简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

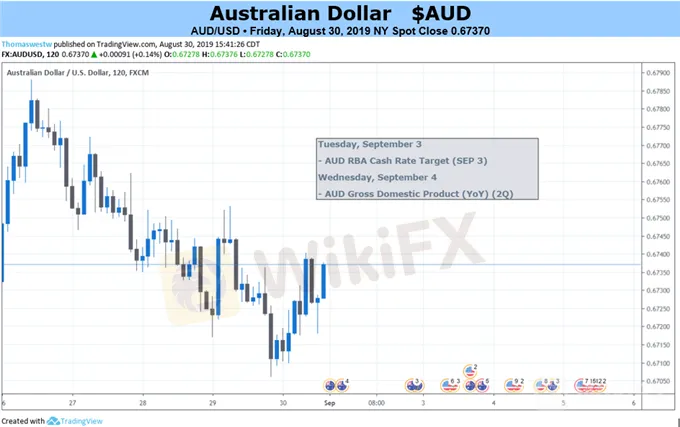

Australian Dollar Battered Amid Market Turmoil Faces RBA and GDP

Abstract:The Australian Dollar has got two huge economic data points on the schedule this week, but they may have to stray far from expectations to loosen overall risk appetites grip.

Fundamental Australian Dollar Forecast: Neutral

基本澳元预测:中性

The Reserve Bank of Australia is not expected to pull the interest rate trigger yet

澳大利亚储备银行预计不会拉动利率触发器

Growth looks certain to be anemic, the question is to what extent

增长看起来肯定是贫血,问题是在多大程度上 p>

Trade, recession worries may continue to drive

贸易,经济衰退的担忧可能继续推动

Find out what retail foreign exchange traders make of the Australian Dollars prospects right now, in real time, at the DailyFX Sentiment Page

了解什么零售外汇交易商现在,实时地,在DailyFX情绪页面,

The Australian Dollar faces a busy week for domestic economic news but may require significant deviations from market forecasts if they‘re to tear the currency out of overall risk appetite’s grip.

澳大利亚元面临国内经济新闻繁忙的一周,但可能需要显着偏离市场预测,如果他们要将货币从整体风险偏好中解脱出来。

The Reserve Bank of Australia will give its September monetary policy verdict on Tuesday. Markets expect that the record-low 1% Official Cash Rate will be staying put. That probability is around 90%, according to index provider ASX. Futures markets still reckon we‘ll see two more quarter-point reductions over the next six months, but they don’t price in the first of them until November.

澳大利亚储备银行将给出其9月的货币政策周二判决。市场预计创纪录的低1%官方现金利率将保持不变。根据指数提供商ASX的说法,这个概率约为90%。期货市场仍然认为我们将在未来六个月内再次下调两个季度,但直到11月它们才会在第一个季度降价。

Assuming the RBA keeps its hands of the monetary levers this week, what it may say in any statement will be important. In recent months these tended to emphasize both the long-term nature of historically low interest rates and the benefits of a weaker Australian Dollar in the RBA long fight against weak inflation. More of the same is unlikely to offer the currency much respite.

假设澳大利亚央行本周掌握货币杠杆,它在任何声明中所说的都很重要。最近几个月,这些往往强调历史低利率的长期性质以及澳大利亚元走弱对抗疲弱通胀的长期斗争中的利益。更多同样的情况不太可能为货币提供足够的喘息机会。

GDP Prospects Look Mixed at Best

GDP前景看起来好极了

Wednesday will bring a first look at official second-quarter Gross Domestic Product data. Here things are very much in the balance. Business investment has already been shown to have sagged in that period but spending on plant, equipment and machinery remains robust in corporate Australia. There has been a marked slowdown in overall construction activity, however, which is bound to make its presence felt in the numbers.

周三将带来第一个看看官方第二季度国内生产总值数据。这里的事情非常平衡。在此期间,商业投资已经显示出下滑,但在工厂,设备和机械方面的支出依然强劲澳大利亚企业然而,整体建筑活动明显放缓,这必将使其在数字中出现。

The markets is looking for quarterly expansion of between 0.2% and 0.5%, after the first quarters insipid 0.4% rise. Assuming no surprises an outcome within that range may pass the market by. After all the second quarter is long behind us and investors may see far more pressing current risks in the form of global trade and recession fears.

市场正在寻求季度扩张0.2%至0.5%后,第一季度平淡上涨0.4%。假设没有任何意外,该范围内的结果可能会超过市场。毕竟第二季度已经远远落后于我们,投资者可能会看到全球贸易和经济衰退担忧的当前风险更加紧迫。

Its a cautious neutral call this week.

本周这是一个谨慎的中立态度。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator