Score

Shaw and Partners

Australia|5-10 years|

Australia|5-10 years| https://www.shawandpartners.com.au/home

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Australia 7.50

Australia 7.50Contact

Licenses

Licenses

Licensed Institution:Shaw and Partners Limited

License No.:236048

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by Australia ASIC(license number: 236048)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

Basic information

Australia

AustraliaUsers who viewed Shaw and Partners also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

shawandpartners.com.au

Server Location

United States

Website Domain Name

shawandpartners.com.au

Website

WHOIS.AUDA.ORG.AU

Company

AU-NIC

Server IP

104.22.1.79

Company Summary

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded Year | 2008 |

| Company Name | Shaw and Partners Limited |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | MetaTrader4 (MT4) |

| Tradable Assets | Equities, fixed income securities, derivatives, managed funds |

| Account Types | Not specified |

| Demo Account | Available |

| Customer Support | Phone, email, and social media |

| Payment Methods | Not specified |

| Educational Tools | Not specified |

Overview of Shaw and Partners

Shaw and Partners Limited is a worldwide financial trading platform and broker, founded in 2008, it now serves over 10,000 retail investors to offer a variety of trading instruments, including equities, fixed income securities, derivatives, and managed funds. As an unregulated broker, trading with it can be risky for traders. Shaw and Partners also provides access to the MetaTrader4 (MT4) trading platform, which offers a user-friendly interface and comprehensive features. While specific details about account types, leverage, spreads, and payment methods are not specified, Shaw and Partners do offer a demo account for traders to familiarize themselves with the platform. It provides customer support through phone, email, and social media. Further information regarding educational tools and additional services are not specified, so it's recommended to visit the Shaw and Partners website or contact their customer support for more details.

Is Shaw and Partners legit or a scam?

When considering Shaw and Partners Limited for your trading activities, its financial regulatory status in your region is crucial. One of the primary considerations when evaluating a broker, such as Shaw and Partners Limited, is to assess the broker's regulatory status and administrative body. Brokers operating without supervision from a regulatory authority are free to make their own rules, which may pose a risk to investors.

Shaw and Partners Limited is not regulated, which means Shaw and Partners Limited are not supervised by any regulatory bodies. Brokers that operate under the supervision of regulatory authorities like Shaw and Partners Limited are subject to strict guidelines that prohibit them from manipulating market prices to their advantage. Regulatory oversight ensures brokers operate with integrity, fairness, and transparency, safeguarding investors' deposits. Shaw and Partners Limited are held accountable for their actions and may face severe consequences if they violate any financial regulations.

Pros and Cons

Shaw and Partners Limited offers a wide range of market instruments, allowing investors to diversify their portfolios and participate in various asset classes. The user-friendly MetaTrader4 (MT4) platform enhances trading performance with its comprehensive features. Opening an account is relatively straightforward, and the availability of a demo account helps users familiarize themselves with the platform. However, a major drawback is that Shaw and Partners Limited is not regulated, which raises concerns about investor protection. The company also charges commissions on CFD instruments and imposes fees for inactivity, withdrawals, and deposits. Live chat support is lacking, and customer support response times can be slower. Additionally, a minimum deposit of $100 may be relatively high for some potential clients.

| Pros | Cons |

| Wide range of market instruments | Not regulated |

| User-friendly MetaTrader4 (MT4) platform | Charges commissions on CFD instruments |

| Opening an account is relatively straightforward | Fees for inactivity, withdrawals, and deposits |

| Demo account | Lack of live chat support |

| Relatively high minimum deposit of $100 |

Market Instruments

Shaw and Partners is an Australian financial services firm that offers a range of market instruments to its clients. The firm provides access to various investment options, including equities, fixed income securities, derivatives, and managed funds. These market instruments allow investors to diversify their portfolios and participate in different asset classes.

In terms of equities, Shaw and Partners facilitate trading in shares listed on the Australian Securities Exchange (ASX) as well as international exchanges. They provide research and analysis to assist clients in making informed investment decisions. Additionally, the firm offers fixed income securities such as government bonds, corporate bonds, and hybrid securities, which provide investors with income-generating opportunities and capital preservation. Shaw and Partners also provide access to derivative instruments, including options and futures, which enable investors to hedge their positions or speculate on price movements. Lastly, the firm offers managed funds, allowing clients to invest in a diversified portfolio managed by experienced investment professionals.

Account Types

The assets and products available to you on the Shaw and Partners Limited trading platform depends on the region of the world, you are in and the Shaw and Partners Limited entity you have an account. With Shaw and Partners Limited you will need a minimum deposit of $100. You can sign up for a demo account to acquaint yourself with Shaw and Partners Limited platform. Shaw and Partners Limited are able to accommodate various levels of traders whether you are experienced or a beginner.

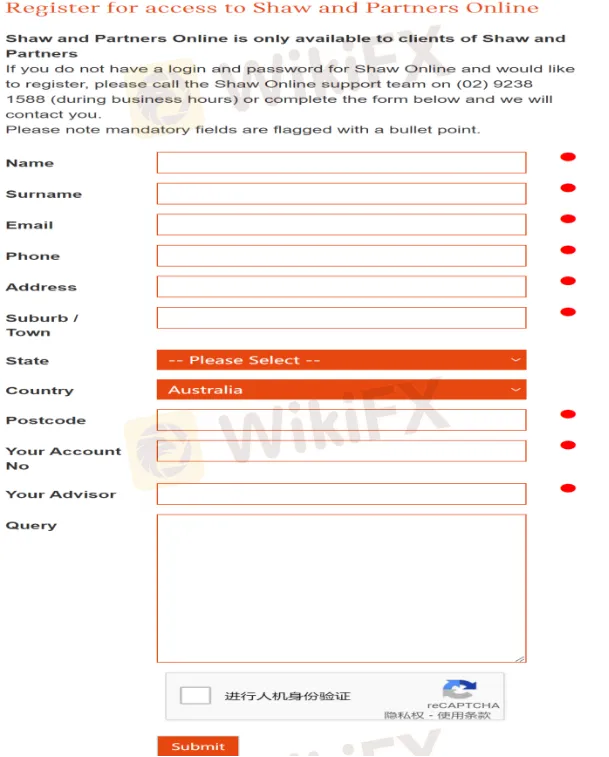

How to Open an Account?

To open an account with Shaw and Partners, you will need to follow these steps:

1. Visit the Shaw and Partners website at https://www.shawandpartners.com.au.

2. On the homepage, navigate to the “Login” bottom. This might be located in the top menu or in the footer of the website. Click to proceed.

3. You will likely be presented with an online application form. Fill in the required information accurately and completely. The details may include personal information, contact details, financial information, and investment preferences.

4. Review the terms and conditions of opening an account with Shaw and Partners. Ensure that you understand and agree to the terms before proceeding.

5. Submit the completed application form. At this point, you may be required to upload certain documents, such as identification (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided to submit the required documents securely.

6. After submitting your application, you should receive confirmation that your application has been received. Shaw and Partners may contact you for any additional information or documentation if needed.

7. Once your application has been processed and approved, Shaw and Partners will provide you with further instructions on how to fund your account and start investing.

Trading Platforms

After logging into your Shaw and Partners Limited account, you'll find a range of trading platform options available below. Please be aware that Shaw and Partners Limited does not currently support the MetaTrader5 (MT5) trading platform and the cTrader trading platform.

MetaTrader4(MT4), has been a well-known and widely used trading platform in the financial markets since its inception in 2005. MT4 on Shaw and Partners Limited offers traders comprehensive features and tools to enhance their trading performance. The Shaw and Partners Limited MT4 user-friendly interface and highly customized trading environment allow traders to tailor the Shaw and Partners Limited platform to their needs. One of the standout features of MT4 is its charting functionality, which allows Shaw and Partners Limited traders to analyze price movements and make informed trading decisions. Additionally, advanced order management tools give Shaw and Partners Limited traders greater control over their trades, allowing them to manage risk better and optimize their trading strategies on the MT4 Shaw and Partners Limited trading platform.

You can start using the MetaTrader4 platform with Shaw and Partners Limited in multiple formats including through an online web platform, Through a downloadable application for Windows PCs and Apple Macintosh computers. Shaw and Partners Limited MetaTrader4 is compatible with the latest macOS. Shaw and Partners Limited allows traders to trade on mobile devices through Android and iOS devices like the iPhone.

Commissions

Shaw and Partners Limited does charge commission on CFD instruments. Brokers like Shaw and Partners Limited may charge commission fees as compensation for executing trades on behalf of traders on their trading platforms. Commission fees can vary depending on the type of financial asset being traded and the Shaw and Partners Limited trading account level held by the trader. Shaw and Partners Limited may charge commission fees for fulfilling, modifying, or canceling an order on behalf of its clients. However, if a market order is not fulfilled, no commission fee is usually charged. Reviewing Shaw and Partners Limited terms and conditions to understand the commission fees and any other charges that may apply is essential.

Non-trading Fees

Shaw and Partners Limited does charge a fee for inactive accounts. When a trading account goes unused for a certain period, brokerage clients may be charged an account inactivity fee. To avoid such fees, clients may need to fulfill specific trading activity requirements outlined by Shaw and Partners Limited terms and conditions. It's important to note that inactivity fees are not unique to online trading accounts, as many financial service companies may also charge them. Make sure you're fully aware of all Shaw and Partners Limited fees and services. It's recommended that you check the Shaw and Partners Limited website before signing up.

Deposit & Withdrawal

The fees for withdrawing funds from your Shaw and Partners Limited account will differ depending on your chosen payment method. Reviewing the fees associated with each payment method before making your Shaw and Partners Limited withdrawal request is important. Shaw and Partners Limited Withdrawal rules may vary across different brokers when it comes to transferring funds from your Shaw and Partners Limited or other broker trading account. Each brokerage firm has its specific withdrawal methods. The payment provider associated with Shaw and Partners Limited may have different transfer processing fees and processing times, affecting how long it takes to receive your funds. In addition, currency conversion fees may apply if the Shaw and Partners Limited withdrawal and receiving currencies differ, adding to the overall transaction costs.

Shaw and Partners Limited do charge deposit fees. Reviewing deposit fees before initiating a transaction is imperative, as certain brokers might impose a charge for depositing funds from your payment method to your trading account. The payment method employed for funding your account might also incur a fee. Depositing funds into your trading account may incur a fee, which could vary depending on the fiat currency used. For instance, depositing funds from a credit card can attract high fees. Additionally, not all brokers accept credit card payments for account funding. It's crucial to review the funding options and associated fees the broker provides before depositing any funds.

Customer Support

Shaw and Partners Limited provides customer support through phone calls, emails, and social media channels, offering assistance in various languages such as English, Spanish, Czech, Chinese, Russian, and more. However, when compared to other brokers, Shaw and Partners Limited has fewer customer support features as they do not offer live chat support. Additionally, some users have reported that their phone and email support can be slow in responding to inquiries.

Conclusion

In conclusion, Shaw and Partners Limited offers a range of market instruments and account types for investors, providing access to equities, fixed income securities, derivatives, and managed funds. However, it is important to note that Shaw and Partners Limited is not regulated, which may raise concerns about investor protection and oversight. While the MetaTrader4 trading platform offered by Shaw and Partners Limited is user-friendly and provides comprehensive features, the absence of live chat support and potential slow response times in customer support may be a disadvantage for some users. Additionally, Shaw and Partners Limited charges commissions on CFD instruments and may apply fees for account inactivity, withdrawals, and deposits. It is crucial for potential clients to carefully review and understand the fees and terms associated with Shaw and Partners Limited before opening an account.

FAQs

Q: Is Shaw and Partners a legitimate company or a scam?

A: Shaw and Partners Limited is not regulated. This lack of regulation may pose a risk to investors, as regulated brokers are held to strict guidelines and oversight.

Q: What types of market instruments does Shaw and Partners offer?

A: Shaw and Partners offers a range of market instruments, including equities, fixed income securities, derivatives, and managed funds.

Q: What trading platforms does Shaw and Partners offer?

A: Shaw and Partners offers the MetaTrader4 (MT4) trading platform. This platform is well-known and widely used in the financial markets.

Q: Does Shaw and Partners charge commissions?

A: Yes, Shaw and Partners does charge commissions on CFD instruments. The commission fees can vary depending on the type of financial asset being traded and the trader's account level.

Q: Are there any non-trading fees associated with Shaw and Partners?

A: Yes, Shaw and Partners charges an inactivity fee for inactive accounts. Clients may be charged if their trading account remains unused for a certain period.

Q: What are the fees for depositing and withdrawing funds from Shaw and Partners?

A: Shaw and Partners charges deposit and withdrawal fees. The fees may vary depending on the chosen payment method and the currency used.

Keywords

- 5-10 years

- Regulated in Australia

- Investment Advisory License

- Suspicious Overrun

- Medium potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now