Forex trading can be complex, yet trading with forex brokers first adds an extra layer of complexity. The pool of forex brokers is extensive, housing both reliable and unreliable entities. Amidst numerous forex brokers, spotting those to avoid is crucial.

7 Common Types of Forex Brokers to Avoid

Unregulated Forex Brokers

Any unregulated or questionably regulated forex broker should be carefully avoided by traders seeking to protect their capital and ensure legitimate market access. Unlicensed brokers have not undergone the proper compliance vetting and oversight processes necessary to confirm operational integrity and ethical trading practices. Unregulated brokers frequently defraud customers through fraudulent price feeds, excessive trading slippage, denial of withdrawal requests or other illegal schemes aimed at misappropriating trader deposits. They rely on lack of enforcement to perpetrate systematic abuses with impunity.

Offshore Forex Brokers

While the allure of tax savings or other financial incentives with offshore brokers may be appealing initially, the lack of oversight into these overseas operations opens the door to potential fraud and misconduct. Some offshore regulated brokers operate outside the jurisdiction of major financial authorities, allowing them to avoid mandatory compliance standards, audits and reporting designed to ensure fair trading and ethical business practices. As such, they can easily manipulate trading platforms, forge data and abscond with customer deposits without facing penalties - leaving traders powerless.

Illegally Operated Forex Broker

Unscrupulous forex brokers openly engaging in illegal activities such as money laundering or fraud have no place in the marketplace and should be staunchly avoided. Regulators like the NFA, FCA or MAS maintain thorough blacklists of rule-breaking forex brokers and regularly levy harsh punishments to those caught flouting laws and regulations. Traders, therefore, should keep a close eye out for warning signs of illicit operations, such as irregular fund flows, suspiciously consistent winning trade rates and unclear underlying business structures.

Forex Brokers with an Inaccessible Website

Traders should avoid forex brokers with an inaccessible, unreliable official website or online presence. Legitimate, ethical brokers invest heavily in robust web infrastructure and site availability to ensure customers enjoy responsive access for managing accounts, tracking positions and deposits as well as contacting support. By contrast, scam brokers running fly-by-night scams have little incentive wasting resources on truly functional websites when the goal is simply siphoning trader money as rapidly as possible before inevitably vanishing.

Liquidity Provider Brokers

Forex brokers claiming access to unnamed ‘direct’ liquidity providers should also avoided. Unlike reputable brokers who publicly disclose their liquidity relationships with major banks, hedge funds and transparent non-bank liquidity sources, murky third party aggregators raise doubts. Vague references to anonymous backing partners you cannot independently research should be seen as warning signs by savvy traders. A lack of verifiable information on the brokers liquidity providers prevents confirming whether promised pricing feeds and execution models live up to their marketed expectations.

Bonus Spamming Brokers

Forex brokers dangling excessive signup bonuses packed with unreasonable trading volume or asset holding prerequisites before withdrawals are permitted, should also be avoided. Rather than provide value, these misleading promotional tactics aim to deceptively restrict client capital under the guise of extra rewards. These delays pressure anxious customers awaiting their own money into resuming trading - feeding more spreads and commissions back to the broker.

Forex Brokers with Ticky Withdrawal Requirements

Forex brokers frequently impose stringent withdrawal conditions and delays to prevent customers from retrieving their rightful funds, should be avoided. Some unethical brokers levy exorbitant withdrawal fees up to several percentage points of transfer amounts, making withdrawals financially punishing. Others cite necessary manual approval procedures for releases, dragging out the process to 1-2 months. In a word, these brokers seem to bend over backwards to block traders' withdrawal requests. The patterns are clear - exploitative brokers leveraging every trick to obstruct withdrawals aim to extract maximum value from traders rather than facilitate smooth operations.

An In-depth Analysis: 5 Scam Forex Brokers to Avoid

After outlining the prevalent scam brokers, let's now dig deeper into dissecting some specific unregulated brokers that traders should avoid. This will offer a clearer perspective. These five brokers share a common trait—lack of regulatory licenses or the use of forged licenses, coupled with dysfunctional official websites and a high volume of complaints from affected traders.

| Forex Brokers to Avoid | Logo | Why are they forex brokers to avoid? |

| OmegaPro |  |

No License, Inaccessible website, 61 scam exposures |

| VOREX |  |

No license, Short operational history, 39 scam exposures |

| Dollars Markets |  |

No license, Short Operational Duration, 3 scam exposures |

| Ortega Capital |  |

Clone license, Fake physical office, Inaccessible website |

| Hankotrade |  |

No license, Registered offshore, 3 scam exposures |

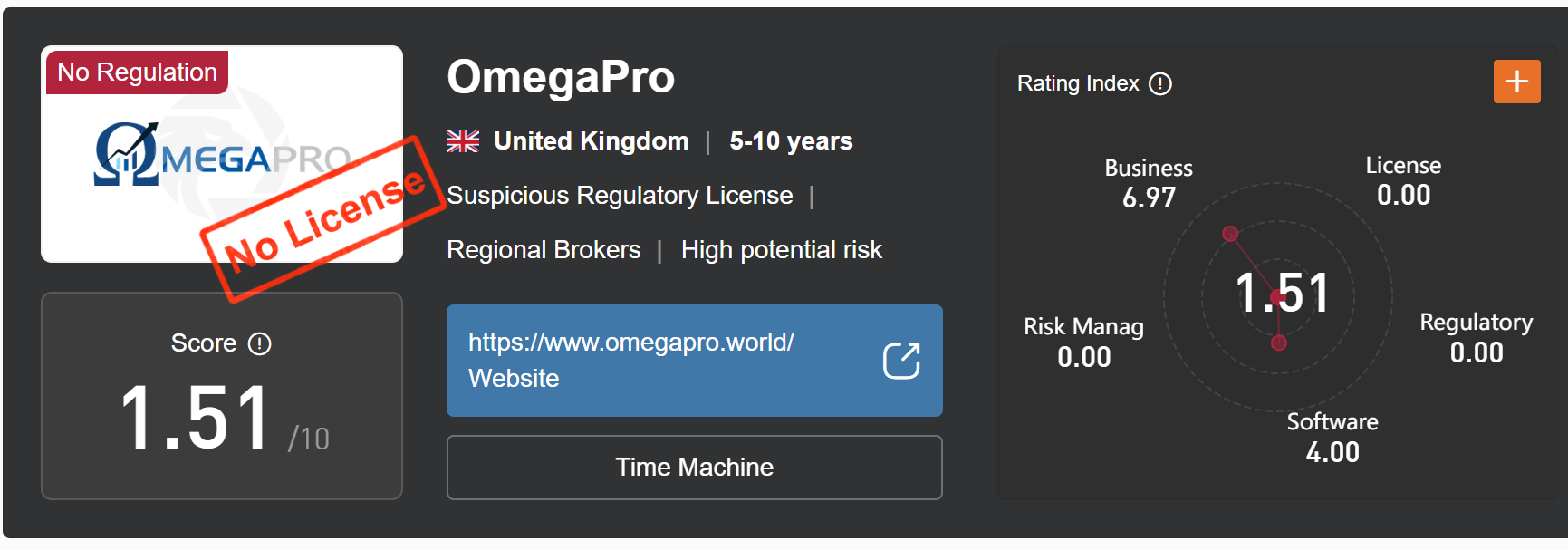

OmegaPro - A Forex Broker to Avoid, in a unscrupulous operation

Broker |

OmegaPro |

Registered Country |

United Kingdom |

Establishment of Years |

5-10 Years |

Regulation |

No License |

Minimum Deposit |

Not specific |

Official Website |

https://www.omegapro.world/ |

Customer Support |

Email:support@omegrapro.world Facebook:https://www.facebook.com/OmegaProOfficial/ Ins: https://www.instagram.com/omegapro.official/ Youtube: https://www.youtube.com/c/OmegaProOfficial/ |

Scam Exposures on WikiFX |

61 |

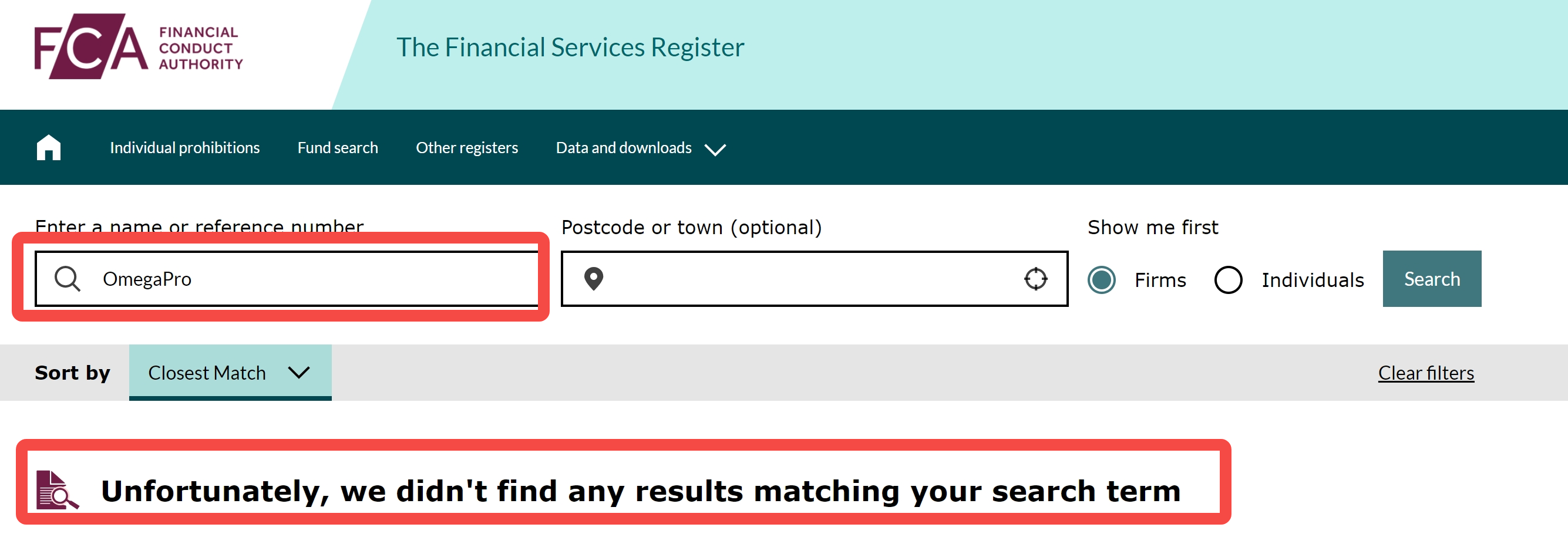

Operating without Regulation. OmegaPro claims to be registered in the UK, yet it lacks regulation by the FCA. Upon checking the FCA official website, it prominently states: “Unfortunately, we did not find any results matching your search term.” Trading with an unregulated broker is like playing fire and don't even start, or you end up with losing all your money.

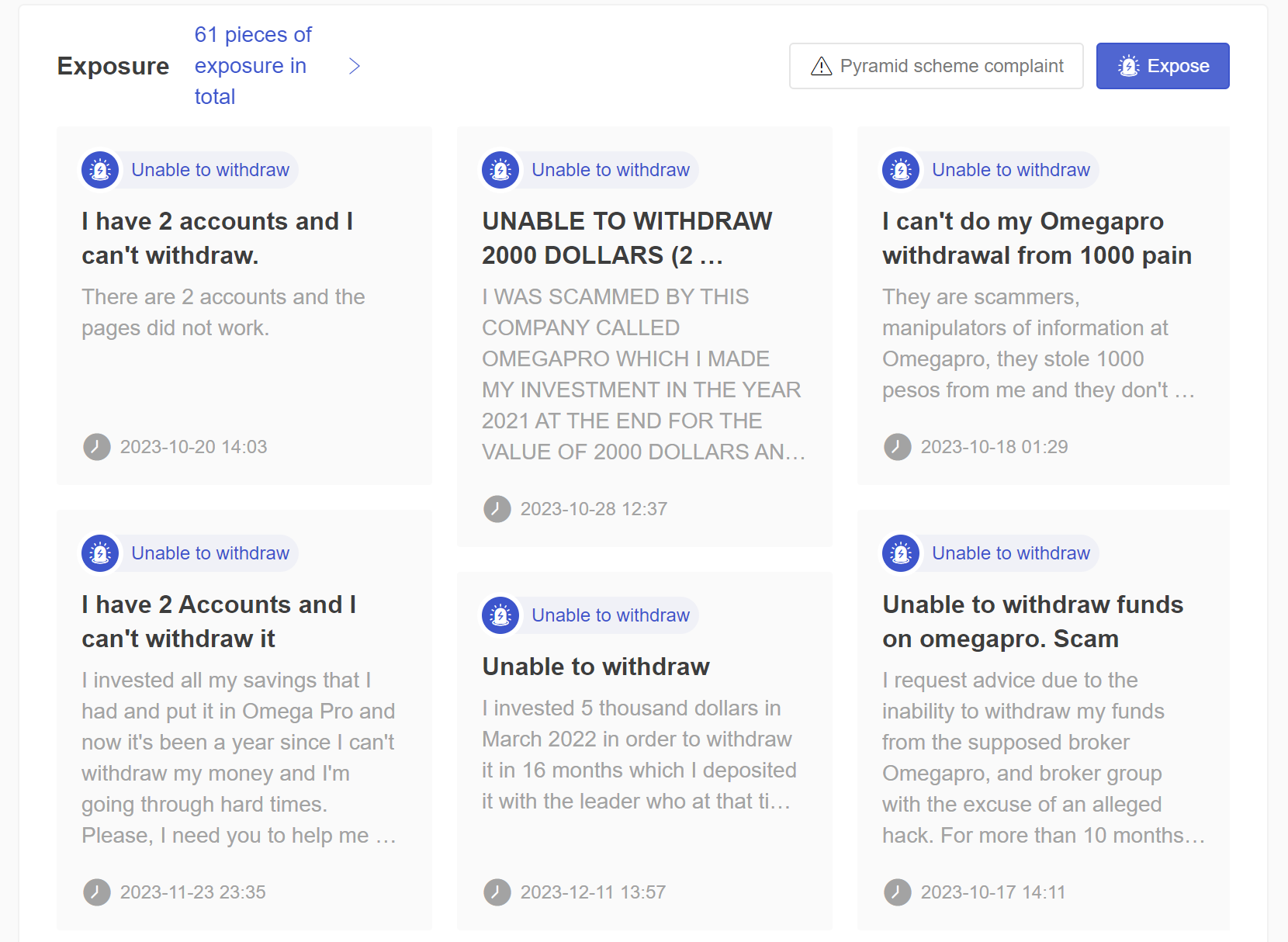

Vast Scam Exposures. In the WikiFX exposure section, there's a startling count of 61 complaints and disclosures from victims directed at the trading company Omega. Such a high volume is truly alarming and underscores the fact that this firm has deceived numerous traders. So, as we repeatedly stress, conducting thorough online research, particularly on industry-specific forums or websites, is crucial to assess a trading firm's reputation before engaging with its services.

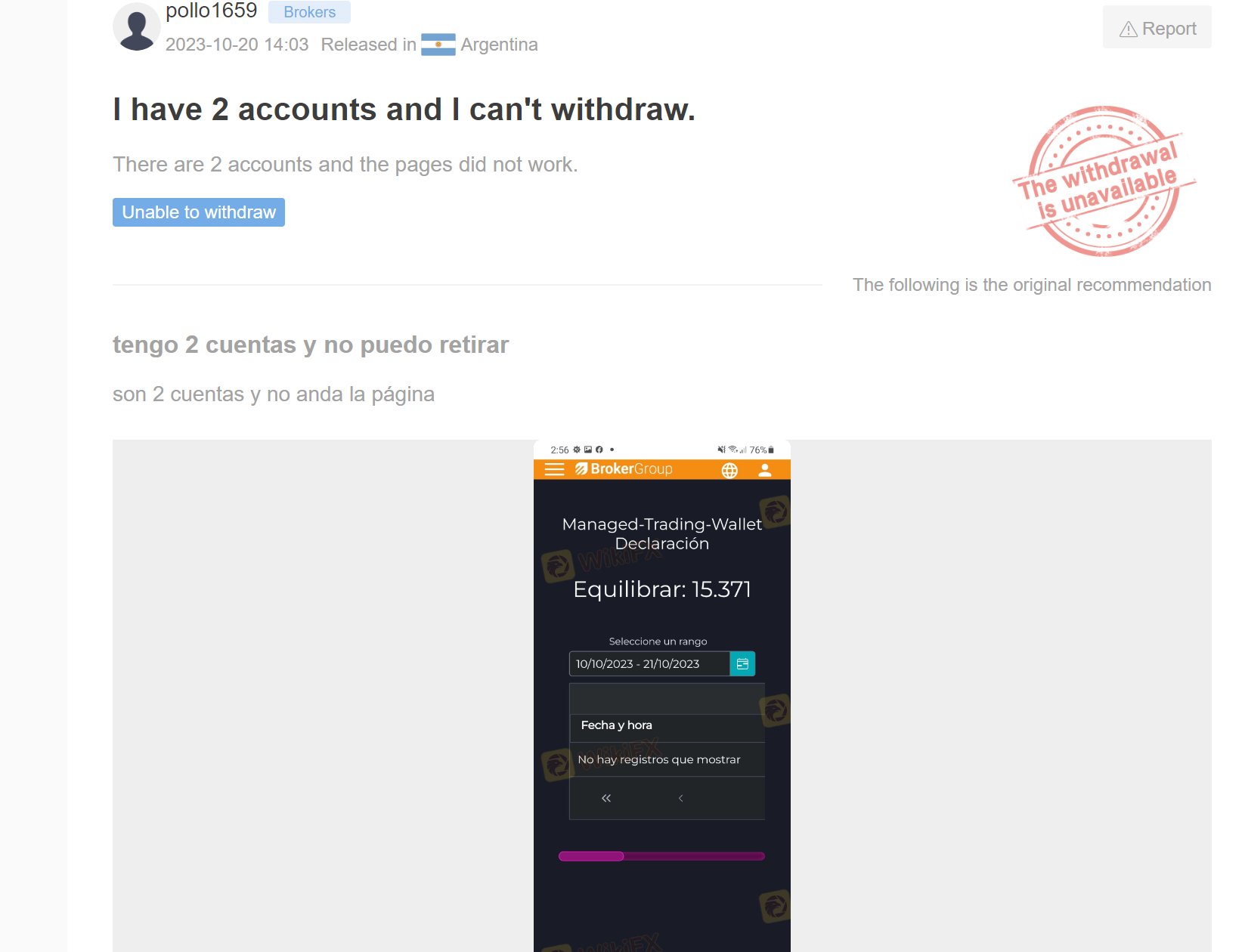

Severe Withdrawal Issues. Severe withdrawal problems exist on the OmegaPro platform. From the 61 disclosures, let's consider a case, for instance, a trader from Argentina asserted that while trading with OmegaPro, he opened two trading accounts. However, both accounts encountered issues with withdrawals as the withdrawal page malfunctioned, making it impossible to withdraw funds. This is one of the common tactics employed by fraudulent trading firms—disallowing users from withdrawing and devouring their funds.

Boasting A High Return. Omega Pro purported a 200% Return on Investment (ROI) in a span of 16 months, attributed to their undisclosed AI bot technology. However, the lack of disclosure or verification regarding this technology makes such claims unrealistic and risky.

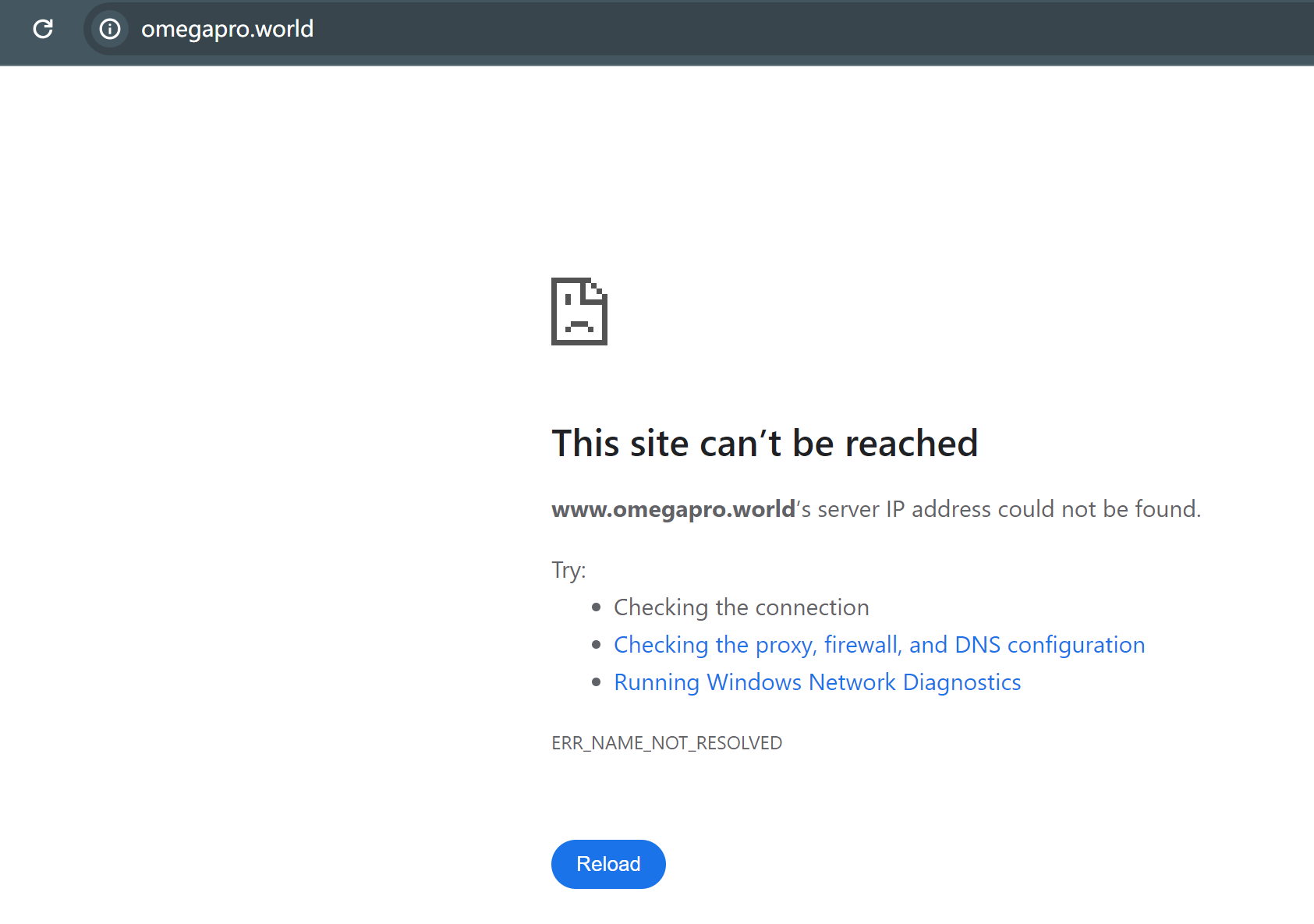

Inaccessible Official Website. Coincidently, OmegaPro's official website is presently inaccessible. This occurrence unavoidably sparks thoughts that the brokerage might have encountered regulatory actions, compelling the closure of their site. Alternatively, given the exposure of fraudulent activities, it's conceivable that the company opted to voluntarily shut down its website to shift funds and eliminate evidence.

Public Warnings. Multiple nations, such as France, Belgium, Congo, Spain, Mauritius, Argentina, Colombia, Peru, Chile, and Nicaragua, have issued fraud warnings associated with OmegaPro, highlighting significant risks linked to this broker.

VOREX - A Forex Broker to Avoid, with a notorious reputation

Broker |

VOREX |

Registered Country |

Australia |

Establishment of Years |

2-5 years |

Regulation |

No License |

Minimum Deposit |

Not specified |

Official Website |

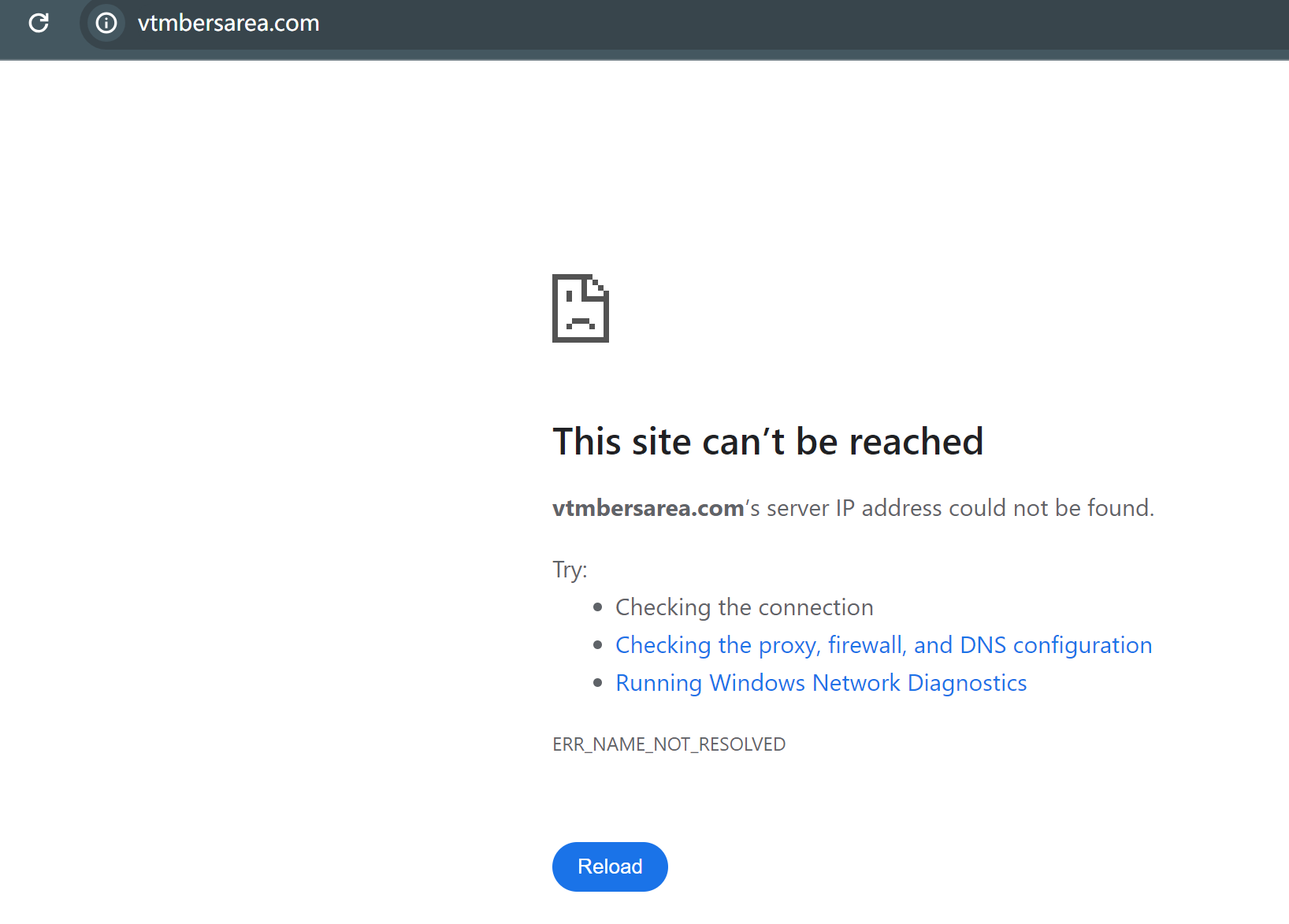

https://vtmbersarea.com/ |

Customer Support |

support@vorextrading.com.au |

Scam Exposures on WikiFX |

39 |

No License Authorized. VOREX currently operates without any regulatory oversight, and its prior ASIC license has been revoked. Trading with an unregulated broker like this is incredibly risky, as it means customers' funds lack protection, leaving ample room for brokers to abscond with their money.

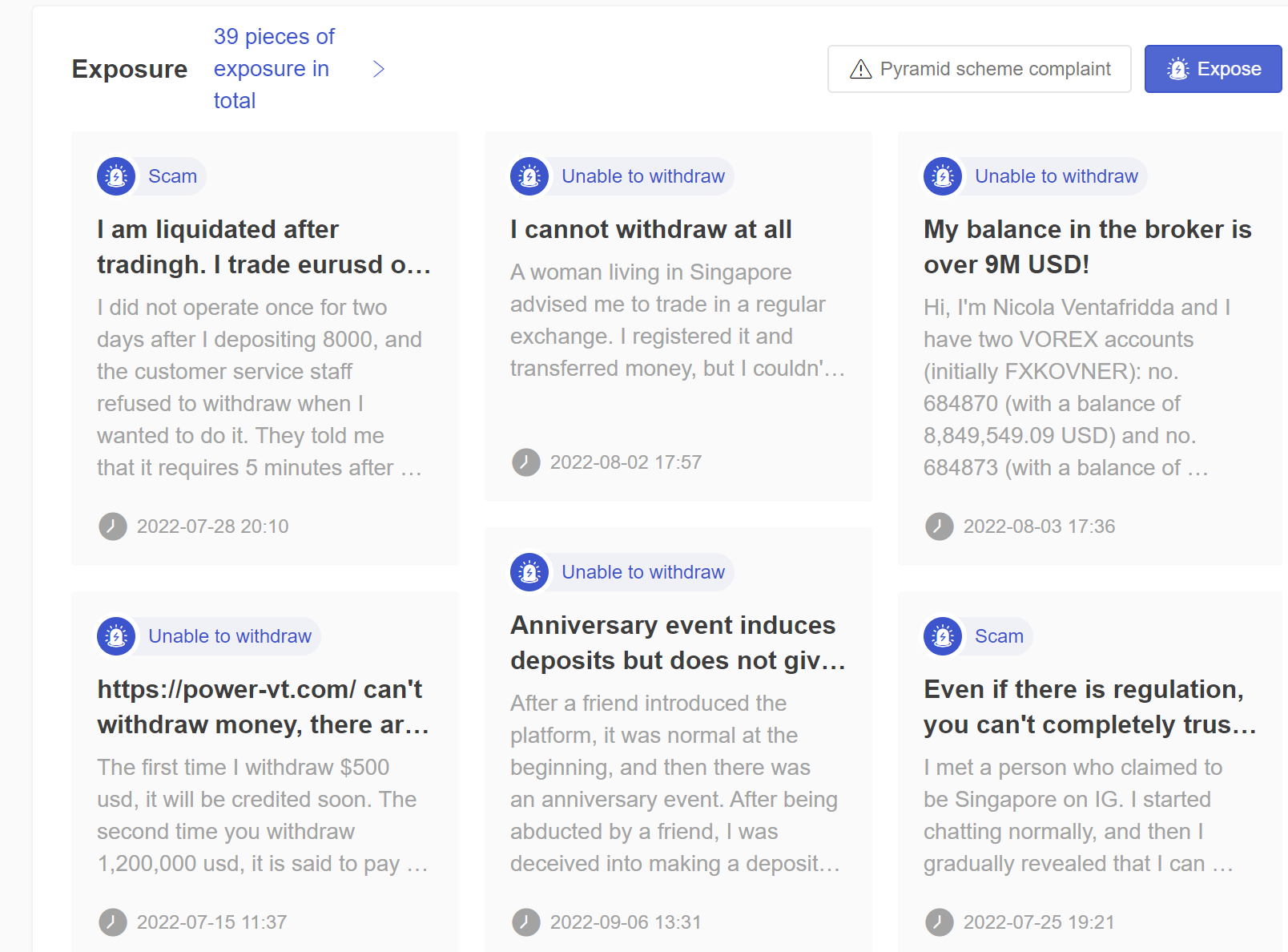

39 Scam Exposures. On WikiFX, there are a total of 39 exposures about this broker, with most victims complaining about the inability to withdraw funds from the platform. Typically, blacklisted platforms refuse users' withdrawals for two main reasons: First, their purpose is fraudulent, and if users withdraw funds, their fraudulent nature will be exposed. Second, such blacklisted platforms typically abscond with enough user funds before disappearing, hence they reject withdrawal requests beforehand.

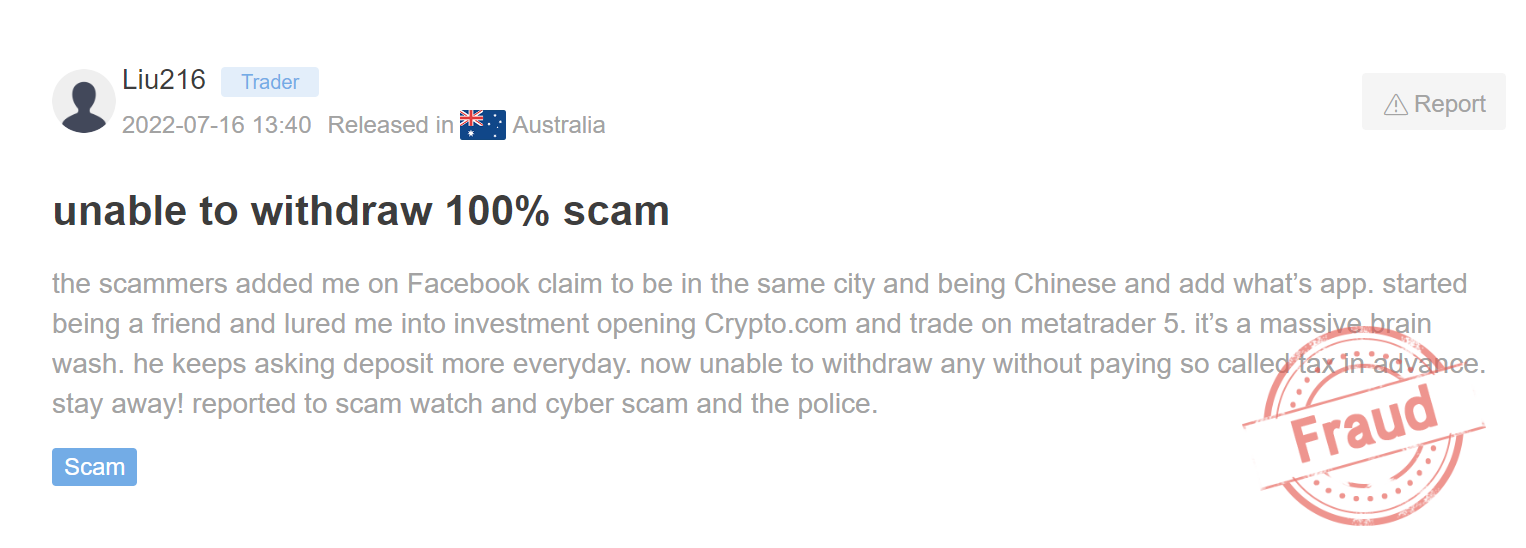

For instance, a trader from Australia lodged a complaint stating that a broker's representative contacted them via Facebook to deposit funds for trading, but subsequently declined their withdrawal requests.

Inaccessible Official Website. The official website of Vorex is currently inactive, indicating its abnormal operation. This domain seems to have been established solely for conducting fraudulent activities within a short period.

Short Operational History. The brief operating period of VOREX signifies its primary purpose: engaging in fraudulent and illicit activities, constantly poised to abscond.

Significant Withdrawal Difficulties. VOREX is facing severe withdrawal issues, leaving numerous victims struggling to withdraw funds. They often encounter customer service representatives who either deflect responsibility or completely ignore their concerns.

Dollars Markets- A Forex Broker to Avoid, with an elaborate mask

Broker |

Dollars Markets |

Registered Country |

Mauritius |

Establishment of Years |

2-5 years |

Regulation |

No license |

Minimum Deposit |

$15 |

Official Website |

https://www.dollarsmarkets.com/ |

Customer Support |

Phone: +230 214 3371 Email: support@dollarsmarkets.com Twitter: https://twitter.com/dollars_markets Facebook:https://web.facebook.com/Dollars-Markets-103540458530606 Ins:https://www.instagram.com/dollarsmarkets |

Scam Exposures on WikiFX |

3 |

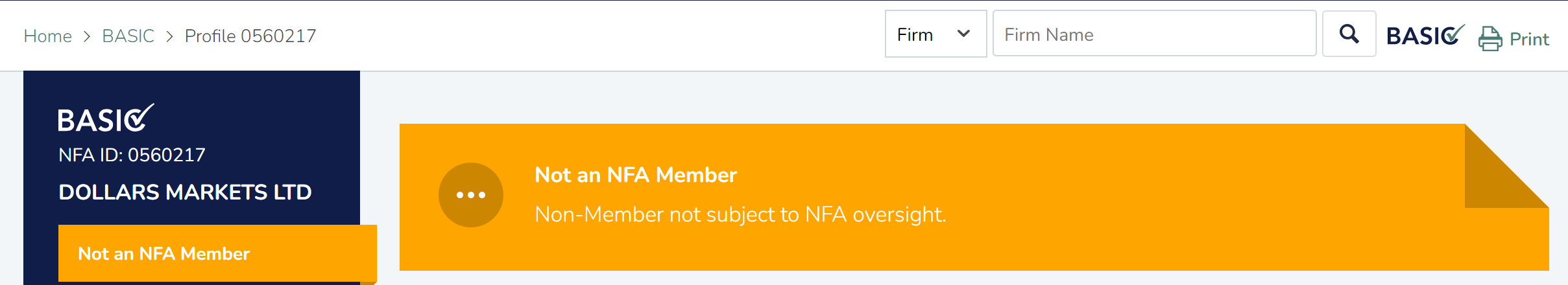

Fake Regulatory License. Dollars Markets is presently functioning without regulatory oversight. Despite its assertion of being regulated by the NFA, scrutiny of the NFA's official website reveals no indication of the brokerage being under its supervision.

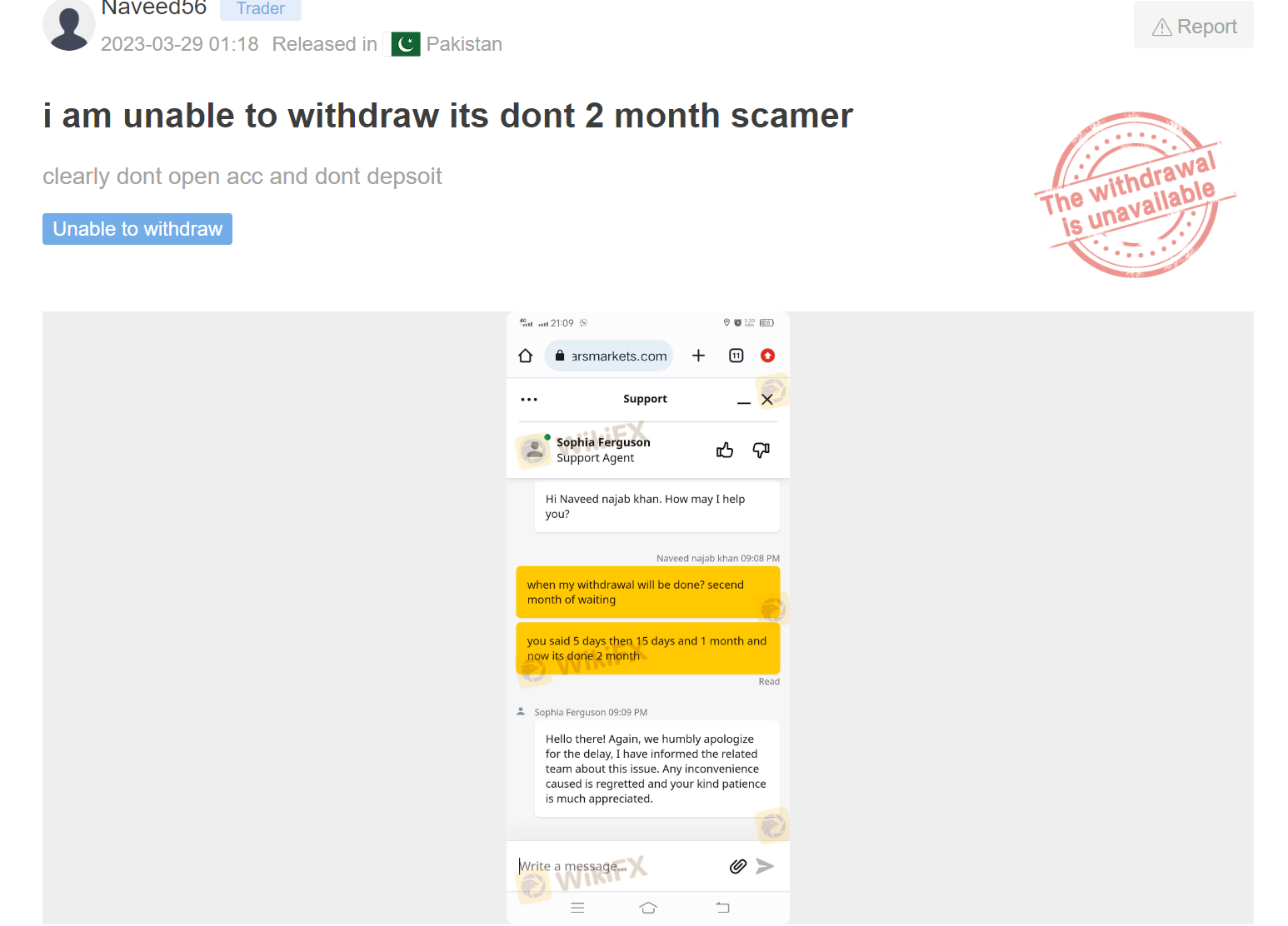

3 Scam Exposures. On WikiFX, there are three instances exposing issues with this broker, particularly regarding withdrawal problems. Interestingly, a trader from Pakistan faced blatant disregard and evasion from their customer service representatives when discussing withdrawal matters with this broker. Such behavior unmistakably reveals the broker's intent to deceive traders.

Short Operational History. Dollars Markets features a very short operating history, spanning only 2-3 years, and is registered in Mauritius, an offshore region. This fact naturally raises suspicions, suggesting that its establishment might be solely aimed at engaging in fraudulent activities to seize users' funds.

No demo accounts Offered. Dollar Markets boasts an array of trading products and sets a low minimum deposit of $15 for a standard account, but surprisingly lacks a demo account. Such a practice is rather uncommon in the industry. A demo account is pivotal for traders to acquaint themselves with the platform's genuine trading environment. This absence raises skepticism about the broker's credibility.

2000X Leverage. Dollar Markets provides notably high leverage, a strategy aimed at attracting a larger investor base. Unregulated brokers typically overlook investors' risk tolerance, focusing instead on encouraging increased trading activity to profit from higher transaction fees. Their primary objective revolves around prompting more trades without considering investors' risk capacity.

Claimed Low Spreads:Dollar Markets claims to partner with top-tier liquidity providers to offer its users the most competitive spreads in the industry. However, upon verification with these liquidity providers, it was found that this broker is not even listed among them. Therefore, this appears to be nothing more than a tactic by the broker to deceive more traders.

Ortega Capital- A Forex Broker to Avoid, operating in a shady way

Broker |

Ortega Capital |

Registered Country |

Malaysia |

Establishment of Years |

5-10 Years |

Regulation |

No License |

Minimum Deposit |

Varies depending on payment methods |

Official Website |

http://ww12.ortegacapital.com/ |

Customer Support |

cs@ortegacapital.com |

Scam Exposures on WikiFX |

No |

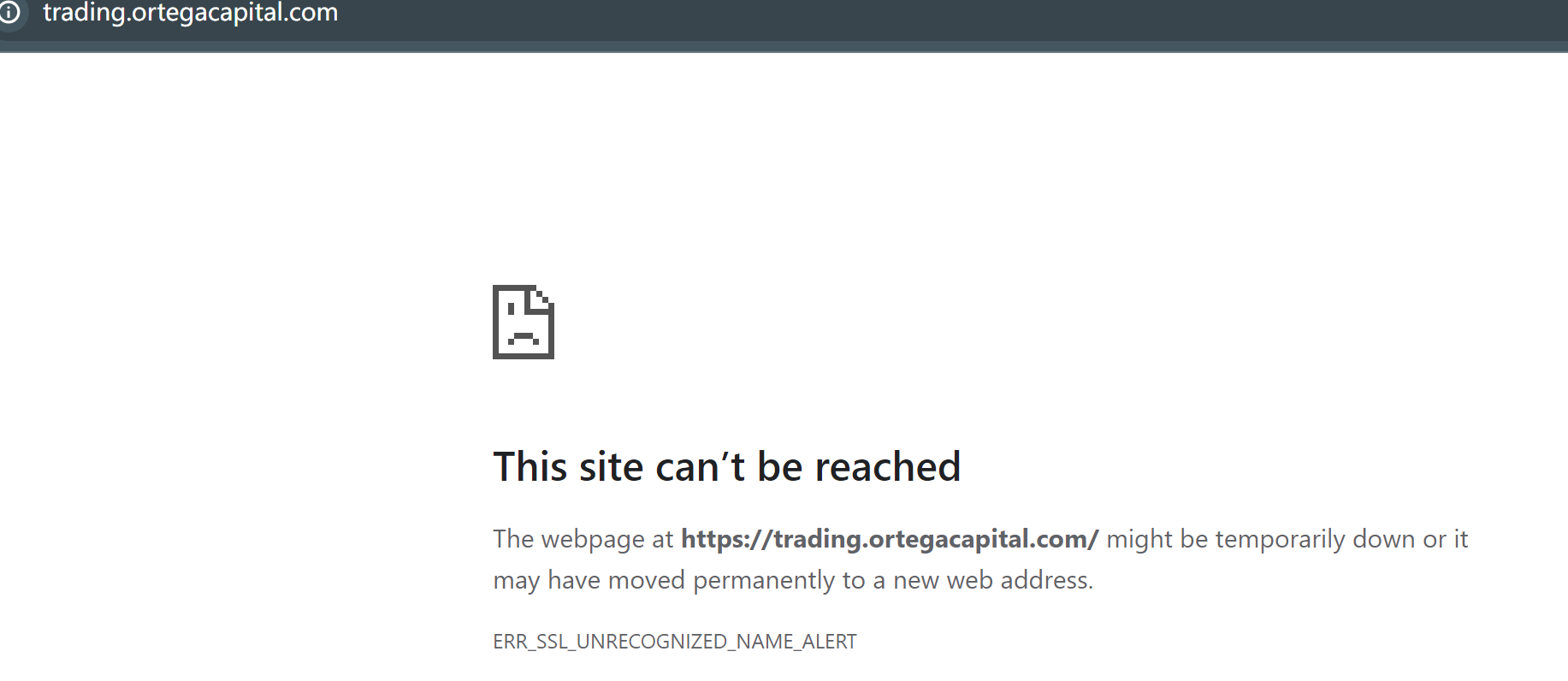

Fake Licensing. Ortega Capital claims to be regulated by LFSA, but in reality, this is a false license. The broker is, in fact, unregulated, following the typical strategy of fraudulent brokers. They fabricate counterfeit licenses to deceive unsuspecting traders, initiating fraudulent activities under the guise of legitimacy.

Non-Exsitent Office. The WikiFX investigation team physically visited the address claimed by Ortega Capital and found that the location provided does not exist at all. This common strategy is used by deceptive forex brokers—they furnish fake office addresses to give an air of legitimacy and compliance, fooling investors into believing they have a physical base. Consequently, they don't necessarily maintain genuine office addresses.

Inaccessible Official Website . When attempting to access Ortega Capital's official website, we discovered that its domain had expired and was up for sale. This strongly suggests that the broker merely created a temporary domain for short-term deception, with the intent to abscond as soon as they amassed users' funds.

Hankotrade - A Forex Broker to Avoid, purely established to defraud traders

Broker |

Hankotrade |

Registered Country |

Saint Vincent and the Grenadines |

Establishment of Years |

2-5 years |

Regulation |

No License |

Minimum Deposit |

$10 |

Official Website |

https://hankotrade.com/stp |

Customer Support |

contactus@hankotrade.com |

Scam Exposures on WikiFX |

3 |

Lack of Regulation. Ortega Capital operates without any regulatory oversight, despite its false claim of being regulated by LFSA. A search on the LFSA official website yielded no results for this broker's name. Engaging with an unregulated broker poses significant risks, as they have the potential to disappear without warning.

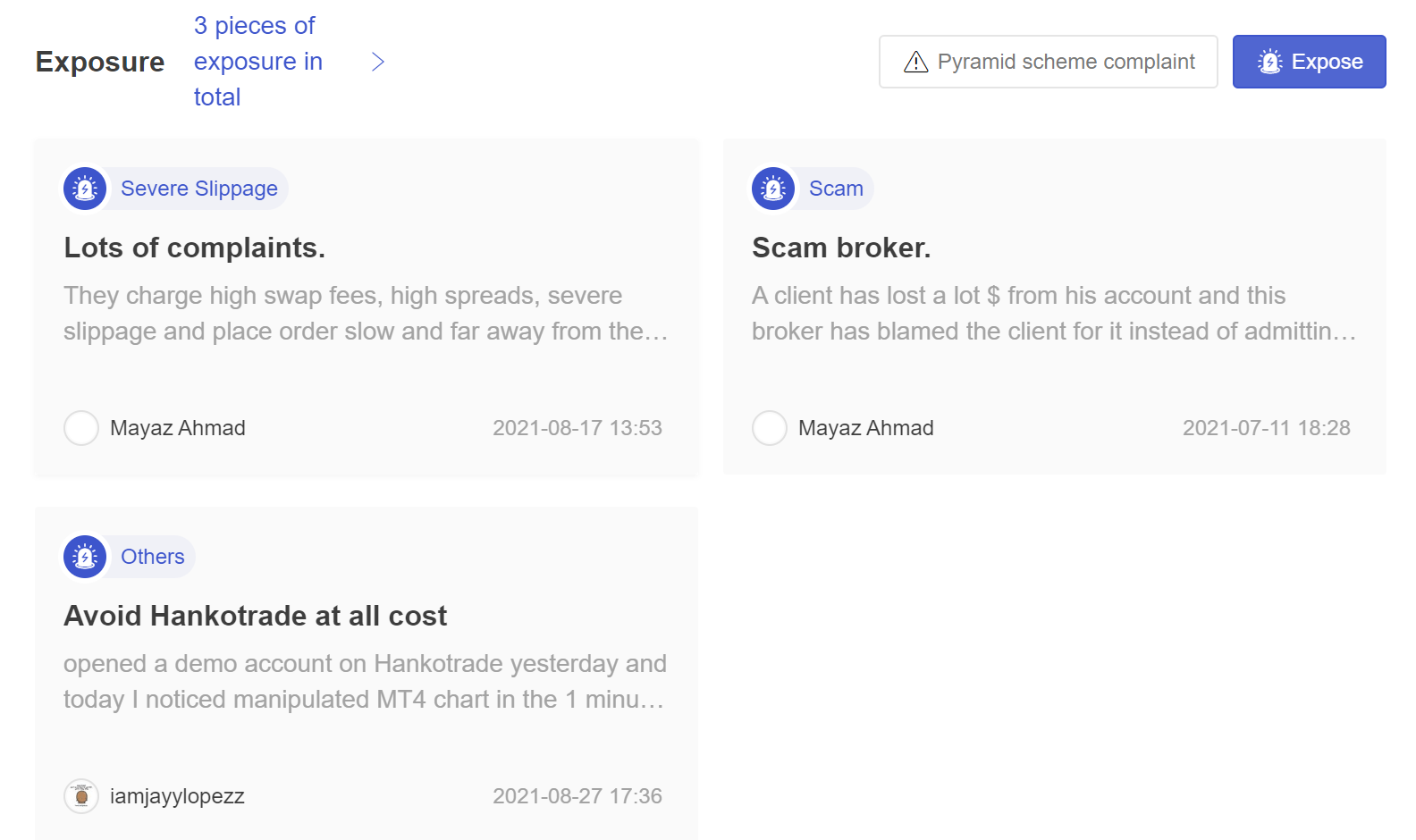

3 Scam Exposures. Regarding Hankotrade, there are three exposure reports where victims have complained that the broker operates as a blacklisted platform. The grievances range from the inability to withdraw funds to encountering high slippage rates and experiencing exceedingly wide spreads.

Easy Entry with just $10. Hankotrade allows traders to commence trading with as little as $10. This strategy is aimed at enticing a larger pool of traders, laying the groundwork for subsequent substantial transactions and consistent deposits.

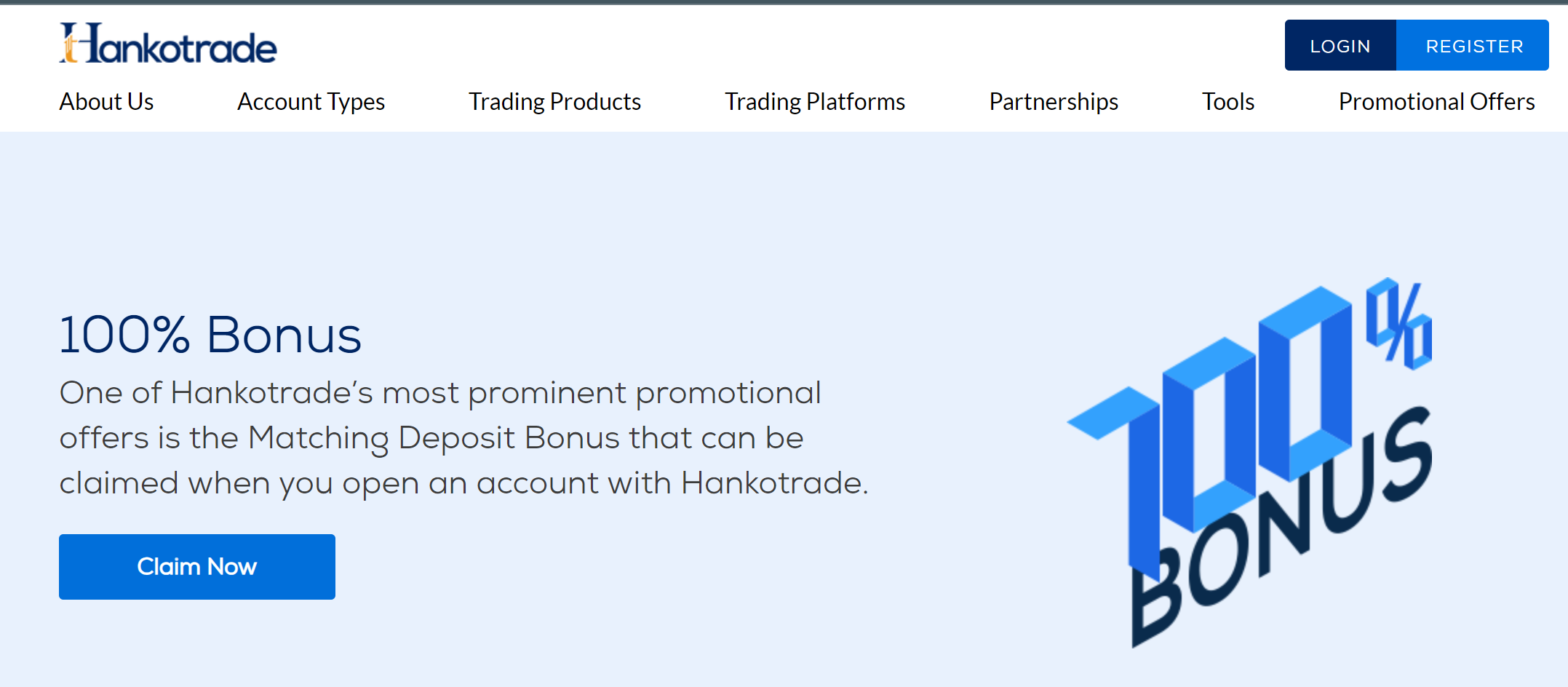

100% Deposit Bonus. Seemingly, Hankotrade relies heavily on providing substantial deposit bonuses, essentially as a means to entice a larger pool of investors to their platform. Ah, through these significant deposit incentives, they aim to capture the attention of potential traders, fostering increased participation in their services.

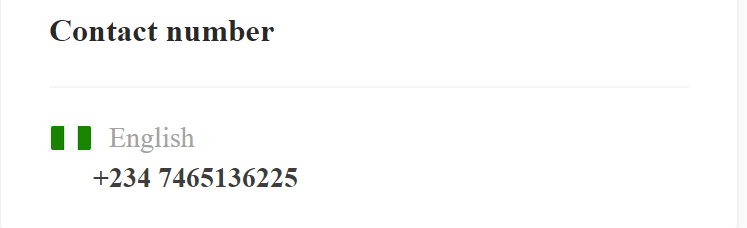

Conflicting Contact Details. This brokerage asserts its registered address is in Comoros and its actual location in Dubai. However, the contact phone number provided belongs to Nigeria. These conflicting contact details are undeniably suspicious and further solidify its identity as an unregulated broker.

WikiFX:Check Forex Brokers to Avoid Easily

Trading forex is energy-consuming since you have to spend a lot of time checking forex brokers and deciding whether to avoid them. Fortunately, WikiFX makes this job much easier.

WikiFX serves as a professional platform for querying forex regulatory information, housing a vast directory of over 50,000 brokers and encompassing more than 60 regulatory bodies worldwide. Where WikiFX shines is that it has been continued to synchronize its regulatory information with global authorities, ensuring a fair and transparent approach for traders. On WikiFX, a broker's regulatory status falls into three distinctive categories, verified through rigorous checks on registered addresses, domain name validations, on-site visits to registered locations, and cross-confirmations with local regulatory bodies.

The first category is labeled as “No License”, which means brokers in this group operate without any regulatory oversight, presenting significant risks. Hence, it's crucial to steer clear of brokers flagged with the “No License” status.

Another is the “Suspected Fake Clone” category. These brokers frequently pose as authorized and genuine entities to entice unaware traders. It's strongly advised to steer clear of such brokers for your personal safety.

And lastly, brokers labeled as “Illegal” have been involved in unlawful operations, sparking numerous complaints from affected traders. These are brokers you'd want to avoid entirely safeguarding your investments.

With just a simple click, you can check the specific regulatory status of brokers, thereby allowing you to take necessary precautionary measures.

Small Tips to Avoid Risks in Forex Trading

Conduct Comprehensive Background

When selecting a broker, no matter how you discovered them through advertising or referrals, conduct thorough background checks on the brokerage. Mainly verify:

Regulatory Licenses: Check if the broker is officially licensed by local financial regulators. Search the regulator's website and check if the broker is on their license list.

Company History: Assess if the brokerage has at least 5+ years of operating history. Excessively short histories are red flags.

Physical Offices: Verify if the brokerage maintains physical offices, and try contacting or visiting them. Lack of physical presence suggests extremely high risk.

Customer Feedback: Search for client reviews of the company on industry forums. Avoid strictly if excessive complaints exist.

Beware of False Promises or Incentives

Fraudulent brokers use unrealistic profit promises or special offers to attract clients. Be very wary of:

Claims of 20%, 50% or even higher annualized returns, which far exceed normal levels.

Offering higher leverage levels than rivals, like 1:1000+ dangerously high leverage ratios.

Claims of risk-free trading or ability to cancel trades without fees. All trading carries risks.

Opt for Reputable & Established Brokers

Choosing well-known brokers with stable performance and strong reputations better ensures fund security, over new or opaque brokers. Verify the broker ranks highly with steady profitability and sustainable business models.

Ensure Availability of Risk Separation Measures

Select brokers providing third-party account custody, investor compensation funds or rigorous financial separation structures. This allows assets protection if bankruptcy or violations occur.

Utilize Stop Losses and Margin Controls

Use stop loss tools to prevent huge losses from extreme market moves. Reasonable stop loss levels are typically 2-5% of total exposure. For margin trading, maintain at least 10% margin ratio per position.

Limit Position Sizes Based on Investment Principal

Avoid blindly allocating more funds to brokers. Establish independent risk management frameworks, rigidly controlling the exact proportions of capital deployed, so total exposure remains within loss tolerance thresholds.

Some Reputable Forex Brokers to Consider

While traders actively avoid unscrupulous brokerage firms, ah, there exist highly respected entities within the forex industry that stand tall. These brokers boast strict regulatory oversight, transparent fee structures, cutting-edge trading platforms, expedited order execution, swift withdrawal processes, and highly-praised user testimonials. These pillars of excellence in the forex landscape not only prioritize client security but also offer a smooth trading experience. Here we list three big names in the industry, Forex.com, XM and IG.

Forex.com, a reputable broker offering all-around services

Broker |

|

Regulated by |

ASIC, FCA, FSA, NFA, IIROC, CIMA, MAS |

Min. Deposit |

$100 |

Tradable Assests |

Forex, Spot Metals |

Trading Platform(s) |

MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Order Execution | Around 30 Milliseconds |

Leverage |

1:50 |

Trading Fees |

EUR/USD as low as 0/0 pips, commissions at $7 per side |

Payment Methods |

Wire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH Transfer |

Copy Trading |

✅ |

Demo Accounts |

✅ |

Bonus |

✅ |

Customer Support |

5/24 live help, multilingual |

Established in 1999, Forex.com has been a leading forex and CFD broker ever since. The NFA, the FCA, the IIROC, and ASIC are among the several regulatory bodies that supervise it. Tradable instruments include fiat currency, digital currencies, commodities, stock indexes, bonds, shares, and exchange-traded funds (ETFs). For the flagship platform FOREXTrader PRO, the average EUR/USD spread is 0.9 pips, whereas for the web-based Advanced platform, the normal difference is 1.2 pips. MetaTrader4, Advance Web, Webtrader, the desktop platform, and the mobile app are the five trading platforms. As of December 2022, the fill percentage for all order types was 95.18%. Customer support is provided via 24/5 live chat, UK and US-based phone lines, and email.

IG, a trusted broker offering low costs on FX

Broker |

IG |

Regulated by |

ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA |

Min. Deposit |

$250 |

Tradable Assests |

Forex,Shares,Indices,Commodities,Thematic and basket,Options trading, Futures trading, Spot trading, Cryptocurrencies |

Trading Platform(s) |

MT4, IG Web Platform, IG Mobile App |

Order Execution |

0.016 secs |

Leverage |

1:50 |

Trading Fees |

0.9 pips on EUR/USD, Commission-free for FX |

Payment Methods |

debit card, wire transfer or bank transfer (Automated Clearing House (ACH) |

Copy Trading |

✅ |

Demo Accounts |

✅ |

Educational Resources |

Rich and Quality |

Customer Support |

7/24 live help, multilingual |

IG is a pioneering brokerage founded in 1974 in the UK and it regulated across multiple tier-1 jurisdictions like the FCA, ASIC, FMA. Asset classes tradable with IG spanForex,Shares,Indices,Commodities,Thematic and basket,Options trading, Futures trading, Spot trading, Cryptocurrencies. Average EUR/USD spreads are 0.70 pips on the proprietary IG Web Platform and IG App.

XM, a respected broker friendly to both beginners and seasoned traders

Broker |

XM |

Regulated by |

ASIC, CYSEC, FSC, DFSA |

Min. Deposit |

$5 |

Tradable Assests |

Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies |

Trading Platform(s) |

MT4 & MT5, available on PC, iPhone, iPad |

Order Execution |

Around 30 Milliseconds |

Leverage |

1:1000 |

Trading Fees |

0.6 pips on all major currency pairsNo commissions on FX accounts |

Payment Methods |

credit and debit cards, bank transfers, e-wallets, and many more |

Withdrawal Time |

Withdrawal via e-Wallets can be processed instantlyWithdrawals via bank wire, credit or debit card usually take 2-5 business days |

Copy Trading |

✅ |

Demo Accounts |

✅ |

Bonus |

$50 trading bonusDepsoit bonus up to $5,000 |

Customer Support |

7/14 live help, multilingual |

XM is a reputable broker with a nearly 15-year operational history, earning a remarkable 9.01 out of 10 on WikiFX, reflecting its solid reputation and excellence in operation. Regulated across four global regions, including oversight by the tier-1 ASIC in Australia, XM offers a diverse range of tradable assets, such as Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, and Energies. This array provides traders with extensive options to explore.

Particularly welcoming to novice traders, XM stands out as one of the few major brokers allowing a minimum deposit of just $5. Moreover, it offers an appealing no deposit bonus of up to $50, which enhances its attractiveness to traders. Beyond its vast tradable instruments offered, XM provides an abundance of trading resources, such as live education, educational webinars, videos, and more, enriching the trading experience for its users.

When it comes to trading fees, XM features a competitive edge, charging just 0.6 pips on all major currency pairs with no commissions on FX accounts. This stands as one of the most cost-effective options within the industry. With an average order execution time of approximately 30 milliseconds, traders benefit from low latency and minimal slippage. XM ensures convenience and efficiency in customer service by offering 24/7 multilingual support, coupled with swift and hassle-free deposit and withdrawal processes.

About WikIFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.