Are you a trading novice seeking an advantage? Or perhaps you've been trading for a while but have yet to see profit? If this sounds like you, forex signals may be the boost you need to expedite your learning process. It is an understated fact that Forex trading is a challenging field. It requires years of experience, and every trade necessitates in-depth analysis of technical and fundamental factors. This complexity is why only a select few traders ever reach their objectives.

This guide will address some frequently asked questions and misconceptions about trading signals, guide you towards reliable forex signal providers, and assist you in selecting the best forex broker for exploiting trading signals. Get ready to immerse yourself in the intricate world of forex trading signals, and take your trading game to new heights. Your journey to trading mastery starts here.

What are Forex Signal Providers?

Forex signals are essentially recommendations that provide guidance on the best timing to buy or sell a specific currency pair, such as USD/EUR, based upon certain factors. These alerts may stem from automated software that monitors currency trends or originate from seasoned traders.

Forex signal providers are skilled individuals or teams who use market conditions and technical indicators to deliver trading signals to investors. Understanding how to read forex signals is crucial for making the most out of them. Typically, a forex signal will include several key components:

Currency Pair: Specifies the currencies to be traded.

Direction: Indicates whether to buy or sell.

Entry Point: The price at which to enter the trade.

Take Profit: The price at which to take your earnings and close the trade.

Stop Loss: The price at which to cut your losses and close the trade if it moves against you.

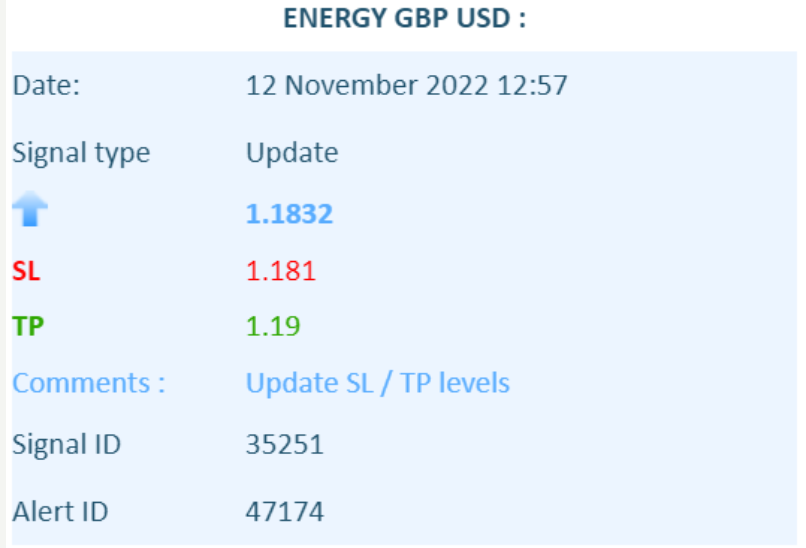

The following diagram is an interface displaying email signals. Depending on the direction of the transaction, there will be different backgrounds, with upward/downward trends, stop loss and profit levels shown in red and green. Compared to telegram, additional information is included, such as signal ID, alert ID, and signal type (open, update or close). Having these elements in hand enables traders to execute a potentially profitable forex signals strategy, ensuring that they are taking calculated risks and maximizing returns.

Best Forex Signals Providers

1. 1000pipBuilder

Top Forex Signal Provider with More than 10-year-experience

1000pip Builder is a leading forex signal provider with over a decade of experience in the market. Offering signals for 15 different forex pairs, this provider is popular for its simplistic yet effective approach: all signals come with limit, stop-loss, and take-profit prices, eliminating any guesswork. up to 5 signals are delivered daily via Telegram, Email or SMS, accommodating worldwide trading sessions as the service operates 24/5.

The company claims to target 350 pips of monthly gains and integrates with MyFXBook for independent verification of results. Subscription plans are competitive with flexible options, however, drawbacks are that free signals and free trialare not available. Here is a summary of its basic information:

| 1000pipBuilder | |

| Rating | ⭐⭐⭐⭐⭐ |

| Premium Signals | 1-5 signals daily |

| Free Signals | ❌ |

| Subscription Fees | £19-44 per month |

| Channels to Receive | Direct email and SMS signals |

| Service Support | In 24 hours in 5 days |

| Free Trial | ❌ |

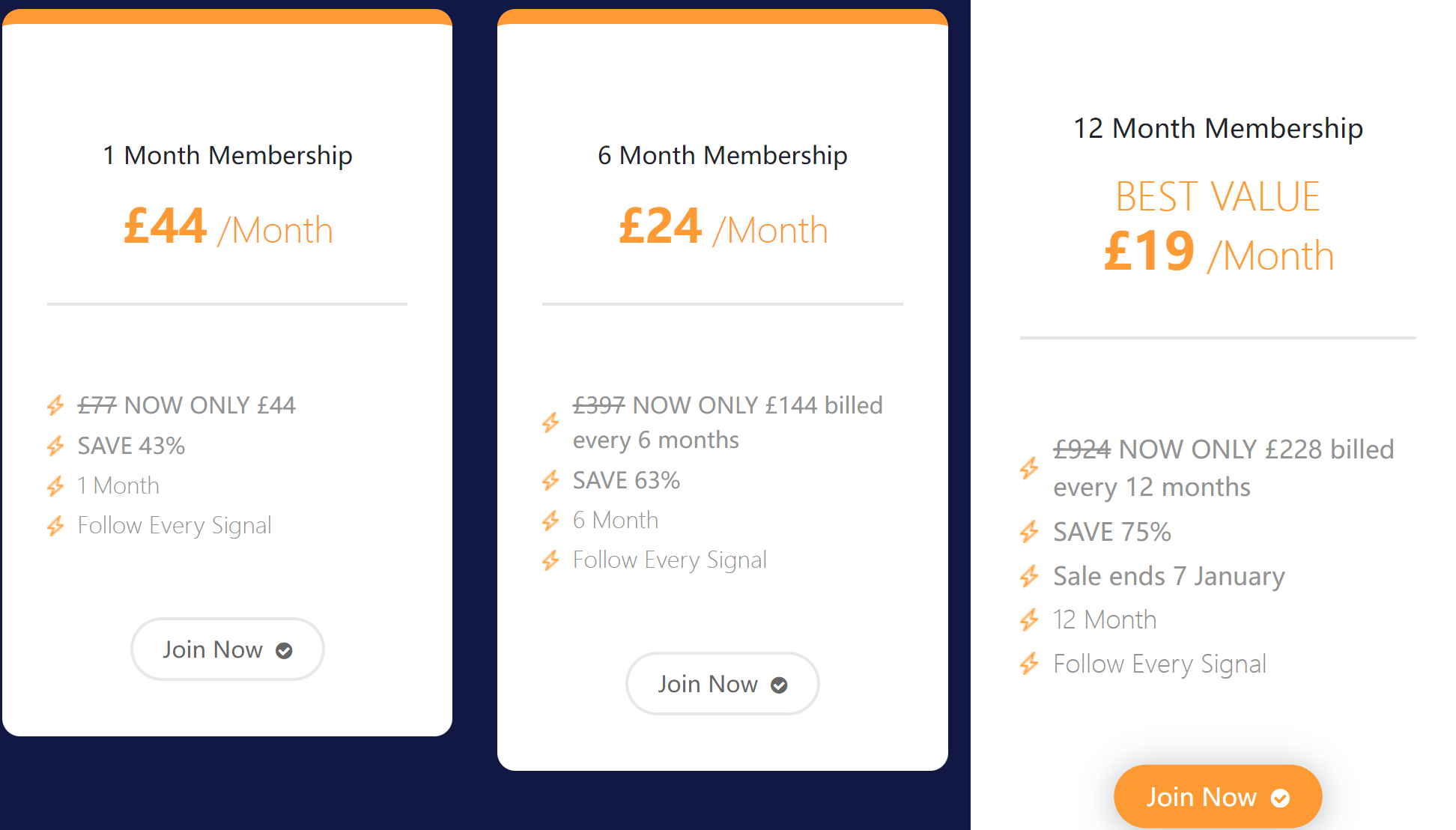

Subscription Fees

| 1 Month Membership | 6 Month Membership | 12 Month Membership | |

| Cost | £44/Month | £77 NOW ONLY £44 | £924 NOW ONLY £228 |

| Discount | None | SAVE 43% | SAVE 75% |

Reasons for being listed and shortcomings

Pros

Compatible with 15 forex pairs

User-friendly, suitable for beginners

Daily signals covering various time zones

Transparent performance via MyFXBook

Competitive, flexible pricing plan

Cons

No free forex signals

Free Trial not available

2. Learn2Trade

Leading Technical Signal Provider - Emerging Forex Signal With L2T Algo

Learn 2 Trade (L2T) distinguishes itself among the best forex signal providers for several compelling reasons, with a focus on cutting-edge technology and a commitment to delivering superior trading signals.

What makes Learn 2 Trade unique is its advanced L2T Algorithm, a meticulously crafted program that generates forex signals. The technological prowess of L2T's system is evident in its adaptability to market changes and fluctuations. The algorithm's ability to adjust in real-time guarantees a constant flow of dependable trading signals. For traders engaged in 24/7 cryptocurrency trading, L2T offers a reassuring feature – the execution of crypto trades even when they are not actively monitoring the markets.

Here is a summary of its basic information:

| Learn2Trade | |

| Rating | ⭐⭐⭐⭐⭐ |

| Premium Signals | 3-5 signals daily |

| Free Signals | ✔️ |

| Subscription Fees | £21.5-50 per month |

| Channels to Receive | Telegram |

| Service Support | In 24 hours in 7 days |

| Free Trial | ❌ |

You can watch this video to understand how these signals work:

L2T's user-friendly setup process, taking approximately ten minutes, adds to the platform's allure. Each purchase comes with a detailed manual, facilitating a hassle-free experience for traders.

The 79% success rate means that for every 1,000 signals sent, Learn2Trade aims for 790 profitable trades. Learn2Trade is suitable for beginners and experienced traders alike, as it provides all trading order requirements.

Subscription Fees

| Subscription Type | Monthly Price | Total price | Billing Cycle |

| 1 month subscription | £40 | £40 | billed every month |

| 3 month subscription | £29.70 | £89 | billed every 3 months |

| 6 month subscription | £21.50 | £129 | billed every 6 months |

| Lifetime subscription | N/A | £399 | one-time payment |

| Separate Swing Trading Group | £50 | £50 | billed every month |

Reasons for being listed and shortcomings

Pros

Applying advanced algorithm technology

Five premium signals sent daily via Telegram

Up To 70 Signals Monthly

Copy Trading

More Than 70% Success Rate

24/7 Cryptocurrency Trading

Cons

Functions are more cumbersome for beginners

3. PRICEACTION FOREX

Popular Trading Signal Provider with Comparatively Lowest Price

In terms of its strategy, PriceAction Ltd specializes in intraday and swing trading. As such, some trades are kept in place for minutes or hours, and others for days or weeks. PriceAction focuses on the London and New York trading sessions, so you‘ll need to ensure you’re available during these hours. When it comes to pricing, youll have three plans to choose from.

Flexible monthly plans cost $119 per month. You can save 40% by signing up for three months, which costs $120. There‘s also a lifetime plan at $250. However, you’d want to test PriceAction Ltd out before considering this option. PriceAction Ltd also has a separate Telegram channel that offers free forex signals. This currently has over 86,000 members.

Here is a summary of its basic information:

| PRICEACTION FOREX | |

| Rating | ⭐⭐⭐⭐ |

| Premium Signals | 3-8 signals daily |

| Free Signals | ✔️ |

| Subscription Fees | $40/mo or $250 lifetime |

| Channels to Receive | Telegram |

| Service Support | In 24 hours in 7 days |

| Free Trial | ❌ |

Subscription Fees

| Level | Duration | Price per Month | Total Price | Savings |

| Novice | 1 month | $119 | $119 | - |

| Intermediate | 3 months | $40 | $120 | $120 |

| Expert | Lifetime | - | $250 | $249 |

Reasons for being listed and shortcomings

Pros

Top-tier forex signals suitable for trading during the London and New York sessions.

Receives between 3 to 8 premium signals daily, offering ample trading opportunities.

The free Telegram signal channel boasts a robust community with over 86,000 members.

Provides signals that cater to intraday and swing trading strategies, supporting flexibility in trading styles.

Cons

Does not provide coverage for the Asian trading session, potentially missing opportunities in this market.

4. WOLFX Signals

Comprehensive Signal Provider for Combining Forex and Cryptocurrency Signals

WOLFX Signals combines forex and cryptocurrency signals together. For cryptocurrency or forex signals, the service is priced at $89 per month respectively. So, if you‘re interested in both asset classes, WOLFX Signals charges $139 per month, which is more cost-effective. If you’re happy with the signals received, theres also a lifetime plan for $399.

Alternatively, for just $89 per month, you can choose to solely receive forex signals. In any case, the delivery of all signals is facilitated through the WOLFX Signals Telegram channel, ensuring immediate receipt upon posting.

If you're contemplating a trial of WOLFX Signals prior to engaging in a monthly subscription, the option to join their free Telegram group is available. This group provides two forex and cryptocurrency signals per week. In addition, it provides regular updates on the performance of their VIP groups across both asset classes. WOLFX Signals' free Telegram group, boasting over 84,000 members, showing its wide-reaching popularity. Here is a summary of its basic information:

| WOLFX Signals | |

| Rating | ⭐⭐⭐⭐ |

| Premium Signals | 1-4 signals daily |

| Free Signals | ✔️ |

| Subscription Fees | $89 per month or $399 lifetime plan |

| Channels to Receive | Telegram |

| Service Support | In 24 hours in 7 days |

| Free Trial | ❌ |

Subscription Fees

| Categories | Monthly Price ($) | Lifetime Price ($) |

| Crypto Signals | 89 | 279 |

| Forex Signals | 89 | 279 |

| Crypto & Forex Signals | 139 | 399 |

Reasons for being listed and shortcomings

Pros

Provides signals covering both forex and cryptocurrency markets.

Offers a free plan, providing two complimentary signals each week.

Operates a bustling free Telegram group, capturing a community of over 84,000 members.

Significant discounts are available for lifetime plan subscriptions.

Cons

Does not disclose historical returns, limiting transparency on past performance.

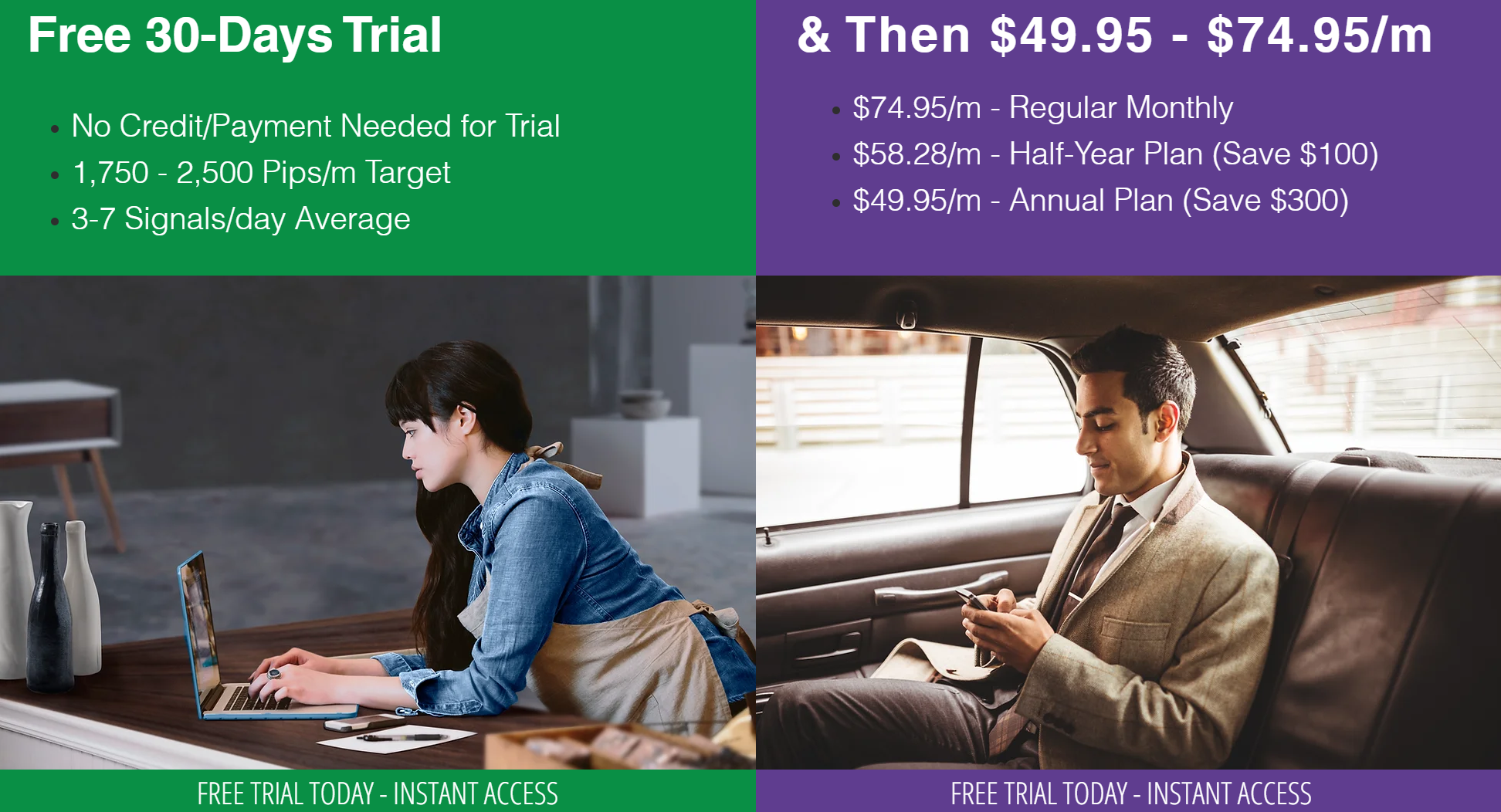

5. Pips Alert

User-friendly Signal Provider with a 30-day Long Free Trial Period

Pips Alert is a specialized company that focuses on offering forex trading signals. It has a dedicated team and sophisticated analysis system for the purpose of creating as many profit opportunities as possible in the forex market. You can start testing the service by paying nothing for a 30-day trial period with no need for a credit card, debit card or PayPal. If you're a beginner or risk-averse, you can try their services on a demo account, which is 100% risk-free for you.

Pips Alert can provide up to 2,500 pips per month. You can gain access to three different trading rooms, each offering a variety of FX signals. On average, you can receive 3-7 signals daily, all of which can be sent to any device.

Here is a summary of its basic information:

| Pips Alert | |

| Rating | ⭐⭐⭐⭐ |

| Premium Signals | 3-8 signals daily |

| Free Signals | ✔️ |

| Subscription Fees | $49.95-$74.95 per month |

| Channels to Receive | Telegram |

| Service Support | In 24 hours in 7 days |

| Free Trial | 30 days |

Subscription Fees

| Subscription Type | Monthly Fee | Savings |

| Regular Monthly | $74.95 | N/A |

| Half-Year Plan | $58.28 | $100 |

| Annual Plan | $49.95 | $300 |

Reasons for being listed and shortcomings

Pros

Professional team and an advanced analysis system

Offers a 30-day free trial to fully test the service

Can be tested without the need for a credit card, debit card, or PayPal

100% Risk Management Commitment

Can provide up to 2,500 pips each month

Cons

Signal success rate is not stated

Forex Trading Knowledge Questions and Answers

How Do Forex Trading Signals Work?

Forex trading signals are suggestions or recommendations for making trades in the Forex market. These recommendations, which can be generated manually by an experienced trader or automatically by a software or robot, provide insights on specific currency pair trades at a specific time and price.

Heres a simple step-by-step explanation of how forex trading signals work:

Generation of Signal:

The first step is the signal generation. This can happen in two ways — manual or automated. In manual signal generation, an experienced individual trader, professional team of traders, or experienced analysts scrutinize and analyze the market trends, and predict which currencies pairs to trade on. In an automated system, a software or robot is used to create signals based on trends and algorithms.

Signal Reception:

Once the signal is generated, it is sent out to the subscribers of the forex trading signal service. These signals can be sent via various means such as emails, SMS, or directly into the trading systems.

Interpretation of the Signal:

The next step involves understanding the signal. Typically, a signal contains the information about which currency pair to trade, whether to buy or sell the pair, the entry price, the stop loss price, and the take profit price.

Trade Execution:

After understanding the signal, the trader can choose to follow the signal and execute the trade as suggested or ignore it if they do not agree with it.

Management of the Trade:

Finally, after the trade has been placed, it's important to monitor the market conditions and manage the trade. This may involve moving your stop loss or take profit levels.

Benefits of Using Forex Trading Signals

Forex Trading Signals provide several benefits valuable to traders. Firstly, they offer valuable guidance for decisions, especially for beginners unsure about when or what to trade. They provide concrete trading advice based on robust technical analysis by experienced professionals, eliminating guesswork and helping to mitigate potential losses.

Secondly, these signals can save considerable time as the laborious task of market analysis is already undertaken by seasoned experts. Therefore, traders can utilize their time more efficiently on other aspects of trading or on their other commitments.

Finally, Forex Trading Signals can also be a tool for learning. Traders can study the decision-making process backed by these signals, understanding the rationale behind each signal, and gain considerable insights into market analysis and forecasting. This can prove beneficial for strengthening one's trading strategy over time.

What to Consider When Choosing A Forex Signals Provider?

When selecting a Forex signals provider, several crucial factors merit consideration to ensure that the chosen service aligns well with your trading goals and strategies.

Choosing a reliable provider is not just about the potential for profit; it also encompasses understanding the credibility of the signal source, their performance track record, fees, and the type and frequency of the signal they provide. It's a multifaceted decision that requires careful research and comparison, as this can largely influence the success of your Forex trading journey.

✔️ Quality of Signals

When it comes to choosing forex signals, the emphasis should rest on quality and depth, rather than sheer quantity. Seek platforms that furnish extensive supplementary information and market analysis along with the trading signal itself.

At its most basic, your forex trading signal should delineate the currency pair involved, the direction of the trade, the optimal entry price, along with guidance on where to position your stop-loss and take-profit markers. Preferably, you would want price charts that rationalize the trading decision, further enhancing your insight. Premium platforms serve these signals well in advance, often providing anticipatory 'ready' advisories suggesting an impending buy or sell signal, ensuring you're never caught off guard.

✔️ Success Rate/History performance

It pays to take time to examine the returns that a forex signal service has provided in the past. This is where a free trial can be useful, as you can get an idea of how successful the signals are. You'll want to look at the success rate of the signal provider's past trades. The higher the success rate, the more reliable their signals are likely to be.Good, reputable signal providers should show you their historical performance themselves as proof you can trust their work.

✔️Subscription Fees

The first point to consider is cost. In terms of cost, most signal providers offer two or more pricing plans to pick from, including monthly and lifetime plans. Usually, according to the signal providers mentioned earlier, the monthly fee tends to be around $50-$100.

On the other hand, a lifetime plan is relatively more cost-effective, typically around $300, allowing you to enjoy a lifetime signal service.

✔️ Free Trial

Find out if the provider offers a trial period or demo version for you to test their signals before committing your money. Several signal providers give membership subscription plans with a 7-day or 1-month trial duration.

Leveraging this component, we can garner a comprehensive understanding of whether the service provider is congruent to our prerequisites at a negligible expense, or even without incurring any costs at all. The subsequent selection to collaborate with them can effectively mitigate prospective risks.

✔️ Types Of Forex Pairs

Some forex signals providers will specialize in certain trading pairs – like GBP/USD or EUR/USD. In the case of Learn 2 Trade, its algorithm has the capacity to analyze dozens of majors, minors, and exotics – subsequently giving you the greatest number of trading opportunities throughout the week. Moreover, its algorithm also analyzes other asset classes such as cryptocurrencies, indices, and commodities.

Remember, the more currency pairs a provider offers signals for, the more opportunities you have to trade.

✔️ Technicals, Fundamentals, Or Both

Depending on the source of the signals, signal providers focus on different aspects. A majority of signal providers analyze signals through advanced algorithmic technology, while others pay attention to the latest news events. For instance, at Learn 2 Trade, this signal provider obviously utilizes algorithm techniques.

How to Use Forex Signals?

We've unpacked virtually everything you need to understand about forex signals for 2024, using Learn 2 Trade, which we referenced earlier, as a working example. Below are subsequent steps on its application:

Step 1: Register for the Flexible Monthly Plan

Start by navigating to the Learn 2 Trade website and subscribing to a premium plan. Opting for a long-term plan could effectively lower your monthly charges.

Step 2: Participate in the Learn 2 Trade Premium Telegram Group

Access to the Learn 2 Trade premium Telegram group is afforded exclusively to paid subscribers. Post-subscription, you'd receive an email briefing you on the membership process.

When Learn 2 Trade broadcasts a signal, it'll promptly show up in this Telegram group. Therefore, setting a personalized alert might ensure you keep tabs on each signal as swiftly as arrives.

Step 3: Initiate a Forex Demo Account

Before staking real money, we reckon it prudential to backtest Learn 2 Trade's signals. This would necessitate a brokerage demo account that syncs with real-time forex market trends - an easy feat given forex's daily multi-trillion-dollar traction.

Step 4: Apply Recommended Signals on Your Demo Account

With the demo account in place, you are equipped to commence the backtesting operation. An alert from the Learn 2 Trade Telegram group signifies you've been served a signal.

Here's a case in point: Learn 2 Trade suggests:

Pair: USD/EUR

Trade: Buy

Limit: 1.0926

Stop-Loss: 1.0900

Take-Profit: 1.0989

This implies that you're to lodge a buy order on AUD/CHF. Be sure to pick a 'limit order' and key in the suggested 1.0926 price. An appropriate stop-loss and take-profit at 1.0900 and 1.0989, respectively, should follow. Also, input your stack, an value that should ideally remain consistent through the backtesting phase. Lastly, post the order - only to be actioned if Learn 2 Trade's advised limit order price (1.0926) comes into effect.

Step 5: Assess Signal Performance

The preceding steps should guide your handling of each signal from Learn 2 Trade. Ideally, sustain this backtesting run for no less than 3 weeks.

This period serves to evaluate Learn 2 Trade's profitability levels, considering you're to receive up to five signals/day. Provided you find Learn 2 Trade's service satisfactory, you could contemplate subscribing to a lengthy plan, potentially sparing you monthly expenses.

You Also Like

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!