简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Banking Digital Trust Study from Business Insider - Business Insider

Abstract:The US banks with the highest levels of digital trust in 2020 are PNC, Chase, and Citibank, according to our inaugural Banking Digital Trust study.

This is a preview of Business Insider Intelligence's US Banking Digital Trust Report 2020.The full report will be available to Business Insider Intelligence enterprise clients in late April. To learn more about this report, email Business Insider Intelligence Client Services at bii-clientservices@businessinsider.com.The US banks with the highest levels of digital trust in 2020 are PNC, Chase, and Citibank, according to Business Insider Intelligence's inaugural Banking Digital Trust study. Digital trust is the confidence that consumers place in their banks' digital channels — and that confidence is more important now than ever. As the coronavirus pandemic sparks branch closures, digital banking outages, and fraud schemes, trust is being put to the test on multiple levels. Building digital trust could unlock valuable benefits for banks, including increased satisfaction, engagement, and customer lifetime value. Respondents who rated their bank above average in digital trust ratings considered themselves likely to open their next account at the bank at more than twice the rate of those with low trust (22.6% versus 10.4%).Even with high digital trust among their customers, banks still face the looming threat of tech giants: The provider cited by the highest percentage of respondents as one of their most-trusted banking services providers was fintech PayPal (43.1%), edging out respondents' primary bank (42.5%). To help banks pinpoint how to maintain and grow trust among customers, our Banking Digital Trust 2020 study surveyed 2,055 US banking customers on which factors play the biggest part in determining the level of confidence they feel when using digital banking channels, namely: Security, Privacy, Reputation, Reliability, Feature Breadth, and Ease of Use.We asked respondents to rate their bank's performance in each of those factors, and used these rankings to determine which banks have the highest levels of digital trust overall. We also dove into our survey results to offer banks data-driven insights on how they can improve trust levels across the six factors. This study looked exclusively at the top 10 consumer-facing banks in the US by asset size.Here are the top three leading banks in digital trust overall:

Business Insider Intelligence

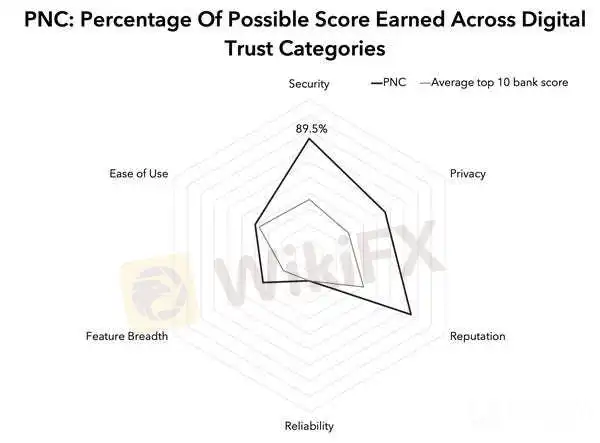

PNC punched above its weight, earning the highest overall digital trust score. Despite being middle-of-the pack by asset size, the bank earned the highest customer marks in the three most important categories of the study: Security, Privacy, and Reputation. The bank's strong lead within those heavily weighted categories, along with its second-place score in Feature Breath, were enough to offset its average customer ratings in the Ease of Use and Reliability categories. Rank: 1stScore: 87.3 out of 100

Business Insider Intelligence

Chase was a top contender in all six pillars of trust, clinching second place overall. The bank placed second in Security and Reliability, and third in Reputation, Feature Breadth, and Ease of Use. Chase's strong digital trust scores in Reliability, Feature Breadth, and Ease of Use likely benefit from its industry-leading IT budget — the bank reportedly spent $11.4 billion on technology in 2019 alone.Rank: 2ndScore: 86.2 out of 100

Business Insider Intelligence

Citibank took third place overall in digital trust, earning top marks in the Reliability category, and scoring among the top three in the Security and Privacy categories. The bank's strong scores in the two most important categories of digital trust, Privacy and Security, helped it secure third place overall, despite scoring seventh place in reputation — a category in which all the largest banks struggled.Rank: 3rdScore: 85.9 out of 100 Business Insider Intelligence's Banking Digital Trust study ranks US banks according to how confident customers feel when using their digital channels and offers analysis on what banks need to do to maintain and grow trust levels. The study is based on a January 2020 flash survey that narrowed down the six biggest factors that determine customers' levels of digital trust, and a February-March 2020 study of 2,055 respondents on how they rank their bank on each of these six factors. The full report will be available to Business Insider Intelligence enterprise clients in late April. To learn more about this report, email Business Insider Intelligence Client Services at bii-clientservices@businessinsider.com. The Banking Digital Trust study ranks: Bank of America, BB&T, Chase, Capital One, Citibank, PNC, SunTrust, TD Bank, US Bank, and Wells Fargo. It also includes supplementary data on Ally Bank, BBVA USA, Chime, NFCU, USAA, and Varo Money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator