Score

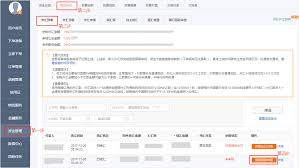

AK Global Markets

Cayman Islands|5-10 years|

Cayman Islands|5-10 years| https://akglobalmarkets.com/fx/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Cayman Islands

Cayman IslandsUsers who viewed AK Global Markets also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

akglobalmarkets.com

Server Location

United States

Website Domain Name

akglobalmarkets.com

Server IP

173.236.226.123

Company Summary

Abstract:

AK Global Markets, founded in 2020 and headquartered in the Cayman Islands, operates as an unregulated brokerage offering a diverse array of trading instruments, including currency pairs, commodities, cryptocurrencies, indices, and stocks. Despite its lack of regulatory oversight, the brokerage offers two distinct account types: a Standard Account for general traders and a Premium Account designed for high-volume professional traders. AK Global Markets uses its proprietary VetaTrader platform alongside web-based and mobile trading options, and provides customer support via phone and email. However, the unregulated status significantly raises the risk profile of engaging with this broker.

| AK Global Markets | Basic Information |

| Company Name | AK Global Markets |

| Founded | 2020 |

| Headquarters | Cayman Islands |

| Regulations | None |

| Tradable Assets | Currency pairs, commodities, cryptocurrencies, indices, stocks |

| Account Types | Standard, Premium |

| Minimum Deposit | $500 for Standard, $500,000 for Premium |

| Maximum Leverage | 1:100 for Standard, 1:500 for Premium |

| Spreads | Not specified |

| Commission | Starts at 3% |

| Deposit Methods | Credit/debit cards, bank wire transfers |

| Trading Platforms | VetaTrader, web-based, mobile platforms |

| Customer Support | Phone: 18882004278/+13024988325, Email: support@akglobalmarkets.com |

| Education Resources | Not specified |

| Bonus Offerings | Not specified |

Overview of AK Global Markets

AK Global Markets, established in 2020 and headquartered in the Cayman Islands, is an unregulated brokerage offering a diverse range of trading instruments including currencies, commodities, cryptocurrencies, indices, and stocks. It provides trading services via the proprietary VetaTrader platform along with web-based and mobile options, catering to both novice and experienced traders with its Standard and Premium accounts. While the platform offers several advanced trading features and supports various deposit and withdrawal methods, the absence of regulatory oversight poses significant risks, making it crucial for potential traders to approach with caution and fully assess the implications of trading with an unregulated entity.

Is AK Global Markets Legit?

AK Global Markets is not regulated by any recognized financial regulatory body. This means it does not adhere to the specific rules, standards, and protections that govern regulated financial entities, which can raise concerns about the security of funds and the overall transparency of its operations for traders and investors. Engaging with an unregulated firm like AK Global Markets typically carries a higher risk, and it's crucial to be aware of these potential risks before initiating any trading activities.

Pros and Cons

AK Global Markets, operating from the Cayman Islands since 2020, presents itself as a comprehensive trading platform with a broad spectrum of tradable assets, which appeals to traders looking for variety in markets including forex, commodities, cryptocurrencies, indices, and stocks. The platforms proprietary VetaTrader, alongside web and mobile trading capabilities, offers advanced features designed to enhance the trading experience. Additionally, the firm provides accessible customer support to assist traders. However, its lack of regulation is a significant drawback, introducing potential risks associated with non-regulation such as less financial protection and transparency. This uncertainty, combined with unclear information about fees and spreads, could deter potential clients seeking a secure and predictable trading environment.

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

AK Global Markets offers a range of trading instruments that include currency pairs, commodities, cryptocurrencies, indices, and stocks. However, the specific details regarding the number of instruments available in each category are not disclosed on their website, leaving the exact scope and diversity of their asset portfolio unclear.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| AK Global Markets | Yes | Yes | Yes | No | Yes | Yes | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

AK Global Markets offers two types of trading accounts:

1. Standard Account: Suitable for both beginners and experienced traders, with a minimum deposit of $500. This account provides leverage up to 1:100. The specifics regarding spreads are not disclosed, and commissions start at 3% or possibly higher.

2. Premium Account: Tailored for professional clients capable of meeting the high deposit requirement of $500,000 or a trading volume exceeding $500 million USD per month. Premium account holders enjoy benefits such as one-on-one sessions with senior traders, complimentary training courses, briefings with the Chief Market Strategist, and lower commission fees set at 3%. The details on spreads for this account are also not provided.

Both accounts lack clear information on spreads and precise commission rates, which could affect the decision-making process for potential clients.

Leverage

AK Global Markets offers leverage of up to 1:100 for Standard account holders and up to 1:500 for Premium account clients.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | AK Global Markets | eToro | XM | RoboForex |

| Maximum Leverage | 1:1000 | 1:400 | 1:888 | 1:2000 |

Spreads and Commissions

AK Global Markets structures its trading costs around spreads, swaps, commissions, and fees for dormant accounts. The website indicates a minimum commission rate of 3%, which applies to Premium accounts; this rate may be higher for Standard accounts or potentially discounted for Premium accounts. Swaps are charged on positions held overnight, with triple swap fees applied on Wednesdays. Specific swap rates can only be viewed directly on the trading platform. Additionally, accounts that remain inactive for six months are subject to a monthly fee of 10% of the available balance.

Deposit & Withdraw Methods

AK Global Markets provides deposits and withdrawals primarily via credit/debit cards and bank wire transfers. The minimum deposit is $500 for a Standard account and $500,000 for a Premium account, with card deposits capped at $10,000 monthly. Deposits are free of charge, while withdrawal methods must match the deposit methods and currency, and are subject to undisclosed handling fees. The minimum bank wire withdrawal is $3,000, and withdrawals typically take up to 5 business days to process, with an additional 10 days possible for funds to reach accounts.

Trading Platforms

AK Global Markets offers its proprietary VetaTrader platform, which can be downloaded for desktop use. The firm also provides web-based and mobile trading platforms. VetaTrader is distinct from the well-known MetaTrader platform and boasts features such as compatibility with running alongside other programs, support for one-click trades, limit orders, and customizable options for personal trading preferences.

Customer Support

AK Global Markets provides customer support through their phone line at 18882004278/+13024988325 and via email at support@akglobalmarkets.com.

Conclusion

AK Global Markets offers innovative trading solutions with its VetaTrader platform and a range of tradable assets, catering to both general and high-volume traders through its tiered account system. However, the lack of regulation and transparency regarding fees and operational specifics presents considerable risks that potential clients must weigh carefully. While the technology and customer support may appear robust, the uncertainties tied to its unregulated status could deter those seeking a more secure and transparent trading environment.

FAQs

Q: Is AK Global Markets regulated?

A: No, AK Global Markets is not regulated by any recognized financial regulatory authority. This means there is no official oversight ensuring compliance with industry standards or protecting client funds and interests.

Q: What types of assets can I trade with AK Global Markets? A: AK Global Markets allows trading in a variety of asset classes, including forex, commodities, cryptocurrencies, indices, and stocks.

Q: What platforms does AK Global Markets offer for trading?

A: AK Global Markets provides the VetaTrader platform, along with web and mobile trading options.

Q: What is the minimum deposit required at AK Global Markets?

A: The minimum deposit is $500 for a Standard account and $500,000 for a Premium account.

Q: How can I contact AK Global Markets for support?

A: You can reach their customer support via phone at 18882004278 or email at support@akglobalmarkets.com.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now