Contracts for Difference (CFDs), in essence, are a popular financial derivative that allows traders to speculate on fluctuating asset prices with the allure of leverage, thus gaining higher exposure to underlying assets with smaller amounts of trading capital. When trading CFDs, seriously, choosing a broker well-suited to your's trading style and needs is critical. To find a suitable CFD platform, you need to thoroughly consider factors like regulation, trading costs, leverage levels, capital security, customer service and more. This article aims to provide an in-depth analysis of the pros and cons of several leading CFD brokers, evaluating their performance across metrics like regulatory compliance, trade execution quality, platform optimization and customer satisfaction, to offer valuable information and guidance to readers.

Best CFD Brokers

A well-established broker that has operated for over 40 years, with a solid reputation.

Offering a broad spectrum of markets, including forex, indices, shares, cryptocurrencies, and options for CFD trading.

Operating under a strong regulatory framework, including tier-1 regulations, FCA, ASIC, adding some security for traders.

Highly advanced trading technology, yielding lower costs and higher order execution speed.

Offering a vast range of investment products (stocks, ETFs, bonds, mutual funds, crypto ETPs) and leveraged products (options, futures, forex, forex options, crypto FX, CFDs, commodities, turbos).

Access to advanced multi-asset trading platforms such as SaxoTraderGO and SaxoTraderPRO.

Partnering with top-tier liquidity providers, providing competitive pricing in the industry.

Optimized trading platforms, coupled with VPS, ensuring a smooth trading experience.

Offering competitive spreads and over 1,000 CFDs across forex, commodities, indices, and stocks.

Advanced trading platforms (MT4, MT5) with negative balance protection and fast execution.

more

Best CFD Brokers Compared

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best CFD Brokers Reviewed

① IG

Best CFD brokers for advanced trading platforms

|

|

Broker |

|

Regulated by |

ASIC, FCA, FSA, AMF, FMA, MAS, DFSA |

Min. Deposit |

$0 |

Tradable Instruments |

Forex, shares, indices, commodities, thematic and basket, options, futures, spot, cryptocurrencies |

Trading Platforms |

Online trading platform, mobile trading app, progressive web app, ProRealTime, MT4, L2 Dealer |

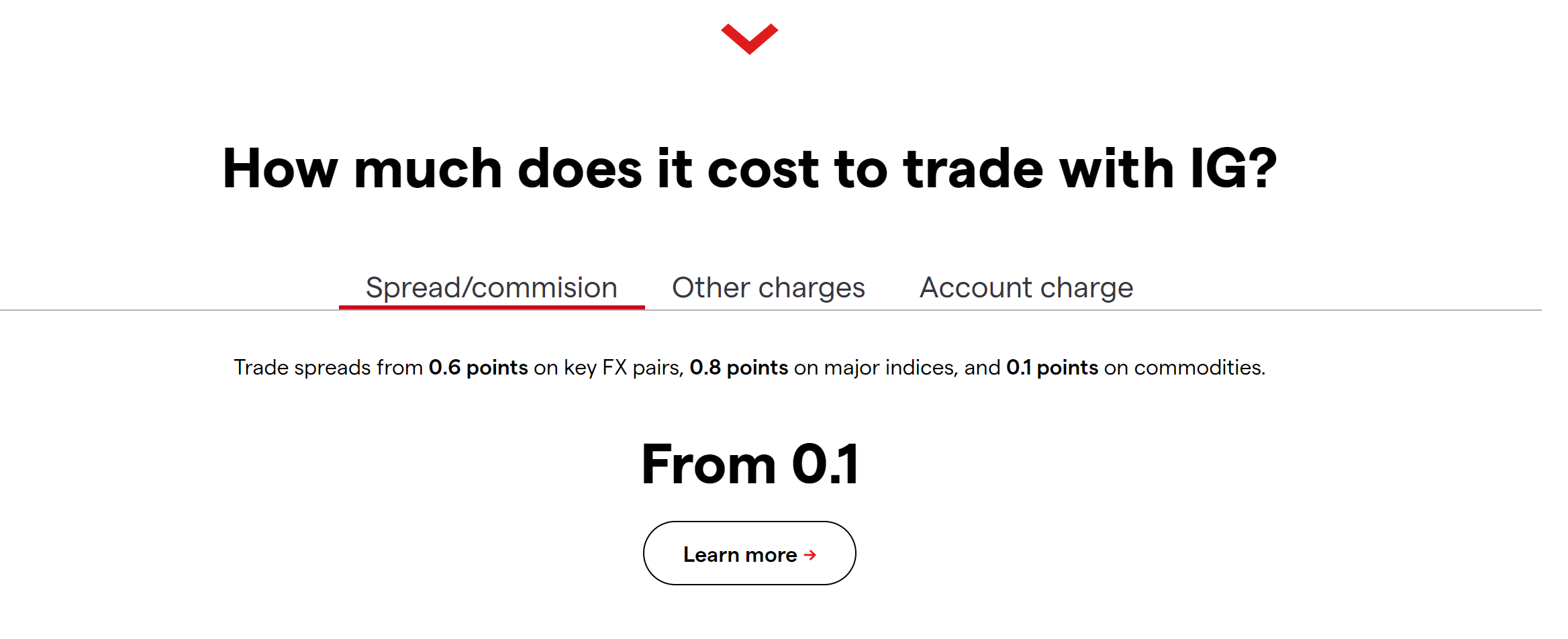

CFD Trading Costs |

Spreads from 0.6 points on key FX pairs, 0.8 points on major indices, and 0.1 points on commodities |

Demo Account |

✅ |

Copy Trading |

❌ |

Payment Methods |

Apple Pay, PayPal, BAY, EFT Payments and more |

Customer Support |

24 hours a day, except from 6am to 4pm on Saturday (UTC+8) |

Founded in London in 1974, IG is a well-regarded broker registered in the United Kingdom. This brokerage firm is seen as a pioneer in the world of online trading, specifically in contracts for difference (CFDs) and spread betting services. IG's trading platform is a great example of complexity and user-friendliness combined. It provides numerous advanced tools for trading, comprehensive market analysis resources, and even educational materials for beginners. While some might find the extensive array of tools and resources complex, those with sufficient trading experience often appreciate the breadth of options available.

With regards to IG's Contracts for Difference (CFD) product, the broker offers them on a variety of assets. CFD trading allows traders the benefit of speculating on price variations without the requirement of owning the underlying asset. This is coupled with competitive spreads and low trading fees, adding to the attraction of trading CFDs with IG.

✅Where IG shines:

• Heavily and globally regulated, a respected CFD provider, giving traders vast trading assurance.

• A well-regarded and offers a wide variety of features and tools for traders, excellent for professionals.

• Competitive fees in the industry, especially for CFD trading, with spreads from 0.6 pips on major currency pairs.

❌Where IG shorts:

• Despitebeing feature-rich, the trading platform may seem complex and overwhelming to some, particularly beginners.

• With CFDs and spread betting, IG allows traders to hedge their positions, potentially reducing risk.

② Interactive Brokers (IB)

Best CFD brokers for technologies-supporting trading experience

|

|

Broker |

Interactive Brokers (IB) |

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Stocks, options, futures, currencies, bonds and funds |

Trading Platforms |

IBKR GlobalTrader, Client Portal, IBKR Desktop, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR ForecastTrader, IMPACT |

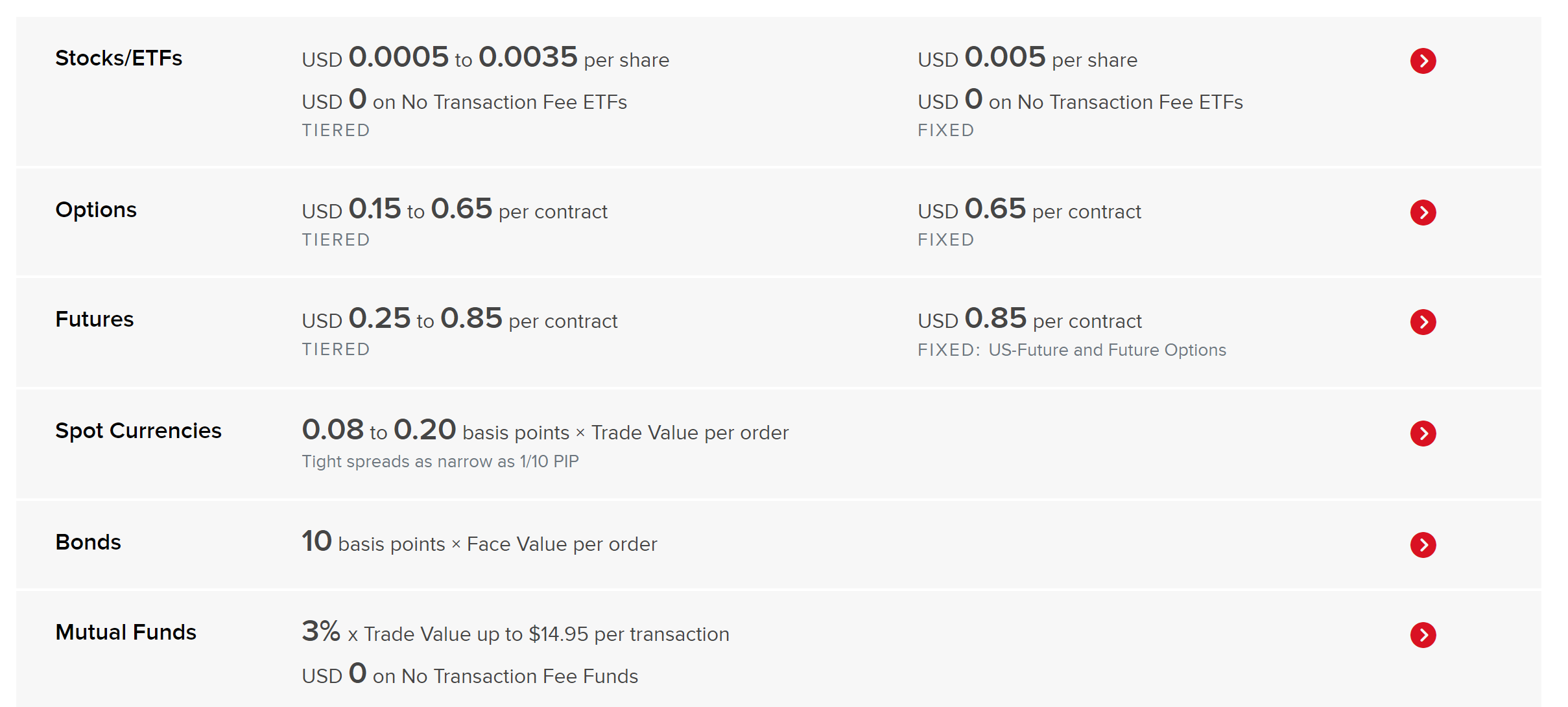

Trading Costs |

No commissions on 150 global products, no added spreads; overnight fees typcially varying 0.1%-0.5% per day |

Demo Account |

✅ |

Copy Trading |

❌ |

Payment Methods |

Wire Transfer, Check, Direct Bank Transfer (ACH) |

Customer Support |

5/24 |

Interactive Brokers, also known as IBKR, was established in 1978 and is headquartered in the United States. This reputable broker is highly recognized for providing diverse financial services to individual and institutional clients all over the world. By far as one of the largest electronic brokers worldwide, Interactive Brokers offers its clients access to trade a broad range of financial instruments including but not limited to stocks, options, futures, currencies, bonds and funds. When it comes to their trading platform known as Trader Workstation (TWS), it is highly advanced and equipped with top-of-the-line trading tools, sophisticated charting features, risk management tools, and real-time monitoring. As far as customer support is involved, Interactive Brokers provides assistance via multiple channels and also has an extensive online support centre. However, some users might find its trading platform and support services bit complex.

Turning to Interactive Brokers' Contracts for Difference (CFDs), this broker offers asset classes like shares, indices, forex, and commodities. Interactive Brokers' CFD trading fees are known to be competitive and transparent, with commissions lower in the industry, no added spreads.

✅Where Interactive Brokers shines:

• Trader Workstation (TWS) is known for its advanced trading tools, extensive charting features, and reliable order executions.

• Providing competitive, clear, and concise pricing, particularly with its CFD products.

• Overseen by multiple regulatory bodies across the globe, ensuring compliance with financial standards.

• Heavily invests in technology to provide high-speed trading services which can be especially beneficial for active and professional traders.

• InteractiveBrokers does not cease to impress with its Trader's Academy, webinars, courses, and helpful trading tools that cater to both beginner and experienced traders.

❌Where Interactive Brokers shorts:

• With its wide range of features and tools, TWS platform might seem complex and daunting for beginners.

③ Saxo

Best CFD broker for the most traders' recognization

|

|

| Broker | Saxo |

| Regulated by | ASIC, FCA, FSA, AMF, CONSOB, FINMA, MAS |

| Min. Deposit | $0 |

| Tradable Instruments | Investment products: stocks, ETFs, bonds, mutual funds, crypto ETPs |

| Leveraged products: options, futures, forex, forex options, crypto FX, CFDs, commodities, turbo | |

| Trading Platforms | Saxoinvestor, SaxoTraderGO, SaxoTraderPRO |

| Trading Costs | Three pricing tiers, classic, Platium, and VIP |

| Demo Account | ✅(20 days with $100,000 virtual fund) |

| Copy Trading | ✅ |

| Payment Methods | Bank transfer, quick payment, card funding |

| Customer Support | 5/24 |

Saxo Bank, a leading player in the global online trading and investment sector, was founded in 1992 and is headquartered in Denmark. Known for its robust Fintech and Regtech solutions, Saxo Bank is recognized by numerous individual and institutional investors worldwide. Saxo Bank offers three different account tiers, namely Classic, Platinum, and VIP account. The 'Classic' tier requires no minimum deposit, making it quite accessible for beginners or those with limited capital.

Dig deeper into its CFD offerings, Saxo Bank provides competitive spreads and flexible trading on over 8,800 CFD products. Whether one chooses to trade indices, stocks, forex or commodities, Saxo Bank's CFDs provide an avenue to speculate on price movements without actual ownership of underlying assets. Yet, Saxo Bank emphasises that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

✅Where Saxo Bank shines:

• Probviding access to over 8,800 CFD products, Saxo Bank provides broad-spectrum trading opportunities.

• The proprietary SaxoTraderGO platform offers high-end functionality suitable for both beginners and experienced traders.

• Depending on the account tier, Saxo Bank offers different pricing structures that can be quite competitive, especially for higher tier account holders.

• For high net worth individuals (such as VIP account holders), Saxo Bank offers more personalized services.

❌Where Saxo Bank shorts:

• Saxo Bank has higher minimum deposit requirements on Platium and VIP accounts, compared to many other brokers, potentially discouraging low-budget traders.

• Some users have mentioned that customer support, while generally comprehensive, can sometimes be slow to respond or hard to reach, particularly during peak trading hours.

④ Forex.com

Best CFD brokers for low-cost trading

|

|

Broker |

|

Regulated by |

ASIC, FCA, FSA, NFA, CIRO, MAS |

Min. Deposit |

$100 |

Tradable Instruments |

Forex, indices, stocks, cryptocurrency, commodities, gold & silver |

Trading Platforms |

Web Trader, Mobile App, TradingView, MT4, MT5 |

CFD Trading Costs |

Spread from 0.0 pips for major currencies with a $5 commission per $100k USD traded |

Demo Account |

✅(90 days risk-free trading with $50,000 in virtual funds) |

Copy Trading |

✅ |

Payment Methods |

Local online transfers, credit/debit card, wire transfer, Neteller, Skrill |

Customer Support |

7/24 |

Forex.com is a trusted global brand, established in 2001 and is a part of GAIN Capital Holdings. The firm is registered and regulated in seven jurisdictions worldwide, including the United States. As a major player in the forex market, Forex.com offers an impressive number of over 80 forex pairs to trade. Along with forex, users can also trade in indices, commodities, stocks and cryptocurrencies. Besides, this broker provides access to powerful and robust trading platforms, such as MT5 and MT4. Features of these platforms include advanced charting tools, robust technical analysis capabilities, and efficient order execution processes.

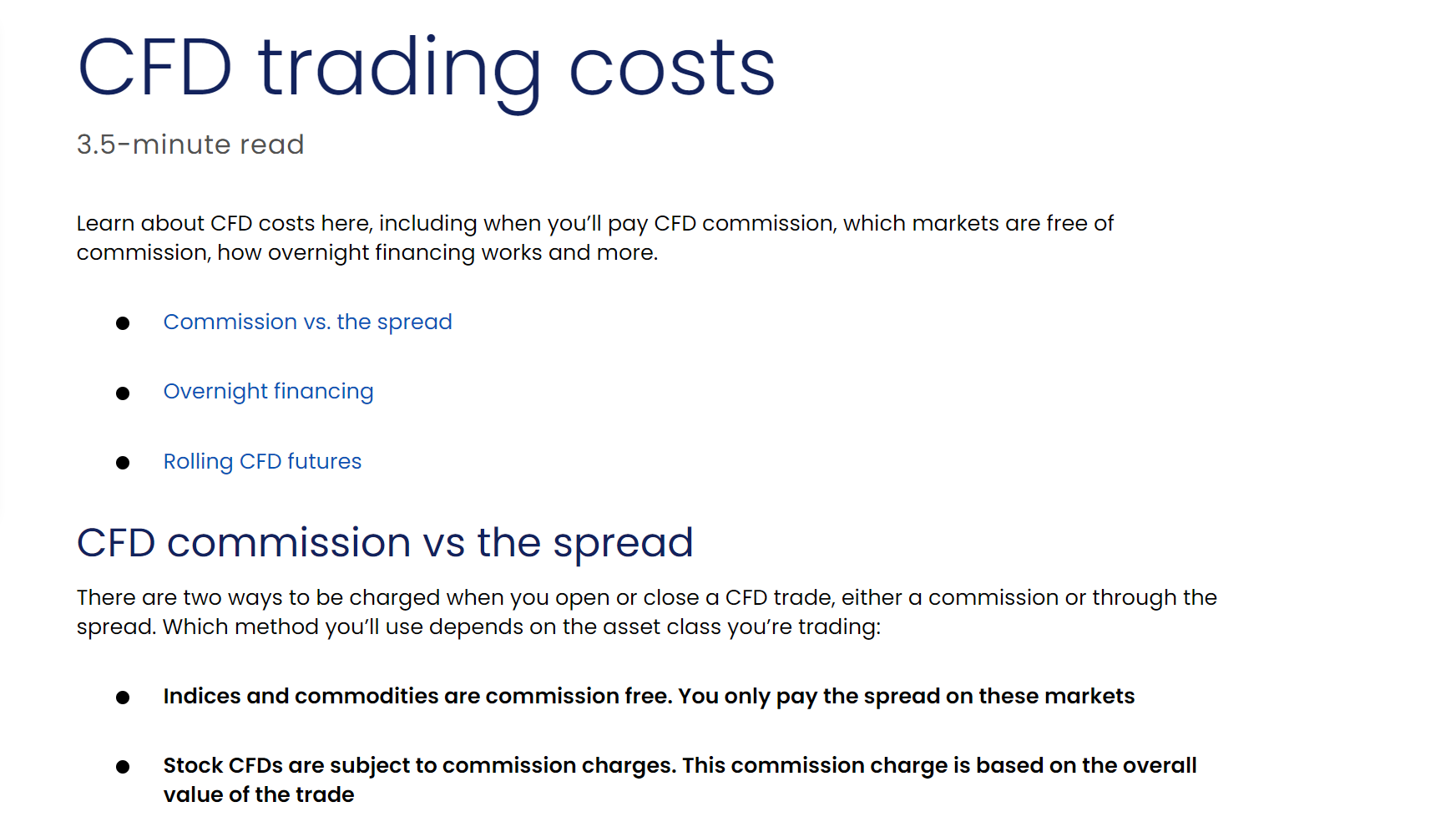

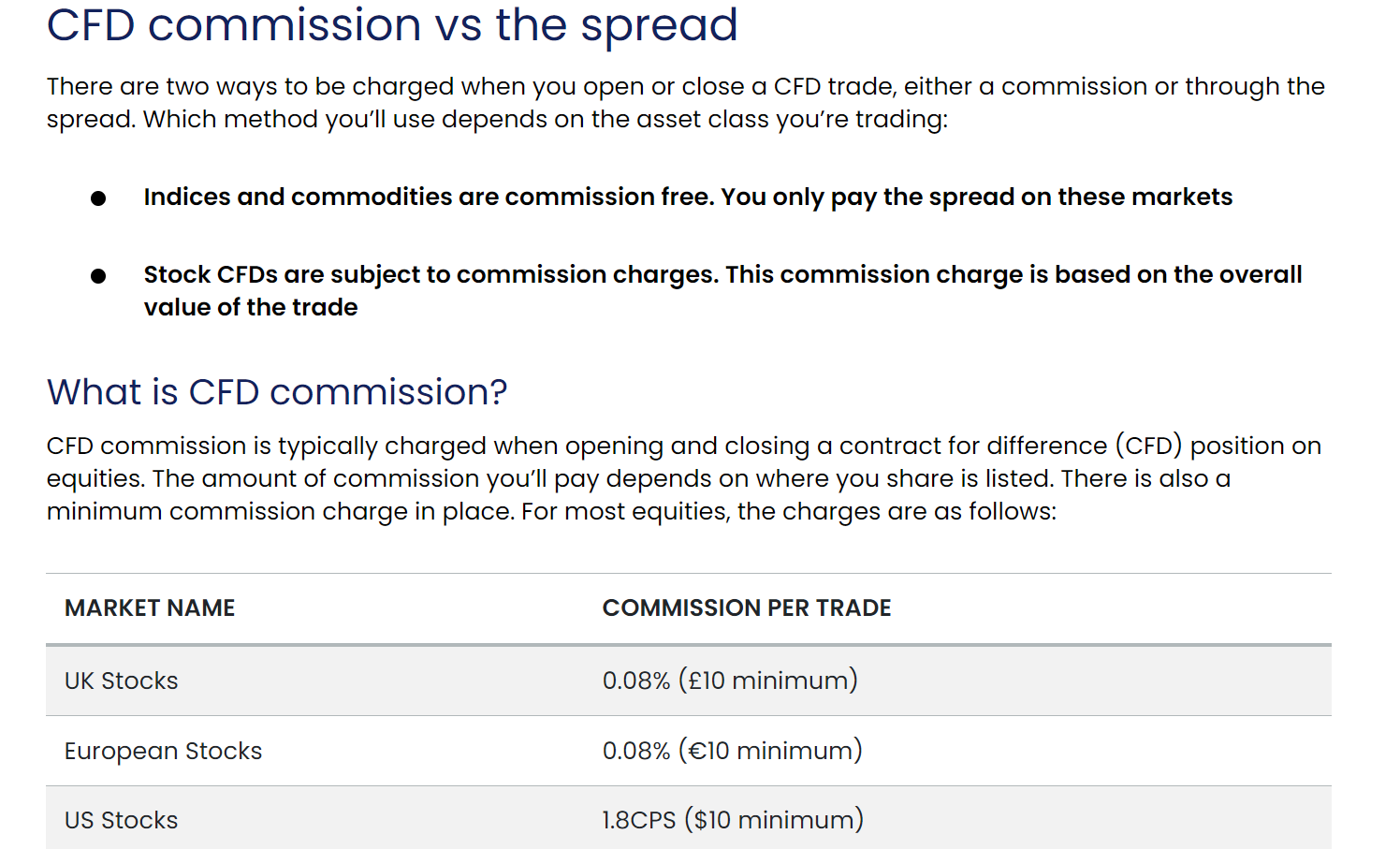

In regards to CFD trading, two types of fees can occur, either a commission or a charge within the spread. Notably, trades involving indices and commodities are not subject to commission, only the spread. However, for CFDs concerning stocks, a commission, calculated based on the overall trade value, is applied. Specifically, the commission rate for UK and European stocks is 0.80% per trade, while for US stocks, the rate is at 1.8 cents per share.

✅Where Forex.com shines:

• Flexible leverage rates for CFD trading, allowing traders to control larger positions with a smaller initial deposit.

• A series of useful risk management tools like stop orders and limit orders, allowing traders to manage and control their trading risks effectively.

• Globally regulated, a highly recognized broker, adding security for its clients.

• Robust trading platforms, coupled with VPS, ensure a smooth and high-effiency trading experience.

❌Where Forex.com shorts:

• Besides forex and CFDs, the product portfolio of Forex.com doesn't cover other popular assets like cryptos or bonds.

• Forex.com's stock CFD fees are higher compared to other brokers in the market.

• A fee of $15 per month is charged after no trading for 12 months.

⑤ XM

Best CFD broker for low-cost trading and diverse market access

|

|

| Broker | XM |

| Regulated by | ASIC, CySEC, FSC, DFSA, FSCA |

| Min. Deposit | $5 |

| Tradable Instruments | Forex, precious metals, stock derivatives, commodities, equity indices, energies |

| Trading Platforms | MT4, MT5 |

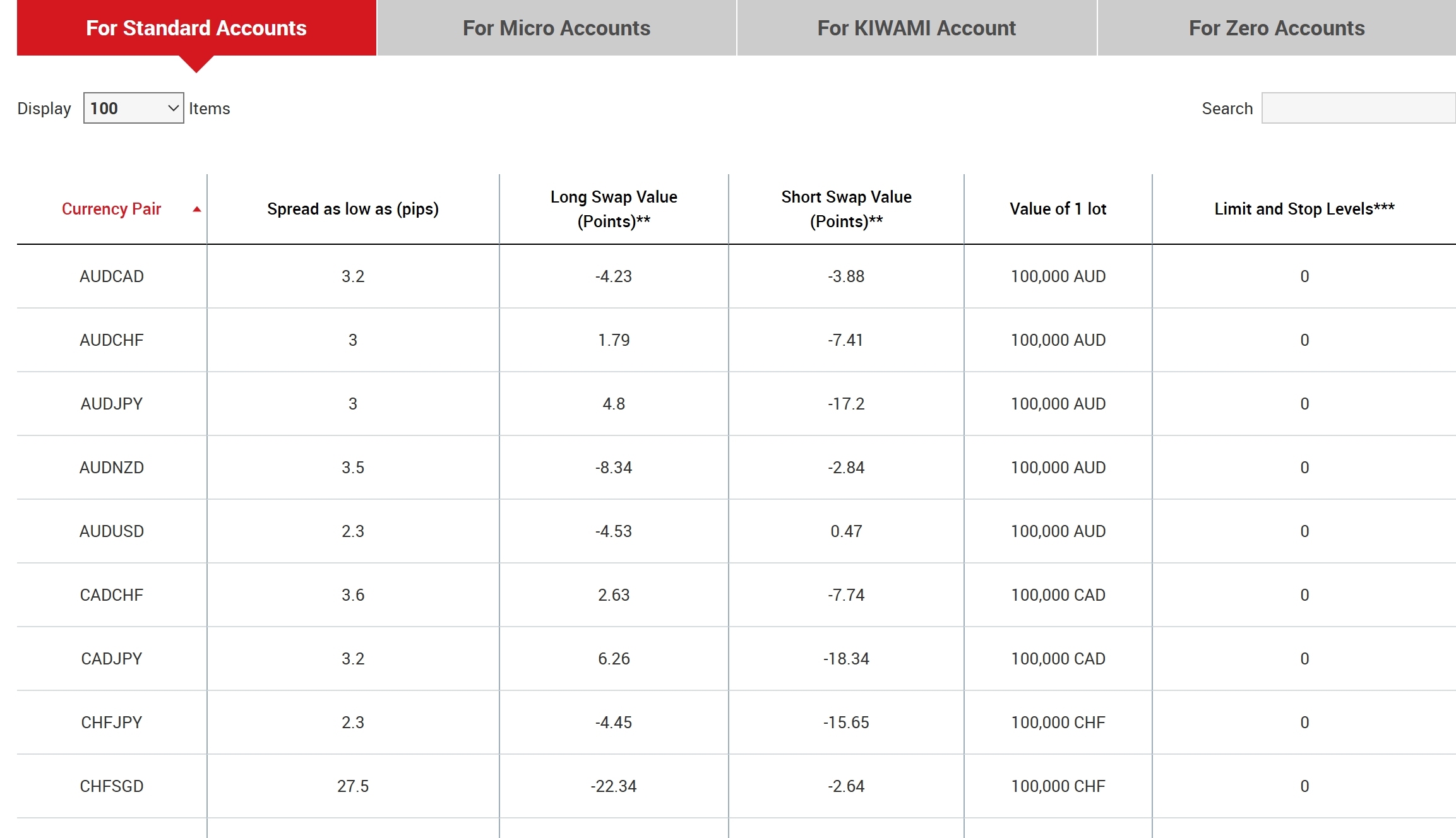

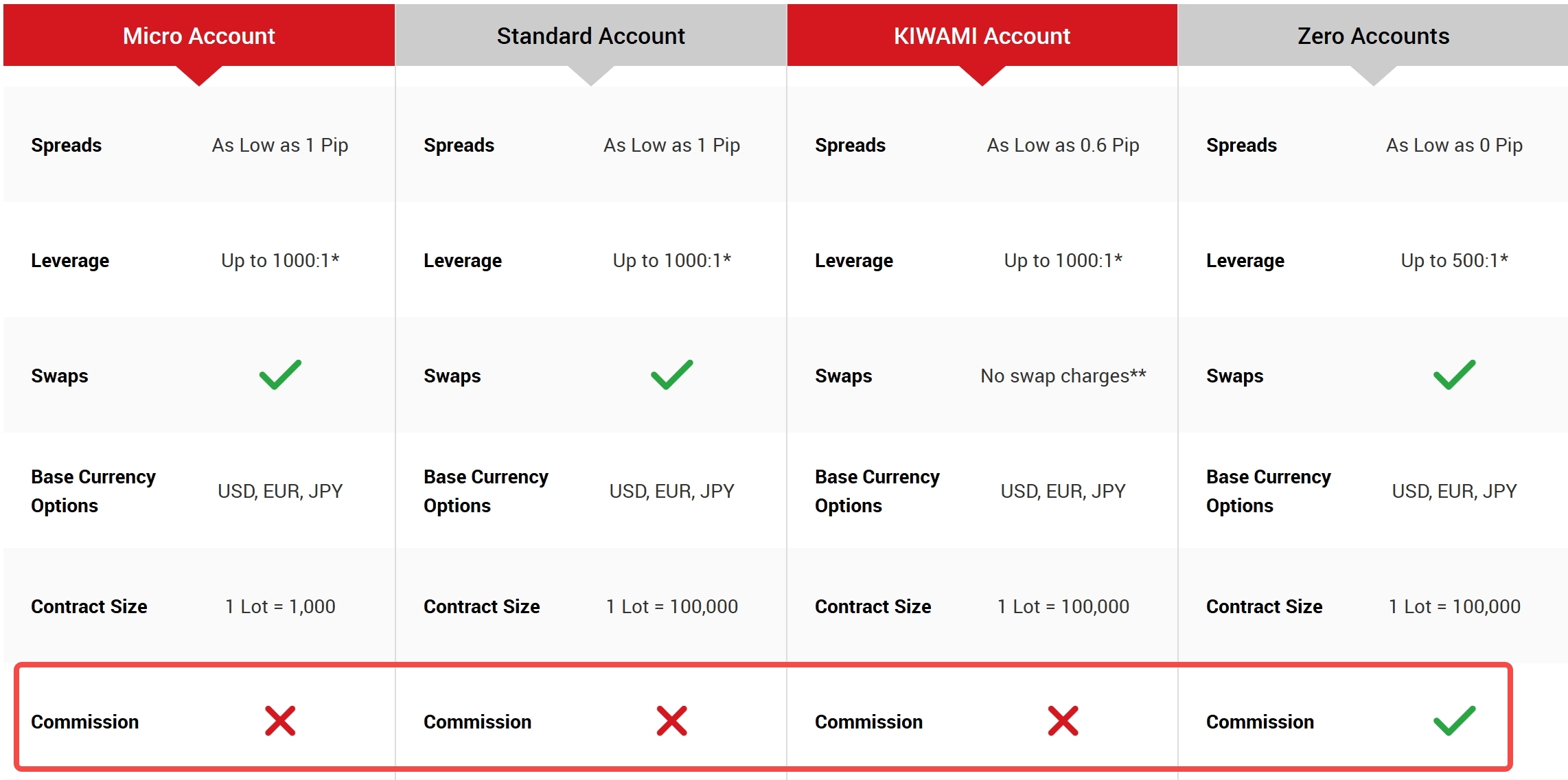

| CFD Trading Costs | From 1.6 pips on EUR/USD & commission-free (Standard account), positions held open overnight may be charged rollover interest |

| Demo Account | ✅ |

| Copy Trading | ❌ |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets |

| Customer Support | 5/24 |

XM is a highly reputable online broker founded in 2009, offering a wide range of trading instruments across global markets. With over 5 million clients in more than 190 countries, XM is known for its robust regulatory framework, being regulated by top-tier authorities such as ASIC, CySEC, and FSC. The broker is particularly favored for its user-friendly trading platforms, low deposit requirements, and a strong focus on client education. XMs customer support and transparent trading conditions have made it a popular choice for traders of all levels.

XM provides an extensive range of CFD instruments, covering over 1,000 markets. These include CFDs on forex, commodities, indices, stocks, metals, and energies. Spread varies on the account type and trading instruments, e.g., from 1.6 pips for EUR/USD pair on the Standard account. There are no commission charges for CFD trading on most account types except for the Zero account. Additionally, positions held open overnight may be charged rollover interest.

✅Where XM shines:

• Regulated by multiple authorities (ASIC, CySEC, FSC, DFSA, FSCA).

• $5 minimum deposit for all account types.

• Wide variety of CFD instruments (forex, commodities, stocks, etc.).

• Negative balance protection.

• Multiple platform support (MT4, MT5).

• Fast order execution and no re-quotes.

❌Where XM shorts:

• Limited offerings for professional traders with high leverage needs.

• Inactivity fees after 90 days of dormancy.

• No proprietary trading platform, relying on MT4 and MT5.

⑥ IC Markets Global

Best CFD brokers for dedicated customer service

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

CFDs on forex, commodities, indices, bonds, stocks, and futures, digital currencies |

Trading Platforms |

MT4, MT5, cTrader, TradingView |

CFD Trading Costs |

Spreads on EUR/USD pair from 0.0 pips, Apple CFD fees at $1.6, Euro Stoxx 50 index CFD fee at $3.0 |

Demo Account |

✅ |

Copy Trading |

✅ |

Payment Methods |

Credit/debit cards (MasterCard/Visa), PayPal, Neteller, Neteller VIP, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLI, Thai/Vietnamese Internet Banking, Rapidpay, Klarna |

Customer Support |

7/24 |

IC Markets, founded in 2007, is an established broker originating from Australia, offering an extensive range of tradable instruments, spanning CFDs on forex, commodities, indices, bonds, stocks, and futures, and digital currencies. The broker is well-known for its integration with popular trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, which are equipped with advanced tools and provide exceptional order execution. IC Markets customer service is both proficient and accessible around the clock via live chat, contact form, email, and phone. IC Markets enjoys a firm reputation among its forum of users for transparency, reliability, and competitive offerings.

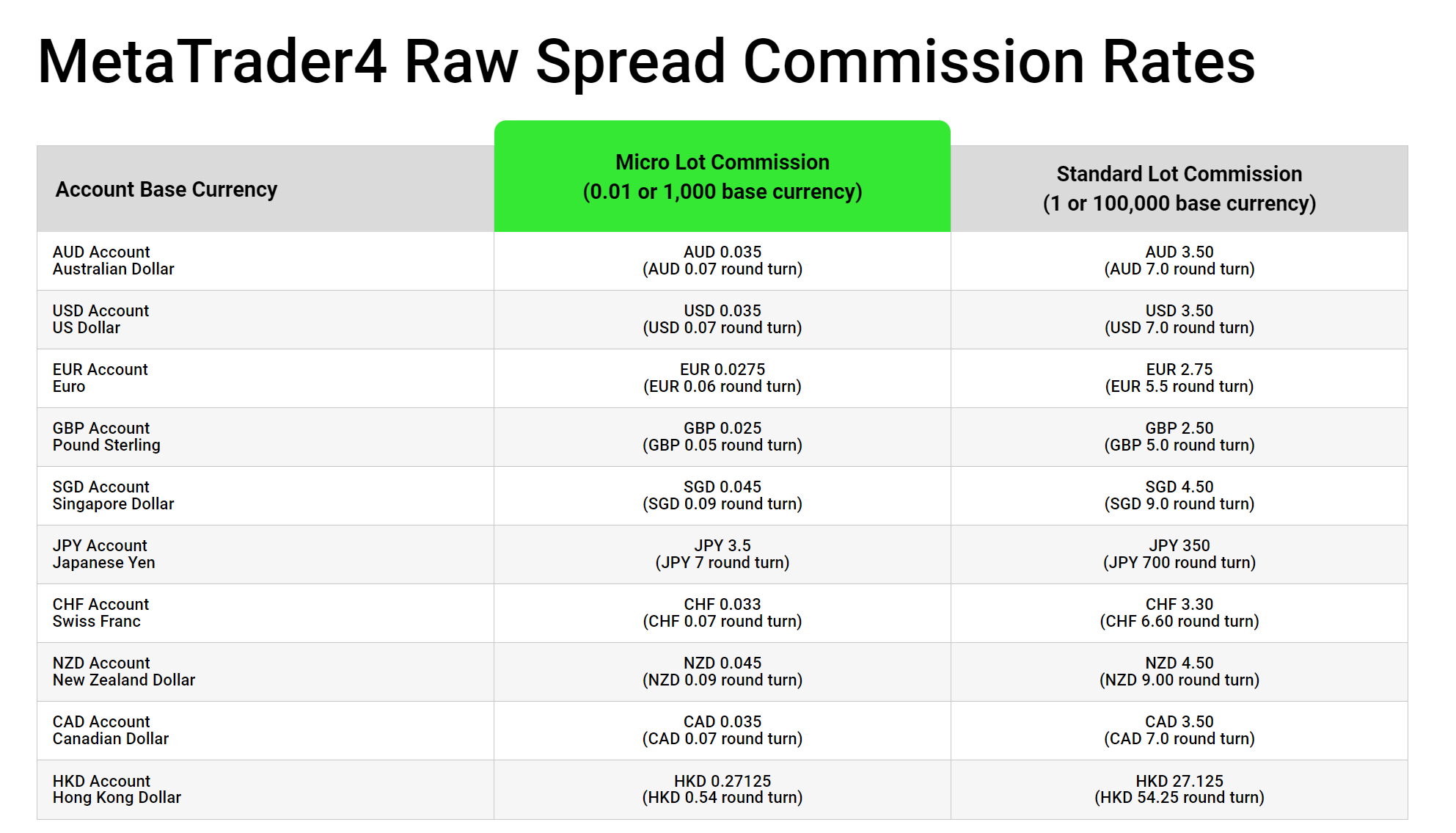

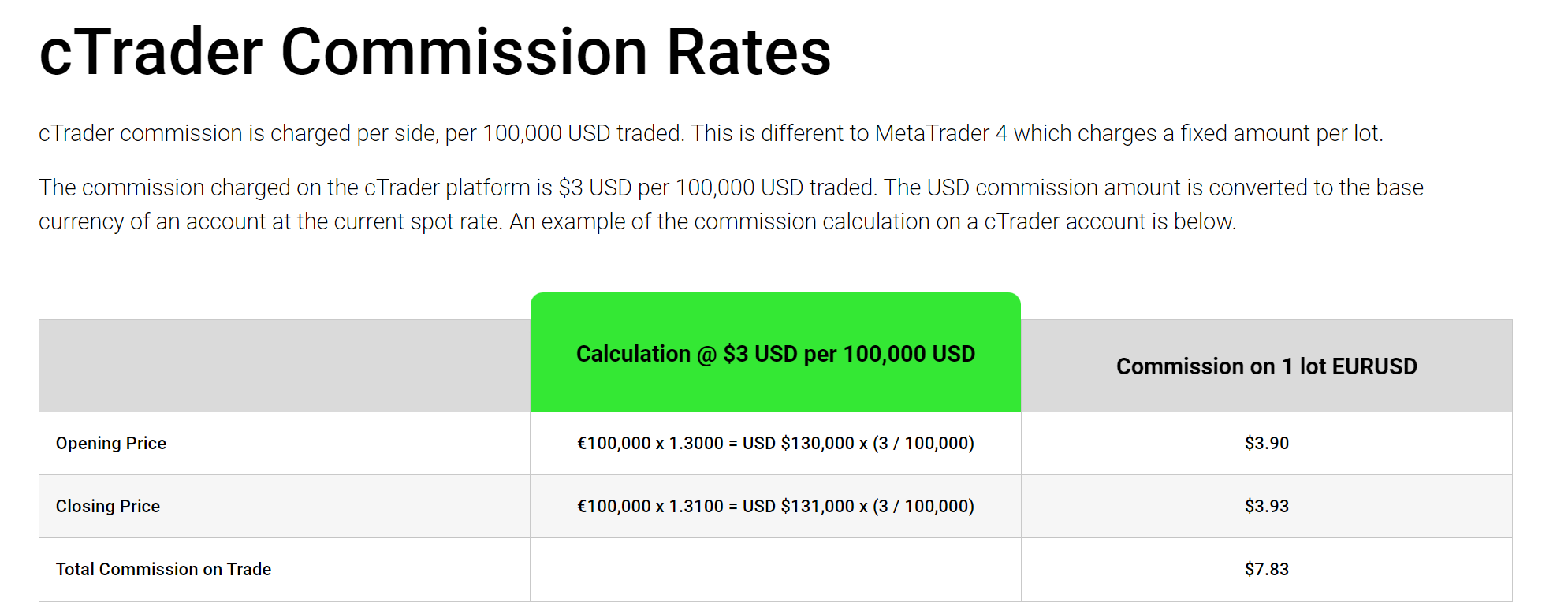

In terms of their CFD trading fees, IC Markets charge mainly via spreads and commissions, but trading fees are slightly vary depending tarding platforms. For example, the spreads begin at as low as 0.0 pips, with a commission charged at $3.0 for every lot traded on the cTrader platform. However, the commission fees are slightly higher when using the MetaTrader platform.

✅Where IC Markets shines:

• Imposing no restrictions on trading, including no restrictions on stop/limit levels.

• Partnering with top-tier liquidity providers, IC Markets is able to provide deep liquidity, ensuring trades are filled without significant slippage.

• Efficient and rapid order execution, on average less than 40 milliseconds owing to their superior technology.

• IC Markets delivers dependable, multilingual, 7/24 customer support.

• Competitive pricing applied on cTrader, with commission at $3 per lot per side.

• No inactivity fees charged, winning most brokers already.

❌Where IC Markets shorts:

• Spreads tend to be higher on the Standard account compared to the Raw Spread account.

• No Cent/Micro accounts designed for beginners, which may disappoint those who want to start small.

⑦ FP Markets

Best CFD Brokers for convenient and quick withdrawals

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 AUD or equivalent |

Tradable Instruments |

Forex, shares, metals, commodities, indices, digital currencies, bonds, ETFs |

Trading Platforms |

MT4, MT5, cTrader, TradingView, WebTrader, MT5 Mobile Trader |

CFD Trading Costs |

Raw acccount: spread from 0.0 pips, $3 commission per lot; Standard acccount: spreads from 1.0 pips, no commissions |

Demo Account |

✅(free for 30 days) |

Copy Trading |

✅ |

Payment Methods |

Credit/debit card (Visa, MasterCard), Bank Transfer, Crypto Payments, Cryptocurrency Solution (LetKnowPay), m2p crypto payments, Perfect Money, Skrill, AstroPay, Monetix Wallet, Neteller |

Customer Support |

7/24 |

FP Markets is a well-regarded online forex and CFD trading broker that was founded in 2005, strictly regulated by the Australian Securities and Investments Commission (ASIC), ensuring a safe and regulated trading atmosphere. FP Markets offers rich tradable instruments, giving traders large flexibility to trade on the international markets. Further, traders using FP Markets get access to globally recognized trading platforms such as MT4, MT5, cTrader, TradingView, WebTrader, and MT5 Mobile Trader. As a broker, FP Markets is not only recognized for its transparency but also its dedication to delivering an outstanding trading experience.

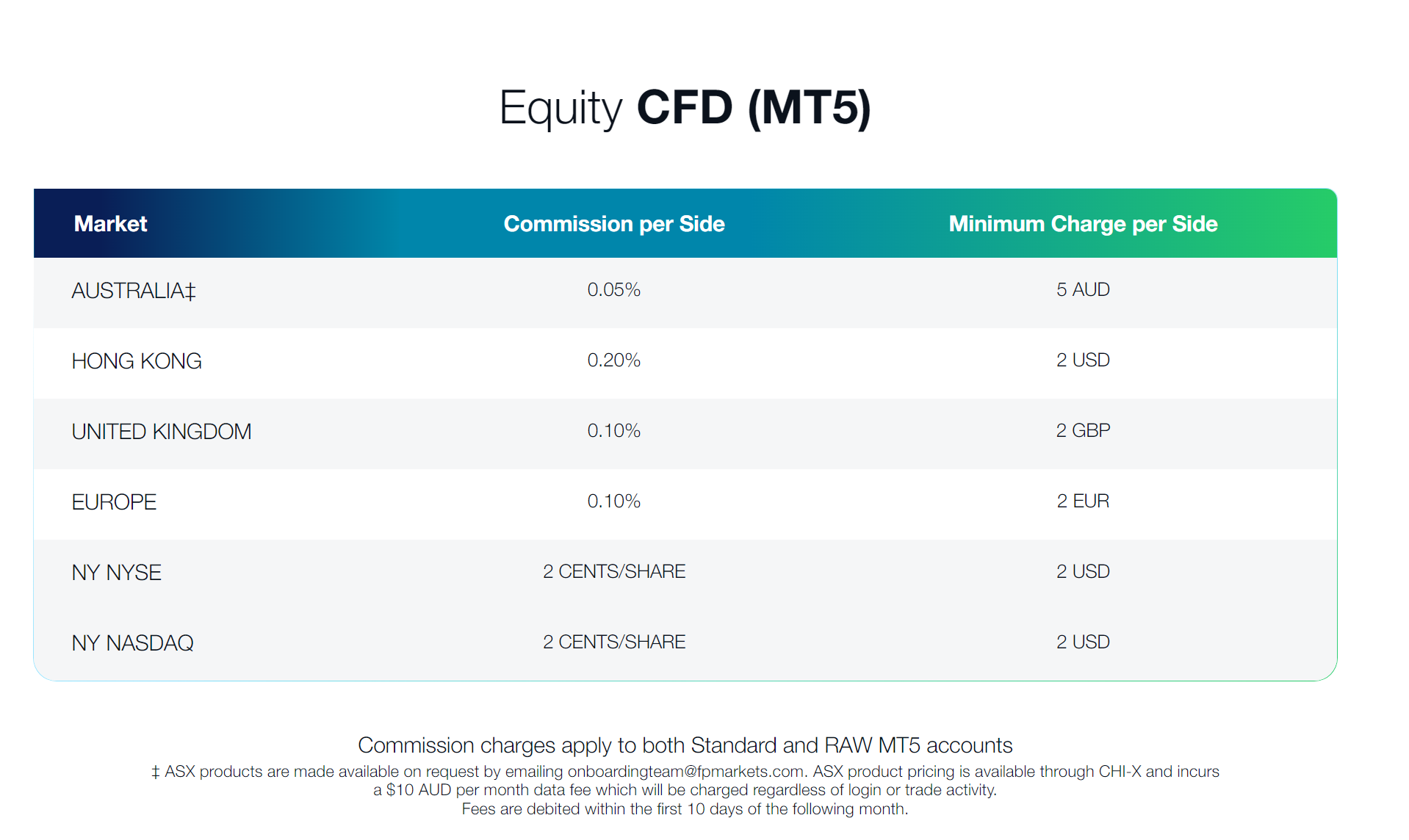

FP Markets' CFD selection is vast, covering forex, shares, metals, commodities, indices, digital currencies, bonds, and ETFs. In terms of trading fees, FP Markets Iress platform uses a Direct Market Access (DMA) pricing model for CFD Equities and Futures. For example, equity CFD trading comes with a low commission, with equities in the Australia Markets from 0.05% ( minimum charge per side at 5 AUD).

✅Where FP Markets shines:

• Vast CFD options, allowing traders to choose their preferred markets.

• Operating primarily on a spread and commission model that is competitive, offering cost-effective trading.

• Robust trading platforms including MT4, MT5, cTrader, TradingView, WebTrader, and MT5 Mobile Trader, renowned for their advanced charting capabilities, automated trading features.

• 7/24 responsive and multilingual customer support, available via phone, live chat, or email,professional help enhancing trading experience.

❌Where FP Markets shorts:

• For Iress Trader ViewPoint, there is a $60 monthly fee, including GST.

• The absence of promotional benefits may disappoint some traders.

• For newcomers to trading, the IRESS platform might seem complicated.

⑧ Pepperstone

Best CFD brokers for quick order execution, minimal slippages

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex, commodities, indices, currency indices, cryptocurrencies, shares, ETFs |

Trading Platforms |

MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform |

CFD Trading Costs |

Commissions vary by markets, for most US stocks, 1.8 cents per share, 0.08% for most UK, EU, and Asian stocks |

Demo Account |

✅ |

Copy Trading |

✅ |

Payment Methods |

Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT |

Customer Support |

7/24 |

Pepperstone is a leading online forex and CFD broker founded in 2010. The firm is headquartered in Australia and is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. Pepperstone offers a wide range of tradable instruments, including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs. The broker provides access to popular trading platforms including MT4, MT5, cTrader, TradingView, and Pepperstone Trading Platform. All three platforms are well-reputed for their speed, ease of use, and advanced trading capabilities, ensuring optimal order execution. Pepperstone customer support is highly responsive and available 24/7 via live chat and contact form. The broker is highly recognized for its transparency and commitment to providing a superior trading experience.

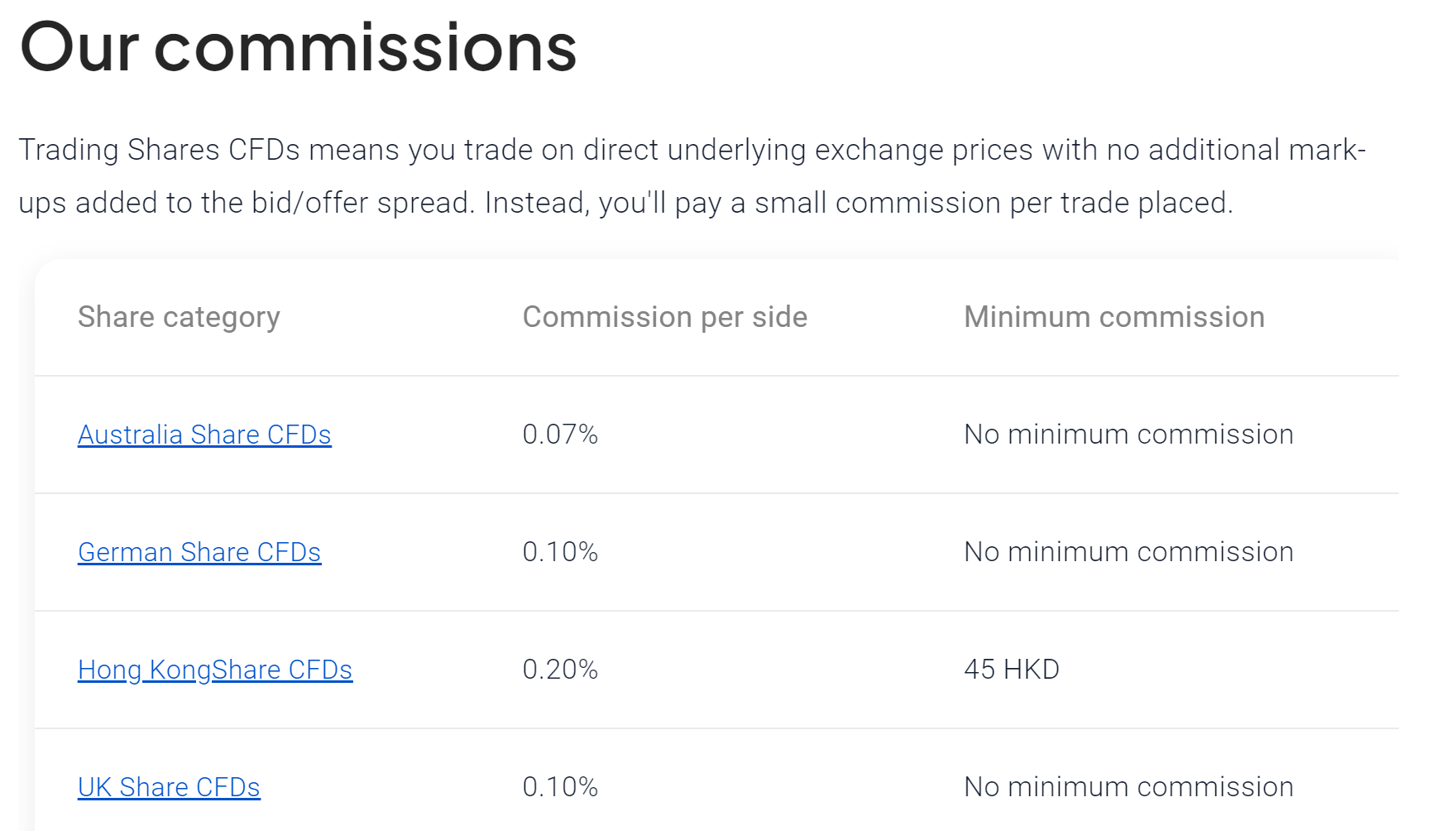

Pepperstone's CFD offerings cover a wide range of markets, which includes forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs. Regarding CFD trading fees, Pepperstone operates on a spread or commission basis. For example, if you are trading share CFDs, a percentage of commissions is applied, let's say, a commission of 0.07% per trade charged on the Australia Share CFDs, 0.10% charged on German Shares CFDs.

✅Where Pepperstone shines:

• Pepperstone ensures minimal slippage, thanks to their superior technology and robust servers.

• Compatible with automated trading systems and strategies, such as Expert Advisors on MetaTrader.

• Offering some of the industry's most competitive spreads, contributing to lower trading costs.

• Providing negative balance protection which safeguards clients from losing more than their account balance.

❌Where Pepperstone shorts:

• Limited account types, only Razor and Standard accounts.

Forex Trading Knowledge Questions and Answers

What is a CFD broker?

A CFD broker is a financial services brokerage that provides traders access to trade Contracts for Difference (CFDs). CFD brokers offer leveraged derivatives products that allow traders to speculate on the price movements of underlying financial assets like stocks, indices, commodities and currencies without taking ownership of the underlying assets. They earn revenue through spreads, commissions and financing charges on overnight positions. Reputable CFD brokers are regulated to provide oversight and protections for clients' funds. Trading CFDs through brokers involves significant risks due to the leverage involved.

What fees are charged by a CFD broker?

Spreads - This is the difference between the buy and sell price quoted for an instrument, essentially representing a broker's compensation on each trade. For example, if a broker quotes EUR/USD at 1.1250/1.1252, the 2 pip spread is their fee. The spread is considered an integral part of the overall cost structure and a key consideration for traders who want to optimize their trading costs.

Commission - A fixed per-trade commission, such as $5 per executed order, regardless of the trade size. Commissions, typically, are applied to add trading costs when traders are offered raw spreads. For example, FP Markets's raw account offers spreads from 0.0 pips, yet charging a commission at $3.5 per lot traded.

Overnight Fees - Charged to keep a position open beyond the daily market close. For example, a 2% annualized overnight fee means a 2% fee charged on the position value for holding a trade overnight. Most CFD brokers impose overnight fees, therefore, it can be an additional cost for traders.

Inactivity Fees - These fees refer to a certain fixed amount that a broker charges to maintain client accounts that have not executed any trades for a defined period. For instance, a broker may levy a fee of $10 per month after an account has been inactive, meaning no trades have been executed, for a period of 6 months. This is a common practice amongst brokers to offset the administrative costs associated with maintaining these inactive accounts.

How are CFDs different from forex?

CFDs allow traders to speculate on the price movements of stocks, indices, commodities and currencies. With CFDs, you never actually own the underlying asset, you are simply speculating on price movements. Forex trading involves buying and selling currencies, with the aim of profiting from favorable exchange rates. With CFDs, you can trade on margin, meaning you only put down a small deposit (margin) to gain exposure to a much larger position size. With forex, margin trading is also available, but generally margin requirements are lower compared to CFDs. Additionally, CFDs provide exposure to a wider range of markets compared to forex, but they involve higher trading costs in the form of wider spreads and overnight financing. Forex offers exposure solely to currency markets, but may have lower trading costs. Both CFD and forex trading involve leverage and thus have inherent risks.

Is CFD trading profitable?

Yes, CFD trading can be profitable for traders who have the appropriate skills, knowledge, risk management approach, and discipline. However, it is a complex instrument with significant risks, and consistently generating profits is quite difficult. Many traders lose money trading CFDs due to factors like overleveraging, lack of risk management, acting on emotion, or not having a strategic trading plan. Profitability requires strong analytical skills, an edge in the markets, discipline to follow a trading system, and the ability to manage trading risks. With proper education, practice, and rational trading strategies, some traders are able to trade CFDs profitably over the long run. But like any leveraged trading, profits are never guaranteed.

Is CFD trading good for beginners?

No, CFD trading is generally not a good idea for beginners. The high leverage, complexity, and risks involved make it an inappropriate instrument for those new to trading. Beginners are better off starting with regular stocks, forex, or other assets using little or no leverage initially. CFDs should only be considered after one has gained extensive trading experience and knowledge, as they require a higher level of risk management that most beginners do not yet possess.

What leverage is available with CFD forex brokers?

The leverage commonly available with CFD forex brokers ranges from 1:5 up to 1:500. Most brokers offer a maximum of 1:30 baseline leverage, while some may provide up to 1:500 or even higher. However, leverage above 1:50 is considered extremely risky. Traders should use leverage prudently based on their capital and risk management abilities, as higher leverage can lead to amplified losses if not used properly.

How does trading forex CFDs differ from spot forex?

Leverage

With CFD forex you could use 1:30 leverage or even up to 1:500 leverage depending on the broker. Spot forex has lower fixed leverage limits, such as 1:50.

Financing fees

If you hold a CFD forex position overnight, you pay a daily financing fee. There are no financing fees for spot forex trades.

Spreads

CFD forex spreads are often wider, like 3 pips for EUR/USD, due to broker fees. Spot forex spreads are narrower, such as 1 pip for EUR/USD.

Expiry

CFD forex positions remain open until you close them. Spot forex positions expire at 5pm New York time and need to be rolled over daily.

Slippage

Entering or exiting CFD forex trades can involve slippage in volatile markets as you are trading the derivative. Spot forex has little slippage in normal conditions.

So in summary, with CFD forex you are trading a derivative product provided by a broker, while spot forex involves direct currency trading in the interbank market. This leads to differences in leverage, fees, spreads, and expiry.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers. We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities, boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

Best Binary Options Brokers in 2026

Best Bitcoin Brokers for 2026

The text discusses Bitcoin brokers' role and criteria for selecting the top providers, emphasizing their key functionalities.

7 Best Crypto Brokers in 2026

Examine the top 5 futures trading platforms , considering user experience, tradable assets, educational resources, commissions, and more.

10 Best Forex Brokers for Professional Traders in 2026

Discover the '10 Best Forex Brokers for Professional Traders', your ultimate guide to thriving in the forex market.