The oil market, much like the stock market, is driven by a combination of investor and speculator activity. Yet, its unique susceptibility to geopolitical risks sets it apart. These geopolitical factors can introduce a higher degree of volatility into the oil market.

Crude oil's high liquidity and low spreads are vivid traits for traders seeking fast-paced, high-frequency trading opportunities. While OPEC once held a dominant position in the market, its influence has waned in recent years, giving way to a more complex geopolitical landscape. Today, Russia and the US exert significant influence over oil prices, often counteracting Saudi Arabia's policies within OPEC.

Starting with a solid grasp of the oil market is crucial for traders, as it's a complex ecosystem with many moving parts. In crude oil trading, fundamentals often outweigh technicals.

Some factors to consider before trading crude oil:

Trading regulations: Contracts for Difference (CFDs) are a popular choice for oil traders, allowing them to speculate on price movements without owning the underlying asset. However, due to regulatory restrictions in the US and Canada, traders in these regions may need to consider options or futures contracts.

Volatility: Crude oil has the characteristic of price fluctuations, making it a risky but potentially rewarding asset.

Benchmark contracts: West Texas Intermediate (WTI) and Brent Crude are the two most widely traded oil benchmarks. Brent is considered the global benchmark, while WTI is more closely tied to the US market.

Price spread: The price difference between Brent and WTI, also called the Brent-WTI spread, provides valuable insights into market dynamics.

Influencing factors: Geopolitical events, economic conditions, and weather patterns can all significantly impact oil prices.

Comparison of the Best Oil Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Oil Forex Brokers Overall

| Brokers | Logos | Why are they listed as the Best Oil Forex Brokers? |

| IG |  |

✅ Strong regulatory presence in the UK, US, and Australia, ideal for risk-averse traders. ✅ Award-winning trading platform with advanced tools and market analysis, suitable for experienced traders. ✅ Competitive spreads on major oil pairs, attractive for frequent traders. |

| Avatrade |  |

✅ Heavily and globally regulated, giving its clients more ressurance and trading flexibilty. ✅ Broad range of oil CFDs and options, offering flexibility for different trading strategies. ✅ Easy-to-use platform, copy trading solutions, educational resources, and demo accounts, perfect for newcomers. |

| IC Markets |  |

✅ True ECN model with raw spreads and low commissions, appealing to high-volume traders. ✅ Choice of MT4, MT5, and cTrader platforms, catering to different technical analysis preferences. ✅ Excellent order execution speeds and deep liquidity, crucial for swift trading during volatile oil markets. |

| TickMill |  |

✅ A well-regulated broker offering $30 welcome bonus, extremely for most traders. ✅ Robust trading platforms ensure fast order execution, minimizing slippages. ✅ Convenient deposit and withdrawal options, simplifying financial issues. |

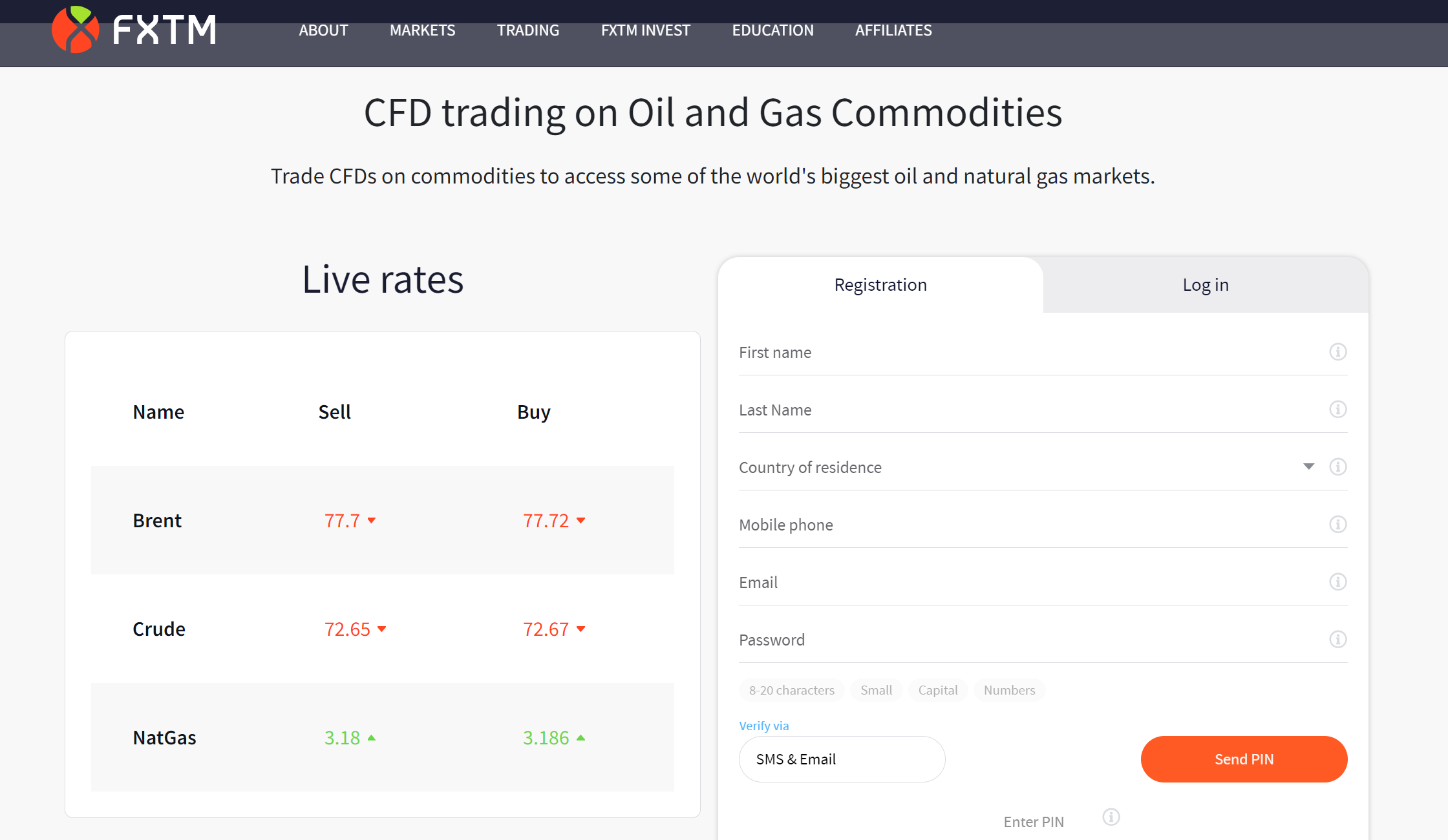

| FXTM |  |

✅Regulated in multiple jurisdictions, catering to traders from various regions. ✅ Transparent trading structure, competitive trading costs, highly praised by numerous users. ✅ Extensive educational resources and market analysis, valuable for learning oil trading strategies. |

| Forex.com |  |

✅ Globally and heavily regulated, a well-established broker that has won millions of traders' recognizations. ✅ Commission-free trading on certain oil pairs, attractive for frequent traders. ✅ Award-winning customer support team, offering assistance and guidance throughout your trading journey. |

| FP Markets |  |

✅ Offers services tailored to institutional clients, ideal for experienced traders seeking advanced solutions. ✅ Deep integration with MT4 and MT5 platforms, popular among technical analysts. ✅ Providing protection against account losses exceeding deposited funds, valuable for risk management. |

| Plus500 |  |

✅ Widest range of oil CFDs, including exotic pairs and levered options, offering diverse trading opportunities. ✅ User-friendly platform with straightforward interface, perfect for beginners and casual traders. ✅ Charging competitive spreads instead of commissions, potentially minimizing trading costs on frequent trades. |

| IronFX |  |

✅ Competitive spreads on major oil pairs, particularly attractive for frequent traders aiming to minimize trading costs. ✅ Platform for copying experienced traders' oil trades, suitable for beginners seeking guidance. ✅ Various oil pairs beyond major benchmarks, including exotic pairs and mini contracts, catering to diverse trading strategies and risk appetites. |

| Blackbull |  |

✅ An influential broker that has rooted deeply in New Zealand, featuring a solid reputation. ✅Direct access to interbank liquidity with competitive raw spreads, beneficial for high-volume traders. ✅ Focuses on MT4 and MT5 platforms, ideal for traders proficient in these tools. |

Overview of the Best Oil Forex Brokes

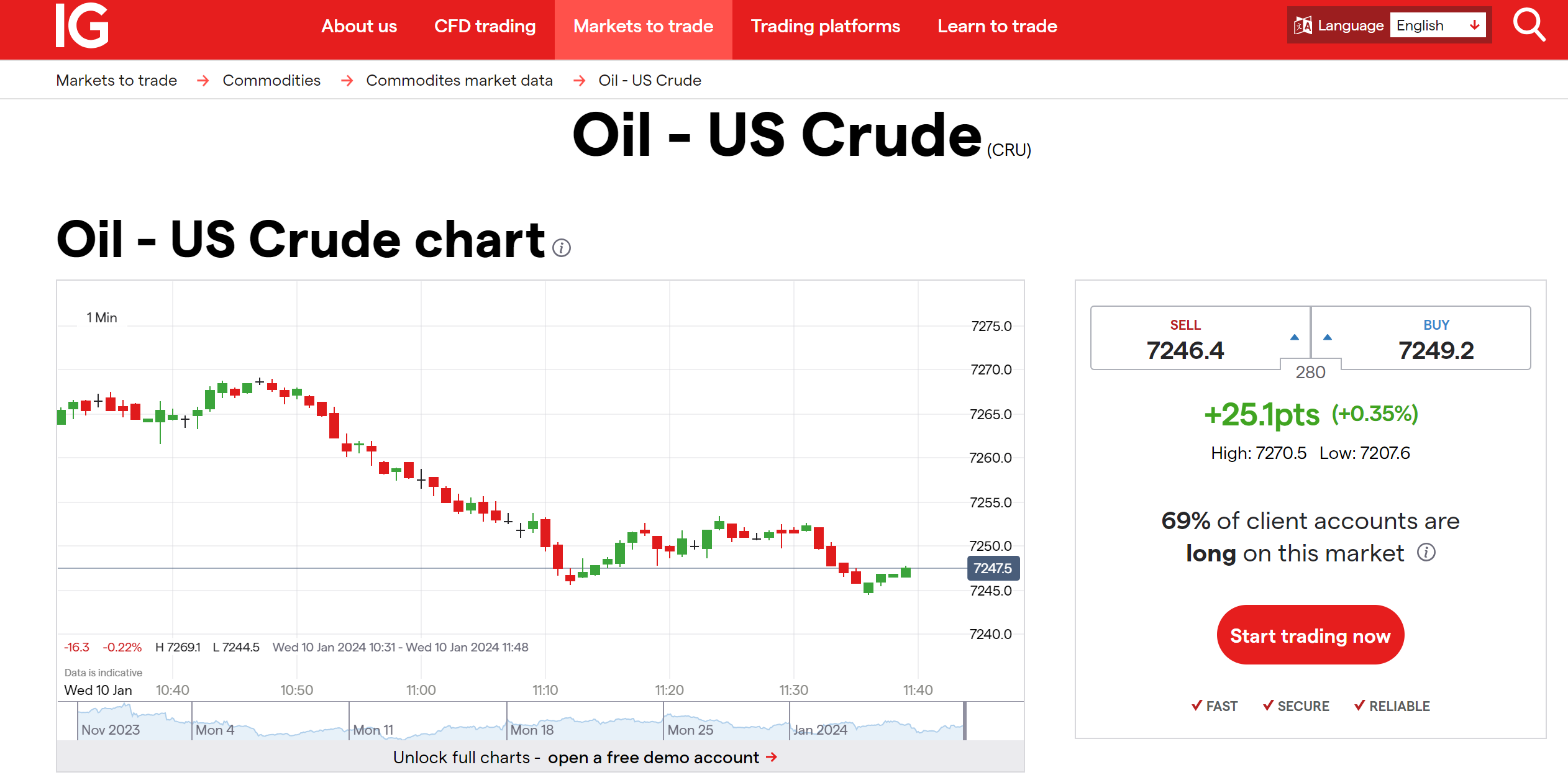

IG

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

Oil Trading Costs |

Around 1.2 pips for WTI and Brent |

Max. Leverage |

50:1 |

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG Group's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

✅Where IG shines:

• Globally regulated, IG's services are accessible globally, making them a go-to source for international trading.

• Their proprietary platform stands out with its high reliability, speedy execution, and advanced charting tools.

• FTSE 250 trading is one of IG's standout offerings, with tight spreads, direct market access, and up-to-date FTSE-related news.

• Providing guaranteed stop-loss orders (GSLOs), which lock in a maximum loss limit in advance, which few other brokers can do this.

• 7/24 customer support, IGs attentive and widely accessible customer support sets them apart in addressing trader queries and issues.

❌Where IG Shorts:

• IG charges an inactivity fee of $12 per month after two years of inactivity, unfavourable for long-term investors who trade less frequently.

• Presently, its product range is limited in the U.S with focus largely on forex, causing them to miss out on traders interested in other instruments.

• Some users might find the desktop trading platform complex and difficult to navigate, especially beginners.

• Some superior research tools and features are available at an extra cost which could be discouraging for some traders.

Avatrade

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

currency pairs, major stock indices, Cryptocurrencies, commodities (such as gold, silver, sugar, coffee), bonds, individual shares and ETFs |

Trading Platforms |

AvaSocial, Web trader , AvaTradeGO, MetaTrader 4, MetaTrader 5, AvaOptions, Automated Trading, Mac Trading, Mobile trading. |

Oil Trading Costs |

$0.02 spread (Retail), $0.015 spread (Professional) |

Max. Leverage |

30:1 ( retail tarders), 400:1 ( Pros) |

Founded in 2006, AvaTrade is a well-established and trusted broker with its headquarters in Dublin, Ireland. The company is regulated in several jurisdictions, including Australia, Japan, the British Virgin Islands, and South Africa. AvaTrade offers a broad spectrum of more than 250 financial instruments, covering forex pairs, stocks, indices, commodities, cryptocurrencies, and bonds. The broker provides several advanced trading platforms, such as MetaTrader 4 and 5, AvaTradeGO, AvaOptions, and a variety of automated trading platforms. AvaTrade pride themselves on their competitive spreads and no commission structure, allowing traders to manage their trading costs effectively. They offer dedicated customer service support in multiple languages, reachable through various avenues such as phone, email, and live chat. AvaTrade's global standing is solidified by numerous international recognitions, including awards like 'Most Trusted Forex Broker' and “Best Forex Trading Experience.”

Regarding oil trading, AvaTrade offers a robust platform for traders interested in crude oil CFDs. These include WTI Crude Oil, Brent Crude, and Heating Oil. The costs of trading oil are wrapped into the spread, from $0.03 over markets, with no additional commission charges. With AvaTrade, traders can speculate on the price movements of oil using leveraged trading. Traders can access sophisticated charting tools and automated trading features on either AvaTrade's proprietary platform or the well-known MetaTrader 4 and 5 platforms.

✅ Where Avatrade shines:

• Regulated by multiple top-tier regulatory bodies, providing traders with a safer and more secure trading environment.

• AvaTrade has received multiple awards, further cementing its reputation as a trusted and reliable broker in the forex trading industry.

• Multiple choices of MetaTrader 4 and 5, AvaTradeGO, AvaOptions, and several automated trading platforms provides flexibility for traders in choosing a platform that best suits their style.

• AvaTrade has a dedicated customer service team that is available in several languages and can be reached via various channels, including phone, email, and live chat.

• AvaTrade supports several social trading platforms like ZuluTrade and DupliTrade, allowing traders to copy the strategies of experienced traders.

❌Where Avatrade Shorts :

• Withdrawal requests usually take 1-2 business days to process, which is slower compared to some competitors.

• AvaTrade offers a limited range of cryptocurrencies for trading, which could disappoint traders interested in this area.

• AvaTrade requires a relatively high initial deposit to open an account, with no micro account offered, slightly disappointing beginners.

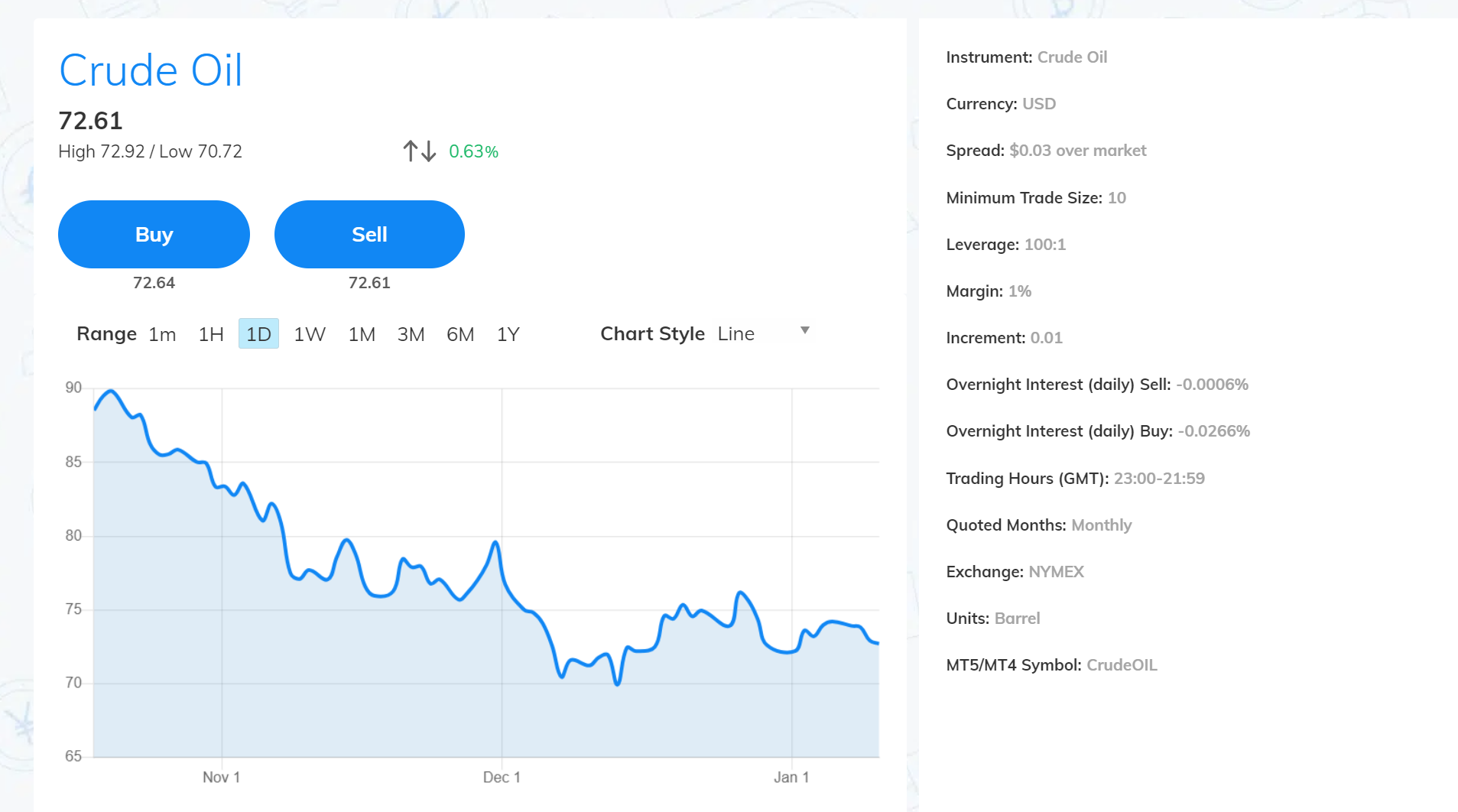

IC Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Commodities CFDs,Indices, Bonds, Digital Currency.Stock, Futures |

Trading Platforms |

MetaTrader 4, MetaTrader 5, MetaTrader WebTrader, MetaTrader iPhone/iPad.MetaTrader Android, MetaTrader Mac |

Oil Trading Costs |

Around 0.3 pips for major pairs |

Max. Leverage |

500:1 |

IC Markets, founded in Sydney, Australia, in 2007, is a highly commended broker recognized globally for its superior trading services. Registered with the Australian Securities and Investments Commission (ASIC), it also enforces strict regulatory compliance, assuring reliability and security. IC Markets, renowned for its wide assortment of tradable instruments, gives traders access to forex pairs, commodities, indices, bonds, and cryptocurrencies, among others. By offering both the MetaTrader and cTrader platforms, the broker cares about more traders, facilitating sophisticated charting, algorithmic trading, and more. IC Markets is celebrated for its competitive trading costs, notably for its low spreads and affordable commissions. With customer service held in high regard, you can expect prompt, multilingual assistance 24/7 via live chat, email, and phone. The recognition IC Markets boasts is solidified by its global reputation, network of international clients, and high recognization from professional traders.

Turning attention to oil trading, IC Markets offers appealing benefits. It presents access to major oil markets globally including Brent Crude Oil and WTI. IC Markets give traders superb oi trading experience though its raw spread accounts, featuring ultra-tight spreads and a reasonable commission structure, significantly reducing trading costs for oil traders. The MetaTrader and cTrader platforms come into play here, providing robust trading tools, superior execution speeds, and responsive charts, equipping oil traders to navigate the volatile oil markets adeptly.

✅ Where IC Markets shines:

• Heavily regulated by ASIC, and CYSEC, operating in a transparent and secure way.

• IC Markets worldwide presence, supported by a diverse global client base, solidifying its reliable reputation.

• Grantingaccess to a broad range of tradable instruments from forex, commodities, to indices, giving traders more trading fexiblity.

• Recognized for offering some of the lowest spreads in the industry, starting from 0.0 pips on major Forex pairs.

• For oil traders, IC Markets' competitive edge lies in the low fees for oil trading supported by their raw spread accounts.

• With MetaTrader and cTrader on offer, traders can benefit from the detailed charting and algorithmic trading capabilities.

❌Where IC Markets Shorts :

• IC Markets primarily focuses on forex and CFDs, and may not be suitable for traders seeking to invest in other financial instruments such as stocks and ETFs.

• For certain CFD trades, IC Markets require a higher margin which might be intimidating to novice traders or those with limited capital.

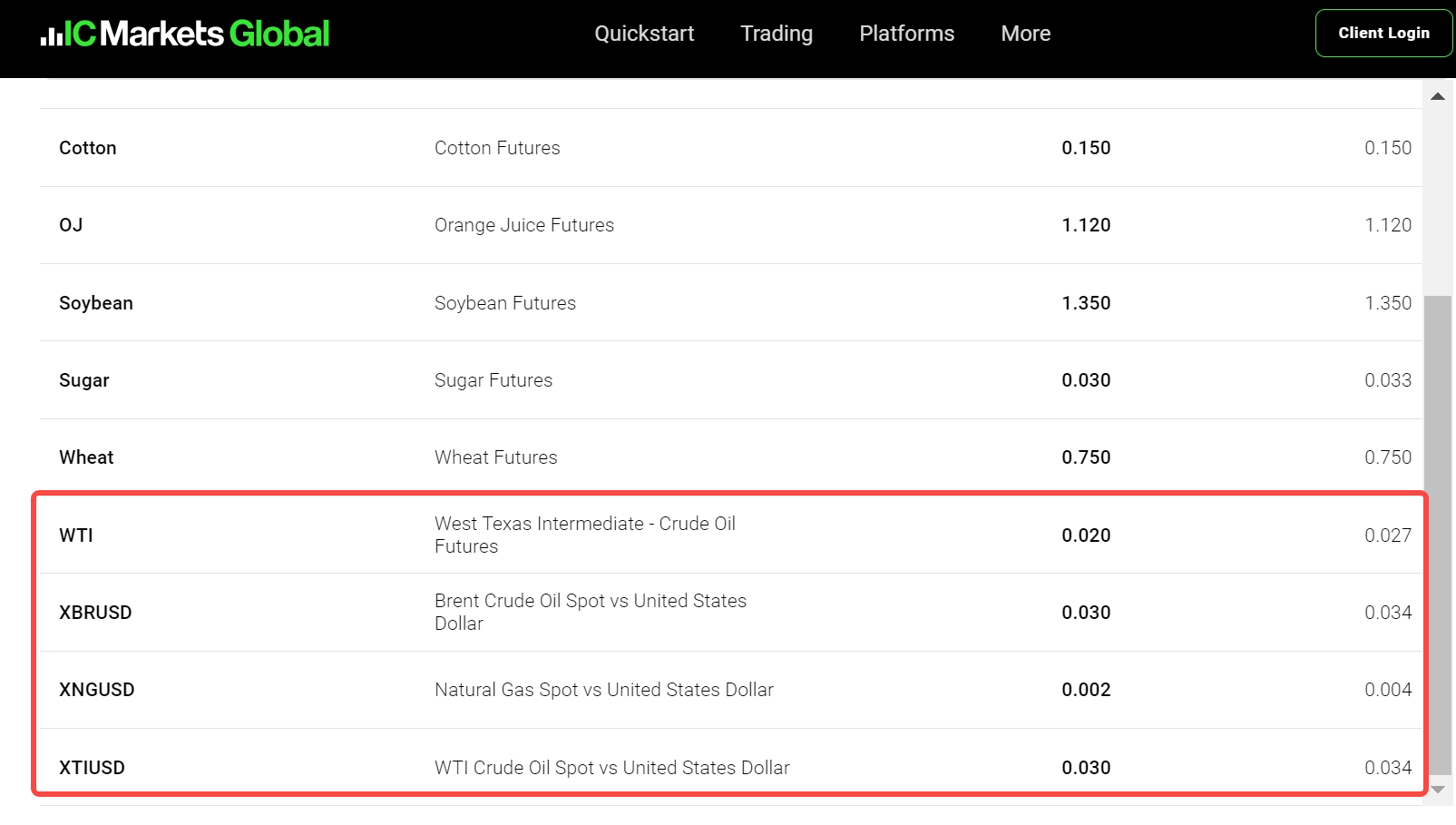

TickMill

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Stock Indices, Commodities, Bonds Cryptocurrencies and more |

Trading Platforms |

MetaTrader 5MetaTrader 4MetaTrader WebTrader PlatformMetaTrader for MacTickmill Mobile App |

Oil Trading Costs |

Min Spread: 0.04 |

Max. Leverage |

500:1 |

TickMill, established in 2014, is a renowned broker with roots in the United Kingdom. The financial services firm operates under the strict regulation of UK's FCA, and CySEC in Cyprus. It provides wide access to tradable instruments, spanning a variety of asset classes including forex, stock indices, commodities, and bonds. Advanced platform offerings include the industry-favored MetaTrader 4, MetaTrader 5, and TickMill mobile app, known for its exemplary charting, analytical capabilities, and support for automated trading strategies. TickMill is recognized for its competitive trading costs, known to offer low spreads and meager commissions. Traders can access multilingual customer service, available during market operating hours via several channels, including live chat, email, and a call back service. Its firm standing in the current marketplace is perpetuated globally, confirmed by a large network of international clients and positive acclaims from industry experts.

Focusing particularly on oil trading, TickMill furnishes traders with competitive access to major oil markets such as Brent Crude Oil and West Texas Intermediate. Its oil trading fees are generally low, underscored mainly by narrow spreads and low-cost-per-lot commissions. Besides, oil traders can access flexible leverage up to 500:1 on oil trading, giving traders more trading flexibility.

✅ Where TickMill shines:

• Regulated by well-known, reputable agencies including Seychelles Financial Services Authority, UK's FCA, and CySEC.

• Offers extensive financial instruments across different asset classes which makes for a comprehensive trading environment.

• $30 welcome bonuses, giving traders more counrage to start trading without using their own money.

• TickMill stands out for its competitive conditions in oil trading, featuring low oil trading fees, thereby reducing overall trading costs for oil traders.

• Traders praise its customer support for its responsiveness and proficient multilingual service.

• Additional features like social trading, copy trading also provided, allowing beginner traders to trade with ease.

❌Where TickMill Shorts:

• Although it provides multilingual support, some users have reported delays in response times during non-market hours.

• The accounts offered by TickMill come in predefined forms, and no option is provided for customizing account conditions to better suit unique trading strategies.

FXTM

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$10 |

Tradable Instruments |

Forex, Commodities, Metals, Stocks, Indices, and Stock CFDs |

Trading Platforms |

MT4, MT5, FXTM Trader app |

Oil Trading Costs |

Competitive |

Max. Leverage |

2000:1 |

Founded in 2011 and headquartered in Limassol, Cyprus, ForexTime (FXTM) is a name synonymous with global excellence in the trading world. Extensively regulated by top-tier authorities like CySEC in Cyprus, the FCA in the UK, and FSCA in South Africa, it adheres to stringent standards enhancing its credibility. FXTM avails an array of tradable instruments to its clientele, constituting forex pairs, commodities, indices, equities, and cryptocurrencies. The borker relies on the robust MetaTrader 4 and MetaTrader 5 platforms, known for their extensive charting tools, fast order execution, and support for automated trading systems. Regarding trading costs, FXTM stands competitive with its reasonably low spreads and commissions, especially on ECN (Advantage Plus) accounts. FXTM's client-centric approach is further emphasized by its responsive, multilingual customer service, reachable via live chat, phone, or email. Its strong reputation on the global stage is confirmed by numerous accolades, broad client base, and positive client testimonials.

Discussing its oil trading, FXTM grants access to the most widely-traded oil markets globally, including Brent Crude Oil and WTI, supported by competitive trading conditions. Their trading costs for oil are generally dynamic, as they depend on factors like the specific oil contract, market conditions, and the type of account that a broker operates on. However, typically, FXTM charges reasonable commissions for trades on oil CFDs and offers comparatively narrow spreads.

✅ Where FXTM shines:

• Duly regulated by top-tier regulatory entities such as CySEC in Cyprus, the FCA in the UK, and FSCA in South Africa, thus ensuring a high level of regulatory compliance.

• Offering a diverse range of tradable assets, presenting an opportunity for a more diversified portfolio which includes forex pairs, commodities, indices, equities, and cryptocurrencies.

• This affordability makes trading operations cost-effective, particularly on the broker's advantage plus accounts.

• FXTM's reputation in the global trading community is quite noteworthy, fortified by a large international client base.

• FXTM also stands out with its feature “FXTM Invest” which allows for copy trading.

❌Where FXTM Shorts:

• Despite offering a wide asset range, they don't offer certain financial instruments, such as single stock CFDs, which traders might be interested in.

• Some users have reported occasional delays in the withdrawal process which could be an area of improvement.

• A fee of $5 per month after 6 months of inactivity is applied, increasing traders' overall trading costs.

Forex.com

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Stock CFDs, Indices, Cryptocurrencies, Commodities |

Trading Platforms |

Webtrader, Mobile Apps MetaTrader 4 |

Oil Trading Costs |

Competitive |

Max. Leverage |

50:1 |

Established in 2001 and headquartered in Bedfordshire, UK, Forex.com is an respected player among online brokerages. It operates under multiple regulations, including ASIC in Australia, FCA in the UK, FSA in Japan, and more. Forex.com opens up access to various markets across forex pairs, indices, shares, commodities, and cryptocurrencies. The broker supports multiple advanced trading platforms, including the well-respected MetaTrader 4, MetaTrader 5, along with their proprietary Forex.com platform and WebTrader. Each of these platforms brings forth impressive technological features, like extensive charting tools, rapid order execution, and comprehensive back-testing options. Forex.com presents competitive trading costs through low spreads and transparent commissions. Their customer support, accessible via live chat, phone, and email, is known for their swift and knowledgeable responses. Forex.com's credibility is further amplified by their international recognition, with a large global client base and several industry awards to their credit.

When it comes to oil trading, Forex.com offers CFDs on both Brent Crude Oil and WTI, allowing traders to capitalize on the price movements of these major oil markets. The broker maintains competitive trading conditions for oil, with relatively low and transparent trading fees. This includes low spreads for oil CFDs, accompanied by transparent commission structure based on volume traded. Leveraging the robust capabilities of MetaTrader 4, Tradingview, and properitary trading platforms offered, Forex.com ensures a 99.99%* execution rate of less than a second.

✅ Where Forex.com Shines:

• Globally and heavily regulated, ranking top among brokers in the world, trusted and respected.

• Being one of a few online brokers offering Direct Market Access (DMA), allows trading directly into the forex interbank market.

• Web trading platform is powered by TradingView, known for its unparalleled charting features, greatly enhancing the traders' analytical efficiency.

• Providingspot oil trading, differing from many online brokers who offer Oil trading via CFDs.

• Offering up-to-date analysis, including actionable trade ideas, directly from their team of globally-experienced market professionals and strategic partners.

❌Where Forex.com Shorts:

• While Forex.com boasts of cost efficiency, it charges an inactivity fee after a year of account dormancy.

• Although they offer customizable platforms like MT4 and their proprietary software, some traders might miss vast third-party platform options.

• While Forex.com provides prompt customer service, their service isn't available over the weekends, which might be problematic for some traders.

• Unlike many modern brokers, Forex.com doesn't yet offer a native social trading platform. It might be a drawback for traders keen on collaborative trading or pursuing copy trading.

FP Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

forex, shares, commodities, stock market indices and digital currencies |

Trading Platforms |

MetaTrader 4, MetaTrader 5, WebTrader, Iress |

Oil Trading Costs |

0.5 pips for accounts with Raw spreads |

Max. Leverage |

500:1 |

FP Markets is an Australian-based Forex and CFD broker that was established in 2005. This brokerage firm operates under the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), demonstrating strong regulatory compliance. FP Markets boasts a diverse offering of over 22,500 tradeable instruments, including forex, indices, commodities, shares, and cryptocurrencies. The broker provides traders with leading trading platforms MetaTrader 4 and MetaTrader 5, as well as the IRESS platform, known for their sophisticated charting tools and automated trading features. FP Markets prides itself on its low-cost trading experience, offering competitive spreads, low commissions, and no hidden fees. Its customer support is accessible 24/5 via email, phone, and live chat. FP Markets has received global recognition, winning over 35 industry awards for its service and performance in the Forex marketplace.

In terms of oil trading, FP Markets provides access to trade oil CFDs, specifically Brent Crude Oil and WTI (US) Crude Oil, with leverage up to 500:1. The costs associated with trading oil typically include the spread and potentially a small commission, depending on the account type. Utilizing either the MetaTrader 4 or MetaTrader 5 platform, traders can take advantage of the advanced charting tools and rapid execution, both key factors in the often volatile oil market.

✅ Where FP Markets Shines:

• Regulated by multiple top-tier regulatory bodies such as ASIC and CySEC, ensuring transparency and protection for traders.

• Offering both MetaTrader 4 and MetaTrader 5, plus the IRESS platform, provides traders with a comprehensive and highly customizable trading environment.

• Offering more than 10,000 trading instruments, spanning from forex, commodities, indices, shares to cryptocurrencies.

• FP Markets provides a range of educational materials and tools to assist new traders in learning the ropes and experienced traders in improving their strategies.

• FP markets provide the opportunity for VPS (Virtual Private Server) hosting, which allows for faster and more reliable automated trading.

• FP Markets supports copy trading through various platforms which allows less experienced traders to mimic the strategies of successful traders, potentially boosting their trading success.

❌Where FP Markets Shorts:

• Unlike many competitors, FP Markets provides a limited choice of cryptocurrencies for trading.

• FP Markets does not offer its services in certain countries, which hinders its accessibility to traders across the globe.

Plus500

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Currency Pairs, Cryptocurrencies, Soft and Hard commodities (such as wheat, gold and oil), Shares |

Trading Platforms |

|

Oil Trading Costs |

Zero commissions, spread 0.04 |

Max. Leverage |

300:1 |

Established in 2008, Plus500 is a leading CFD brokerage firm originating from Israel. It is currently based in Haifa and registered under Plus500UK Ltd in the United Kingdom. Plus500 firm operates under the strict regulatory supervision of FCA in the UK, and ASIC in Australia. With Plus500, traders have access to over 2800 instruments spanning forex, indices, commodities, shares, ETFs, options, and cryptocurrencies. The firm deploys a proprietary trading platform, WebTrader, praised for its user-friendly interface, advanced charting resources, and varied trading tools. Plus500 is renowned for its competitive cost structure, featuring tight spreads and no commission on trades, which significantly reduces overall trading costs. Its support service is robust with 24/7 availability of customer care representatives who can be reached via live chat and email. Plus500 is globally recognized, noted for its listing on London Stock Exchange's Main Market, and its sponsorship of football club Atletico Madrid, demonstrating the firm's strong industry presence.

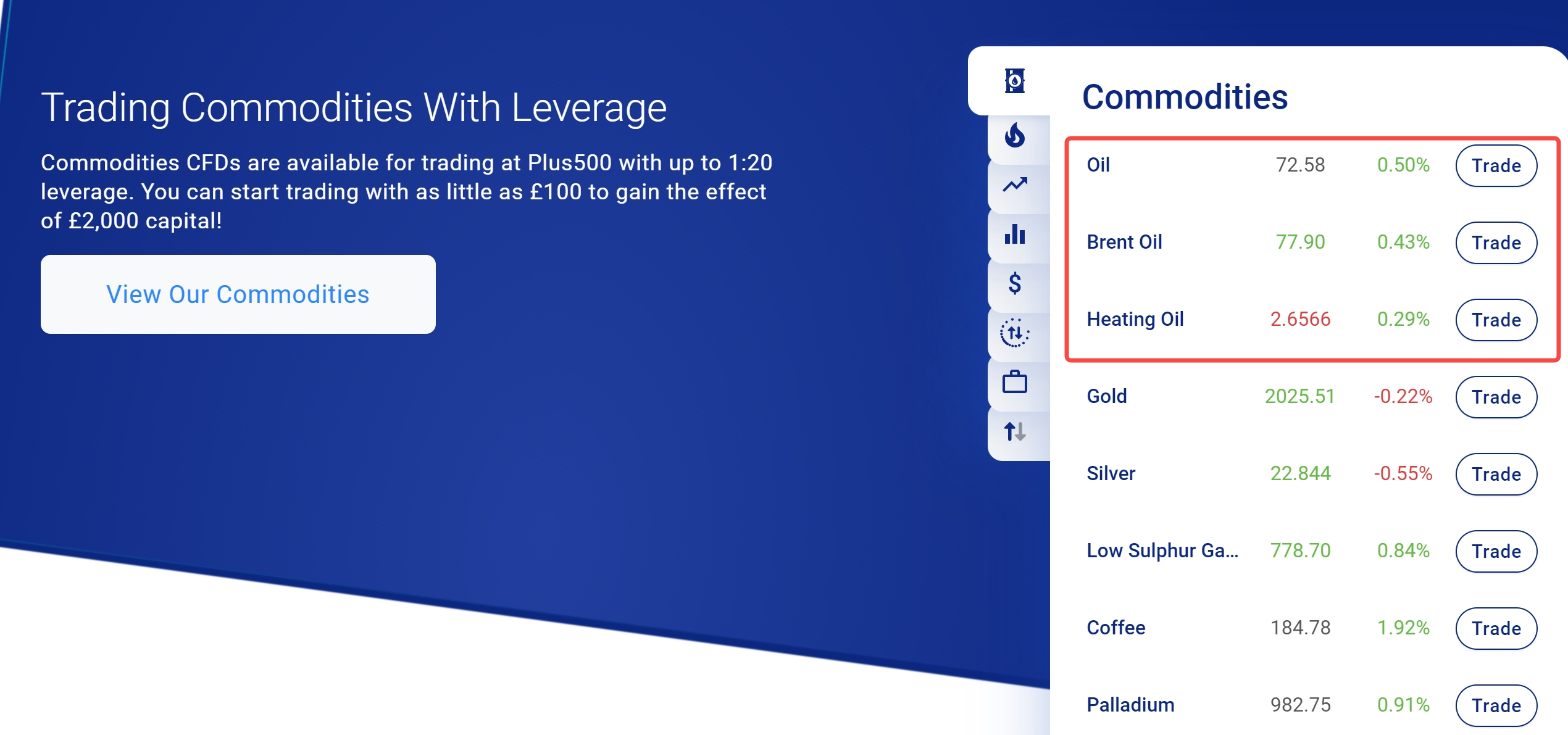

Plus500 offers trading on the most widely traded oil markets including WTI Crude Oil, Brent Oil, and heating oil. Plus500 stands out for offering its customers the ability to trade oil CFDs with up to 1:20 leverage, allowing them to amplify their trading position. The trading costs associated with oil trading generally manifest as part of the spread, which are competitive and in line with industry standards.

✅ Where Plus500 Shines:

• Authorized and regulated by top-tier regulatory bodies, like FCA, ASIC, reflecting a high standard of regulatory compliance.

• Plus500's listing on London Stock Exchange's Main Market and sponsorship of football club Atletico Madrid underscores the firm's global recognition.

• Giving access to over 2,800 tradable instruments, including forex, commodities, shares, ETFs, options, and cryptocurrencies.

• At Plus500, traders enjoy a commission-free trading structure, as costs are mainly included in spreads.

• Plus500 offers 24/7 customer support, handling inquiries promptly and effectively to ensure customer satisfaction.

❌Where Plus500 Shorts:

• Plus500 provides 24/7 customer support primarily through chat and email. The lack of phone support could be a roadblock for users requiring urgent assistance.

• Plus500 does not extend investor protection to clients outside the European Union. As a result, they might lose more than they initially deposited.

• Plus500 solely relies on its proprietary platform, WebTrader. Although the platform is comprehensive and user-friendly, the absence of MetaTrader might disappoint some traders.

IronFX

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$50 |

Tradable Instruments |

shares, indices, forex, futures, metals and commodities |

Trading Platforms |

MetaTrader 4, MetaTrader 4 Web Trader and proprietary Personal Multi Account Manager (PMAM) |

Oil Trading Costs |

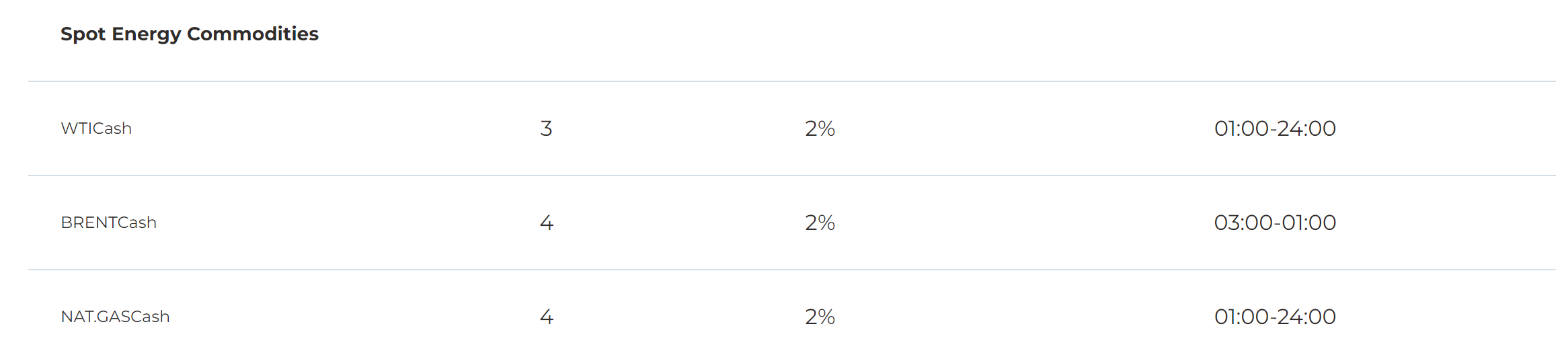

0.8 pips for WTI and Brent |

Max. Leverage |

1000:1 |

Customer Support |

5/24 |

Founded in 2010, IronFX is a globally recognized brokerage firm based in Cyprus, regulated by FCA in the UK, CYSEC in Cyprus. IronFX boasts more than 300 tradable instruments, including forex pairs, spot indices, shares, futures, commodities, and cryptocurrencies. IronFX offers clients a choice between several trading platforms, including the industry-leading MetaTrader 4, along with their bespoke WebTrader platform. All platforms come equipped with advanced charting tools and automated trading capabilities. IronFX's trading cost model incorporates both fixed and floating spreads, with competitive commissions charged. The broker provides 5/24 customer service via phone, email, and live chat, ensuring that clients' needs are promptly addressed. IronFX's reputation is globally acknowledged, demonstrated by its multiple industry awards for quality service and innovative trading technology.

As for oil trading, IronFX gives traders exposure to the oil market through CFDs on Brent Crude Oil and WTI, and spreads for oil trading are competitive. By using the MT4 platform or IronFX's WebTrader, traders get access to features like advanced technical analysis charts, one-click trading, and various order types, which can be indispensable tools in the fast-moving oil market.

✅ Where IronFX Shines:

• Regulated by top-tier bodies such as CySEC, ASIC and FCA, giving traders more reassurance.

• IronFX's industry recognition, with multiple awards for its service and platform, underscores its position as a leader in the online trading industry.

• IronFX offers competitive spreads, with a choice between fixed and floating spread accounts, the broker also offers commission-based pricing for even lower spreads.

• IronFX allows traders to hedge their positions, providing a risk management tool for traders.

❌Where IronFX Shorts:

• No 7/24 customer support, cannot address trading problems during weekends.

• IronFX supports several common deposit and withdrawal methods, yet the absence of e-wallets like PayPal can prove to be inconvenient for some traders.

• While IronFX does offer negative balance protection, it is not universally applied and is conditional, which may put traders' funds at risk.

Blackbull

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex, Shares, CFDs & Commodities |

Trading Platforms |

TradingView, MT4, MT5, cTrader, Blackbull Copytrader |

Oil Trading Costs |

Spreads starting from around 0.8 pips for WTI and Brent |

Founded in 2014, BlackBull Markets is a New Zealand-based online broker that operates under the regulation of the Financial Markets Authority (FMA). It provides traders access to vast financial instruments including forex pairs, commodities, indices, metals, and energies through the industry-renowned MetaTrader 4 platform, which boasts advanced charting tools, customizable indicators, and algorithmic trading capabilities. Featuring a transparent pricing structure, BlackBull Markets operates on an Electronic Communications Network (ECN) model, offering competitive spreads and charging commissions on certain account types. BlackBull Markets maintains a dedicated customer service team that can be reached via email, live chat, and phone. Globally, BlackBull Markets enjoys a solid reputation acknowledged through its receipt of the Deloitte Fast 50 award in 2020.

Focusing on oil trading, BlackBull Markets offers its clients the opportunity to trade WTI Crude Oil and Brent Crude Oil. Trading costs for oil, as with their other commodities, are incorporated within the spread and there may also be a commission depending on the chosen account type. Thanks to their ECN model, traders can expect rapid trade execution and competitive pricing, which is crucial in volatile markets like oil.

✅ Where Blackbull Shines:

• BlackBull Markets is regulated by the Financial Markets Authority (FMA) of New Zealand, providing traders with a secure and reliable trading environment.

• Employing an Electronic Communication Network (ECN) trading model, offering traders tight spreads and faster trade execution.

• BlackBull Markets provides 24/7 customer support via email, live chat, and phone.

• $0 to start real trading, making it easily accessible for most traders, especially beginners.

• Flexible leverage up to 500:1, an ideal option for scalping and high-frequency traders.

❌Where Blackbull Shorts:

• Not globally regulated, operating under weaker regulations compared with other brokers.

• Unfortunately, Blackbull Markets does not serve clients from certain countries, including the United States.

• All accounts at BlackBull Markets come with a floating spread model, which may not suit traders looking for predictable trading costs.

Forex Trading Knowledge Questions and Answers

Oil Trading Background Information

The futures market is underpinned by two primary crude oil benchmarks: West Texas Intermediate (WTI) and Brent Crude. WTI, a lighter, sweeter crude, is ideal for gasoline production with a sulfur content of around 0.24%. In contrast, Brent Crude, heavier and more sulfurous (0.37%), is better suited for diesel.

The oil market's modern trajectory began with the dramatic price spikes of the 1970s, triggered by the Arab oil embargo. Subsequent decades witnessed a rollercoaster ride of prices, from the lows of the late 1990s to the record highs of 2008. Since then, prices have consolidated within a more defined range, though they haven't yet reclaimed the heights of the pre-financial crisis era. The divergence between Brent and WTI prices, known as the Brent/WTI spread, has been a recurring theme in oil market dynamics.

Oil Trading Regulations

When selecting a broker, traders should prioritize regulatory compliance. While regulatory bodies such as ESMA, the SEC, and IIROC have robust frameworks, historical data suggests that even in well-regulated markets, significant fraud can occur.

For US investors, due to regulatory restrictions, CFDs may not be the best option. Oil ETFs and futures contracts on US crude oil and Brent crude traded on the NYMEX, including e-mini contracts offered by CME Group for smaller investment amounts, are more suitable options.

Types of Oils

Primarily, two types of oil are traded on the market:

West Texas Intermediate (WTI): This is a grade of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange's oil futures contracts. WTI is known for its high quality and easy refinement into products like gasoline.

Brent Crude: This type of oil comes from the North Sea and is used as an international benchmark for oil prices. Brent crude is slightly less “light” and “sweet” than WTI but is still of high quality.

Both types serve as global price benchmarks, with Brent representing international prices and WTI domestic US prices.

How Much do I Need for Oil Trading?

Some brokerage firms might allow you to start oil trading with as little as $100 margin for a futures contract or even lower for CFDs. Being techinically allowed, it is unwise and potentially dangerous to start oil trading with that amount. Specifically, oil trading often involves leverage, meaning you control a larger contract value than your actual capital. $100 is extremely low for leveraging such volatile assets, exposing you to larger losses even with small price movements. Therefore, realistically, considering at least $5,000-$10,000 as a starting point for active trading is a smart move.

Is Oil Trading Suitable for Beginners?

Absolutely not for beginners. Oil trading can be complex and volatile and wild oil price swings and leverage traps can devour a beginner's capital faster than a hurricane. Oil trading requires knowledge about geopolitical events, global economics, and specific industry dynamics influencing oil prices.

Spot Oil VS CFD Oil: What are the Differences?

Spot Oil and CFD Oil trading both involve dealing with oil as a commodity, but they operate differently. Spot oil means you physically own the underlying oil barrels, and you can buy or sell oil at its 'spot' price for immediate delivery. In contrast, CFD trading involves speculating on the price movement of oil without owning the underlying asset. Besides, spot oil trading entails the physical transportation of the commodity, which adds complexities regarding storage and delivery costs that you don't encounter with CFD trading. What's more,CFD trading often involves leverage, meaning you can open a larger position with a small initial deposit, while spot oil trading does not have this option. Lastly, spot oil markets typically have set trading hours, while CFD trading can often be done around the clock.

What are Some Useful Oil Trading Strategies?

Fundamental Analysis

It involves understanding influences on oil prices such as geopolitics, various supply and demand factors, and global economics. For example, if tensions rise in a key oil-producing region, this could indicate potential supply disruption leading to price increases.

Technical Analysis

This strategy involves using previous market data to predict future price trends. For instance, if the 50-day moving average of oil prices crosses above the 200-day average, it could indicate a bullish trend, prompting a buy decision.

Hedging

Oil investors can hedge their risks through other financial instruments. For instance, if you hold crude oil in your portfolio and worry about potential price falls, you could take a short position on oil futures to mitigate potential losses.

Swing Trading

Swing traders buy or sell oil based on its price 'swings'. For example, if oil prices drop suddenly due to unexpected oversupply, a swing trader might view this as a temporary fall and buy, expecting the price to rebound.

Spread Trading

Some traders utilize the price difference between two futures contracts for profit. For instance, if the December oil futures price is significantly higher than November, traders can sell the December contract and buy the November contract, profiting from the spread.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers. We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Forex Brokers with Instant Withdrawals in 2024

Explore the top 7 Forex Brokers offering instant withdrawals. Enjoy secure, fast trading and quick access to your earnings.

8 Best CFD Brokers in 2024

Analyze the top 7 CFD brokers, focusing on their regulatory compliance, performance, and customer satisfaction.

Best Brokers with Instant Deposits for 2024

In this article, we’ll explore five top brokers that offer instant deposits, allowing you to quickly fund your trading account and seize market opportunities without delay.

Best PayPal Forex Brokers for 2024

Discover top Forex Brokers that use PayPal, understand how transactions work, consider the pros & cons, and make your Forex trading plan!