Why does forex trading still feature a high failure rate in 2024? Out of 100 traders, only 5 are profitable, while the remaining 95 end up failing. The actual reason behind this is not solely the trading skill of the traders but also because a significant number of beginner traders choose unregulated brokers, which are forex scams, setting them up for a 100% failure right from the start.

A real scam example to share

Start with a real example:

Malik, an investing novice, came across Emar Markets, a forex brokerage purportedly registered in the Saint Vincent and the Grenadines and advertising zero commissions and tight spreads, while researching online. Intrigued, Malik opened a live trading account with Emar Markets. Initially, he was assigned an account manager named Andrew who provided personalized guidance around the clock via Skype, offering trading strategies and recommendations. Under Andrew's tutelage, Malik managed to profit $5,000 over the first two months.

In the third month, however, Malik's fortunes reversed as he racked up losses on several trades. Andrew shifted blame onto Malik for not adhering closely to his counsel. To retain access to the ostensible “expert,” Malik deposited another $8,000. But Andrew's subsequent tips proved ineffective and Malik slid deeper into the red. Attempts to reach out found that he had been blocked. It finally dawned on Malik that this was a scheme to push sales volumes and siphon client funds. Withdrawal requests were rejected by Emar on the grounds that account balances fell below the minimum threshold. Further checks showed that Emar Markets held no legitimate regulatory licenses.

Here is the question then: What can we learn from the example above or more simply put, where it started becoming abnormal for a forex trader?

Now, we summarized the following five points to show you a typical forex scam operation:

•No verifiable registration or regulation

Emar Market's purported Saint Vincent and the Grenadines base in and and lack of ties to regulatory bodies like NFA or FCA demonstrates it is an illegal shell entity operating without oversight. Being not regulated, such scams are quickly repackaged under a new name once exposed.

•Promises of unrealistic returns

Guaranteed profitable signals and flawless strategic advice enabling a beginner trader to generate quick returns of $5,000 in 2 months should raise skepticism. Even pro traders can suffer losses. Those results seem artificially inflated.

•Pattern of building trust and increasing deposits

Gaining a new client's trust with early wins, then cranking up deposits and risk under the guise of expertise before dissipating funds is a well documented scam tactic.

•Refusal to Allow Withdrawals

By denying clients withdrawal access through procedural obstacles, the scam brokers create a one-way valve to siphon deposits with little intention of letting clients cash out earnings. And this is what 99% forex scams will do.

•Sudden Disappearing of account manager

Sudden breakdown in communication channels and making account managers inaccessible is a final phase move indicating intention to abscond entirely with the accumulated client funds.

Troubling Data: Most traders chose scam brokers

Actually, research reveals a troubling data - almost 60% of novice forex traders end up registering with unregulated or shadily overseen brokers in their first year.

For instance, a 2022 report by UK's Financial Conduct Authority (FCA) discovered over 50% of traders had signed up with at least one unregulated broker. Additionally, around 30% remained oblivious to the legal status of their own account. Similarly, a survey by Australian Securities and Investments Commission (ASIC) highlighted over 60% of polled beginners could not conclusively ascertain if their chosen forex platform was legitimate. This turns them into sitting ducks for scams.

The implications are clear - most fresh traders lack proper awareness around regulatory compliance in forex markets. This often leads them to blindly opt for brokers promising high, quick rewards with low barriers to entry. Per estimates, over 500,000 such duped newcomers face losses annually.

Why do forex scams succeed often?

Forex scammers exploit human psychology - primarily greed and confirmation bias - to continually profit off unwary aspirants.

Intense greed makes fanciful high, rapid returns seem plausible. Scams leverage this with headlines like “Earn 50% monthly” or “Get $1000 bonus for $10,000 deposit”. Such promises readily lure inexperienced traders into their honeytraps.

Confirmation bias also assists scams. People gravitate toward information aligning with preconceptions while ignoring contradicting cues. Early fake wins are staged to stoke beginners' profit fantasies. Then restrictions escalate gradually once initial trust is secured. Losing victims rationalize away later red flags, clinging to original positive impressions.

A Strong Tool: Where can WikiFX help to avoid forex scams?

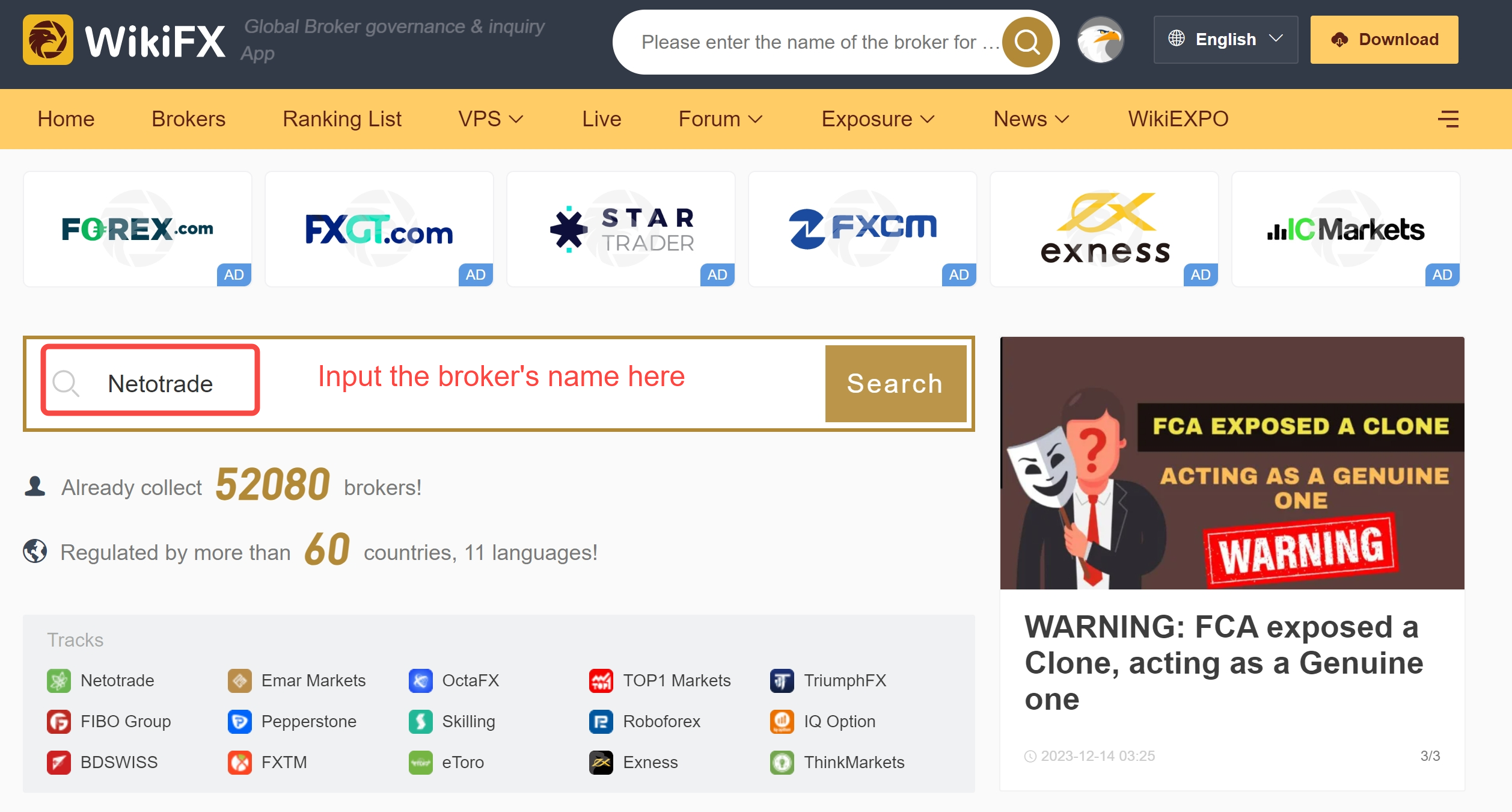

To avoid forex scam, traders can turn to regulatory databases such as WikiFX for verification. WikiFX has covered regulatory details on 50,000+ brokers so far, offering a comprehensive resource for the brokers you wish to investigate. Easily check a broker's regulatory status, business scope, address authenticity, user reviews, and more using this app or the official website.

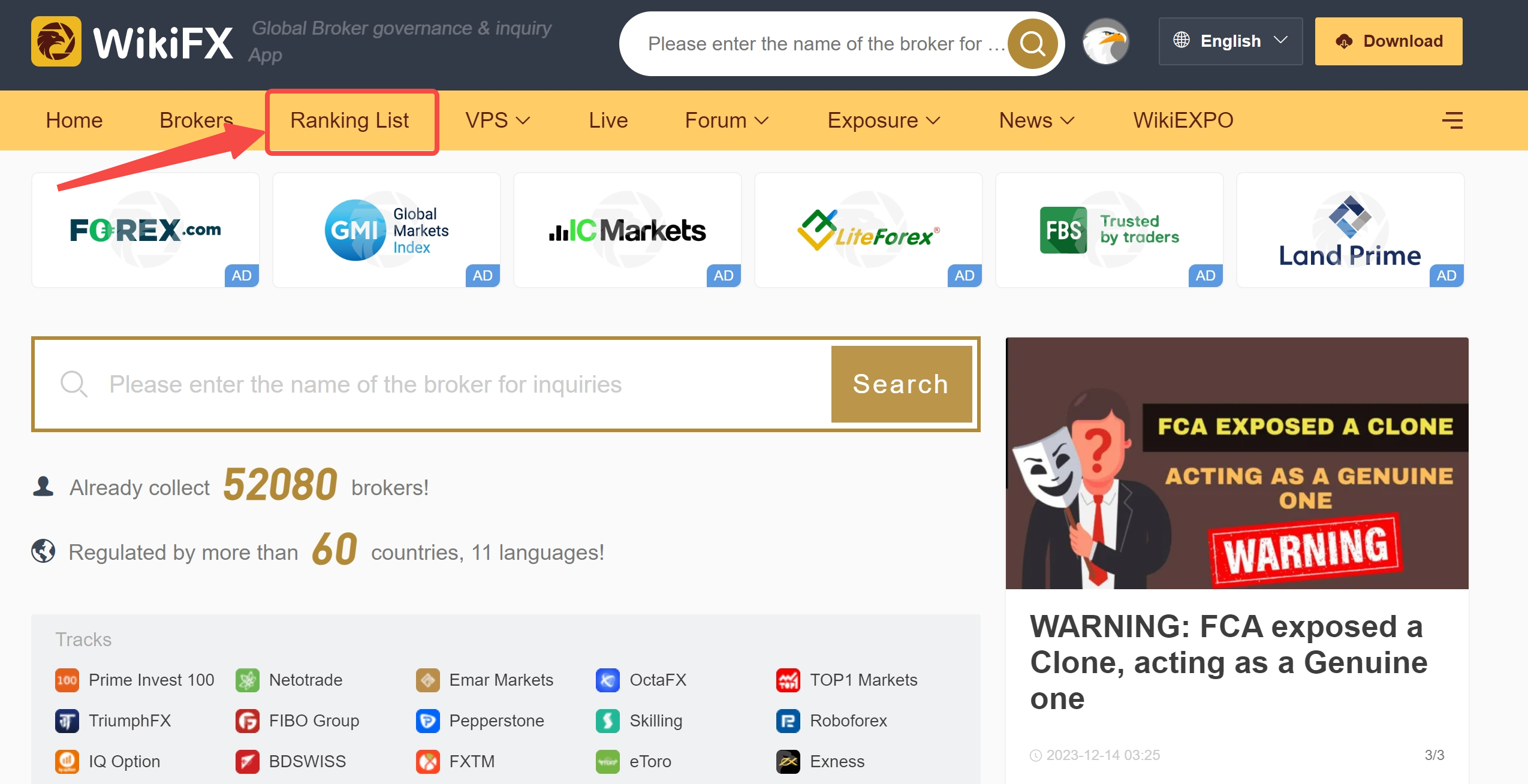

Next, let's detail how to use WikiFX to check if a broker is legitimate and avoid forex scammers. There are three methods.

Method 1

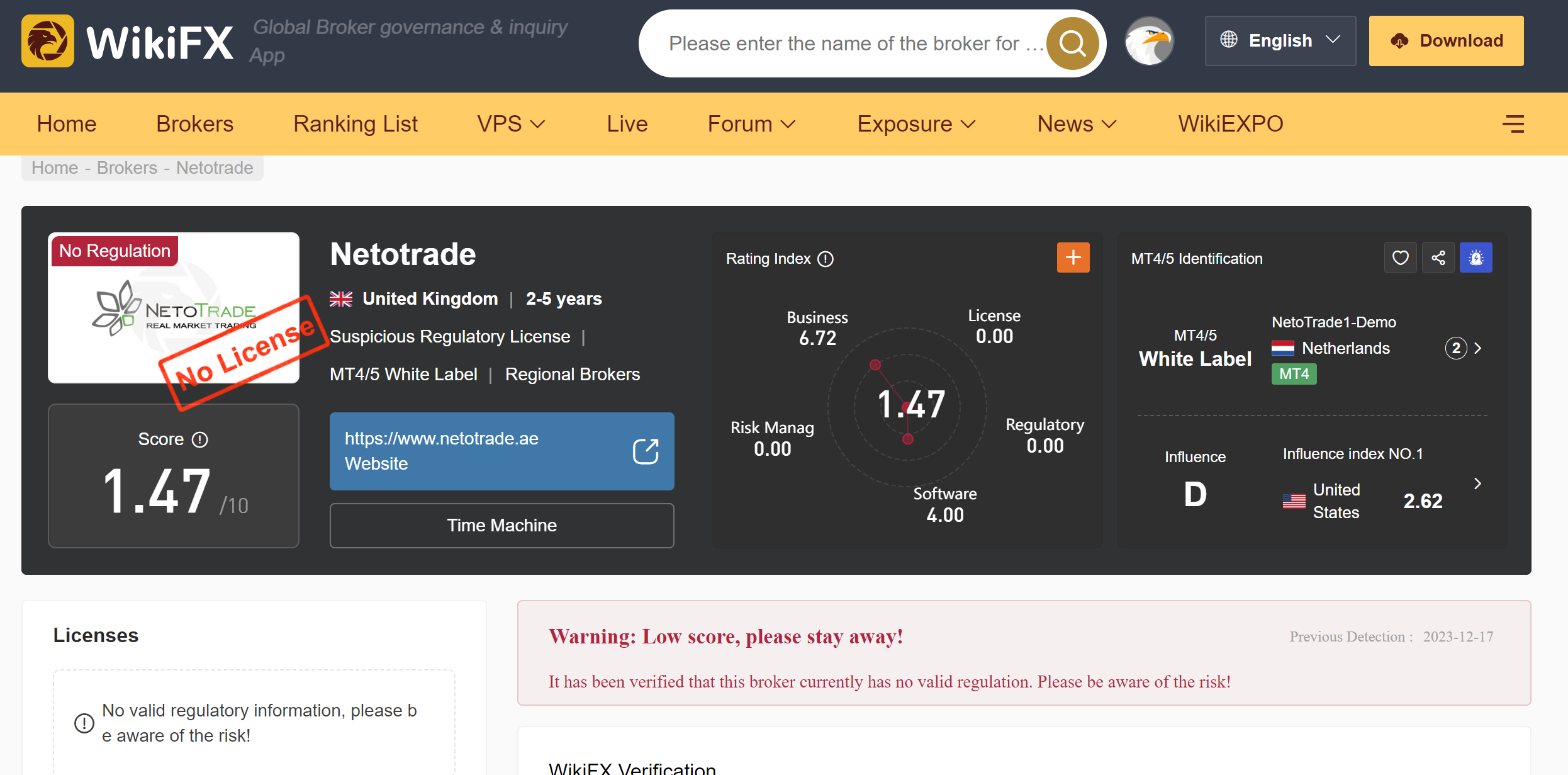

Firstly, open the official website of WikiFX. Enter the name of the broker you wish to check in the search bar, then click on “Search” to begin the query.

Next, you'll be directed to the detailed page of that broker. Here, it's clearly visible that the broker is registered in the UK, operating for 2-5 years, and marked with a “No License” tag. The regulatory information on WikiFX is synchronized globally to provide traders with the latest and most accurate regulatory data.

Moreover, the broker's WikiScore is only 1.47 (out of 10). WikiScore is given based on five crucial dimensions: Regulatory, Licensing, Business operations, Risk Management, and Software (authentication of the MT4/MT5 trading platforms provided by the broker). This comprehensive assessment offers a fair evaluation with caution and professionalism.

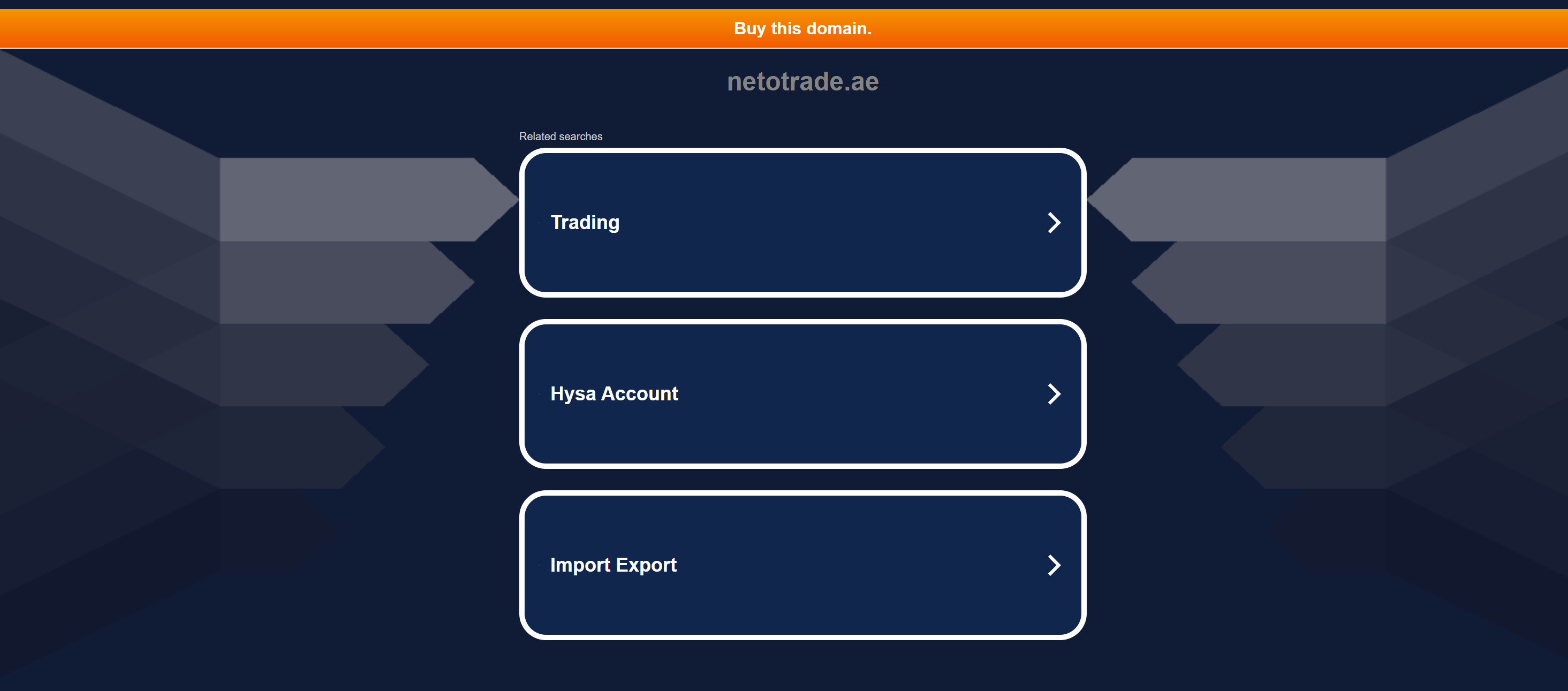

Upon attempting to access the broker's official website, it was discovered that the broker is selling its domain name. This observation directly indicates that the broker has only temporarily created a domain to offer forex-related services.

Essentially, this confirms that the broker is not legitimate but rather a forex scammer fabricating its trading regulatory status and utilizing an anonymous website to swiftly obtain funds from traders.

Method 2

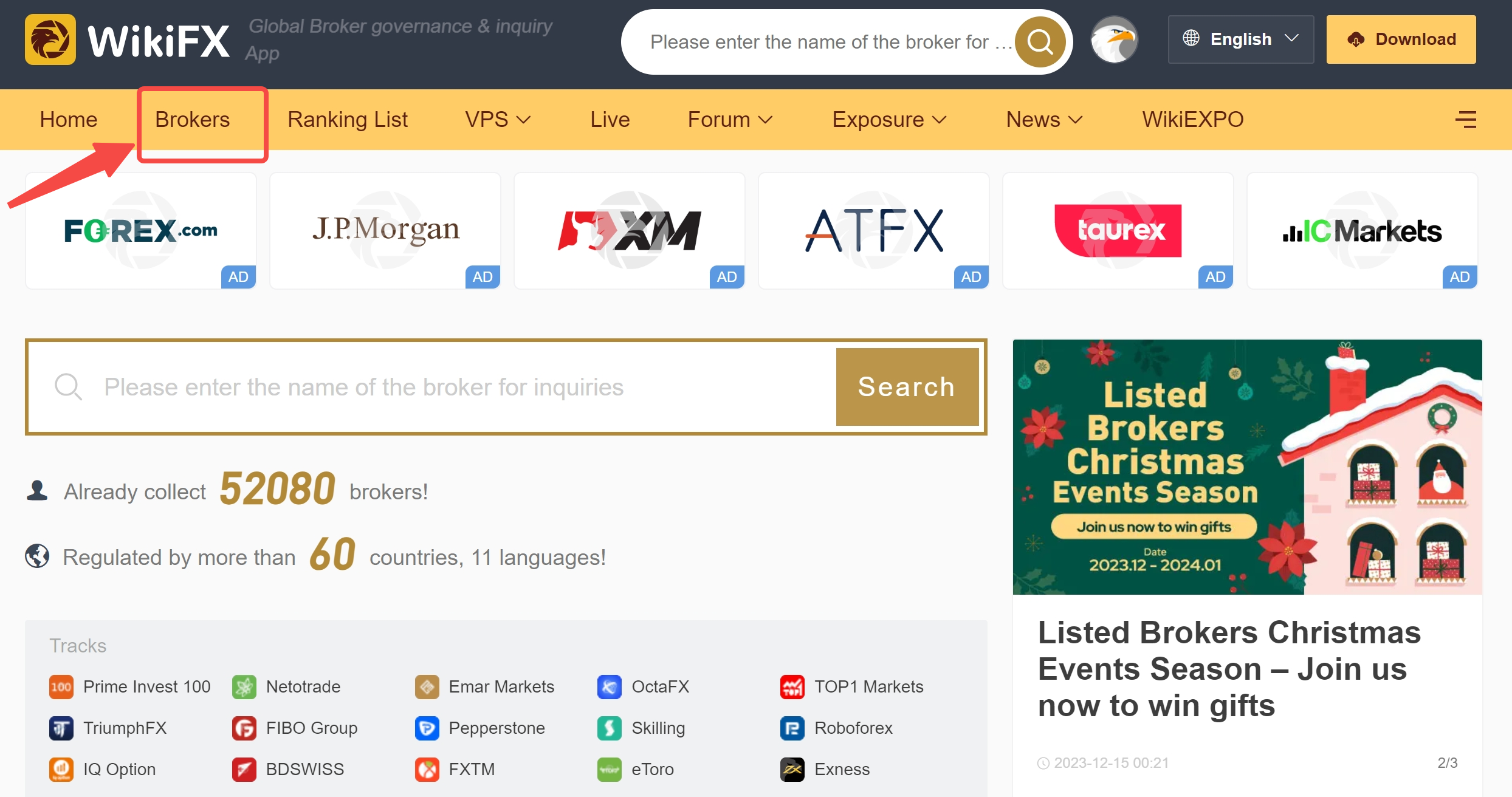

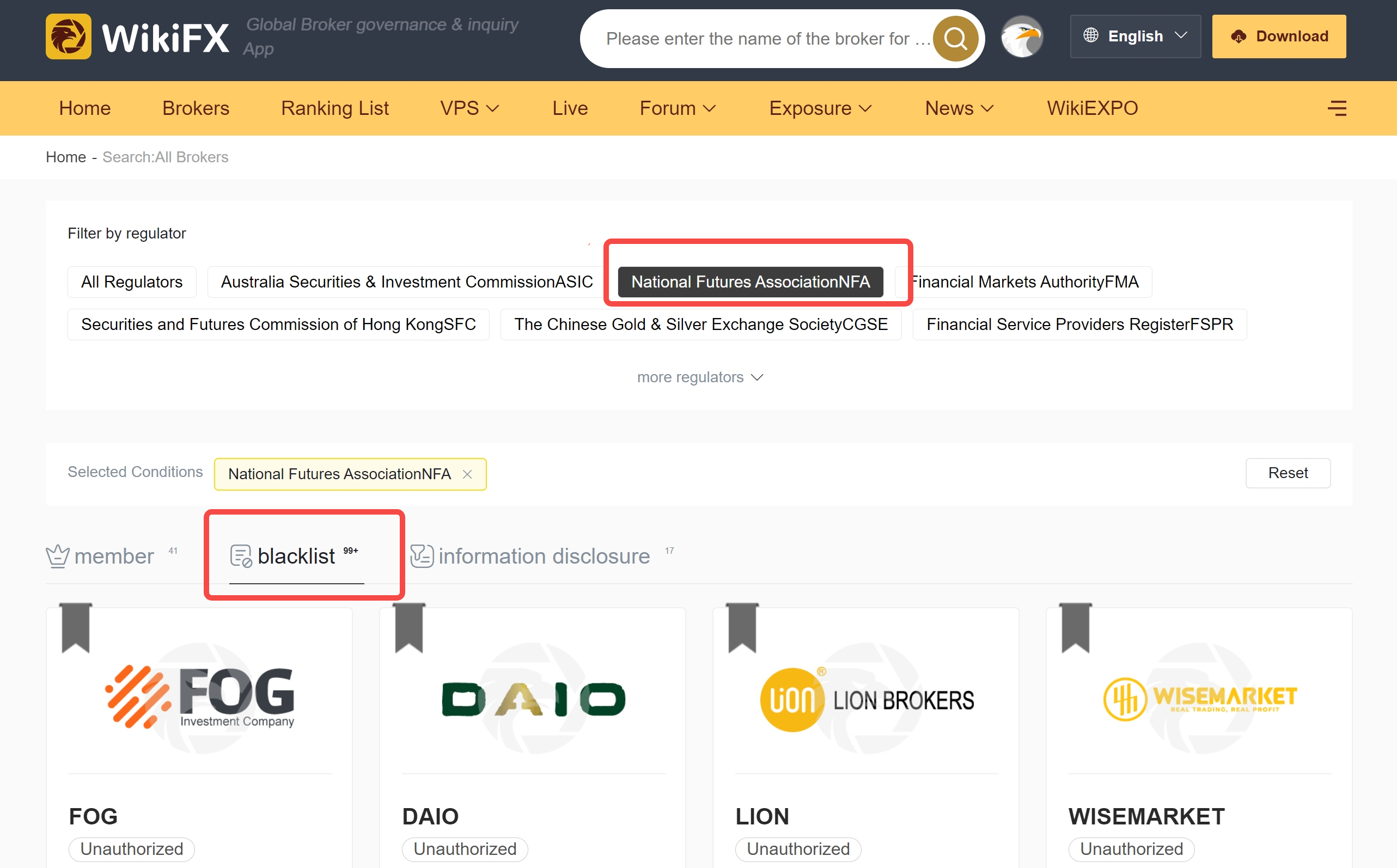

By clicking on the “Brokers” section on the WikiFX homepage, you'll find a comprehensive list covering nearly 60 regulatory bodies worldwide along with the brokers under their regulation.

Next, click on any regulatory body, then select the “BlackList” button below. This section displays brokers that have been blacklisted or warned by that regulatory authority. Traders should also avoid brokers listed here as they are considered illegal and scams.

Method 3

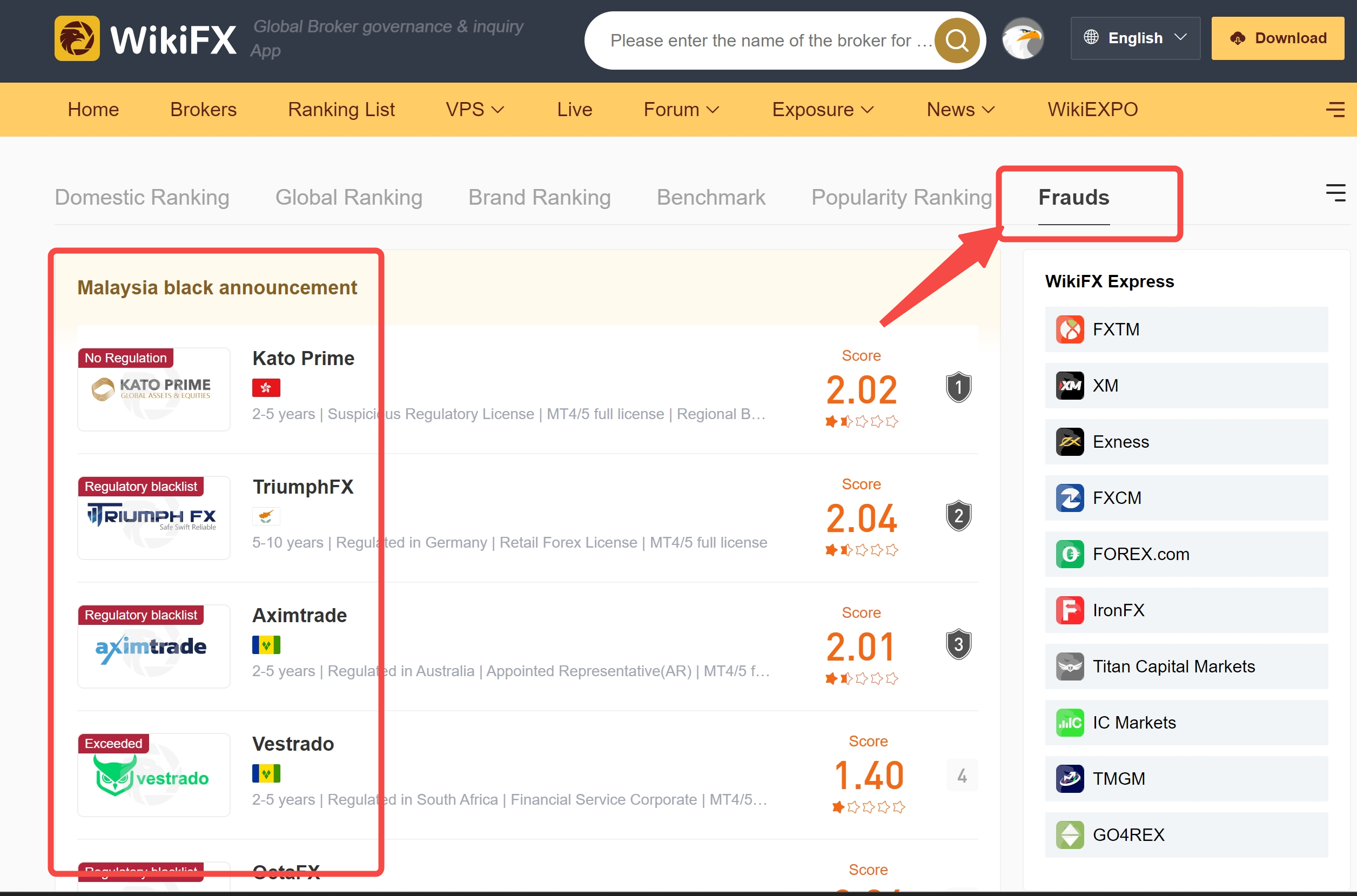

Navigate to the “Ranking List” tab situated on the WikiFX homepage. Here, you'll find a ranking of brokers that includes a list of highly-rated legitimate brokers, as well as some irregular brokers that traders should avoid.

Within the “Frauds” section, you'll discover an array of scam brokers that have been blacklisted by relevant regulatory bodies. These are precisely the brokers traders must steer clear of. Vigilantly observing this compilation of forex scammers is pivotal in evading potential encounters with such entities, marking it an essential practice for traders.

By using these three methods, you can easily avoid many forex scammers. Be sure to leverage professional tools like WikiFX. The forex trading market and its scammers are ruthless, yet remember, WikiFX is always here to provide you with warm assistance.

Some other tips to avoid forex scams

In addition to using WikiFX to verify a broker's regulatory and business standing and identifying potential forex scams, traders must also elevate their trading skills to remain vigilant. Being alert and actively verifying potential forex scams is crucial for traders to safeguard themselves.

Review online comments

Search Reddit forums, Quora advice boards and comparative review sites like TrustPilot for genuine user experiences instead of promotional posts. If 90% of commentary calls out delays in this forex broker withdrawing client funds, pay heed to such warnings.

Test with small sums

Initiate your live trading account on a new platform with just $100 instead of allocating your entire trading capital. Evaluate how smooth and timely the process is of withdrawing your profits from a few small trades. This gauges reliability before considering bigger transfers.

Supervise software access

Insist that any automated trading bots or AI tools plug into your account only operate while you monitor them live. Use remote access to view all ongoing processes. Beware if the platform insists on fully unattended autonomy that allows background manipulation.

Record all interaction

Save chat transcripts, emails as PDFs and video recordings of all instructions provided over phone/webcam along with dates/times. If the broker later denies providing certain directives or exaggerates the degree of risk you opted for, concrete evidence is invaluable.

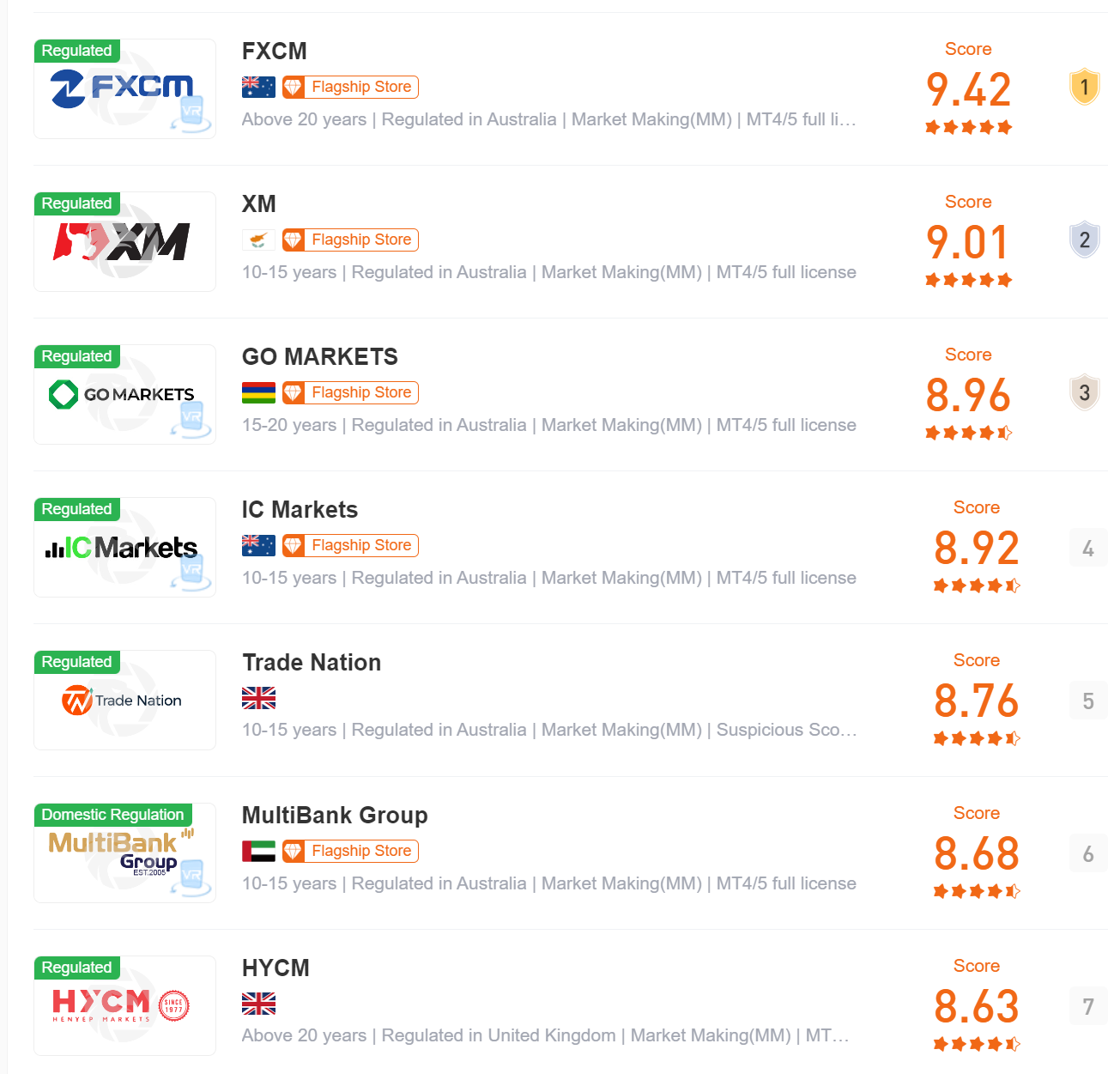

Your legit alternatives - some trusted forex brokers to share

Beyond the swarm of unregulated brokers, the standout aspect is WikiFX's catalog of regulated, well-operated, and highly reputable brokers. This comprehensive list serves as crucial guidance for numerous traders, especially those just starting out. Let's simply put it, choosing a dependable broker means waving goodbye to forex scams once and for all.

Legit and trusted brokers commonly share the following characteristics:

•Being Well-Regulated

They operate under stringent regulation, with many being regulated globally, including top-tier supervision like FCA and ASIC. Brokers under regulation don't misuse client funds. In cases of bankruptcy or mismanagement, they provide compensation to their clients.

•Solid Reputation

Reputable brokers are well-regarded for their exceptional reputation and stellar user feedback. You can easily spot user reviews on industry websites or forums. Trusted brokers tend to feature a long-standing presence in the market, building a robust and credible legacy over time. On the flip side, brokers with only 1-2 years in operation might raise eyebrows, signaling a swift interest in acquiring funds rather than prioritizing long-term trust.

•Transparent Pricing

Reputable brokers offer transparent spreads, real-time quotes, comprehensive trade records, ensuring fairness in trading. This can be verified by reviewing their past records or by opening a demo account for testing purposes. Moreover, reputable brokers usually provide competitive spreads and fees within the industry.

•Convenient & Geninue Trading Software

Reputable brokers typically offer industry-leading, authentic platforms like MT4, MT5, or proprietary trading software. These platforms ensure that trade orders are not artificially manipulated to control order speed or cause delays, thereby avoiding losses in client funds. They also provide swift order execution. In contrast, some counterfeit or scam brokers manipulate trading products using false trade signals or pirated MT4/MT5. This unethical practice results in losses for traders while brokers profit from these deceitful tactics.

•Quick and Easy Withdrawal

Swift withdrawals are a distinctive feature of reputable brokers. They promptly handle users' withdrawal requests without any delay and, importantly, without requesting extra fees. Usually, withdrawals with legitimate brokers are processed within 24 to 48 hours.

•Professional & Accountable Customer Service

Throughout the trading journey, various issues may arise, such as deposit or withdrawal concerns, technical glitches on the trading platform, among others. In response to these, prompt assistance from customer service is vital. Reputable brokers typically offer 24/7 customer support to address customers' needs and inquiries in a timely manner.

Within WikiFX, there's a multitude of reliable brokers, including familiar names like FXCM, XM, IC Markets, HYCM, and others. For this review, let's delve into the specifics of the two among these brokers. However, please note, our aim here is solely to analyze the traits of trusted brokers, not to provide recommendations.

Broker |

XM |

Regulated by |

ASIC, CYSEC, FSC, DFSA |

Min. Deposit |

$5 |

Tradable Assests |

Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies |

Trading Platform(s) |

MT4 & MT5, available on PC, iPhone, iPad |

Order Execution |

Around 30 Milliseconds |

Leverage |

1:1000 |

Trading Fees |

0.6 pips on all major currency pairsNo commissions on FX accounts |

Payment Methods |

credit and debit cards, bank transfers, e-wallets, and many more |

Withdrawal Time |

Withdrawal via e-Wallets can be processed instantly Withdrawals via bank wire, credit or debit card usually take 2-5 business days |

Copy Trading |

✅ |

Demo Accounts |

✅ |

Educational Resources |

Rich and Quality |

Bonus |

$50 trading bonusDepsoit bonus up to $5,000 |

Customer Support |

7/24 live help, multilingual |

XM is a reputable broker with a nearly 15-year operational history, earning a remarkable 9.01 out of 10 on WikiFX, reflecting its solid reputation and excellence in operation. Regulated across four global regions, including oversight by the tier-1 ASIC in Australia, XM offers a diverse range of tradable assets, such as Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, and Energies. This array provides traders with extensive options to explore.

Particularly welcoming to novice traders, XM stands out as one of the few major brokers allowing a minimum deposit of just $5. Moreover, it offers an appealing no deposit bonus of up to $50, which enhances its attractiveness to traders. Beyond its vast tradable instruments offered, XM provides an abundance of trading resources, such as live education, educational webinars, videos, and more, enriching the trading experience for its users.

When it comes to trading fees, XM features a competitive edge, charging just 0.6 pips on all major currency pairs with no commissions on FX accounts. This stands as one of the most cost-effective options within the industry. With an average order execution time of approximately 30 milliseconds, traders benefit from low latency and minimal slippage. XM ensures convenience and efficiency in customer service by offering 24/7 multilingual support, coupled with swift and hassle-free deposit and withdrawal processes.

Overall, XM is considered trusted, with a high rating of 4.5 out of 5 based on over 2,000 reviews.

Broker |

IC Markets |

Regulated by |

ASIC (Australia) , CYSEC (Cyprus) |

Min. Deposit |

$200 |

Tradable Assests |

Forex CFDs,Commodities CFDs, Indices CFDs, Bonds CFDsDigital currencies, Stocks CFDs, Futures CFDs |

Trading Platform(s) |

MT4, MT5, cTrader |

Order Execution |

Under 40 milliseconds |

Leverage |

1:1000 |

Trading Fees |

Spreads as low as 0.0 pips, commissions at $3 per lot per side on cTrader |

Payment Methods |

bank / wire transfer, Paypal, credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli. |

Withdrawal Time |

Credit / Debit Card withdrawals may take 3-5 business days e-Wallets withdrawals can be processed instantlyInternational Bank Wire Transfers may take up to 14 days (not recommended) |

Copy Trading |

✅ |

Demo Accounts |

✅ |

Educational Resources |

Comprehensive |

Bonus |

❌ |

Customer Support |

7/24 multilingual |

IC Markets is another big name in the forex industry, having operated successfully for nearly 15 years, holding strict regulation from top-tier regulatory bodies like ASIC and CYSEC. IC Markets offers access to an extensive range of over 2250 tradable instruments. These include Forex CFDs, Commodities CFDs, Indices CFDs, Bonds CFDs, Digital currencies, Stocks CFDs, and Futures CFDs available through MetaTrader 4, MetaTrader 5, and cTrader platforms. Regarding trading fees, IC Markets Global offers some of the most competitive rates in the industry, with spreads as low as 0.0 pips and commissions set at $3 per lot per side on cTrader.

IC Markets provides rich educational resources and demo accounts for clients to gain risk-free trading experience. Additionally, their 24/7 multilingual customer support assists with trading-related queries about trading and withdrawals.

Overall, IC Markets stands out as a respected broker, scoring an impressive 4.5 rating from over 2,500 reviews.

To Wrap Up

In essence, forex traders must remain vigilant and not fall for the smooth talk of forex scammers. Mastering the use of professional tools like WikiFX, is pivotal in pinpointing forex scams, which can significantly boost efficiency in the process. Genuinely, avioding a forex scam means you are adead compared to most brokers.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.