Ready to transform your financial future with spread betting? Imagine capitalising on market movements, regardless if they go up or down. This is not a dream, but a real possibility with the strategy of spread betting.

In this comprehensive guide, we'll demystify spread betting by breaking down its workings into 6 easy steps, comparing it with CFDs, laying out its pros and cons, and delivering proven strategies. We will also answer those frequently asked questions you've always wanted to ask. So sweep your fears and doubts aside, let's unveil the dramatic potential of spread betting together. Are you ready for a financial revolution?

What is Spread Betting?

Spread betting is a type of speculation on the direction of a financial market without actually owning the underlying securities. It involves predicting whether the market's price will rise or fall within a certain spread or range.

If the market moves in the direction that you predict, you'll profit for each point it moves; if it moves against you, you will incur a loss for each point.

This type of betting is particularly popular in forex and commodities markets.

What Markets Can Spread Betting Be Used in?

Spread betting can be used across a variety of financial markets, including:

Forex: This is the most popular market for spread betting. Traders speculate on the price movements of currency pairs.

Indices: Spread betting on indices allows you to speculate on the movement of an entire stock market index, rather than individual shares.

Commodities: Traders can speculate on the price movements of different commodities like oil, gold, silver, and wheat using spread bets.

Shares: Traders can spread bet on individual company shares, predicting whether the share price will rise or fall.

Bonds and Interest Rates: Some spread betting platforms also allow for speculation on changes in government bonds and interest rates.

Cryptocurrencies: Some providers allow spread betting on the price of various cryptocurrencies such as Bitcoin or Ethereum.

How does Spread Betting Work? (6 Steps)

Spread betting works by speculating on the direction of a financial market without actually owning the underlying securities. Here are the main steps involved:

Step 1: Choose a Market

First, you select a financial market that you want to place a spread bet on. This could be forex, indices, commodities, shares, and more.

Step 2: Decide to Buy or Sell

If you believe the market price will rise, you 'buy' or go 'long'. If you predict the market price will fall, you 'sell' or go 'short'.

Step 3: Choose Your Stake

Determine the amount you are willing to risk for each point the market moves in your chosen direction.

Step 4: Place Your Bet

With your decision made, you can place your spread bet.

Step 5: Monitor the Market

After your bet is placed, you closely monitor the market movement.

Step 6: Close your Bet

You can decide to close your bet at any time.

If the market moves in the direction of your bet, you earn profits for each point it moves. If the market moves against your bet, each point moves in the opposite direction results in a loss of your stake.

Spread Betting vs CFD: What's the Difference?

When deciding between spread betting and CFD (Contract for Difference) trading, it is useful to understand the difference between the two practices. Both offer unique advantages and limitations that may influence your decision.

The table below outlines the key differences in several factors including ownership, taxation, trading costs, market availability, deal size, and complexity.

| Factors | Spread Betting | CFD Trading |

| Ownership | No ownership of asset | No ownership of asset |

| Taxation | No Capital Gains Tax (in the UK) | Capital Gains Tax applicable (in the UK) |

| Trading Costs | Included in the spread | Separate commission charge |

| Market Availability | Forex, indices, commodities, shares | More market variety |

| Deal Size | Amount per point of movement | Quantity of contracts traded |

| Complexity | Less complex | More complex and suited for experienced traders |

As you can see above, both spread betting and CFD Trading enable traders to speculate on price movements without owning the underlying asset. While spread betting can be more simple and straightforward, CFD trading tends to offer more variety in the markets and may be more suitable for experienced traders.

Pros & Cons of Spread Betting

The following table summarizes the advantages and disadvantages of spread betting. It provides an at-a-glance view of the key factors you should consider when evaluating whether spread betting is right for you.

| Pros √ | Cons × |

| No Capital Gains Tax | High Risk |

| Access to Various Markets | Fast Losses |

| 24 Hour Markets | Complicated for Beginners |

| No Ownership of Underlying Asset | Overnight Financing Cost |

| Potential Profits in Falling | Potential for Large Losses |

Pros

No Capital Gains Tax: In some jurisdictions, spread betting is not subject to capital gains tax. Remember to check the tax regulations of your own country.

Access to Various Markets: Spread betting is available on hundreds of markets including forex, indices, commodities, shares, and more.

24 Hour Markets: Some platforms allow you to spread bet 24 hours a day.

No Ownership of Underlying Asset: You're betting on the potential price movement of an asset, but you don't actually own it.

Potential Profits in Falling Markets: By going short, you could potentially profit from falling markets.

Cons

High Risk: Spread betting typically carries a higher level of risk compared to other trading forms.

Fast Losses: The markets can move quickly, and you can lose your total stake in a short amount of time.

Complicated for Beginners: It may be difficult to understand for novice traders due to its complexity.

Overnight Financing Cost: If you hold your bet overnight, many providers charge a financing cost.

Potential for Large Losses: Spread betting is a leveraged product, meaning you can lose more than your initial deposit.

Spread Betting Strategies

In the domain of spread betting, understanding strategic movements can be the key to anticipated success. Three fundamental strategies that every spread betting enthusiast should comprehend are 'Going Long', 'Going Short', and 'Hedging'.

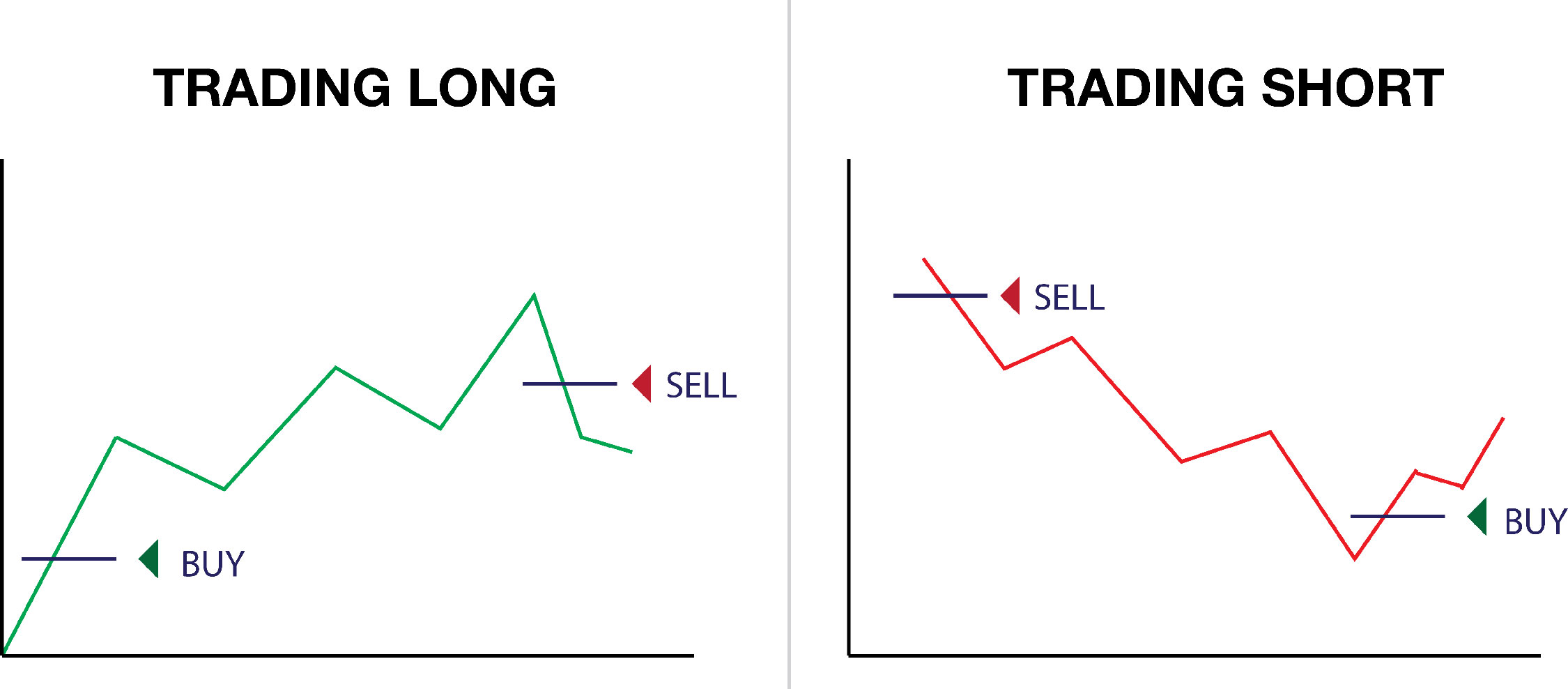

Going Long/Buy (Betting that the Price Will Rise)

When you go long in spread betting, you bet that the price of an asset will rise. This term is used when you believe the market price of a particular asset is going to increase, so you ‘buy’ in anticipation of profiting from the increase.

e.g. Going Long on EUR/USD:

Suppose the current forex spread for EUR/USD is 1.2000/1.2002, with 1.2000 being the sell price and 1.2002 being the buy price. Predicting that the EUR will strengthen against the USD, you decide to 'go long' and buy at the rate of 1.2002 for $1 per point. Later, if the price rises to 1.2030/1.2032, you can close your position at the new sell price of 1.2030. Your profit will be (1.2030−1.2002) x $1 x 10,000*= $28.

* When calculating profits or losses from forex spread betting, the amount is usually multiplied by 10,000 because a standard “lot” in forex trading is 100,000 units of the base currency, and the price movements are typically measured in pips, where 1 pip is equal to 0.0001.

Going Short/Sell (Betting that the Price Will Fall)

Going short, on the other hand, is betting that the price of an asset will fall. This means you sell or 'short' the market with the expectation that the price will decrease, allowing you to buy back at a lower price to make a profit.

e.g. Going Short on USD/JPY:

The current forex spread for USD/JPY is 110.00/110.02. Thinking that the USD will weaken against the JPY, you decide to 'go short' and sell at the rate of 110.00 for $1 per point. If the price later falls to 109.70/109.72, you can close your position at the new buy price of 109.72. Your profit will be (110.00−109.72) x $1 x 100* = $28.

* In the provided USD/JPY example, the amount is multiplied by 100 because the second decimal place in a yen-based forex pair equals 1 pip, not the fourth as in most other pairs. This is due to the difference in value between the yen and other major currencies.

Hedging

Hedging involves placing a bet that will offset potential losses incurred by another investment.

e.g. Hedging on GBP/USD:

Let's say you have a large amount of cash in GBP and you're worried the GBP might decrease in value compared to the USD in the near future. You could place a spread bet that GBP/USD will fall. If GBP/USD does fall, the profit from your spread bet could offset some or all of the losses from your GBP cash value.

To recap, 'Going Long', 'Going Short', and 'Hedging' represent core spread betting techniques. Mastering them will not only provide a sturdy foundation for your spread betting journey, but also equip you with the necessary tools to venture into more complex strategies.

How to Start Spread Betting As a Beginner?

If you're a beginner looking to start spread betting, you should follow the following steps:

Understand What Spread Betting Is

Make sure you fully understand what spread betting is, how it works, and the potential risks involved. It's important to recognize that it's a complex form of financial trading that isn't suitable for everyone.

Educate Yourself

Take the time to educate yourself about spread betting and financial markets. This may involve reading books, taking courses, or learning from experienced spread bettors.

Choose a Spread Betting Broker

Do some research to find a reputable spread betting company that provides user-friendly platforms for beginners, educational resources, and good customer service.

There are several notable companies that offer spread betting services. Here are some of them:

IG: IG is a leading spread betting and CFD provider that offers access to a wide range of markets including forex, indices, shares, and cryptocurrencies. They're well-regarded for their trading platforms and educational resources.

CMC Markets: CMC Markets offer competitive spreads, a wide variety of markets and they have an excellent provision of educational materials and tools.

City Index: City Index also offers spread betting on various markets. They provide a suite of trading platforms and also have strong educational resources.

Spreadex: Spreadex offers a unique combination of sports spread betting and financial spread betting services.

On WikiFX, we have meticulously compiled a list of exceptional brokers from various regions and with a variety of trading conditions that you can query based on your requirements. We point you to top-notch Forex brokers around the globe through our handpicked selection like 'Best Forex Brokers in the World for 2024'. For those interested in high-volume trading, our round-up of the '10 Largest Forex Brokers in the World by Volume (2024)' could be of significant use. Please peruse through these carefully crafted listings and more on WikiFX to identify a broker that will best suit your trading needs.

Open a Demo Account

As a beginner, it can be helpful to start with a demo account to practice without risking real money.

Develop a Trading Strategy

Start to develop a simple trading strategy. This should include what markets you want to bet on, how much money you are prepared to risk, and when you will open and close your bets.

Risk Management

Spread betting has the potential for significant losses. It's essential to use tools like stop-loss orders* to manage your risk effectively.

* A stop-loss order is a type of order used in trading to limit potential losses or protect potential gains in case the price of a security moves in an unfavorable direction. Investors specify a particular price at which to buy or sell a security. If the price of the security reaches or crosses this specified price (the stop price), the order is executed.

Start Small

When you're ready to start trading with real money, start small. As your confidence and understanding increase, you can gradually begin to take on more risk.

Monitor the Market

Keep a close eye on the markets you're betting on and stay informed about relevant news and events.

Continuous Learning

Keep learning and adapting your strategies as you gain more experience.

Frequently Asked Questions about Spread Betting

Is spread betting legal in all countries?

No, spread betting is not legal in all countries. It's mostly popular and legal in the UK and some parts of Europe where it's regulated by financial authorities. It's also allowed in some other countries with certain restrictions. However, in the United States and some other countries, spread betting is considered illegal due to their gambling laws.

Is spread betting risky?

Yes, spread betting can be highly risky due to several factors:

Leverage: Spread betting often involves trading on margin, which means you only deposit a small percentage of the full value of your position. While this leverage can magnify profits, it can also lead to losses that exceed your initial deposit if the market moves against you.

Market Volatility: Financial markets can be unpredictable and can change direction quickly. This volatility can lead to losses if it moves against your position.

Overtrading: The ease and accessibility of spread betting can lead traders to make too many trades, or too large trades, which can amplify losses.

Lack of Ownership: In spread betting, you don't actually own the underlying asset you're betting on. This means you don't have the same rights as you would if you actually owned the asset.

Gap Risk: This refers to the risk that the price of an asset may “gap” or significantly change from one level to another without trading at prices in between. This can lead to losses that exceed your initial deposit.

Execution Risk: There is also a risk that your trades may not be executed at the prices you expect, which can lead to unexpected losses.

Keep in mind, understanding the markets and knowing how much you are willing to risk are key components of successful trading.

Do I need to pay taxes on spread betting?

In the UK, spread betting is classed as gambling, rather than trading, so it's exempt from Capital Gains Tax and Stamp Duty. However, tax laws vary by country and your personal circumstances can also affect your tax obligations.

Can I spread bet on both rising and falling markets?

Yes, one of the benefits of spread betting is that it allows you to speculate on both rising and falling markets. If you believe the price of an asset will rise, you can go long, or buy, and if you think it will fall, you can go short, or sell. This flexibility is part of what makes spread betting a popular strategy for many traders.

Risk Disclaimer

Please note that spread betting and other forms of trading involve significant risk of loss. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. Past performance is not indicative of future results.

You Also Like

Forex Day Trading VS Forex Scalping: Which One to Choose?

Unravel the clash of Forex day trading and scalping - grasp their tactics, track differences, and tailor your trade.

How to Hedge Forex Positions? Some Relevant Strategies to Share.

Dive into Forex hedging strategies - reducing risk, seizing opportunities and securing robust trading profits.

Can I Trade Forex without Stop-Loss? Here Lets’ Discuss

Start Forex trading without stop-loss - understand how it works, explore other options and possible risks.

Forex Market Hours: What is the Best Time to Trade Forex?

Master the clock of Forex trading - optimize profits by knowing the best trading times globally!