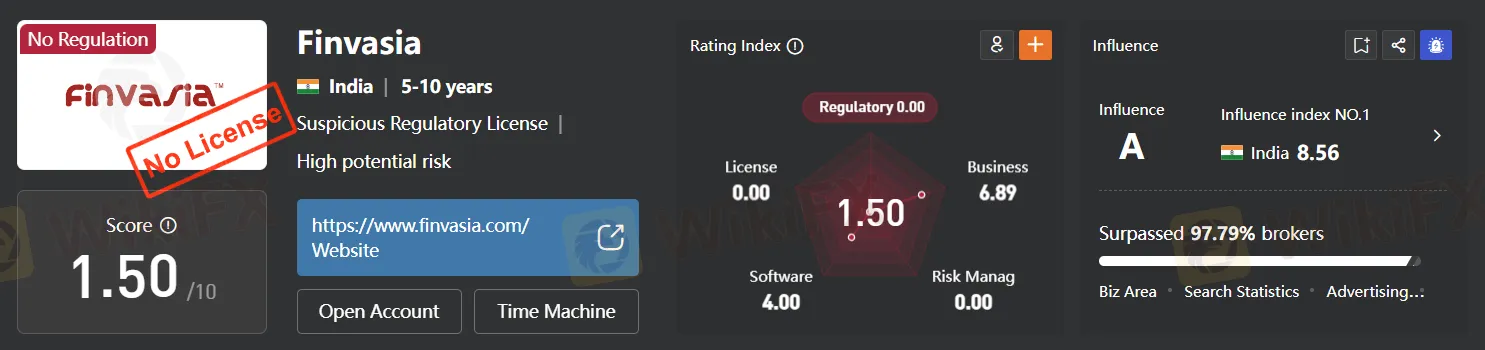

Score

Finvasia

India|5-10 years|

India|5-10 years| https://www.finvasia.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

India 8.56

India 8.56Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

India

IndiaUsers who viewed Finvasia also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

finvasia.com

Server Location

India

Website Domain Name

finvasia.com

Server IP

182.156.197.108

Company Summary

| Company Name | Finvasia Securities Private Limited |

| Registered in | India |

| Year of Establishment | 2009 |

| Regulatory Status | Not regulated |

| Commission Fees | None (Commission-Free Trading) |

| Tradable Instruments | Equities, Derivatives, Currencies, Commodities, Mutual Funds, ETFs, Bonds |

| Targeted Investor Types | Retail Traders, NRIs, FPIs, HNIs |

| Trading Platform | Shoonya (Available on Desktop, Web, and Mobile) |

| Customer Support | Phone, Email, Live Chat |

| Website | Finvasia Website |

General Information

Finvasia, a trading name of Finvasia Securities Private Limited, is allegedly a broker based in India and founded in 2009, claiming to provide clients of Retail, NRIs, FPIs and HNIs with multiple tradable financial instruments on its own-designed trading platforms, as well as financial services ranging from zero brokerage, zero clearing to zero account opening and zero AMC.

Regulation

Finvasia was not regulated by a recognized financial authority or regulatory body.This lack of regulation may raise concerns for some investors, as regulatory oversight is typically seen as a safeguard to protect traders and investors from potential fraud or malpractice within the financial industry. Therefore, individuals considering using Finvasia's services should exercise caution and conduct thorough research to assess the risks associated with trading on an unregulated platform. It is advisable to check for any regulatory updates or changes that may have occurred since my last update in order to make an informed decision when choosing a trading platform.

Pros and Cons

Finvasia presents a mix of advantages and disadvantages. On the positive side, they offer commission-free trading, making it cost-effective for clients. They provide a diverse range of tradable instruments and tailor their services to various investor types, enhancing accessibility. The multi-asset trading platform Shoonya and user-friendly trading tools add to their appeal. However, it's essential to consider the lack of regulation and limited information available on their website, which might raise concerns for some clients. Moreover, there is a notable absence of comprehensive educational resources, and clients should be cautious due to the absence of regulatory oversight.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

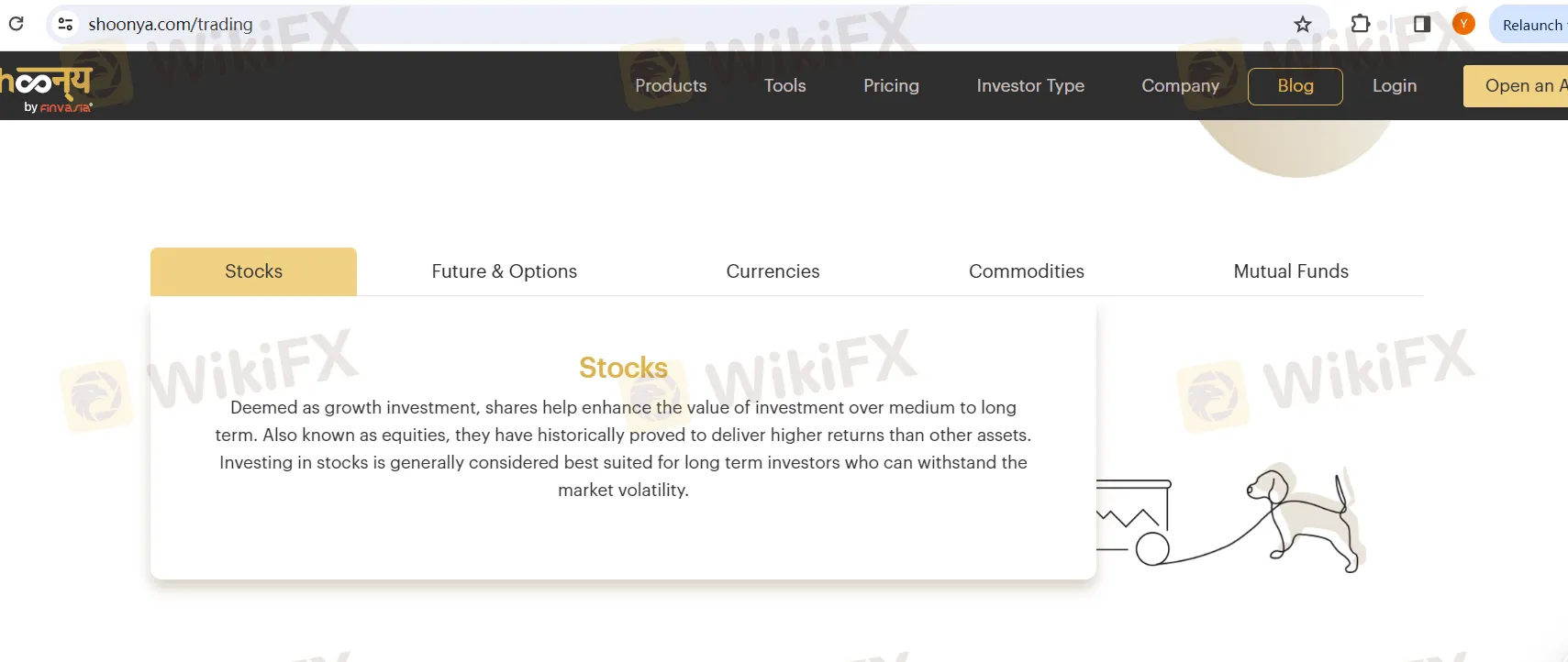

Market Instruments

Finvasia prides itself on offering a wide spectrum of financial market instruments, ensuring a diverse and flexible investment environment for its clients. These market instruments include:

Equities (Stocks): Providing access to a vast array of individual company stocks, enabling investors to take ownership in businesses and participate in potential long-term growth.

Derivatives (Futures & Options): Offering derivative contracts, such as futures and options, for hedging and speculative trading strategies, providing opportunities to profit from price movements without owning the underlying asset.

Currencies (Forex): Facilitating forex trading, allowing clients to engage in the foreign exchange market and trade currency pairs, capturing opportunities in the dynamic world of forex.

Commodities: Enabling the trading of commodities, including precious metals, energy resources, agricultural products, and more, to diversify portfolios and capitalize on commodity price movements.

Mutual Funds: Providing access to a variety of mutual funds, enabling investors to pool their resources with others to access professionally managed, diversified investment portfolios.

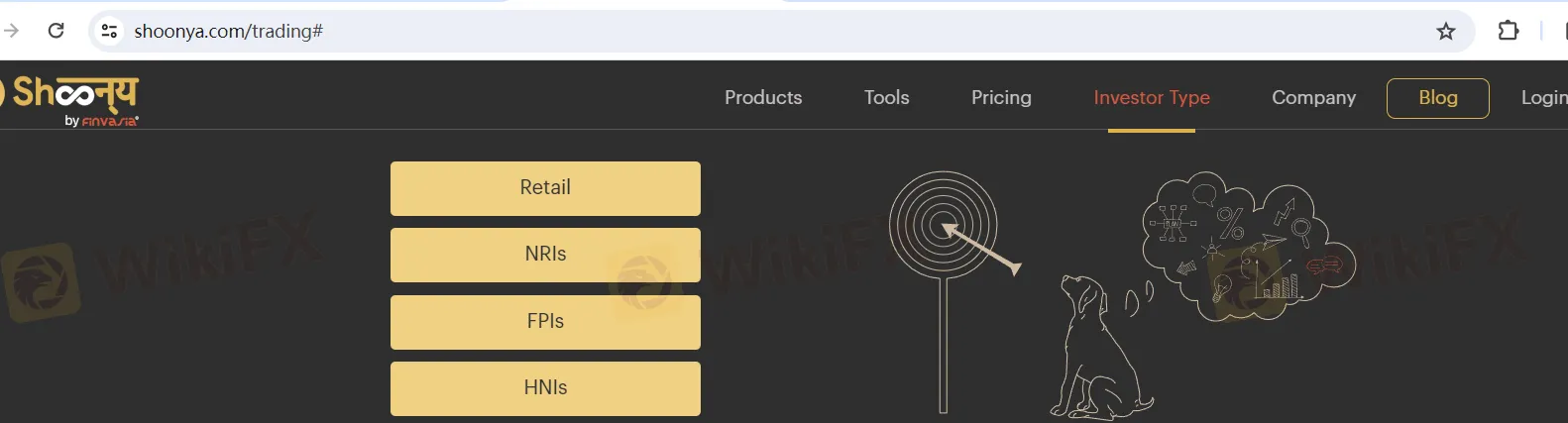

Investor Types

There are four investor types offered by Finvasia, namely Retail, NRIs (Non-Resident Indian), FPIs(Foreign Portfolio Investors) and HNIs(High Networth Investors).

Retail Investors: These are individual investors who participate in financial markets for personal wealth creation and portfolio growth. Retail investors typically trade or invest with their own funds and may have varying levels of experience and risk tolerance. Finvasia provides a user-friendly platform and services tailored to the needs of retail investors.

NRIs (Non-Resident Indians): Finvasia extends its services to Non-Resident Indians, individuals of Indian origin living abroad. NRIs often seek investment opportunities in India and require specialized services to navigate the Indian financial markets, comply with regulatory requirements, and manage their investments effectively.

FPIs (Foreign Portfolio Investors): Foreign Portfolio Investors comprise institutional investors, including foreign funds, asset management companies, and hedge funds, who invest in Indian financial markets. Finvasia offers solutions tailored to the specific needs of FPIs, including efficient trading and regulatory compliance support.

HNIs (High Net Worth Investors): High Net Worth Investors are individuals or families with substantial financial assets, seeking sophisticated investment strategies and personalized services. Finvasia acknowledges the unique requirements of HNIs and provides them with dedicated assistance, portfolio management, and access to a wide range of investment opportunities.

Commissions

Finvasia claims to provide its clients with commission-free trading indefinitely. This sets it apart from conventional brokerage firms that usually charge commissions for their services. By not imposing commission fees, Finvasia aims to offer a cost-effective trading experience, allowing clients to allocate more of their capital towards their investments. This commission-free model reflects Finvasia's approach to delivering financial services to investors and traders.

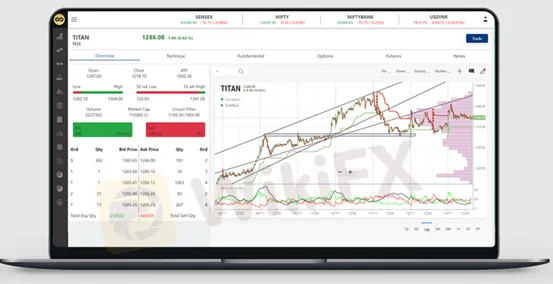

Trading Platforms

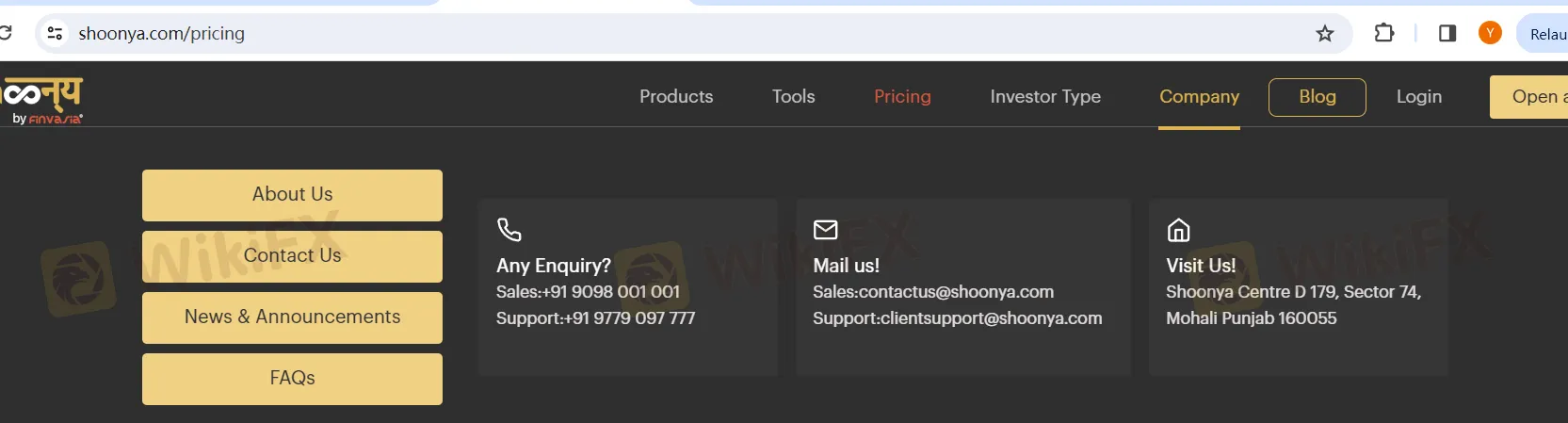

Finvasia offers traders access to the Shoonya platform, which is available on desktop, web, and mobile devices. Shoonya is promoted as a robust multi-asset platform that comes equipped with a range of features. These include technical and fundamental analysis tools, option chain functionality, support for multiple timeframes, more than 100 analytical studies, various time intervals for charting, as well as screeners and analytics. Furthermore, the Shoonya mobile app allows traders the flexibility to execute trades from any location and at any time, providing convenient access to the platform through compatible mobile devices.

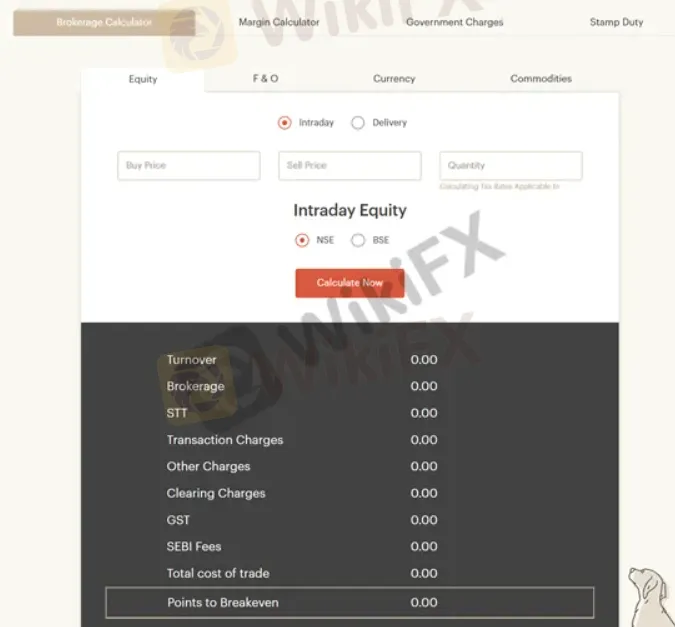

Tools

Additionally, Finvasia provides traders with an extensive array of useful tools, including calculators such as the brokerage calculator and margin calculator. These tools are designed to assist traders in making informed decisions and managing their investments effectively. The user interface of these calculators is intuitive, boasting a straightforward and user-friendly design. This simplicity ensures that traders can easily navigate and utilize the calculators to determine brokerage costs and assess margin requirements, enhancing their overall trading experience. As illustrated in the screenshot below, the interface offers a clear and straightforward representation, making it accessible to both novice and experienced traders.

Customer Support

Finvasias customer support can be reached by telephone: +91 9779 097 777, either email: clientsupport@finvasia.in, Besides, you can also follow this broker on some social media platforms like Facebook, X, Instagram, YouTube and LinkedIn. Company address: Plot No D-179 Finvasia Centre Phase 8b Industrial Area G F Sector 74 Sas Nagar Mohali Mohali 160054 Punjab.

Conclusion

Finvasia, operating as Finvasia Securities Private Limited, is an Indian brokerage firm established in 2009, aiming to serve a diverse range of investors, including retail traders, NRIs, FPIs, and HNIs. They offer a wide array of tradable financial instruments and pride themselves on commission-free trading. However, it's important to note that the company was not regulated by any recognized financial authority, which may raise concerns for some potential clients. They provide a multi-asset trading platform called Shoonya, accessible across various devices, and offer a range of trading tools and calculators to assist traders. Customer support options are comprehensive, and the company has offices in Punjab and Maharashtra. It's advisable for individuals considering Finvasia's services to exercise caution and conduct thorough research due to the lack of regulatory oversight.

FAQs

Q1: Is Finvasia regulated by any financial authorities?

A1: No, as of my last update, Finvasia was not regulated by any recognized financial authority.

Q2: What types of investors does Finvasia cater to?

A2: Finvasia caters to a diverse range of investors, including retail traders, NRIs, FPIs, and HNIs.

Q3: Does Finvasia charge commissions for trading?

A3: No, Finvasia offers commission-free trading to its clients.

Q4: What trading platform does Finvasia provide?

A4: Finvasia offers the Shoonya platform, accessible on desktop, web, and mobile devices.

Q5: Where are Finvasia's main office locations?

A5: Finvasia has its head office in Mohali, Punjab, and a corporate office in Mumbai, Maharashtra.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now