Imagine steering significant trading activity or testing financial strategies using large amounts of capital, all while keeping your personal funds safe. This is the exciting possibility offered by funded trader programs. A game-changer in the world of trading, these programs provide an empowering platform for both established and novice traders alike. Through our exploration of funded trading, we on WikiFX aim to arm you with the knowledge needed to take decisive steps towards your own financial triumph.

Best Funded Trader Programs

| Rank | Best Funded Trader Programs | Why We Chose? | |

| ① |  |

TopStep | Transparent, low entry barrier, Forex and Futures, educational resources, active community |

| ② |  |

FTMO | Flexible, many trading instruments, generous profit share, trading challenges |

| ③ |  |

The5ers | Progressive profit splits, no upfront evaluation fee |

| ④ |  |

Apex Trader Funding | High funding limits, flexible trading times, competitive profit splits, various account sizes |

| ⑤ |  |

Earn 2 Trade | Extensive educational resources, webinars, multiple account sizes to fit different trading styles |

| ⑥ |  |

OneUp Trader | No time limit for evaluation, diverse contract sizes, frequent withdrawal facilities |

| ⑦ |  |

Fidelcrest | Wide variety of trading instruments, tiered programs for different levels |

Best Funded Trader Programs Compared

|

|

|

|

|

|

|

|

| Trial Period | No, but offers a lower-cost evaluation plan | No, but offers a demo account | Nol, but has a smaller account challenge for less | No, but offers a practice account | No, but has a lower-cost plan for beginners | No, but offers a demo account | No, but offers a micro challenge for less |

| Profit Share | 80/20 | 70/30 | 50/50 to 95/5 | Varies based on performance | 80/20 | 80/20 | Varies |

| Cost (Evaluation Fee) | Starts from $150/month | Starts from €155 | No | Starts from $325 | Starts from $150 | Starts from $150 | Starts from €349 |

| Overnight Position | Not allowed | Allowed | Allowed | Allowed | Allowed | Allowed | Allowed |

| Trading Instruments | Futures, Forex | Forex, Indices, Commodities, Cryptocurrencies, more | Forex only | Forex, Futures, Commodities | Futures only | Futures | Forex, Commodities, Cryptocurrencies, Indices |

| Learn More | TopStep | FTMO | The5ers | Apex Trader Funding | Earn 2 Trade | OneUp Trader | Fidelcrest |

Best Funded Trader Programs Reviewed

① TopStep

|

|

| Feature | Detail |

| Founded In | 2012 |

| Founder | Michael Patak |

| Funding Levels | $30,000 to $150,000 |

| Process to Get Funding | Pass the Trading Combine®, a simulated trading test |

| Trading Assets | Futures across various global exchanges, specializes also in forex |

| Risk Management | Enforced daily and weekly loss limits |

| Educational Resources | Squawk radio, chatrooms, one-on-one mentoring (extra cost) |

| Profit Share | Initial 80/20 favoring trader, can reach up to 90% |

| Compatible Platforms | TradeStation, NinjaTrader, MultiCharts, TSTrader™ |

| Visit TopStep | |

Founded by Michael Patak in 2012, TopStep is a leading proprietary trading firm that offers funded trading accounts to futures and forex traders. This Chicago-based firm stands out in its mission to find successful traders without requiring them to risk their own capital.

To start off, traders have to pass Topstep's Trading Combine®, a real-time, simulated trading test that assesses a trader's ability to profit and manage risk.

Funding levels begin at $30,000 and can reach up to $150,000 for the Trading Combine and Funded Account®. TopStep accommodates a range of trading styles by allowing traders to trade futures across numerous global exchanges, with specialty in forex as well.

One of the notable aspects of TopStep is their emphasis on financial risk management. They have rules in place to limit daily and weekly losses, enforcing a solid discipline in traders.

Another significant feature is their performance coaching. TopStep offers access to squawk radio, chatrooms, and even one-on-one mentoring at additional cost. This helps traders to learn, improve and build a trading community.

Their profit share is also quite advantageous to traders. In the Funded Account, the initial profit share is 80/20 favoring the trader, and it can increase up to 90% based on the trader's profitability.

TopStep is compatible with several trading platforms, but the most commonly used ones are TradeStation, NinjaTrader, MultiCharts, and their web-based platform, TSTrader™.

Overall, TopStep has made a name for itself in the funded trading space by emphasizing trader education, sound risk management, and providing a fair profit-split arrangement.

TopStep is a popular funded trading program based out of Chicago. Like any trading program, it has its own set of advantages and disadvantages:

TopStep Pros & Cons

Pros

√ Skill Improvement: The Trading Combine allows traders to build their skills and confidence in a simulated environment before trading with real money.

√ No Financial Risk: Traders don't risk their own capital when trading with a TopStep-funded account.

√ Access to Larger Capital: Once traders pass the Combine, they can use TopStep's capital to trade in futures and forex markets.

√ Trading Education: TopStep offers several educational resources, including webinars, trading courses, and coaching, to help traders develop their skills.

√ Clear Rules: The rules for the Trading Combine are clear and straightforward from the outset.

Cons

× Fees: There are fees for participating in the Trading Combine, and these are non-refundable whether or not you pass the Combine.

× Strict Rules: TopStep's Trading Combine has very strict rules, which can be challenging for some traders. Failure to adhere to any rule can lead to a loss of the funded account.

× Restricted Trading Times: The trading times are regulated, which can affect traders who use different timezones.

× Profit Share: There is a profit share once the trader gets funded. The trader retains 80% of the first $5,000 they make in profit and 75% after that.

× No Overnight Positions: For Futures Traders, TopStep does not allow overnight positions which can limit certain trading strategies.

② FTMO

|

|

| Feature | Detail |

| Founded In | 2014 |

| Location | Czech Republic |

| Funding Levels | $10,000 to $200,000 |

| Process to Get Funding | Pass the FTMO Challenge and Verification phases |

| Trading Assets | Forex |

| Risk Management | Preset maximum loss limit |

| Educational Resources | Custom analytics app, accountability partner, psychological assistance |

| Profit Share | Initial 70% favoring trader, can reach up to 90% |

| Compatible Platforms | MetaTrader 4 and 5, cTrader, DXtrade |

| Visit FTMO | |

FTMO was established in 2014 and is based in the Czech Republic. They provide funding to forex traders around the world and have quickly become one of the global leaders in forex funded trader programs.

Aspiring traders have to pass the FTMO Challenge and Verification phases, both designed to assess a trader's suitability for funding. The challenge is a simulated test where the trader is given a set account balance and must hit a profit target within a specified number of trading days without depleting the account by more than a designated maximum loss.

FTMO provides a variety of account sizes that range from $10,000 up to $200,000. They are renowned for a favorable profit share, with traders keeping 70% of profits in the initial phase, which can eventually increase to 90% based on continuous profitability.

One appealing aspect of FTMO is their supportive trading environment. They provide a number of tools and resources including a custom analytics app, an accountability partner, and psychological assistance to help guide traders.

From a flexibility standpoint, FTMO is not restrictive about trading strategies and allows overnight and over-the-weekend positions. The company works with multiple third-party platforms, including MetaTrader 4 and 5, cTrader and DXtrade.

FTMO has developed a solid reputation in the funded trading community owing mainly to their trader-friendly parameters, comprehensive support structure for traders, and flexible platform and strategy options.

FTMO Pros & Cons

Pros

√ Access to Capital: Once traders pass the evaluation phase, they get access to sizeable capital for trading, which can increase based on the performance.

√ No Risk to Personal Capital: Traders trade with FTMO's capital, not risking their own funds.

√ Flexible: You can trade any day, any time, you can even hold positions overnight and over the weekend.

√ Generous Profit Share: FTMO offers an attractive profit share of 70/30 (70% for the trader, 30% for FTMO).

√ FTMO Challenge: The evaluation process is clear and straightforward.

√ Multiple Instruments: With FTMO, you can trade Forex, indices, commodities, cryptocurrencies, and more.

Cons

× Fee for the Challenge: There are fees required to participate in the FTMO challenge, which are non-refundable whether or not you pass the challenge.

× Strict Rules: There are certain rules for traders such as the maximum loss limit, which if violated, could end your FTMO Trader contract.

× Account Termination: If a trader does not make a new high in the funded account in a 6-month period, FTMO reserves the right to terminate the agreement.

× Profit Withdrawal: The profit withdrawal process can be quite stringent and it can take up to 20 days to receive your payment.

③ The5ers

|

|

| Feature | Detail |

| Founded In | 2016 |

| Founder | Gil Ben-Hur |

| Funding Levels | $10,000 to $4 million |

| Process to Get Funding | Pass The5ers' Evaluation Program |

| Trading Assets | Forex |

| Risk Management | Risk and trading psychology education |

| Educational Resources | Various educational contents available to funded traders |

| Profit Share | Initial 50% favoring trader, can increase up to 95% |

| Compatible Platforms | MetaTrader 4 |

| Visit The5ers | |

Created in 2016 by Gil Ben-Hur, The5ers is a proprietary trading fund that focuses specifically on Forex trading. The fund is based in Israel but provides funding to talented Forex traders globally.

To qualify for funding, traders have to pass The5ers' Evaluation Program, which is a demonstration of consistent profit generation with risk management considerations. The evaluation program has a one-time payment fee, which covers both the evaluation and provided service throughout the program.

The5ers offers funding from $10,000 and up to $4 million, one of the highest in the industry. Their growth scheme is defined by a milestone target. Once a 10% profit target is hit on the initial capital, the account size is automatically doubled.

One of the most attractive aspects of The5ers is their profit share, which starts at 50% for the trader and can increase up to 95% based on continuing profitability. This is a much higher split than most trading programs.

Risk management and trading psychology education is a priority in The5ers trade approach, with educational resources made available to funded traders. There are no restrictions on trading hours, style, or holding positions over the weekend.

Regarding platforms, The5ers is compatible with MetaTrader 4.

In a nutshell, The5ers' distinguishing features are their high funding levels, generous profit shares, and focus on both risk management and Trader's growth. They are applauded for their straightforward program rules and ongoing support for funded traders.

The5ers Pros & Cons

Pros

√ No Evaluation Fees: Unlike many funded trading programs, The5ers does not require an upfront fee to participate in the evaluation process.

√ Profit Share: The5ers offers a favorable profit share, starting at 50/50 and going up to 95/5 as traders progress in the program.

√ Growth Scheme: The5ers provides a unique growth plan where traders can double their trading account balance after reaching a 10% profit target.

√ No Risk To Personal Capital: Traders use The5ers' capital to trade, eliminating the risk of losing personal funds.

√ Flexible Trading Style: The5ers allows various trading strategies and does not restrict holding positions over the weekend or overnight.

Cons

× Strict Rules: While the company provides a flexible trading style, there are still rules that traders must comply with, including a maximum risk exposure of 1.5% per trade.

× Limited Trading Instruments: The5ers only allows trading in Forex.

× Profit Target: Traders must reach a 6% profit target during the evaluation period, which might be challenging for some.

× Drawdown Limit: There is a 4% drawdown limit, which if breached results in termination of the funded account.

× Platform Restriction: Trading is allowed only through MetaTrader 4.

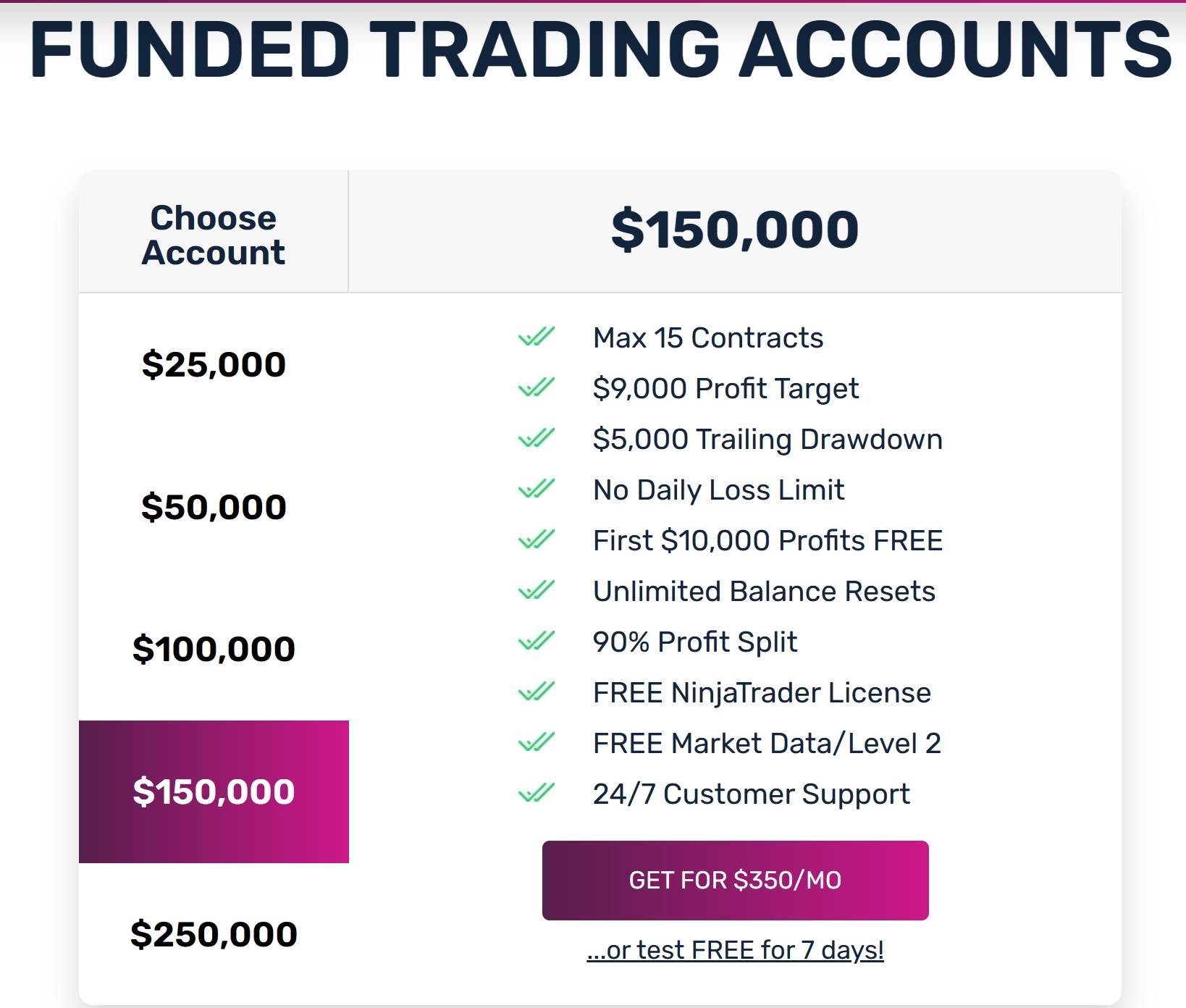

④ Apex Trader Funding (71% off)

|

|

| Feature | Detail |

| Founded In | 2020 |

| Location | United Kingdom |

| Funding Levels | $25,000 to $100,000 |

| Process to Get Funding | Pass initial challenge & verification process |

| Trading Assets | Various (platform dependent) |

| Risk Management | Relaxed approach |

| Profit Share | Starts at 50%, can increase up to 80% based on profit generated |

| Compatible Platforms | NinjaTrader, MetaTrader 4 & 5, TradeStation |

| Visit Apex Trader Funding | |

Apex Trader Funding is a relatively new entrant into the prop trading space, having been established in 2020. Despite its recent launch, it has quickly gained a reputation for its trader-friendly terms and diverse trading options.

Based in the United Kingdom, Apex Trader Funding offers a straightforward path to become a funded trader. Candidates need to pass a two-step evaluation process: the initial challenge and the verification process. The challenge allows traders to gain access to a funded account provided they maintain their account balance above 90% of the initial start value and reach a minimum of 10% profit.

Apex offers a variety of account sizes ranging from $25,000 up to $100,000. They have a fairly relaxed approach to risk management rules and allow traders a fair degree of latitude in executing their strategies.

One standout feature is their profit share. Unlike most firms that offer fixed profit shares, Apex gives traders linear incremental profit shares, which begin at 50% and can eventually reach 80% based on the amount of profit generated by the trader.

Apex Trader Funding allows for various trading strategies, making them a good fit for both intraday traders and swing traders. They offer compatibility with a variety of platforms, primarily NinjaTrader, MT4, MT5, and TradeStation.

In summary, Apex Trader Funding stands out for its direct path to funding, generous profit shares, and its lack of strict trading rules, making them a potentially appealing choice for experienced traders.

Apex Trader Funding Pros & Cons

Pros

√ Variety of Trading Instruments: They offer a wide range of Forex pairs, Futures contracts and commodities to trade.

√ Multiple Account Sizes: Apex offers different account sizes to fit varied trading styles and risk appetites.

√ No Time Limit on the Evaluation: Traders can take their time to complete the evaluation phase, as there isn't a predefined time limit.

√ Reasonable Drawdown Limits: Apex has practical drawdown rules compared to some other funding firms.

√ Profit Share: The profit share favors the trader substantially, beginning at 80/20 and potentially increasing based on performance.

√ Discounts: The company currenctly offers 71% discounts.

Cons

× Evaluation Fee: There's an upfront fee to participate in the evaluation phase, with the amount depending on the selected account size.

× Risk Management Rules: Like all such programs, Apex imposes specific rules and constraints on its traders which, if broken, can lead to losing the funded account.

× Account Scaling Policy: The scaling policy can be less aggressive than what other programs offer, meaning it can take longer for traders to qualify for larger funded accounts.

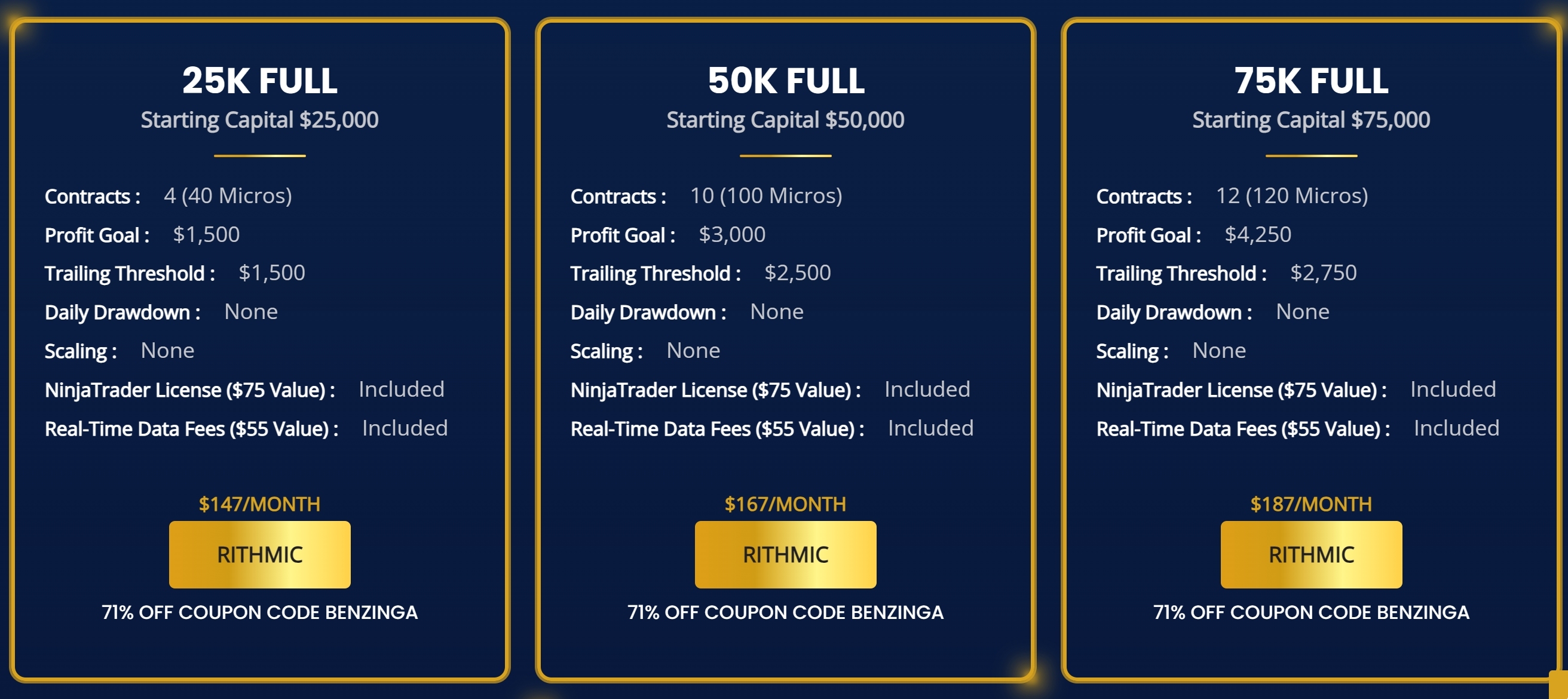

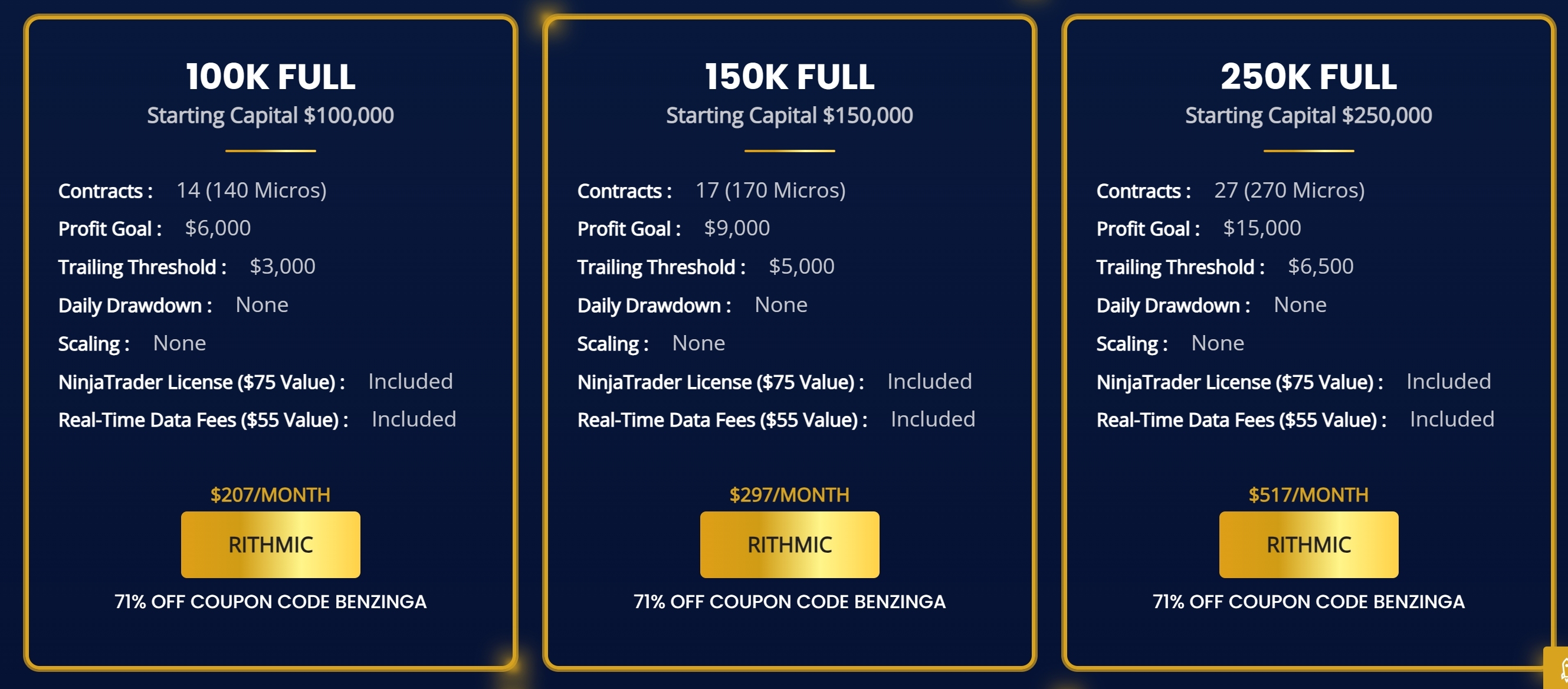

⑤ Earn 2 Trade (50% off - Trader Career Path® 50)

|

|

| Feature | Detail |

| Founded In | 2018 |

| Location | Texas, USA |

| Funding Levels | $25,000 to $400,000 |

| Process to Get Funding | Education course and passing the Gauntlet evaluation |

| Trading Assets | Indices, energies, metals, currencies, bonds |

| Risk Management | Gauntlet tests risk management skills |

| Educational Resources | Webinars, bootcamp course, access to private community |

| Profit Share | 80/20 favoring trader |

| Compatible Platforms | NinjaTrader, Rithmic, and others |

| Visit Earn 2 Trade | |

Established in 2018 and based out of Texas, USA, Earn 2 Trade is a proprietary trading firm that offers a direct path to becoming a funded futures trader. Earn 2 Trade focuses on providing education, trader evaluation, and the opportunity to join a prop trading firm.

The process requires candidates to undergo an education course and pass the Gauntlet — a simulated trading evaluation. The Gauntlet tests traders' ability to hit a profit target, manage risk, adhere to a trading plan, and meet other criteria within a stated period.

Earn 2 Trade offers account sizes ranging from $25,000 to $400,000 in their Gauntlet programs. They permit a variety of trading instruments including indices, energies, metals, currencies, and bonds.

One of the aspects that several traders appreciate is their 80/20 profit sharing arrangement, favoring the trader. But the biggest draw is perhaps the one-time payment for the evaluation, unlike other prop firms that require monthly payments.

Earn 2 Trade emphasizes on education and offers a comprehensive educational package that includes webinars, a bootcamp course, and access to their private community where traders can discuss strategies, charts, and more.

As for platform compatibility, Earn 2 Trade works with a wide variety of platforms such as NinjaTrader, Rithmic, and others.

In summary, Earn 2 Trade offers a combination of excellent education, a transparent evaluation process, and favorable terms for funded traders.

Earn 2 Trade Pros & Cons

Pros

√ No Time Limit on Evaluation Phase: Unlike some programs, there is no restriction on how quickly you must complete the evaluation phase.

√ Access to Education: Earn2Trade offers educational content and webinars to help enhance trading knowledge.

√ Various Account Sizes: Traders can choose from various account sizes based on their risk appetite and trading style.

√ Discounts: The company currenctly offers 50% discounts on Trader Career Path® 50.

√ Allows Swing Trading: Earn2Trade allows holding positions overnight, making it suitable for swing traders.

Cons

× Fee for Evaluation Phase: There is an upfront fee to participate in an evaluation phase which is non-refundable regardless of whether you pass or fail.

× Limited to Futures Trading: Earn2Trade's funded account is only for futures trading.

× Strict Rules: If you violate the program's rules, such as hitting the maximum drawdown limit, you risk losing your funded account.

× Profit Share: Earn2Trade takes a 20% cut of the profits you make on the funded account.

× Trading Platform: Trading is allowed only through the use of specific software.

⑥ OneUp Trader (20% off)

|

|

| Feature | Detail |

| Founded In | 2012 |

| Process to Get Funding | Pass OneUp Trader's Evaluation |

| Funding Levels | $25,000 to $250,000 |

| Trading Assets | Wide range of futures contracts |

| Risk Management | Evaluation validates risk and money management skills |

| Profit Share | Keep 100% of the first $10,000 profits for the 90% split option |

| Overnight and Weekend Positions | Allowed with no restrictions |

| Compatible Platforms | Works with Rithmic, CQG data feeds; Supports NinjaTrader, Trade Navigator, among others |

| Visit OneUp Trader | |

OneUp Trader, founded around 2012, is a funded trader program that offers a fast pathway for traders to access a funded account for futures trading. The platform operates under a straightforward model: demonstrate your trading skills in a simulated environment, and you become eligible to trade OneUp Traders money.

To get funded, traders have to pass OneUp Trader's Evaluation (also known as the Combine process). This involves traders showcasing their trading ability in a simulated environment over an allotted period while respecting risk and money management rules.

OneUp Trader offers funding levels ranging from $25,000 to $250,000 depending on the trader's choice of subscription. They permit a wide array of futures contract trading, including indices, energies, metals, grains, softs, and many others.

Funded traders keep 100% of their first $10,000 profits for the 90% split option. The platform also allows traders to hold overnight and weekend positions with no restrictions on the trading style.

It's compatible with Rithmic and CQG data feeds and works with various trading platforms such as NinjaTrader, Trade Navigator, among others.

In summary, OneUp Trader is recognized for its straightforward funding process, flexible rules, and favorable profit shares. It is suggested for any aspiring trader who wants to trade futures via a funded account.

OneUp Trader Pros & Cons

Pros

√ No Time Limit for Evaluation Phase: Unlike certain other programs, OneUp Trader doesn't rush you through the evaluation process. You can take as much time as you need to complete this phase.

√ Variety of Contract Sizes: OneUp Trader offers various contract sizes in their evaluation process, allowing traders to select an option that best fits their trading style.

√ Provides Education: OneUp Trader provides educational resources to help traders improve their trading skills and knowledge.

√ Multiple Withdrawals: You can make profit withdrawals once per month without additional charges.

√ Auto Scaling: Based on a trader's performance, OneUp Trader can automatically consider the trader for higher account steps.

Cons

× Evaluation Fee: Participation in OneUp Trader's evaluation process includes an upfront, non-refundable fee.

× Profit Share: Once funded, traders are required to split their profits with OneUp Trader, often in an 80/20 ratio in favor of the trader.

× Trading Restrictions: OneUp Trader imposes restrictions regarding maximum position size, trading times, and max drawdown. If these rules are broken during the funded trader program, the trader may lose the account.

× Limited to Futures Trading: The program is limited to trading futures and does not include other trading instruments like stocks or forex.

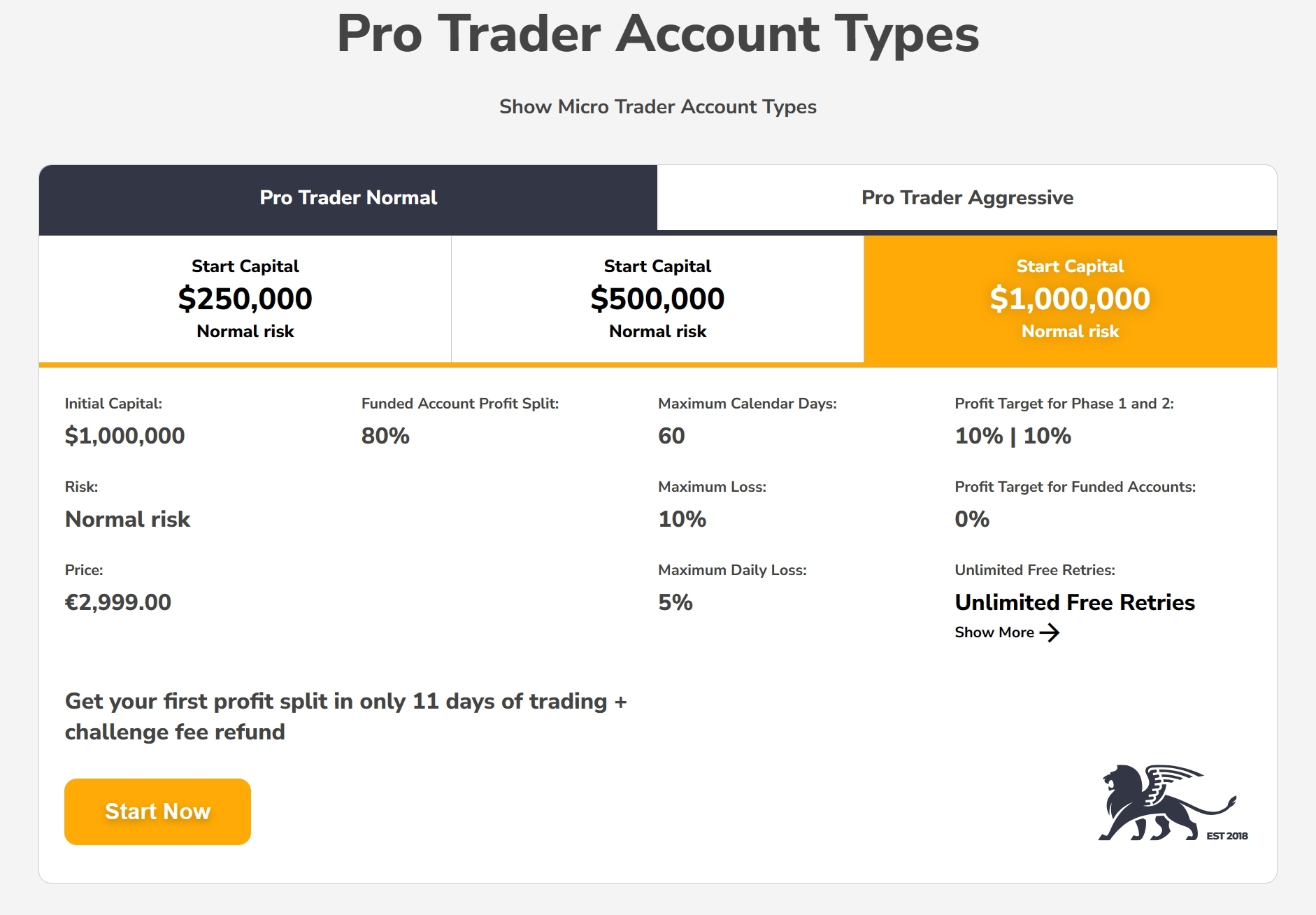

⑦ Fidelcrest

|

|

| Feature | Detail |

| Founded In | 2018 |

| Location | Finland, Europe |

| Funding Levels | $250,000 to $1,000,000 |

| Process to Get Funding | Pass Risk-Free Trading Challenge |

| Trading Assets | Forex, indices, commodities, stocks |

| Risk Management | Challenge tests risk management skills |

| Profit Share | Starts at 70/30 favoring trader, can increase up to 90% based on performance |

| Compatible Platforms | MetaTrader 4, MetaTrader 5 |

| Visit Fidelcrest | |

Fidelcrest is a reputable proprietary trading platform based in Finland, Europe. Since its founding in 2018, the company has gained significant traction in the prop trading industry by offering a unique path to a funded trading career.

Traders can apply to become a Fidelcrest Trader and, if their application is approved, they will start a Risk-Free Trading Challenge. By passing this challenge, traders demonstrate that they can trade profitably and manage risk wisely. Successful traders are then provided with a Fidelcrest funded trading account, with funding levels ranging from $250,000 up to $1,000,000.

The assets available for trading through Fidelcrest include Forex, indices, commodities, and stocks. They also support multiple trading platforms, with a focus on MetaTrader 4 and MetaTrader 5.

One of the major benefits of trading with Fidelcrest is its performance-based trading environment. Traders are offered an initial profit share ratio of 70/30, but this can increase up to 90% for traders as their trading performance improves.

Fidelcrest is recognized for its transparency, providing comprehensive information regarding their trading conditions and requirements on their website. In addition, they strongly emphasize trader education and support, providing valuable resources and a community to their traders.

In summary, Fidelcrest has strong offerings in the prop trading space with educated risk rules, an attractive profit share, and solid support for their traders.

Fidelcrest Pros & Cons

Pros

√ Variety of Trading Instruments: Fidelcrest allows traders to trade a wide range of instruments, from forex and commodities to cryptocurrencies and indices.

√ Tiered Program Structure: Fidelcrest offers various trading programs to fit different experience levels and trading styles.

√ High Capital Access: High levels of trading capital are available, ranging from $250,000 to $1,000,000.

√ No Time Limit for Evaluation: Unlike some programs that require you to hit targets within a specific time frame, Fidelcrest has no time limit in the evaluation stage.

√ Additional Training and Support: Fidelcrest offers access to their training resources and continuous trader support.

Cons

× Challenge Fee: To join the program, traders need to pay a fee to take the trading challenge. This fee is non-refundable even if you don't pass the challenge.

× Strict Profit Targets: Traders have to achieve a set profit target during the evaluation phase. Depending on your trading strategy, meeting this target can be challenging.

× Drawdown Rules: As with most trading programs, Fidelcrest has strict maximum drawdown rules. If you break these, you may lose the funded account.

× Profit Share: In the funded account phase, profits are split between the trader and Fidelcrest.

What are Funded Trader Programs?

Funded Trader Programs are financial setups where proprietary trading firms or individual investors provide capital to skilled traders. These programs usually involve an evaluation process where traders are tested for their ability to generate consistent profits and manage risk. The tests often occur in a simulated trading environment.

Once traders pass the evaluation, they are given access to the funding firm's capital to trade in the financial markets. The profits generated from the trades are then split between the trader and the trading firm, usually in a predefined proportion.

These programs provide an opportunity for talented traders to trade with significant capital which they might not have access to on their own. Furthermore, traders assume none of the financial risks since the capital is provided by the firm.

Funded Trader Programs typically require an upfront payment from traders for participating in the evaluation process. The cost can vary depending on the funding provider, the trading capital offered, and the terms of the agreement. Please note that it's crucial to carefully read, understand, and agree with the terms of a Funded Trader Program before getting involved.

Popular Funded Trader Programs include companies like TopStep, OneUp Trader, and Earn 2 Trade, amongst others.

How do Funded Trader Programs Work?

Funded Trader Programs work through a relatively simple process:

Evaluation Phase

Interested traders sign up with the funded trader program, often paying an upfront fee to participate in the evaluation process. The trader then enters the evaluation phase, also known as the trading challenge or combine, in which they trade on a simulated platform. Trading rules and risk parameters are imposed, and participants must prove their ability to generate consistent profits while managing risk effectively. This phase is designed to assess the potential trader's skills and confirm they can consistently operate under predefined rules.

Funding Phase

If the trader successfully completes the evaluation phase, they are offered a funded trading account by the program provider. The size of the account and trading parameters depends on the specialized rules of each program.

Live Trading

The trader then begins to trade in the live markets with the funded account. They must follow the rules set forth by the provider, such as restrictions on maximum drawdown, trading times, and certain trading instruments.

Profit Sharing

Profits made from trading are divided between the trader and the funding provider, typically in a predetermined ratio. For instance, the trader may keep 80% to 90% of profits, while the remaining share goes to the funding firm.

Continued Assessment

Funded traders continue to be evaluated. If a trader violates the trading rules or is unable to generate consistent profits, they risk losing the funded account.

By providing capital to talented traders, these programs not only fill a market need, but also create career opportunities for successful traders.

Note that not all Funded Trader Programs are the same; each has its own rules, evaluation process, fund level and profit sharing percentage that aspiring traders should research carefully.

How to Choose the Right Funded Trader Programs?

Choosing the right Funded Trader Program can be a critical decision that may impact your trading career. Here are some pointers to consider before making a choice:

Research: Carry out an extensive research about different funded trading programs. This can involve reading reviews, checking their presence on social media, gauging their reputation among the trading community, and so on.

Understand the Rules: Each program has its own unique rules. Some have strict drawdown rules, while others may have restrictions on the times you can trade. Make sure you understand and are comfortable with these rules before you join.

Funding Level: The amount of funding provided by trading programs can vary significantly. Choose a program that offers a level of funding that aligns with your trading strategy and goals.

Profit Share: Look for programs that offer a reasonable profit share. This will vary between programs. Remember, higher isnt necessarily better if it comes with more risk or strict rules.

Fee Structure: Fee structures can vary between programs. Some programs might charge a monthly fee, while others might deduct a percentage of your profits. Choose a program whose fee structure best aligns with your financial situation and trading strategy.

Evaluation Process: Most funded trading programs have an evaluation process where they assess your trading skill and risk management capability. Opt for a program that has a rigorous yet fair qualification process.

Support and Education: Some programs also offer educational resources, software tools, and personal support. Decide how important these features are to you.

Comparison: Compare various platforms based on the features important to you. There is no one-size-fits-all solution, so it's important to find the one that best suits your needs.

Pros and Cons of Funded Trader Programs

Pros

√ Access to Capital: Funded trading programs allow traders to trade with larger capital than they might personally have, providing the potential to earn more significant profits.

√ Reduced Financial Risk: Traders use the firm's money to trade, not their own. This means they do not risk their own personal funds.

√ Skill Enhancement: The evaluation or challenge period of these programs can enhance a trader's skills, as they have to adhere to certain strict rules and maintain consistent performance.

√ Professional Experience: Trading with a funded trading firm can mimic the pressure and scenarios of professional trading, preparing traders for future roles in the financial industry.

√ Profit Sharing: Successful trades can lead to high-profit shares, which can serve as a significant income source.

| Pros √ | Cons × |

| · Access to Capital | · Evaluation Fees |

| · Reduced Financial Risk | · Strict Rules |

| · Skill Enhancement | · Profit Share |

| · Professional Experience | · Pressure |

| · Profit Sharing | · No Ownership |

Cons

× Evaluation Fees: Most of these programs require an upfront payment to enter into the evaluation process. If a trader fails in the assessment, they might lose this money.

× Strict Rules: Trading firms impose certain rules and restrictions that traders must follow. These rules could relate to the maximum drawdown, trading times, and minimum trading days. Not everyone might be comfortable with these rules.

× Profit Share: While traders can make profits, they will have to share a portion of these profits with the trading firm.

× Pressure: The pressure to maintain performance parameters and meet the program's rules could potentially lead to stress and affect a trader's decision-making skills.

× No Ownership: Even if you're trading and making profits, the trading account belongs to the firm, and not to the trader.

Final Thoughts

Funded Trader Programs can offer excellent opportunities to traders without capital access to trade larger sums, hone their skills, and potentially earn substantial profits while limiting their financial risk. However, these programs also come with their downside, including fees, strict rules, potential stress, and profit share.

Every trader should carefully consider their trading style, risk tolerance, and personal goals before choosing a program. An informed decision, backed by extensive research and understanding, is the way to go. As always, remember to consistently update your market knowledge, trading skills, and risk management techniques, as these are keys to sustained success in any trading endeavor.

Funded Trader Programs FAQs

What is funded trading?

Funded trading is a scenario where a firm provides capital to traders who demonstrate skill and efficiency. Traders are first evaluated, and if successful, gain access to a funded account to trade. Profits are then shared between the firm and the trader. The main advantage is trading larger capital without personal financial risk.

Can I become a funded trader?

Yes, you can become a funded trader if you can demonstrate your trading skills and efficiency. Most funded trading programs have an evaluation phase where you'll have to meet certain targets while sticking to set risk parameters. If successful, you then get access to a funded account to start live trading.

How much do funded traders make?

The earning potential of a funded trader varies widely depending on the performance of the individual traders, the size of the funded account, the profit split agreement, and the funding firm's rules. Typically, a funded trader could make anywhere from a few hundred to several thousand dollars per month depending on their trading success.

What makes a good-funded trader program?

A well funded trader program typically has several key characteristics:

√ Transparency

√ Fair Profit Share

√ Reasonable Evaluation Period

√ Support and Education

√ Minimal Restrictions

√ Positive Reviews

√ Reasonable Pricing

Disclaimer

This information is for informational purposes only and should not be considered investment advice. Please consult with a qualified financial advisor before making any investment decisions. The specific risks associated with your investments will vary depending on the assets you choose and your overall investment strategy. Some common risks include market volatility, interest rate changes, inflation, and issuer default. Remember, diversification does not guarantee a profit or protect against loss.

You Also Like

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!