Score

Mensa Finance

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://mensafinance.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:Mensa Finance Limited

License No.:16416966

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by United States NFA(license number: 16416966)Common Business Registration Non-Forex License. Please be aware of the risk!

Basic information

United Kingdom

United KingdomFormal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Mensa Finance also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

mensafinance.com

Server Location

France

Website Domain Name

mensafinance.com

Server IP

92.205.3.240

Company Summary

| Mensa Finance | Basic Information |

| Company Name | Mensa Finance |

| Founded | 2023 |

| Headquarters | Bosnia |

| Regulations | Not regulated |

| Tradable Assets | Forex, Metals, Indices, Commodities, Futures, Shares |

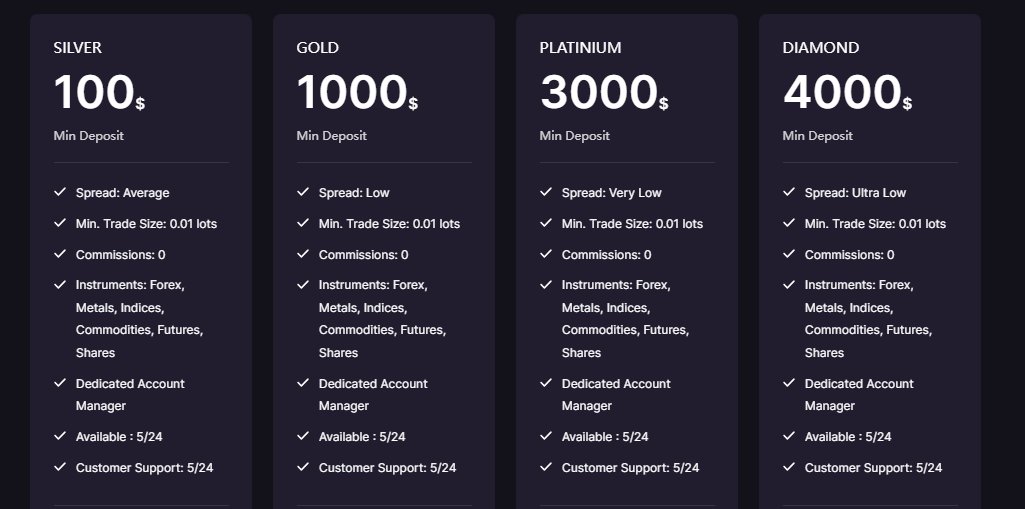

| Account Types | Silver, Gold, Platinum, Diamond |

| Minimum Deposit | Varies by account type |

| Maximum Leverage | Up to 1:500 |

| Spreads | Varies by account type |

| Commission | None (commission-free trading) |

| Deposit Methods | Credit card, e-bank transfer, Cryptocurrencies |

| Trading Platforms | Web Trader, MensApp |

| Customer Support | 24/6 multilanguage support via phone, email, WhatsApp, and contact form |

| Education Resources | Expert Advisors (EA), Trading signals, Daily news updates, Market analysis, Economic calendar, Technical Analysis Education (for Platinum and Diamond accounts) |

| Bonus Offerings | None |

Overview of Mensa Finance

Mensa Finance is a relatively new player in the financial brokerage industry, having been established in 2023 and headquartered in Bosnia. This brokerage offers a wide array of trading assets, including forex, metals, cryptocurrencies, indices, commodities, futures, and shares, catering to a diverse range of trader preferences. However, a significant point of consideration is that Mensa Finance operates without regulatory oversight. This lack of regulation can raise concerns among potential traders about the safety and security of their investments.

Despite the regulatory aspect, Mensa Finance provides various account types with varying minimum deposit requirements and spreads, allowing traders to choose options that align with their trading styles and financial capabilities. Moreover, it offers substantial leverage of up to 1:500, which can be appealing to those who seek to maximize their trading potential. It's essential to recognize, though, that while high leverage can amplify profits, it also increases the level of risk associated with trading.

One notable feature of Mensa Finance is its commitment to commission-free trading. Traders using this platform won't incur additional charges for executing trades, making it a cost-effective choice for those who engage in frequent trading. Additionally, Mensa Finance provides various educational resources, including Expert Advisors (EA), trading signals, daily news updates, market analysis, and an economic calendar. These resources are designed to empower traders with the information and tools needed to make informed trading decisions. However, it's imperative that individuals considering Mensa Finance thoroughly evaluate the broker's offerings and carefully weigh the absence of regulatory oversight in their decision-making process.

Is Mensa Finance Legit?

Mensa Finance is not regulated by any valid regulatory authority. Traders should exercise caution and be aware of the associated risks when considering this broker, as the absence of regulation can raise concerns about the safety and security of their investments.

Pros and Cons

Mensa Finance presents a wide range of assets and account types, providing flexibility for traders. The absence of commissions simplifies cost considerations. However, the lack of regulation is a notable drawback, and there's limited information about the company itself. While educational resources are offered, they may not be comprehensive. Traders should be aware of potential non-trading fees and the relatively limited bonus options when considering this broker.

| Pros | Cons |

| - Diverse range of tradable assets. | - Lack of regulation raises concerns. |

| - Four account types for various preferences. | - Limited company information available. |

| - High maximum leverage (up to 1:500). | - Educational resources are not extensive. |

| - Commission-free trading. | - Non-trading fees like overnight swaps may apply. |

| - Educational resources available. | - Limited bonus offerings. |

Trading Instruments

Mensa Finance offers a wide variety of trading instruments to suit different trader preferences:

Indices: Trade 15 global indices as Contracts for Difference (CFD), allowing you to speculate on major stock market performances without owning the underlying assets.

Cryptocurrencies: Engage in cryptocurrency trading with options like Bitcoin, Ethereum, and Ripple, offering opportunities in this highly volatile market.

Forex: Access over 40 major and minor currency pairs to participate in the dynamic foreign exchange market, which operates 24/5.

Energies: Trade energy commodities such as Brent Oil and Crude Oil, providing opportunities in the energy sector.

Stocks: Invest in a wide range of stocks, enabling you to diversify your portfolio by trading specific companies or industries.

Valuable Markets: Trade precious metals like gold and silver, a traditional safe haven for investors during economic uncertainty.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indices | Stock | ETF | Options |

| Mensa Finance | Yes | Yes | Yes | Yes | Yes | No | No | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IC Markets | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Exness | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

Account Types

Mensa Finance offers a range of account types to cater to various trading needs:

Silver Account: This entry-level account requires a minimum deposit and offers average spreads. Traders get access to Forex, Metals, Indices, Commodities, Futures, and Shares. Silver account holders enjoy services like a dedicated account manager, 24/5 customer support, Expert Advisors (EA) trading tools, trading signals, daily news updates, live market analysis, and an economic calendar.

Gold Account: With a slightly higher minimum deposit than the Silver Account, Gold Account holders benefit from low spreads. They have access to the same wide range of instruments as the Silver Account, along with the additional services of a dedicated account manager, 24/5 customer support, EA trading tools, trading signals, daily news updates, live market analysis, and an economic calendar.

Platinum Account: The Platinum Account offers very low spreads, making it attractive for traders looking for tighter pricing. It provides access to Forex, Metals, Indices, Commodities, Futures, and Shares. In addition to the features available to Gold Account holders, Platinum Account users also receive technical analysis education.

Diamond Account: This top-tier account type offers ultra-low spreads for the most cost-conscious traders. It provides access to the full range of instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares. Diamond Account holders enjoy all the features of the other account types, plus technical analysis education.

How to Open an Account

To open an account with Mensa Finance, follow these steps.

Visit the Mensa Finance website. Look for the “Open Account” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

Mensa Finance offers leverage of up to 1:500 to its traders, regardless of their chosen account type. This high level of leverage can be appealing to traders as it allows them to control larger positions in the market with a relatively smaller amount of capital. Leverage can magnify both potential profits and potential losses, making it an essential consideration for traders.

However, it's crucial to note that while high leverage can amplify gains, it also increases the level of risk associated with trading. Traders using high leverage should exercise caution, implement effective risk management strategies, and be fully aware of their risk tolerance. Additionally, the availability of such high leverage may vary based on the regulatory environment and the specific trading instrument, so traders should always stay informed about the associated risks when trading with leverage.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Mensa Finance | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:500 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions (Trading Fees)

Mensa Finance provides spreads and a trading structure without commissions across its various account types. Spreads represent the difference between buying and selling prices, impacting trading costs.

For SILVER, GOLD, PLATINUM, and DIAMOND account types, Mensa Finance offers spreads that vary from average to ultra-low. These spreads can be important for traders, especially those who trade frequently. Notably, there are no commissions on these accounts, simplifying cost considerations.

However, traders should be aware that while Mensa Finance offers commission-free trading, other fees might still apply, such as overnight swap fees or instrument-specific charges. It's essential to review Mensa Finance's complete fee structure to fully understand the costs related to different types of trades.

Non-Trading Fees

Mensa Finance, like many other brokers, has certain non-trading fees that traders should be aware of. These fees can impact the overall cost of trading and should be considered in addition to spreads and commissions.

One notable aspect is the swap or overnight financing fee. This fee is incurred when traders hold positions overnight. Mensa Finance provides an Economic Calendar and Daily News Update, which can help traders stay informed about events that might trigger overnight fees. These fees can vary depending on the instrument being traded and whether the position is long or short.

Additionally, Mensa Finance might charge fees related to deposit and withdrawal methods. Different payment providers may impose their own fees for transactions, which can add to the overall non-trading costs. Traders should carefully review these fees, especially if they plan to move funds frequently.

Lastly, it's essential to keep in mind that non-trading fees can vary over time and across different account types. Traders should regularly check Mensa Finance's fee schedule and account terms to stay informed about any changes or updates to these fees.

Deposit & Withdraw Methods

Mensa Finance simplifies financial transactions with three main methods: credit card payments, e-bank transfers, and cryptocurrencies.

Credit cards like Visa or Mastercard are commonly accepted, but please note that your card provider might apply additional fees.

E-bank transfers offer a secure option, ideal for larger transactions. However, remember that banks may have their fees, and the processing time can vary.

Cryptocurrencies, including Bitcoin and Ethereum, provide a decentralized and often faster transaction option. Yet, be cautious of cryptocurrency price fluctuations.

Before choosing a method, consider your preferences and potential fees, and check Mensa Finance's website or contact their support for specific details.

Trading Platforms

Mensa Finance offers two trading platforms for your convenience.

First is the Web Trader, which provides easy web access to the world's most popular Forex trading application. This user-friendly platform simplifies your trading experience.

Second, there's MensApp, the next generation platform for CFDs, commodities, and currency pairs. This modern platform is designed to enhance your trading capabilities.

Customer Support

Mensa Finance takes customer support seriously, offering 24/6 multilanguage assistance to cater to your needs. Whether you have questions, concerns, or need assistance with your trading journey, their support team is ready to help.

You can reach out to them through various channels. You can call them at +387 62 182 291, send an email to info@mensafinance.com, or even connect with them on WhatsApp for quick responses.

If you prefer a more instant way to get in touch, Mensa Finance provides a convenient contact form on their website. Just fill in your name, phone number, email address, and your message, and they will respond promptly.

Educational Resources

Mensa Finance offers a range of educational resources designed to assist traders in their journey towards becoming more informed and successful. While the broker doesn't boast an extensive educational section, it provides valuable features for traders across different account types.

These features include access to Expert Advisors (EA), which is a valuable trading tool for automation and strategy development. Additionally, trading signals are available to help traders make data-driven decisions. Daily news updates and market analysis, including live broadcasts, ensure that traders stay updated with the latest market trends and events. An economic calendar is also provided, helping traders plan their strategies around key economic events.

For those with Platinum and Diamond accounts, there's the added benefit of technical analysis education, which can be instrumental in enhancing one's trading skills.

Conclusion

In conclusion, Mensa Finance offers a diverse array of tradable assets and account types, providing traders with flexibility and options. The high maximum leverage and commission-free trading are attractive features. However, the absence of regulation raises concerns about investor protection, and the limited company information is a drawback. While there are educational resources available, they are not extensive, and traders should be aware of potential non-trading fees. Additionally, the broker provides limited bonus offerings. Therefore, prospective traders should carefully weigh these advantages and disadvantages when considering Mensa Finance as their trading platform.

FAQs

Q: Is Mensa Finance a regulated broker?

A: No, Mensa Finance is not regulated by any valid regulatory authority, which means traders should exercise caution and understand the associated risks.

Q: What types of assets can I trade with Mensa Finance?

A: Mensa Finance offers a diverse range of tradable assets, including forex, metals, cryptocurrencies, indices, commodities, futures, and shares.

Q: What is the maximum leverage available at Mensa Finance?

A: Mensa Finance offers a high maximum leverage of up to 1:500, allowing traders to control larger positions with less capital.

Q: Are there any commissions for trading with Mensa Finance?

A: No, Mensa Finance offers commission-free trading, making it straightforward for traders to consider their costs.

Q: Does Mensa Finance provide educational resources?

A: Yes, Mensa Finance offers educational resources such as Expert Advisors (EA), trading signals, daily news updates, market analysis, and an economic calendar.

Keywords

- 1-2 years

- Regulated in United States

- Common Business Registration

- Self-developed

- Suspicious Scope of Business

- Suspicious Overrun

- Medium potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1670650374

Peru

The major challenge of this app is we can’t set any limit order as of today. Also some chart analytical features like marking the nearest support and resistance levels would be greatly helpful.

Neutral

05-07

✨LL✨

Ecuador

Mensa Finance caught my eye with its diverse asset range and multiple account types. It's nice to have options that cater to different trading preferences. The high leverage they offer is a definite pro for experienced traders looking to maximize their positions. Commission-free trading is a relief, and the educational resources provided are a helpful touch. My only concern is the lack of regulatory information and limited details about the company itself. I'd recommend it with a cautious approach, especially for those who value regulation in the trading space.

Neutral

2023-12-05

Smartduna

Australia

I've been with Mensa Finance for a few months now, and the variety of assets they offer is impressive. It gives me the flexibility to explore different markets. The fact that they don't charge commissions is a plus for me – keeps things straightforward. However, I do wish they were more transparent about their company details. The lack of regulation is a bit concerning, but so far, no major issues. The educational resources are okay, but they could use more depth. Keep an eye out for potential non-trading fees. Overall, a decent choice for those who prioritize asset variety and commission-free trading.

Neutral

2023-12-04

FX1520894144

New Zealand

I remembered one instance very distinctly, where an unexpected declaration by the Federal Reserve fueled a rally in the USD against the AUD. With the predictions indicating a further appreciation of the USD, I decided to maintain my open position for a few days. The following nights were filled with anxiety, as the swap charges levied against my open position were significantly high. I'd hung onto the hope that my calculated risk would lead to an ample reward, justifying these high swaps.

Neutral

2023-10-13

Cherrie

Malaysia

Mensa Finance's trading platforms are user-friendly and packed with advanced features, making it easy for traders of all levels to navigate. And with competitive spreads, they make it even more attractive for those looking to maximize their returns. Overall, I'm very satisfied with my experience with Mensa Finance.

Positive

07-09

shriy

Cambodia

Really appreciate Mensa Finance for their competitive spreads and 24/7 support! It's refreshing to trade with a broker that not only offers great terms but also backs it up with solid customer service. Additionally, the free training was a fantastic bonus for getting up to speed.

Positive

06-21