简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AT&T sets its future course after Q4 earnings - Business Insider - Business Insider

Abstract:AT&T's mediocre Q4 2019 earnings shed light on the company's plan to intertwine its media and connectivity businesses while reducing its debt.

This story was delivered to Business Insider Intelligence Connectivity & Tech subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.US telecom giant AT&T's Q4 2019 earnings disclosed disappointing results while also outlining a strategy for future growth. The second-largest US wireless carrier by volume, AT&T collected $36.5 billion in revenue, 1.9% less than its Q4 2018 revenue.

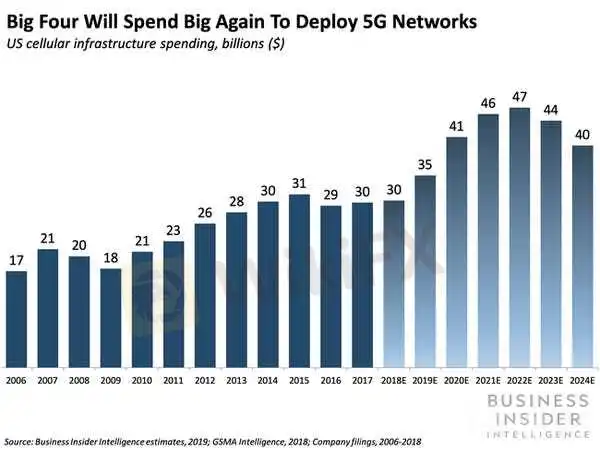

Business Insider Intelligence

During the quarter, the company also gained 3.6 million new wireless customers, down more than 5% year-over-year (YoY) from 3.8 million in Q4 2018. Additionally, the company experienced a higher rate of customer churn at 1.29%, up from 1.23% in Q4 2018. Amid these mediocre results, AT&T laid out its vision for the next few years, with both short- and long-term plans.Here's what AT&T intends to accomplish in the next year:In 2020, the company plans to turn its massive investments into sources of revenue. AT&T plans to establish nationwide 5G coverage by mid-2020, a costly endeavor — in July 2019, the company spent almost $1 billion on 5G spectrum alone at an FCC auction. Building a nationwide 5G network will expand the addressable audience for AT&T's service, which launched in December 2019 in just 10 US cities — by comparison, rival Verizon finished 2019 with 5G service in over 30 cities, after launching commercial 5G in April 2019.On the entertainment front, AT&T has spent $1.2 billion, in addition to the $85 billion spent to acquire Time Warner, to develop its HBO Max streaming service, which it plans to launch in May 2020. The debut of HBO Max is expected to be bolstered by the company's nationwide 5G network; AT&T anticipates the subsequent 5G device upgrade cycle will present an opportunity to distribute HBO Max, likely by bundling the service with new 5G data plans. Here's what AT&T plans to do in the long term:Over the next three years the telecom will focus on unburdening itself of debt. AT&T aims to pay off the massive debt it took on to fund its acquisition of Time Warner, and plans to avoid incurring additional debt by abstaining from major acquisitions during that three-year period.The company's efforts to scale down its debt could also lead it to sell off additional assets, like non-core businesses or cell towers. In October 2019, amid pressure from investors, AT&T sold off its business in Puerto Rico and the US Virgin Islands to pay down some of its debt; later that month the company sold over 1,000 cell towers to monetize non-strategic assets as part of its debt reduction effort. Focusing on debt reduction will limit AT&T's flexibility to make strategic purchases or investments, meaning the company could be receptive to partnerships that would split the cost of continuing to grow.Want to read more stories like this one? Here's how to get access: Sign up for Connectivity & Tech Pro, Business Insider Intelligence's expert product suite keeping you up-to-date on the people, technologies, trends, and companies shaping the future of connectivity, delivered to your inbox 6x a week. /> /> Get StartedCheck to see if you already have access to Business Insider Intelligence through your company, or inquire about access if you don't. /> /> Check If You Have Enterprise AccessExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US personal savings rate increases due to lowered spending amid social distancing - Business Insider

The US personal savings rate increased from 8% in February to 13.1% in March due to lowered spending from social distancing.

US Banking Digital Trust Study from Business Insider - Business Insider

The US banks with the highest levels of digital trust in 2020 are PNC, Chase, and Citibank, according to our inaugural Banking Digital Trust study.

Goldman Sachs sees higher loan deferral opt-ins than competitors - Business Insider

Goldman Sachs has seen between 10% and 20% of its consumer loan customers request payment deferrals across its Marcus and Apple Card products.

Online Grocery Shopping Industry in 2020: Market Stats & Trends - Business Insider

Business Insider Intelligence looks at the growing online grocery shopping market and delivery trends in the industry to look out for in 2020 and beyond.

WikiFX Broker

Latest News

One article to understand the policy differences between Trump and Harris

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

M2FXMarkets Review 2024: Read Before You Trade

How can the forex fix be manipulated?

CMC Markets and ASB Bank Form Strategic Partnership

FX SmartBull Review! Read first, then Invest

Currency Calculator