简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Week Ahead – Top 5 Events: September RBA Meeting & AUD/USD Rate Forecast

Abstract:The Australian Dollar will likely be in focus to kick off the trading week as forex traders turn to the September RBA meeting for clues on where the Aussie might head next.

RESERVE BANK OF AUSTRALIA (RBA) RATE REVIEW & AUDUSD PRICE OUTLOOK:

保留澳大利亚银行(RBA)房价回顾和澳元兑美元价格展望:

The Reserve Bank of Australia is on deck to release its updated monetary policy stance this coming Tuesday

储备澳大利亚央行即将于周二公布其最新货币政策立场

The September RBA meeting will largely dictate spot AUDUSDs next direction as the Australian Dollar hangs in limbo

9月澳洲联储会议将在很大程度上决定澳元兑澳元下一轮方向美元陷入困境

The September RBA meeting is on deck for next week and is certainly a top event to keep on the trading radar. High-impact event risk surrounding the Reserve Bank of Australia‘s latest interest rate decision due for release this coming Tuesday at 4:30 GMT stands to send spot AUDUSD price action swinging despite the central bank widely expected to stay on hold. Although, the RBA’s most recent monetary policy statement noted that “it is reasonable to expect that an extended period of low interest rates will be required” which could foreshadow further dovish action in the near future.

9月份的澳大利亚央行会议将在下周举行,这无疑将成为保持交易雷达的重头戏。澳大利亚储备银行即将于周二格林威治标准时间4点30分公布的最新利率决定引发的高影响事件风险将导致澳元兑美元现货价格走势摆动,尽管中央银行普遍预计将保持不变。尽管如此,澳大利亚央行最近的货币政策声明指出“有理由期望需要延长低利率时期”,这可能预示着在不久的将来会采取进一步的温和行动。

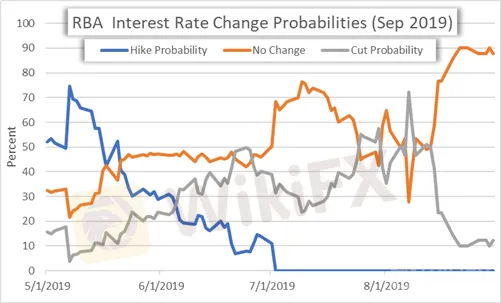

SEPTEMBER RBA MEETING INTEREST RATE CHANGE PROBABILITIES

9月RBA会议利率变化概率

Nevertheless, there is a 12.2% probability that the Reserve Bank of Australia cuts its policy interest rate next week according to the latest overnight swaps pricing.

然而,根据最新的隔夜掉期定价,澳大利亚储备银行下周削减其政策利率的可能性为12.2%。

AUSTRALIAN DOLLAR IMPLIED VOLATILITY & TRADING RANGES

澳大利亚美元的波动和交易范围

That said, the Australian Dollar remains at risk considering that RBA Governor Lowe could hint at another interest rate cut is coming down the road. Aussie risk is also highlighted by the rise in Australian Dollar implied volatility with the 1-week measures for the major AUD-crosses resting comfortably above their 12-month averages.

尽管如此,考虑到澳元仍处于危险之中澳大利亚央行行长罗威可能会暗示另一次降息正在走下坡路。澳大利亚元隐含波动率的上升也凸显了澳元风险,主要澳元交叉盘的1周测量值远高于其12个月平均值。

AUDUSD PRICE CHART: DAILY TIME FRAME (APRIL 08, 2019 TO AUGUST 30, 2019)

澳元兑美元价格走势图:每日时间框架(2019年4月8日至2019年8月30日)

We recently highlighted how Australian Dollar price action remains sluggish trade war tensions simmering. One possible explanation could be due to the looming September RBA meeting as forex traders await fundamental clarity. Consequently, Australian Dollar outlook will be largely dictated by the markets reaction to the September RBA meeting.

我们最近突出了澳元兑美元价格走势如何仍然缓慢的贸易战紧张局势酝酿。一个可能的解释可能是9月RBA会议迫在眉睫,因为外汇交易商等待基本清晰度。因此,澳大利亚元的前景在很大程度上取决于市场对9月份澳大利亚央行会议的反应。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

eToro Expects to Close Q4 2021 with 33% Higher Commission Revenue

The company is expecting the commissions to be between $285 million and $295 million. It added 2.1 million new users in Q4 alone.

SEC Indicts 5 Russians for $82M Hacking and Insider Trading Scheme

The accused hacked into the systems of two US filing agencies. They generated a profit of $82 million in around 3 years.

OANDA CONFIRMS CHIEF REVENUE OFFICER DAVID HODGE RESIGNED

OANDA has confirmed the news and will certainly be looking to fill his position at the helm of the EMEA operation as well as the Chief Revenue Officer for the global operation.

USGFX UK CEO Simon Quirke Leaves the Company

Quirke joined the company in 2018 and previously worked at Credit Suisse and Lehman Brothers.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator