Company Summary

| QuoMarkets Review Summary | |

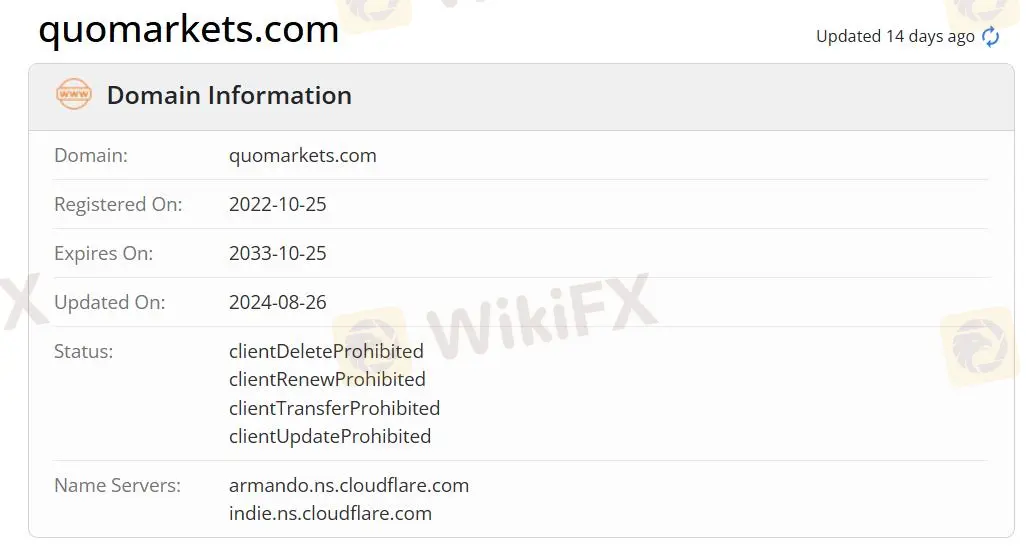

| Founded | 2022-10-25 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex/Metals/Indices/Energies/Crypto/Stocks |

| Demo Account | ✅ |

| Leverage | Unlimit |

| Spread | As low as 0 pip |

| Trading Platform | MT4/MT5(Desktop(Windows/Mac/Supercharts)/Mobile(Android/iOS/Supercharts)) |

| Min Deposit | $1 |

| Customer Support | Email: support@quomarkets.com, support@tqgbltd.com |

| Phone: +35725123894 | |

| Twitter/LinkedIn/Instagram/Facebook/TikTok/YouTube | |

| Live chat | |

QuoMarkets Information

QuoMarkets.com is an investing platform in online trading and provides both beginner and professional traders with access to various opportunities across global financial markets including Forex, Metals, Indices, Energies, Crypto, and Stocks. The broker also provides unlimit leverage and popular MT4 and MT5 platform. The minimum spread is from 0 pips and the minimum deposit starts from $1. QuoMarkets is still risky due to its unregulated status and high leverage.

Pros and Cons

| Pros | Cons |

| MT4/MT5 available | Unregulated |

| Spread as low as 0.1 pip | No 24/7 customer support |

| Demo account available | High max leverage |

| Various tradable instruments |

Is QuoMarkets Legit?

QuoMarkets is not regulated, making it less safe than a regulated one, even though it claims Quo Global Ltd, a securities dealer firm that is authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD140.

What Can I Trade on QuoMarkets?

QuoMarkets offers various market instruments, including Forex, Metals, Indices, Energies, Crypto, and Stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Stocks | ✔ |

| Crypto | ✔ |

| Metals | ✔ |

| Shares | ❌ |

| Commodities | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

QuoMarkets has four account types: Raw, Standard, Zero, and Limitless. Standard accounts are ideal for traders with all experience levels, raw accounts are for experienced traders seeking ultra-low and stable spreads, zero-accounts are ideal for traders focused on major currency pairs and top assets, free from spread concerns, and Unlimited Account offers traders the advantage of unlimited leverage.

In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only. Swap-Free Account, or Islamic Account, tailored for traders adhering to Islamic principles against interest.

| Account Type | Raw | Standard | Zero | Limitless |

| Maximum Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:2000 | Limitless |

| Swap free | By Request | By Request | By Request | By Request |

| Spread on all majors | As low as 0.1 pip | As low as 0.4 pip | ZERO “O” in major Pairs up to 97% of the day | As low as 0.6 pip |

| Commission | $3 per side | $0 | $4 per side | $0 |

| Minimum Deposit | $1 | $1 | $1 | $1 |

QuoMarkets Fees

The spread is as low as 0 pip, the commission is from $0. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is no restrictions that maybe mean irreparable losses.

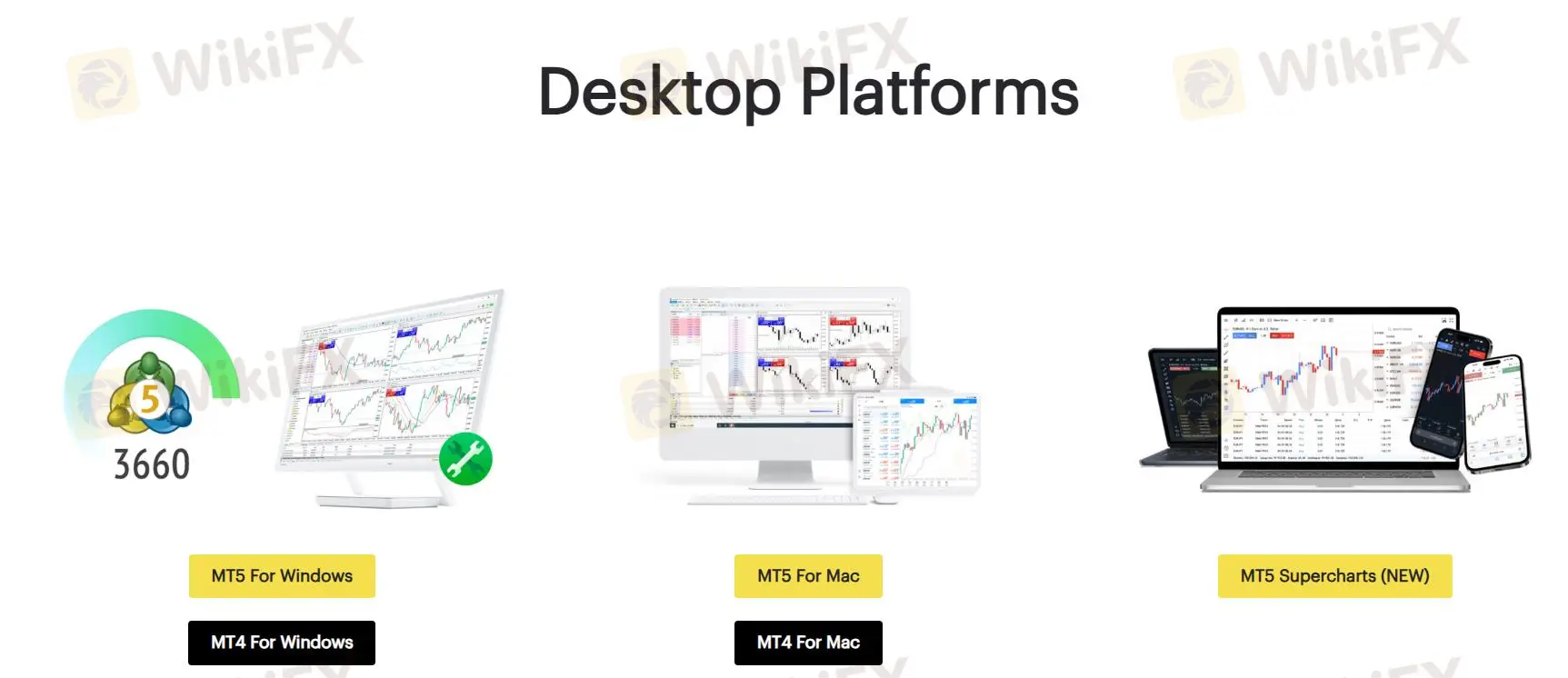

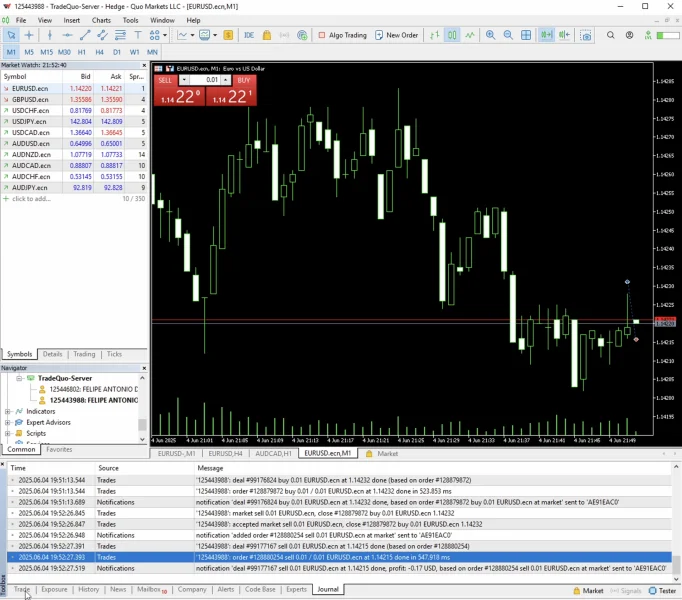

Trading Platform

Traders can conduct financial activities in MT4/MT5 available in Windows, macOS, iOS, Android, and Web through QuoMarkets. Junior traders prefer MT4 over MT5. Both MT4 and MT5 provide various trading strategies and implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows, macOS, iOS, Android, Web | Experienced traders |

| MT4 | ✔ | Windows, macOS, iOS, Android, Web | Junior traders |

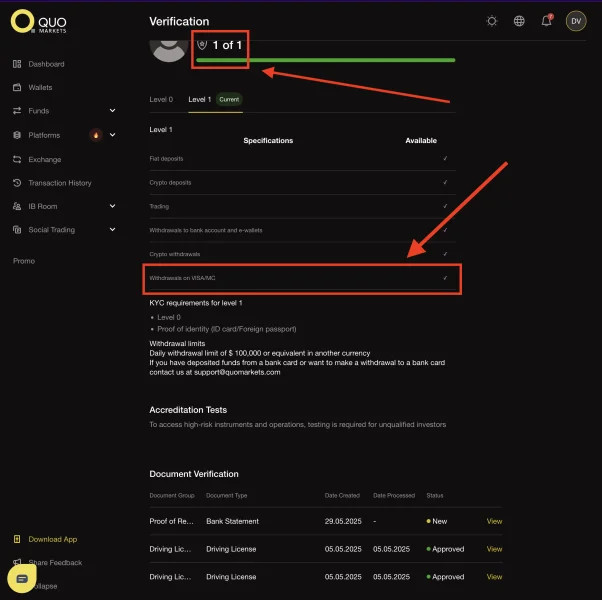

Deposit and Withdrawal

The first account deposit must be $1 or above. QuoMarkets accepts credit/debit cards (Visa, Mastercard), international bank transfers, local bank transfers, online transfers, and cryptocurrencies for deposit and withdrawal. Deposit processing times are instant and associated fees are free, and withdrawal processing times are up to 1 day and associated fees are also free.

Withdrawal requests will be processed within 24 hours. However, the arrival of funds varies depending on your chosen withdrawal method. For E-Wallets, Crypto-Wallets, and local bank transfers, clients will receive their funds on the same day. Bank wire transfers or withdrawals to credit/debit cards usually take 3-14 business days.

Deposit:

| Funding Option | Processing Time | Fees | Min Amount | Max Deposit |

| Visa/MasterCard | Instant | Free | 10 USD | $10000 per day |

| Bank Transfer | Instant | Free | 10 USD | $50000 per day |

| Neteller | Instant | Free | 10 USD | $10000 per day |

| Skrill | Instant | Free | 10 USD | $10000 per day |

| Dragonpay | Instant | Free | 10 USD | $50000 per day |

| Fasapay | Instant | Free | 10 USD | $50000 per day |

Withdrawal:

| Funding Option | Processing Time | Fees | Min Amount | Max Deposit |

| Visa/MasterCard | 1 Day | Free | 10 USD | $100000 per day |

| Bank Transfer | A few minutes-3 hours | Free | 10 USD | $100000 per day |

| Bitcoin | Depends on Blockchain | Free | 10 USD | $100000 per day |

| USDT- ETH | Depends on Blockchain | Free | 10 USD | $100000 per day |

| Ethereum | Depends on Blockchain | Free | 10 USD | $100000 per day |

| USDT- TRX | Depends on Blockchain | Free | 10 USD | $100000 per day |

| Dragonpay | A few minutes-3 hours | Free | 10 USD | $100000 per day |

| Fasapay | A few minutes-3 hours | Free | 10 USD | $100000 per day |

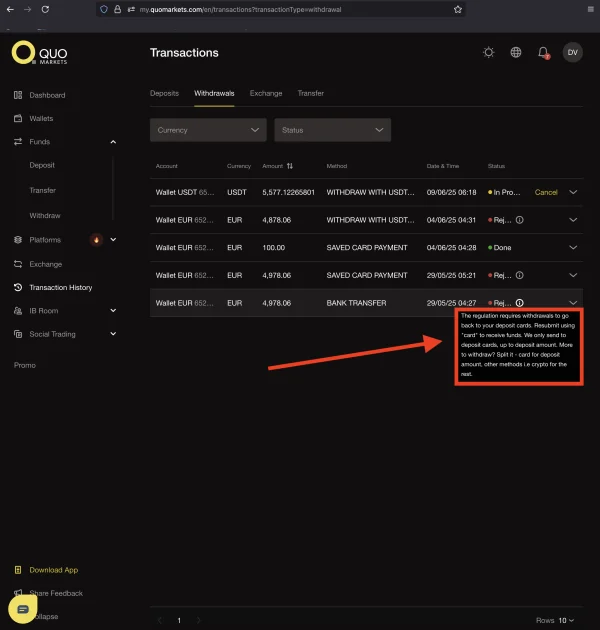

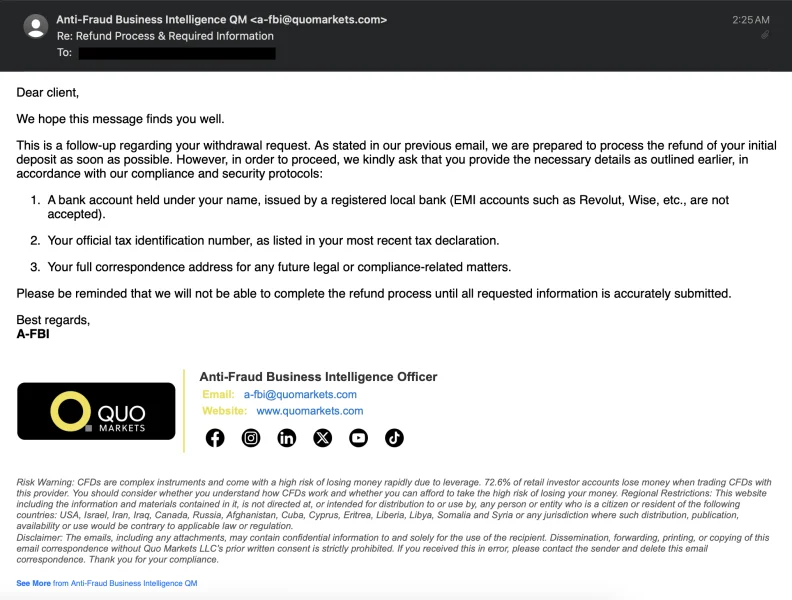

Mr. Rolex

United States

I deposited after full KYC and built my balance to €4,878.06. When I tried to withdraw, QuoMarkets first refused to return funds to my Visa card, then told me to use USDT. I complied, converted everything to USDT, and even deposited more via crypto to meet their conditions. They still blocked the withdrawal and demanded unrelated documents like a tax ID and local bank account — none of which are in their Client Agreement. Worse, they emailed me from a-fbi@quomarkets.com, falsely implying law enforcement involvement, and demanded I delete public posts and sign a legal waiver just to access my own money. This is not just unethical — it’s coercive and deceptive. Their multiple offshore registrations make enforcement difficult, and they rely on that. If you value your money, stay far away from QuoMarkets.

Exposure

FiboMen

Brazil

When i deposited the execution was fast and after a few trades i noticed execution was delayed to 1 second, severe slippage where the price is not even there, sometimes 30 points slippage on eurusd on a flat market!! spread manipulation, on zero spread account...a complete disaster of broker. stay away

Exposure

FX3711430029

Poland

Polecam jak najbardziej :) szybka bezproblemowa wypłata ⛄

Positive

Paluszkiewicz M.

Poland

Great service. The QuoMarkets platform is very easy to use plus also available on supercharts which is great. Provide great customer service Deposits/Withdrawals are quick and easy

Positive

Zootarder83

Poland

I have been trading on their platform for several months now, everything is ok, deposits and withdrawals are instant. Low transaction costs. Support very helpful - nothing to complain about. A solid broker that operates in a regulated group.

Positive

Masterswing

Indonesia

Very good customer service, low spreads, I'm trading there over 6 months and I'm very happy, Customer service always respond very fast and withdrawals are done the same day, where most brokers they takes 2-3 days. I recommend this broker.

Positive

BerniH

Croatia

I'm trading there last 6 months, everything is great and super low spreads. Very happy with this broker

Positive

毫无抵抗力

New Zealand

When QuoMarkets contacted me, they said that their company wants to make investment easy for everone, I think this is their slogan. But as we all know, foreign exchange trading is really difficult, and most people will lose money. I will not trade here because they don't have any regulatory licenses. I also advise everyone to be vigilant when choosing a forex broker.

Positive