Score

BCEL

Thailand|2-5 years|

Thailand|2-5 years| https://www.bcel.com.la/bcel/?lang=en

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Laos 8.01

Laos 8.01Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Thailand

ThailandUsers who viewed BCEL also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

bcel.com.la

Server Location

Laos

Website Domain Name

bcel.com.la

Website

WHOIS.NIC.LA

Company

LANIC

Domain Effective Date

2000-11-20

Server IP

103.138.142.2

Company Summary

D

| Aspect | Information |

| Registered Country/Area | Thailand |

| Founded Year | 2-5 years |

| Company Name | Banque Pour Le Commerce Exterieur Lao Public |

| Regulation | No valid regulatory information, please be aware of the risk! |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Account Types | Kids Saving Account, Fixed Deposit Account, Pension Saving Account, Saving Account, Current Account |

| Demo Account | Not specified |

| Customer Support | Telephone: (+856-21) 213200, Email: bcelhqv@bcel.com.la |

| Payment Methods | Card-based Payment Methods, Electronic Banking, Other Products and Services |

| Trading Tools | Calculators |

Overview of BCEL

BCEL is a broker based in Thailand that operates without valid regulation, posing potential risks. They offer a range of account types, including Kids Saving, Fixed Deposit, Pension Saving, Saving, and Current Accounts. However, there is limited information on specific terms and conditions, and certain account types may have associated fees and charges.

BCEL provides various payment methods, including card-based options and electronic banking services like online banking, mobile banking, and SMS banking. They also offer additional services such as LapNET, CDM, and ATM services. However, there are potential risks of fraud, limited availability in certain locations, and reliance on internet connectivity for seamless transactions.

Trade Finance services offered by BCEL include Import Services, Export Services, Letter of Guarantee, and Gold Trading Services. However, specific details about the Gold Trading service are not provided.

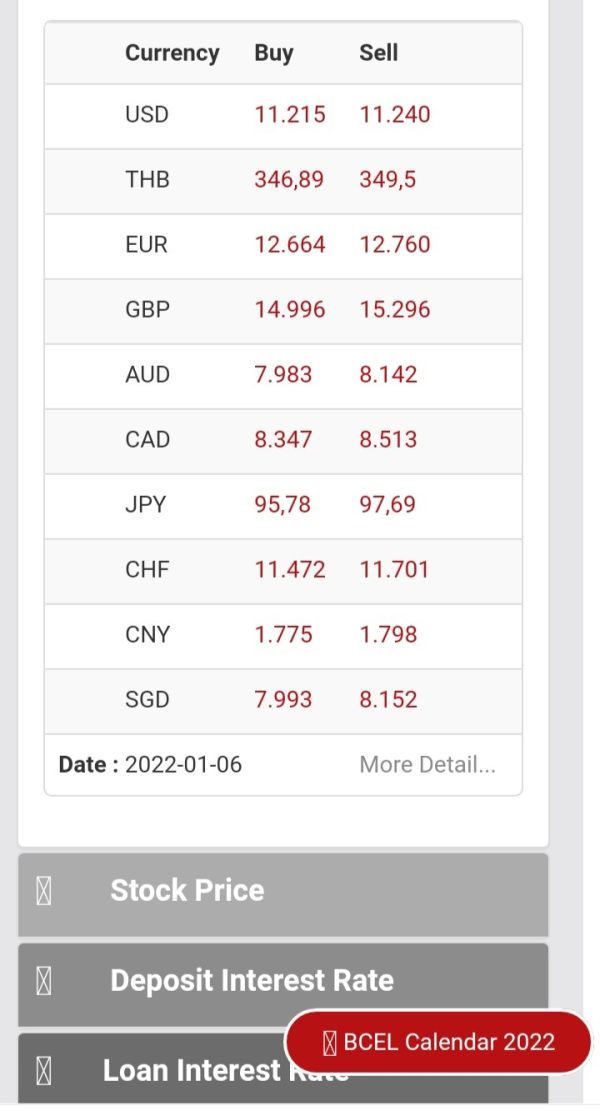

BCEL provides trading tools such as a currency converter, savings calculator, and deposit calculator. These tools assist users in currency conversions and estimating savings and deposit growth. However, there is limited information on their functionality and guidance on factors and methodology.

Customer support is available through various communication channels, including telephone, fax, email, and social media platforms. BCEL's Corporate and Private Banking Division offers a range of services to corporate entities and SMEs, including investment consulting and assistance in finding alternative funding sources.

Overall, while BCEL offers a range of services and tools, the lack of regulation, limited information, potential fees, and reliance on user input should be considered before engaging with them as a broker.

Pros and Cons

BCEL (Banque pour le Commerce Extérieur Lao) has its own set of pros and cons. On the positive side, the bank provides various account types that cater to different savings goals, offering flexibility and options for customers. Additionally, BCEL offers convenient payment methods, including card-based and electronic banking, allowing for easy and efficient transactions. The bank also supports trade finance services, which can benefit importers and exporters in their business activities. Furthermore, BCEL provides trading tools for financial transactions, enhancing the overall banking experience. On the downside, there is a lack of detailed information on specific terms and conditions, which can be frustrating for customers seeking transparency. Additionally, there may be potential risks associated with fraud and unauthorized transactions, emphasizing the need for vigilance. It's worth noting that BCEL's availability and access might be limited in certain locations. Lastly, while the bank offers customer support through multiple channels, there may be limitations in terms of assistance provided for tool-related queries.

| Pros | Cons |

| Provides various account types for different savings goals | Lack of detailed information on specific terms and conditions |

| Offers payment methods including card-based and electronic banking | Potential risks of fraud and unauthorized transactions |

| Supports trade finance services for importers and exporters | Limited availability or access in certain locations |

| Provides trading tools for financial transactions | Limited customization and advanced tools |

| Offers customer support through multiple channels | Limited customer support for tool-related queries |

Is BCEL Legit?

BCEL, as described in the warning message, is a broker that lacks valid regulation. This means that it operates without oversight or supervision from any regulatory authority. The absence of regulatory oversight poses significant risks for individuals considering engaging with BCEL as a broker.

Account Types

BCEL offers various account types to cater to the diverse needs of its customers. These account types include Kids Saving Account, Fixed Deposit Account, Pension Saving Account, Saving Account, and Current Account.

| Pros | Cons |

| Provides options for different savings goals | Lack of detailed information on specific terms and conditions |

| Tax advantages for retirement savings | Potential fees and charges associated with certain account types |

| Educational resources for young savers | Limited interest rates for some account types |

Payment Methods

BCEL offers a variety of payment methods to cater to the diverse needs of its customers. These payment methods can be classified into different categories:

1. Card-based Payment Methods:

BCEL accepts various international cards, including VISA, Mastercard, Maestro, Cirrus, Diners Club International, JCB, and CUP. These cards allow BCEL cardholders to withdraw cash at BCEL ATMs. Additionally, BCEL offers specific card options such as BCEL VISA, WORLD Mastercard, Virtual Prepaid Mastercard, BCEL Prepaid Mastercard, Smart VAT Card, Co-Brand Card, Smart Tax, Pay Card, and BCEL UnionPay Cards.

2. Electric Banking:

BCEL provides a range of electronic banking services to its customers. These services include:

- BCEL i-Banking: An online banking platform that allows customers to perform various banking transactions remotely.

- FastTract: A service that enables quick and financial transactions through designated BCEL branches.

- BCEL OneCare: A mobile banking app that offers a wide range of banking services and features.

- BCEL OnePay: A mobile payment solution that allows customers to make payments using their mobile devices.

- SMS Banking: A service that allows customers to perform banking transactions through SMS messages.

- EDC/POS Services: BCEL offers Electronic Data Capture (EDC) and Point of Sale (POS) services for businesses to accept card payments.

- Online Payment Gateway Solutions: BCEL provides online payment gateway solutions for e-commerce businesses.

- BCEL OneHeart: A comprehensive financial management platform that helps customers manage their finances.

3. Other Products and Services:

Apart from card-based and electronic banking options, BCEL offers additional products and services such as LapNET, CDM (Cash Deposit Machine), and Automatic Teller Machine (ATM) services. These services provide customers with access to cash withdrawal, deposits, and other banking functionalities.

One notable product offered by BCEL is the BCEL World Mastercard. This credit card is designed for customers who enjoy traveling and prefer classy payment options. The World Mastercard offers global acceptance, cardholder privileges, and recognition from Mastercard. It can be used for cash withdrawals, payments for goods and services domestically and internationally, online payments, and other privileges.

Additionally, BCEL offers the Smart VAT Card, which allows customers to make value-added tax payments using a card instead of cash or checks.

BCEL also collaborates with Lao Airlines and UnionPay to offer Co-Brand Credit Cards. These cards, including the BCEL Co-Brand Platinum, Gold Sky (insured and uninsured options), and Silver Cloud, come with different privileges and usage options.

| Pros | Cons |

| Online payment gateway solutions facilitate e-commerce transactions | Potential risks of fraud and unauthorized transactions |

| Options for different transaction needs | Limited availability or access in certain locations |

| Mobile banking apps for banking on the go | Potential reliance on internet connectivity for seamless transactions |

| SMS banking allows basic banking transactions through text messages | Possible additional fees or charges associated with certain services |

| Wider acceptance and compatibility with international cards | Potential technical issues or interruptions during transactions |

Trade Finance

Trade Finance comprises several services offered by BCEL to support importers and exporters. These services include Import Services, Export Services, Letter of Guarantee, and Gold Trading Services.

Import Services:

BCEL provides Letter of Credit (L/C) services to facilitate import transactions. The L/C acts as a means to ensure payment to overseas suppliers. Importers must obtain an L/C from the bank, which guarantees payment to the supplier if the importer fulfills the specified conditions.

Export Services:

BCEL offers services to assist exporters in receiving payments from their trading partners. The bank has gained acceptance as an intermediary for transactions worldwide. Exporters can apply for L/C services at the BCEL headquarters or branches.

Letter of Guarantee:

BCEL provides Letter of Guarantee services, which serve as a commitment to fulfill financial obligations on behalf of customers. This can be useful in various business transactions where a guarantee is required.

Gold Trading Services:

BCEL extends its services to include Gold Trading, facilitating transactions related to buying and selling gold. The specific details of this service are not provided.

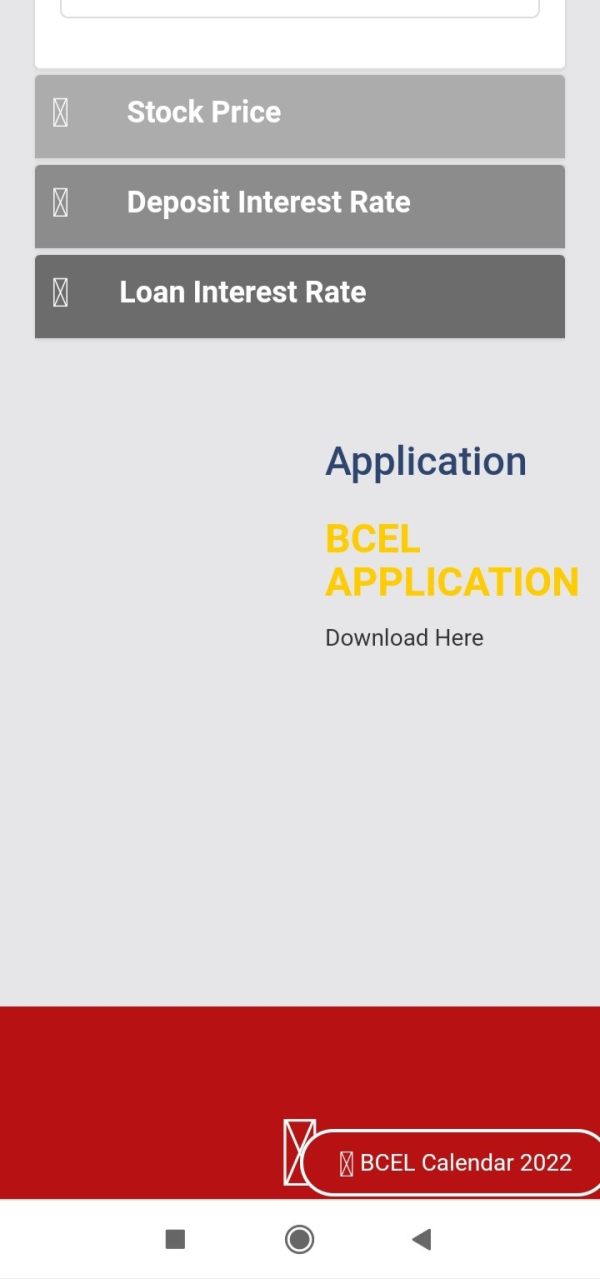

Trading Tools

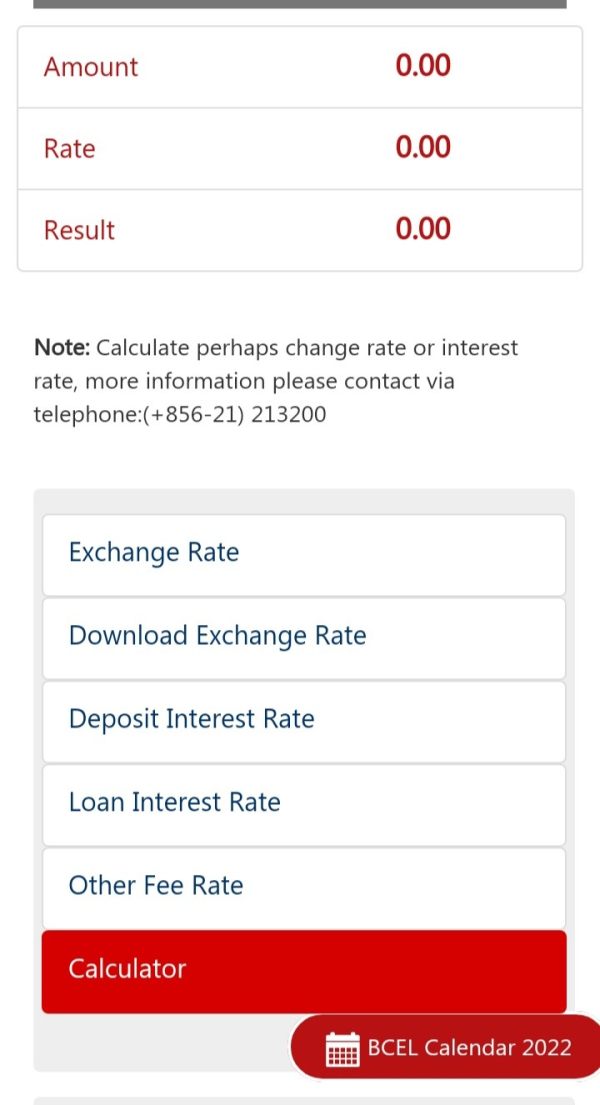

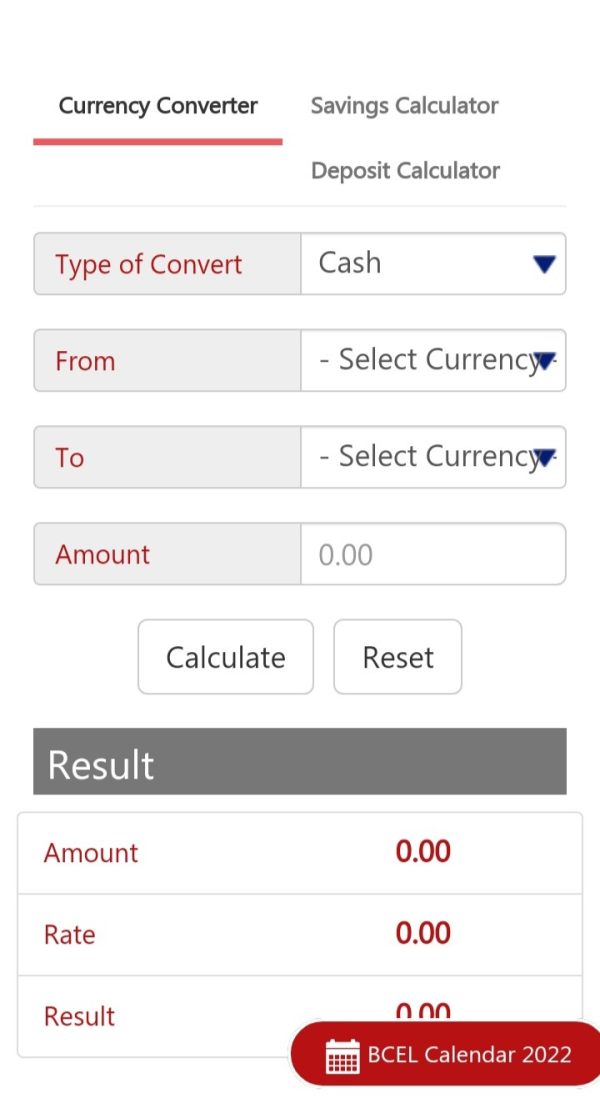

BCEL provides a range of trading tools to assist clients with their financial transactions. These tools include a calculator, a currency converter, a savings calculator, and a deposit calculator.

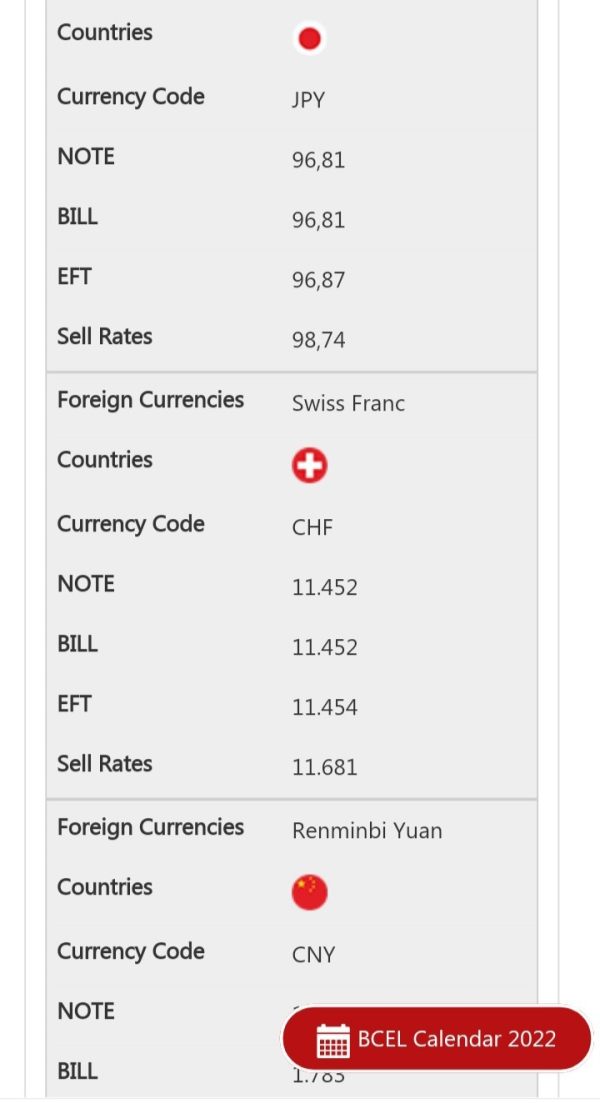

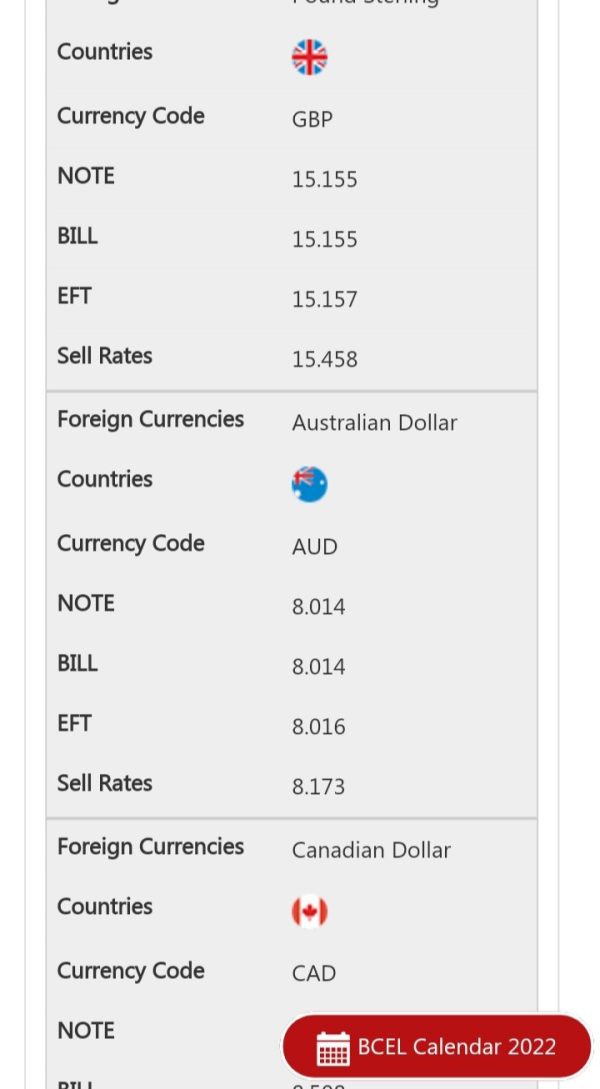

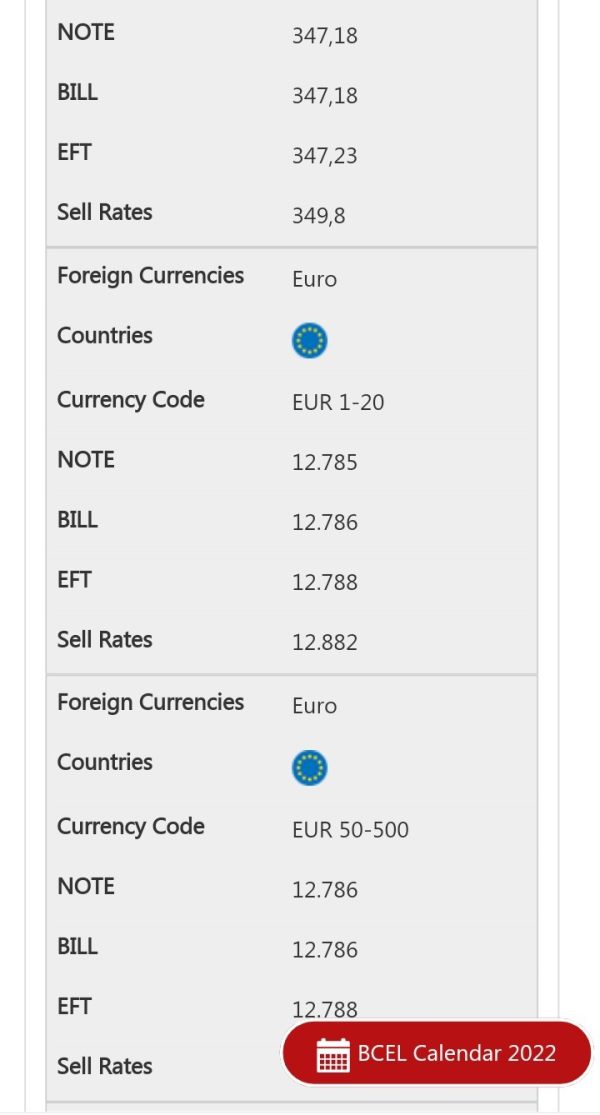

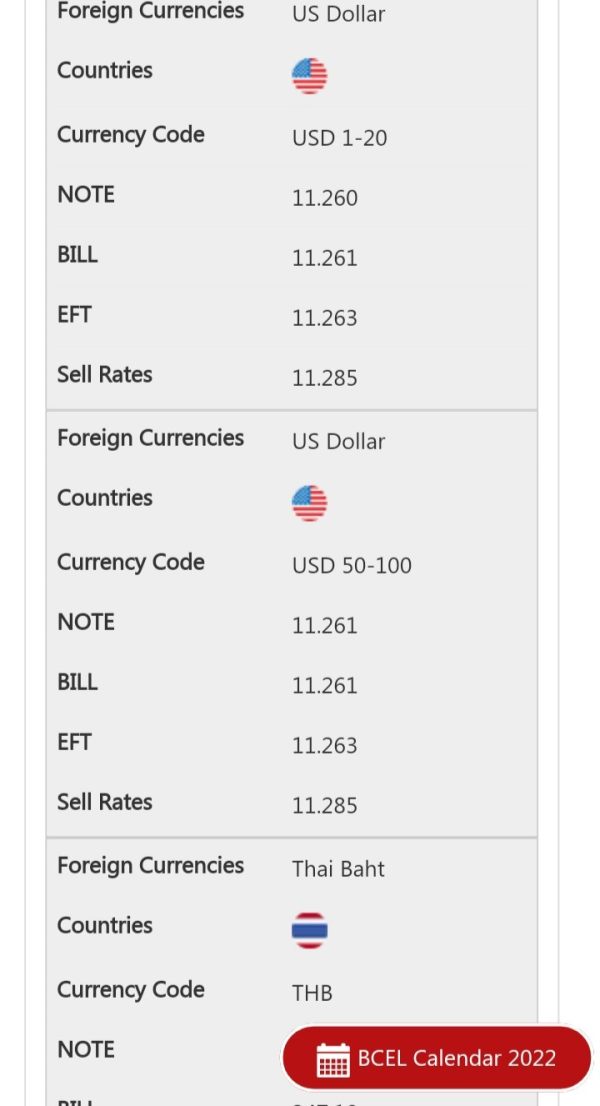

The currency converter tool provided by BCEL allows users to convert currencies. It provides real-time exchange rates, helping users determine the value of one currency in relation to another.

The savings calculator assists individuals in estimating their potential savings based on factors such as initial deposit, interest rates, and the duration of the savings period.

Similarly, the deposit calculator helps individuals determine the growth of their deposits over time. By inputting information such as the initial deposit amount, interest rates, and the deposit duration, users can estimate the future value of their deposits.

| Pros | Cons |

| Provides accurate trading calculations | Lack of detailed information on functionality |

| Offers easy currency conversions | Limited range of supported currencies |

| Includes savings and deposit calculators | Insufficient guidance on factors and methodology |

| Assists in making informed financial decisions | Potential for technical glitches or inaccuracies |

| Enhances overall trading experience | Limited customization and advanced tools |

| Provides currency conversions | Reliance on user input and possible human errors |

| Supports evaluation of deposit options | Limited customer support for tool-related queries |

Customer Support

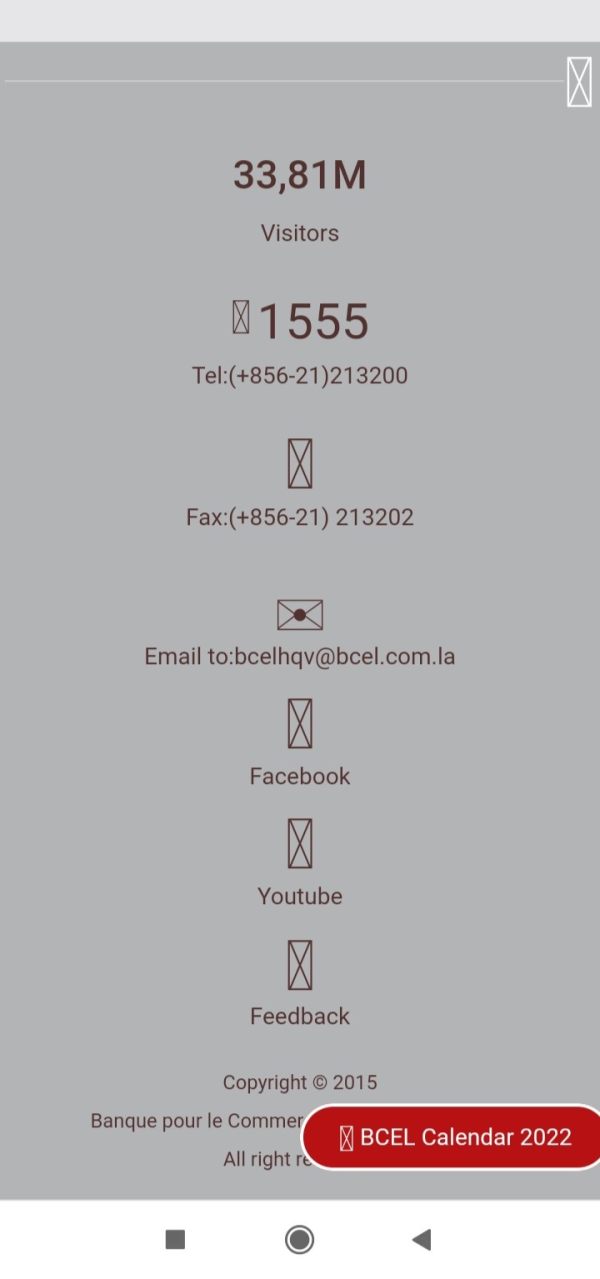

BCEL offers customer support services through multiple communication channels. They can be contacted via telephone at (+856-21)213200 or through fax at (+856-21)213202. Customers also have the option to reach out via email at bcelhqv@becl.com,la. Additionally, BCEL maintains a presence on social media platforms like Facebook and YouTube, allowing customers to connect and provide feedback.

BCEL's Headquarter serves as the central location for their Corporate and Private Banking Division. This division focuses on establishing relationships with customers and providing a range of commercial banking services. These services cater to corporate entities and small and medium-sized enterprises (SMEs). BCEL's team members have extensive banking and financial experience, with some having over 20 years of expertise in the field.

The services provided by BCEL's Corporate and Private Banking Division include investment and business operations consulting, investment analysis, assistance in finding alternative funding sources for businesses, guidance on working with business documents, and the provision of information about their products and services. These services aim to meet customer needs.

For further information or contact with BCEL's Headquarter, individuals can reach them at 2nd and 3rd Floor, Building A, BCEL Public, No 1, Pangkham Rd, Chanthabouly District, Vientiane Capital, Laos.

Conclusion

In conclusion, BCEL is a broker that operates without valid regulation, which poses significant risks for potential users. While BCEL offers various account types to cater to different savings goals and provides a range of payment methods, there are notable disadvantages. These include the lack of detailed information on specific terms and conditions, potential fees and charges associated with certain account types and services, limited interest rates for some accounts, potential risks of fraud and unauthorized transactions, and the reliance on user input and possible human errors in the trading tools. Additionally, BCEL's customer support may have limitations, and their trade finance services and gold trading details are not thoroughly explained. It is crucial for individuals to carefully consider these disadvantages and conduct thorough research before engaging with BCEL as a broker.

FAQs

Q: Is BCEL a regulated broker?

A: No, BCEL lacks valid regulation, posing significant risks for potential users.

Q: What account types does BCEL offer?

A: BCEL offers various account types, including Kids Saving Account, Fixed Deposit Account, Pension Saving Account, Saving Account, and Current Account.

Q: What payment methods does BCEL offer?

A: BCEL offers card-based payment methods, electronic banking services, and other products and services such as LapNET, CDM, and ATM services.

Q: What trade finance services does BCEL provide?

A: BCEL offers import services, export services, letter of guarantee services, and gold trading services.

Q: What trading tools does BCEL provide?

A: BCEL provides a calculator, currency converter, savings calculator, and deposit calculator as trading tools.

Q: How can I contact BCEL's customer support?

A: You can contact BCEL's customer support through telephone, fax, email, or their social media platforms.

Q: What services does BCEL's Corporate and Private Banking Division offer?

A: BCEL's Corporate and Private Banking Division offers investment and business operations consulting, investment analysis, assistance in finding alternative funding sources for businesses, guidance on working with business documents, and information about their products and services.

Keywords

- 2-5 years

- Suspicious Regulatory License

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Phed Tollen

Laos

Who withdrew it for me?

Exposure

2022-08-11

FX3660911861

Mexico

I invested $132.96 and operated as a professional trader. I can say that the black market is being manipulated, so that any type of operation that I carry out goes to negative and loses everything.

Exposure

2022-01-13

FX2704492760

Argentina

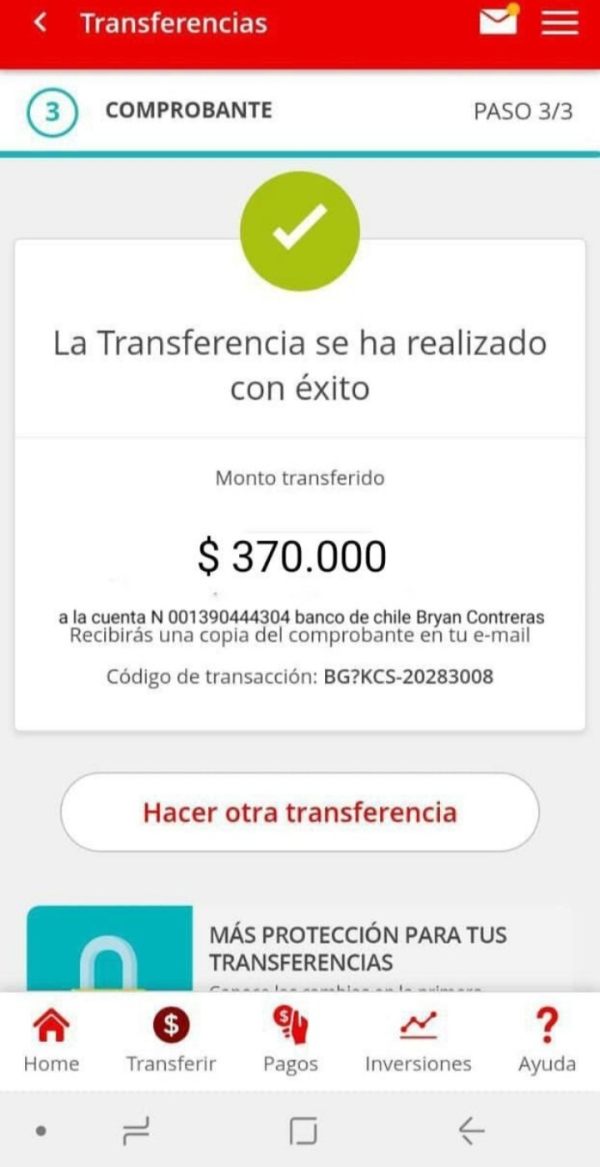

The operations are completely false. In addition to the fact that once you reach the minimum of $1500, they tell you that the payment will arrive within a period of 3 weeks, but it is not in reality. They only tell you that to calm you down and do not report, but they make me angry anyways. They scammed me $370

Exposure

2022-01-07

卢付祥

United States

I am so glad to have been referred to BCEL by my friend, who is into Forex trading as well. They are very proficient at monitoring the system, implementing the Forex trades and being constantly supportive whenever I requested additional information or assistance. Now, all I do is just have a quick look at their daily report. Thanks a lot!

Positive

2023-03-08