Score

Silom International

Hong Kong|1-2 years|

Hong Kong|1-2 years| https://www.silomcfd.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Japan

JapanContact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Silom International also viewed..

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

silomcfd.com

Server Location

Singapore

Website Domain Name

silomcfd.com

Server IP

85.187.128.38

Company Summary

| Silom International Review Summary | |

| Founded | 2024 |

| Registered Country/Region | HongKong |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Shares (CFDs), Cryptocurrencies |

| Demo Account | Available |

| Leverage | Up to 1:200 |

| Spread | From 2.2 pips |

| Trading Platform | MT4(Web and Mobile) |

| Min Deposit | $10 |

| Customer Support | Phone: +60 82360563 |

| Email: cs@silomcfd.com | |

| 24/7 Online Chat: Not mentioned | |

| Physical Address: 2nd Floor of Private Lot No.7, Kuching, Sarawak, Malaysia | |

Silom Information

Set in Hong Kong, Silom is a brand-new formed corporation Among the several trading tools it offers are FX, commodities, indexes, and cryptocurrency. Together with minimal spreads beginning at 0 pip, they support MT4 platforms and provide competitive leverage up to 1:200. Users may test trading with a demo account.

Pros and Cons

| Pros | Cons |

| Offers over 12,000 products for trading | Unregulated |

| Competitive spreads starting from 2.2 pips | No 24/7 customer support |

| Provides a demo account |

Is Silom Legit?

Silom International Limited is unregulated.

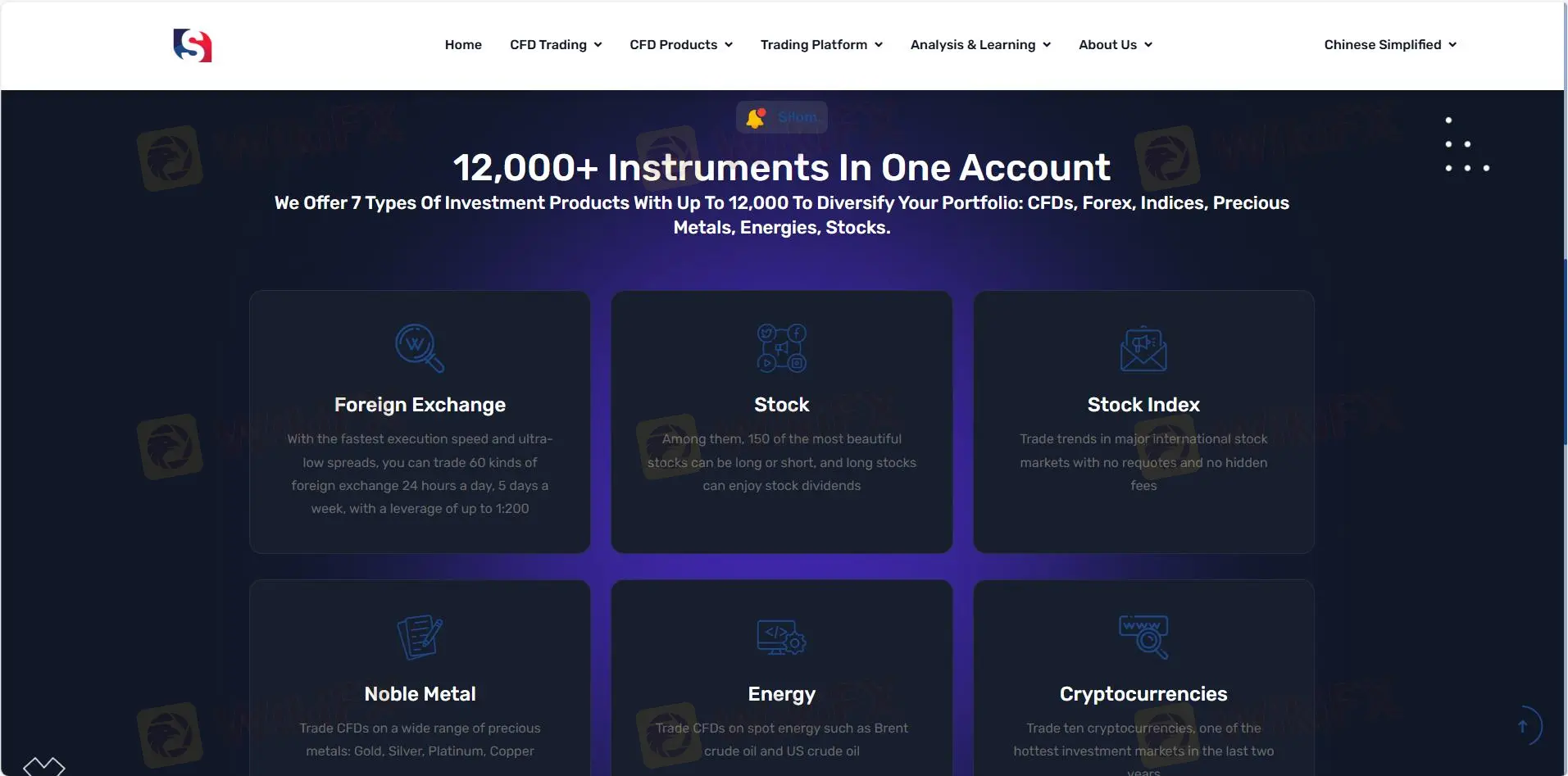

What Can I Trade on Silom?

Silom mainly provides CFD trading. It offers over 12,000 particular products, including 60 Forex pairs, CFDs on commodities, precious metals, and energy, 150 equities, main stock indexes, and 10 cryptocurrencies.

| Instrument | Details | Supported |

| Forex | 60 currency pairs available, 24/5 trading | ✔ |

| Commodities | CFDs on various commodities including oil, natural gas, etc. | ✔ |

| Indices | Trade major international stock indices with no requotes and hidden fees | ✔ |

| Shares (CFDs) | 150 popular stocks available for long/short, with dividends on long positions | ✔ |

| Cryptocurrencies | 10 cryptocurrencies, including Bitcoin and Ethereum | ✔ |

| Precious Metals | CFDs on gold, silver, platinum, copper, and other precious metals | ✔ |

| Energies | CFDs on spot energy, such as Brent Crude and US Crude oil | ✔ |

Account Types

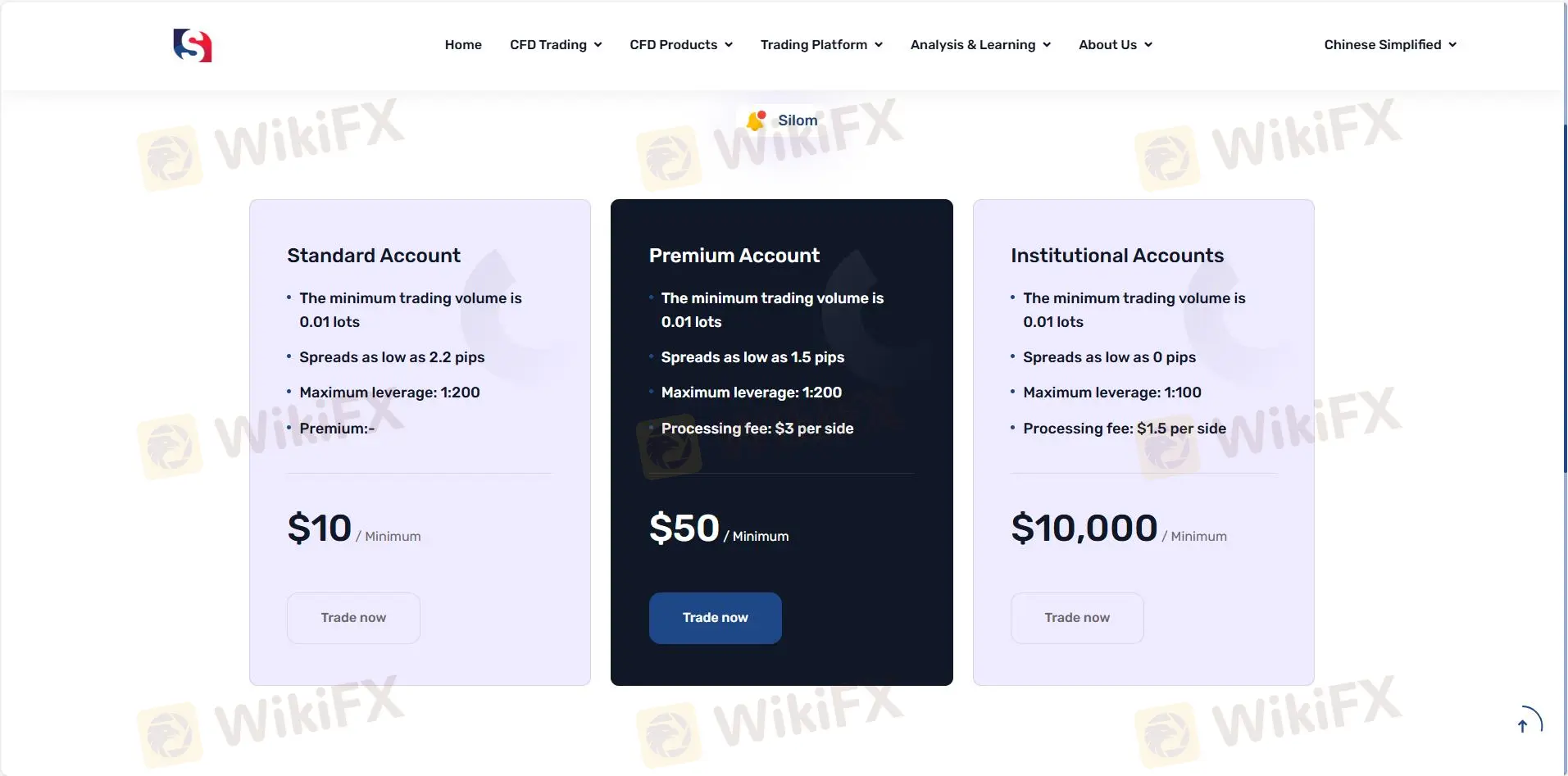

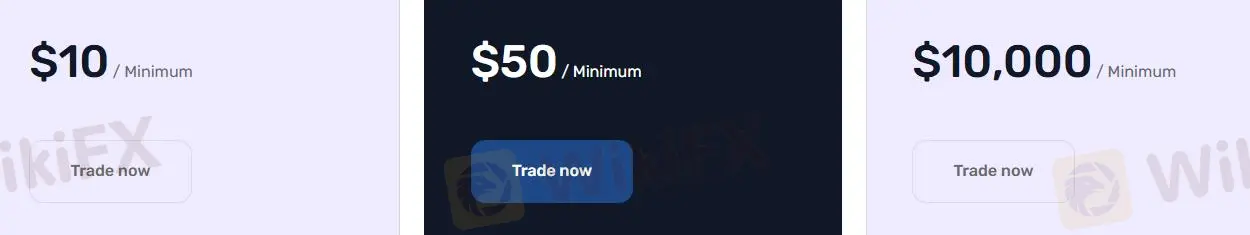

Silom offers three types of live trading accounts: Standard, Advanced, and Institutional.

| Account Type | Standard Account | Advanced Account | Institutional Account |

| Min Deposit | $10 | $50 | $10,000 |

| Max Leverage | 1:200 | 1:200 | 1:100 |

| Spread | From 2.2 pips | From 1.5 pips | From 0 pips |

| Processing Fees | $0 | $3 per side | $1.5 per side |

| Min Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Other Features | Suitable for most traders | Suitable for experienced traders | For institutional investors, advanced features |

Leverage

The leverage of Silom international is up to 1:200. It offers 1:200 leverage in standard account and premium account, but offers 1:100 leverage in institutional account.

Silom Fees

While higher-tier accounts have tighter spreads, Silom offers the spreads of standard account starts from 0 pips. The processing fee ranges from 0 to $3.

| Account Types | Spread | Processing Fees |

| Standard Account | From 2.2 pips | $0 |

| Advanced Account | From 1.5 pips | $3 per side |

| Institutional Account | From 0 pips | $1.5 per side |

Trading Platform

Silom supports MT4 platforms, available for mobile, desktop, and web trading.

| Trading Platform | Supported |

| MT4 | ✔ |

| MetaTrader Web | ✔ |

| MetaTrader Mobile | ✔ |

| MT5 | ❌ |

Deposit and Withdrawal

Silom does not charge any fees for deposits or withdrawals. Also, it doesn't mention the payment methods. The minimum deposit for it is $10.

Keywords

- 1-2 years

- Suspicious Regulatory License

- MT4 Full License

- Regional Brokers

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now