简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

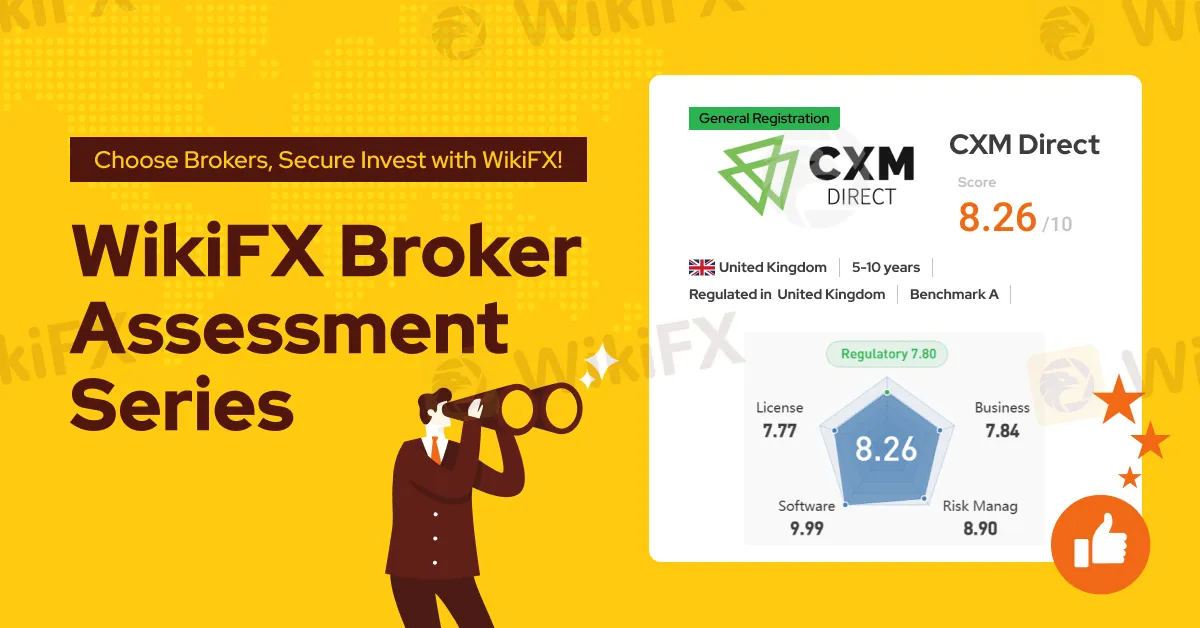

WikiFX Broker Assessment Series | CXM Direct: Is It Trustworthy?

Abstract:In this article, we'll look in-depth at CXM Direct, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at CXM Direct, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

Background:

Established in 2015, CXM Direct LLC (CXM Direct) is part of CXM Group of companies with broker entities that are authorised and regulated across multiple jurisdictions. The company is regulated by several financial authorities, which gives traders peace of mind knowing their funds are safe.

CXM Direct provides access to over 200+ CFD Instruments of 8 respective asset classes encompassing currency pairs, energy, cryptocurrencies, global indices, precious metals, baskets, and US/EU stocks.

In addition, CXM Direct offers a social trading service that can help money managers and traders improve their efficiency and profitability and generate passive income via copy-trading.

CXM Direct also offers an introducing broker (IB) program that allows individuals and businesses to earn commissions paid weekly by referring new clients to the company.

It is important to note that CXM Direct does not provide services to residents of the Algeria, Belarus, Canada, China, Cuba, Iran, Myanmar, North Korea, Russia, Sudan, Syria, UK, USA.

Types of Accounts:

CXM Direct offers a range of account options, namely the ECN Account, Standard Account, Standard Bonus Account, Cent Account, Zero Account, and Islamic Account. See the images attached below for more detailed information of each corresponding account.

Deposit and Withdrawals:

CXM Direct offers clients with multiple accounts the convenience of Instant Internal Transfer options. These transfers can be easily executed through the Client Portal with just a few clicks. It's important to be aware that this function is only operational during market open hours; therefore, clients should always consult their Client Portal for additional details.

CXM Direct provides several payment options, including FasaPay, bank transfers, cryptocurrencies, and Perfect Money. Notably, CXM Direct does not charge any commission or fees for both deposit and withdrawal processes.

Withdrawal requests at CXM Direct are typically processed within 1 business day. The duration for receiving payments depends on the chosen payment system.

Trading Platforms:

CXM Direct provides a range of trading platforms:

- The MT4 trading platform (available on PC, mobile, and web) is widely used in the industry. Utilizing CXM Direct's MT4 platform allows traders to experience consistent and efficient trade execution, and access transparent quotes for various trading products.

- The MetaTrader 5 trading platform (available on PC, mobile, and web), renowned for its technological sophistication, provides access to a depth of market and various advanced solutions, offering features such as new order types, the powerful MQL5 programming language for creating Expert Advisors and indicators, a Code Base with a database of technical indicators, MT5 Bridge technology for interbank liquidity access, and more than 20 technical indicators and 12 timeframes, along with a built-in strategy tester and interactive charts.

- CXM Direct's social trading hub allows users to follow and copy the strategies of their preferred traders with just a few clicks, providing an opportunity to experience the trading trend of the decade on a high-tech platform.

- The Percentage Allocation Management Module (PAMM) is a trading model wherein investors invest their funds with an experienced trader or Money Manager, expecting profits based on the manager's trading strategy.

Research & Education:

CXM Direct offers a range of educational resources to support traders. On CXM Direct's 'Education Site', traders can find three respective sections, namely FX Trading 101, CXM Member Area Tutorial, and CXM Trading Tools.

Customer Service:

CXM Direct offers 24/5 customer service support in several foreign languages, including English, Indian, Malay, Mandarin, Vietnamese, Thai, and Indonesian. Clients can also contact CXM Direct via email (info@cxmdirect.com) or by submitting an inquiry through the brokers' question form.

Conclusion:

To summarize, here‘s WikiFX’s final verdict:

WikiFX, a global forex broker regulatory platform, has given CXM Direct a WikiScore of 8.26 out of 10, indicating that it is a highly reliable broker in the forex trading industry.

Upon examining CXM Direct‘s licenses, WikiFX found that the broker is regulated by the United Kingdom’s Financial Conduct Authority (FCA). WikiFX has also validated the legitimacy of the said license.

In conclusion, CXM Direct is a good and safe choice for traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

Webull Canada Expands Options Trading to TFSAs and RRSPs

Webull Canada launches options trading for TFSAs and RRSPs, offering Canadian investors tax-free growth and retirement savings optimization opportunities.

Interactive Brokers Boosts IBKR Desktop with Advanced Tools

Interactive Brokers upgrades IBKR Desktop with powerful tools like MultiSort, Option Lattice, and enhanced charting, simplifying global trading for all skill levels.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator