Score

BV Trading

Switzerland|5-10 years|

Switzerland|5-10 years| https://www.bcdforex.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Switzerland

SwitzerlandUsers who viewed BV Trading also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

bcdforex.com

Server Location

United States

Website Domain Name

bcdforex.com

Server IP

98.126.219.131

Company Summary

| Aspect | Information |

| Registered Country/Area | Switzerland |

| Founded Year | Unknown |

| Company Name | BV Trading |

| Regulation | None |

| Minimum Deposit | Starter Account: $100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starter Account: Starting from 1.0 pip |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Indices, Commodities, Cryptocurrencies |

| Account Types | Starter Account, Advanced Account, Pro Elite Account |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | International phone numbers, limited email support |

| Payment Methods | Bank Wire Transfers, Credit/Debit Card Payments, select E-Wallets |

| Educational Tools | Not mentioned |

Overview

BV Trading is an online brokerage providing trading services in Forex, indices, commodities, and cryptocurrencies, offering leverage of up to 1:500 and spreads starting from 0.0 pips; however, there are troubling aspects to consider as its website is currently down, and the company lacks transparency regarding its account tiers and minimum deposit requirements, with no disclosed regulatory information, leading some users to label it as a potential scam; caution is advised when dealing with unregulated offshore brokers like BV Trading to avoid potential financial loss or fraudulent activities, and instead opt for regulated and reputable platforms for their trading needs.

Based on the information provided above, the table for BV Trading would look like this:

Regulation

None.

When a company like BV Trading has no regulation, it means that it is not governed or supervised by any recognized financial regulatory authority. As a result, the company operates without being subject to the strict rules, standards, and oversight that regulated entities must adhere to.

The absence of regulation raises significant concerns for potential customers. Without regulatory oversight, there is a higher risk of fraudulent activities, financial mismanagement, and unethical practices. Customers who engage with unregulated companies like BV Trading may have limited recourse in case of disputes or issues, and there is a greater likelihood of encountering scams or unfair treatment.

Regulated financial entities are subject to stringent guidelines that aim to protect consumers, ensure transparency, and maintain market integrity. They are required to meet specific capital requirements, safeguard client funds, and follow ethical business practices. In contrast, unregulated companies lack these crucial safeguards, making it essential for traders and investors to exercise extreme caution when considering such platforms and to prioritize using regulated and reputable alternatives for their financial transactions and investments.

Market Instruments

BV Trading offers a diverse range of market instruments to cater to the trading preferences of its clients. The broker provides access to various financial markets, enabling traders to participate in a wide array of assets. Here are the main market instruments available at BV Trading:

Forex Trading:

BV Trading covers major, minor, and exotic currency pairs in the Forex market. This allows traders to speculate on the exchange rate movements between different global currencies. Major pairs include well-known currencies like the US Dollar (USD), Euro (EUR), British Pound (GBP), and Japanese Yen (JPY). Minor pairs consist of less commonly traded currencies paired with major ones, while exotic pairs involve currencies from emerging or smaller economies.

Index Trading:

For those interested in index trading, BV Trading offers access to some of the most widely followed indices in the world. This includes well-known indices like the NASDAQ, S&P500, Dow Jones, DAX30, CAC40, FTSE100, and Nikkei225. By trading indices, investors can speculate on the overall performance of specific markets or sectors without having to buy individual stocks.

Commodity Trading:

Commodity trading is also available at BV Trading, with popular choices like Gold, Silver, Oil, and Natural Gas. Commodities provide a way for traders to diversify their portfolios and hedge against inflation or economic uncertainties. Gold and Silver are considered safe-haven assets, while Oil and Natural Gas are influenced by global supply and demand dynamics.

Cryptocurrency Trading:

Cryptocurrency enthusiasts can access the fast-growing digital asset market through BV Trading. The broker offers trading in major cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrencies have gained significant popularity due to their decentralized nature and potential for high volatility, which presents both opportunities and risks for traders.

Overall, BV Trading's broad range of market instruments caters to both novice and experienced traders, allowing them to engage in various markets and diversify their trading strategies. Whether traders are interested in Forex, indices, commodities, or cryptocurrencies, BV Trading provides options to suit their individual preferences and risk appetite.

Account Types

Starter Account:

The Starter Account is designed with beginners and traders who prefer straightforward trading conditions in mind. It requires a minimum deposit of $100, making it accessible to a wide range of clients. Traders benefit from competitive spreads starting from 1.0 pip and leverage of up to 1:200. This account grants access to an extensive selection of market instruments, including Forex, indices, commodities, and cryptocurrencies. Traders can utilize popular trading platforms such as MetaTrader 4, MetaTrader 5, web-based platform, and mobile trading apps. With its user-friendly features, the Starter Account is an ideal choice for those new to trading or looking for a simple trading experience.

Advanced Account:

The Advanced Account is tailored for more experienced traders seeking enhanced trading conditions and improved account benefits. It requires a minimum deposit of $1,000, providing traders with access to tighter spreads starting from 0.5 pips and leverage of up to 1:400. With reduced trading costs compared to the Starter Account, traders can optimize their trading strategies for potential higher profits. Like the Starter Account, the Advanced Account includes access to a wide range of market instruments and popular trading platforms, such as MetaTrader 4, MetaTrader 5, web-based platform, and mobile trading apps. The Advanced Account is an attractive option for traders with some experience who wish to benefit from improved trading conditions.

Pro Elite Account:

The Pro Elite Account is tailored for professional traders and high-net-worth individuals who demand top-tier services and personalized support. With a minimum deposit of $10,000, the Pro Elite Account grants traders access to the tightest spreads starting from 0.1 pip and leverage of up to 1:500. Traders with a Pro Elite Account also receive priority access to exclusive features and resources, ensuring a tailored trading experience to suit individual needs. Like the other account types, the Pro Elite Account offers access to a diverse range of market instruments and popular trading platforms, providing seasoned traders with the tools they need for successful and strategic trading.

| Account Type | Minimum Deposit | Spreads (Starting from) | Leverage | Features |

| Starter Account | $100 | 1.0 pip | Up to 1:200 | Access to Forex, indices, commodities, cryptocurrencies; MetaTrader 4, MetaTrader 5, web-based platform, and mobile apps; user-friendly for beginners. |

| Advanced Account | $1,000 | 0.5 pip | Up to 1:400 | Access to Forex, indices, commodities, cryptocurrencies; MetaTrader 4, MetaTrader 5, web-based platform, and mobile apps; improved trading conditions for experienced traders. |

| Pro Elite Account | $10,000 | 0.1 pip | Up to 1:500 | Access to Forex, indices, commodities, cryptocurrencies; MetaTrader 4, MetaTrader 5, web-based platform, and mobile apps; top-tier services for professional traders and high-net-worth individuals. |

Leverage

BV Trading offers the maximum trading leverage of up to 1:500. Leverage allows traders to control larger positions in the market with a smaller amount of capital. For example, with 1:500 leverage, a trader can control a position worth $50,000 with a margin requirement of only $100. While high leverage can amplify potential profits, it also increases the risk of significant losses. Traders should exercise caution when using high leverage and employ risk management strategies to protect their capital. The availability of high leverage at BV Trading provides traders with the opportunity to take advantage of larger market movements, but it's essential to use it judiciously and be aware of the increased risk involved.

Spreads & Commissions

Based on the information provided above, BV Trading offers spreads and commissions that vary depending on the trading accounts. The broker offers three different account types, each with its own set of trading conditions.

Starter Account:

Traders using the Starter Account can benefit from competitive spreads starting from 1.0 pip. It's important to note that spreads refer to the difference between the buy and sell prices of a financial instrument, and a lower spread can be advantageous for traders as it reduces trading costs. As for commissions, the Starter Account is not mentioned to have any additional commissions on trades.

Advanced Account:

With the Advanced Account, traders can access tighter spreads starting from 0.5 pips. Tighter spreads can potentially lead to reduced trading costs and improved profitability. Like the Starter Account, there is no specific mention of commissions for the Advanced Account.

Pro Elite Account:

The Pro Elite Account offers the tightest spreads starting from 0.1 pip. This account is tailored for professional traders and high-net-worth individuals, and the tight spreads can be attractive to those seeking the most favorable trading conditions. Again, there is no specific information about commissions for the Pro Elite Account.

It's important for traders to carefully review the detailed trading conditions and fee structures for each account type before making a decision. Spreads and commissions can significantly impact trading costs and overall profitability, so traders should consider these factors along with other account benefits when choosing the most suitable account for their trading needs.

Please note that the information provided here is based on the available data, and it is always best to verify the exact spreads and commissions with the broker directly, as these details may be subject to change and could differ from the information mentioned above.

Deposit & Withdrawal

Deposit Methods:

BV Trading offers a limited selection of deposit methods, including:

Bank Wire Transfers: While accepted, this method may not be the most convenient due to potential delays and additional fees from sending and receiving banks. It may not suit traders seeking quicker and more cost-effective options.

Credit/Debit Card Payments: BV Trading accepts major credit cards like Visa, MasterCard, or Maestro. However, some credit card companies may impose additional fees for international transactions, leading to unexpected costs.

E-Wallet Services: BV Trading supports e-wallets like Skrill, Neteller, and PayPal. However, the limited range of options and potential fees imposed by e-wallet service providers may not satisfy all traders.

Withdrawal Methods:

BV Trading's withdrawal methods raise concerns due to reported delays and complications experienced by traders. Withdrawal options include:

Bank Wire Transfers: This method can be time-consuming and subject to delays due to multiple banks' involvement and international transaction processes. Additional fees from intermediary banks and the recipient's bank may be charged.

Credit/Debit Card Refunds: The option of credit/debit card refunds may seem convenient, but potential restrictions imposed by card issuers and withdrawal delays leave clients uncertain about reliability.

E-Wallet Withdrawals: E-wallet withdrawals may have shorter processing times, but traders should be cautious of withdrawal fees imposed by service providers, which could reduce the amount of funds received.

Overall, BV Trading's limited and inefficient deposit and withdrawal methods raise questions about the broker's commitment to providing a seamless and satisfactory trading experience. The lack of transparency on potential fees, delays, and restrictions discourages traders from entrusting their funds with this broker. It is advisable for traders to consider alternative brokers that offer more reliable and diverse payment options to ensure a smoother and more secure financial transaction process.

Trading Platforms

BV Trading's offering of trading platforms lacks innovation and fails to distinguish itself from competitors. While providing the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, BV Trading lacks a unique selling point in this regard. Many other brokers offer the same platforms, leaving BV Trading without a distinctive advantage.

The MetaTrader 4 platform may be suitable for beginners but lacks advanced tools and features sought by seasoned traders. The absence of proprietary platforms or exclusive trading tools suggests a lack of investment in research and development to provide cutting-edge solutions.

Moreover, BV Trading mentions mobile trading apps for Android and iOS devices, but their reliability and performance remain uncertain. Traders may become frustrated with subpar mobile trading experiences, potentially missing out on crucial market opportunities.

In conclusion, BV Trading's choice of trading platforms appears outdated and uninspiring, leaving traders looking for modern and innovative solutions wanting. With limited options and a lack of unique features, potential clients may find other brokers more appealing, offering a broader range of cutting-edge trading platforms and tools.

Customer Support

BV Trading's customer support raises concerns due to several issues. Firstly, all language-specific phone numbers, including English (+41 26 605 92), Traditional Chinese (HK) (+41 26 605 92), German (+1 (855) 266-0592), and French (+1 (855) 266-0592), share the same international phone number. This lack of dedicated phone lines for different languages may result in language barriers and difficulties in effective communication, particularly for non-English speakers.

Moreover, the use of an international phone number for customer support can lead to high call charges for clients, potentially causing financial burden and frustration. The absence of localized and dedicated phone support may leave customers feeling unsupported and dissatisfied when seeking assistance.

Furthermore, the availability of other contact options, such as email support, is limited to generic email addresses like service@bcdforex.com and service@bvcoins.com. The absence of personalized and department-specific email addresses raises doubts about the level of dedication and effectiveness in resolving customer inquiries and issues.

Overall, BV Trading's customer support falls short, with shared international phone numbers and generic email addresses impacting the quality of assistance provided to clients. This may lead to a subpar customer experience, discouraging potential clients from relying on the broker for their trading needs.

Summary

BV Trading is an online brokerage offering trading services in Forex, indices, commodities, and cryptocurrencies with leverage of up to 1:500 and spreads starting from 0.0 pips. However, the company faces significant concerns. The website is currently down, and the lack of transparency regarding account tiers and minimum deposit requirements raises doubts about its reliability. Additionally, BV Trading lacks regulation, leading some users to label it as a potential scam. Caution is advised when dealing with unregulated offshore brokers like BV Trading, as there are potential indications of a scam.

Pros:

Broad Range of Market Instruments: BV Trading offers a diverse selection of market instruments, catering to both novice and experienced traders, allowing them to engage in various markets and diversify their trading strategies.

High Leverage: BV Trading offers high leverage of up to 1:500, providing traders with the opportunity to take advantage of larger market movements. However, traders should exercise caution and use leverage judiciously due to increased risk.

Cons:

Lack of Regulation: BV Trading is not regulated by any recognized financial authority, raising concerns about potential fraudulent activities and financial mismanagement.

Troubling Aspects: The website's current downtime, lack of transparency regarding account tiers and minimum deposits, and absence of regulatory information have led some users to label BV Trading as a potential scam.

Outdated Trading Platforms: BV Trading lacks innovative and modern trading platforms, with only the widely-used MetaTrader 4 and MetaTrader 5 options available.

Limited and Inefficient Deposit and Withdrawal Methods: BV Trading offers a limited selection of deposit and withdrawal methods, with potential delays, fees, and complications reported by traders.

Shared International Phone Numbers for Customer Support: The lack of dedicated phone lines for different languages and the use of an international phone number may lead to language barriers and high call charges for clients seeking customer support.

In conclusion, BV Trading's offering may not inspire confidence in potential traders due to the lack of regulation, troubling aspects surrounding its website and transparency, and outdated trading platforms. The limited and inefficient deposit and withdrawal methods, along with the shared international phone numbers for customer support, further raise concerns about the quality of the trading experience and customer service provided. Traders are advised to exercise caution and consider regulated and reputable alternatives for their trading needs to ensure a safer and more reliable trading environment.

FAQs

Q1: Is BV Trading a regulated brokerage?

A1: No, BV Trading is not regulated by any recognized financial authority.

Q2: What is the maximum leverage offered by BV Trading?

A2: BV Trading offers a maximum leverage of up to 1:500.

Q3: Are there any account tiers at BV Trading?

A3: BV Trading lacks transparency regarding account tiers and their benefits.

Q4: What are the available deposit methods at BV Trading?

A4: BV Trading offers deposit options such as bank wire transfers, credit/debit card payments, and select e-wallet services.

Q5: Does BV Trading provide innovative trading platforms?

A5: No, BV Trading offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, lacking unique features and innovation.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX5439220949

Hong Kong

The trading was normal at the first 2 days. Then the withdrawal became unavailable on the third day. I was asked to pay risk fee, which is simply a con.

Exposure

2020-06-24

周锋69655

Hong Kong

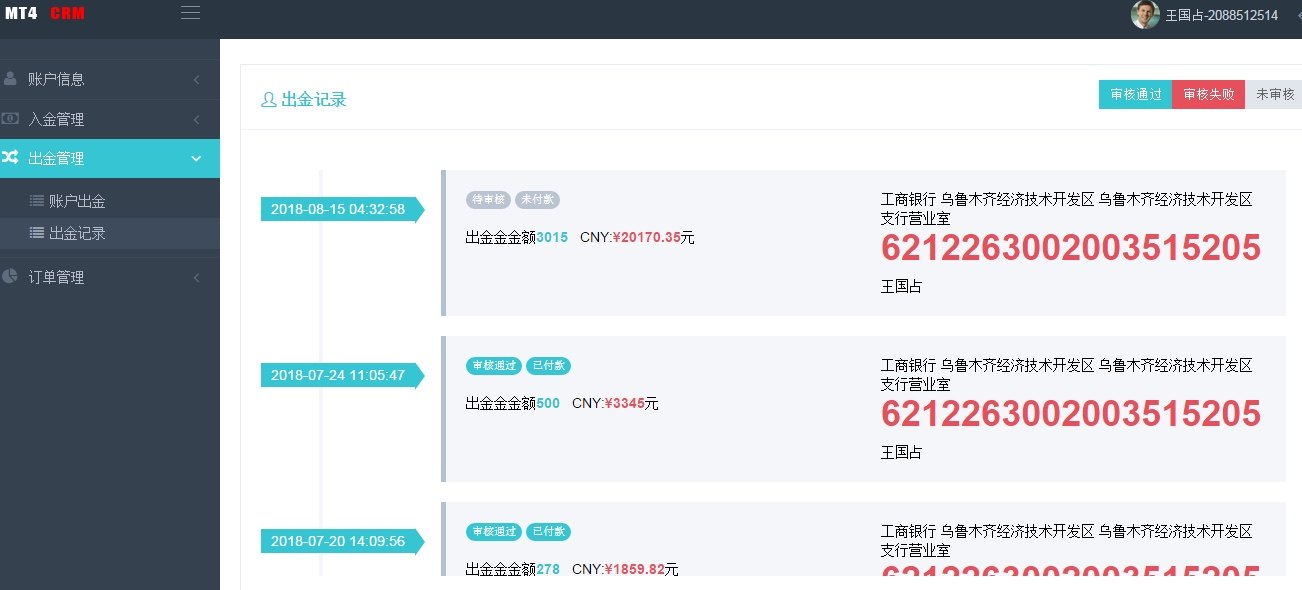

None of the four gold payments were received on June 26, 2018. I asked the person who opened the account for me that the country cracked down on the third-party payment platform, and the funds were frozen, so I had to wait for half a year to release the seal. Now half a year has passed and still no money has arrived.Currently the platform website is still in place, accounts and mt4 accounts are no longer accessible, now request platform exposure

Exposure

2019-01-21

FX1539713295

Hong Kong

I deposited $3000 on July 4th and earned a little later. I tried to deposit, but it has been a month and I didn’t see my money arriving.

Exposure

2018-08-30

FX5139116137

Hong Kong

A man called himself Long induced me to deposit $7000 on this platform. He made me earn a little for the first week since May 11th. During my trading, he asked me not to close position. Then my position was liquidated. My $20000 reduced to $2000. Then he asked me to deposit $1000 more and gave me another wrong direction. I lost a lot and my money reduced to $800.

Exposure

2018-06-11