简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

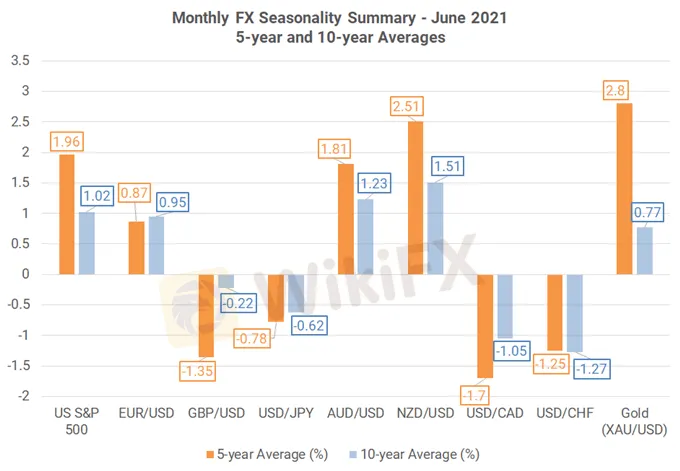

Monthly Forex Seasonality - June 2021: Best Month of Year for AUD, CAD, & NZD

Abstract:Monthly Forex Seasonality - June 2021: Best Month of Year for AUD, CAD, & NZD

JUNE FX SEASONALITY OVERVIEW:

If “sell in May and go away” was nonsense, its because risk appetite has remained strong through the end of June. The US S&P 500 is in positive territory in June over the past 5-year and 10-year averages.

The trio of commodity currencies are embarking on their best month of the year. Historically speaking, the Australian, Canadian, and New Zealand Dollars have had their best month of the year during June.

May was supposed to be the best month of the year for the US Dollar. Failure to liftoff with seasonal tailwinds may foreshadow a rough month of June, which is otherwise one of the worst months of the year for the greenback.

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. For June, our focus is on the trailing 5-year and 10-year performances, both of which fully capture trading during the era of quantitative easing and expanding government deficits since the 2008/2009 Global Financial Crisis – not dissimilar from the environment we find ourselves in during the coronavirus pandemic recovery.

MONTHLY FOREX SEASONALITY SUMMARY – JUNE 2021

FOREX SEASONALITY IN EURO (VIA EUR/USD)

June is a bullish month for EUR/USD, from a seasonality perspective. Over the past 5-years, it has been the fifth best month of the year for the pair, averaging a gain of +0.87%. Over the past 10-years, it has been the second best of the year, averaging a gain of +0.95%.

FOREX SEASONALITY IN BRITISH POUND (VIA GBP/USD)

June is a very bearish month for GBP/USD, from a seasonality perspective. Over the past 5-years, it has been the second worst month of the year for the pair, averaging a loss of -1.35%. Over the past 10-years, it has been the fifth worst month of the year, averaging a loss of -0.22%.

FOREX SEASONALITY IN JAPANESE YEN (VIA USD/JPY)

June is a very bearish month for USD/JPY, from a seasonality perspective. Over the past 5-years, it has been the third worst month of the year for the pair, averaging a loss of -0.78%. Over the past 10-years, it has been the third worst month of the year, averaging a loss of -0.62%.

FOREX SEASONALITY IN AUSTRALIAN DOLLAR (VIA AUD/USD)

June is a very bullish month for AUD/USD, from a seasonality perspective. Over the past 5-years, it has been the best month of the year for the pair, averaging a gain of +1.81%. Over the past 10-years, it has been the best month of the year, averaging a gain +1.23%.

FOREX SEASONALITY IN NEW ZEALAND DOLLAR (VIA NZD/USD)

June is a very bullish month for NZD/USD, from a seasonality perspective. Over the past 5-years, it has been the best month of the year for the pair, averaging a gain of +2.51%. Over the past 10-years, it has been the best month of the year, averaging a gain of +1.51%.

FOREX SEASONALITY IN CANADIAN DOLLAR (VIA USD/CAD)

June is a very bearish month for USD/CAD, from a seasonality perspective. Over the past 5-years, it has been the worst month of the year for the pair, averaging a loss of -1.7%. Over the past 10-years, it has been the second worst month of the year, averaging a loss of -1.05%.

FOREX SEASONALITY IN SWISS FRANC (VIA USD/CHF)

June is a very bearish month for USD/CHF, from a seasonality perspective. Over the past 5-years, it has been the second worst month of the year for the pair, averaging a loss of -1.25%. Over the past 10-years, it has been the worst month of the year, averaging a loss of -1.27%.

FOREX SEASONALITY IN US S&P 500

June is a bullish month for the US S&P 500, from a seasonality perspective. Over the past 5-years, it has been the fifth best month of the year for the index, averaging a gain of +1.96%. Over the past 10-years, it has been the seventh best month of the year, averaging a gain of +1.02%. Not only are the June seasonal averages positive for the US S&P 500, but so too are the 5- and 10-year seasonal averages for July; ‘sell in June and go away’ hasnt been valid recently (but then again, if you look at December, neither too has been the famed Santa Claus rally).

FOREX SEASONALITY IN GOLD (VIA XAU/USD)

June is a bullish month for gold (XAU/USD), from a seasonality perspective. Over the past 5-years, it has been the third best month of the year for the precious metal, averaging a gain of +2.8%. Over the past 10-years, it has been the sixth best month of the year, averaging a gain of +0.77%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

WikiFX Review: Something You Need to Know About Markets4you

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator