简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Use Bollinger Bands® in Forex Trading

Abstract:How to Use Bollinger Bands® in Forex Trading

Bollinger Bands® are utilised by technical traders in all financial markets including forex. This article will introduce Bollinger Bands® and how they assist traders in technical analysis. It will also provide an overview of top strategies and tips for trading forex with Bollinger Bands® - including trading the trend and the Bollinger squeeze.

WHAT ARE BOLLINGER BANDS® AND HOW TO DO THEY WORK?

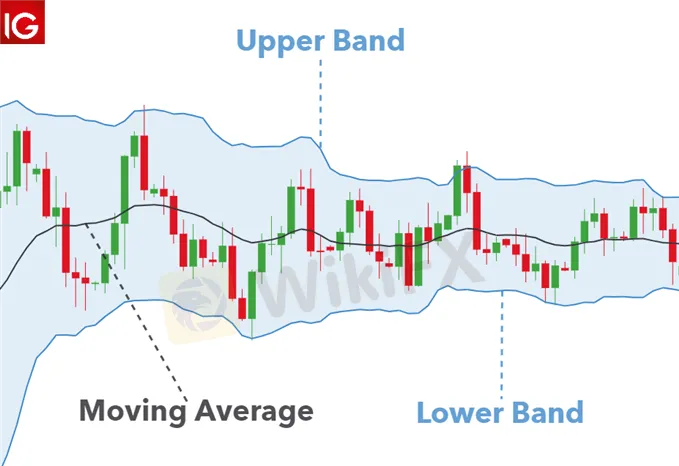

Bollinger Bands® are a versatile technical analysis indicator widely used among traders. John Bollinger first developed this indicator as a solution to find relative highs and lows in dynamic markets. The indicator itself is comprised of an upper band, lower band and moving average line.

The two trading bands are placed two standard deviations above and below the moving average (usually 20 periods). Using two standard deviations estimates that 95% of price data will be contained within the two bands.

As a rule of thumb, prices are deemed overbought on the upside when they touch the upper band and oversold on the downside when the reach the lower band.

As price oscillates between the indicators upper and lower extremes Bollinger Bands® become an excellent tool to gauge volatility. When bands contract there is less volatility in the market, which is a great indication to use a range bound strategy. Likewise, Bollinger Bands® will expand as the market becomes more volatile. At these times traders may employ a breakout or a trend-based strategy.

HOW TO TRADE FOREX WITH BOLLINGER BANDS®

There are several different techniques involved in using Bollinger Bands® to trade the forex markets. The most popular are:

1) Using market trends: Traders can identify entry signals using the bands as a measure of support and resistance.

2) Bollinger Squeeze: Applying the volatility indications of the bands

1) TRADING THE TREND

EUR/USD weekly chart

The chart above shows the EUR/USD chart in an uptrend – depicted by higher highs and higher lows. Using the Bollinger Band® indicator, the lower band is seen as a gauge of support. When price touches the lower band, traders use this as a signal to enter a long (buy) trade. This strategy works for both uptrends and downtrends. Take profit (limit) levels are generally taken from the upper and lower bands depending on trend. In this example, the upper band will be used as the take profit level.

In summary, trading the trend with Bollinger Bands® is relatively simple:

Identify the trend

Use upper and lower bands in conjunction with price movement to identify entry points

Use respective upper and lower band as target levels

2) TRADING THE BOLLINGER BAND® SQUEEZE

EUR/USD weekly chart:

As mentioned previously, when the bands contract volatility is low and vice versa. The Bollinger squeeze looks for breakouts above/below the band depending on trend to be used as entry signs.

Highlighted in green shows these breakouts in an uptrend. Traders will look to enter at the indicated green circles. After each entry, it can be seen that the candles are ‘walking the Bollinger’ (following the upper band). After the breakout candle the bands expand implying greater volatility in the market.

The black shaded circles illustrate the point at which traders will look to take profit before looking for further breakout signals.

To summarise, when trading the Bollinger Band® squeeze:

Look for low volatility (contracting bands)

Wait for breakout of upper/lower band

Close trade when price reaches moving average

------------------

Use WikiFX to get free trading strategies, scam alerts, and experts experience! https://bit.ly/2XhbYt5

Any question please contact us via inbox of Wikifx Malaysia: m.me/Wikifx.myMY

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Inflation hot at 13-year high, what will happen to gold?

Inflation hot at 13-year high, what will happen to gold?

Optimism Ahead Of Bank Of Canada Decision

Optimism Ahead Of Bank Of Canada Decision

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

Find Your Forex Entry Point: 3 Entry Strategies To Try

Find Your Forex Entry Point: 3 Entry Strategies To Try

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator