Score

FTX

China|2-5 years|

China|2-5 years| https://www.ftxxzz.com/_FrontEnd/index.aspx

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed FTX also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ftxxzz.com

Server Location

United States

Website Domain Name

ftxxzz.com

Server IP

172.67.163.218

Company Summary

Note: FTXs official site - https://www.fxzz.com/_FrontEnd/index.aspx is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| FTX Review Summary in 10 Points | |

| Founded | 2022 |

| Registered Country/Region | China |

| Regulation | No license |

| Market Instruments | forex, cryptocurrencies, stocks, commodities and stock indices |

| Demo Account | N/A |

| Leverage | N/A |

| EUR/USD Spread | N/A |

| Trading Platforms | N/A |

| Minimum deposit | N/A |

| Customer Support | N/A |

What is FTX?

FTX is a newly-established unregulated forex broker registered in China that claims to offer a wide range of trading instruments. But the FTX website is currently unavailable and there is a lack of information regarding accounts, leverage, spreads, commissions, trading platforms, deposits, and withdrawals, it raises significant concerns about the transparency and reliability of the platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

There is limited information available about FTX and its website being currently unavailable. It is important to note that the lack of transparency and unavailable information raises significant concerns and may indicate potential risks associated with the platform.

| Pros | Cons |

| N/A | • No valid regulation |

| • Unavailable website | |

| • Report of unable to withdraw |

FTX Alternative Brokers

Axi - a reputable and regulated broker with a wide range of trading instruments, advanced trading platforms, and excellent customer support, making it a recommended choice for traders.

LiteForex - offers competitive trading conditions, a variety of account types, and a user-friendly platform, making it a suitable option for both beginner and experienced traders.

FxPrimus - a reliable broker with strong regulatory oversight, offering a range of trading tools, competitive spreads, and excellent customer service, making it a recommended choice for traders seeking a trusted trading environment.

There are many alternative brokers to FTX depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is FTX Safe or Scam?

Based on the information provided, the lack of valid regulation and the unavailability of the website raise concerns about the safety and legitimacy of FTX. It is advisable to exercise caution and avoid trading with unregulated brokers, as there may be risks involved. It is recommended to choose a regulated and reputable broker to ensure the security of your funds and a fair trading environment.

Market Instruments

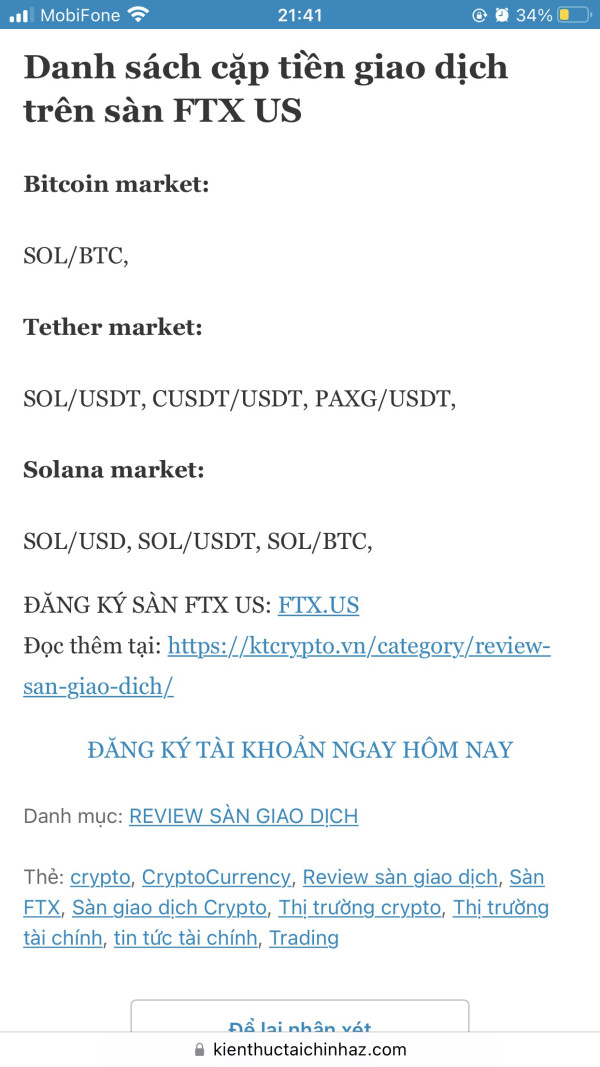

FTX claims to offer a wide range of trading products, encompassing various asset classes. This includes forex currency pairs, allowing traders to speculate on the exchange rate movements of major and minor currencies. Additionally, they provide access to popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, allowing traders to participate in the growing digital asset market.

Furthermore, FTX offers the opportunity to trade stocks, enabling investors to buy and sell shares of publicly listed companies. Traders can also access the commodities market, allowing them to speculate on the price movements of precious metals like gold and silver, as well as energy resources like oil and natural gas. Lastly, they offer trading on stock indices, providing exposure to the performance of a basket of stocks from specific markets or sectors.

Customer Service

Unfortunately, since there is no available information on FTX's customer support, it is challenging to provide a detailed description of their customer service. Customer support is a crucial aspect of any reputable trading platform, as it plays a vital role in addressing user inquiries, resolving issues, and providing assistance to traders. As the specific details regarding FTX's customer service are unknown, potential traders should exercise caution and consider this aspect when evaluating the overall reliability and trustworthiness of the platform.

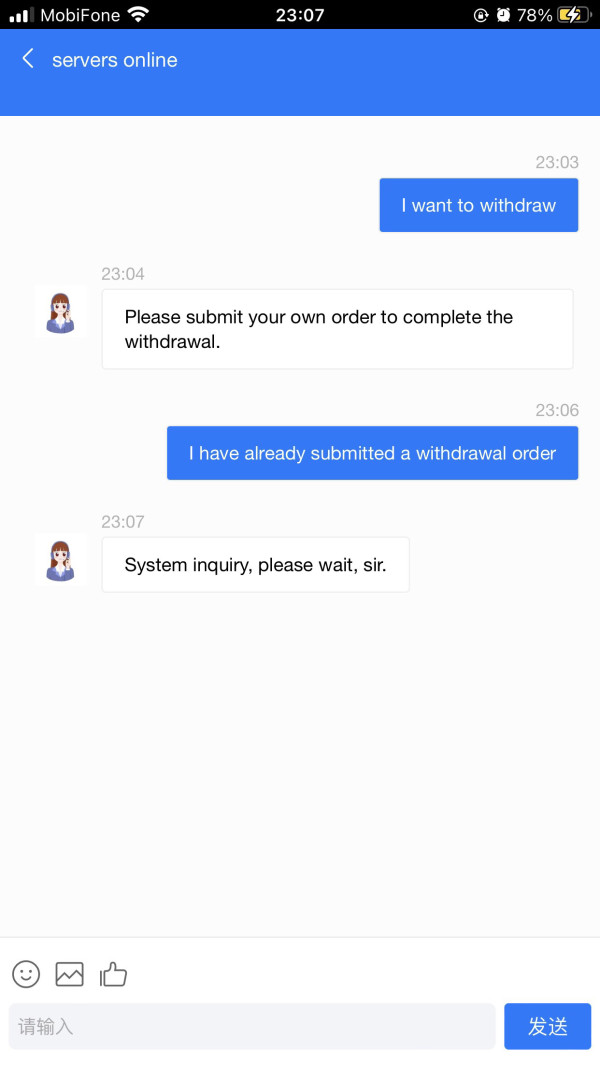

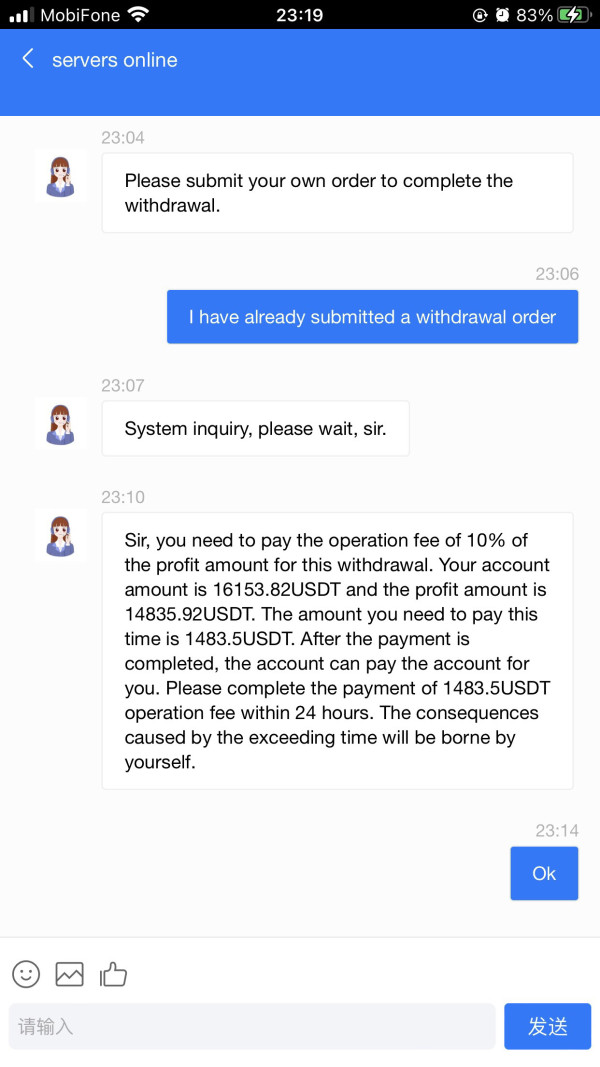

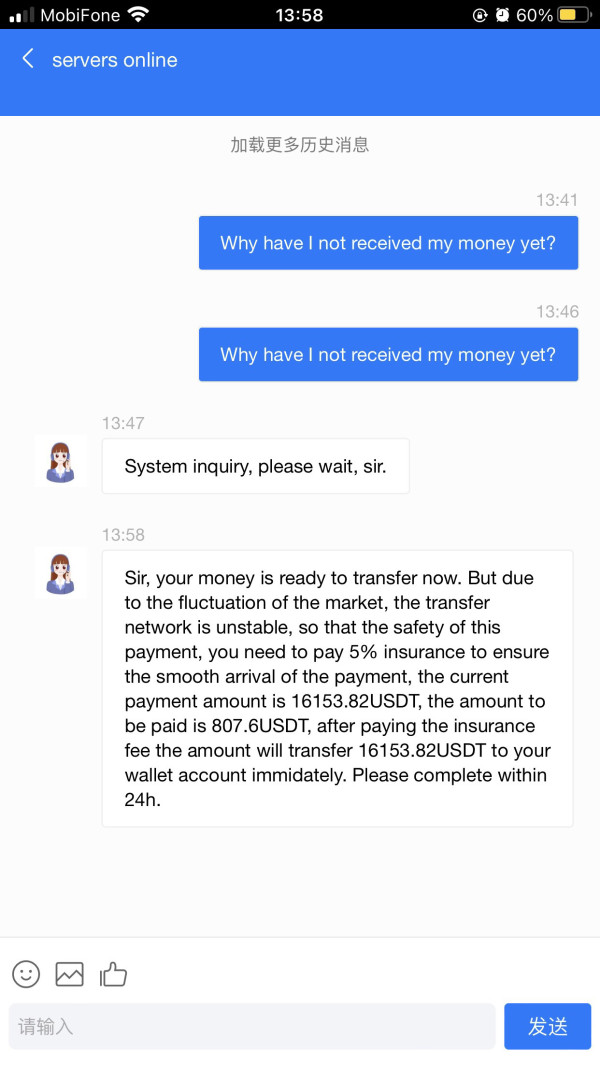

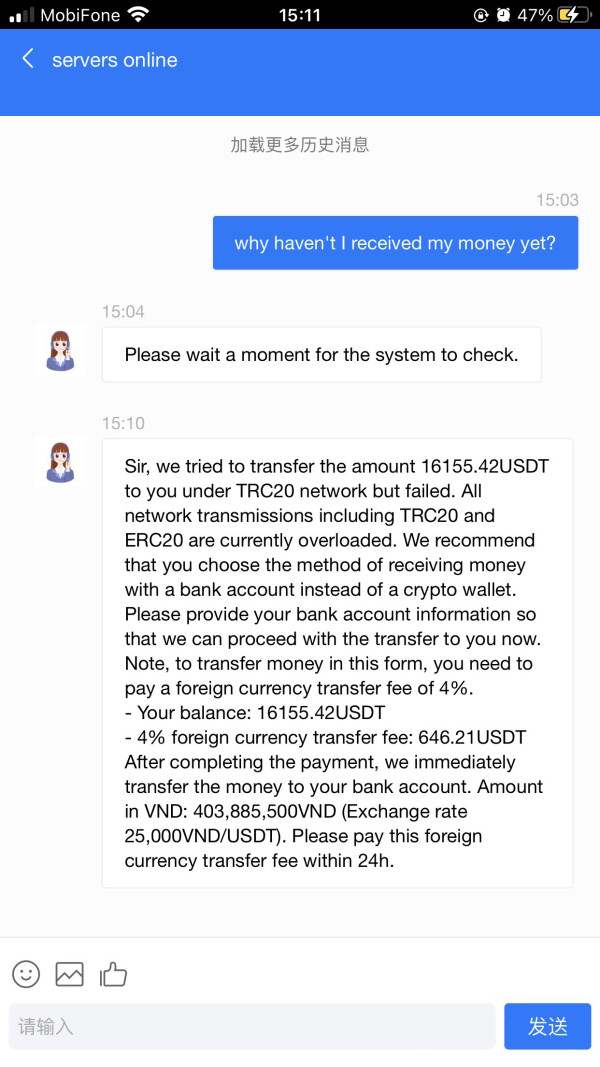

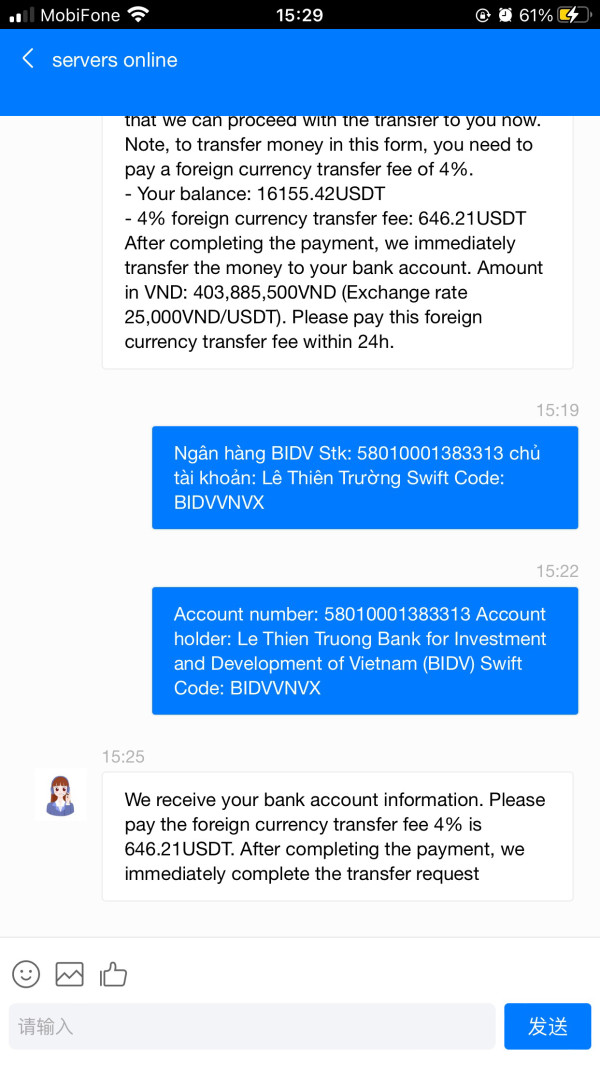

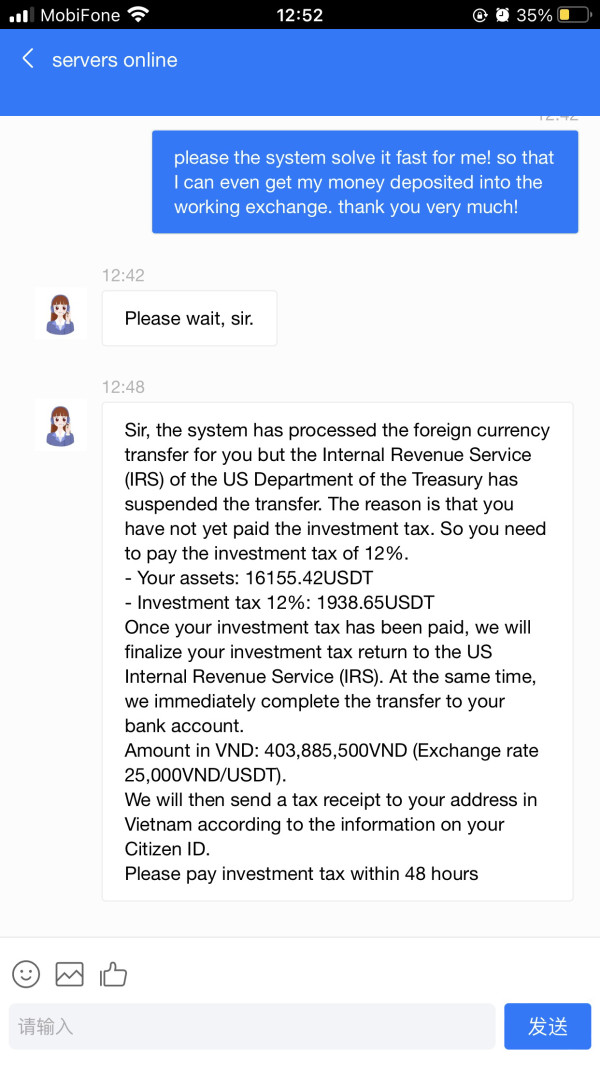

User Exposure on WikiFX

On our website, you can see that a report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

Based on the limited information available and the fact that the FTX website is currently unavailable, it is not possible to provide a comprehensive review or draw a conclusion about the platform. The lack of transparency, unavailability of key information, and reports of issues raise significant concerns and indicate potential risks associated with FTX. Traders are advised to exercise extreme caution and consider regulated and reputable brokers that provide transparent information, regulatory oversight, and reliable customer support. It is crucial to prioritize the security and protection of your funds when engaging in online trading.

Frequently Asked Questions (FAQs)

| Q 1: | Is FTX regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Is FTX a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

News Temasek of Singapore Examines $275 MNL FTX-Related Loss

Temasek had invested around $275 million in FTX, which it has decided to write off after the exchange's spectacular collapse.

2022-11-30 14:05

News Who Are The People Behind FTX?

FTX's demise was rapid and severe. The crypto exchange, which began as a skunk-work project within Sam Bankman's quant-driven Fried's trading firm, Alameda Research, went from being one of the most used and valuable crypto companies ever to a pile of lost bets and worthless tokens in just eight days earlier this month.

2022-11-23 14:34

News The 3 Most Important Takeaways from FTX's First Day in Bankruptcy Court

Tuesday, lawyers and officials for the now-defunct cryptocurrency platform FTX went to court and said that an investigation is still going on into the assets that the company's founder and former CEO, Sam Bankman-Fried, once owned.

2022-11-23 12:04

News Solana Stablecoins Are Suspended By Binance, OKX, Bitmex, and Bybit

At least five cryptocurrency exchanges told their customers today that the Solana network has stopped all deposits and withdrawals of Tether's USDT and Circle's USDC.

2022-11-21 14:08

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now