简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Goldman announces consumer growth targets at investor day - Business Insider

Abstract:At its first-ever investor day, Goldman Sachs announced its plans to grow consumer deposits to at least $125 billion over the next five years.

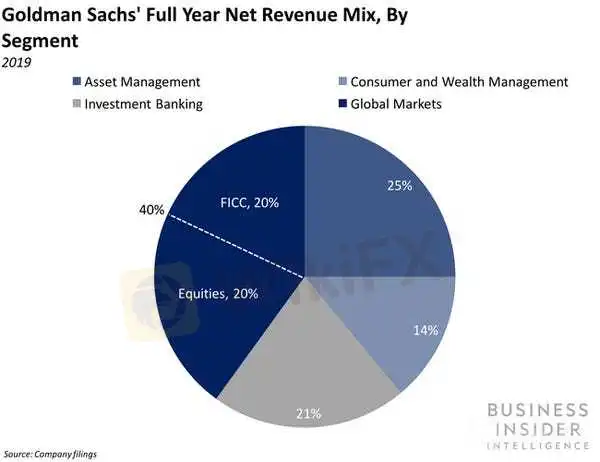

This story was delivered to Business Insider Intelligence Banking subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Goldman Sachs' first investor day was Wednesday, and it announced its forward-looking targets for its consumer banking division — comprised of Goldman's online bank Marcus and Apple Card — saying that it plans to grow consumer deposits to at least $125 billion over the next five years, per a presentation cited by Reuters.

Business Insider Intelligence

It also said that it intends to grow its consumer loans and card balances to over $20 billion in the same period. Hitting those targets would be an impressive leap from where Goldman currently stands: As of the year ended December 31, 2019, Goldman's consumer deposits totaled $60 billion, and it had issued $7 billion worth of loans and credit card balances during Q4 2019.Scaling its two main consumer products has not been without struggles for Goldman Sachs:Marcus has seen heavy costs since its launch. Marcus saw $1.3 billion in losses between its 2016 debut and October 2019, driven largely by spending on acquisitions, cloud storage space, and tech talent hiring, and the bank wrote off $155 million in the first six months of 2019. While these costs weren't unexpected — Goldman CFO Stephen Scherr previously stated that 2019 and 2020 represent “the depth of [Goldman's] investment cycle” for building new businesses and digital platforms — they still weigh down Goldman's progress toward profit in consumer banking.The development of Apple Card cost $300 million. And on top of the financial costs, Goldman reassigned thousands of its engineers to finish the product on time for its launch. Then, shortly after the card's launch, it faced an initial investigation by the New York Department of Financial Services to determine whether its creditworthiness algorithm demonstrates gender bias.But the long-awaited release of the Marcus app could help spur Goldman toward its goals. The bank finally unveiled an app for Marcus customers earlier this month, a surprising three years after Marcus itself launched, signifying the bank's deepening commitment to retail banking.Prior to the launch of the app, Marcus customers could only handle transfers and loan payments through Goldman's website. The new app could be instrumental to Marcus' growth trajectory, as it vastly enhances ease of use for the digital bank and could persuade prospective clients that had previously been dissuaded by Marcus' lack of an app to give the offering a try.Want to read more stories like this one? Here's how to get access: Sign up for Banking Pro, Business Insider Intelligence's expert product suite tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedCheck to see if you already have access to Business Insider Intelligence through your company, or inquire about access if you don't. /> /> Check If You Have Enterprise AccessExplore related topics in more depth.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Broker Review: Is FOREX.com a solid Broker?

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Pros & Cons of Automated Forex Trading

Magic Compass Sponsors World Taekwondo Poomsae Championships 2024

Trump tariffs: President-elect is serious but it\s not about trade

Currency Calculator