简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Goldman Sachs sees higher loan deferral opt-ins than competitors - Business Insider

Abstract:Goldman Sachs has seen between 10% and 20% of its consumer loan customers request payment deferrals across its Marcus and Apple Card products.

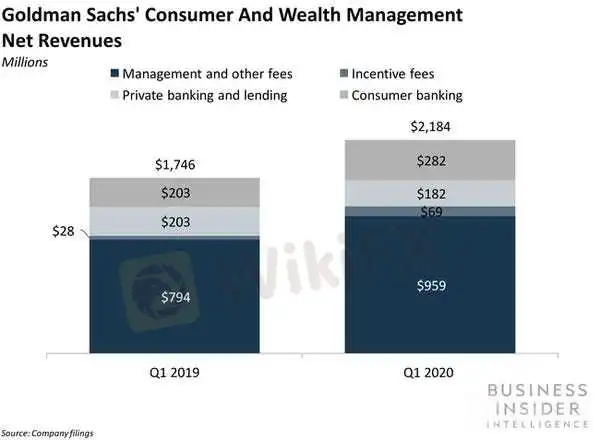

This story was delivered to Business Insider Intelligence Banking Briefing subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Stay up-to-date with our latest coverage on the impacts of coronavirus on technology, marketing, and the digital economy here.The bank has seen 10% to 20% of its consumer loan customers across its Marcus and Apple Card products request payment deferrals in response to the coronavirus pandemic, the Financial Times reports, citing a person familiar with the matter. Marcus is Goldman's digital-only offshoot which offers personal loans and a high-yield savings account, and Apple Card is its cobranded credit card that launched last year. These two products comprise most of Goldman's consumer banking business, which it's been aggressively working to build out.

Business Insider Intelligence

Goldman's deferral rates are higher than its competitors', but its smaller size might afford it some flexibility. Recently announced Q1 2020 bank earnings shed light on shifting consumer behaviors due to the pandemic, as well as on what banks are doing to brace for losses they expect to incur from extending relief to customers.Compared with Goldman's 10% to 20%, Bank of America said that 3% of its consumer and business card customers had opted to defer payments as of April 8, while JPMorgan Chase has seen 4% of its mortgage customers opt into forbearance.The person familiar with the matter told the FT that the newness and smaller size of Goldman's 4-year-old consumer lending business relative to its more mature competitors allows it to extend forbearance to a higher percentage of customers without taking as big of a financial hit: Goldman's provisions for loan losses in Q1 2020 increased annually to $937 million — significantly lower than competitors', all of which are in the billions — and the bank plans to reduce its pace of origination in order to manage risk during the coronavirus crisis, which could help cushion losses.By now, all major banks have extended some form of coronavirus relief — and Goldman was one of the banks at the forefront. Banks are offering help ranging from loan forbearance to increased credit limits, among several areas of relief.Goldman Sachs was one of the first banks to extend coronavirus-response accommodations: By mid-March, Apple Card cardholders had the option to skip their March payments without incurring interest — through Apple's Customers Assistance Program — which came weeks before some competing banks extended comparable options. This could have contributed in part to Goldman's higher level of deferrals. While the risks of losses associated with granting payment deferrals might be high, the reputational damage of not extending the option could ultimately be worse. A prolonged period of rising unemployment could cause borrowers to fall behind on loan repayments and heighten the risk of delinquencies, even after a deferral period has been granted. However, the fallout from the Great Recession demonstrated that customers have a long memory when it comes to how their banks responds in a crisis.As Wells Fargo analyst Mike Mayo pointed out per the FT, Goldman's higher level of deferrals could be “indicative of an extra effort to work with customers through a period that would be deemed transient.” Maintaining a good reputation among customers is especially important for Goldman given that its consumer business — particularly Apple Card — is still young, and it has big plans to continue building out Marcus. Generating goodwill among existing and prospective customers with its response to the current crisis could bode well for the bank's efforts in this area even after the pandemic subsides.Want to read more stories like this one? Here's how to get access:Business Insider Intelligence analyzes the banking industry and provides in-depth analyst reports, proprietary forecasts, customizable charts, and more. /> /> Check if your company has BII Enterprise membership accessSign up for the Banking Briefing, Business Insider Intelligence's expert email newsletter tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

Two Californians Indicted for $22 Million Crypto and NFT Fraud

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

Currency Calculator