简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

Abstract:FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

FX WEEK AHEAD OVERVIEW:

The second week of June sees a global focus on inflation concerns, both in data and in rhetoric.

US economic data due comes in the wake of the disappointing May US jobs report.

Overall, recent changes in retail trader positioning suggest that the US Dollar has a mixed bias.

06/09 WEDNESDAY | 01:30 GMT | CNY INFLATION RATE (MAY)

Like other central banks dealing with a statistical base effect coupled with rapidly appreciating commodity price and supply chain constraints, the Peoples Bank of China may look through any spike in the inflation figures that would, in an otherwise normal environment, suggest that a reduction in monetary support might be considered. And just recently, the PBOC mandated that financial institutions must increase the ratio of their foreign exchange deposits to 7% from 5%, forcing Chinese domestic market players to rebalance away from the Yuan, a move that may help support inflation pressures. Either way, due in at +1.6% from +0.9% (y/y), the headline May Chinese inflation reading may not influence Yuan rates, one way or the other.

06/09 WEDNESDAY | 11:00 GMT | MXN INFLATION RATE (MAY)

According to a Bloomberg News survey, the May Mexican inflation rate (CPI) is expected to show aslight deceleration to +5.86% from +6.08% (y/y). Now well into the base effect period around the start of the pandemic, Banxicos dovish inclinations are still being held at bay.

Recently, Mexican President Andres Manuel Lopez Obrador announced that he would not be nominating current Banxico Governor Alejandro Diaz de Leon for a second term, noting the replacement would be one “with a social dimension, one who is in favor of a moral economy.”

The implicit understanding is that the next Banxico Governor may not be has hawkish as their historical predecessors. In turn, Banxico may tolerate higher inflation without responding with corresponding rate hikes henceforth, a potential demerit against an otherwise seemingly bullish Peso.

06/09 WEDNESDAY | 14:00 GMT | CAD BANK OF CANADA RATE DECISION

The BOC meets this week for its June policy meeting, bringing CAD-crosses into the limelight for the next several days. Having already tinkered with its QE program (so it doesnt run into its self-imposed statutory limit), the BOC now appears that it will keep its main policy in place for the next several months. In fact, in recent weeks, BOC Governor Tiff Macklem expressed confidence in the decision to begin withdrawing stimulus, reaffirming the perception that the BOC has a somewhat hawkish bias relative to its other major peers.

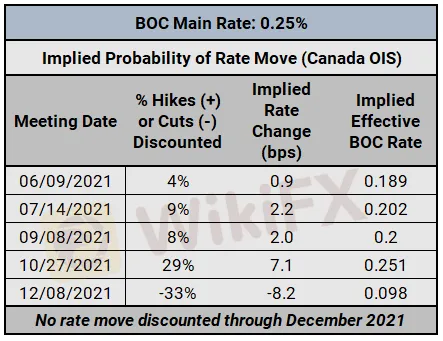

BANK OF CANADA INTEREST RATE EXPECTATIONS (JUNE 7, 2021) (TABLE 1)

Shifts in Canadian global bond yields may be leading to some temporary quirky pricing thanks to shifting expectations. For example, there is a 29% chance of a 25-bps rate hike by the October meeting, but then there is a 33% chance of a 25-bps rate cut by the end of the year. The BOC has made clear its content with its decision to taper; it remains the case that further action along the interest rate channel remains highly unlikely.

IG CLIENT SENTIMENT INDEX: USD/CAD RATE FORECAST (JUNE 7, 2021) (CHART 1)

USD/CAD: Retail trader data shows 77.23% of traders are net-long with the ratio of traders long to short at 3.39 to 1. The number of traders net-long is 4.68% higher than yesterday and 6.22% lower from last week, while the number of traders net-short is 19.64% higher than yesterday and 9.09% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

06/10 THURSDAY | 11:45 GMT | EUR EUROPEAN CENTRAL BANK & PRESS CONFERENCE

Since 2017, the ECB has defined its price stability target of achieving inflation “below but close to 2%,” which is why recent data may start to make some policymakers nervous. But after a decade following the Eurozone debt crisis of low inflation and meager rates of growth, it doesnt seem likely that the ECB will act quickly to address what it has called transitory inflation, of which it has limited monetary tools to address.

With the context defined by ECB Governing Council member Klaas Knot, who has previously said that higher yields are welcomed because “what the market is actually doing is pricing that optimism” about a recovery in the second half of 2021, if higher inflation leads to higher yields, the ECB wont be inclined to do much whatsoever when it meets this week for its June policy meeting.

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (JUNE 7, 2021) (TABLE 2)

It appears that rates markets feel similar, insofar as the ECB won‘t overreact to recent inflation data as a sign that they need to add to or withdraw stimulus in the near-term. According to Eurozone overnight index swaps, the ECB won’t be changing rates anytime soon. In mid-January, there was a 54% chance of a 10-bps rate cut by December 2021; that probability now stands at 0%. Through April 2022, there is only an 11% chance of a 10-bps rate cut.

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (JUNE 7, 2021) (CHART 2)

EUR/USD: Retail trader data shows 34.90% of traders are net-long with the ratio of traders short to long at 1.87 to 1. The number of traders net-long is 5.19% higher than yesterday and 3.81% lower from last week, while the number of traders net-short is 12.37% higher than yesterday and 2.39% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

06/10 THURSDAY | 12:30 GMT | USD INFLATION RATE (MAY)

According to a Bloomberg News survey, further upside in price pressures is anticipated with the headline inflation rate due in at +4.7% from +4.2% (y/y) in May, while core inflation is due in at +3.4% from +3%. Still “largely” anticipated by Federal Reserve policymakers, accelerating price pressuresstill may not do much to move the needle for the FOMC in the wake of the May US non-farm payrolls report. That said, it appears that taper talk is about to intensify as inflation readings peak.

IG CLIENT SENTIMENT INDEX: USD/JPY RATE FORECAST (JUNE 7, 2021) (CHART 3)

USD/JPY: Retail trader data shows 55.34% of traders are net-long with the ratio of traders long to short at 1.24 to 1. The number of traders net-long is 8.14% higher than yesterday and 32.69% higher from last week, while the number of traders net-short is 6.91% higher than yesterday and 13.86% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Inflation hot at 13-year high, what will happen to gold?

Inflation hot at 13-year high, what will happen to gold?

Optimism Ahead Of Bank Of Canada Decision

Optimism Ahead Of Bank Of Canada Decision

Find Your Forex Entry Point: 3 Entry Strategies To Try

Find Your Forex Entry Point: 3 Entry Strategies To Try

USD/CAD Weekly Forecast: Waiting for the catalyst?

USD/CAD Weekly Forecast: Waiting for the catalyst?

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator