Score

PLSXA

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://www.plsxa.cc

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:PLSXA GLOBAL LIMITED

License No.:15503273

+40%

+40%Basic information

United Kingdom

United KingdomAccount Information

Users who viewed PLSXA also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

capus-c.cc

Server Location

United States

Website Domain Name

capus-c.cc

Server IP

104.21.85.93

plsxa.cc

Server Location

United States

Website Domain Name

plsxa.cc

Server IP

172.67.199.231

Company Summary

| PLSXAReview Summary | |

| Founded | 2024 |

| Registered Country | United Kingdom |

| Regulation | General Registration |

| Market Instruments | Forex, Commodities, Indices |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | EUR/USD: 0.0 pip |

| Trading Platform | MT4 |

| Min Deposit | $100 |

| Customer Support | Online chat |

PLSXA Information

PLSXA, part of PLSXA Limited, is a broker established in 2024 and headquartered in London, United Kingdom, regulated by the FCA. It currently offers products including currency pairs, commodities and indices to traders. In addition, it offers two types of accounts and it also supports the use of the MT4 platform, allowing traders to trade with 0 commissions and 0 spreads.

Pros and Cons

| Pros | Cons |

| No commissions | |

| Spread as low as 0 pips | |

| Support MT4 |

Is PLSXA Legit?

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| FCA | PLSXA GLOBAL LIMITED | Common Business Registration | 15503273 | General Registration |

What Can I Trade on PLSXA?

You can trade on PLSXA: forex, such as EUR/USD,GBP/USD, GBP/USD, etc. Then there are commodities, both hard and soft; In addition, more than 15 index CFDS are traded.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

PLSXA offers two types of accounts-STANDARD ACCOUNT and ECN ACCOUNT. They all require a minimum deposit of $200.

Compare the two accounts. The difference is spread and commission. The minimum spread is from 1 pip for the STANDARD ACCOUNT and from 0.0 pip for the ECN ACCOUNT. The commission is $0 on the STANDARD ACCOUNT and $4 per round trade on the ECN ACCOUNT.

| Account Types | STANDARD ACCOUNT | ECN ACCOUNT |

| Platforms | PLSXA | PLSXA |

| Speed | Instant Execution | Instant Execution |

| Products | 250+ Currency pairs, Indices, Commodities, Share CFDs | 250+ Currency pairs, Indices, Commodities, Share CFDs |

| Leverage | Up to 500:1 | Up to 500:1 |

| Min Spread | From 1 pip | From 0.0 pip |

| Commission | $0 Commission | $4 per round trade |

| Min. Deposit | $200 | $200 |

PLSXA provides a simple and straightforward account opening procedure.

PLSXA Fees

Given the account type, the lowest difference is supported from 0.0 pip. There is also no commissions .

In the forex pairs, the EUR/USD spread is 0.0, and the rest of the forex pairs are between 0.2 and 0.5. The spread for commodities ranges from 0.2 to 11.4. In addition, the spread of the index remained at 0.2 to 1.9.

Trading Platform

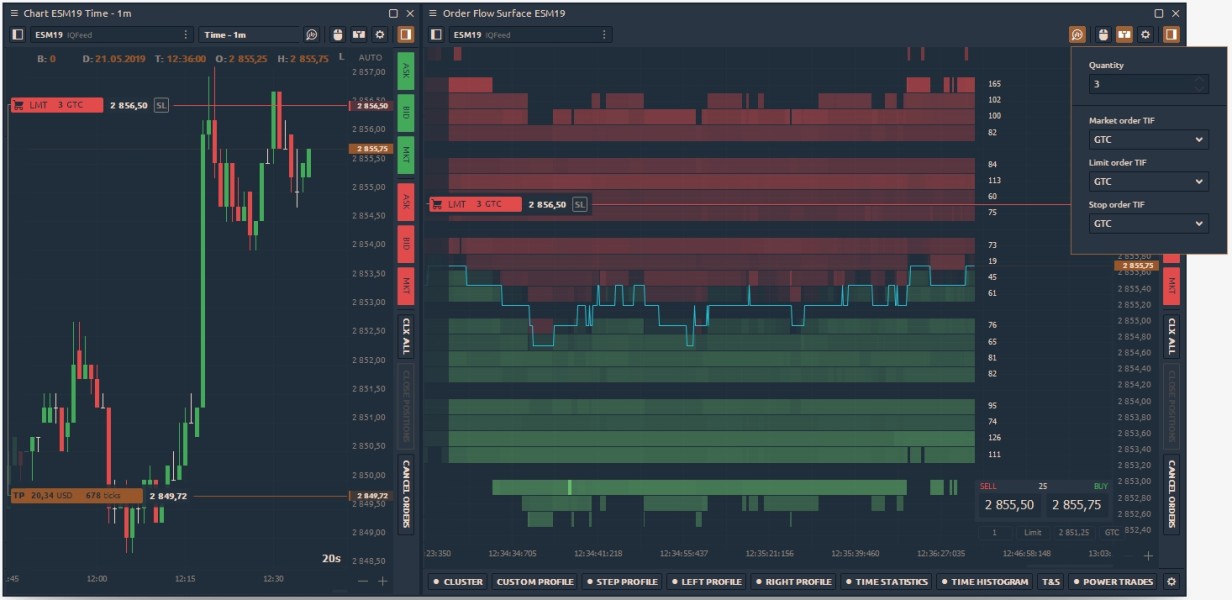

The trading platform PLSXA offers is MT4, which traders can use on both desktop and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile | Beginner |

| MT5 | ❌ |

Deposit and Withdrawal

PLSXA supports Mastercard, VISA, NETELLER, Skrill and BANK TRANSFER.

Keywords

- 1-2 years

- Regulated in United Kingdom

- Common Business Registration

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now