Score

DLS GROUP

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://www.dlstraderfx.com/zh-cn

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed DLS GROUP also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

dlstraderfx.com

Server Location

France

Website Domain Name

dlstraderfx.com

Server IP

217.70.184.38

Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Founded year | 2-5 years (exact founding year not provided) |

| Company Name | DLS Group Limited |

| Regulation | Unverified NFA regulation, caution advised |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | Typically around 1 pip for most major currency pairs |

| Trading Platforms | Online Trading Platform, Mobile Trading Platform |

| Tradable assets | EQUITY INSTRUMENTS, DEBT INSTRUMENTS, DERIVATIVE INSTRUMENTS, COMMODITY INSTRUMENTS, FOREIGN EXCHANGE INSTRUMENTS, REAL ESTATE INSTRUMENTS |

| Account Types | Current Accounts, Savings Accounts, ISAs |

| Demo Account | Information not provided |

| Islamic Account | Information not provided |

| Customer Support | Information not provided |

| Payment Methods | Bank transfer, Credit/Debit card, E-wallet |

| Educational Tools | Information not provided |

Overview of DLS GROUP

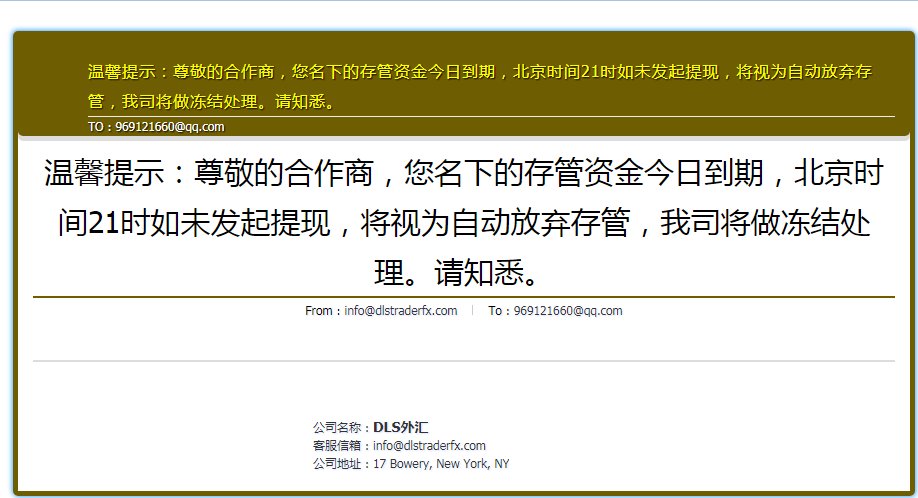

DLS GROUP Limited, a United States-based company, claims to offer various financial instruments through its trading platform. However, caution is advised as there are concerns about the legitimacy of its claimed regulation by the United States National Futures Association (NFA). The absence of valid regulation raises significant risks for those considering engaging with this unregulated entity.

The market instruments offered by DLS GROUP include equity instruments such as Common Stock and Preferred Stock, debt instruments like Bonds and Debentures, derivative instruments such as Futures contracts and Options, commodity instruments like Commodity Futures and Exchange-Traded Commodities (ETCs), foreign exchange instruments like Spot Contracts and Currency Options, and real estate instruments like Real Estate Investment Trusts (REITs) and Real Estate Mortgage Investment Conduits (REMICs).

DLS GROUP provides current accounts, savings accounts, and ISAs to cater to different banking and saving needs. Leverage of up to 1:500 is available for trading products, and the spreads and commissions are in line with industry standards. The minimum deposit required is $100, and various deposit and withdrawal methods are supported, although fees may apply.

The company offers an Online Trading Platform and a Mobile Trading Platform for investors to execute trades and access real-time market data. However, specific information about customer support is currently unavailable. Reviews on WikiFX indicate negative exposure and complaints, including allegations of involvement in pyramid schemes and scam activities, difficulties in fund withdrawals, and dissatisfaction with the platform's performance and customer support.

Pros and Cons

DLS GROUP, a financial services provider based in the United States, presents a set of pros and cons for potential clients to consider. On the positive side, the company offers a wide range of market instruments and account types, along with the advantage of a maximum leverage of 1:500, enabling clients to amplify their trading positions. Moreover, DLS GROUP provides accessible online and mobile trading platforms, catering to the needs of investors on the go. Additionally, the availability of tax-efficient ISAs and various deposit/withdrawal methods provides options for clients. However, caution is warranted, as DLS GROUP is not regulated by a valid authority, and there have been suspicions regarding the legitimacy of its claimed NFA regulation. Negative reviews and complaints about scams, difficulties in withdrawals, limited information about customer support, and the unavailability of the main website further raise concerns for potential investors. Moreover, there is a minimum deposit requirement of $100, which may be a consideration for some traders.

| Pros | Cons |

| Offers various market instruments | Not regulated by a valid authority (suspected clone NFA regulation) |

| Provides different account types | Negative reviews and complaints about scams and difficulties in withdrawals |

| Maximum leverage of 1:500 | Limited information about customer support |

| Provides online and mobile trading platforms | Limited information on trading conditions |

| Offers tax-efficient ISAs | Main website currently unavailable |

| Variety of deposit/withdrawal methods | Minimum Deposit: $100 |

Is DLS GROUP Legit?

DLS GROUP claims to be regulated by the United States National Futures Association (NFA) with license number 0271678 and under the name of JOHN LAWRENCE KELLER. However, it has been verified that this broker currently has no valid regulation, and its claimed NFA regulation is suspected to be a clone. As a result, there may be significant risks associated with dealing with this unregulated entity. Caution is advised when considering any financial services offered by DLS GROUP.

Market Instruments

EQUITY INSTRUMENTS: DLS GROUP offers Common Stock, Preferred Stock, Warrants, and Convertible Bonds. Common Stock grants ownership and voting rights, while Preferred Stock provides fixed dividends and priority in liquidation. Warrants allow buying shares at a fixed price, and Convertible Bonds can be converted into common stock.

DEBT INSTRUMENTS: DLS GROUP offers Bonds (Government and Corporate), Debentures, and Mortgage-Backed Securities (MBS). Bonds involve borrowing money and paying interest until maturity. Debentures are unsecured loans, and MBS is backed by a pool of mortgages.

DERIVATIVE INSTRUMENTS: DLS GROUP provides Futures contracts, Options, and Swaps. Futures allow buying/selling assets at a set price on a future date. Options provide the right (but not obligation) to buy/sell assets at a specific price within a timeframe. Swaps exchange cash flows based on financial variables.

COMMODITY INSTRUMENTS: DLS GROUP deals in Commodity Futures and Exchange-Traded Commodities (ETCs). Commodity Futures involve buying/selling commodities at a predetermined price and date. ETCs represent ownership of commodities without physical possession.

FOREIGN EXCHANGE INSTRUMENTS: DLS GROUP offers Spot Contracts, Forward Contracts, and Currency Options. Spot Contracts allow immediate currency exchange at the market rate. Forward Contracts fix an exchange rate for future transactions. Currency Options provide the right to buy/sell currency at a specific rate on/before a particular date.

REAL ESTATE INSTRUMENTS: DLS GROUP deals in Real Estate Investment Trusts (REITs) and Real Estate Mortgage Investment Conduits (REMICs). REITs own/finance income-generating real estate. REMICs represent pooled mortgages with distributed income to investors.

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments available | Limited information on trading conditions |

| Offers various options for investment diversity | Main website currently unavailable |

| Potential for owning and voting rights (equities) | Not regulated by a valid authority (suspected clone NFA regulation) |

Account Types

CURRENT ACCOUNTS:

Current accounts provided by DLS GROUP are designed for everyday banking needs. They come with standard features like a debit card, online and mobile banking access, and bill pay services. Some current accounts may also offer additional benefits, such as earning interest on the deposited funds, access to ATMs, and the option to have a cheque book.

SAVINGS ACCOUNTS:

DLS GROUP offers savings accounts as a means to save money for future needs. These accounts typically provide a higher interest rate compared to current accounts, encouraging customers to grow their savings over time. Some savings accounts might also come with extra features like tax-free growth on the interest earned, access to a range of investment opportunities, and the advantage of no withdrawal fees.

ISAS:

DLS GROUP provides ISAs (Individual Savings Accounts) which are tax-efficient savings accounts. Different types of ISAs are available, each offering unique benefits to investors. These accounts often come with tax-free growth on the accumulated savings and investment options. Additionally, some ISAs may have no withdrawal fees, allowing customers to access their funds without incurring any additional charges.

| Pros | Cons |

| Offers everyday banking needs | Not regulated by a valid authority (suspected clone NFA regulation) |

| Higher interest rate compared to current accounts | Limited information on specific features and benefits of each account type |

| Tax-efficient savings accounts |

Leverage

DLS GROUP offers a maximum leverage of 1:500 on all of its trading products. This means that for every $100 that you deposit, you can trade up to $50,000 worth of assets. The leverage offered by DLS GROUP is in line with the industry average.

Spreads & Commissions

DLS GROUP charges spreads on all of its trading products. The spreads are typically around 1 pip for most major currency pairs. Commissions are charged on some products, such as futures and options, and the rate is generally around $0.50 per contract. The spreads and commissions charged by DLS GROUP may change from time to time. For the most up-to-date information, please visit the DLS GROUP website or contact a customer service representative.

Minimum Deposit

The Minimum Deposit required by DLS GROUP is $100.

Deposit & Withdrawal

DLS GROUP offers a variety of deposit and withdrawal methods, including bank transfer, credit/debit card, and e-wallet. There are fees for deposits made via credit/debit card and e-wallet, but there are no fees for withdrawals. The minimum deposit amount is $100 and the minimum withdrawal amount is $50. The processing time for deposits and withdrawals varies depending on the method used.

| Pros | Cons |

| Variety of deposit and withdrawal methods | Fees for deposits made via credit/debit card and e-wallet |

| No fees for withdrawals | Minimum deposit amount: $100 |

| Offers options in choosing deposit and withdrawal options | Minimum withdrawal amount: $50 |

Trading Platforms

ONLINE TRADING PLATFORM:

DLS GROUP offers an Online Trading Platform, providing investors with a digital interface to execute trades. This platform allows customers to buy and sell various financial instruments, such as stocks, bonds, and commodities, through their internet-connected devices. The Online Trading Platform offers real-time market data, charts, and analysis tools to help users make informed decisions. Investors can place orders, track their portfolios, and access research resources through this platform.

MOBILE TRADING PLATFORM:

DLS GROUP provides a Mobile Trading Platform, enabling investors to trade on the go. The mobile app offers a user-friendly interface, allowing customers to monitor the markets, execute trades, and manage their accounts using their smartphones or tablets. This platform ensures that investors can stay connected to the financial markets and act promptly on market movements, irrespective of their location.

| Pros | Cons |

| Online Trading Platform with real-time market data | Limited information on trading conditions |

| Access to a variety of financial instruments | Mobile app details (features, reliability) not specified |

| User-friendly Mobile Trading Platform for on-the-go trading | Trading platform performance and stability not mentioned |

Customer Support

No specific information about the Customer Support of DLS GROUP is available at the moment.

Reviews

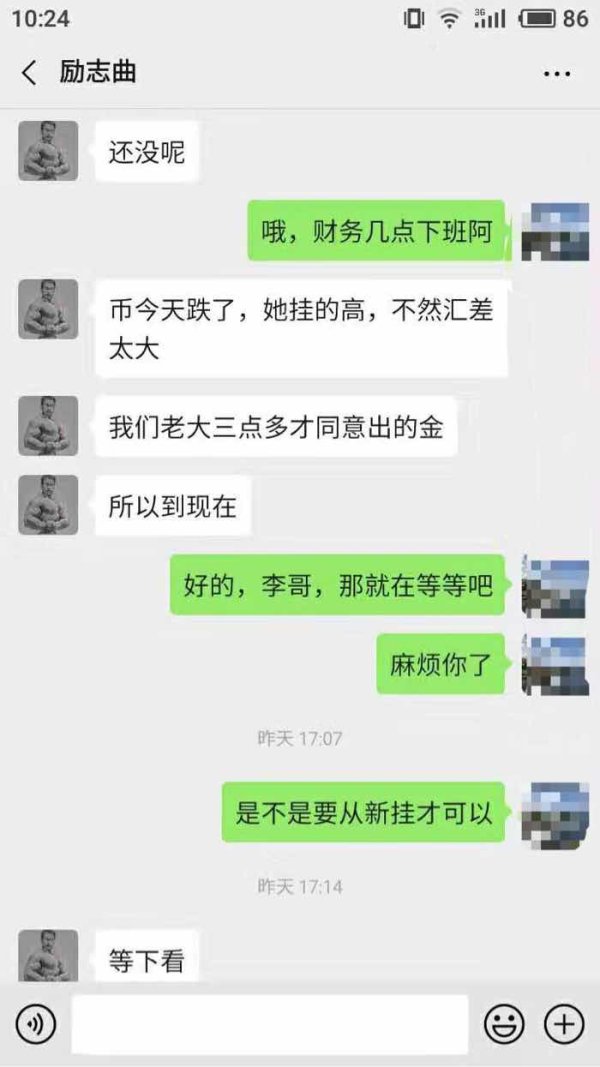

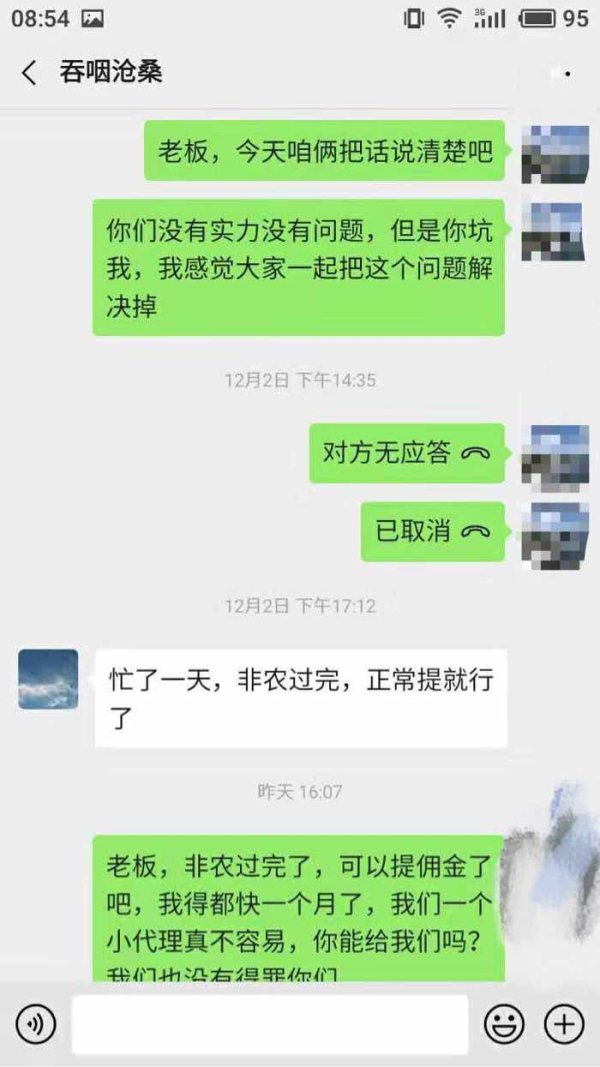

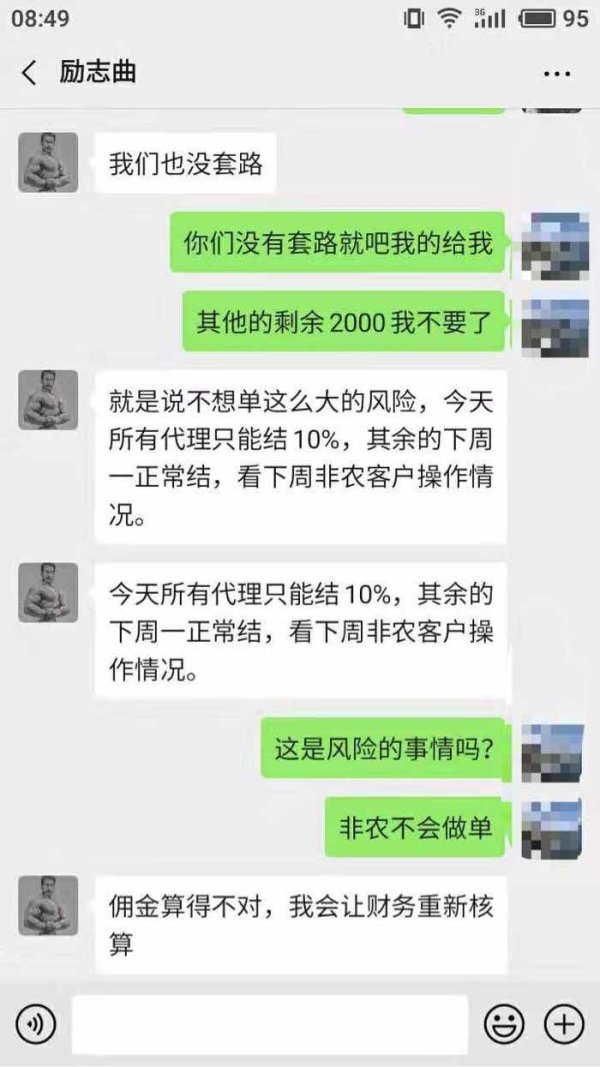

The reviews of DLS GROUP on WikiFX indicate several instances of negative exposure and complaints. There are allegations of it being involved in a pyramid scheme and scam activities. Some users have reported difficulties in withdrawing funds, and there are warnings to be cautious about the platform's legitimacy. Traders have expressed dissatisfaction with the services, stating that they have been defrauded and had negative experiences with the platform's performance and customer support. Overall, the reviews suggest a lack of trust and confidence in DLS GROUP as a reliable trading platform.

Conclusion

DLS GROUP, a company based in the United States, offers various market instruments, account types, leverage options, and trading platforms to its customers. However, caution is advised due to concerns about its legitimacy and regulatory status, as it claims to be regulated by the United States National Futures Association (NFA) but there is suspicion that its regulation might be a clone. The reviews of DLS GROUP on WikiFX raise further doubts, with negative feedback indicating issues related to customer support, alleged involvement in pyramid schemes and scams, difficulties in fund withdrawals, and overall lack of trust in the platform's reliability. Potential users should carefully assess the risks associated with dealing with an unregulated entity before considering any financial services offered by DLS GROUP.

FAQs

Q: Is DLS GROUP a regulated company?

A: DLS GROUP claims to be regulated by the United States National Futures Association (NFA), but its regulation status is doubtful, and caution is advised.

Q: What financial instruments does DLS GROUP offer?

A: DLS GROUP offers equity instruments (stocks, bonds, etc.), debt instruments (bonds, debentures, etc.), derivative instruments (futures, options, etc.), commodity instruments (commodity futures, ETCs), foreign exchange instruments, and real estate instruments (REITs, REMICs).

Q: What types of accounts are available at DLS GROUP?

A: DLS GROUP provides current accounts for daily banking needs, savings accounts for higher interest rates, and ISAs for tax-efficient savings.

Q: What is the maximum leverage offered by DLS GROUP?

A: DLS GROUP offers a maximum leverage of 1:500 on its trading products.

Q: What are the deposit and withdrawal options at DLS GROUP?

A: DLS GROUP accepts bank transfer, credit/debit card, and e-wallet for deposits and withdrawals.

Q: What trading platforms does DLS GROUP offer?

A: DLS GROUP provides an Online Trading Platform and a Mobile Trading Platform for investors to trade digitally and on-the-go.

Q: Are there any reviews or feedback on DLS GROUP?

A: Reviews suggest negative experiences and complaints about DLS GROUP, cautioning about its legitimacy and performance.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

乐天7151

Hong Kong

The website of this scam platform is http://www.dlstraderfx.com/. After you become an agent, it will ask you to induce clients to add fund. Then it will clear your accounts to led to pull more clients into, thus your commission is gone. Besides, clients’ fund is unable to withdraw.Please don’t be cheated. I have told them to call the police.

Exposure

2019-12-13

一春鱼雁

Hong Kong

Be careful about DLS scam. It is going to set up another platform to continue to defraud.

Exposure

2019-12-11

FX3792673861

Hong Kong

Exposure platform: DLS GROUP Product: Forex Method: through group and one-to-one instruction In this September, I was pulled into a stock exchange group. Having observed for some while, I found that the teacher was professional and the stocks recommend were all profitable. Then, saying that the stock market was volatile, he advised us to trade forex products in DLS GROUP . He sent the assistant contact in the group. Out of curiosity, I added the assistant. What has shocked me was that, on the next day, many member showed their profits screenshots. With the teacher’s lobbying, I invested several tens thousand of RMB. At first, I profited 10 thousand RMB, which made me overexcited. After adding 300000 RMB to profit more, I made all losses within one week! When I inquired the teacher, he comforted me and asked me to add fund. After I refused, he didn’t reply to me anymore. I realized that I had been cheated!

Exposure

2019-12-09

...72321

Hong Kong

Only fools trade in this platform,in which salesmen are all of long experience.No one will trade in it.Counterfeit MT4.

Exposure

2019-11-11

FX1389515178

Australia

Dear DLS GROUP Team, I am sending many emails to support mail id, but no response from your end. I don’t understand why you are not replying to emails, so my humble request is to look into my issue and resolve the same. If you guys continue to neglect my withdrawal requests, I’ll report you to the regulatory institutions.

Neutral

2023-03-24