Pre-market trading refers to the trading activities that occur before the official start of the market hours, also known as early morning trading. Typically, this session sees less liquidity and volume compared to regular trading hours, yet it is crucial as it sets the stage for the forthcoming regular session. Forex pre-market trading allows traders to capitalize on significant news events, economic indicators, and corporate announcements that are often released before the market officially opens. This period can also set the tone for the sentiment that might prevail throughout the day, providing insightful cues to strategically oriented traders. Numerous forex brokers support pre-market trading to cater to more traders' trading preferences. However, there are truly sincere ones. Therefore, here we selected the best forex brokers with pre-market trading as per some core dimensions like regulation, reputation, trading costs, trading platform, customer service to provide better guidance for traders who look for this type of brokers.

Comparsion of the Best Brokers with Pre-Market Trading

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Brokers with Pre-Market Trading Overall

| Brokers | Logos | Why are they listed as the Best Forex Brokers with Pre-Market Trading? |

| InteractiveBrokers |  |

✅ Safe and trustworthy, InteractiveBrokers is regulated by multiple top-tier authorities, establishing a high-trust environment. ✅ Greatly recognized for advanced trading tools ideal for serious traders, especially its comprehensive risk management tools. ✅Allowing one of the earliest pre-market trading hours, starting from 4:00 a.m. EST, offering substantial flexibility to its clients. |

| eToro |  |

✅ Operating under the regulation of notable bodies like the FCA, CySEC, and ASIC, ensuring a secure trading environment. ✅Highly commended for its pioneering social trading platform that promotes a collective trading experience. ✅ Offering fairly broad extended hours, providing options to trade from pre-market to post-market periods. |

| WeBull |  |

✅ Webull is strictly regulated, enhancing its reliability as a broker. ✅ Having gained a strong reputation for its user-friendly interface and in-depth market data comprehensive enough for both new and seasoned traders. ✅ Boasting one of the longest pre-market trading sessions from 4:00 a.m. to 9:30 a.m. EST, it stands out with its flexibility. |

| Fidelity |  |

✅ Fidelity is regulated by top-tier authorities, a well-established brokerage firm, ensuring trustworthy operations. ✅ Comprehensive research tools, advanced order options, and strong emphasis on retirement services contribute to its high user rating. ✅ Permiting pre-market trading from 7:00 a.m. to 9:30 a.m. EST, giving users a jumpstart on the market day. |

| Charles Schwab |  |

✅ Charles Schwab, strictly regulated, reputable and trusted, provides a safe investing environment. ✅Broad array of tradable instruments, robust trading platform, and quality customer service have earned it a good reputation among users. ✅Offering pre-market trading from 7:00 a.m. to 9:28 a.m. EST, it equips clients with extra time to process market moves. |

| Robinhood |  |

✅ The simplicity and minimalism of Robinhood's platform, combined with its introduction of commission-free trading, high recognized. ✅Their pre-market session, from 9:00 a.m. to 9:30 a.m. EST, gives an early start for those looking to trade ahead of regular hours. |

Overview of the Best Brokers with Pre-Market Trading Overall

InteractiveBrokers

|

|

Broker |

|

Registered in |

United States |

Regulated by |

|

Min. Deposit |

$100 |

Products |

Stocks, Options (Incl. Futures Options), Futures, Forex, Interactive Brokers CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, and Inter-Commodity Spreads. |

Trading Costs |

Stocks fees: $0.0035 Fractional Shares: $1Options Fees: $0.03 ETFs Fees: $0.0035 |

Trading Platform |

IBKR Trading Platform, Desktop Platform, Web Platform, InteractiveBrokers App |

Payment Methods |

Bank Wire, Online Bill Pay, Check, Wise Balance. |

Customer Support |

7/24 |

Founded in 1978, InteractiveBrokers is a leading global brokerage firm headquartered in the United States, duly registered and regulated by multiple reputable authorities, including ASIC, FCA, FSA, SFC, IIROC. This broker offers extensive tradable instruments spanning across stocks, options, futures, EFPs, futures options, forex, bonds, and funds through its flagship trading platform, Trader Workstation (TWS), equipped with innovative features, high customization, and seamless execution. Interactive Brokers customer support is easily reachable through various channels, 7/24 available, including phone, email, and live chat, and they also support an extensive library of educational resources, making it an excellent choice for traders seeking comprehensive broker assistance. InteractiveBrokers is extensively recognized, winning numerous awards, thereby solidifying its reputation in the industry. Unique features include its IBKR Debit Mastercard, which allows clients to easily spend and borrow directly against their account.

As for pre-market trading, InteractiveBrokers extends its trading hours to provide more trading opportunities for its users. In fact, it offers one of the longest trading hour services among brokers. Clients can start trading most stocks from as early as 4:00 am ET, enabling them to respond to international events and announcements outside of standard market hours. This extended hours trading includes not only stocks but also ETFs and warrants.

✅Where InteractiveBrokers shines:

• Come with a strong regulatory backdrop, InteractiveBrokers affords a robust level of security.

• Offering extensive tradable instruments across various markets, making it an ideal option for traders looking for multi-asset trading.

• Trader Workstation, its proprietary trading platform, is highly customizable and feature-rich, making it suitable for experienced traders.

• InteractiveBrokers feaures a comprehensive customer support system, 7/24 customer service and provides extensive educational resources.

❌Where InteractiveBrokers shorts:

• Trader Workstation maybe complicated for novice traders, as features are way too steep for them.

• Its fee structure may not be the most competitive for certain tradable assets. Traders with low trading volumes may find better value elsewhere.

eToro

|

|

Broker |

|

Registered in |

United Kingdom |

Regulated by |

|

Min. Deposit |

$10 |

Products |

Cryptocurrencies, Stocks, Commodities, Currencies |

Trading Costs |

Zero commissions on stock trading |

Trading Platform |

eToro trading platform |

Payment Methods |

Debit Card, Bank CardPayPal, Wire Transfer |

Customer Support |

5/24 |

Established in 2007, eToro is a pioneering broker originating from Israel, globally renowned for its innovation in social trading and well-regulated by reputed authorities such as the FCA, CySEC, and ASIC, offering a diverse selection of assets including Cryptocurrencies, Stocks, Commodities, Currencies. eToro's proprietary trading platform, particularly known for its social trading features, allows users to engage with other traders, share information, and even mimic trading strategies of successful users via its popular 'CopyTrade' feature. Additionally, their customer support, available via live chat and ticket system, is noted for efficiency and responsiveness. Recognition for eToro comes in the form of widespread popularity and an array of awards certifying its pioneering role in the industry. Notable unique features include the ' CopyPortfolio' feature, a managed portfolio grouping multiple assets or top-performing users, further strengthening its position as a leader in social trading.

eToro notably provides a pre-market trading session allowing trades to be carried out ahead of traditional market opening times. Traders can set pre-market orders at any point in time, however, they are only processed between 6:30 a.m. and 9:30 a.m. US Eastern Standard Time, or equivalent to 10:30 a.m. to 14:30 GMT. This provision grants eToro clients enhanced adaptability and the prospect of responding to developments disclosed outside of standard trade hours.

✅Where eToro shines:

• The unique offering of eToro is its virtual portfolio feature, which allows users to practice risk-free trading with virtual money.

• Intuitive and user-friendly interface, providing a superb trading experience, pursued by many traders, especially beginners.

• Featuring strong customer support with a responsive live chat feature and an extensive FAQ section.

• Zero-commissions for stock trading, which can reduce overall trading costs greatly.

❌Where eToro shorts

• The innovative CopyTrade feature, although useful, might lead to overreliance and hinder the growth of essential trading skills.

• Its educational resources, though available, do not cover broad learning preferences and can be a little basic.

• No 7/24 customer support, which can lead to some inconvenience for brokers who have trading platforms during weekends.

WeBull

|

|

Broker |

|

Registered in |

United States |

Regulated by |

|

Min. Deposit |

$0 |

Products |

Stocks, Options, ETFs, and OTC |

Trading Costs |

Stocks & ETFs: $0 commission for trading US-listed securities on Webull app or web platform. Margin Interest: No fees for intraday margin usage. Options Contracts: $0.55 per contract fee applies for all options trades. |

Trading Platform |

WebTrader 4.0, Mobile Apps |

Payment Methods |

eDDA, FAST, TT, ACH transfers |

Customer Support |

5/24 |

WeBull, established in 2017, is an innovative and dynamic brokerage firm based in the United States, offering a secure and reliable platform for trading extensive financial instruments, which include stocks, options, ETFs, and OTC. WeBull proprietary trading platform is robust and user-friendly, packed with sophisticated charting tools, live customer support via chat, email, and phone, and simulcast news from multiple outlets. Clients appreciate WeBull for its commission-free trades, comprehensive market data, and extensive research tools, all enhancing its reputation. The platform possesses several unique features, such as a paper trading function allowing novices to practice strategies without risking real money.

As for pre-market trading, WeBull offers an extended timeframe, which includes one of the longest pre-market trading sessions in the industry from 4:00 a.m. to 9:30 a.m. ET. This capacity caters to the needs of early-rising traders who wish to position themselves ahead of the regular market opening. Tradable instruments during pre-market hours include stocks and ETFs, providing ample opportunities to seize potential profits from overnight price fluctuations triggered by international news. Yet, extended trading hours often bring about increased volatility, lower liquidity, and wider bid-ask spreads. Investors are advised to approach pre-market trading with a well-formulated strategy and risk management plan.

✅Where WeBull shines:

• Features a no commission policy, which means that there are no charges for opening and closing trades, reducing trading costs considerably.

• Extensive Pre-Market trading hours offered, Webull offers extended hours for trading which translates to greater flexibility for traders to react to news and events occurring outside typical market hours.

• Unique paper trading function allows beginners to practice trading strategies without risking real money.

• No minimum deposit required, making it easily accessible for most traders, especially novices traders.

❌Where WeBull shorts

• For beginner traders, the array of features and tools available on Webull's platform can potentially be overwhelming.

• While Webull offers multiple types of instruments like stocks, options, ETFs, and OTC, it lacks direct access to certain asset classes such as mutual funds and bonds.

• No 7/24 customer suppport offered, which may lead to some inconvenience to traders who have trading problems during weekends.

Fidelity

|

|

Broker |

|

Registered in |

China Hong Kong |

Regulated by |

SFC |

Min. Deposit |

$0 |

Products |

Individual Bonds, Bond Funds, Bond ETFs, CDs, Fractional CDs, CD Ladders, Money Market Funds, Fixed Annuities. |

Trading Costs |

Stock and ETF trades: No commissionOptions: per contract fee of $0.65. |

Trading Platform |

Online Trading |

Payment Methods |

Electronic Funds Transfer (EFT), Check, |

Customer Support |

24/7 |

Established in 1946, Fidelity Investments is one of the oldest and most respected brokerage firms in the United States. Known for its diverse range of tradable instruments including stocks, bonds, mutual funds, options, ETFs, and cryptocurrencies, it draws in a wide circle of investors. Fidelity's user-friendly proprietary trading platform, both desktop and mobile versions, possess powerful research tools, customizable charts, and advanced order options suitable for newbies and experienced traders alike. In terms of customer support, Fidelity offers 24/7 phone and live chat services, along with a comprehensive FAQ section on its platform. Users widely recognize Fidelity for its strong emphasis on retirement services and impressive research offerings, contributing to its distinguished reputation in the trading community. Notably, it has a unique feature, Fidelity's 'Stock Picking Experience', which offers personalized stock recommendations based on users' trading habits and preferences.

Regarding Fidelity's pre-market trading, it extends the opportunity to trade from 7:00 a.m. to 9:28 a.m. Eastern Standard Time (EST). This extended period allows investors to respond to overnight news and events that are likely to impact the market. The main types of tradable products during this period are stocks and ETFs. However, investors should be mindful of the potential risks involved in pre-market trading such as lower liquidity, wider bid-ask spreads, and higher volatility.

✅Where Fidelity shines:

• Offering various products like stocks, bonds, mutual funds, options, and ETFs to suit different investment strategies.

• Offering excellent customer service with 24/7 phone and live chat assistance.

• Fidelity's 'Stock Picking Experience', offering personalized stock recommendations.

❌Where Fidelity shorts

• Cryptocurrency trading, an increasingly popular product, is not available on its platform.

• While it has broad market access, its international trading is limited compared to some competitors.

Charles Schwab

|

|

Broker |

Charles Schwab |

Registered in |

United States |

Regulated by |

SFC |

Min. Deposit |

$0 |

Products |

Mutual Funds, ETFs, Index Funds, Stocks, Options, Bonds, CDs & Fixed Income, Money Market FundsCash Solutions & Rates, Annuities, Cryptocurrency |

Trading Costs |

Commission-free online stock, ETF, and option trades |

Trading Platform |

Thinkorswim |

Payment Methods |

ACH, Wire Transfer, Mobile, Check |

Customer Support |

24/7 |

Founded in 1971, Charles Schwab is a major U.S-based brokerage firm with a deep-rooted reputation in the industry. It was originally branded as TD Ameritrade, and following its acquisition by Charles Schwab in 2023, took on its current name. This platform offers a wide array of tradable instruments, covering stocks, options, futures, ETFs, mutual funds, and fixed income securities, among others. Its trading platform, the famous Thinkorswim, both web-based and mobile version, known for its robustness, customizable charting tools, and streamlined navigation, caters to all levels of traders. Charles Schwab's customer support is comprehensive with 24/7 phone service, live chat, and a detailed FAQ section on the platform. Apart from its significant recognization for quality services and low-cost structures, Charles Schwab sets itself apart with key features such as 'Schwab Intelligent Portfolios', a robo-advisory service, and the 'StreetSmart' advanced trading platform for sophisticated traders

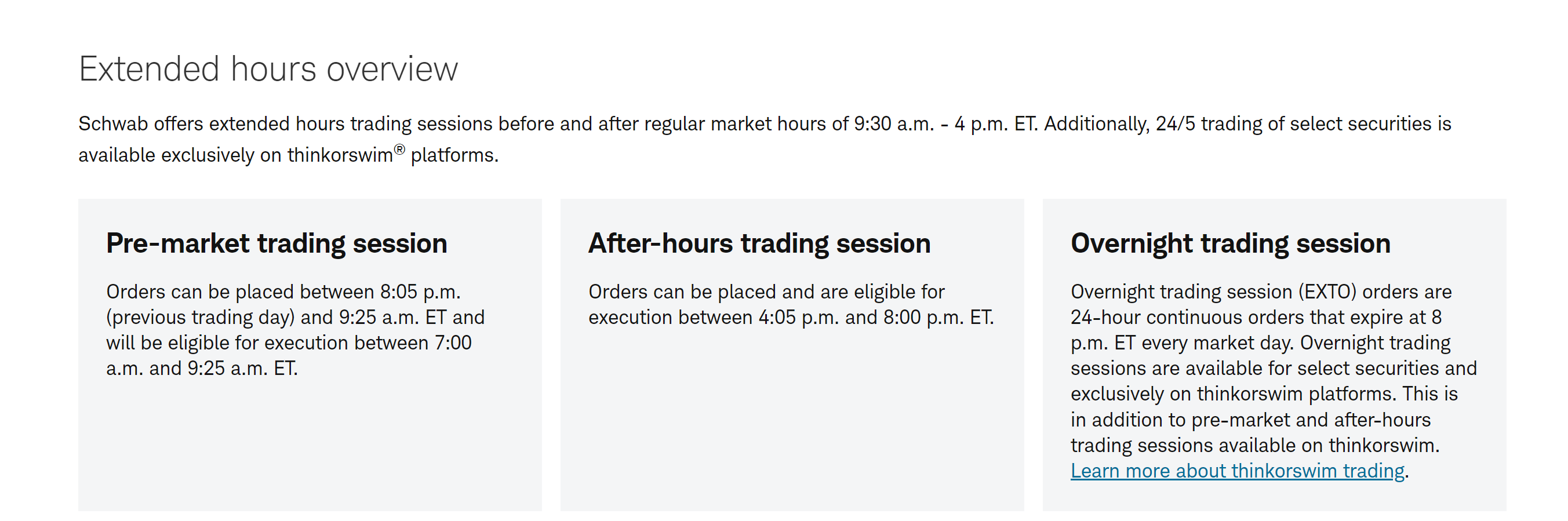

When it comes to pre-market trading, Charles Schwab extends the trading hours for its clients, allowing them to trade from 7:00 a.m. to 9:25 a.m. Eastern Standard Time (EST). This expanded period enables traders to take advantage of the market momentum caused by overnight news and events. Primarily, traders can deal with stocks and ETFs during the pre-market hours. Nonetheless, it's essential to keep in mind the inherent risks associated with trading outside regular hours, including lower liquidity and potential price volatility.

✅Where Charles Schwab shines:

• A U.S-based broker that has operated for over 50 years, which has a solid reputation among traders globally.

• Extensive tradable instruments, including stocks, ETFs, mutual funds, options, and futures, giving traders more flexibility to trade per their preferences.

• Robust and customizable trading platform, along with 24/7 customer support, makes it user-friendly for both beginners and experienced traders.

• Recognized for its educational resources and low-cost structure, making it appealing to cost-conscious investors.

• Offering extended trading hours, both pre-market and after market, giving more traders to chance to trade per their own trading style.

❌Where Charles Schwab shorts:

• Their trading pllatform Thinkorswim interface, although robust, is not as intuitive as some competitors.

• While the broker offers extensive tradable instruments, it does not offer cryptocurrency trading.

• Some users may find the process of transferring accounts to and from Charles Schwab to be time-consuming and complex.

Robinhood

|

|

Broker |

|

Registered in |

United States |

Min. Deposit |

$0 |

Products |

ETFs, Stocks, Cryptos, and more |

Trading Costs |

Commission free for stock trading |

Trading Platform |

Robinhood Platform |

Payment Methods |

Debit card, Instant bank transfer, |

Customer Support |

7/24 |

Robinhood, established in 2013, is a U.S. based brokerage firm widely recognized for its innovative digital trading. Offering limited tradable instruments include stocks, ETFs, and cryptocurrencies, there are some room to be desired to attract more clients. Robinhood's intuitive and robust platform, available on both desktop and mobile, is known for its ease of usability and visually appealing interface, making it particularly attractive for novice traders. Customer support at Robinhood includes email-based assistance and a comprehensive in-app Help Center, although it's noted that there's no telephone support. Robinhood has gained good user recognition for its pioneering introduction of commission-free trading and fractional shares trading, a feature that allows investing with minimum dollar amounts.

In terms of pre-market trading, Robinhood provides its users with the opportunity to trade during extended hours, specifically, from 7:00 a.m. to 9:30 a.m. Eastern Standard Time (EST). During these pre-market hours, users have the flexibility to trade stocks and ETFs. However, as pre-market trading could accompany higher volatility and decreased liquidity, traders are struggling to make big profits during this period, especially for beginners.

✅Where Robinhood shines:

• Its simplicity and accessibility, making it appealing to novice traders and those with smaller portfolios.

• Well-known for its commission-free trading of stocks, ETFs, and options, making investing more accessible to the average person.

• Robinhood's intuitive, user-friendly platform is another standout, offering an easy-to-understand interface that is appreciated by many new to investing.

• Featuring an extended trading hour, pre-market trading hour from 7:00 a.m. to 9:30 a.m. ET, giving its traders more possibilities.

❌Where Robinhood shorts:

• Educational resources are basic compared to competitors, which may not be sufficient for novices investors looking to learn.

• While the platform is user-friendly, it lacks the advanced analytical tools and trading features preferred by more experienced traders.

• Robinhood's customer service, which operates largely through email, has been criticized for slow response times.

Forex Trading Knowledge Questions and Answers

What time is pre-market trading?

Pre-market trading in the U.S typically occurs between 4:00 a.m. to 9:30 a.m. Eastern Standard Time (EST). Most brokers offers pre-market trading hour between 7:00 a.m. to 9.30 a.m, and very few begin as early as 4:00.a.m. Engaging in pre-market trading allows traders to react promptly to overnight news and events, giving them a potential edge before regular market hours kick in. Besides, it also grants added flexibility, providing access for those in different time zones or who can't trade during the usual market hours.

Is pre-market trading be defined as day trading?

No, pre-market trading is not the same as day trading. Pre-market trading refers to the trading activities that occur before the regular market session opens, typically from 4:00 a.m. to 9:30 a.m. EST in the U.S. In contrast, day trading is a trading strategy that involves buying and selling securities within the same day, with the goal to profit from short-term price movements. Day trading can occur at any time during the full trading day, including during pre-market, regular market, and post-market hours.

Pre-Market VS After Market: Which period is better?

Typically, pre-market trading occur between 4 a.m. to 9:30 a.m. Eastern Time, while after-market trading commences from 4 p.m. to 8 p.m. Eastern Time. Pre-market trading can provide opportunities based on overnight news or events that might affect a currency pair's price. However, it often has lower liquidity, which can result in higher spreads. After-market trading, on the other hand, is featured by the reaction to news that comes out after the regular market close. It can, sometimes, offer greater volatility, which some traders may find advantageous. Yet, it can also bring about significant risk due to potentially abrupt price shifts. Overall, choosing pre-market trading or after-market trading totally depends on traders' own trading preferences.

Can I make profits during pre-market trading hours?

While profiting during pre-market trading is possible, it can be a risky endeavor better suited for experienced traders with a clear strategy. Lower liquidity means fewer buyers and sellers, leading to wider spreads and potential losses if you need to exit quickly. Information also plays a role, as institutional investors often have access to news and data before retail traders. For example, if a company announces positive earnings before the market opens, institutional investors might quickly buy shares in pre-market, driving the price up. Retail traders who enter later might end up paying a higher price or even buying at the peak before a correction.

When Does the Nasdaq Pre-Market Open?

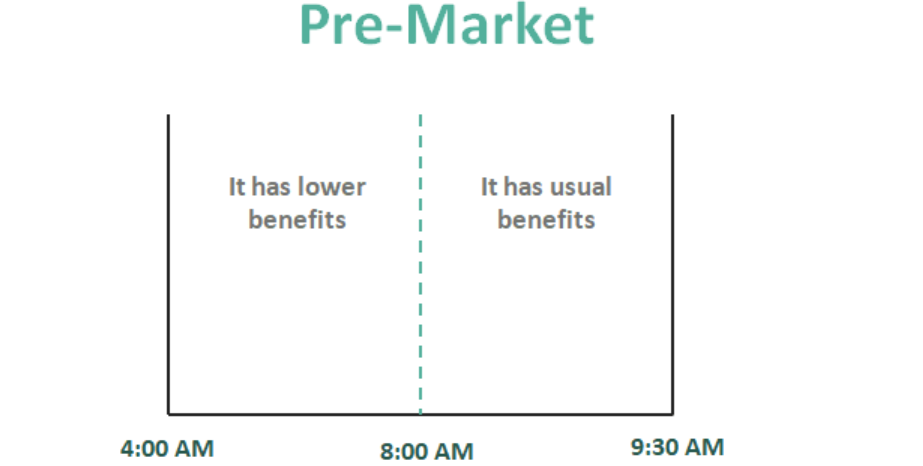

The Nasdaq pre-market actually has two opening times:

4:00 AM Eastern Time (ET): This is the earliest access point for electronic communication networks (ECNs), which allow limited pre-market trading for some investors. However, liquidity is very low at this time, and trading activity is minimal.

8:00 AM Eastern Time (ET): This is when most pre-market trading activity starts to pick up. Many retail investors and brokers offer access to pre-market trading starting at this time.

What are pros and cons of pre-market trading?

Pros of Pre-Market Trading

• Early Access: Traders can act on overnight news or earnings announcements before regular market hours, potentially gaining a competitive edge.

• Flexibility: It provides extra trading hours, convenient for traders in different time zones or those unable to participate during regular market hours.

• Less Competition: Pre-market session may have less competition, which can sometimes yield attractive opportunities.

• Convenient for Retail Traders: Pre-market trading can be particularly convenient for retail traders who work during normal market hours.

Con of Pre-Market Trading

• Limited Liquidity: Pre-market trading often has lower liquidity which can lead to wider bid-ask spread, potentially making it harder to execute trades at favorable prices.

• Higher Volatility: Lower liquidity also means higher volatility, which can result in rapid price movements. Its crucial to monitor your trades carefully.

• Not All Stocks Available: Not all securities are available for trading in the pre-market session, and availability differs based on the broker.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers with Trading APIs for 2026

Dive into top Forex Brokers with exceptional trading APIs, offering benefits, security, and a variety of platforms.

Best Forex Trading Signal Providers for 2026

Uncover the top Forex signal providers, their benefits, quality selection criteria, and insight into useful Forex trading knowledge.

Best Scalping Forex Brokers for 2026

Examine best scalping Forex brokers, learn their strategies and advantages, and assess their suitability for different traders.

6 Best Brokers for Long-Term Investing in 2026

Explore the top six brokers for long-term investing encompassing their offerings, analysis, and comparative insights.