbase to buy 1 BTC at $19,000. Crypto brokers take the other side of a user's trade. Brokers do not execute trades directly on the blockchain. Rather, they provide derivatives like CFDs that derive value based on underlying crypto prices. For instance, eToro allows you to buy a CFD representing the price of Ethereum without buying the actual coin.

Traded Assets Differ

On exchanges, users trade cryptocurrencies against other cryptocurrencies (trading pairs) or fiat currencies like USD or EUR. Exchanges allow withdrawals of actual digital coins. You can trade BTC/ETH on Binance and withdraw BTC to your wallet. Brokers only offer derivatives contracts related to cryptocurrency prices. You are trading a financial instrument, not the actual crypto. Brokers do not facilitate deposits/withdrawals of digital assets. Platforms like FOREX.com let you trade a BTC/USD derivative.

Trading Interface Differ

Exchanges utilize an order book system with different bid and ask prices. Users place market, limit, or other types of orders directly on the exchange's matching engine. You can see the order book and place limit orders on Kraken. Brokers offer trading via a platform where users only see the broker's quoted price rather than a full market depth chart. Brokers fill orders internally as the counterparty. Platforms like AvaTrade provide an easy buy/sell interface with the broker's prices.

Ownership & Control Differs

With exchanges, you take full ownership of the cryptocurrency bought. You have control of managing the coins in your own wallet. If you buy BTC on Coinbase, you can withdraw it to a private BTC wallet. Brokers retain custody and ownership of derivatives contracts. You must close positions to realize profits/losses according to the broker's policies. If you trade BTC CFDs on Plus500, you cannot withdraw any actual BTC.

Fees & Leverage Differs

Exchanges tend to have lower trading fees, often under 0.5%. Some offer margin and leverage options. Binance has a 0.1% spot trading fee and up to 5x leverage. Brokers have higher fees but frequently support leveraged trading exceeding 100x. Brokers can liquidate positions if margin requirements are not met. Brokers like IQ Option offer leverage over 500x but have higher trading fees.

Trading Cryptocurrency CFDs vs. Buying Cryptocurrency Directly

Trading cryptocurrency CFDs and buying cryptocurrency directly are two distinct investment approaches, each with its own set of advantages and disadvantages. Let's break down the key differences:

Trading Cryptocurrency CFDs

A CFD (Contract for Difference) is a derivative that allows traders to speculate on the price movements of an underlying asset, in this case, a cryptocurrency, without actually owning the asset. You simply predict whether the cryptocurrency's price will rise or fall and place a buy or sell order on a trading platform. CFD trading often offers high leverage, meaning you can control a larger position with a smaller amount of capital. CFDs allow traders to go short, meaning you can profit from a decline in the cryptocurrency's price. In addition to trading commissions, you may incur overnight financing charges.

Buying Cryptocurrency Directly

Buying cryptocurrency directly involves purchasing and holding the actual cryptocurrency. You create a cryptocurrency wallet and purchase the desired cryptocurrency through a cryptocurrency exchange. You own the cryptocurrency you purchase and can store it in your own wallet. Primarily consists of trading fees and network fees. You need to securely store your private keys to protect your assets.

Comparison Table

| Feature | Trading Cryptocurrency CFDs | Buying Cryptocurrency Directly |

| Asset Ownership | Do not own | Own |

| Leverage | High | Generally lower |

| Short Selling | Possible | Generally not possible |

| Costs | Trading commissions, overnight financing charges | Trading fees, network fees |

| Risk | High, leverage amplifies risk | Relatively lower, but prices can be volatile |

| Suitable for | Traders seeking high returns and willing to take on high risk | Long-term holders who value asset ownership |

Trading cryptocurrency CFDs is more suitable for short-term traders seeking high returns but willing to take on higher risk.

Buying cryptocurrency directly is more suitable for long-term holders who value asset ownership and are willing to accept lower returns.

What are the Minimum Deposits to Start Crypto Trading with Forex Brokers?

The minimum initial deposit to open a live crypto trading account can vary across different forex and CFD brokers. Many brokers have a relatively low barrier to get started. For example, eToro allows traders to explore crypto trading with just a $10 minimum deposit. AvaTrade requires $100 to open a standard account where you can trade crypto. In addition to minimum deposits, most brokers implement minimum trade sizes on crypto positions such as 0.01 BTC or 1 ETH. This represents the smallest position that can be opened. The minimum trade size also varies by crypto.

Which Crypto Broker has the Best Mobile App for Trading?

Can I Stake or Earn Interest on My Crypto Assets Held with Forex Brokers?

The answer is no. Staking or earning interest on your crypto assets directly is not generally possible with most forex brokers. While some forex brokers offer CFD (Contract for Difference) trading on cryptocurrencies, this doesn't involve holding the actual underlying crypto assets. You essentially speculate on the price movement without owning the coins themselves.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!