Score

MACRO MARKETS

Seychelles|5-10 years| Benchmark B|

Seychelles|5-10 years| Benchmark B|https://www.macrogm.com/

Website

Rating Index

Benchmark

Benchmark

B

Average transaction speed (ms)

MT4/5

Full License

MacroMarketsSolutions-Demo

Benchmark

Speed:AAA

Slippage:D

Cost:C

Disconnected:B

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

Hong Kong

Hong KongContact

Single Core

1G

40G

1M*ADSL

- The Seychelles FSA regulation with license number: SD139 is an offshore regulation. Please be aware of the risk!

Basic information

Seychelles

Seychelles

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed MACRO MARKETS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Website

macrogm.com

Server Location

China

Website Domain Name

macrogm.com

Server IP

221.128.225.72

macromarkets.co

Server Location

United States

Website Domain Name

macromarkets.co

Server IP

172.67.149.117

macrobullion.com

Server Location

United States

Website Domain Name

macrobullion.com

Server IP

172.67.153.52

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| MACRO MARKETS Review Summary | |

| Founded | 2010 |

| Registered Country/Region | Seychelle |

| Regulation | FSA (Offshore), ASIC |

| Market Instruments | Forex, Commodities, Indices, and Share CFDs |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | ECN spreads from 1.0 pips |

| Trading Platforms | MT4 Trading, Web Terminal |

| Minimum Deposit | N/A |

| Customer Support | 24/7 Multilingual Online Messaging, Email: info@macrofx.com, macrofxcom@gmail.com, Phone: +61 4 3486 9014 (Australia) |

What is MACRO MARKETS?

Established in 2010, MACRO MARKETS stands as a regulated brokerage firm registered in Seychelles. Over the course of a decade, this broker has evolved into a firmly established entity with a robust reputation. It operates within a framework of strong regulation, providing five classes of trading instruments spanning Forex, Commodities, Indices, and Share CFDs through the MT4 and Web Terminal trading platforms. Renowned for delivering an exceptional trading environment, MACRO MARKETS consistently caters to its clients' needs.

Pros & Cons

| Pros | Cons |

| • Regulated by ASIC, and FSC in Seychelles |

|

| • Over 35,000 tarders choose to open accounts here |

|

| • Popular trading instruments to trade | |

| • MT4 trading platform | |

| • Social trading supported | |

| • Multiple contact channels | |

| • Tight spreads | |

| • 24/7 multilingual online messaging |

Is MACRO MARKETS Legit ?

MACRO MARKETS is a trading platform that is strictly regulated by the Australian Securities and Investment Commission (ASIC No. 001301383), and the Financial Services Authority in the Seychelles (FSA No. SD139) offshore. As we all know, regulation holds immense significance for both brokers and traders alike. MACRO MARKETS instills profound confidence in its clients by operating within a robust regulatory framework.

Besides, MACRO MARKETS also offers several safety features, including segregated client funds, negative balance protection, and regular audit. Client funds are held in a segregated account with AA-Rated Global Bank and trading accounts have negative balance protection. You are subject to regular audits and have comprehensive indemnity insurance.

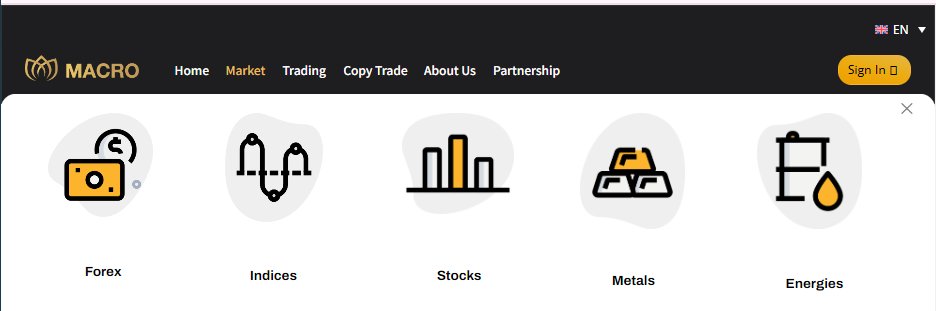

Market Instruments

Macro Markets offers five classes of popular tradable assets. Specifically, their product lineup covers Forex, providing access to the world's largest and most liquid market. Traders can also engage with global Indices, allowing for exposure to broader market movements. For those interested in individual companies, Stocks are available for trading. The broker rounds out its offerings with Metals and Energies, providing opportunities in commodities markets.

Account Types

Macro Markets provides four tailored account types targeting traders of different experience levels:

The STD Account is designed for beginners, with a low minimum deposit of 100 USD. It offers medium spreads and is ideal for those starting their trading journey. The PRO Account, requiring a 200 USD minimum deposit, maintains similar features but is geared towards more experienced traders.

For those seeking more advanced trading conditions, the Premium Account requires a 500 USD minimum deposit and offers lower spreads. The ECN Account, with a 1000 USD minimum deposit, is tailored for professional traders, featuring the lowest spreads and direct market access, albeit with transaction fees.

All accounts utilize the popular MT4 platform, providing a familiar and robust trading environment. Notably, all accounts feature market execution, a minimum lot size of 0.01, a maximum lot size of 20, unlimited maximum opening positions, and a 50% stop-out level. The broker also provides free demo accounts and supports Expert Advisors across all account types, allowing for automated trading strategies.

Leverage

MACRO MARKETS offers flexible leverage ratio ranging from 1:1 to 500:1. Leverage can magnify your profits, but it can also magnify your losses. If the market moves against you, you could lose more money than you deposited. For example, if the company offers maximum leverage of up to 1:500, which means that you can control a position worth 500 times your initial deposit. And, if you deposit $100, you could control a position worth $50,000.

Spreads and Commissions

Macro Markets offers a tiered account structure with varying spread conditions across its four account types. The STD and PRO accounts feature medium spreads, while the PREMIUM and ECN accounts boast lower spreads, targeting more active traders. Notably, the broker advertises minimum spreads from as low as 0.1 pips on its homepage, which likely applies to the ECN account type. However, Macro Markets does tell its commission structure.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| MACRO MARKETS | From 0.1 pips | N/A |

| IC Markets | From 1.0 (Std) | No commissions (Std) |

| XM | 1.0 (Std) | No commissions (Std) |

| FBS | From 0.5 (Std) | No commissions (Std) |

Promotions

Macro Markets is currently running an enticing mid-year promotion, offering clients a generous 10% deposit bonus. This seasonal campaign is designed to reward traders and enhance their trading capital, providing an excellent opportunity for both new and existing clients to boost their investment potential.

The promotion is straightforward yet impactful: for every deposit made, clients receive a 10% bonus, which is fully unlocked and available for immediate trading. This bonus applies to deposits of various sizes, from as little as $200 up to $50,000, with the maximum bonus capped at $5,000. For instance, a $200 deposit would yield a $20 bonus, resulting in a total trading balance of $220. On the higher end, a $50,000 deposit would earn the maximum bonus of $5,000, creating a substantial $55,000 trading balance.

What makes this offer particularly attractive is its flexibility and potential for substantial rewards. The bonus funds are not just a nominal addition but are fully integrated into the trading balance, allowing traders to leverage these extra funds in their market activities. This structure encourages active trading, as each transaction brings the trader closer to realizing the full benefits of the bonus.

Trading Platform

MACRO MARKETS offers several trading platforms for its clients, including MT4 Trading Platform and Web Terminal.

• The MetaTrader 4 (MT4) platform is the most popular trading platform in the world. They are used by millions of traders to trade a wide range of financial instruments, including forex, CFDs, and stocks.

• Web Terminal is a web-based trading platform that allows you to trade from any device with an internet connection. It is a simplified version of the MT4 platform, but it still offers several useful features.

Both of these platforms are available to MACRO MARKETS clients. The best platform for you will depend on your individual trading needs and preferences. If you are a serious trader who wants access to a wide range of features, then MT4 Trading Platform is a good choice. If you are looking for a more simplified platform that you can access from anywhere, then Web Trader is a good option.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| MACRO MARKETS | MT4 Trading, Web Terminal |

| IC Markets | MT4/5, Web trader |

| XM | MT4/5, Web trader |

| FBS | MT4/5, Web trader |

Copy Trading

Macro Markets enhances its offering with a popular copy trading feature. This social trading tool allows users to automatically replicate the strategies of top-performing traders on the platform.

The copy trading feature is designed to bridge the gap between novice and experienced traders, offering a unique learning opportunity while potentially generating returns. Users can browse through a selection of successful traders, analyze their performance metrics, and choose whose strategies they wish to follow.

Customer Service

MACRO MARKETS offers multiple channels to support its customer service, including email, and phone and online chat. Traders can also access a customized VIP customer service program, which includes dedicated account managers and priority support.

8 languages are available on this platform to serve traders from various regions or countries better.

Customers can get in touch with their customer service line using the information provided below:

Email: info@macrofx.com, macrofxcom@gmail.com

24/7 Multilingual Online Messaging

Social media: Facebook, Twitter, YouTube, Linkedin, and Instagram

Phone: +61 4 3486 9014 (Australia)

Conclusion

Overall, MACRO MARKETS is a trustworthy brokerage firm that strictly follows the rules set by financial authorities. It gives traders lots of different trading tools to use, offering both the reliable MT4 platform, and the modern and efficient Web Terminal platform. This lets traders choose the platform that suits them best. MACRO MARKETS has got you covered by providing a safe, diverse, and flexible trading experience.

Frequently Asked Questions (FAQs)

Is Macro Markets legit?

Yes, Macro Markets operates legally under regulations of ASIC in Australia and FSA in Seychelles.

What types of trading instruments are available at MACRO MARKETS?

MACRO MARKETS offers a variety of trading instruments, including Forex, Commodities, Indices, and Share CFDs.

What trading platforms does MACRO MARKETS provide?

MACRO MARKETS offers MT4 and Web Terminal.

Does Macro Markets offer copy trading?

Yes, this broker offers copy trading.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Keywords

- 5-10 years

- Regulated in Australia

- Regulated in Hong Kong

- Regulated in Seychelles

- Market Making(MM)

- Type AA License

- Retail Forex License

- MT4 Full License

- Global Business

- Medium potential risk

- Offshore Regulated

News

News 【MACRO Alert】The Fed's "hawkish rate cut" policy forces emerging market central banks to actively re

In its recent policy meeting, the Federal Reserve unexpectedly showed a hawkish stance, a shift that occurred three months after it slashed interest rates by 50 basis points to "fend off a reces

2024-12-20 17:25

Review 【MACRO Insight】The market reacted strongly to the Fed’s third rate cut, and expectations for future

At the policy meeting on December 19, the U.S. Federal Reserve (Fed) announced its third interest rate cut this year, a 25 basis point cut, adjusting the federal funds rate target range to 4.25%-4.5%.

2024-12-19 16:07

News 【MACRO Alert】Sachs is optimistic about gold prices as U.S. retail sales grow strongly in November

US retail sales data showed the resilience of consumer spending and solid economic growth. Retail sales rose 0.7% in November, beating expectations of 0.5% and the previous value was revised up from 0

2024-12-18 17:05

Review 【MACRO Insight】Fed may adjust rate cut expectations in response to productivity growth and economic

As Federal Reserve policymakers prepare to hold their final meeting of the year this week, markets widely expect a 25 basis point rate cut. However, more attention will be paid to their latest assessm

2024-12-17 16:22

News 【MACRO Alert】Wall Street analysts predict the trend of the U.S. dollar and the impact of Trump's pol

Wall Street analysts generally predict that the dollar may peak in the middle of next year and then begin to decline, predicting that it may fall by 6% by the end of the year. This forecast is mainly

2024-12-16 15:17

Review 【MACRO Insight】Ray Dalio advocates hard assets, the future roles of gold and Bitcoin

Billionaire investor Ray Dalio recently expressed concerns about potential “unresolved debt problems” in global finance and suggested that investors turn to hard assets such as gold and Bitcoin. Dalio

2024-12-13 14:37

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Seyhmus POLAT

Turkey

No one should trust this company and deposit money. Don't let the company's ratings mislead you. Definitely a scammer and not sending money.

Exposure

2023-11-07

Seyhmus POLAT

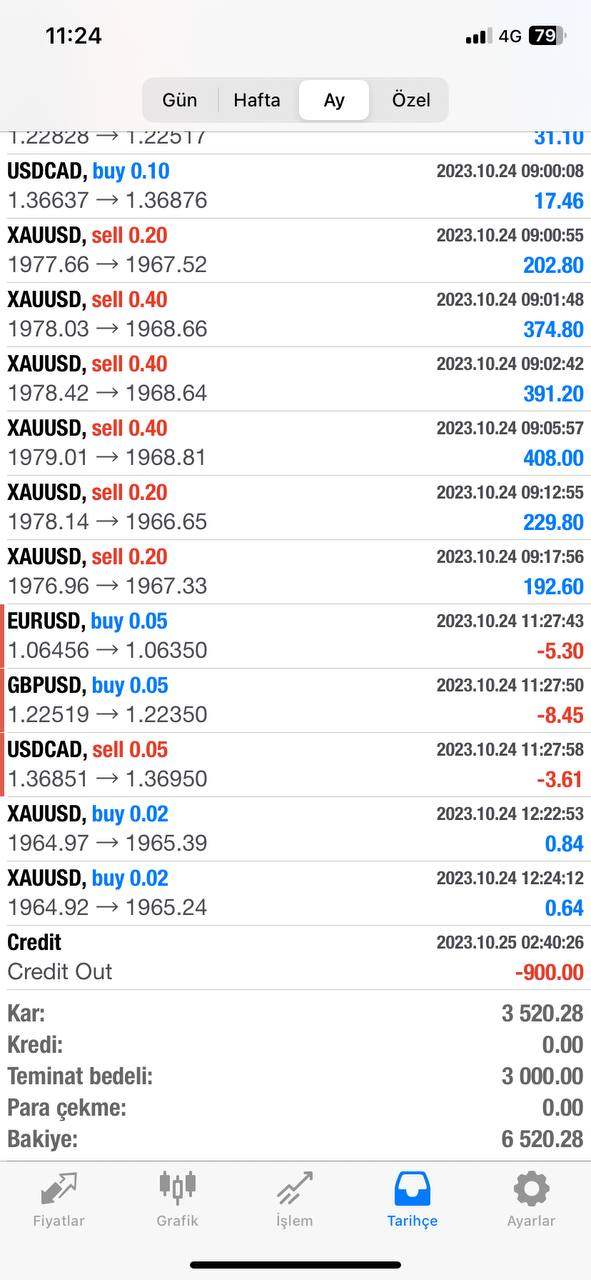

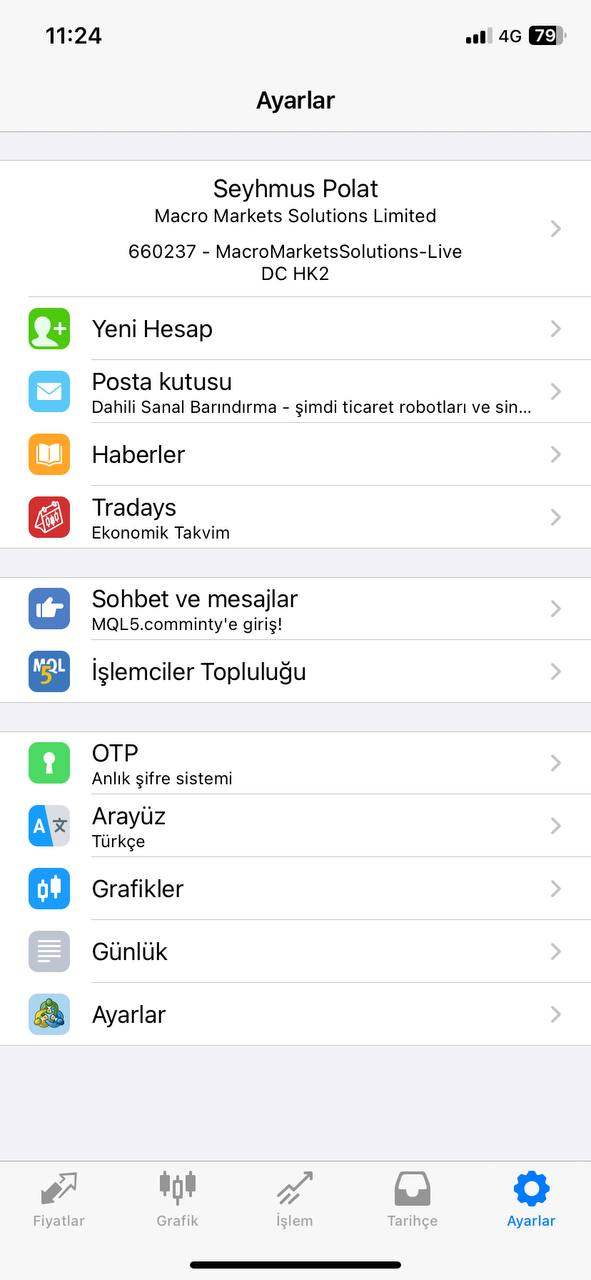

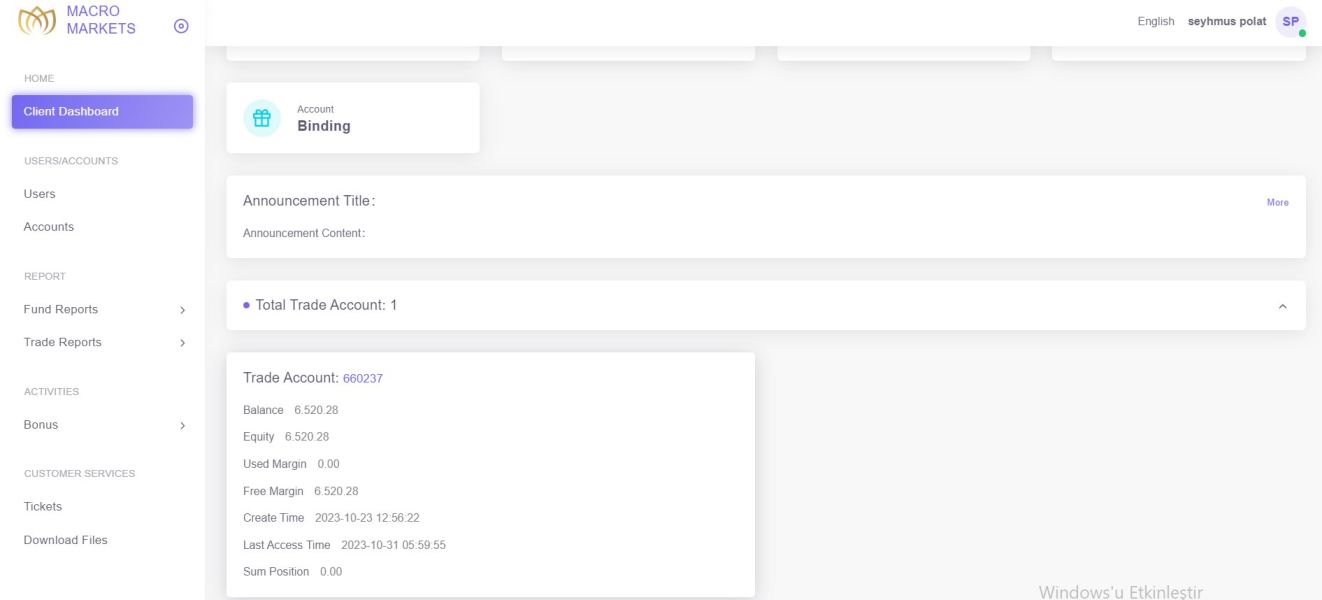

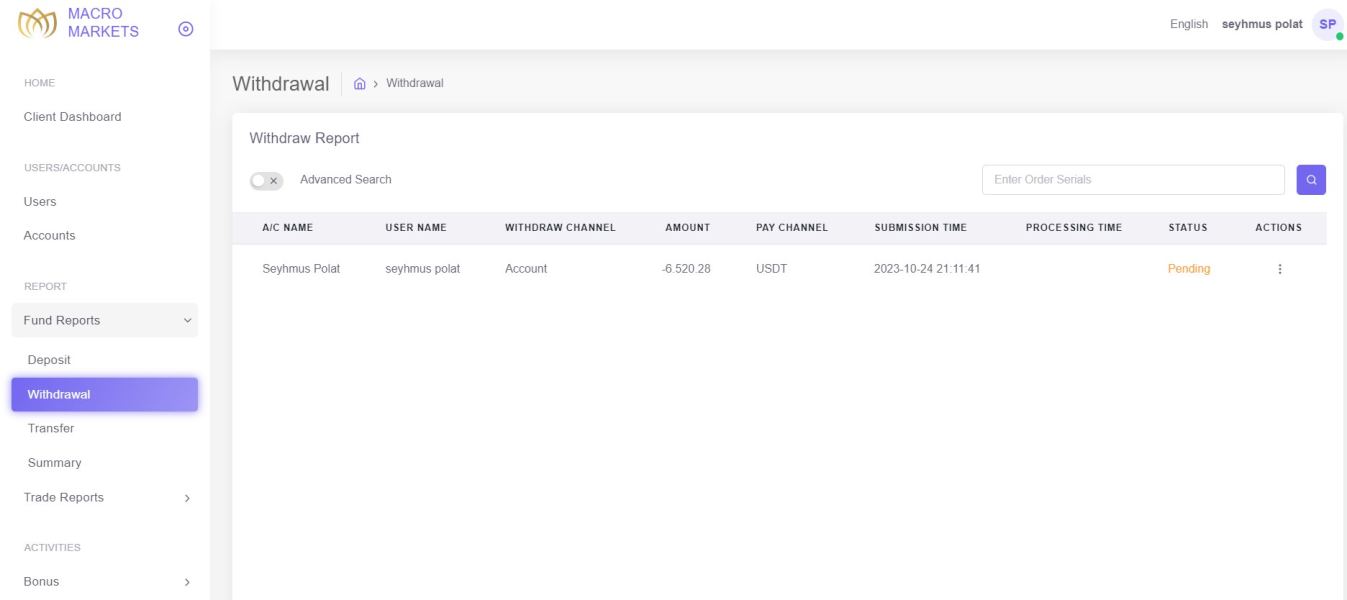

Turkey

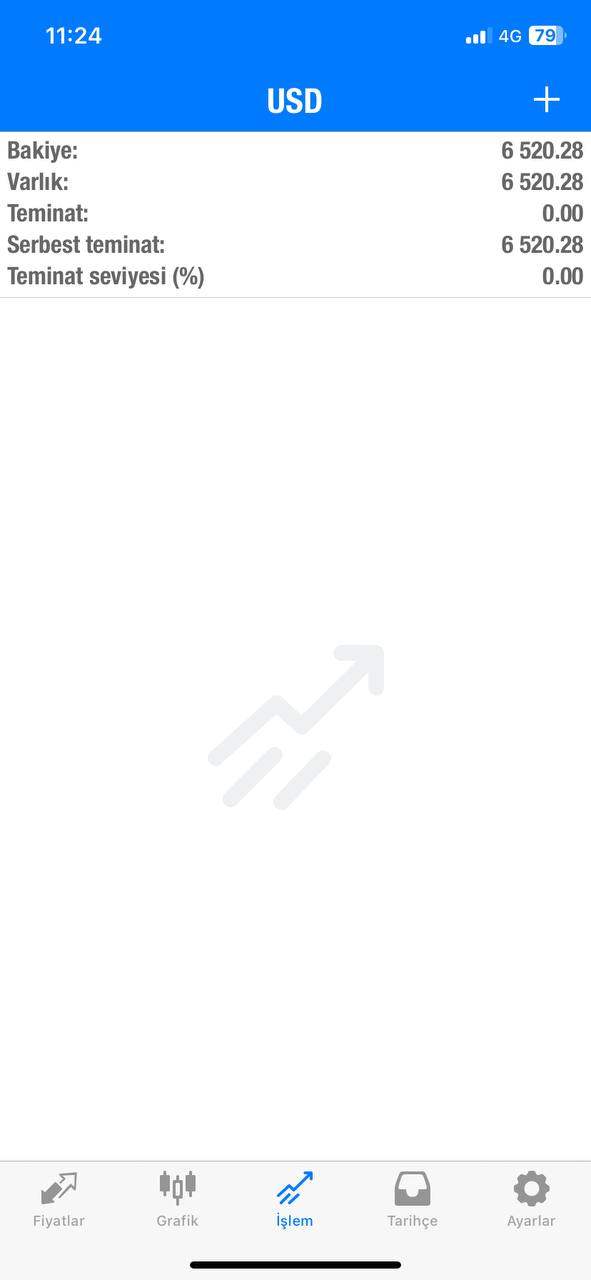

İ made deposit to Macro Markets 23-10-2023. After my deposit,they were providing bonus promotion to the deposits,so i got deposit 3000$,they got me credited 900$ on 24-10-2023. İ traded on my account,after my transactions are done from my side. İ wanted to make a withdrawal to test,how they are fast and reliable. My balance reached 6520$. İ made a request from client panelt o withdrawa the amount. So i waited 24 hours in a patiente way,because they told formal procedure is 24 hours for withdrawals. After that,they told me suddenly,your account is under investigation from risk department of Macro Markets. After this messafe they are not paying my money. 8 days are already done from my request. Still i can not withdraw,my money.

Exposure

2023-10-31

Pongin

Italy

MACRO MARKETS offers a robust selection of market instruments with a strong regulatory framework, making it a reliable choice for traders looking for a secure and diverse trading platform.

Positive

07-30

Mark Carter

New Zealand

Trading costs are transparent, but the overnight interest rates seem a bit high. The regulatory status is solid, offering peace of mind about fund safety. Well, it's a decent choice for cautious traders, like me.

Positive

06-28

46etth

Philippines

I enjoyed using the MT4 and Pro Trader platforms and appreciated the variety of trading instruments. The hassle-free account opening and smooth deposit and withdrawal process were positives.

Positive

05-15