Proprietary trading, or prop trading, is a strategy where financial firms trade using their own capital, not client funds. They aim to profit directly from market fluctuations by buying and selling various financial instruments. While offering significant potential rewards, prop trading also carries substantial risks due to market volatility.

If you're considering a career in prop trading, it's crucial to choose a firm that aligns with your goals and offers the necessary support. In this article, we'll explore key factors to consider when selecting a prop trading firm, including capital, technology, training, commission structures, reputation, and risk management.

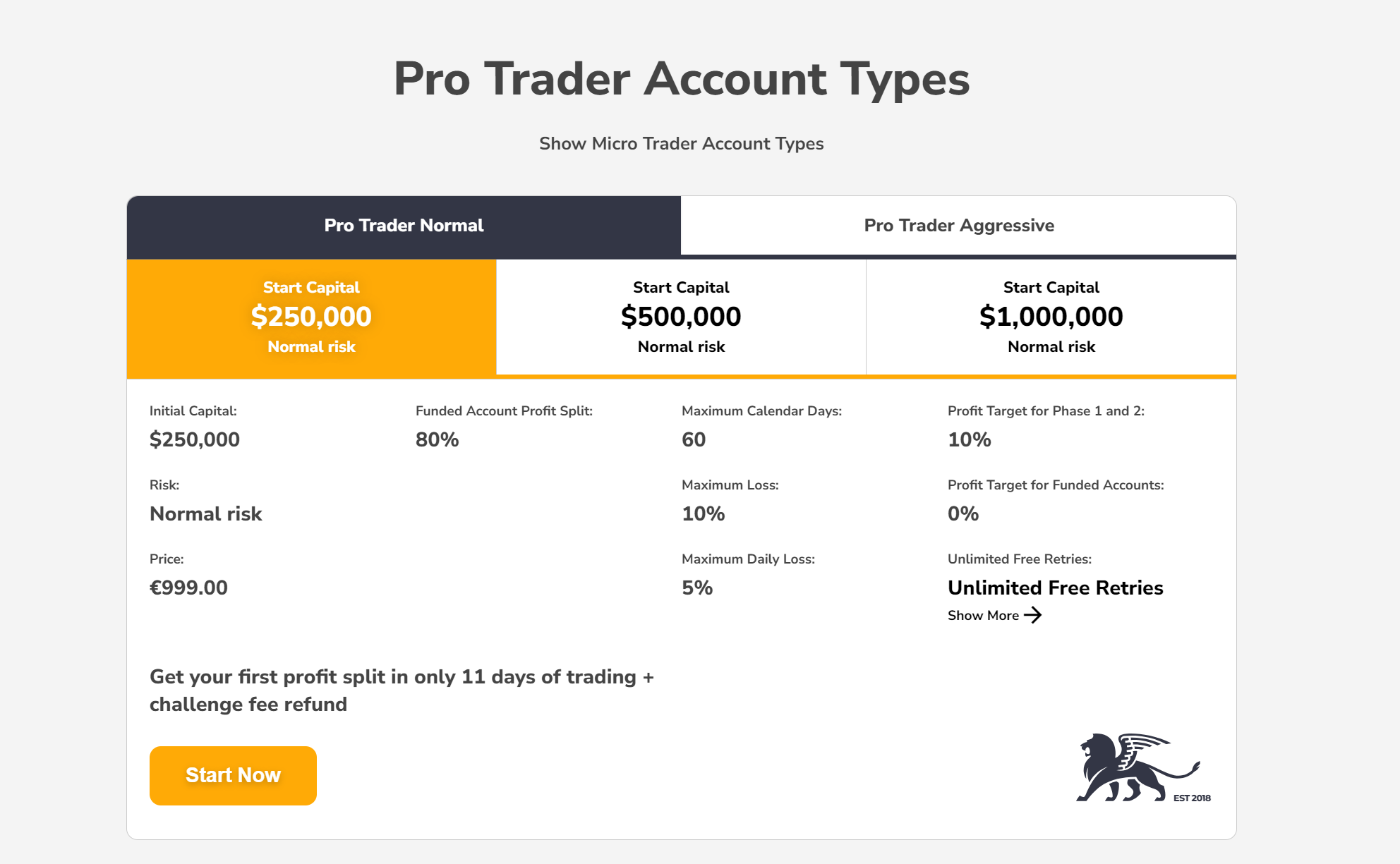

Capital Matters: One of the key parts, is the capital that the firm can provide for you to trade with. More capital, generally, allows for diverse strategies and greater flexibility in trades.

Technology: How up-to-date are the technologies, software, and trading platforms the firm offers? Superior technology can help you perform more efficiently and be more successful in your trades.

Training Program: If you're a novice trader, a prop trading firm offering robust training programs and mentoring offers a significant advantage compared with those who don't.

Commission and Payout Structure: Firms differ in their commission structures and how profits are split between the trader and the firm. Higher payouts and lower commission costs are generally more favorable.

Reputation and Track Record: Companies with a stable track record of success and a good industry reputation usually equate to better opportunity and security for their traders.

Risk Management: Strong risk management practices in the firm can protect both the firm's and trader's interests, contributing substantially toward long-term profitability.

Best Prop Trading Firms Overall

| Prop Trading Firms | Why are they listed as the Best Prop Trading Firms? |

| Offers evaluation combine challenges to fund traders with up to $300,000 in trading capital. Traders keep up to 90% of generated profits while meeting daily loss limits. | |

| Offers starting capital up to $100k through rigorous evaluation. Lucrative profit splits and payouts upon consistently hitting monthly targets. Strong focus on risk management and psychology. | |

| Up to $5 million in funding allocation after passing combine challenges testing skills. State-of-the-art trading infrastructure and resources to empower traders. | |

| Has funded over $400 million to traders while managing risk prudently. Custom challenges match experience levels, with 70% profit share deals. Supportive community. | |

| Provides up to $1.4 million in prop firm funding globally. Some of the highest profit splits in the industry at 80% post challenge. High transparency. | |

| Combines funding up to $4 million with bespoke mentorship programs for nurturing top talents. Lux Core community builds camaraderie and skill sharing. | |

| Specializes in cryptocurrency trader funding with allocation exceeding $1 million equivalent. Strong focus on trader psychology and risk tolerance. | |

| Supports traders across Europe through tiered evaluation phases culminating in generous account funding potential. Highly personalized approach. | |

| Featuring a dual cryptocurrency and forex firm funding program pathway with renowned accuracy challenges. Lucrative profit splits and payout support long careers. | |

| Providing funding allocations of up to $4 million to traders clearing evaluation phases. Access to deep liquidity pools and fast execution through top tier liquidity providers. |

Overview of the Best Prop Trading Firms

TOPSTEP

|

|

Name |

|

Registered Country |

United States |

Founded in |

2012 |

What You Can Trade |

E-mini S&P 500, NASDAQ 100, Crude Oil, Gold, Interest Rates, Micro Gold, Micro Crude Oil, and Micro Bitcoin |

Profit Share |

80% |

Capital Provided |

$500,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

Topstep, established in 2012, is a proprietary trading firm headquartered in the United States, specifically in the thriving financial hub of Chicago. Known for its robust opportunities in futures trading, Topstep offers a distinct platform for traders to prove their trading skills and earn a funded trading account. The firm facilitates a generous profit-sharing model where the traders keep 80% of the profits, and it provides funded trading accounts up to $500,000.

Topstep maintains rigid risk management rules to ensure sustainable trading practices, particularly stressing the importance of a solid stop-loss strategy. Unique aspects of Topstep also include its Trading Combine - a simulated trading evaluation where traders must meet specific objectives to surpass the Combine and earn a funded account, underscoring practical risk and money management skills.

✅Where TOPSTEP Shines

• With traders keeping 80% of their profits, the profit-sharing model is quite attractive.

• Topstep offers a comprehensive training program with resources like personalized coaching and webinars.

• The firm's focus on risk management encourages sustainable trading habits.

• They provide up to $500,000 for funded trading accounts.

• Their unique Trading Combine feature allows traders to showcase and hone their skills in a simulated trading environment.

❌Where TOPSTEP Shorts

• Topstep primarily focuses on futures trading, even no forex trading provided currently.

• The strict rules for passing the Trading Combine can be challenging, particularly for novice traders or those with aggressive strategies.

The Funded Trader

|

|

Name |

The Funded Trader |

Registered Country |

United Kingdom |

Founded in |

2016 |

What You Can Trade |

Forex trading |

Profit Share |

up to 95% |

Capital Provided |

$600,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

The Funded Trader, established in 2016, is a proprietary trading firm based in the United Kingdom. The firm emphasizes Forex trading, offering a platform for emerging and experienced traders to excel in this particular market. The Funded Trader operates a tiered profit split, rewarding consistency with increased capital and more favorable profit shares, with traders starting off keeping up to 95% of the profits. The company provides trading accounts funded up to $600,000, one of the highest in the industry.

A standout feature is their educational approach to trading. On top of self-study resources and webinars, they offer direct mentoring from experienced professional traders, positioning beginners and intermediate traders alike for rapid development.

Risk management is emphasized by The Funded Trader implementing a drawdown limit rule, reducing the risk of substantial losses. An undeniable selling point is their 'no time limit' feature, allowing traders to achieve their targets at their own pace without monthly deadlines to add pressure.

✅Where The Funded Trader Shines

• Offering up to $600,000 of funded accounts, one of the highest in the industry.

• They provide strong educational resources including direct mentoring from professional traders.

• The absence of strict monthly deadlines allows stress-free strategic trading.

❌Where The Funded Trader Shorts

• The focus is primarily on Forex trading, which may not appeal to traders looking for opportunities in other markets.

• The initial 50% profit share might be less attractive for some traders, though it can increase over time with consistency and successful trading.

SurgeTrader

|

|

Name |

SurgeTrader |

Registered Country |

2010 |

Founded in |

United States |

What You Can Trade |

Equities, Futures, Options, and Forex |

Profit Share |

Up to 90% |

Capital Provided |

$25K |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

SurgeTrader, established in the year 2010 and registered in the United States, is a distinguished proprietary trading firm that offers a unique trading experience. With SurgeTrader, traders have the opportunity to trade a variety of asset classes including Equities, Futures, Options, and Forex, offering a diversified trading environment. The firm is known for its attractive profit-sharing structure, providing traders with a hefty 90% virtual profit. Furthermore, traders are allocated a considerable capital base, up to $25,000, allowing them opportunities to execute larger trades and expand profit margins considerably.

In addition to this, SurgeTrader stands out for its comprehensive training program, which includes mentored learning, hands-on market exposure, and theoretical education - elements that nurture the development of novice traders to seasoned professionals. Importantly, SurgeTrader doesn't overlook the critical aspect of risk management. They employ advanced risk mitigation strategies to safeguard the firm's and traders' capital from extreme market volatility.

What sets SurgeTrader apart are its proprietary trading methodologies, advanced technology offering high-speed trade execution, and a collaborative trading community, encouraging traders to share ideas and strategies. However, SurgeTader's strengths also mirror its weaknesses. While they offer an expansive trading environment, their focus on complex strategies and instruments may seem daunting for inexperienced traders.

✅Where SurgeTrader Shines

• Offering Equities, Futures, Options, and Forex, offering an expansive trading environment to its traders.

• Attractive Profit-sharing model, traders retain 90% of net profits, one of the highest in the industry.

• This firm provides a substantial capital base for traders to engage with larger trades.

• This firm requires no minimum deposit, removing a barrier often faced by many traders at other platforms.

• There is no monthly fee which makes the firm more accessible to traders with different budget capacities.

❌Where SurgeTrader Shorts

• The firm's strong focus on complex trading strategies and variety of instruments could intimidate novice traders.

• The substantial capital provided, while beneficial for some trades, could potentially be risky when investing in volatile markets.

FTMO

|

|

Name |

FTMO |

Registered Country |

Czech Republic |

Founded in |

2014 |

What You Can Trade |

Forex, Indices, Commodities |

Profit Share |

70% |

Capital Provided |

$200,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

FTMO, established in 2014 and registered in the Czech Republic, is a leading proprietary trading firm that supports a variety of traders. FTMO provides its traders with a broad spectrum of financial instruments to trade, including Forex, Indices, Commodities, among others. One of the defining features of the firm is its advantageous profit-sharing model wherein traders are able to keep 70% of their profits. Also, FTMO generously provides traders with trading capital up to $200,000, thus enabling the potential for significant gains.

The firm stands apart in its commitment to trader development, offering an extensive educational platform that delivers beneficial trading material, webinars, and coaching. Risk management, a cornerstone of successful trading, is heavily emphasized at FTMO. Traders' positions are managed using predefined risk parameters and the firm's advanced risk management technology.

Unique features of FTMO include its proprietary performance coach, trader psychology articles, statistical app to analyze your performance, and the FTMO challenge - an evaluation process for traders to prove their trading skills and earn a funded account.

✅Where FTMO Shines

• Offers an extensive range of tradable financial instruments, providing ample choice to traders.

• Generously provides substantial trading capital of $200,000, enabling significant trading opportunities.

• The profit sharing model, allowing traders to keep 70% of their profits, is highly beneficial.

• Strong focus on risk management, including predefined risk parameters and advanced risk management technology, contribute to its appeal.

❌Where FTMO Shorts

• The firm imposes a maximum daily loss limit that may hinder trading flexibility for some traders.

• Although a 70% profit share is enticing, traders are required to pass the challenging FTMO challenge before they can benefit, a process that may be difficult and discouraging for some traders.

FundedNext

|

|

Name |

FundedNext |

Registered Country |

United States |

Founded in |

2014 |

What You Can Trade |

orex, Commodities, Stocks and Cryptocurrencies |

Profit Share |

75% |

Capital Provided |

$300,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

FundedNext, registered in the United States and founded in 2015, is a notable proprietary trading firm supporting diverse styles of trading. FundedNext enables traders to deal in Forex, Commodities, Stocks and Cryptocurrencies, providing an expansive trading environment. The firm adopts a 75/25 profit sharing model where traders keep 75% of their trading earnings. Moreover, FundedNext offers significant trading capital, allowing for substantial trade size and potential profits.

In addition to a strong focus on building trading expertise, FundedNext offers a comprehensive training program that emphasizes practical trading skills alongside theoretical knowledge. Risk management is a core principle of the firm, with strategies such as strict stop-loss orders in place to mitigate trading risks.

Unique to FundedNext, is its 'Zero Challenge to Funding' feature, where traders can qualify for a fully funded trading account without undergoing a challenge or evaluation process, a distinct advantage over many competitor firms.

✅Where FundedNext Shines

• Vast tradable instruments including Forex, Commodities, Stocks, and Cryptocurrencies, providing traders with large flexibilty.

• Its profit-sharing model is highly attractive, allowing traders to keep 75% of their profits.

• The firm provides substantial trading capital, enabling larger trades and potentially greater profits.

• It offers a comprehensive training program, fostering the development of practical trading skills.

• Unique Zero Challenge to Funding' feature, enabling traders to qualify for a fully funded account without a challenge process.

❌Where FundedNext Shorts

• Risk management strategy may demand a high level of discipline from traders, which can be challenging for some.

• The comprehensive training provided, while crucial, can also be a daunting prospect for novice traders who may feel overwhelmed with the wealth of information and support provided.

Lux Trading Firm

|

|

Name |

Lux Trading Firm |

Registered Country |

United Kingdom |

Founded in |

2018 |

What You Can Trade |

Forex, Cryptocurrencies, and Commodities |

Profit Share |

70% |

Capital Provided |

$10,000,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

Luxtradingfirm, established in 2018 and registered in the United Kingdom, is a prominent proprietary trading firm providing a diverse trading environment. Luxtradingfirm allows traders to trade various asset classes, such as Forex, Cryptocurrencies, and Commodities. The firm offers an attractive profit-sharing model, where traders can retain 70% of net profits while benefitting from a considerable amount of trading capital provided.

Furthermore, Luxtradingfirm goes the extra mile in fostering trading expertise, offering an exhaustive training program comprising real-world market insights, educational resources, and strategic guidance. Risk management is deeply engrained within Luxtradingfirm's operations, and robust risk limitation strategies are in place to minimize trading volatility. Distinctive to Luxtradingfirm is its no maximum drawdown policy, where traders can trade freely without worrying about hitting a drawdown limit, a standout feature compared to many competitors.

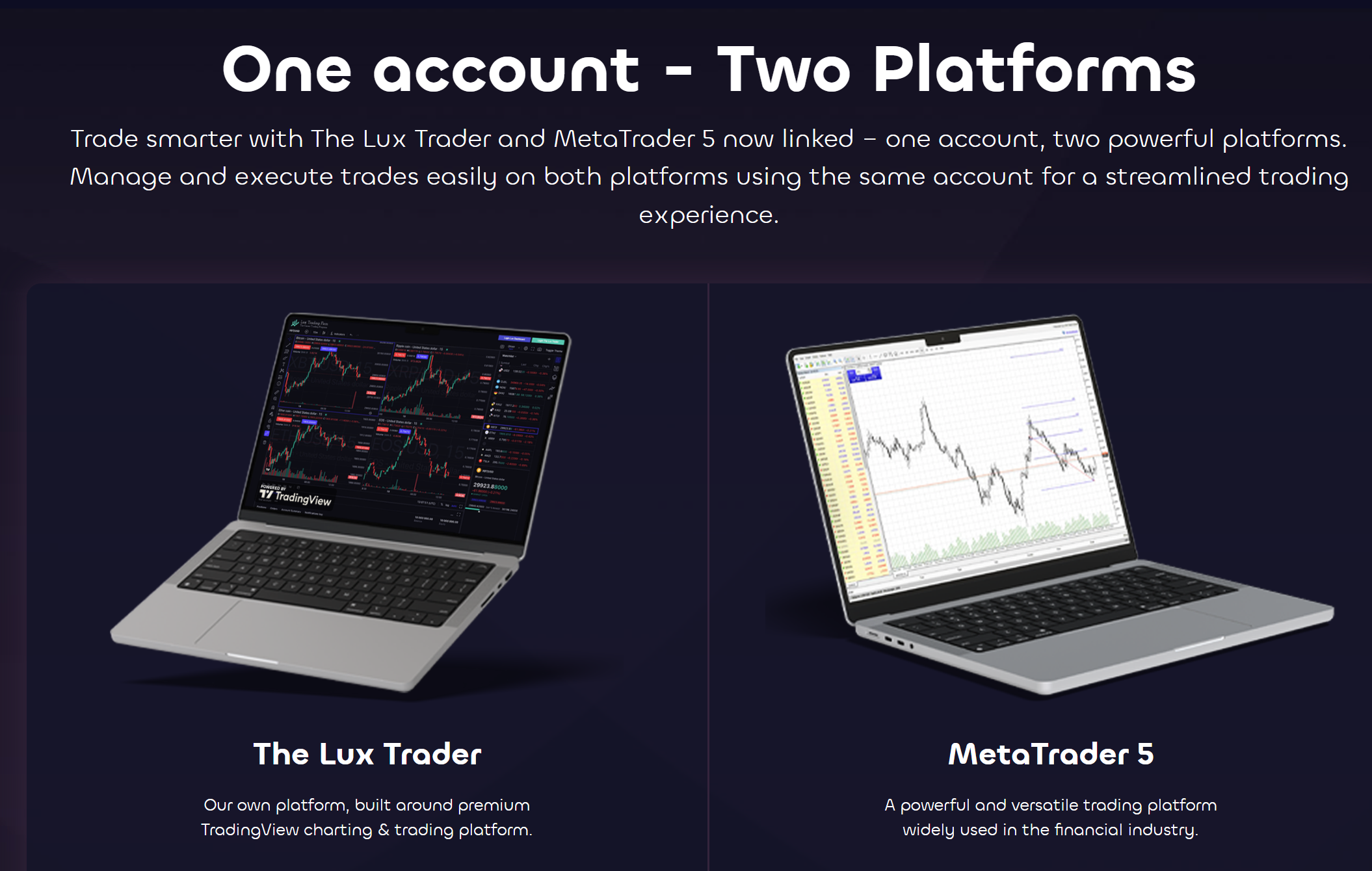

Notably, Luxtradingfirm offers two choices of trading platforms – the proprietary Lux Trader and the widely recognized MetaTrader 5 (MT5). These platforms are both advanced and user-friendly, offering a host of tools and features designed to improve trading efficiency and effectiveness.

✅Where Luxtradingfirm Shines

• The firm provides an attractive 70% profit-sharing model which is beneficial to traders.

• Luxtradingfirm offers significant trading capital to its traders, presenting opportunities for larger trades and potential profits.

• The training program is extensive, covering real-world market insights, educational resources, and strategic guidance.

• The unique 'no maximum drawdown' policy offers enhanced trading freedom.

• Luxtradingfirm provides two choices of advanced, user-friendly trading platforms – the Lux Trader and MetaTrader 5 (MT5).

❌Where Luxtradingfirm Shorts

• The comprehensive training program, though insightful, may be overwhelming for novice traders.

• The 'no maximum drawdown' policy, while liberating for some traders, has the potential to encourage reckless trading if not carefully managed.

The Trading Pit

|

|

Name |

The Trading Pit |

Registered Country |

United States |

Founded in |

2012 |

What You Can Trade |

Forex, Equities, Indices, Futures |

Profit Share |

80% |

Capital Provided |

€5M |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

The Trading Pit, launched in 2012 and based in the United States, is a reputed proprietary trading firm catering to a wide gamut of traders. With this firm, traders have the liberty to trade in numerous asset classes like Forex, Equities, Indices, Futures, and Options. One of its impressive aspects is a lucrative profit-sharing model where traders can retain up to 70% of their earned profits. Also, The Trading Pit provides sizable trading capital, thereby enhancing the possibility of larger gains.

In its quest to cultivate trading proficiency, The Trading Pit offers comprehensive training programs, offering both theoretical concepts and practical insights. It places a strong emphasis on risk management, employing rigorous risk containment strategies to manage trading exposures effectively.

Notably, they offer weekly mentoring sessions, building an active trading community where traders can learn from each other - a standout feature that sets it apart from many competitor firms.

✅Where The Trading Pit Shines

• It offers a rich variety of tradable assets, including Forex, Equities, Indices, Futures, and Options.

• The firm provides a generous profit-sharing model allowing traders to retain up to 70% of their profits.

• It provides substantial trading capital which creates opportunities for larger trades and potential profits.

• The comprehensive training program along with weekly mentoring sessions foster a sense of community and shared learning, a unique feature in such firms.

• The firm's stringent focus on risk management is a major strength.

❌Where The Trading Pit Shorts

• Its high-performance expectations may create a pressurized environment for traders.

• While it offers extensive training, this could potentially feel overwhelming to less experienced traders due to the vast amount of information provided and the high-paced trading environment.

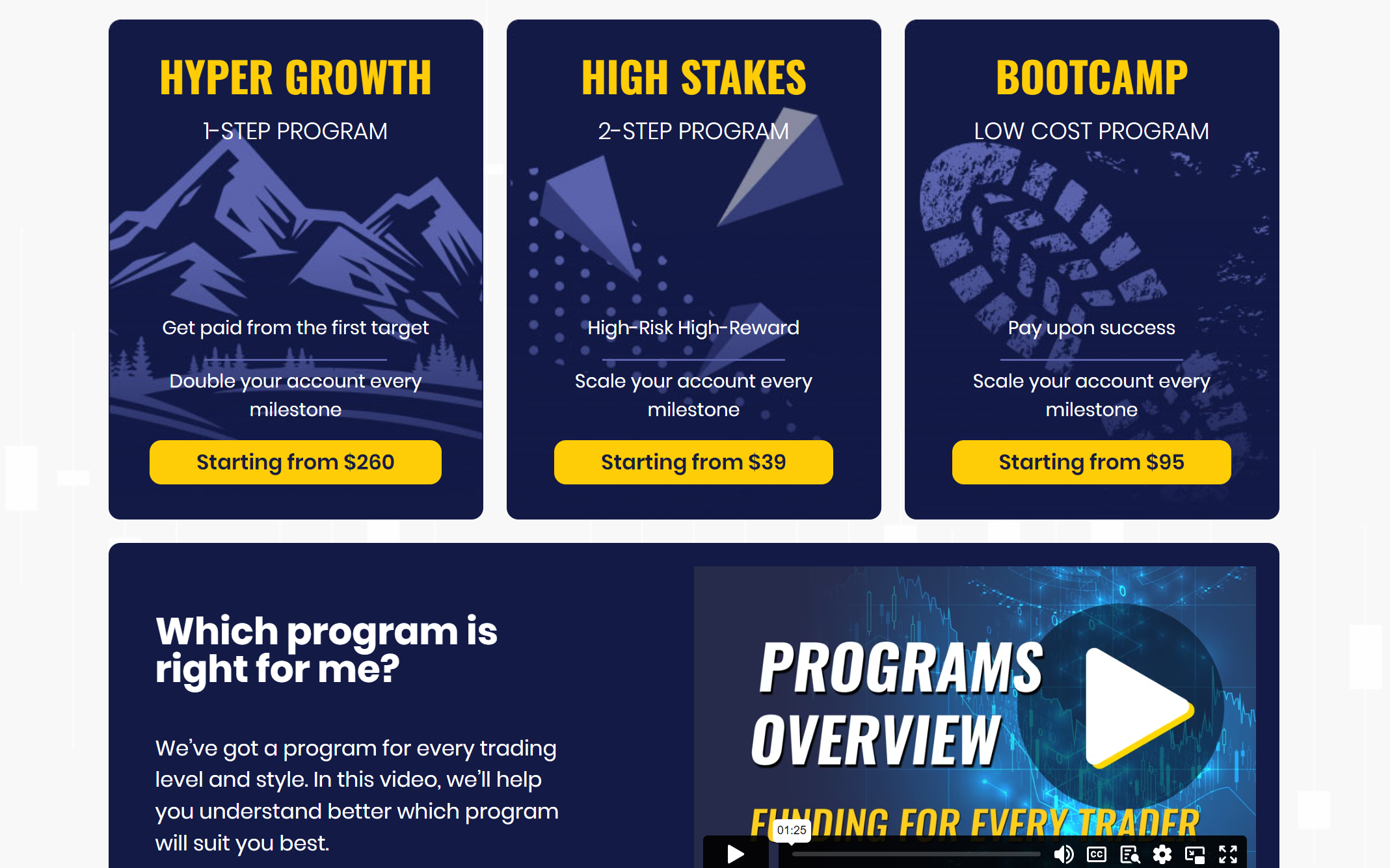

City Traders Imperium

|

|

Name |

City Traders Imperium |

Registered Country |

United Kingdom |

Founded in |

2017 |

What You Can Trade |

Forex |

Profit Share |

60% |

Capital Provided |

$2,000,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

City Traders Imperium, founded in 2017 and registered in the United Kingdom, is a well-reputed proprietary trading firm that provides a comprehensive environment for various types of traders. The firm allows traders the flexibility to trade predominantly in Forex. It follows an attractive profit-sharing model where traders are able to retain 60% of profitable trades, with the potential of the share rising to 90% based on performance. Significantly, it offers trading capital up to $2,000,000, heightening the opportunity for generating substantial profits.

What's more, City Traders Imperium places a strong emphasis on cultivating traders' knowledge and skills, offering extensive coaching programs focusing on strategies, risk management and psychology. Speaking of risk management, it is at the core of the firm's operations, with robust systems in place to limit risk, including the use of stop loss orders and exposure limits. A unique feature of City Traders Imperium is its fully automated trade copy service, which allows less experienced traders to copy the trades of more experienced professionals, which can reduce the learning curve for novices.

✅Where City Traders Imperium Shines

• Its primary focus on Forex trading, making it a great choice for traders specifically interested in this market.

• The firm provides considerable trading capital up to $2,000,000, which opens up opportunities for large trades and potential profits.

• It offers extensive coaching programs, focusing on strategies, risk management and trading psychology.

• City Traders Imperium introduces a unique fully automated trade copy service, allowing the less experienced to learn from professionals.

❌Where City Traders Imperium Shorts

• It focuses predominantly on Forex trading and thus might not appeal to traders interested in diversifying across other financial instruments.

• A starting profit share of 60%, although it can increase up to 90%, might be less enticing for some traders when compared to what some other firms offer.

The5ers

|

|

Name |

The5ers |

Registered Country |

Israel |

Founded in |

2016 |

What You Can Trade |

Forex, Metals, Indices, Commodities, Crypto |

Profit Share |

70% |

Capital Provided |

$4,000,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

The5ers, established in 2016 and registered in Israel, is a distinguished proprietary trading firm catering to a wide collection of traders. The firm provides access to Forex, Metals, Indices, Commodities, Crypto, giving traders an excellent platform to grow their skills in this particular market. They provide an attractive profit-sharing model, enabling traders to keep 50% of the profits with real potential to increase to 70% as traders prove their profitability and consistency. A notable feature is their provision of trading capital, extending up to $1.28 Million and offering traders the chance to go big without risking personal assets.

The5ers also dedicates considerable resources to trader development with a robust online training program that covers trading strategies, market analysis, and risk management. Speaking of risk management, it is a foundational pillar of The5ers operations, with strict risk containment policies like mandatory stop losses in place to manage the risk.

A unique feature of The5ers is their growth plan where consistent traders are rewarded with twice their trading account every time they hit their target, embodying a truly growth-oriented culture.

✅Where The5ers Shines

• Providing access to Forex, Metals, Indices, Commodities, Crypto, larger product offerings compared to other prop trading companies.

• It offers a generous provision of trading capital up to $1.28 Million, enabling larger trades and potentially higher profits.

• The5ers provides a comprehensive training program that covers various aspects of trading, including strategies, market analysis, and risk management.

• Its unique growth plan offers consistent traders with the opportunity to double their trading account each time they hit their target.

❌Where The5ers Shorts

• The profit-sharing model at 50% to start might seem less competitive for traders who can potentially secure a higher percentage with other firms.

• Their growth plan, while ensuring stability and success for the firm by doubling the account size only when traders hit the given target, might pose a challenging milestone for some traders to achieve.

Fidelcrest

|

|

Name |

Fidelcrest |

Registered Country |

England and Wales |

Founded in |

2018 |

What You Can Trade |

Forex, Indices, Metals, Commodities, Stocks and more |

Profit Share |

80% to 90% |

Capital Provided |

$2,000,000 |

Training Program |

✅ |

Risk Management |

✅ |

Official Website |

|

Established in 2018 and registered in England and Wales, Fidelcrest is a globally recognized proprietary trading firm that offers comprehensive trading solutions. The firm provides a wide range of trading options, including Forex, Indices, Commodities and Cryptocurrencies. Fidelcrest has an attractive profit-sharing scheme, where traders can expect to keep around 80% to 90% of the profits they make. In terms of trading capital, the firm allocates funds up to $2,000,000, offering ample opportunities for traders to engage in sizeable trades.

Fidelcrest also extends significant support to its traders in terms of education, offering a robust training program designed to enhance trading skills and knowledge. Risk management forms a critical part of Fidelcrest's operations, with detailed guidelines in place that maintain reasonable risk levels in trading activities. One standout feature of Fidelcrest is its 'Trading Challenge,' an innovative approach that allows traders to showcase their skills and move up the ranks to secure higher trading capital amounts.

✅Where Fidelcrest Shines:

• Raw spreads from 0 pips, with a very low commisisson at $3 per lot.

• Fidelcrest Trading Challenge account featuring a flexible leverage up to 100:1, available for all traders.

• Offering a generous profit-sharing scheme, allowing traders to retain 70% of their profits.

• A substantial trading capital up to $200,000, facilitating opportunities for larger trades and potential profits.

• Unique 'Trading Challenge feature, offering traders an opportunity to showcase their skills and secure increased trading capital.

❌Where Fidelcrest Shorts

• Withdrawal processes and procedures might be complicated or time-consuming.

• Some traders might find the firm's profit-sharing scheme less competitive compared to those offered by other prop trading firms.

Forex Trading Knowledge Questions and Answers

What is Prop Trading?

Proprietary trading, often referred to as prop trading, is when a financial firm or commercial bank invests its own money in different financial instruments, including stocks, bonds, currencies, commodities, their derivatives, etc., to make a profit for itself, as opposed to earning commissions by trading on behalf of its clients. The profits and losses are the firm's own and are not shared with clients or customers. Proprietary desks might operate using various strategies such as index arbitrage, volatility arbitrage, merger arbitrage, statistical arbitrage, etc., and can play a crucial role in providing liquidity in the markets.

Is Prop Trading Legit?

Yes, prop trading is entirely legitimate and forms a critical part of many financial institutions' operations. It involves a firm using its own money to trade financial assets such as stocks, currencies, commodities, and derivatives to generate profits. However, because intrinsic risks are high with prop trading, firms ensure they have strict risk management policies and compliance standards in place. It's worth noting though that while prop trading itself is legit, like any industry, it's not entirely free from unscrupulous participants.

How do Prop Trading Firms Make Money?

Prop trading firms, or prop trading firms, primarily make money by trading financial instruments with their own capital. They engage in a number of trading strategies such as swing trading, arbitrage trading, algorithmic trading, and day trading, amongst others. Prop trading firms aim to exploit market inefficiencies to generate profits.

In addition to trading, prop trading firms may also make money from training programs they provide to prospective or less experienced traders. Some firms may charge for these courses, while others may offer them gratis, seeing them as an investment in the firm's future profitability.

Moreover, prop trading firms also operate via profit-sharing arrangements with their traders. In these cases, the firm provides the capital for trading, and any profits are then split between the trader and the firm at a prearranged ratio.

What are the Monthly Fees Charged by Prop Trading Firms?

Prop trading firms' charges vary. Typically, commonly observed fees include desk fees or access fees which cover the operating expenses of providing traders with technology, data, and tools they need to trade. Monthly fees can range from $150 to $5,000. Here is the table showing the amount of monthly fees of 10 prop trading firms above:

| Prop Trading Firm | Monthly Fee |

| TOPSTEPTrader | $49-$149 |

| The Funded Trader | $145 to $325 |

| SurgeTrader | No |

| FTMO | €155 - €3,100 |

| FundedNext | $299 - $999 |

| Lux Trading Firm | $99 - $499 |

| The Trading Pit | $75 - $299 |

| City Traders Imperium | N/A |

| The5ers | $39 |

| Fidelcrest | $49 - $349 |

How Many Prop Traders Fail?

While specific numbers can vary based on the firm, trading strategy, and market conditions, it is estimated that a significant number of prop traders fail, with estimates even reaching up to 90%. This high failure rate can be attributed to several factors such as insufficient experience, inadequate risk management, lack of discipline, and the inherent unpredictability and volatility of the financial markets

What is the Average Return Rate of Prop Traders?

The average return rate of prop traders can greatly vary based on a multitude of factors, including the trader's skill level, experience, trading strategy, risk tolerance, and the current market conditions. However, a study by Barclays Hedge shows that the average return for traders at prop trading firms sits between 10% to 20% per year. More experienced traders can even exceed this and reach returns of 30% or higher in favorable market conditions.

Hedge Funds VS Prop Trading: What are the Differences?

Hedge funds and proprietary (prop) trading firms operate in the financial markets, but their structures, investment strategies, and risk profiles differ:

Capital Source: Hedge funds pool money from multiple investors and invest these assets using various strategies to generate high returns. In contrast, prop trading firms use their own capital for trading.

Investment Strategies: Hedge funds typically invest in a diverse range of markets and financial instruments, including stocks, commodities, derivatives, and real estate. Prop trading firms often focus on more specific types of trades such as arbitrage, day trading, or swing trading.

Risk and Return Profiles: Hedge funds usually aim for high returns, and with that comes high risk. Since investors fund hedge funds, a portion of the profits is returned to these investors. On the other hand, prop trading firms bear the risks of trading, and any losses are the firm's responsibility. However, all profits made from trading activities are solely for the firm's benefit.

Compensation: In a hedge fund, the managers usually earn a management fee and a performance fee, typically 2% of the asset under management and 20% of the profits, respectively. In prop trading firms, traders are often compensated through a profit-sharing model, where a certain percentage of the profits they make is paid as their compensation.

Regulation: Hedge funds are subject to more intensive regulation and oversight than prop trading firms. They must register with financial regulatory bodies and provide regular reports on their positions and activities.

What are Useful Prop Trading Strategies?

Trend Following: This involves using indicators like moving averages, RSI or channel breakouts to identify the dominant market trend direction on any timeframe, and trade along with it. Detailed entry/exit rules are devised to ride emerging trends until reversal signals appear. This is a core bread-and-butter strategy for prop traders.

High Frequency Scalping: These strategies aim to profit from multiple ultra short-term trades throughout the day capturing small per trade profits. Fast data feeds and order execution are vital to enter and exit positions within seconds or fractions of seconds based on news or sudden order imbalances. Tight stop losses are employed requiring constant monitoring

Statistical Arbitrage: This advanced strategy detects price divergences between correlated instruments like S&P future vs S&P 500 stocks using cointegration modelling and technology. Mispricing opportunities are identified and arbitraged quickly before spreads converge again. Speed and precision both matter greatly.

Intermarket Spread Trading: Here two related securities, like Crude Oil and Oil ETF, are bought and sold simultaneously to benefit from changes in the price spread. Technical and fundamental factors driving spreads apart or back together are analyzed for timing entries and exits.

Algorithmic Liquidity Detection: Cutting edge algorithms designed in-house by prop traders track anonymized order flow activity to detect the footprints of institutional buy/sell programs. Trades are then carefully executed in the same direction attempting to benefit from large order imbalances and hidden liquidity.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.