A bullish or bearish market refers to a trend in investment that has the potential to impact global financial markets. Traders often describe a market as bullish or bearish based on positive or negative price movements. The question is, what does it mean? Now, find the answers by yourself.

In this article, WikiFX will take a close look at the differences between bullish and bearish markets in forex trading and see how to spot and profit from the bullish and bearish strategies.

Q: What is WikiFX?

A: WikiFX is a professional, global forex broker regulatory inquiry tool with extensive and easily accessible data on almost 60,000 FX Brokers around the globe. You can learn about the Forex Industry, News, Educational Resources, and more at “wikifx.com”.

What are Bullish and Bearish Markets in Forex Trading?

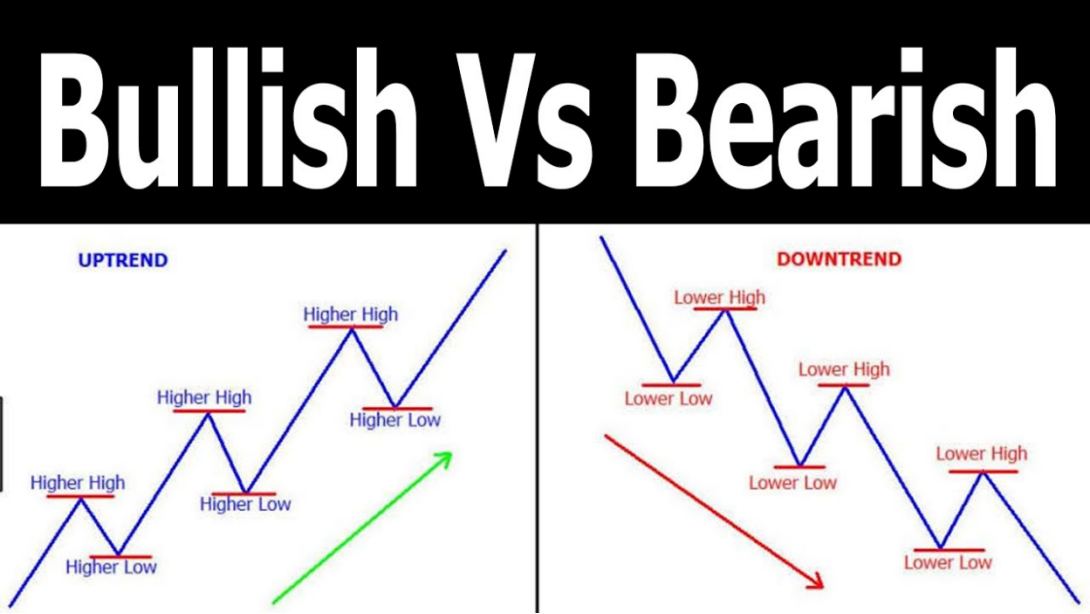

In general, a bullish or bearish market is the price trend or the trend of the market. As a market grows (uptrend) or loses value (downtrend), we say it is “bullish” or “bearish.”.

In forex trading, both types of traders expect the exchange rate to rise or fall depending on whether the base currency is bought or sold against the quoted currency. As the exchange rate fluctuates, market participants attempt to obtain profit.

What is a Bullish Market?

Bullish markets in forex are those that are positive, rising, and showing upward momentum. A market that surges by at least 20% from recent bottoms can be considered bullish. Based on surrounding circumstances, such an uptrend tends to last only a certain amount of time. It is possible for bearish markets to experience a few days of upward movement, but this does not necessarily indicate a change in trend.

Bullish markets are characterized by traders' high expectations, general optimism, and confidence in an ongoing uptrend. During a bullish market, the economy is doing well, unemployment is declining, GDP is increasing, and prices are also rising. In terms of supply and demand, there is a high level of demand and a low level of supply.

In forex pair investments, traders become optimistic about their investments and accept the risks. The investors hope that the market will continue to rise during the period of their investment so that they can increase their investments. Through tools such as candlestick charts and moving averages, they can anticipate the peak when to sell for a profit.

It is considered beneficial to invest in forex currencies such as the Australian dollar, the New Zealand dollar, and the Canadian dollar. A bullish market will also benefit exotic currency pairs.

Different Types of Bullish Market

Bullish Normal: When the trade becomes more bullish, traders can safely leave their commitment for the long term.

Bullish Volatile: It is important to monitor the trade carefully when it is bullish volatile, as things can change quickly. A bullish trend could revert to a bearish one.

What is a Bearish Market?

As opposed to a bullish market, a bearish market is negative, falling, and showing downward momentum. If the price drops by at least 20% from recent tops, the market is considered bearish. It must be a sustained drop. Short-term drops in value do not establish a bear market.

In America, the longest period of a bear market was 61 months during World War II.

Bearish markets are characterized by traders' low expectations and pessimistic outlooks. In a bearish market, unemployment is rising, GDP is declining, and prices are also falling. In terms of supply and demand, there is an excess of supply and low demand. As a result of uncertainty and traders psychology, traders want to avoid losses by selling. Due to speculation that prices will fall, traders are not willing to accumulate more assets.

Traders will begin to sell their investments. As more traders sell, the pair will sink further into a downward spiral. As the bearish market becomes more established, pessimism increases among traders. Bearish forex pairs become harder to sell as general pessimism grows.

“Bearish outlook” people are pessimistic, but many expect short-term fluctuations and look for signs of revival.

Why does “Bullish” Stand for Rising, while “Bearish” Stands for Falling?

“Bullish” and “bearish” are words derived from bull and bear. The way that bull and bear attack the prey is different. A bull attacks with a lowered head when he runs at the target. When he reaches the target, he tosses his prey or flings his head up. In the bullish market, prices rise as aggressive purchases are made by bull traders, and that's why bulls are considered positive.

As a bear attacks its prey, he heaves his paws down from his shoulder, just like the bear trader tries to reduce prices. Negative financial trends can result from this downward movement. The price is declining.

It is sometimes attributed to a painting by William Holbrook Beard called “The bulls and the bears in the market.” The painting depicts bulls and bears stampeding out of the stock exchange and attacking each other. It has been interpreted as a depiction of traders, with the bears symbolizing careful traders, and the bulls representing risk-taking traders. According to others, the bull represents the optimistic trader, and the bear represents the pessimistic trader.

Bullish Market ⇌ Bearish Market

It is possible for the bearish market to turn bullish at any time. Reversals usually occur when the market has moved into an oversold zone and the current price does not suit sellers. It is also possible for the trend to change due to positive news about the base currency. Bears cannot hold the market in this case, so existing deals will need to be closed. Bullish markets may exist until negative news is released or until they move into overbought territory.

Bullish vs Bearish Markets: What’s the Difference?

How to Spot Bullish and Bearish Markets?

Becoming a good trader is the result of developing and utilizing a number of important traits, such as patience, flexibility, decisiveness, open-mindedness, and a hunger for knowledge and experience. Here lets go through several character traits of successful day traders:

It is not easy to identify current market conditions. Identifying a trend direction takes a certain level of skill, and not every trader is capable of doing so. If a trend is clear in the forex market, however, many traders, including beginners, can trade efficiently. You can use technical analysis tools and look for some indicators to determine (not with 100% accuracy but with a high grade of it) where the price will go, such as price chart, MA (Moving Average), RSI (Relative Strength Index) and MACD (Moving Average Convergence and Divergence).

① Price chart

Price charts can be used to determine market trends.

In an uptrend (bullish) market, each subsequent maximum should be higher than the previous one, and each subsequent minimum should also be higher. You can see an uptrend on the EUR/USD pair's daily chart that lasted for 7 months.

By looking at the price chart, you can also determine whether the market is bearish. As you can see from the daily EUR/USD chart, the price has declined for a year.

② MA (Moving Average)

Moving Average is another common trend indicator used to determine whether the market is bullish or bearish. Depending on the direction of the trend, it takes the form of a curve. It is usually used to combine two moving averages. Many traders follow the 50-day and 200-day MAs.

Bullish signals are formed when the price moves above the curve. A bearish signal occurs when the price moves below the MA. It is likely that the trend will reverse when the price crosses the curve. Price movements in the market can be predicted based on the angle of the slope.

③ RSI (Relative Strength Index)

RSI (Relative Strength Index) measures the strength of a market's momentum. As the RSI approaches zero, it indicates weak market momentum. A rising or falling market can be predicted by this indicator.

④ MACD

Indicator of momentum, MACD (Moving Average Convergence and Divergence) shows the difference between two moving averages. When the MACD line crosses below or above the signal line, a buy or sell signal is given. Bullish trends are usually accompanied by bullish MACDs, while bearish trends are usually accompanied by bearish MACDs.

Simply put, it's important to understand that the market doesn't always move in the same direction. Markets can fall even in bullish trends or jump when they are considered bearish.

There are also times when the market is neither bullish nor bearish. This is a period of correction or sideways movement. The market cannot be controlled by bulls or bears.

How to Profit from Bearish and Bullish Strategies?

Currency pairs are what you deal with when you trade forex. The underperforming currency may be bullish, and the bullish currency may be underachieving. Following currency trends and switching currency pairs as one pair swings from bullish to bearish and back again is crucial for successful forex trading.

Next, we will discuss bullish and bearish strategies. These strategies can be applied regardless of the current trend.

How to Profit from Bullish Strategies?

Invest in the market at the beginning of a bull run and acquire more assets. This will allow you to buy assets at their lowest price and have the potential to gain the most capital gains.

Split up your capital if you are not sure that a certain indicator will accurately predict a bull run. When you see the market continues to rise, you can add to your position with the rest of your investment. You should exit your long positions at the end of a bull run when there is sufficient liquidity.

It is best to buy early bullish markets and then sell them when the trend reaches its peak if you want to invest in a bullish market. Keep your investment strategy in mind, or you may miss out on great opportunities.

How to Profit from Bearish Strategies?

Some traders want to sell the forex pairs that are not performing well in a bearish market, while others want to buy those pairs in hopes that they will rise. Buying low and selling high is their motto.

A short position can be opened at the beginning of a bear run, and the price level can be set accordingly. You should add your funds if the short trade is profitable. To extend the duration of your trade, you can add money to increase the position size and replace the take-profit order.

It is best to invest before the market has fallen by about three-and-a-half percent. Nevertheless, they won't last forever. Keep calm and focus on your long-term goals during a bear market.

Conclusion

To conclude, trading forex takes discipline, planning, studying, and financial resources. A bearish and bullish strategy can also be used to win in the forex market. Using these simple techniques, you can make profits from any market trend in the forex market.

WikiFX recommends you educate yourself enough and do more research before starting forex trading. If you want to become a successful forex trader, you should educate yourself enough and do more research on the brokers that you are interested in before you start trading. Visit our website (https://www.WikiFX.com/en) or download the WikiFX APP now to learn more about forex-related information and resources.

You Also Like

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.