Score

AMUNDI

China|2-5 years|

China|2-5 years| https://dya.amuud.com

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

鋒匯集團

AMUNDI

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

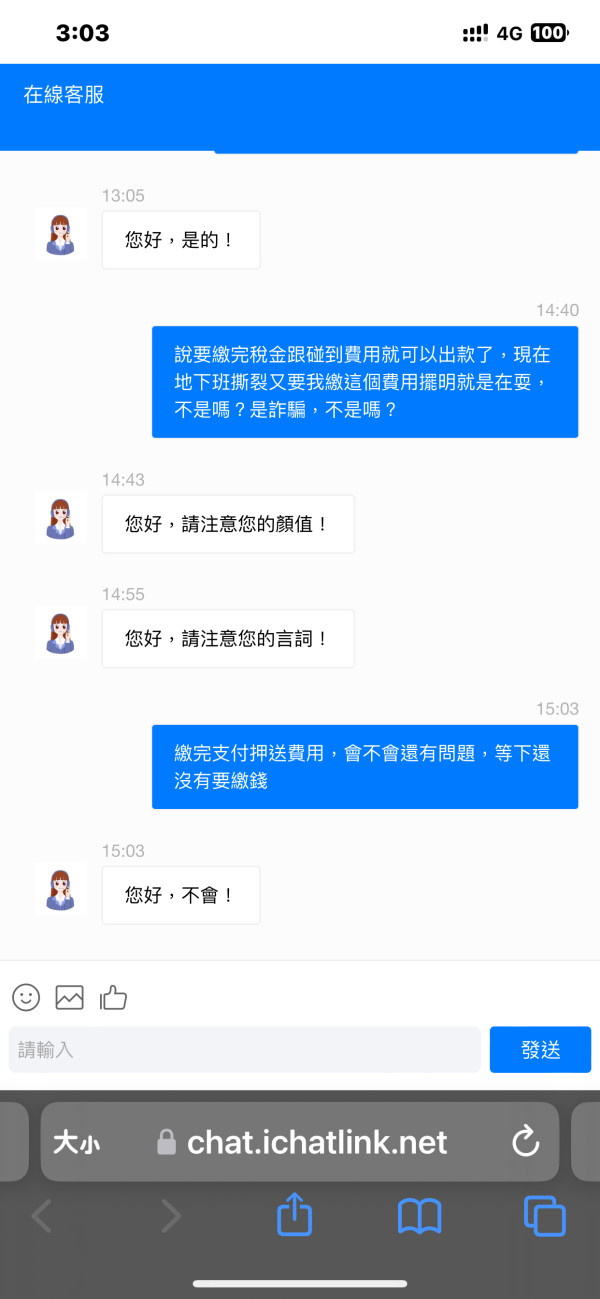

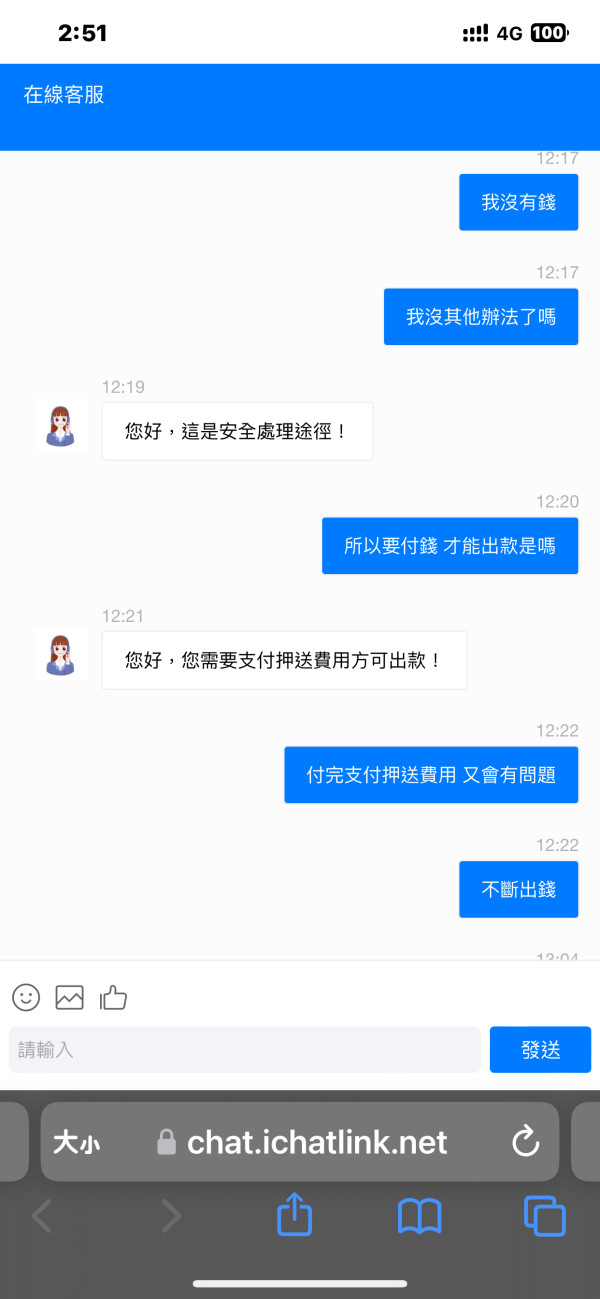

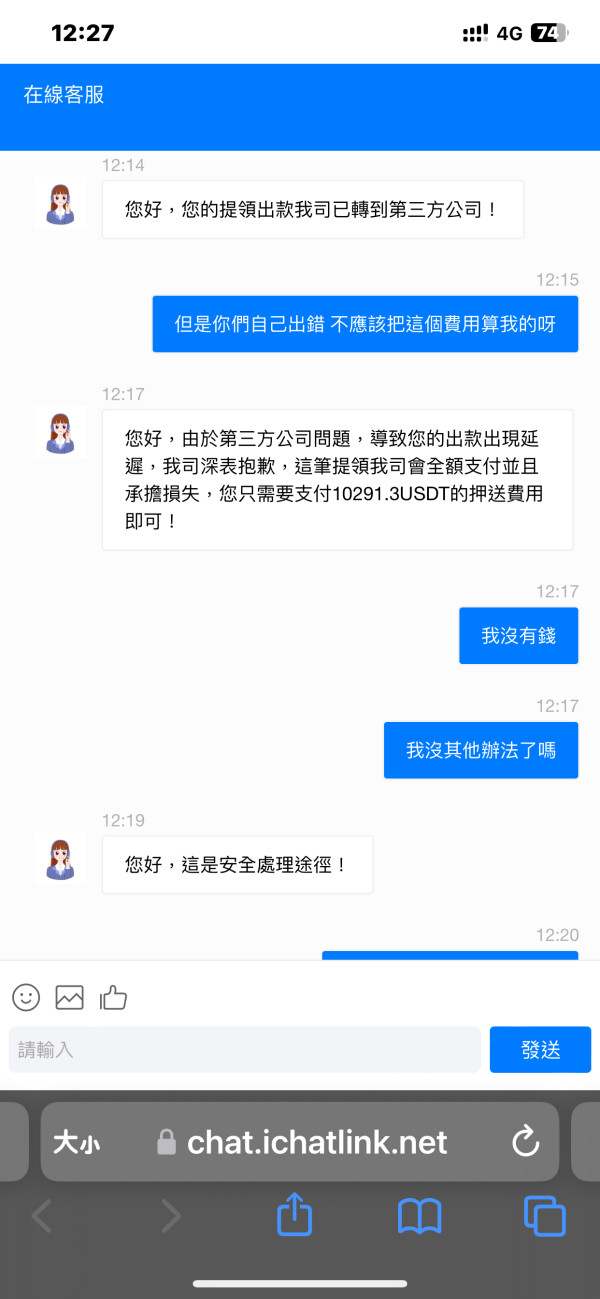

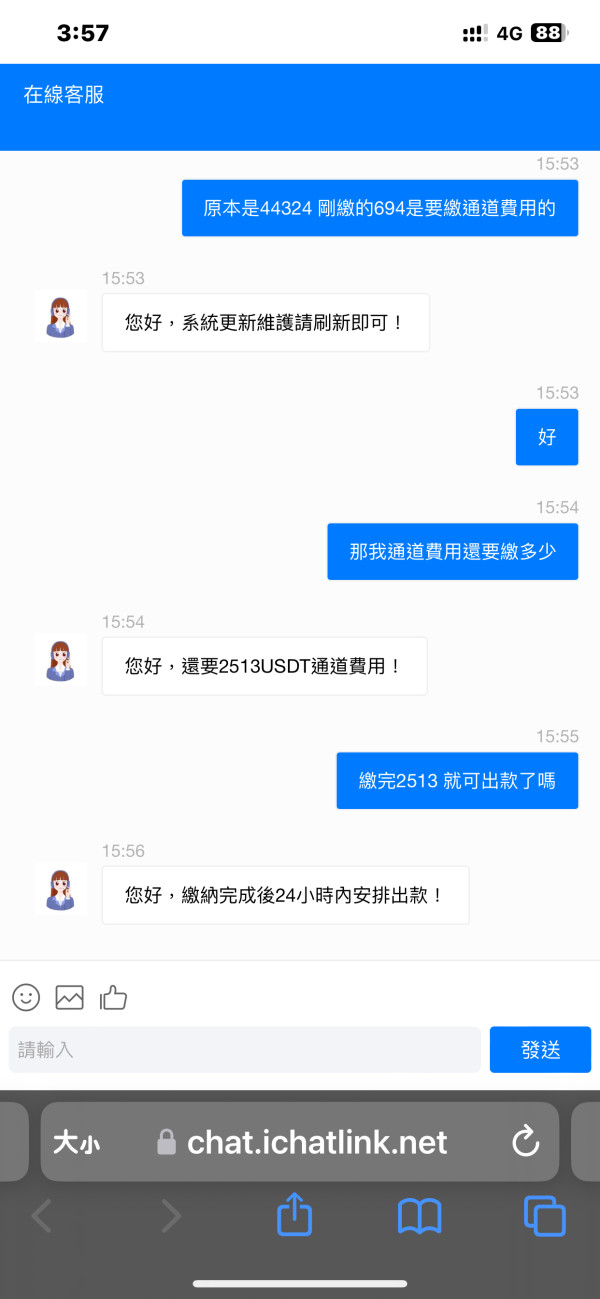

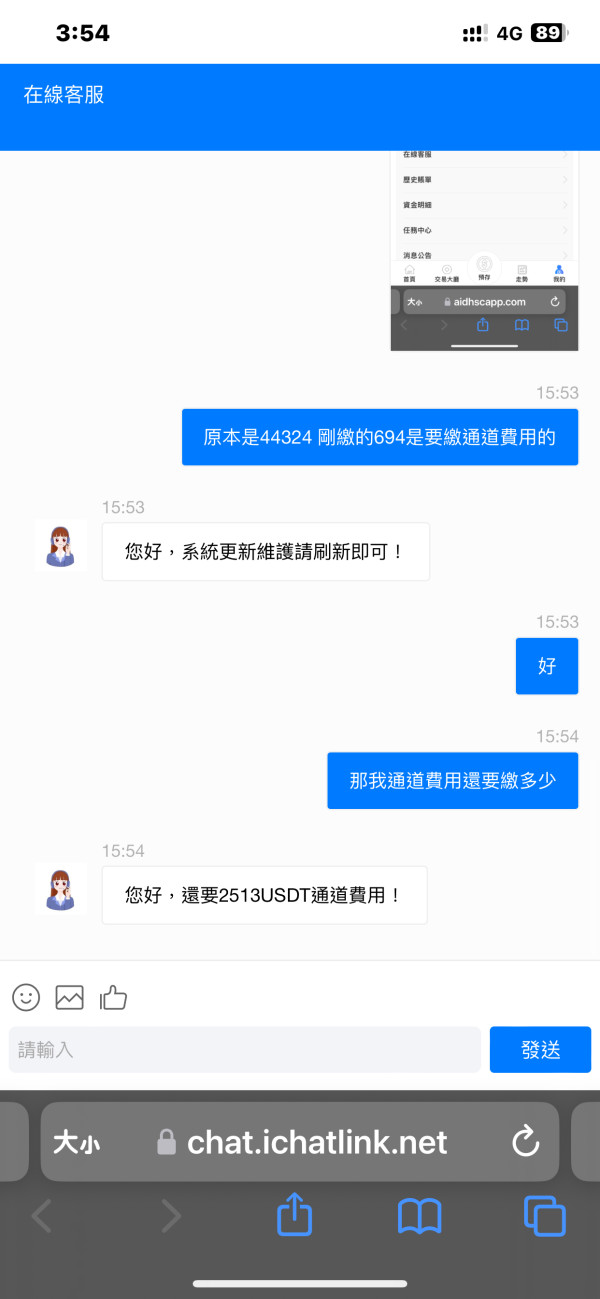

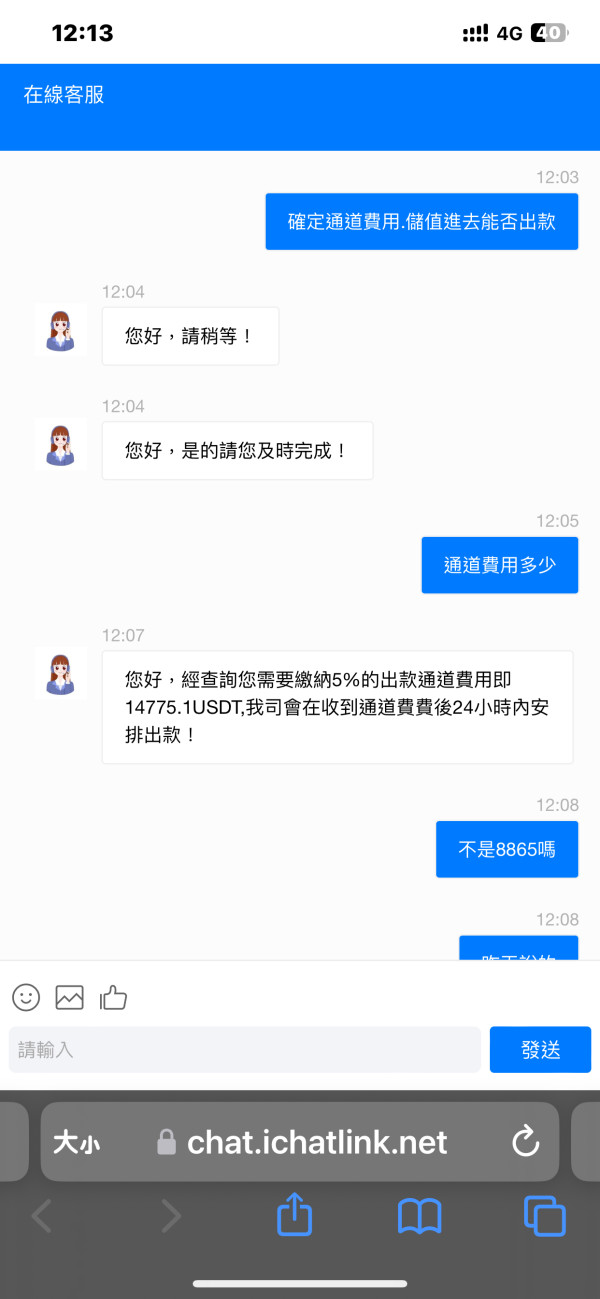

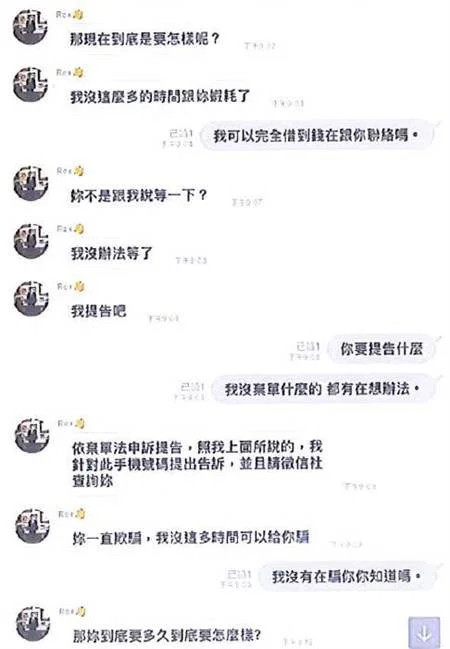

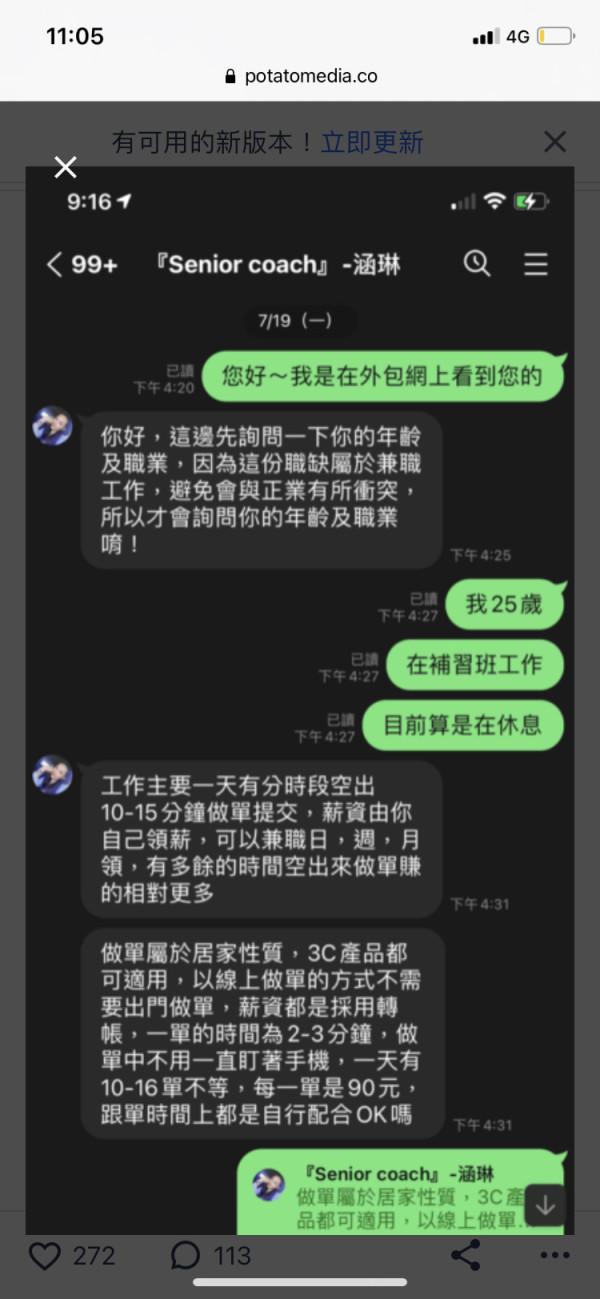

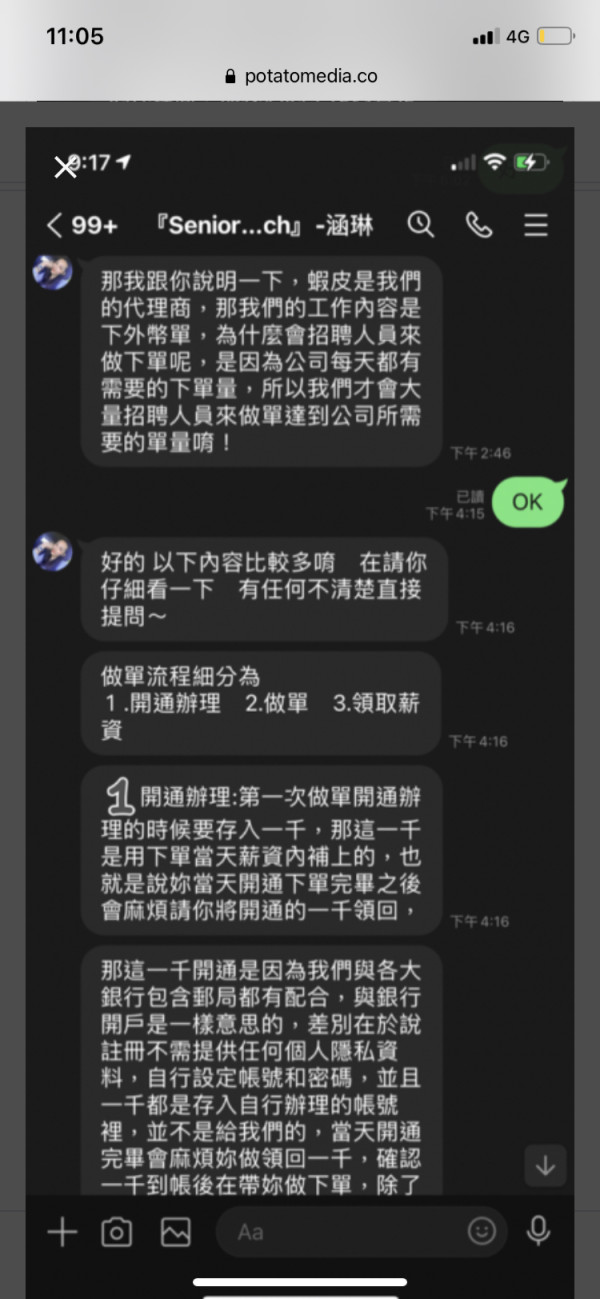

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed AMUNDI also viewed..

XM

IUX

EC Markets

HFM

AMUNDI · Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Company Name | AMUNDI |

| Regulation | Unregulated |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Spreads | Variable, influenced by market conditions |

| Trading Platforms | MetaTrader 4 (MT4) and SalmaFX Trader mobile app |

| Tradable Assets | Forex, CFDs on Indices, Cryptocurrencies |

| Account Types | Single type: STP Account |

| Demo Account | Available with $10,000 demo margin |

| Customer Support | Limited or not specified |

| Payment Methods | Bank transfer, Fasapay, NETELLER |

| Educational Tools | Limited or not specified |

Overview

AMUNDI, based in China, operates as an unregulated brokerage firm, which raises significant concerns about investor protection. While it offers a low minimum deposit of $1 and a high maximum leverage of 1:1000, the lack of regulatory oversight is a major drawback. Spreads are variable and influenced by market conditions. The trading platforms include MetaTrader 4 (MT4) and a mobile app, but the absence of regulatory compliance and reports of its website being down and associated with scams or fraud are alarming. Educational resources are also limited, and customer support is either limited or unspecified. Traders should exercise extreme caution when considering AMUNDI as their trading platform.

Regulation

AMUNDI operates as an unregulated brokerage firm, lacking oversight and regulatory safeguards. This exposes investors to higher risks, including potential fraud and fund mismanagement. Individuals considering AMUNDI or similar unregulated brokers should be cautious, conduct due diligence, and consider regulated firms for better investor protection.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

AMUNDI presents both advantages and disadvantages for traders. It offers a range of trading instruments, low minimum deposits, high leverage, and a demo account for practice. However, its unregulated status raises concerns about investor protection. The use of an outdated MT4 platform and the absence of customer support and educational resources may deter traders. Additionally, reports of website downtime and fraud allegations warrant caution when considering this broker.

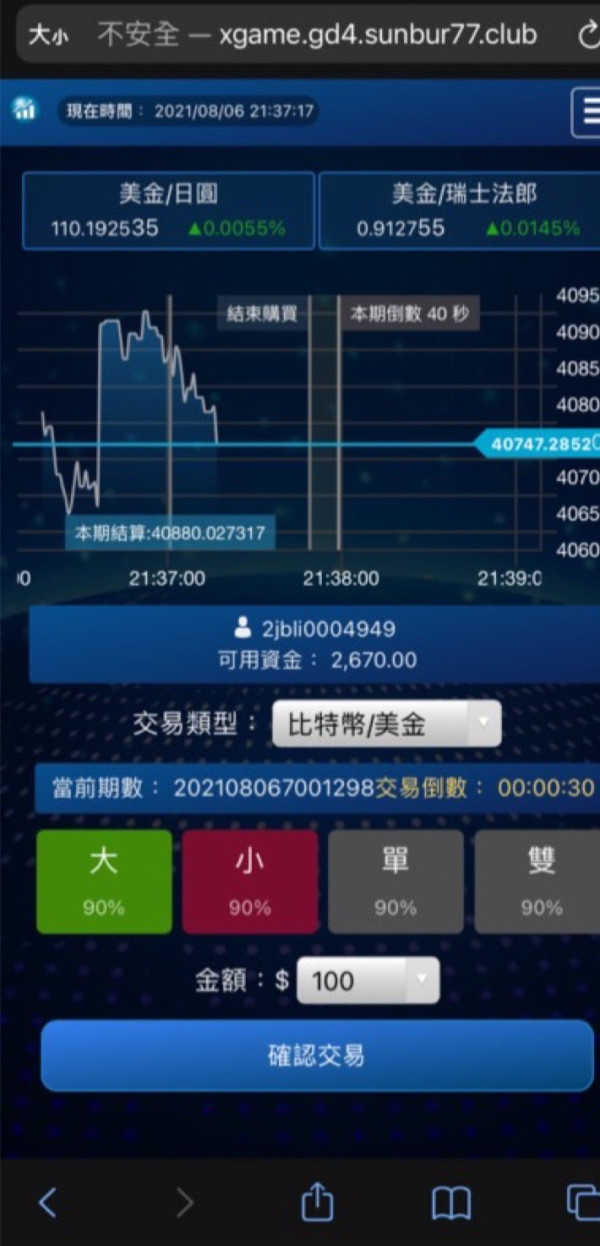

Market Instruments

AMUNDI offers a range of trading instruments, including:

Forex (Foreign Exchange):

Forex trading involves the exchange of one currency for another, such as EUR/USD (Euro/US Dollar) or EUR/GBP (Euro/British Pound). Traders speculate on the price movements of these currency pairs.

CFDs on Indices:

CFDs (Contracts for Difference) on indices allow traders to speculate on the price movements of stock market indices like JPN225 (Japan 225), AUS200 (Australia 200), GER40 (Germany 40), UK100 (UK 100), and ESTX50 (Euro Stoxx 50).

Crypto (Cryptocurrencies):

Crypto trading involves digital currencies like BTC (Bitcoin), ETH (Ethereum), and XRP (Ripple). These cryptocurrencies are used for various purposes, including digital transactions and investments.

Account Types

AMUNDI offers a single trading account type known as the STP Account, which caters to traders of various experience levels. However, it's important to note that AMUNDI does not offer multiple account tiers, which may limit customization options for traders seeking specific features or benefits.

STP Account Details:

Minimum Deposit: $1

Maximum Leverage: 1:1000

Demo Account: Available

Demo Margin: $10,000

Customization: Limited

Suitable For: Traders of Various Experience Levels

STP Account Features:

Affordable Entry: The STP Account has a low minimum deposit requirement of just $1, making it accessible to traders with varying budgetary constraints. This affordability can be particularly attractive to novice traders.

High Leverage: The account offers a high maximum leverage of 1:1000, potentially allowing for amplified positions in the market. However, it's important to understand that higher leverage also entails higher risk.

Demo Account Option:

AMUNDI also provides traders with the option to open a Demo Account, which is suitable for beginners. This demo account offers a risk-free environment for practice. However, traders should be aware that the demo trading experience may not perfectly replicate real market conditions and is often designed to encourage traders to transition to live trading.

In summary, AMUNDI primarily offers the STP Account for live trading, while the Demo Account is available for practice purposes. Traders should carefully consider their trading needs, risk tolerance, and understanding of leverage before engaging in live trading.

Leverage

AMUNDI provides a generous maximum trading leverage of up to 1:1000 for its STP Account, enabling traders to manage positions worth up to 1000 times their initial deposit. It's crucial to recognize that while high leverage can magnify potential gains, it also carries a substantial risk of losses. To safeguard their capital and engage in responsible trading, traders must exercise caution and employ effective risk management strategies when using such elevated leverage. A thorough understanding of leverage mechanics and associated risks is imperative before incorporating it into their trading strategies.

Spreads and Commissions

Spreads: AMUNDI offers variable spreads, meaning that the spread's width can vary based on market conditions. These variable spreads are influenced by factors like market volatility and liquidity. Traders should be mindful that while variable spreads can offer narrower spreads in favorable market conditions, they might widen during periods of heightened volatility.

Commissions: AMUNDI specifies a trading commission of 0 USD, indicating that there is no explicit commission fee applied to trades. Instead, the broker likely derives its revenue from the spread, meaning that traders indirectly incur a cost through the difference between the buying and selling prices, known as the bid-ask spread.

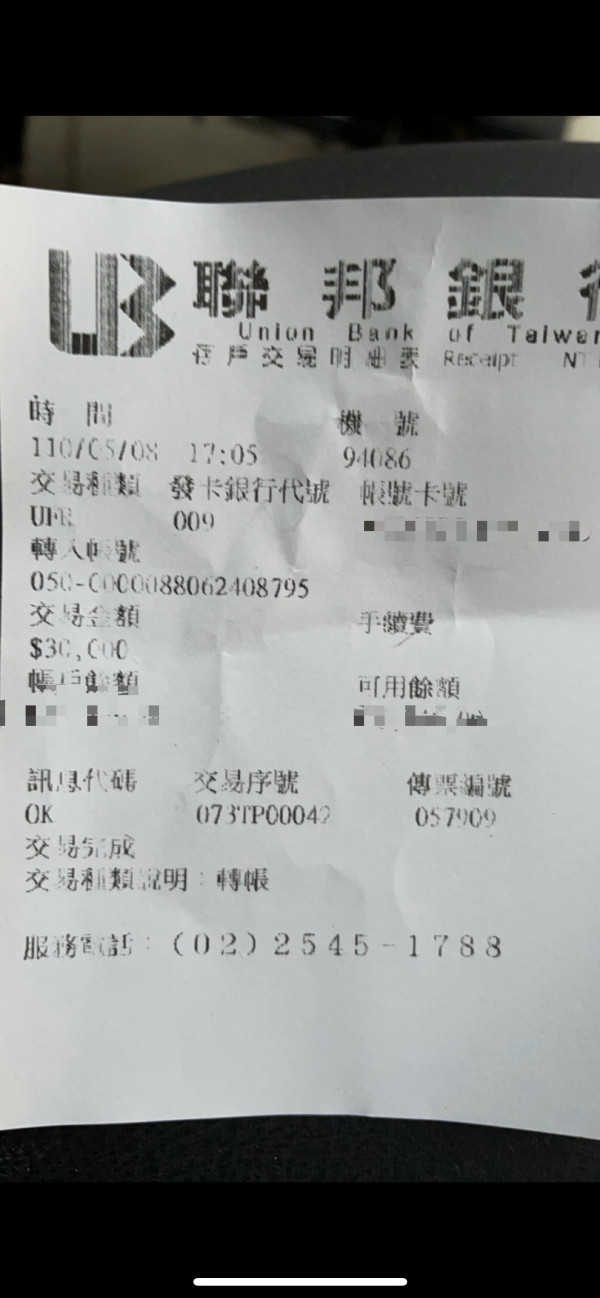

Deposit & Withdrawal

AMUNDI offers three primary deposit methods: bank transfer, Fasapay, and NETELLER. Each method has its own characteristics:

Bank Transfer: This method is secure but typically takes 1 - 5 business days to process deposits, and it does not involve any commissions.

Fasapay and NETELLER: These options allow for instant deposits with no associated fees.

For withdrawals, you have the same choices:

Bank Transfer: Withdrawals via bank transfer and Fasapay may take a bit longer to process, but they come with no withdrawal fees.

NETELLER: NETELLER offers regular withdrawals with no fees. Additionally, there is a Wire Transfer option available with a 0.2% commission (minimum $30).

It's important to note that all deposit and withdrawal methods use the “Current Exchange Rate.” For the most up-to-date information and details, it is advisable to refer to their official website.

Trading Platforms

AMUNDI relies on the MetaTrader 4 (MT4) trading platform, a widely recognized industry standard known for its comprehensive tools suitable for traders of all skill levels. However, it's worth noting that AMUNDI's use of MT4 may be considered somewhat outdated compared to more recent trading software options.

Furthermore, it's important to highlight that AMUNDI operates as an unregulated entity, which raises concerns regarding the reliability of their services, especially in terms of adhering to best execution practices.

For mobile trading, AMUNDI offers the SalmaFX Trader mobile app, which closely resembles MT4. However, doubts may exist about its competitiveness due to AMUNDI's loss of licensing status.

In summary, AMUNDI's primary trading platform remains MT4, but traders should exercise caution due to regulatory concerns. Exploring alternative platforms may be advisable for those seeking a more secure and up-to-date trading experience.

Customer Support & Educational Resources

AMUNDI appears to have limited or no customer support and educational resources available for its clients. This could potentially be a drawback for traders who value access to customer assistance and educational materials to enhance their trading knowledge and skills. When considering this platform, individuals should be aware of the lack of such support and resources and assess whether they are comfortable with this limitation.

Summary

AMUNDI, an unregulated brokerage firm, lacks oversight and regulatory safeguards, exposing investors to higher risks, including potential fraud. Their single STP Account offers high leverage, but caution is needed due to regulatory concerns. The MT4 trading platform is outdated, and doubts exist about their mobile app's competitiveness. AMUNDI's customer support and educational resources are notably limited. Furthermore, their website being down and reports of fraud or scams raise significant red flags. Traders should exercise extreme caution when considering this platform.

FAQs

Q1: Is AMUNDI a regulated brokerage?

A1: No, AMUNDI operates as an unregulated brokerage firm, which means it lacks oversight from financial authorities.

Q2: What trading instruments are offered by AMUNDI?

A2: AMUNDI offers Forex, CFDs on Indices, and Crypto trading instruments.

Q3: What is the minimum deposit required for the STP Account?

A3: The minimum deposit for the STP Account is $1.

Q4: Does AMUNDI offer a demo account for practice?

A4: Yes, AMUNDI provides a Demo Account with a demo margin of $10,000.

Q5: What deposit methods does AMUNDI support?

A5: AMUNDI supports deposit methods including bank transfer, Fasapay, and NETELLER, each with its own processing characteristics.

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now