Score

CXM Direct

United Kingdom|5-10 years| Benchmark B|

United Kingdom|5-10 years| Benchmark B|https://www.cxmdirect.com/

Website

Rating Index

Benchmark

Benchmark

B

Average transaction speed (ms)

MT4/5

Full License

CXMDirect-Live

Benchmark

Speed:C

Slippage:A

Cost:B

Disconnected:D

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Licenses

Licensed Institution:CXM Prime Ltd

License No.:966753

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 966753)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

Basic information

United Kingdom

United KingdomAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed CXM Direct also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Website

vi-cxmdirect.com

Server Location

United States

Website Domain Name

vi-cxmdirect.com

Server IP

18.244.214.97

vietcxmdirect.com

Server Location

United States

Website Domain Name

vietcxmdirect.com

Server IP

23.15.241.75

cxmdirectviet.com

Server Location

Hong Kong

Website Domain Name

cxmdirectviet.com

Server IP

23.35.148.64

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| CXM Direct | Basic Information |

| Registered Country/Region | United Kingdom |

| Founded in | N/A |

| Regulation | Financial Conduct Authority (FCA) |

| Trading Platforms | MetaTrader 4 |

| Trading Assets | currency pairs, indices, shares, commodities, and cryptocurrencies, energies, EU/US stocks, Investment packages |

| Account Types | Cent, Standard, Standard Plus,ECN, Islamic |

| Minimum Deposit | Vary depending on payment methods |

| Maximum Leverage | 1:30 (in line with ESMA regulation) |

| Commission | Vary depending on account types |

| Spread | As low as 0 pips |

| Payment Methods | Fasapay, Local Banks, USDT, Cryptos, Perfect Money |

| Educational Resources | Webinars, seminars, and market analysis |

| Customer Support | Email and phone, Live Chat |

| Copy Trading | Supported |

| Languages | English, Spanish, Chinese, Arabic, French, Russian, and Polish |

Overview of CXM Direct

CXM Direct is a forex broker based in the United Kingdom, offering trading services to clients worldwide. offers a range of trading instruments consisting of currency pairs, indices, shares, commodities, and cryptocurrencies. Clients can trade through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are user-friendly and offer advanced trading functionality such as automated trading, customization of technical indicators, and the ability to trade directly from charts. Amazingly, the maximum trading leverage offered by this broker is 1: unlimited.

CXM Direct offers clients various account types, including Cent, Standard, Standard Plus,ECN, Islamic, each with its own unique features and trading conditions. Clients can also open a demo account to test out the broker's trading conditions before committing to a live account.

In terms of funding options, CXM Direct supports payments via credit/debit cards, bank wires, and e-wallets such as Skrill and Neteller. Withdrawal requests are usually processed within 24 hours for clients who have already been verified. CXM Direct's website is available in multiple languages including English, Spanish, Chinese, Arabic, French, Russian, and Polish, making it accessible to traders worldwide.

Finally, CXM Direct provides clients with access to a range of educational materials, including webinars and seminars. Furthermore, clients can benefit from the broker's market analysis section, which includes daily news updates, technical analysis, and trading signals.

Is CXM Direct legit or a scam?

CXM Prime Ltd is an FX & CFD broker registered in England and Wales company number 13407617, authorised and regulated by the Financial Conduct Authority of the UK (“FCA”), FRN: 966753. Registered Address, Office No. 518 Signature by Regus, 15 St Helen's Place, London, EC3A 6DQ, United Kingdom.

However, it is important to note that the license this broker holds under the regulation of FCA is Investment Advisory License, not Market Marker license or STP license.

Pros and Cons

A benefit of trading with CXM Direct is that it operates a no dealing desk (NDD) model. This means that the broker does not act as a counterparty to its clients' trades, eliminating any potential conflict of interest. In addition, CXM Direct offers tight spreads from as low as 0 pips, making it an attractive option for traders looking to minimize trading costs. CXM Direct also offers a range of account types to suit different trading styles and needs, including Cent, Standard, Standard Plus,ECN, Islamic. The broker also provides access to the popular MetaTrader 4 and 5 trading platforms, which offer advanced charting tools, technical indicators, and automated trading features.

On the downside, CXM Direct is not under strong regulation, which means the license it holds cannot allow it to operate forex and CFD trading services. Besides, CXM Direct has limited educational resources compared to some other brokers. Although the broker does offer webinars, seminars, and market analysis, traders who are looking for comprehensive educational experience may want to consider alternative brokers.

| Pros | Cons |

| No dealing desk means no conflict of interest | Weak Trading Platform |

| Tight spreads from 0 pips | Limited educational offerings compared to some other brokers |

| Low minimum deposit of $10 | Limited customer support options compared to other brokers |

| Range of account types available | No cryptocurrencies offered for trading |

| Advanced trading tools available on the MetaTrader platforms | Limited range of tradable instruments |

| Generous leverage up to 1:500 | Only MT4 trading platform supported |

| Copy trading supported | No proprietary trading platform |

| Weak regulation |

Market Intruments

CXM Direct offers a range of financial instruments for trading on its platform. These include:

Currency Pairs: CXM Direct provides access to over 60 currency pairs, including major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

Indices: CXM Direct offers trading on a selection of stock indices, such as the UK 100, Germany 30, and the US 500.

Shares: The broker provides access to trading shares of some of the world's biggest companies such as Apple, Amazon, Google, and Facebook.

Commodities: CXM Direct offers trading on a range of commodities, including gold, silver, crude oil, and natural gas.

Cryptocurrencies: Currently, CXM Direct does not offer trading in cryptocurrencies.

Energies: The broker also offers trading on a range of energy products such as Brent crude oil, WTI crude oil, and natural gas.

EU/US Stocks: CXM Direct offers a wide range of EU/US stocks that can be traded online.

Metals: CXM Direct also offers trading on a range of metals, including gold, silver, platinum, and palladium.

Investment Packages: CXM Direct offers a range of professionally managed investment portfolios that include a mix of different assets. These investment packages are designed to provide investors with a diversified portfolio while minimizing risk.

Account Types

CXM Direct offers several account types to cater to the needs of different traders. Below are the different account types with their features and details:

Cent Account: This account is ideal for beginners or traders looking to test their trading strategies in a low-risk environment. The minimum deposit requirement for this account is $10, and the maximum leverage is 1:2000. Traders who open this account can get access to a series of trading instruments including FX, Metals, CFDs, Cryptos, and Stocks.

Standard Account: This account is suitable for more experienced traders, and the minimum deposit requirement is $50. The maximum leverage is 1: unlimited, and traders can access a range of trading instruments, including forex, indices, stocks, and commodities.

Standard Bonus Account: This account type is similar to the standard account, with the addition of a bonus program. Traders receive a bonus of up to 35% on their deposit, with the maximum bonus amount being $3,500. The minimum deposit requirements and trading conditions are the same as in the standard account.

ECN Account: This account type is designed for professional traders who require faster order execution speeds and access to deeper liquidity pools. The minimum deposit requirement for this account is $100 and the maximum leverage is 1: unlimited.

Islamic Account: CXM Direct also offers Islamic accounts for clients who require trading accounts that comply with Sharia law. The account type is available to all CXM Direct clients and operates under the Islamic principles of no Riba (interest). The account is available as a swap-free account, with no overnight fees or charges.

Demo Account: CXM Direct also offers a demo trading account that allows traders to practice their trading strategies and test the platform without risking their funds. The demo accounts simulate real market conditions, and traders can access all the trading instruments available on CXM Direct's platform.

How to open an account?

To open an account with CXM Direct, follow these steps:

Visit the CXM Direct website and click on the “Open Account” button.

2. Fill out the registration form with your personal information, including your name, address, phone number, and email address. You will also be required to select a password to access your account.

3. Choose the account type that suits your trading needs and experience. CXM Direct offers several types of accounts, including Cent Account, Standard Account, ECN Account, and Islamic Account. Each account type has different features, minimum deposit requirements, and trading conditions.

4. Verify your identity by providing a copy of your government-issued ID, residency proof, and other documents as required. This is a necessary step to comply with anti-money laundering regulations and protect your account from fraud.

5. Fund your account by selecting a payment method that is convenient for you. CXM Direct supports several payment methods, including credit/debit cards, bank transfers, and e-wallets.

6. Once your account has been funded, you can start trading on CXM Direct's trading platform, which offers access to various financial instruments, including forex, stocks, commodities, and indices.

Leverage

The maximum trading leverage offered by CXM Direct varies depending on the instrument being traded and the client's account equity. As you mentioned, the broker does offer leverage of up to 1:2000 on certain products, such as CFDs on indices, as well as the ability to request higher leverage on some instruments based on your trading experience and suitability.

Regarding the account types, the maximum trading leverage offered by the Standard, Standard Bonus and ECN accounts is indeed up to 1:unlimited, which means that there is no explicit limit on the amount of leverage you can use when trading with these accounts. However, it is important to note that using high leverage levels can increase the potential risk of significant losses, especially for traders with limited experience or poor risk management strategies.

Spreads & Commissions (Trading Fees)

CXM Direct offers variable spreads on all its trading accounts, which means that the spreads may widen or narrow according to market conditions and volatility.

On its Standard account, CXM Direct offers typical spreads starting from 1.5 pips for major currency pairs like EUR/USD, GBP/USD, and USD/JPY. On its ECN account, the spreads start from 0.0 pips but commission fees are applicable based on the traded volume. The commission charges are $7 per lot (one lot = 100,000 currency units).

CXM Direct also offers a Cent account, which has higher spreads starting from 1.5 pips, making it more suitable for novice traders who trade in small volume sizes. On the Cent account, trading is performed in cents rather than in standard lots.

It is also worth noting that the broker offers swap-free accounts to clients following the Islamic faith. These swap-free accounts do not incur any interest charges or overnight fees on open positions, which is in line with Islamic finance principles.

Overall, CXM Direct's spreads and commission rates are competitive compared to other brokers in the industry. However, it is important to note that trading costs should not be the only consideration when choosing a broker, as factors such as regulatory compliance, trading platform features, customer support, and security are also important.

Non-Trading Fees

CXM Direct charges a number of non-trading fees, which are fees charged for various services or actions not directly related to trading.

Here are some examples of non-trading fees charged by CXM Direct:

Deposit and Withdrawal Fees: While CXM Direct does not charge any fees for deposits or withdrawals made using bank transfer, the broker does charge fees for certain other payment methods, such as credit cards and e-wallets. For instance, deposit fees range from 1.5% to 5%, depending on the payment method, while withdrawal fees range from $5 to $25.

Inactivity Fee: CXM Direct charges an inactivity fee of $20 per month if you do not place any trades for 181 consecutive days or more.

Overnight Holding Fees: If you hold a position overnight, you may be subject to swap fees, which are charges for holding positions overnight. The amount of the fee depends on the instrument you are trading and the direction of your position (buy or sell).

Currency Conversion Fee: If you are depositing or withdrawing funds in a different currency than your trading account's base currency, CXM Direct charges a currency conversion fee of 2%.

Other Fees: CXM Direct also charges fees for services such as account transfers, duplicate account statements, and trading reports, among others.

Trading Platform

CXM Direct offers its clients the MetaTrader 4 (MT4) platform for trading, which is a widely used trading platform in the industry known for its reliability and user-friendliness. MT4 is available in desktop, mobile, and web versions, giving CXM Direct clients flexibility in how they trade. The MT4 platform is known for its easy-to-use interface, making it suitable for traders of all skill levels. The platform features customizable charts, indicators, and trading tools that traders can use to analyze the markets and make informed trading decisions.

The MT4 trading platform supports multiple order types, such as market orders, limit orders, stop orders, and trailing stops, giving traders the ability to enter and exit trades in a variety of ways. Besides, MT4 also supports automated trading through the use of Expert Advisors (EAs), which are algorithms that automatically place trades based on the pre-set trading rules. This feature allows traders to execute trades more efficiently and effectively, and can help them avoid missing out on potential trading opportunities.

In addition to the MT4 trading platform, CXM Direct offers a PAMM service to its clients. PAMM stands for Percentage Allocation Management Module, which is a managed account service that allows traders to manage multiple investor accounts through a single platform.

Copy Trading

CXM Direct offers copy trading through the Multi Account Manager (MAM) system instead of ZuluTrade. The MAM system allows experienced traders to manage multiple accounts using a single account, making it easier to execute trades and manage client funds. The system also supports a wide range of order types, allocation methods, and position sizes, allowing traders to customize their approach to suit their trading style.

CXM Direct offers this service to clients who wish to allocate funds to multiple accounts under a single trader. This way, clients can follow the trades of experienced traders and potentially benefit from their performance.

Deposit & Withdrawal

CXM Direct offers various payment methods for its clients, including Fasapay, Local Banks, USDT, Cryptos, and Perfect Money. The minimum deposit amount varies depending on the payment method, with $15 through Fasapay and Local banks, $100 through USDT and other cryptos. Minimum deposit through perfect money should contact account executives for details. However, it's important to note that the minimum deposit amount might be different for other account types or regions, and CXM Direct's website states that the minimum deposit amount is subject to change without notice. If you're interested in opening an account with CXM Direct, contact their customer support or account executives for more specific information on the minimum deposit amount for your preferred account type and payment method.

Customer Support

CXM Direct prides itself on providing exceptional customer service, offering multiple channels for clients to connect with their customer support team.

Live chat: Clients can chat with CXM Direct's support team in real-time through the broker's website.

Phone support: CXM Direct provides phone support to clients through their customer service hotline during business hours.

Email support: Clients can email CXM Direct's support team directly for any questions or issues they may have.

Contact form: CXM Direct also has a contact form on their website which allows clients to fill out a form with their questions or concerns and receive a response via email.

Additionally, CXM Direct's website includes a comprehensive FAQ section covering a wide range of topics, from account opening to trading conditions.

Educational Resources

One of the standout features of CXM Direct's educational offerings is their trading courses, which are designed to help traders of all levels build a strong foundation in the financial markets. These courses cover topics such as risk management, market analysis, and trading psychology, and are taught by experienced instructors who are committed to helping students succeed.

In addition to their courses, CXM Direct also provides a Virtual Private Server (VPS) service, which allows traders to run their trading platforms 24/7 without interruption. This can be a valuable tool for traders who rely on automated trading strategies or who need to access their trading platform from different locations.

CXM Direct also offers a variety of trading tools to help traders analyze the markets and make informed trading decisions. These tools include real-time market data, advanced charting capabilities, and technical analysis indicators.

Conclusion

In conclusion, CXM Direct offers several advantages to traders, such as generous leverage, multiple account options, low minimum requirements, and copy trading support. These features can make it a viable option for traders who are looking for a broker that is accessible and flexible.

However, one potential drawback to using CXM Direct is its regulatory status. While the broker is regulated, the strength of the regulatory oversight is not as robust as some other brokers in the market. This may be a concern for traders who prioritize safety and security when selecting a broker.

Ultimately, traders should weigh the advantages and drawbacks of trading with CXM Direct, and determine whether it aligns with their individual trading needs and goals.

FAQs

Q: What types of trading account does CXM Direct offer?

A: CXM Direct offers four different account types, including Cent, Standard, Standard Plus,ECN, Islamic. The account types differ in terms of their minimum deposit requirements, leverage, and trading conditions.

Q: What is the minimum deposit requirement for CXM Direct?

A: The minimum deposit requirement at CXM Direct varies by account type, with the Cent account starting at $10.

Q: What trading platforms does CXM Direct offer?

A: CXM Direct offers several trading platforms, including MetaTrader 4 (MT4) and mobile trading apps for iOS and Android devices.

Q: Does CXM Direct offer a demo account?

A: Yes, CXM Direct provides a demo account for traders to practice and test their trading strategies without risking any real money.

Q: What types of trading instruments are available at CXM Direct?

A: CXM Direct provides traders with access to a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies, energies, stocks.

Keywords

- 5-10 years

- Regulated in United Kingdom

- Investment Advisory License

- MT4 Full License

- MT5 Full License

- Global Business

- Suspicious Overrun

- Medium potential risk

News

News CXM Direct Shatters Records: A Look at the Monumental Achievements of 2023

A Look at the Monumental Achievements of 2023

2024-02-20 11:23

News WikiFX Broker Assessment Series | CXM Direct: Is It Trustworthy?

In this article, we'll look in-depth at CXM Direct, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

2024-01-25 15:31

News CXM DIRECT's FOREX SPREAD REDUCTION

Unbeatable Trading Conditions: CXM Direct Implements Spread Reduction on Forex Instruments!

2024-01-23 18:39

News BEST TRADE EXECUTION GLOBAL 2023 - CXM DIRECT

CXM Direct Clinches “BEST TRADE EXECUTION GLOBAL 2023” at Ultimate Fintech Awards

2024-01-23 18:36

News MT5 NOW AVAILABLE AT CXM DIRECT

CXM Direct Boosts Trading Experience with the Launch of MetaTrader 5 Platform

2024-01-23 18:30

News CXM DIRECT LEVERAGE UPGRADE OF CENT ACCOUNTS to 1:2000

CXM Direct Unveils Industry-Leading Cent Account Offerings

2024-01-23 18:22

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

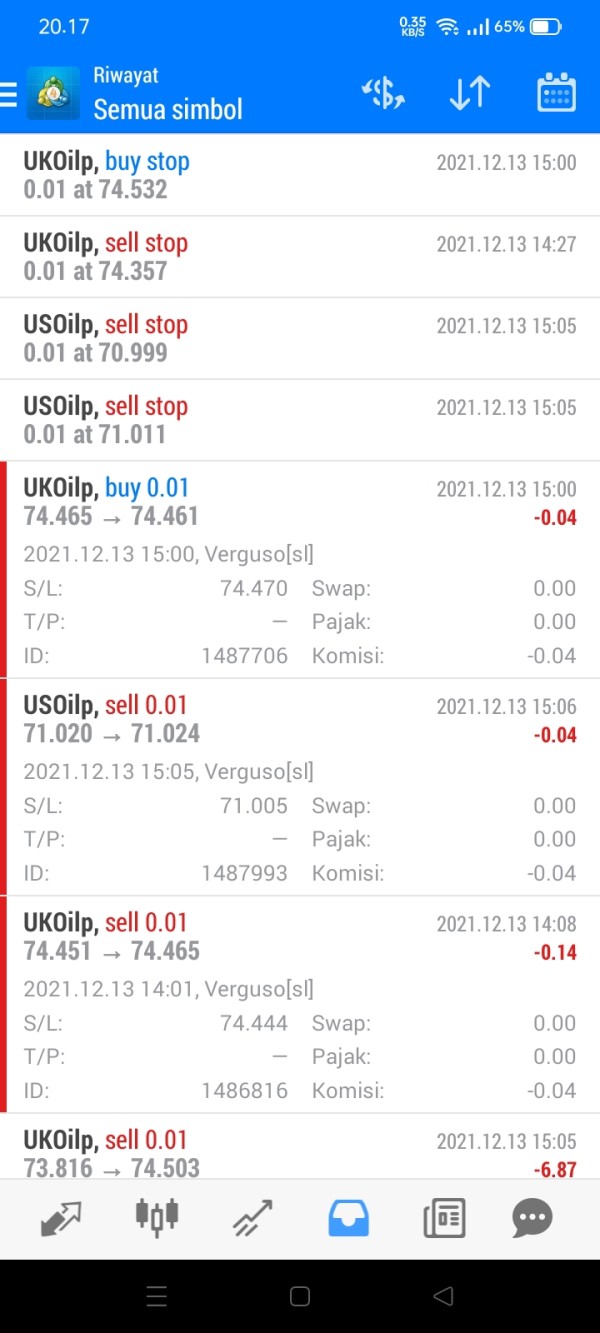

Rosalia Finingrum

Indonesia

Completed slippage, very bad original !!!! Starting from alippage orders, it will stop loss no matter you buy stop or sell stop. Everything slip Severely!!!!

Exposure

2021-12-13

FX1166932667

New Zealand

Thank you, Louis, for introducing me here. During my 2-week trading here, I am quite satisfied so far. Customer support team is very helpful, always available to present solutions. I am enjoying trading with this platform.

Neutral

2022-12-19

FX1490773481

United States

CXM Direct has reliable customer service. Quick and clear responses every time I needed help. However, they could improve their deposit options as the choices are quite limited.

Positive

06-17

小天38510

Hong Kong

CXM Direct is a platform suitable for both novice and experienced traders, with low deposit threshold and good trading conditions. Friends recommended it to me many times, and I chatted with customer service, and I am quite confident. First open a basic standard account and see the situation!

Positive

2022-12-15

FX1160300192

Japan

What really attracted me is that the cent account on this platform only costs $10, which is very user-friendly. In addition, scalping and hedging are allowed, there is no overnight interest, and wireless leverage is also available. I've been trading EURUSD for two weeks now with a cent account and it's been fine.

Positive

2022-12-14