In the dynamic world of forex trading, the line between loss and gain, setback and success, is drawn by thoughtful strategies and meticulous planning. Some of the most influential names in this sphere have proven time and again that achieving gains in forex trading is about more than just intuition – they rely on a blend of disciplined patience, rigorous risk management, emotional resilience, and an in-depth understanding of global economics and politics.

This article seeks to explore the strategies and philosophies of the world's best forex traders such as George Soros, Paul Tudor Jones, and Kathy Lien, among others, as we delve into the secrets of their remarkable achievements in the forex market.

World's Best Forex Traders to Follow

| Rank | Best Forex Traders | Trading Strategies |

| ① | George Soros | Short-term speculation strategies and for making bold bets |

| ② | Paul Tudor Jones | Macro trades, especially bets on interest rates and currencies |

| ③ | Bill Lipschutz | Grand scale risk management and for emphasizing the importance of capital conservation |

| ④ | Stanley Druckenmiller | Top-down trading strategy and for focusing on equity performance |

| ⑤ | Michael Marcus | Focusing on trend following and always using stop-loss orders |

| ⑥ | Andrew Krieger | Aggressive trading strategy, particularly during Black Monday |

| ⑦ | Kathy Lien | Focusing on both fundamentals and technicals with special emphasis on news trading and central bank insight |

| ⑧ | Joe Lewis | Low risk, high reward scenarios, keeping bigger bets for when he is sure he is right |

| ⑨ | Jesse Livermore | A short term trader whose quotes and strategies are timeless and apply to a wide variety of markets |

| ⑩ | Ray Dalio | Following a unique approach known as 'Risk Parity Strategy' and diversifying by asset type, geographic area, and economic environment to limit risk and increase returns |

① George Soros

George Soros is one of the most renowned forex traders in the world and considered a legend in financial circles. He earned the nickname “The Man Who Broke the Bank of England” by making a whopping $1 billion in a single day during the 1992 Black Wednesday UK currency crisis by short selling the British pound. Soros continues to be an active trader through his firm, Soros Fund Management. He's admired not only for his trading acumen but also for his philanthropic efforts and thought leadership in socio-economic issues.

|

|

| George Soros (1930-) | |

| Nationality | Hungarian-American |

| Education | London School of Economics (BSc, MSc) |

| Profession | Forex Trader, Hedge Fund Manager, Philanthropist |

| Notable Achievement | Earned the nickname “The Man Who Broke the Bank of England” in 1992 |

| Trading Style | Active Trader |

| Known For | Made a $1 billion profit in a single day during the 1992 Black Wedne |

| Net Worth | $6.71 billion |

② Paul Tudor Jones

Paul Tudor Jones is an American billionaire hedge fund manager and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. He became renowned in the investment world for predicting the 1987 stock market crash, which earned him a triple-digit return. He's known for his macro trades, particularly in interest rates, currencies, and commodities. Outside of his financial career, he is known for his philanthropic efforts, particularly the Robin Hood Foundation, a charitable organization that attempts to alleviate problems caused by poverty in New York City.

|

|

| Paul Tudor Jones (1954-) | |

| Nationality | American |

| Education | University of Virginia (BA in Economics), Harward Business School (accepted but not attend) |

| Profession | Hedge Fund Manager, Philanthropist |

| Notable Achievement | Predicted and profited from the 1987 stock market crash |

| Trading Style | Macro Trading |

| Known For | Aggressive and diverse trading styles |

| Net Worth | $7.3 billion |

③ Bill Lipschutz

Bill Lipschutz is a renowned foreign exchange trader and co-founder of Hathersage Capital Management. He entered the financial sector as an investment analyst at Salomon Brothers. However, Lipschutz is best known for turning $12,000 of inherited stocks into $250,000 during his college years, then losing it all. The lessons learned from this experience informed his later successes. Notably, he was a key player in bringing about a real-time forex trading platform for Salomon Brothers. Today, Hathersage Capital Management specializes in G10 currencies and is recognized for numerous performance awards in foreign exchange asset management.

|

|

| Bill Lipschutz (1956-) | |

| Nationality | American |

| Education | Johnson School of Management at Cornell University (MBA in Finance) |

| Profession | Forex Trader |

| Notable Achievement | Known as the “Sultan of Currencies,” remembered for making and losing more than $300 million in Forex in 1985 |

| Trading Style | Risks a significant amount of money to take advantage of very low edge opportunities |

| Known For | Recognized as a top forex trader in the 1980s; his views on market psychology are well-respected in the industry |

| Net Worth | $500 million |

④ Stanley Druckenmiller

Stanley Druckenmiller is an American investor, hedge fund manager, and philanthropist. He is the former chairman and president of Duquesne Capital, which he founded in 1981. He's most known for his work with George Soros. As the lead portfolio manager for the Quantum Fund from 1988 to 2000, a period during which the fund obtained an incredible record.

Notably, Druckenmiller and Soros famously 'broke the Bank of England' when they shorted the British pound in 1992, yielding a profit of $1 billion. Druckenmiller is considered one of the most successful investors in history, and even after closing his fund, he continues to manage his wealth through a family office.

|

|

| Stanley Druckenmiller (1953-) | |

| Nationality | American |

| Education | Bowdoin College (BA), University of Michigan |

| Profession | Hedge Fund Manager, Philanthropist |

| Notable Achievement | Successfully managed money for George Soros as the lead portfolio manager for Quantum Fund |

| Trading Style | Macro Trading |

| Known For | Savvy market timing and ability to leverage big bets in both stock and currency markets |

| Net Worth | $6.15 billion |

⑤ Michael Marcus

Michael Marcus is a highly successful commodities trader and a key figure in the evolution of modern futures trading. He is most well known for transforming an initial investment of $30,000 into $80 million over a 20-year period. Marcus got his start as an analyst in 1972 at Commodities Corporation (now a part of Goldman Sachs) where he was mentored by famed trader Ed Seykota. Marcus is renowned for his deep understanding of market behavior, and his success has served as an inspiration for many traders worldwide.

|

|

| Michael Marcus (1947-2023) | |

| Nationality | American |

| Education | Johns Hopkins (Phi Beta Kappa), Clark University (Psychology) |

| Profession | Commodity Trader |

| Notable Achievement | Turned an initial $30,000 into $80 million over 20 years |

| Trading Style | Trend Following |

| Known For | Disciplined approach and focus on preserving capital |

| Net Worth | $1.4 billion |

⑥ Andrew Krieger

Andrew Krieger is a successful forex trader renowned for his aggressive trading style. In 1987, while working for Bankers Trust, he shorted the New Zealand Dollar during a mass selling of the currency, earning a profit reported by various sources to be around $300 million. This infamous trade earned him the nickname the “Kiwi Killer”. After his successful run at Bankers Trust, he moved on to manage his own firm, Krieger & Associates, Ltd, later going on to work for Soros Fund Management. He is now retired from the finance industry. Despite his significant impacts, he remains somewhat enigmatic, rarely appearing in public or giving interviews. His aggressive trading tactics, however, continue to be studied by forex traders today.

|

|

| Andrew Krieger | |

| Nationality | American |

| Education | Wharton School of Business (MBA) |

| Profession | Currency Trader |

| Notable Achievement | Best known for “Black Monday” trade, in which he sold more than the New Zealand's money supply, causing the currency's value to plummet |

| Trading Style | Aggressive currency trades |

| Known For | One of the most aggressive traders of his time, known for his ability to take significant risk |

| Net Worth | $6.2 billion |

⑦ Kathy Lien

Kathy Lien is a highly respected financial analyst, author, and trader in the Forex world. She is currently the Managing Director of FX Strategy for BK Asset Management. Prior to this, she was the Associate Director of Currency Research for Global Forex Trading (GFT), where she provided research and analysis of the global foreign exchange market.

With a career spanning over 20 years in the financial markets, Kathy Lien is known for her unique blend of technical and fundamental analysis. She has written several popular investment books, including “Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Swings.”

She frequently appears in financial news outlets and is highly sought after for her expertise in currency trading. Her insights and forecasts are followed by traders worldwide.

|

|

| Kathy Lien (1980-) | |

| Nationality | American |

| Education | New York University's Stern School of Business |

| Profession | Forex Trader, Analyst |

| Notable Achievement | A leading expert in forex trading; frequently quoted by The Wall Street Journal, Reuters, and Bloomberg |

| Trading Style | Fundamental Analysis with a focus on major economic reports and events |

| Known For | Author of several books, including “Day Trading the Currency Market” and “The Little Book of Currency Trading” |

| Net Worth | $5 million |

⑧ Joe Lewis

Joe Lewis is a British billionaire who is known for his trading in the forex markets. He is the founder of Tavistock Group, a private investment company. In trading, he is most famous for his role in Black Wednesday, the day when speculators “broke the Bank of England” in 1992. Alongside George Soros, Joe Lewis bet against the pound and made significant profits when the Bank of England withdrew the currency from the European Exchange Rate Mechanism. Despite being lesser-known than Soros, it's reported that Lewis actually made a larger profit from this event. Today, his main interests lie within a range of investments, including luxury properties, sports teams and various business ventures.

|

|

| Joe Lewis (1937-) | |

| Nationality | British |

| Education | / |

| Profession | Currency Trader, Investor |

| Notable Achievement | Became a billionaire through forex trading |

| Trading Style | Made significant earnings through currency speculation |

| Known For | Often compared to George Soros for his trading skill and his dramatic impact on the currency market |

| Net Worth | £5.096 billion |

⑨ Jesse Livermore

Jesse Livermore was an American stock trader who obtained massive wealth and fame via his trading activities in the early 20th century. He is often regarded as one of the greatest traders in history. Livermore's monumental successes and failures made him a legendary figure in Wall Street.

He made and lost several multimillion-dollar fortunes and was rumored to have been worth $100 million following the stock market crash of 1929. Yet, he eventually lost his fortune and tragically took his own life in 1940.

Livermore's trading strategies, including his focus on price patterns and the importance of letting profits run and cutting losses, are studied to this day. His observations and trading experiences are documented in the book “Reminiscences of a Stock Operator”, which has become a must-read classic for any trader.

|

|

| Jesse Livermore (1877-1940) | |

| Nationality | American |

| Education | Elementary school |

| Profession | Stock Trader |

| Notable Achievement | Known as one of the greatest traders in history; profited during the 1929 stock market crash |

| Trading Style | Tape reading, or watching the ticker tape for signals about when to trade |

| Known For | Rise and fall from wealth; at his peak, he was one of the wealthiest people in the world |

| Net Worth | $1.5 billion |

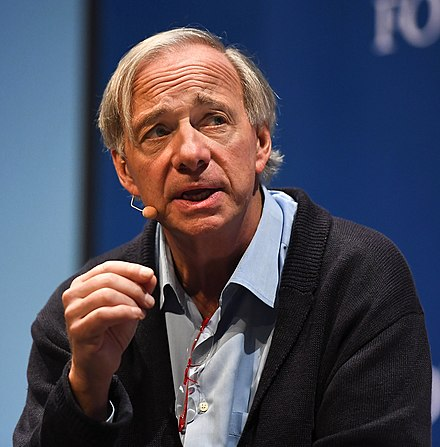

⑩ Ray Dalio

Ray Dalio is an American billionaire hedge fund manager and philanthropist. He founded Bridgewater Associates, one of the world's largest hedge funds, in 1975. Under his guidance, the firm developed a unique approach to investing which is largely based on understanding economic cycles. His macroeconomic analysis and predictions are widely respected within the financial industry.

Dalio is also known for his unique approach to management known as “radical transparency,” which encourages brutally honest critiques among employees at all levels of the company. This philosophy is outlined in his bestselling book “Principles: Life and Work.”

Beyond his success in the financial world, Dalio is a significant philanthropist, having signed The Giving Pledge and committed to giving more than half of his wealth to charitable causes.

|

|

| Ray Dalio (1949-) | |

| Nationality | American |

| Education | Long Island University, Post (BS), Harvard University (MBA) |

| Profession | Hedge Fund Manager, Philanthropist |

| Notable Achievement | Founder of Bridgewater Associates, one of the world's largest and most successful hedge funds |

| Trading Style | Based on a unique philosophy called “Radical Transparency” |

| Known For | Noted for his “Principles”, which is a best-selling book and a set of guidelines used to manage his firm |

| Net Worth | $15.36 billion |

What Can We Learn from the Best Forex Traders?

From studying the best forex traders, we can learn valuable lessons as follows:

Discipline and Patience: Successful forex trading requires discipline to stick to a strategy and patience to wait for the right opportunities.

Risk Management: Top traders understand the importance of limiting losses and not risking more than a small percentage of capital on a single trade.

Emotion Control: It's crucial not to let fear or greed guide trading decisions.

Constant Learning and Adaptability: The market is always changing, and traders must continuously learn and adapt their strategies to stay successful.

Understanding global economics and politics: Forex rates are highly influenced by economic indicators and political events. Understanding these can provide an edge in trading.

Having a well-defined trading strategy: All top forex traders have a clear trading plan and strategy that they stick to.

How to Find a Good Forex Trader?

Experience and Track Record: Consider the trader's experience level in the forex market and their performance history. A consistent, successful track record over a long time period is a good sign.

Risk Management: A good trader should have solid risk management techniques. They should make responsible decisions to safeguard their (and possibly your) investments from dramatic losses.

Trading Strategy: The trader should have a clear, well-defined trading strategy which they adhere to.

Reliability: Check if the trader is reliable and transparent with their operations. Beware of traders who promise guaranteed returns.

Regulation: If using a forex trading service or broker, ensure that they are registered and regulated by an appropriate financial body. This can help to provide a level of protection against fraud or unethical practices.

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Reviews and Recommendations: Look for reviews and recommendations by other clients or users. This can provide insight into their performance and reliability.

Final Thoughts

Investing in forex trading can certainly be a profitable endeavor, but it requires patience, discipline, and a well-structured strategy. Learning from the top forex traders and their methods can offer valuable insights. However, trading always comes with its risks and it's crucial to manage these risks effectively. As an investor, it's important to continuously educate yourself, understand the market, and make informed decisions. Diversification of your investment portfolio is a recommended strategy to mitigate potential risks. Remember, success in trading is not just about making profits, but also about minimizing losses.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Differences between Bullish and Bearish Markets in Forex Trading

Dive into the dynamics of forex trading by understanding the uprising bullish markets and the falling bearish markets.

Differences between Dealing Desk & No Dealing Desk Forex Brokers

Learn about Dealing Desk & No Dealing Desk Forex Brokers, their roles, STP & ECN in NDD brokers, along with their pros & cons.

How to Use Currency Pair Correlations in Forex trading?

Dig into Currency Pair Correlations in Forex trading. Understand their concept, influence, importance, calculation, and common pairs.

What is Forex Technical Analysis? Pro & Cons Revealed

Uncover Forex Technical Analysis. Understand its core principles, strengths and weaknesses, and how to learn and apply it in Forex trading.