Score

TDFX

Australia|2-5 years|

Australia|2-5 years| https://tiandinglimited.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

+852 5226 7054

Other ways of contact

Broker Information

More

TDFX INVESTMENT LIMITED

TDFX

Australia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

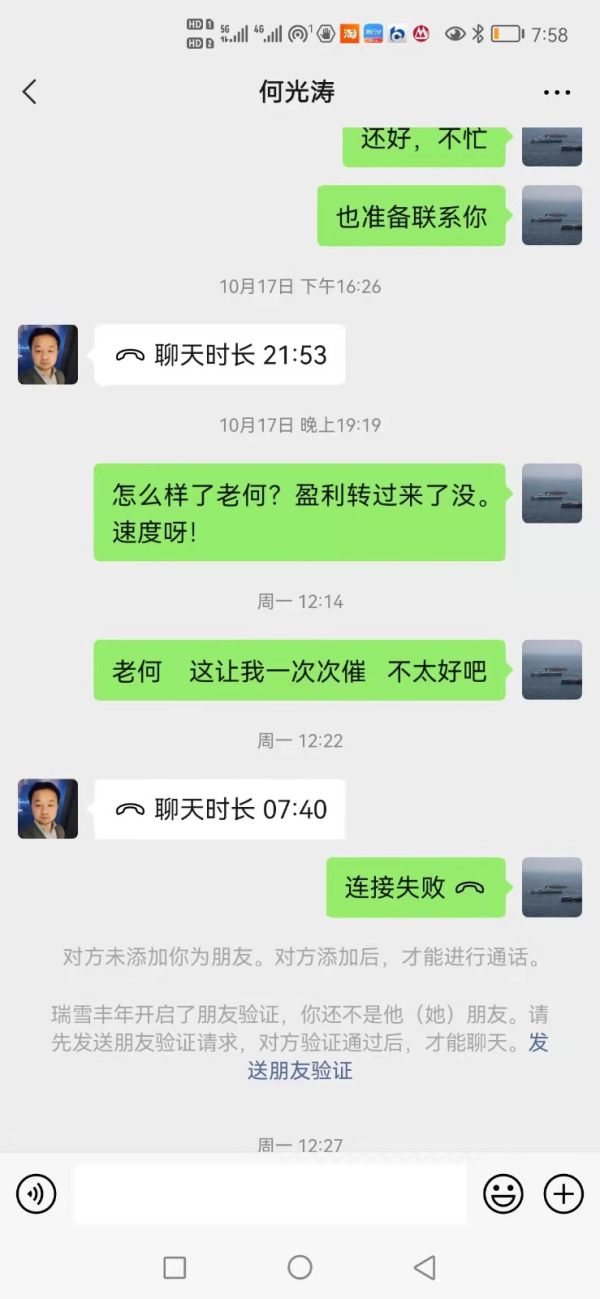

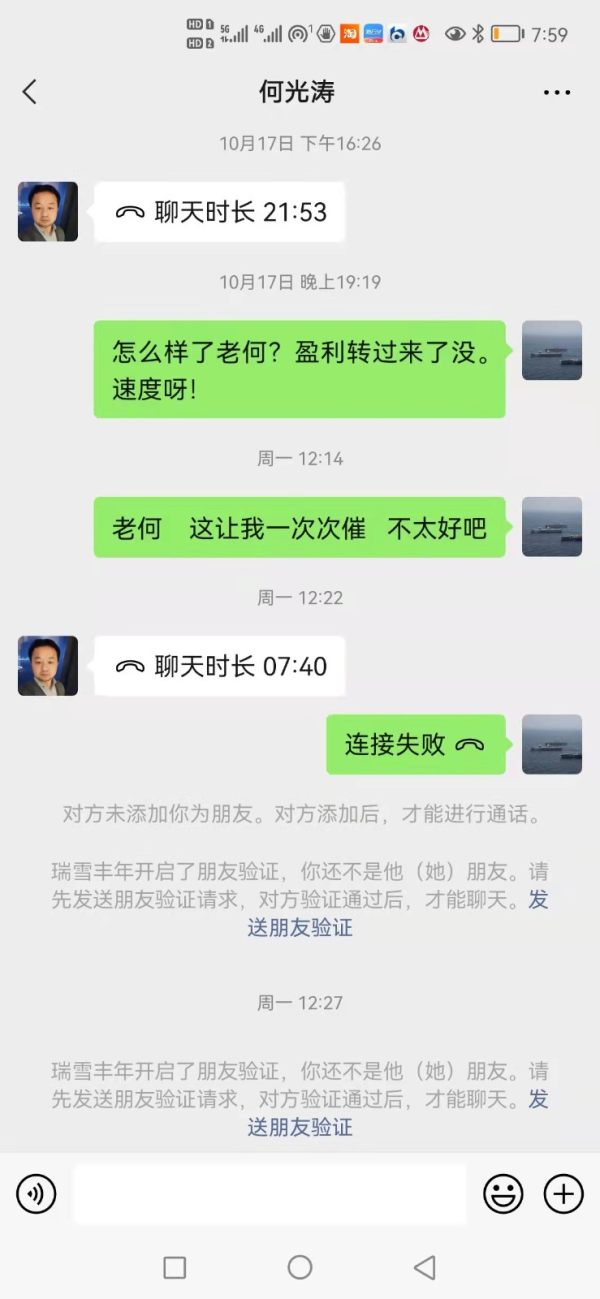

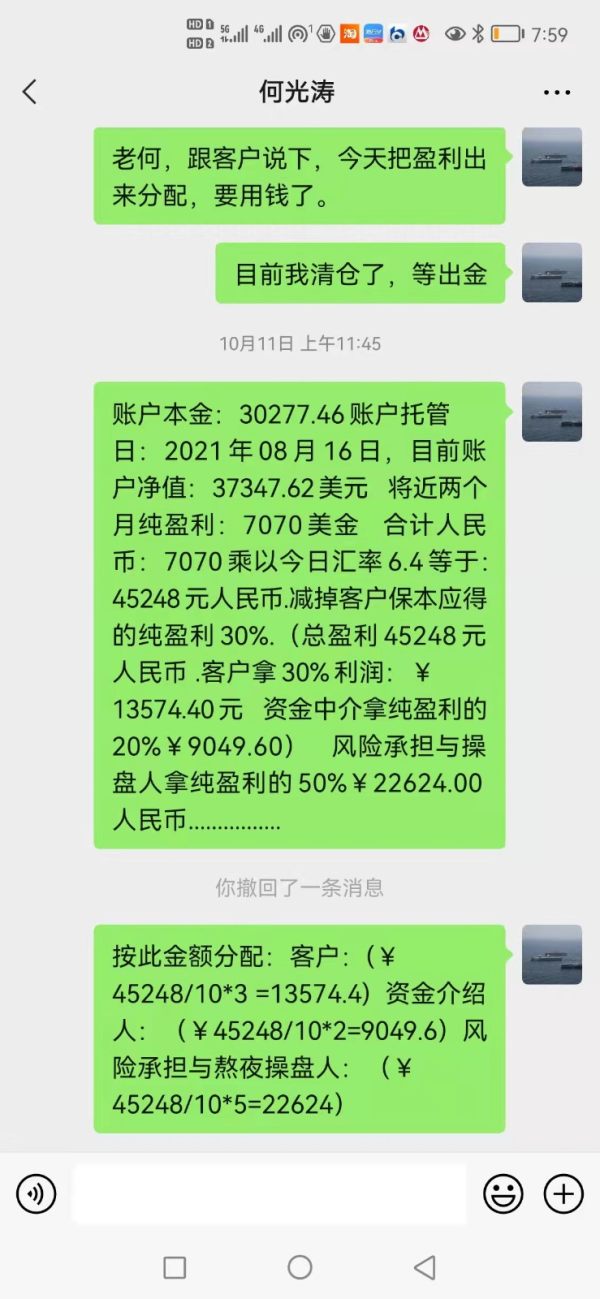

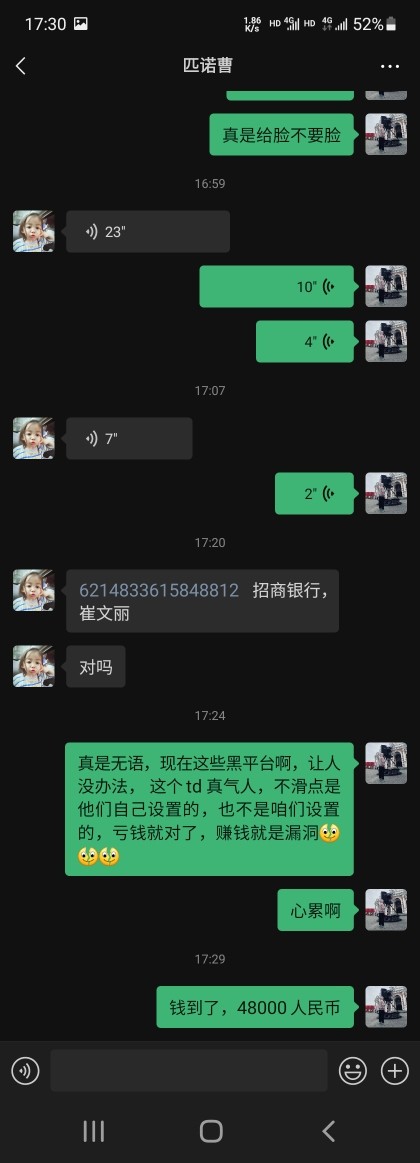

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- AustraliaASIC (license number: 001287717) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

WikiFX Verification

Users who viewed TDFX also viewed..

XM

CPT Markets

ATFX

IUX

TDFX · Company Summary

| Aspect | Information |

| Company Name | TDFX |

| Registered Country/Area | Australia |

| Founded Year | 2-5 years |

| Regulation | Unregulated |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:500 |

| Spreads | starting from 0.01 pips |

| Trading Platforms | TDFX Web, TDFX Mobile (Android and iOS), MetaTrader 4, MetaTrader 5 |

| Tradable Assets | Forex, Metals, Indices, Energies, Cryptocurrencies |

| Account Types | Standard Account, ECN Account, VIP Account |

| Demo Account | Yes |

| Customer Support | contact number: +852 5226 7054, Email: support@tiandinglimited.com |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Card, E-wallets, Cryptocurrencies |

| Educational Resources | TDFX Academy, Trading Guides, Glossary, Daily Market Analysis, and Webinars |

Overview of TDFX

Established in Australia, TDFX is a forex and cryptocurrency broker that caters to traders of all experience levels. With a minimum deposit of $100 and maximum leverage of 1:500, TDFX offers competitive trading conditions on a wide range of instruments, including forex, metals, indices, energies, and cryptocurrencies.

Traders can choose from a variety of account types to suit their needs, including Standard Account, ECN Account, and VIP Account. Each account type offers different features and benefits, such as tighter spreads, faster execution speeds, and personalized customer support.

TDFX is committed to providing its clients with the tools and resources they need to succeed in the markets. The broker offers a comprehensive range of educational resources, including TDFX Academy, Trading Guides, Glossary, Daily Market Analysis, and Webinars. Additionally, TDFX provides 24/7 customer support in multiple languages.

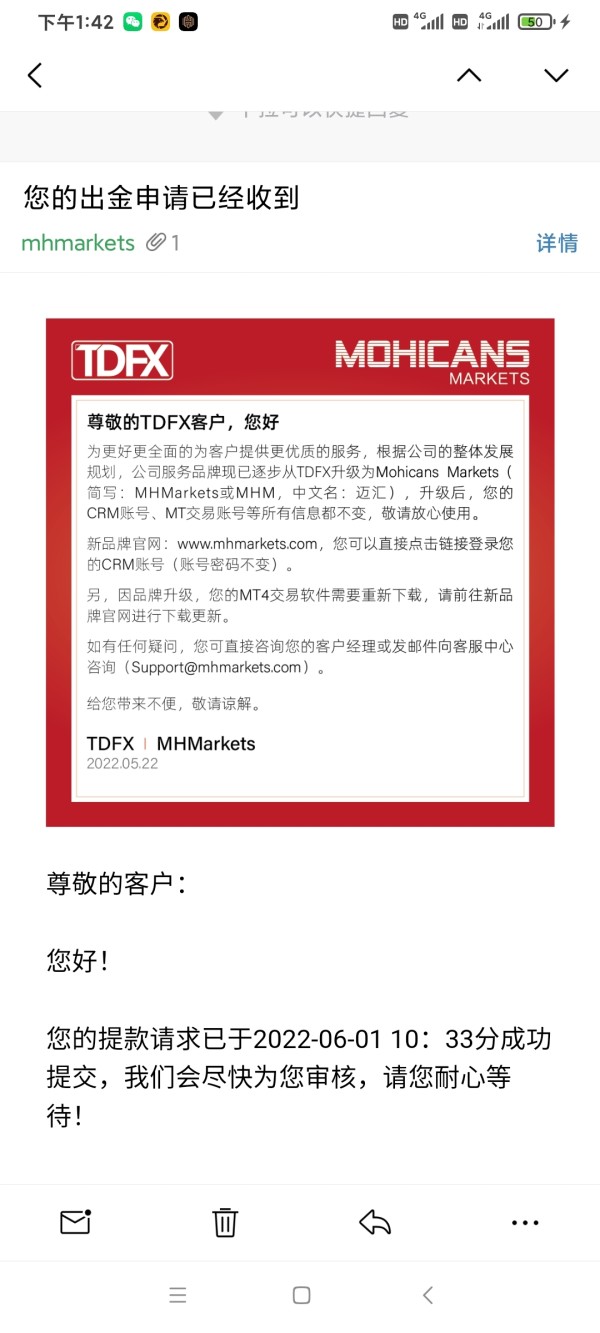

Regulatory Status

TDFX operates as an unregulated trading platform, meaning it does not fall under the oversight of any financial regulatory authority. Traders and investors should be aware that the absence of regulatory supervision may entail additional risk.

In unregulated environments, clients may have limited recourse and protection in the event of disputes or unforeseen issues. It's essential for individuals considering TDFX to exercise caution and carefully assess their risk tolerance when engaging with an unregulated broker.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | Limited regulation |

| Competitive trading conditions | High maximum leverage |

| Diverse account types | Varying withdrawal fees |

| User-friendly trading platforms | Limited customer support languages |

| Comprehensive educational resources | Lack of advanced trading tools |

Pros of TDFX:

Wide range of tradable assets: TDFX offers a comprehensive selection of trading instruments, including forex pairs, metals, indices, energies, and cryptocurrencies. This diversification caters to traders with varying interests and risk appetites.

Competitive trading conditions: TDFX provides competitive spreads, starting from 0.01 pips, and flexible leverage options, ranging from 1:1 to 1:500. These conditions allow traders to implement various trading strategies effectively.

Diverse account types: TDFX offers three account types – Standard Account, ECN Account, and VIP Account – to suit different trading styles and preferences. Each account type provides unique benefits, such as tighter spreads, faster execution speeds, and personalized support.

User-friendly trading platforms: TDFX offers a variety of trading platforms, including TDFX Web, TDFX Mobile, MetaTrader 4, and MetaTrader 5. These platforms provide a user-friendly interface and robust charting tools to support informed trading decisions.

Comprehensive educational resources: TDFX is committed to educating its clients, offering a range of resources, including TDFX Academy, Trading Guides, Glossary, Daily Market Analysis, and Webinars. These resources empower traders to enhance their knowledge and skills.

Cons of TDFX:

Limited regulation: TDFX is not regulated by any major financial authority, which may raise concerns among some traders regarding the security of their funds and the broker's adherence to fair trading practices.

High maximum leverage: While high leverage can amplify profits, it also magnifies losses. TDFX's maximum leverage of 1:500 may pose significant risks for inexperienced traders who may not fully understand the potential consequences of leveraged trading.

Varying withdrawal fees: TDFX charges different withdrawal fees depending on the withdrawal method, which may add to the overall trading costs. It's important to factor in these fees when choosing a withdrawal method.

Limited customer support languages: While TDFX offers 24/7 customer support, the availability of support in multiple languages may be limited, potentially hindering communication for non-English speakers.

Lack of advanced trading tools: While TDFX provides basic charting tools and technical indicators, it may lack more sophisticated tools and functionalities that experienced traders may require for complex trading strategies.

Market Instruments

TDFX provides a diverse range of tradable assets, catering to various investment preferences. Traders on the platform can access the following categories of assets:

Forex: Engage in the dynamic foreign exchange market with TDFX, offering a wide array of major and exotic currency pairs for comprehensive trading opportunities.

Metals: Speculate on precious metals such as gold and platinum, leveraging market fluctuations during periods of volatility for potential returns.

Indices: Trade on leading global indices like FTSE 100, DAX 30, and NIKKEI 225 without the need for in-depth analysis of individual stocks.

Energies: TDFX enables trading on global energy markets, including popular commodities such as WTI and Brent Crude, providing exposure to this sector's opportunities.

Cryptocurrencies: Explore the world of digital assets with TDFX, offering the ability to buy, sell, and trade a variety of cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, and more.This comprehensive selection of tradable assets ensures that traders have a broad spectrum of investment instruments to diversify their portfolios and navigate different financial markets.

Account Types

TDFX offers two types of trading accounts: Standard Account, ECN Account, VIP Account. All accounts offer attractive trading conditions and provide a wide range of base currencies to suit the preferences of different traders.

Traders can select the account type that aligns with their trading strategy and enjoy competitive spreads and high leverage for enhanced trading opportunities.

| Account Type | Minimum Deposit | Spreads | Leverage | Features |

| Standard Account | $0 | Starting from 0.01 pips | 1:1 - 1:500 | Access to all TDFX trading platforms |

| ECN Account | $1,000 | Direct market access (DMA) for tightest spreads | Fastest execution speeds | Access to advanced trading tools |

| VIP Account | $10,000 | All features of the ECN Account | Personalized customer support | Exclusive trading signals |

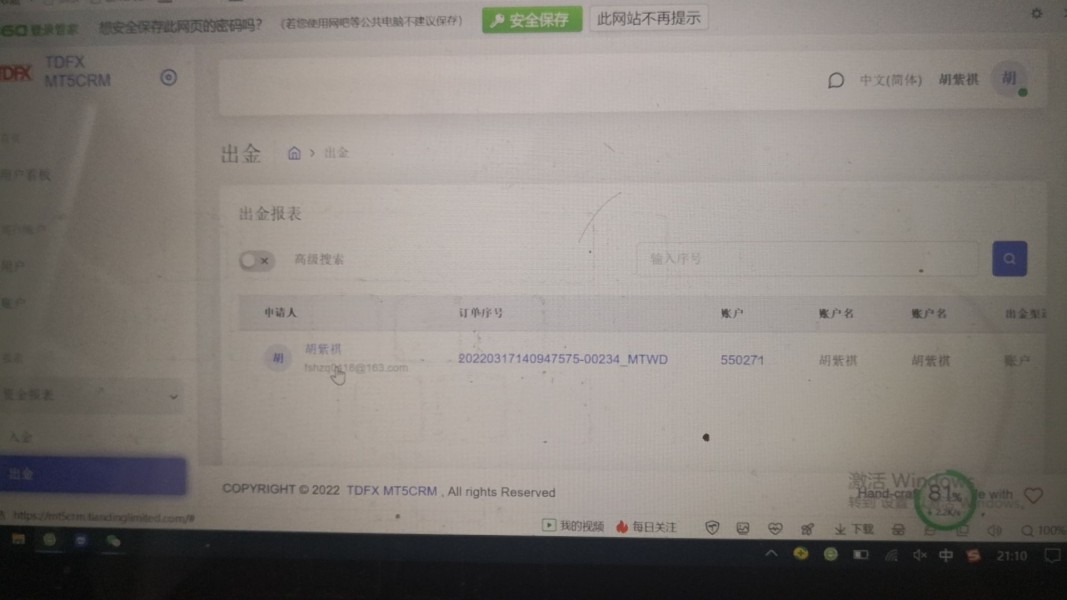

How to Open an Account?

Opening an account with TDFX is a straightforward process that can be completed in a few simple steps. Here's a step-by-step guide on how to open an account with TDFX:

Step 1: Visit the TDFX Website

Begin by navigating to the official TDFX website. Once you reach the homepage, locate the “Open Account” button, typically situated in the top right corner of the page. Clicking this button will initiate the account opening process.

Step 2: Complete the Registration Form

Upon clicking the “Open Account” button, you'll be directed to a registration form. Carefully fill out the form with accurate personal information, including your full name, email address, phone number, and country of residence. Ensure that all details are entered correctly to avoid any delays in processing your application.

Step 3: Verify Your IdentityTDFX adheres to strict regulatory requirements and requires identity verification to ensure the security of its clients' funds. As part of the account opening process, you'll be prompted to upload copies of valid identification documents, such as a passport or driver's license. This step is crucial for preventing fraudulent activities and maintaining the integrity of the trading platform.

Step 4: Make an Initial DepositOnce your identity verification is complete, you'll need to make an initial deposit to activate your trading account. TDFX offers a variety of convenient deposit methods, including credit/debit cards, bank transfers, and e-wallets. Choose the method that best suits your preferences and proceed with the deposit process.

Leverage

TDFX offers up to 1:500 leverage on all account types. Leverage allows traders to control a larger position size with a smaller amount of margin. For example, if you have a leverage of 1:100, you can control a position of $50,000 with a deposit of $100.

Leverage can amplify your profits, but it can also amplify your losses. It is important to use leverage wisely and to understand the risks involved.

Spreads & Commissions

TDFX offers competitive spreads across a wide range of trading instruments, including forex, metals, indices, energies, and cryptocurrencies. Spreads are variable and can change depending on market conditions, but they typically start from 0.01 pips for forex pairs and 0.1 pips for metals.

TDFX does not charge any additional fees for trading, including commissions, account management fees, or inactivity fees.

| Account Type | Minimum Deposit | Spreads |

| Standard Account | $0 | Starting from 0.01 pips |

| ECN Account | $1,000 | Direct market access (DMA) for tightest spreads |

| VIP Account | $10,000 | All features of the ECN Account |

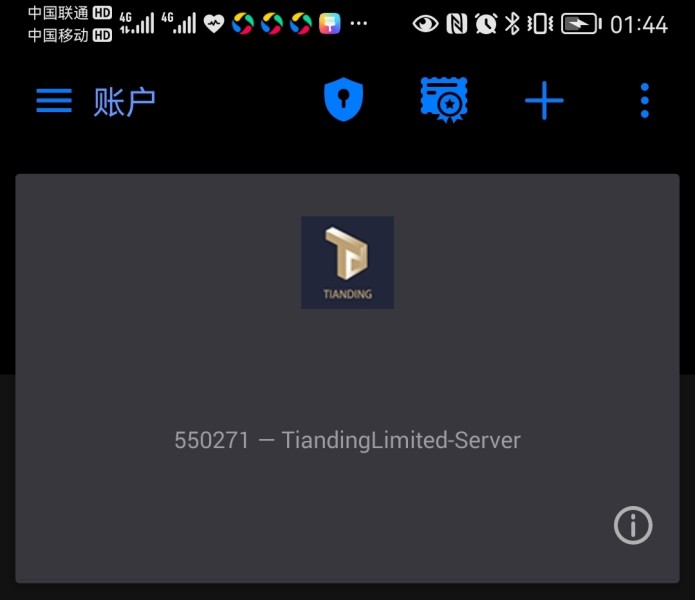

Trading Platform

TDFX provides a versatile array of trading platforms to accommodate the preferences of diverse traders:

TDFX Web: The TDFX Web platform offers traders a convenient and accessible way to engage in online trading directly through their web browsers. With user-friendly interfaces and a comprehensive set of features, the web platform ensures a seamless trading experience.

TDFX Mobile (Android and iOS): TDFX Mobile caters to traders on the go, offering dedicated applications for both Android and iOS devices. These mobile platforms empower users to trade anytime, anywhere, providing real-time market access, account management, and a host of trading tools in the palm of their hands.

MetaTrader 4: TDFX integrates the widely acclaimed MetaTrader 4 (MT4) platform, known for its robust functionality and user-friendly interface. MT4 offers advanced charting tools, technical analysis features, automated trading capabilities, and a vast library of plugins and expert advisors.

MetaTrader 5: The MetaTrader 5 (MT5) platform, available at TDFX, represents a comprehensive upgrade, introducing additional features and asset classes compared to its predecessor. MT5 provides enhanced charting tools, algorithmic trading options, and an extended range of financial instruments.

By offering a range of platforms, TDFX ensures that traders can choose the one that best aligns with their preferences and trading requirements. Whether through web-based interfaces, mobile apps, or industry-standard MetaTrader platforms, TDFX aims to provide a versatile and inclusive trading environment.

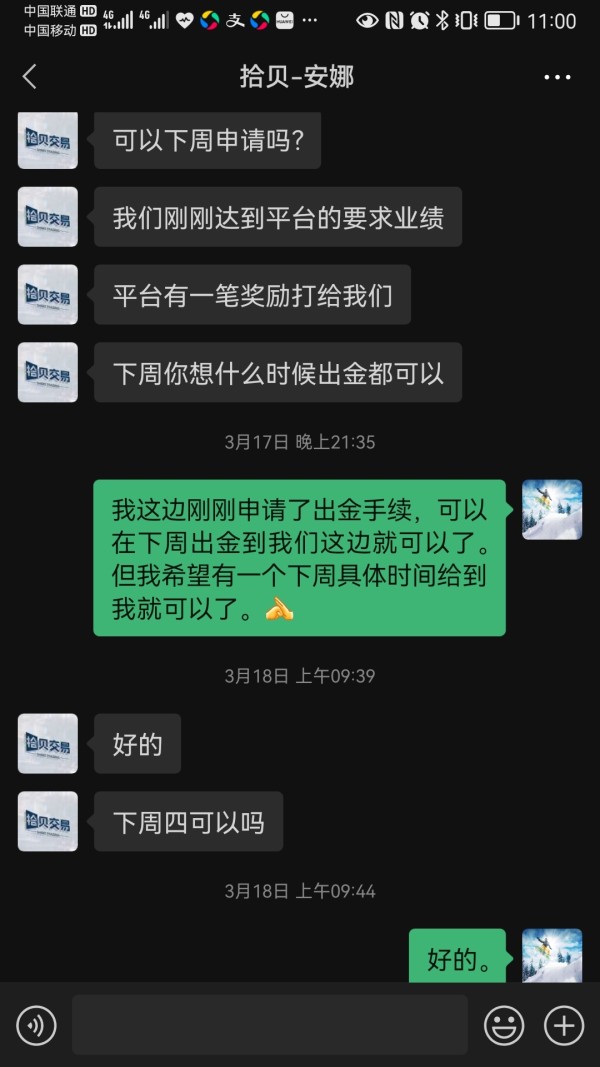

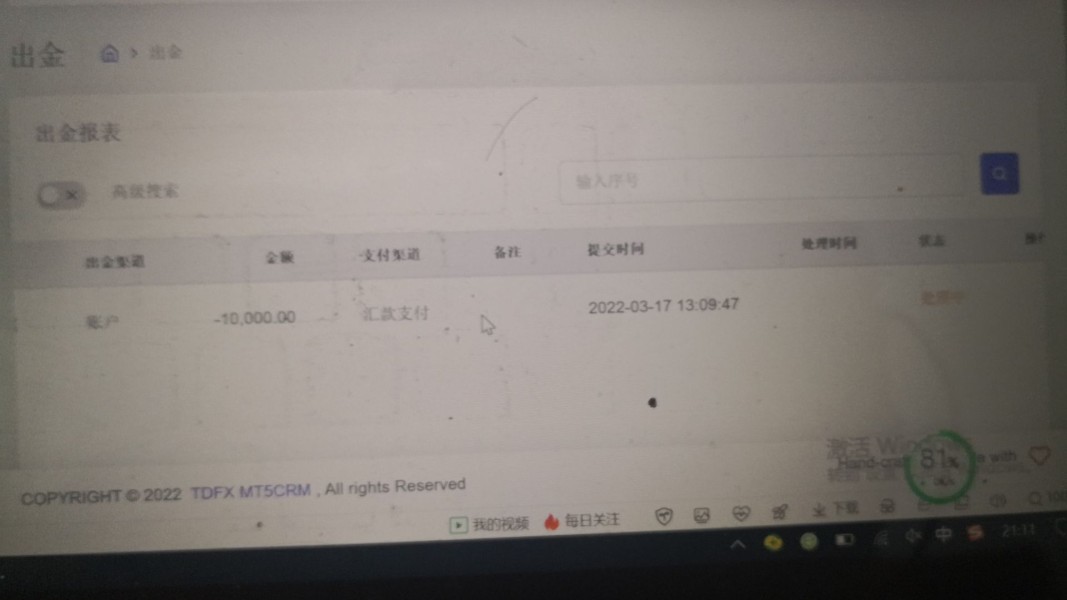

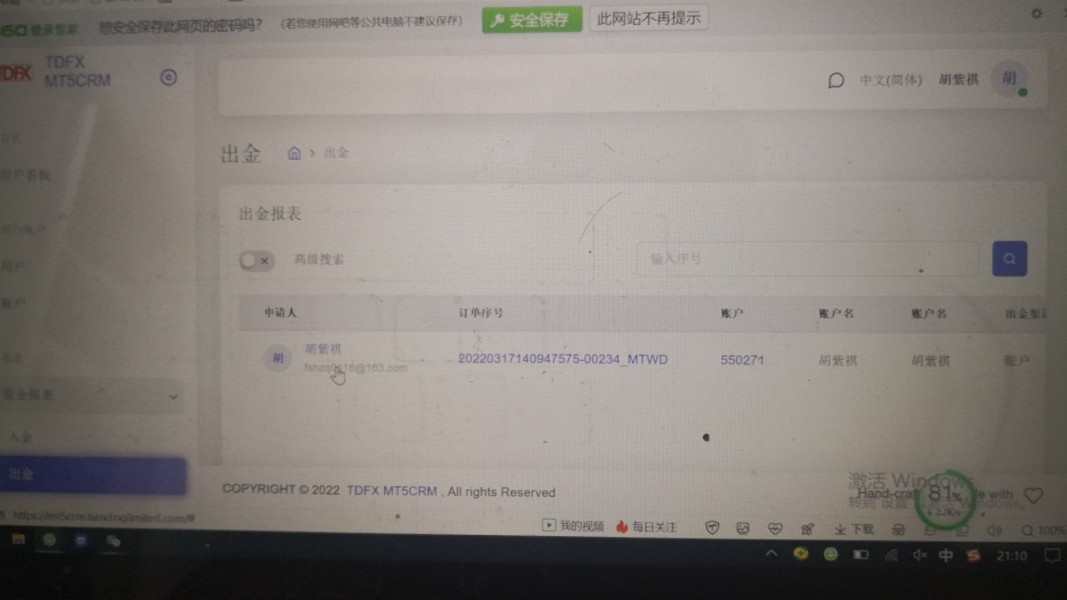

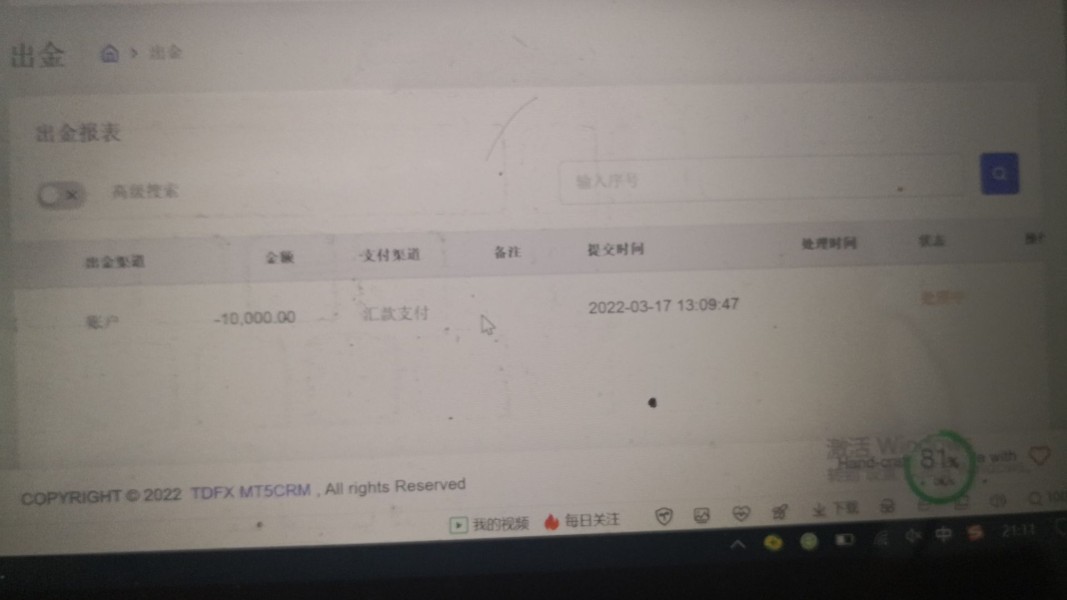

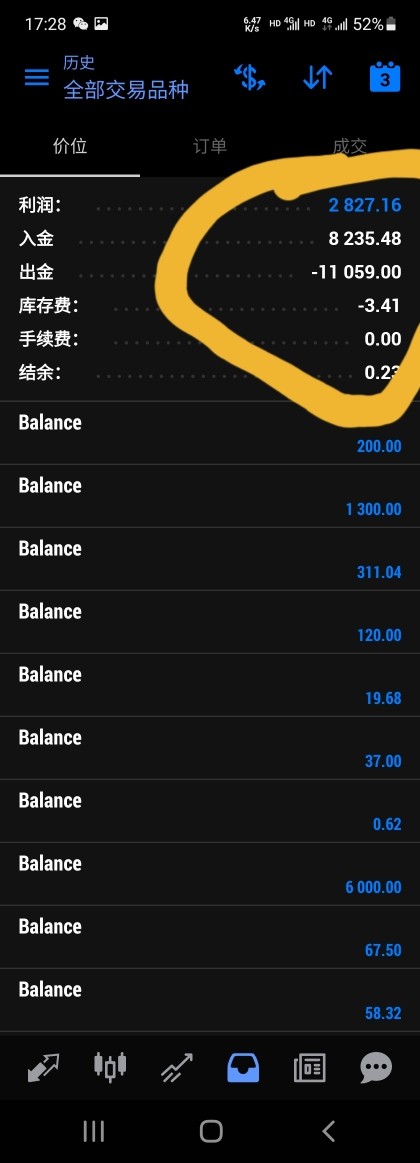

Deposit & Withdrawal

TDFX makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies.

| Payment Method | Deposit Fee | Withdrawal Fee | Processing Time |

| Bank Transfer | Free for deposits above $100 | $30 | 3-5 business days |

| Credit/Debit Card | 1.5% for deposits above $50 | $30 | Instant |

| E-wallets | 1.0% for deposits above $10 | 2.50% | 1-2 hours |

| Cryptocurrencies | Free for BTC, ETH, USDT | 0.001 BTC, 0.01 ETH, 10 USDT | 15-30 minutes |

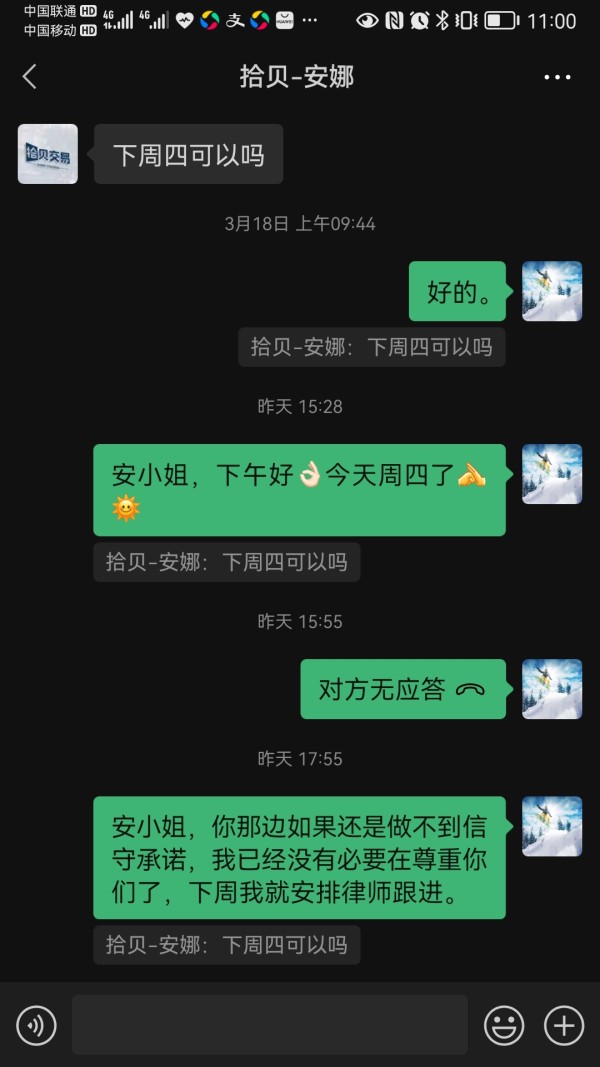

Customer Support

TDFX provides responsive customer support to assist users with their inquiries and concerns. You can reach TDFX's customer support team through the following contact options:

Contact Number: Feel free to contact TDFX's support team directly by calling +852 5226 7054. Whether you have questions about your account or need assistance with trading, the contact number ensures direct access to customer support.

Email: For written inquiries and detailed assistance, you can email TDFX's customer support at support@tiandinglimited.com. This email option allows users to communicate their concerns and receive comprehensive responses from the support team.

TDFX's dedicated customer support channels aim to provide timely and effective assistance to enhance the overall trading experience for its users.

Educational Resources

TDFX provides a robust suite of educational resources aimed at empowering traders with knowledge and skills to enhance their trading experience. These resources encompass TDFX Academy, Trading Guides, Glossary, Daily Market Analysis, and Webinars.TDFX Academy:TDFX Academy serves as a comprehensive learning hub for traders of all levels. It provides structured educational materials covering various aspects of trading, helping users build a strong foundation and enhance their market knowledge.Trading Guides:TDFX offers detailed Trading Guides that delve into specific trading strategies, techniques, and market analysis. These guides are valuable resources for traders seeking practical insights to improve their decision-making skills.Glossary:The Glossary provided by TDFX acts as a reference tool for traders to familiarize themselves with industry-specific terms and jargon. It ensures that traders can navigate the financial markets with a clear understanding of key terminology.Daily Market Analysis:Staying informed is crucial in trading, and TDFX's Daily Market Analysis keeps traders updated on the latest market trends, news, and potential opportunities. This resource aids traders in making well-informed decisions based on current market conditions.Webinars:TDFX conducts Webinars to offer a dynamic and interactive learning experience. These live sessions cover a range of topics, from market trends to advanced trading strategies. Webinars provide traders with the opportunity to engage with experts and ask questions in real-time.With TDFX's array of educational resources, traders can access diverse learning materials tailored to their needs, whether they are beginners looking to start their trading journey or experienced traders seeking to refine their skills.

Conclusion

TDFX emerges as a versatile trading platform, offering a diverse range of tradable assets and competitive trading conditions. Traders benefit from a choice of three account types, accommodating various preferences and trading styles. The user-friendly platforms facilitate informed decision-making, complemented by a wealth of educational resources. However, concerns arise due to the lack of major regulation, emphasizing the importance of risk awareness. The broker's high maximum leverage poses potential risks for inexperienced traders, while varying withdrawal fees and limited customer support languages may impact overall user experience. Despite these considerations, TDFX caters to traders seeking a comprehensive yet accessible trading environment.

FAQs

Q: Can I trade cryptocurrencies on TDFX?

A: Yes, TDFX provides a diverse range of tradable assets, including cryptocurrencies, allowing users to engage in crypto trading.

Q: What account types does TDFX offer?

A: TDFX offers three account types – Standard Account, ECN Account, and VIP Account, each tailored to different trading preferences and styles.

Q: What are the trading platforms available on TDFX?

A: TDFX provides a selection of trading platforms, including TDFX Web, TDFX Mobile, MetaTrader 4, and MetaTrader 5, offering users a choice based on their preferences.

Q: Are there educational resources for traders on TDFX?

A: Yes, TDFX is committed to trader education and provides a range of resources such as TDFX Academy, Trading Guides, Glossary, Daily Market Analysis, and Webinars.

Q: Does TDFX have a maximum leverage limit?

A: Yes, TDFX offers flexible leverage options, with the maximum leverage reaching up to 1:500. Traders should be mindful of the potential risks associated with high leverage.

Q: Is TDFX regulated by any financial authority?

A: No, TDFX is not regulated by any major financial authority, and traders should consider this aspect when evaluating the security of their funds and the broker's practices.

Q: What are the withdrawal fees on TDFX?

A: TDFX charges varying withdrawal fees depending on the withdrawal method. Traders should be aware of these fees as part of their overall trading costs.

Q: Does TDFX offer customer support in multiple languages?

A: While TDFX provides 24/7 customer support, the availability of support in multiple languages may be limited, potentially affecting communication for non-English speakers.

Q: Are there advanced trading tools available on TDFX?

A: TDFX provides basic charting tools and technical indicators, but traders looking for more sophisticated tools for complex strategies may find the offering limited.

News

ReviewU.S. 10-year Treasury yields rose, U.S. stock indexes fell, gold fluctuated

U.S. 10-year Treasury yields rose, U.S. stock indexes fell, gold fluctuated

WikiFX

WikiFX

NewsMohicans Markets recently attended the FinExpo Egypt held in Cairo, Egypt, from 25-26 May 2022.

Mohicans Markets recently attended the FinExpo Egypt held in Cairo, Egypt, from 25-26 May 2022.

WikiFX

WikiFX

NewsMohicans Markets showed its strength in the core booth of FINEXPO in Egypt

Mohicans Markets showed its strength in the core booth of FINEXPO in Egypt

WikiFX

WikiFX

NewsThe situation in Russia and Ukraine is uncertain, and Biden is doing things in Asia again?

The situation in Russia and Ukraine is uncertain, and Biden is doing things in Asia again?

WikiFX

WikiFX

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now