The perpetual Forex market operation has prompted many traders to view Forex trading as an alternative income source. Forex uniquely operates around the clock, diligently remaining open 24/5, in contrast to the sharp closure of stock and commodity markets at 8 p.m.

This leads to the question: why is Forex a 24-hour market? This intriguing concept and its continuous function are explained in detail further ahead. Then you must be wondering if I need to sit in front of my computer 24 hours a day to watch when to trade. No, you don't need to. There are four main trading sessions for Forex trading. You just need to choose the right trading hours according to your schedule and trading preferences.

Through the guidance of WikiFX commentators, we aim to build your understanding of the Forex trading market from novice to proficient level. This comprehensive comprehension of Forex trading paves the path to evolve from a beginner to an expert trader.

What are Forex Trading Sessions?

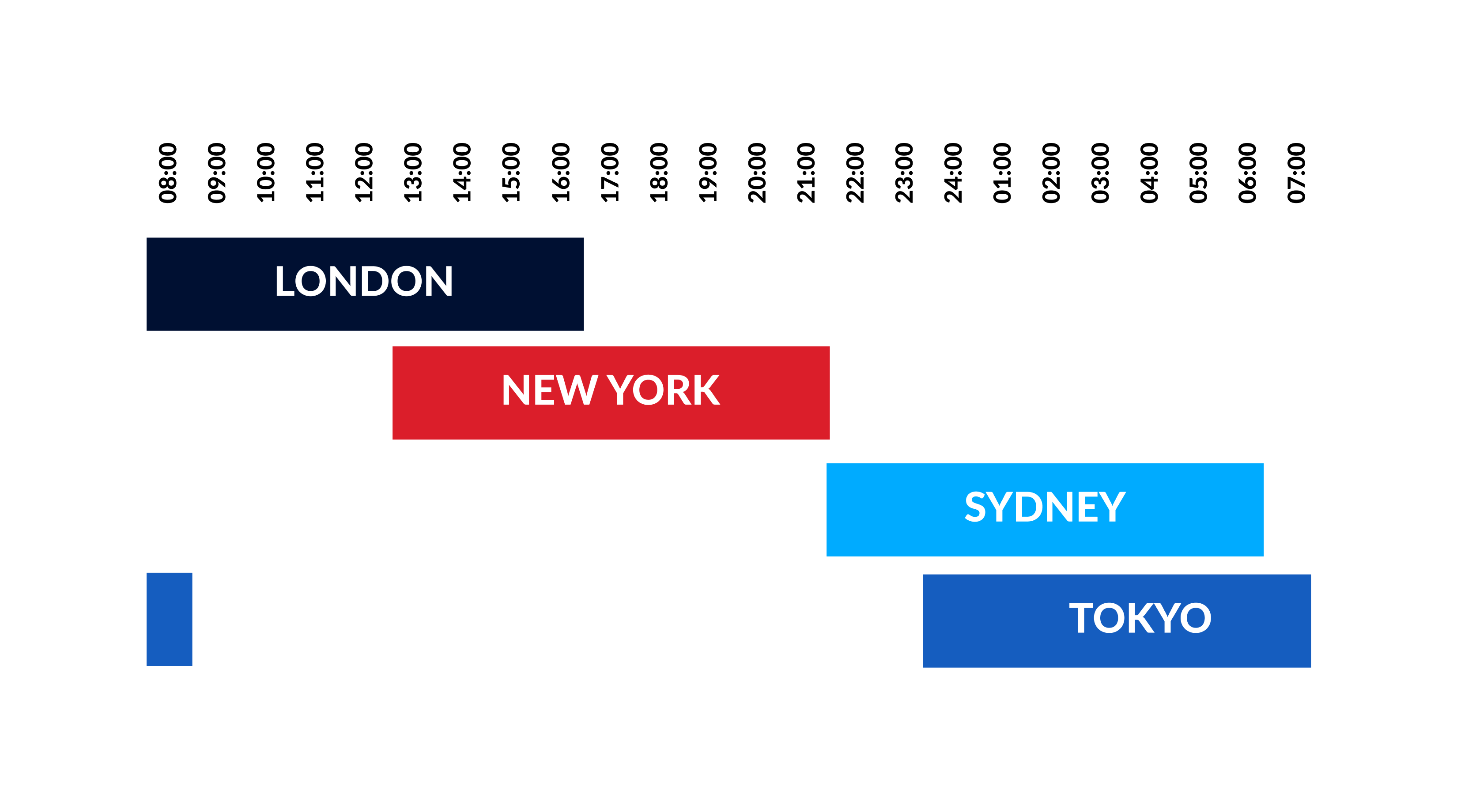

A trading session refers to the timeframe during which a forex market is operational and trades can be conducted. The most common trading sessions are the New York session, London session, Tokyo session, and Sydney session in the Forex market. The name of each Forex trading session is taken from the major financial center city in the region. Of course, these also have other names. The Tokyo session is collectively referred to as the Asian session, the London session is also known as the European session, and the New York session is referred to as the American session.

If you want to analyze and determine the best time to trade Forex currency pairs, you must understand the different trading sessions and which currencies or markets are the most liquid during these time periods.

In this article, we will use GMT to introduce different trading sessions, the best trading hours, and times unsuitable for trading. Please adjust the time difference according to your time zone. For example, if you are in Central Europe, winter time is GMT+1, and summer time is GMT+2. If you are in places like Beijing, Malaysia, Taiwan, Singapore, etc., you are in the GMT+8 time zone.

Four Major Trading Sessions

As we have mentioned earlier, these four places are the largest trading centers, accounting for nearly 75% of the daily foreign exchange trading volume.

Next, we'll discuss their respective characteristics and the trading strategies suitable for traders during these sessions.

Below is a table summarizing the four Forex trading hours, including local time, Eastern time and GMT(Summer Time).

| Forex session | State of Market | Local Time | Eastern Standard Time | GMT(Summer Time) |

| Sydney | opening | 7:00:00 a.m. | 17:00:00 p.m. | 22:00:00 p.m. |

| close | 16:00:00 p.m. | 2:00:00 a.m. | 7:00:00 a.m. | |

| Tokyo | opening | 9:00:00 a.m. | 19:00:00 p.m. | 0:00:00 a.m. |

| close | 18:00:00 p.m. | 4:00:00 a.m. | 9:00:00 a.m. | |

| London | opening | 8:00:00 a.m. | 3:00:00 a.m. | 8:00:00 a.m. |

| close | 16:00:00 p.m. | 0:00:00 a.m. | 17:00:00 p.m. | |

| New York | opening | 8:00:00 a.m. | 8:00:00 a.m. | 13:00:00 p.m. |

| close | 17:00:00 p.m. | 17:00:00 p.m. | 22:00:00 p.m. |

Sydney Session - Lowest Liquidity Trading Session

The Sydney trading session is the first to open, initiating at 10 pm GMT during summer and 9 pm GMT in winter. It concludes at 7 am GMT in summer and 6 am GMT during winter. It would be wise to consider trading the Australian and New Zealand dollars amidst the Sydney session.

Compared to the London, New York, and Tokyo markets, Sydney's liquidity and trading opportunities may be fewer, which impacts that many traders and analysts focus more on other three markets with larger trading volumes and heightened volatility and liquidity.

Tokyo/Asian session - Smallest Trading Volume Session

It starts at GMT 00:00 and ends at 09:00. The main financial centers active during this period are Tokyo, Hong Kong, and Singapore. Currency pairs involving the yen, such as USD/JPY and AUD/JPY, are particularly sensitive to fluctuations during this period. After the market opens, the trading volume gradually increases, but the price changes tend to be balanced due to the relatively small scale of the Australian and Japanese markets.

As the third-largest forex trading center in the world, Japan's yen trading volume accounts for 16.50% of the global forex trading volume, but its market trading volume accounts for only 6%.

Speculators in yen trading usually start trading during this session, and the trend of this session often predicts the direction of other markets throughout the day. Traders in subsequent sessions review market changes during the Tokyo session to plan and evaluate trading strategies for other sessions.

The following table provides an overview of the Tokyo Trading Session:

| Tokyo Session | Features |

| Time Period | GMT 00:00 to 09:00 |

| Main Financial Centers | Tokyo, Hong Kong, Singapore |

| Common Currency Pairs | USD/JPY, AUD/JPY |

| Market Size | 6% of trading volume, Third largest forex trading center globally |

| Impact on Other Markets | Potentially sets the trend for other markets throughout the day |

The characteristics of the Tokyo session

Lower Liquidity:

Lower Volatility:

Clear Entry and Exit Levels:

Suitable for Sound Risk Management:

Breakout Opportunities Post Session:

The lower liquidity in the Asian session means non-Asian markets such as EUR/USD, GBP/USD, and EUR/GBP are less likely to make significant moves outside of normal trading ranges.

The movements in the Asian session, primarily driven by its liquidity, are generally smaller compared to those seen during the London or New York sessions.

Support and resistance levels help traders identify opportunities for entering or exiting trades. Combining these with signals from indicators increases the chances of successful trades.

The calm nature of the Asian session may allow for better trade management due to its slower pace, enabling a more detailed analysis of risk and reward.

As the Asian session concludes, it overlaps with the start of the London session, resulting in increased liquidity and the potential for breakouts from established trading ranges.

London/European Session - Most Liquid and Active Session

The London session starts at GMT 08:00 and ends at 17:00, with London as the main active financial center during this period. The active currency pairs during this period are those related to British Pound and Euro, such as GBP/USD and EUR/GBP. As a traditional global financial center and the earliest forex trading market, banks around the world usually start bulk trading after the London market opens. With the opening of the London market, the global forex market volatility intensified, providing more investment opportunities for individual investors. Compared to other sessions, the London session accounts for about 38% of the global trading volume, even more than the total of New York and Tokyo markets.

The following table provides an overview of the London Trading Session:

| London Session | Features |

| Time Period | GMT 08:00 to 17:00 |

| Main Financial Centers | London |

| Common Currency Pairs | GBP/USD, EUR/GBP, EUR/USD, USD/CHF, USD/ JPY, EUR/JPY and GBP/JPY |

| Market Size | 38% of trading volume, largest forex trading center globally |

| Impact on Other Markets | Possible market trend reversals |

Characteristics of the London Session

Strong Volatility

The slowing down of Tokyo's market often leads to an increased volatility during the London trading session, as prices begin to shift away from liquidity providers in the UK.

Significant Fluctuations in the Overlap Period

The “overlap” refers to the time when the London and New York sessions overlap (from 8 AM to noon Eastern Time). Large and rapid fluctuations can often be seen during this period. More details will be provided in the section discussing the best times for trading.

High Liquidity

The London forex trading session is one of the sessions with the highest liquidity. Owing to the large volumes of buy and sell, major currency pairs can be traded with extremely low spreads. Day traders seeking short-term trends can take advantage of breakout trading to reduce the costs they pay in spreads.

Support and resistance levels are more likely to break than in the Tokyo session, which typically experiences lower volatility. This concept is a core strategy for traders speculating during the London session, who can take advantage of this volatility through breakout trading.

However, traders need to be aware that due to the large amount of trading in the London session, market fluctuations can be significant, especially at the end of the session when there may be a market trend reversal as European traders may start to secure profits.

New York/North American Session - One of the Most Liquid Forex Trading Sessions

The New York session starts at GMT 13:00 and ends at 22:00, with an overlap with the end of the London session. The main financial center active during this session is New York. This session particularly impacts currency pairs related to the US dollar, such as EUR/USD and USD/JPY.

The United States, as the world's largest capital flow center, coupled with the special status of the dollar, makes the New York forex market the most active forex trading market globally, offering numerous profit opportunities for investors.

The New York forex market is significantly influenced by domestic US economic data such as GDP, interest rates, producer price index, consumer price index, unemployment rate, and comments made by the Federal Reserve. It's important to note that due to the special status of the US dollar, any major data released by the US can impact the market at any time.

| New York Session | Features |

| Time Period | GMT 13:00 to 22:00 |

| Main Financial Centers | New York |

| Common Currency Pairs | EUR/USD, USD/JPY |

| Market Size | 15% of the world's total daily foreign exchange transactions |

| Impact on Other Markets | Any important data released by the US can impact the market at all times |

As we mentioned in a previous article about trading strategies: https://www.wikifx.com/en/best/best-forex-trading-strategies.html, we can adopt different trading strategies to manage the different intervals of the New York session, such as breakout strategy and range trading strategy.

Characteristics of the New York Session

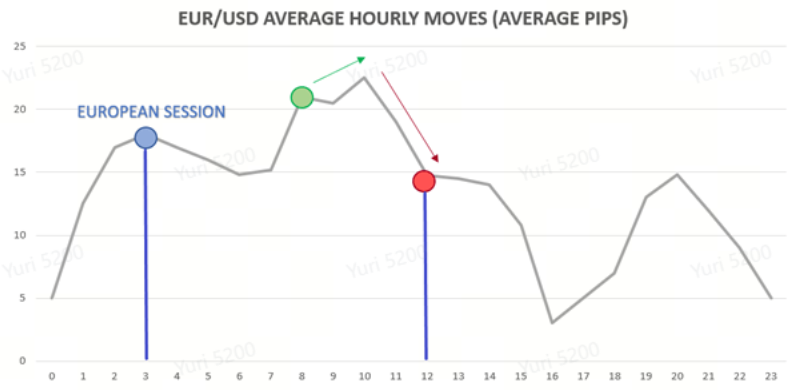

High volatility in overlapping periods

Traders can take advantage of the increased volatility during the overlap period and employ breakout strategies. As London closes, there tends to be a sharp drop in volatility. The direction is marked by the red arrows in the following figure:

Lower Volatility at the Latter Half of the New York Session

Traders can use range trading strategies at this time period. With range trading strategies, traders can leverage support and resistance levels. Traders usually buy at or near the support level (the low point of the range) and sell at or near the resistance level (the high point of the range).

The logic behind using range trading strategies is that with lower volatility, support and resistance levels may be harder to break, thus more likely to hold — this is beneficial for range trading strategies.

Overlap Periods

At certain times, the overlap of two trading sessions can increase trading activity and market volatility. The two major overlap periods are:

Tokyo-London (GMT 08:00 to 09:00): At this time, both markets are open.

London-New York (GMT 12:00 to 17:00): Both markets are active, with high trading volume and significant price fluctuations.

| Overlap Periods | Start Time (GMT) | End Time (GMT) |

| Tokyo - London | 8:00 | 9:00 |

| London - New York | 12:00 | 17:00 |

These overlaps are important because they provide increased market liquidity due to a higher number of traders. High liquidity can reduce the likelihood of price declines, the potential for order fulfillment is higher, the spread within a currency pair is smaller, these are often good trading opportunities.

However, these two overlapping periods need to be distinguished.

During the Tokyo-London overlap, the Asian market usually does not fluctuate much and enters a stable state in the afternoon, while the European market is just starting, lack of liquidity may make traders feel the market is lackluster.

On the other hand, the overlap of London and New York trading sessions is the best trading period, traders from both major financial centers start to become active, market liquidity increases, especially when the US economic data is released, the market changes greatly.

How to Choose a Trading Session that Suits You Best?

With the detailed analysis of trading sessions as mentioned above, you must be eager to understand how to choose the trading session that best suits you or the best trading session. Let's first analyze a few key factors for selection:

Market Activity: Different sessions have varying levels of market activity. Generally, the London and New York trading sessions are more active and provide more trading opportunities.

Volatility: Market volatility also varies between trading sessions. If you are a trader who prefers high risk-high reward scenarios, you may opt for sessions with greater volatility. If you prefer a more stable environment, sessions with less volatility might be your choice.

Trading Strategy: Your trading strategy will also dictate which session suits you best. Certain strategies may perform better during specific sessions.

Personal Preference: Your personal lifestyle and schedule should also factor into your decision. For instance, if you are located in Asia, the Sydney and Tokyo sessions might be more convenient for you.

Economic Data Releases: If you plan to trade a currency pair that involves a specific country's currency, you should keep an eye on when that country's economic data gets released, as it can affect the value of that currency.

We already have some understanding of basic selection criteria. Next, we will provide some widely recognized best and most avoidable timeframes for your reference.

Best time for Forex Trading

The forex market operates 24/5, but our attention is limited, it's crucial to seize the prime time and complete transactions effectively. The following will analyze the optimum trading time in the forex market.

Overlap Time Sessions

This is because the overlay of the forex market is more active, and the overlap means that at this time there are quite a few traders, which will impact the market situation. We have already covered this part earlier, so it won't be reiterated here.

Mid-week Periods (Tuesday to Thursday)

This tends to be more active trading days of the week, suitable for trading. Traders should be aware that when the Asian and European trading sessions overlap, and when the European and American trading sessions overlap, market activity will increase, and price fluctuations become extremely unstable. The state of these markets changes rapidly, especially just as the overlaps begin, so careful trading is necessary.

Concurrently, at the start of the trading week (the beginning of the Asian trading session) and the end (the end of the New York trading session), the market trading volume is often very low, and careful trading should also be practiced.

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday |

Worst Time for Forex Trading

After understanding the optimal trading time periods mentioned above, next, we definitely need to consider what periods are less suitable for trading, to avoid losing money.

The First and Last day of the Trading Week

Generally, the initial 24 hours of each trading week are perceived as slow with participants returning from a 48-hour break. During this period, participants are essentially determining their trading direction for the looming week. It is wise to avoid trading every Monday unless one has already secured a position in the weeks prior.

On the flip side, liquidity tends to slump on Friday afternoons in New York. With markets closed on Saturdays and Sundays, any unexpected news on Fridays might elevate trading risks.

Holidays

When important holidays approach, many individual investors and institutional ones reduce their trading activities. Some banks may also be closed on these days. Hence, trading during these times is usually subdued with poor liquidity, which makes it unfavorable.

For example: UK or US bank holidays. In the absence of these countries' participation, the market's trading volume and liquidity will be lower than average.

Major Events

Making market entries during significant events can be risky as it is hard to predict the direction of price movements. Rapid trading before having a deliberate strategy may result in agony. While major events can pose challenges and opportunities, individuals without substantial skills and experience will face significant risks.

For example: The outbreak of the COVID-19 caused extreme fluctuations in the exchange rate of Yen to USD (including all major global currencies), increasing uncertainties and trading risks.

Six months before the COVID-19, the Yen had depreciated, from 105.12 Yen per US dollar to 109.78 Yen per US dollar.

Trading Sessions Suitable for Beginners

If you are a beginner, then the following content should not be missed. New traders should choose a trading session that best suits their trading strategy and personal preferences.

In general, the most active and therefore most profitable periods are the London and New York sessions. During these periods, market volatility and liquidity is higher, which can lead to more trading opportunities. However, these periods can also come with higher risk due to abrupt market fluctuations.

For those who prefer less volatile market conditions, the Sydney and Tokyo sessions, which are less active, might be a better option.

Regardless of which session you choose to trade in, one thing to note is that you must pay attention to the trading rhythm. Take advantage of profit opportunities when the market is favorable, and conserve your energy when the market is unfavorable. Never be in a rush to achieve results.

How to Develop a "Trading Brain"?

As mentioned earlier, apart from understanding the appropriate trading times, the release of important fiscal and financial information can affect forex fluctuations. So how do forex traders remain constantly sharp on the market? You can choose a platform with an economic calendar and latest forex news, such as our WikiFX APP, or visit our website at https://www.wikifx.com/en/

Firstly, the economic calendar can provide investors with early warnings of major economic events that are about to occur, such as central bank interest rate meetings, the release of important economic data, etc. These may trigger drastic fluctuations in the market, and investors can choose corresponding trading periods based on their risk tolerance.

Secondly, forex news can help investors to be aware of global economic dynamics and policy trends in a timely manner. There are many factors affecting currency exchange rate fluctuations, such as economic growth, interest rates, inflation, political events, etc. Paying attention to and understanding these news can help investors grasp market trends and make wiser trading decisions.

Conclusion

Let's review the key points mentioned in this article: the reasons for the 24-hour opening of the forex market, the four major forex trading sessions, the characteristics of each trading session, and the appropriate trading strategies to adopt. In addition, we also discussed overlapping trading sessions, the most suitable and the most avoidable trading periods, and of course, the trading periods suitable for beginners.

Generally speaking, we need to analyze specific situations, and trading at the right time depends on the expected results we want to achieve. Of course, forex trading carries a high degree of risk, and we can't generalize, universal conclusions still need to be supported by our own study and insight into the market. When reading this article, it is suggested that you also study the article on Best Forex Trading Strategies in 2023 (Top 8) simultaneously, so you can further understand how to observe forex market trends during specific periods and which specific strategies to choose.

You Also Like

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.